User management system capable of fusing real-time taxation with national tax and local tax joint taxation

A user management and local tax technology, applied in finance, data processing applications, instruments, etc., can solve problems affecting tax service quality, tax collection and management efficiency, fair tax law enforcement, inconsistent law enforcement standards, and difficulty in mutual recognition of state and local tax information. The effect of improving the quality of tax service

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

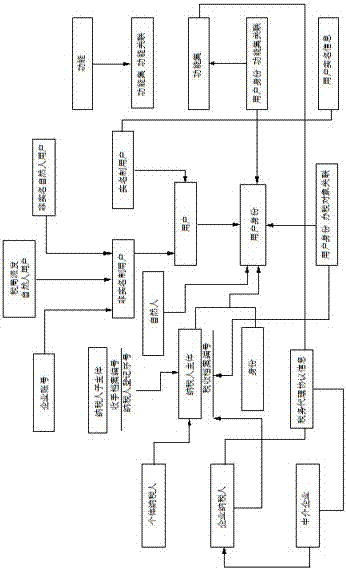

[0025] Such as figure 1 As shown, a user management system that integrates real-name tax handling and national and local tax joint tax handling. The system includes an application unit, a central unit, and a service unit, wherein:

[0026] The application unit refers to the application that the system provides external service pages, that is, the application to which the portal page used by the user belongs;

[0027] The central unit refers to the application that the system mentioned in the country provides external interface services;

[0028] Service unit: refers to the interface services provided by the system;

[0029] The application unit, the central unit and the service unit adopt the separated cloud architecture technology, and the data exchange between each unit is carried out through the high-speed service channel of Alibaba Cloud, which is safe and efficient, and the efficiency is significantly improved.

Embodiment 2

[0031] On the basis of Embodiment 1, the system described in this embodiment adopts real-name accounts, and realizes the identification and distinction between registered accounts and national and local tax original network halls by classifying accounts. When the central unit receives user information (user When the account type is registered and password, etc.), the account type will be automatically identified and the user information will be verified; after the registered user successfully logs in, the real-name information will be collected and bound to complete the user real-name authentication process, so as to qualify for real-name tax handling.

Embodiment 3

[0033] On the basis of Embodiment 1 or 2, the system described in this embodiment forms a taxpayer subject by associating national tax and local tax taxpayer information with key information such as tax file number and social credit code. The original national and local tax accounts are directly associated with the taxpayer, forming a mechanism for multiple accounts corresponding to the same taxpayer.

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap