Hybrid machine learning credit scoring model building method

A credit scoring and machine learning technology, applied in machine learning, computing models, instruments, etc., can solve problems such as poor accuracy and efficiency, and achieve the effects of less time consumption, beneficial risk management, and comprehensive models

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

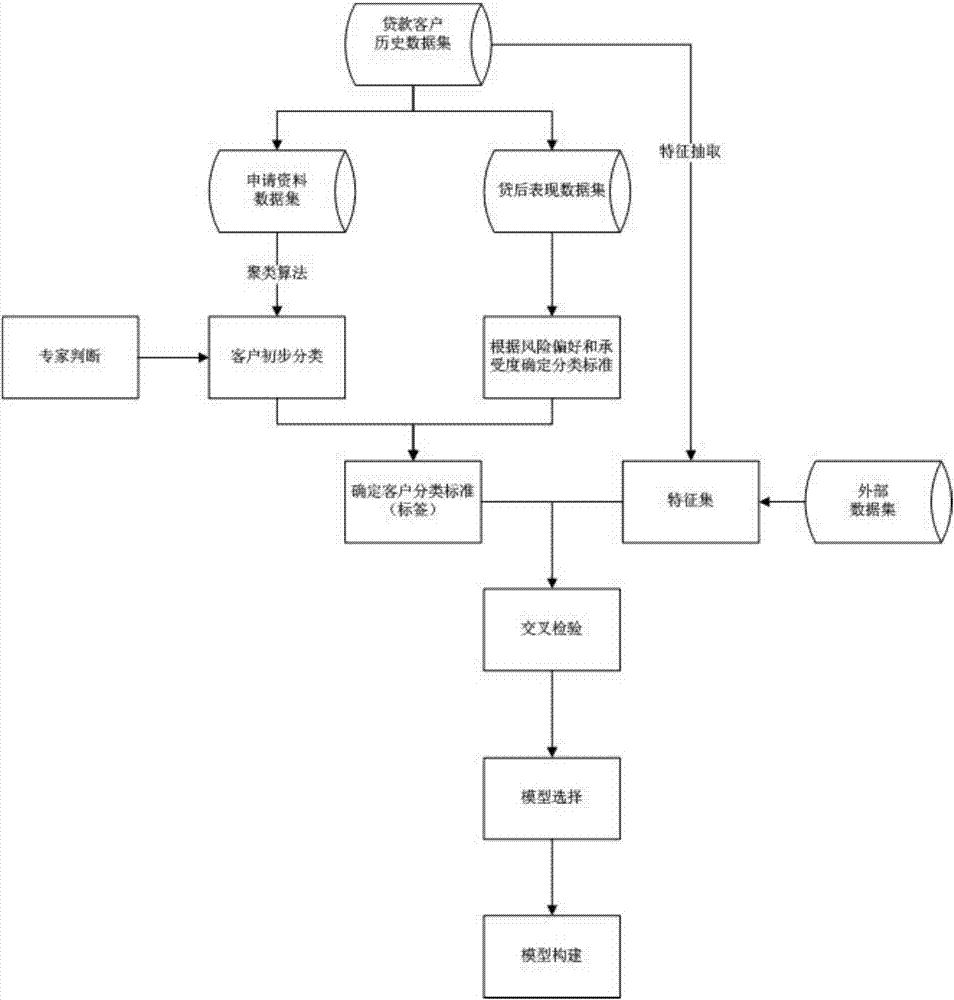

[0043] The present invention provides a method for constructing a hybrid machine learning credit scoring model, which solves the technical problems of poor accuracy and efficiency in traditional credit scoring technology, and realizes that the hybrid machine learning credit scoring model can be constructed efficiently and accurately. Complete the technical effect of user credit evaluation.

[0044] In order to be able to understand the above objectives, features and advantages of the present invention more clearly, the present invention will be further described in detail below in conjunction with the accompanying drawings and specific embodiments. It should be noted that the embodiments of the present application and the features in the embodiments can be combined with each other if they do not conflict with each other.

[0045] In the following description, many specific details are explained in order to fully understand the present invention. However, the present invention can a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com