Method and device for generating quantitative trading strategy based on multi-objective optimization, and storage medium

A multi-objective optimization and multi-objective technology, applied in the field of quantitative trading strategy generation method and device, equipment and storage medium based on multi-objective optimization, can solve the problems of undisclosed target factor optimization, low efficiency, and difficulty in adapting to market changes, etc. To achieve the effect of reducing the number of strategies and the corresponding backtesting running time, reducing the burden

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

no. 1 example

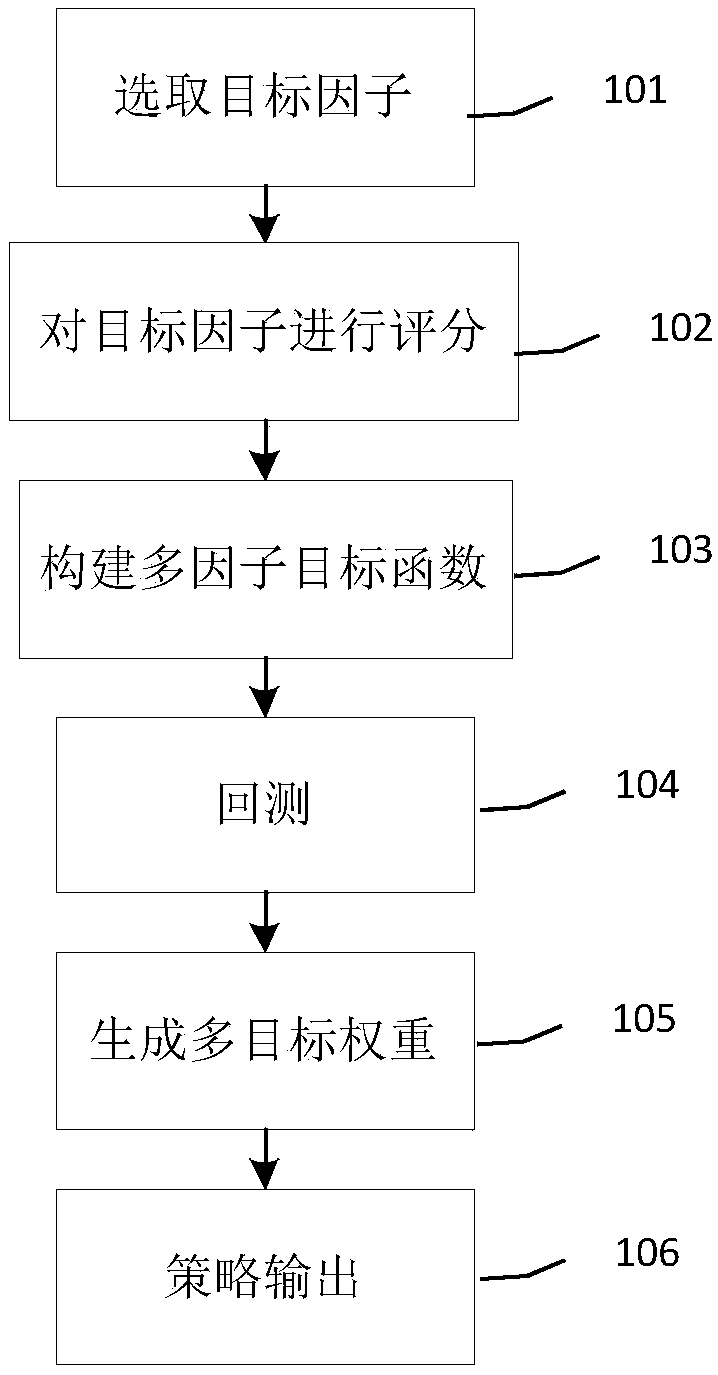

[0039] figure 1 It shows the first embodiment of the present invention, a flow of a quantitative trading strategy generation method based on multi-objective optimization, including the following steps:

[0040] Step 101, determine the target factor generated by the strategy, and the target factor is a financial attribute parameter.

[0041] The target factors generated by the strategy determined by the user are selected according to the user's investment preferences, and the target factors participating in the strategy generation can include one or more. Specifically, the factors are financial attribute parameters, including but not limited to yield curve, alpha yield, beta yield, Sharpe ratio, yield drawdown ratio, maximum drawdown, profit-loss ratio, consecutive loss cycles, and consecutive profit cycles.

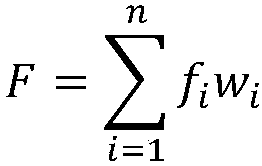

[0042] Step 102, scoring each target factor on the interval sample, and standardizing the score so that the score of the interval sample is in the interval defined by th...

