Dynamic adjusting enterprise credit risk assessment method

A dynamic adjustment and risk assessment technology, applied in data processing applications, finance, instruments, etc., can solve the problems of slow update of credit scores, lack of quantitative indicators, lack of objective fairness and operability, and achieve the effect of avoiding risk losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] In order to make the object, technical solution and advantages of the present invention clearer, the present invention will be further described in detail below in combination with specific embodiments and with reference to the accompanying drawings. It should be understood that these descriptions are exemplary only, and are not intended to limit the scope of the present invention. Also, in the following description, descriptions of well-known structures and techniques are omitted to avoid unnecessarily obscuring the concept of the present invention.

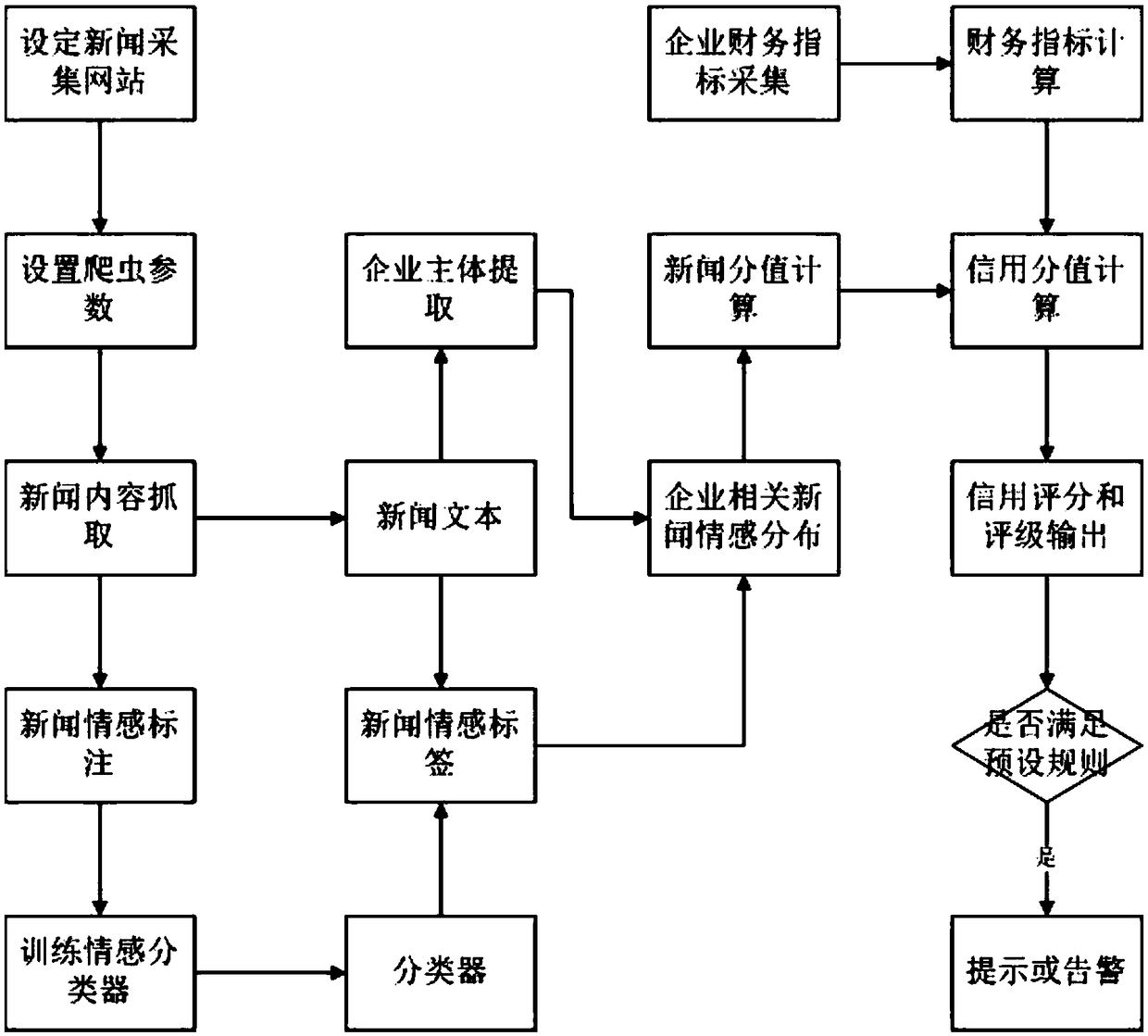

[0030] like figure 1 Shown, the enterprise credit risk assessment method of dynamic adjustment of the present invention comprises the following steps:

[0031] Step 1: Use web crawlers or similar methods to cover the financial news modules of major portal websites and professional websites related to finance, investment, bonds, stocks, and derivatives, as well as policies, laws, corporate administrative agencies, courts,...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com