Loan repaying processing method and system

A processing method and processing system technology, applied in the field of loan repayment processing methods and systems, can solve the problems of widespread loan defaults, difficulty in recovering direct lenders, lack of capital guarantees and supervision mechanisms, etc., and achieve the effect of loan transaction security.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

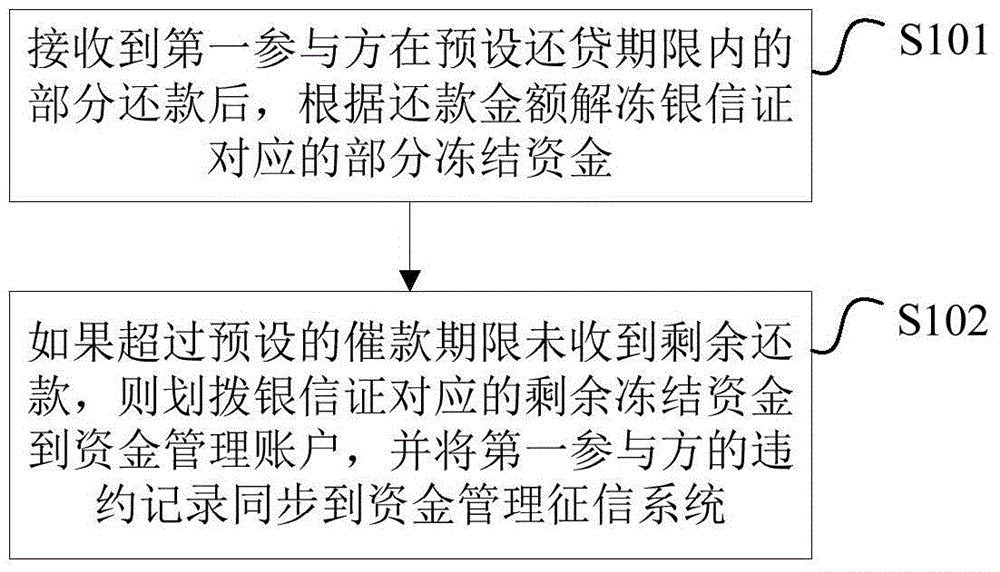

[0023] like figure 1 As shown, a loan repayment processing method provided by an embodiment of the present invention is applied to a fund management server, and the method includes the following steps:

[0024] S101. After receiving the partial repayment of the first participant within the preset loan repayment period, unfreeze the partially frozen funds corresponding to the bank letter of credit according to the repayment amount.

[0025] Specifically, after the first participant repays part of the loan within the agreed loan period, the fund management server unfreezes the partially frozen funds corresponding to the bank letter of credit. automatically becomes available.

[0026] S102. If the remaining repayment is not received after the preset payment deadline, transfer the remaining frozen funds corresponding to the bank letter of credit to the fund management account, and synchronize the default record of the first participant to the fund management credit reporting syst...