Embodiment 2

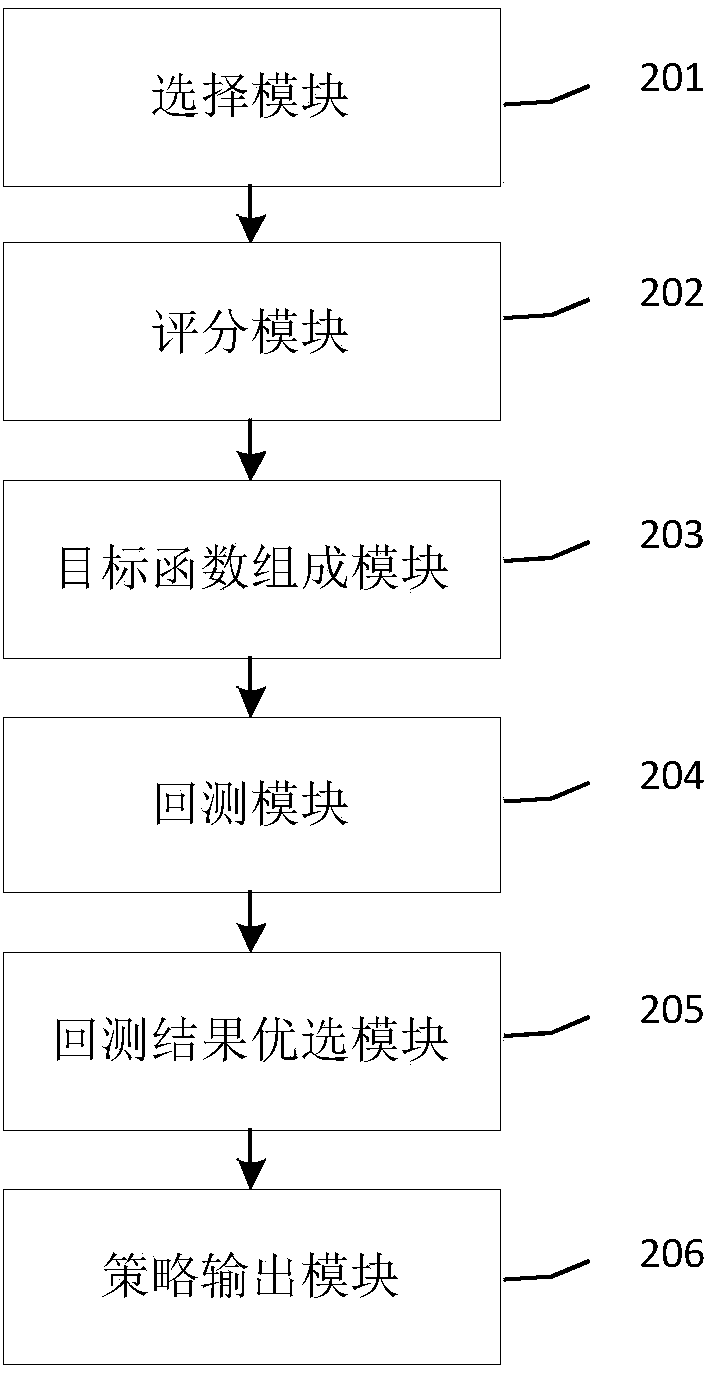

[0057] Corresponding to the method provided in Embodiment 1 of the method for generating a quantitative trading strategy based on multi-objective optimization in the present invention, see figure 2 , the present invention also provides a second embodiment of a quantitative trading strategy generation system based on multi-objective optimization. In this implementation, the system includes:

[0058] The selection module 201 is configured to determine a target factor for strategy generation, where the target factor is a financial attribute parameter.

[0059] The target factors generated by the strategy determined by the user are selected according to the user's investment preferences, and the target factors participating in the strategy generation can include one or more. Specifically, the factors are financial attribute parameters, including but not limited to yield curve, alpha yield, beta yield, Sharpe ratio, yield drawdown ratio, maximum drawdown, profit-loss ratio, consec...

Embodiment 3

[0077] The present invention also provides a quantitative trading strategy generation device based on multi-objective optimization, which includes: one or more processors, memory, and one or more programs, wherein the one or more programs are stored in the memory And configured to be executed by the one or more processors, the one or more programs include instructions for executing any method in the above embodiment of the method for generating a quantitative trading strategy based on multi-objective optimization.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com