Bank and small loan platform direct loan combined lending method based on open platform

An open platform and platform technology, applied in the field of loans, to achieve the effect of expanding consumer credit business and realizing business expansion and extension

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

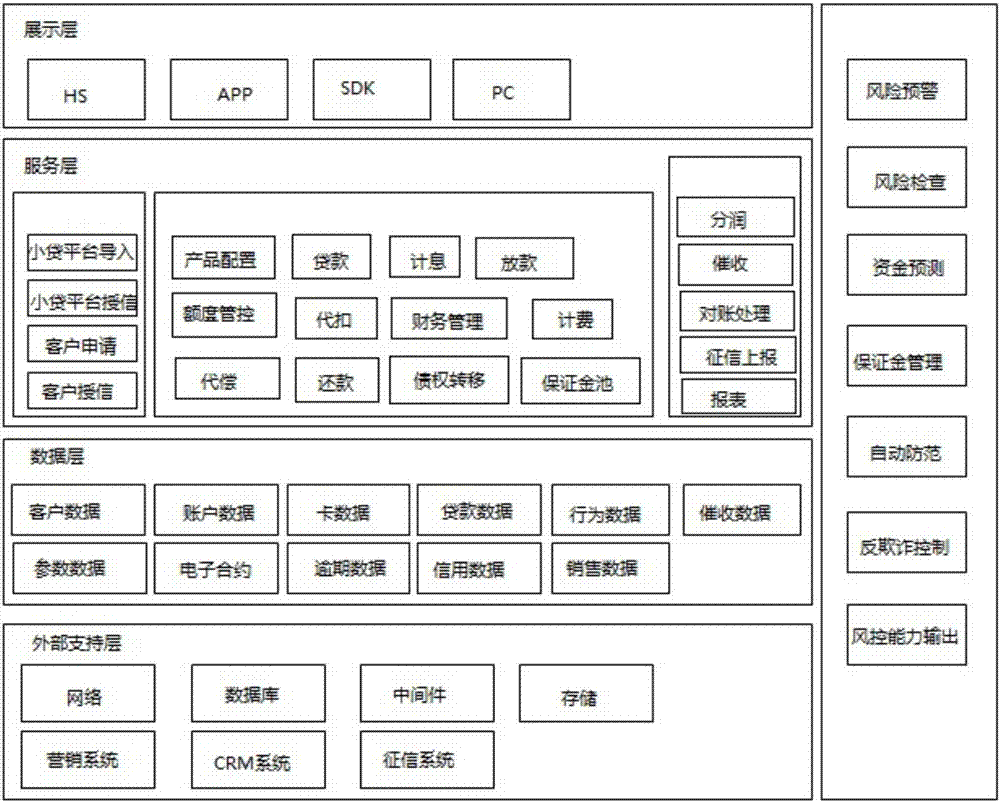

[0053] A method for joint lending based on an open platform between a bank and a small loan platform, the application framework of the method includes: an external support layer, a data layer, a service layer, a display layer, and a risk control layer;

[0054] The service layer includes pre-loan management, in-loan management, and post-loan management. Pre-loan management, in-loan management, and post-loan management respectively decouple and split the entire process nodes of the pre-loan process, in-loan process, and post-loan process into Separate process, the split process can be called separately.