Embodiment 2

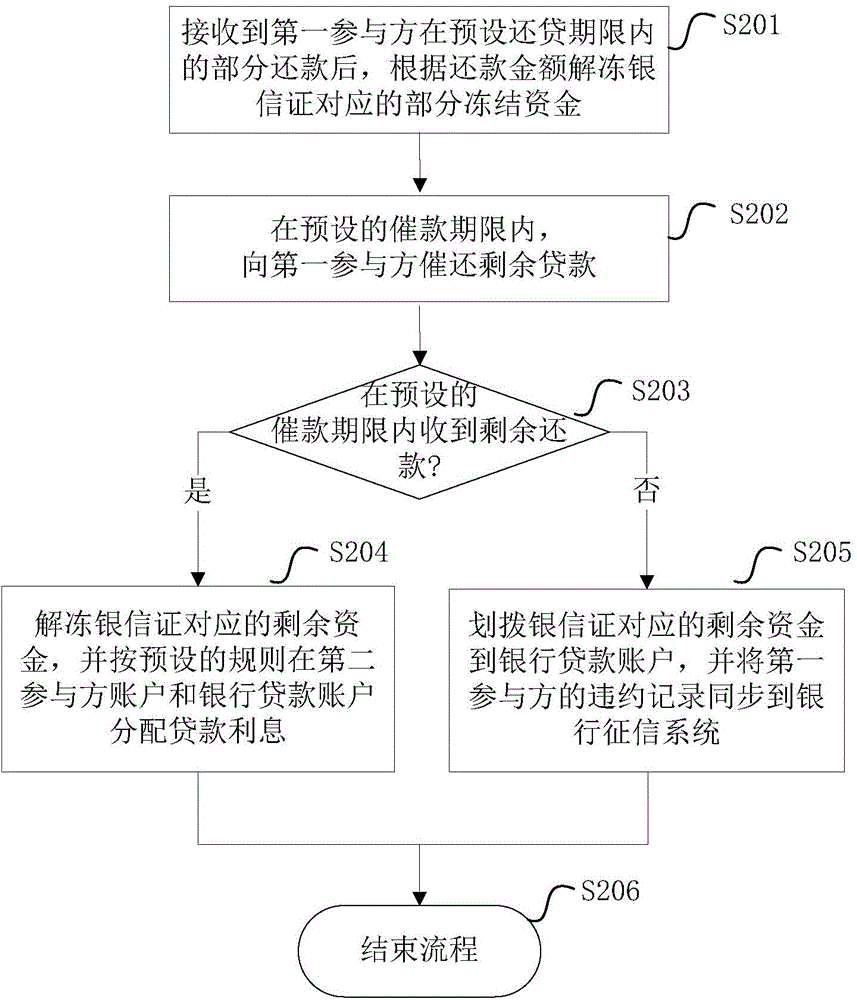

[0030] like figure 2 As shown in the figure, a loan repayment processing method provided by an embodiment of the present invention is described by taking the fund management institution as a bank and the fund management server as the bank server as an example, and the method includes the following steps:

[0031] S201. After receiving the partial repayment of the first participant within the preset loan repayment period, unfreeze the partially frozen funds corresponding to the bank letter of credit according to the repayment amount.

[0032] Wherein, the bank letter of credit is an electronic commitment payment certificate that the second participant applies to the fund management server with the account funds or credit line as a security deposit and is issued by the fund management server.

[0033] As a preferred solution, in order to maximize the interests of the fund management institution, the repayment amount received includes all loan interest and part of the loan princ...

Embodiment 3

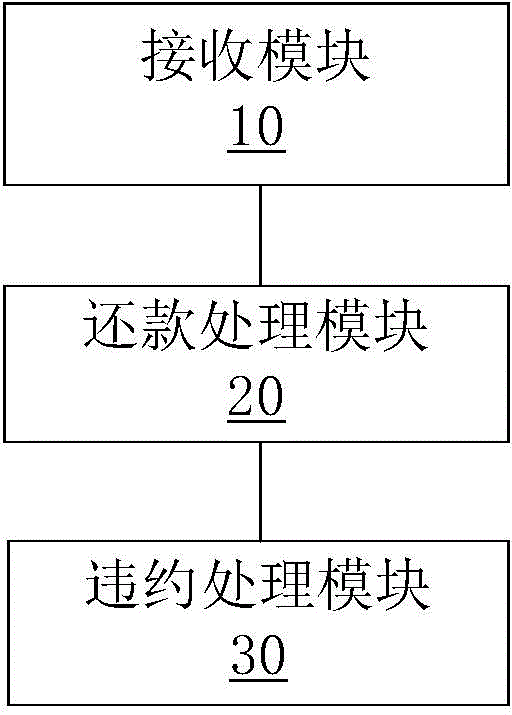

[0043] like image 3 As shown, a loan repayment processing system provided by an embodiment of the present invention is applied to a fund management server, and the system includes the following modules:

[0044] The receiving module 10 is used for receiving the repayment from the first participant.

[0045] Specifically, the receiving module 10 may partially repay the loan by the first participant within the preset loan repayment period.

[0046] The repayment processing module 20 is used to unfreeze the partially frozen funds corresponding to the bank letter of credit according to the repayment amount after receiving the partial repayment of the first participant within the preset loan repayment period, and the bank letter of credit is issued by the second participant. An electronic commitment payment certificate that is applied to the fund management server and issued by the fund management server with the account funds or credit line as the deposit.

[0047] Specifically...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com