Financial time series prediction method based on integrated empirical mode decomposition and 1-norm support vector machine quantile regression

A financial time series and empirical mode decomposition technology, applied in the financial field, can solve problems such as gaps, inconvenient risk control for investors, and lack of price change descriptions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

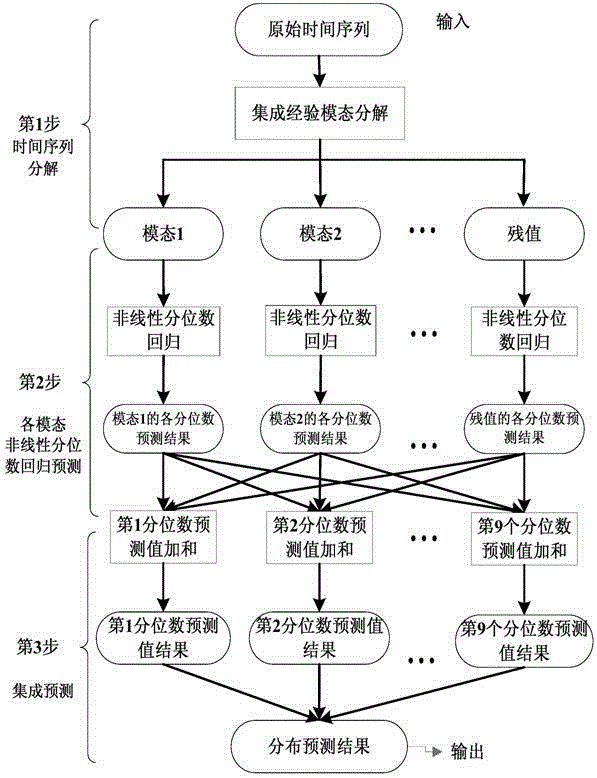

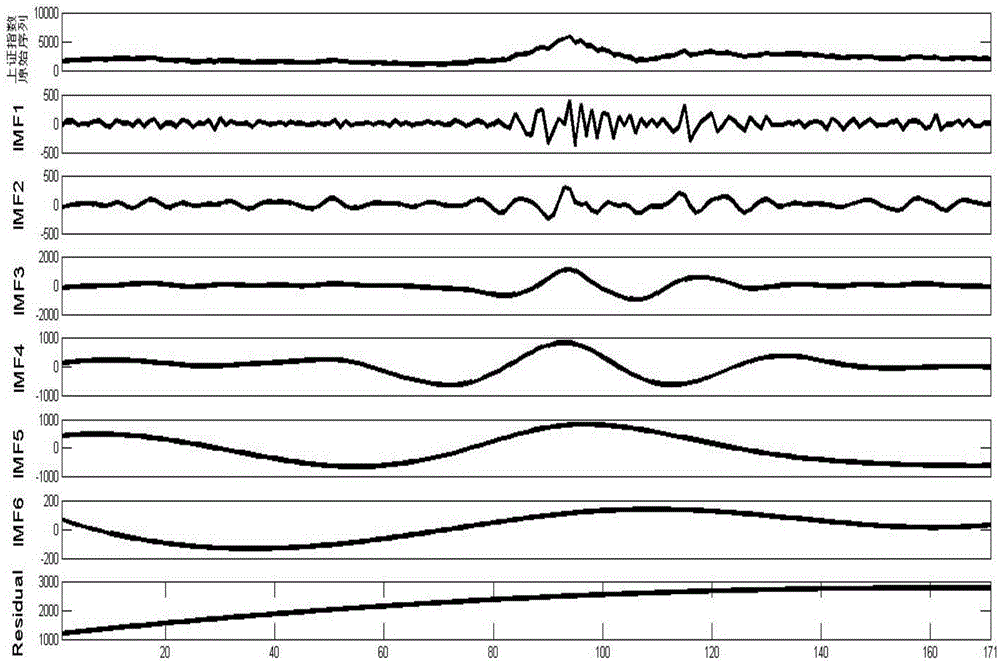

Method used

Image

Examples

Embodiment approach

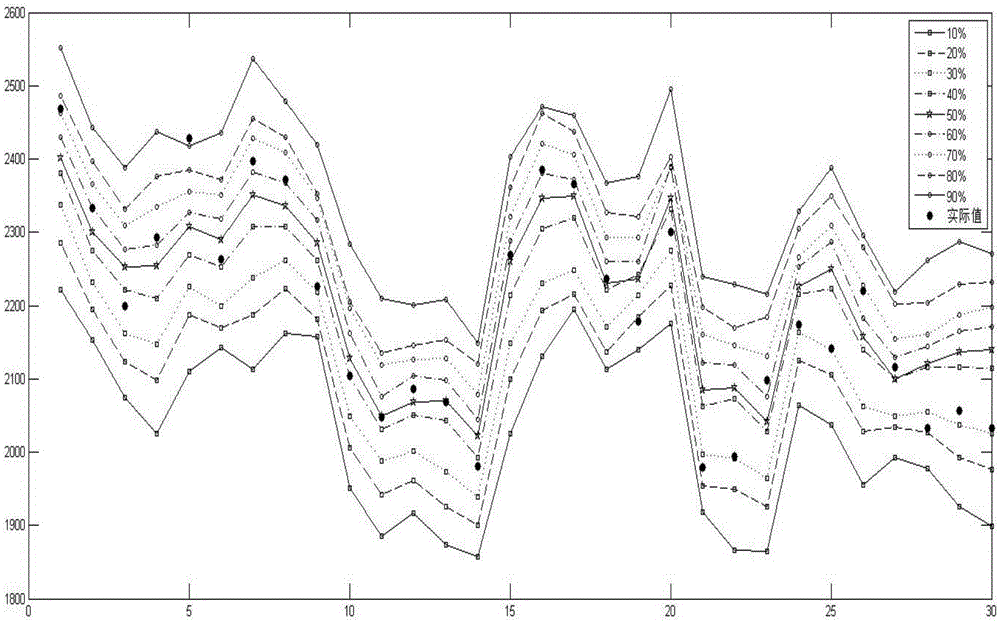

[0053] The second step: use the 1-norm support vector machine quantile regression model to decompose the N+1 sequences, and establish 9 sets of quantile prediction functions for each sequence, that is, τ=0.1,0.2,...,0.9 There are 9 quantiles in total, and a total of 9×(N+1) prediction functions are obtained. use f τ,j ,(j=1,2,...,N) represents the jth eigenmode function sequence c of the quantile τ j,t predictive function, f τ,r Represents the prediction function for the residuals. Its specific implementation method is as follows:

[0054] (1) According to the autocorrelation analysis of the time series, the lag period l (l<T) is determined by the Schwarz minimization principle (Bayesian information volume).

[0055] Take the original time series x t As an example, establish its p-order autoregressive model (AR(p)):

[0056] x t = β 0 +β 1 x t-1 +β 2 x t-2 +...+β p x t-p +ε t

[0057] The maximum likelihood function value L is obtained, then the Bayesian inform...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com