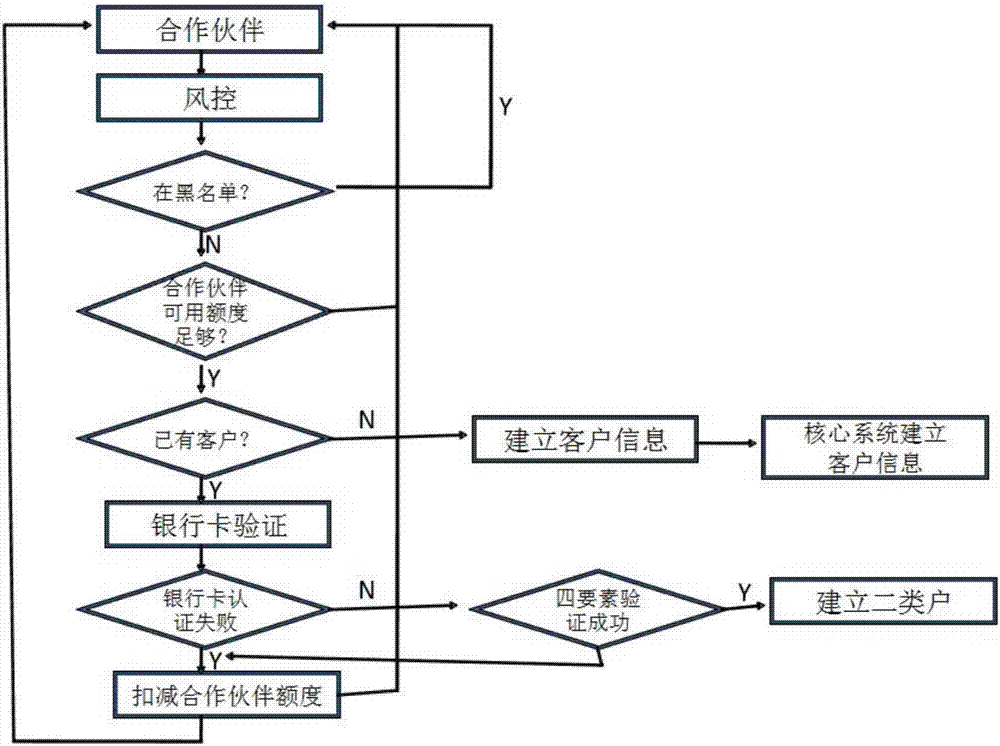

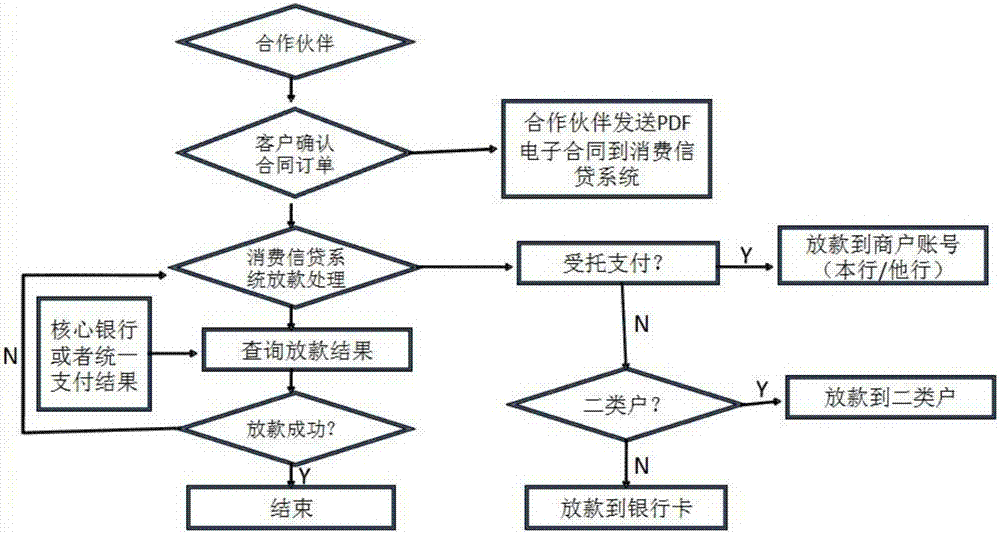

[0055] Specifically, the pre-loan process includes:

[0056] Introduction of small loan platforms: The risk control department of the bank conducts due diligence on the small loan platforms that have cooperation intentions to confirm whether they can cooperate; if not approved, it will end; if passed, it will enter the credit granting process of the small loan platform;

[0057...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com