Method and technology for direct commercial district financing of micro enterprises and shops

An enterprise and tiny technology, applied in finance, using information identifiers to retrieve web data, instruments, etc., can solve the problems of shrinking guarantee business scale of small and medium-sized enterprises, high cost of information acquisition, high financing cost of small and micro enterprises, and reduce access time Loss, the effect of achieving financing efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0026] Hereinafter, the invention will now be described more fully with reference to the accompanying drawings, in which various embodiments are shown. However, this invention may be embodied in many different forms and should not be construed as limited to the embodiments set forth herein. Rather, these embodiments are provided so that this disclosure will be thorough and complete, and will fully convey the scope of the invention to those skilled in the art.

[0027] Hereinafter, exemplary embodiments of the present invention will be described in more detail with reference to the accompanying drawings.

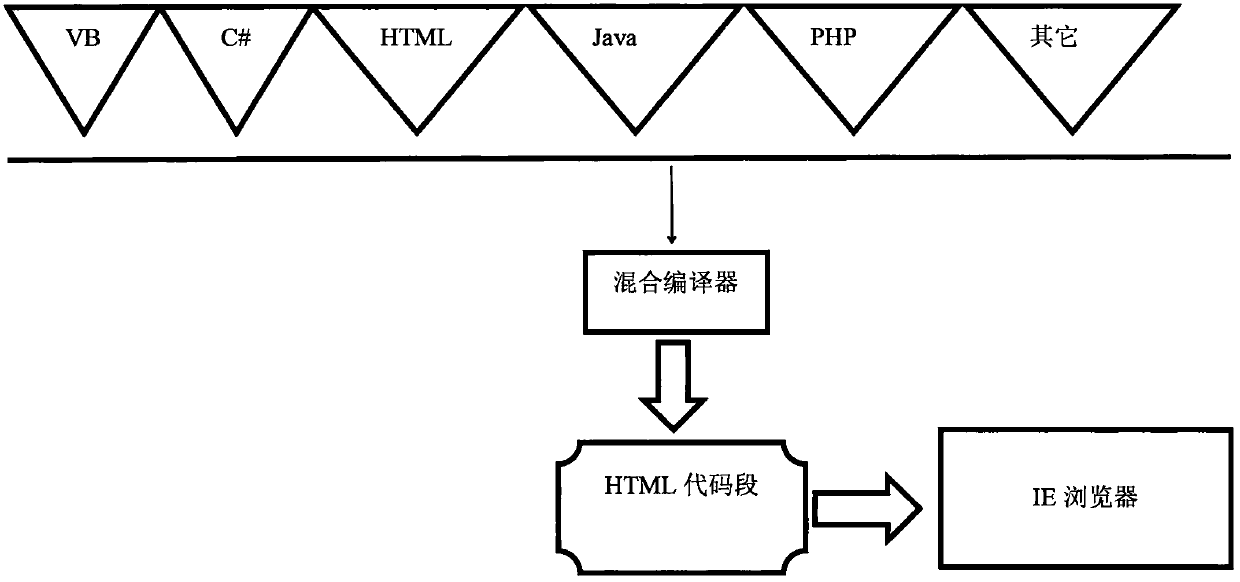

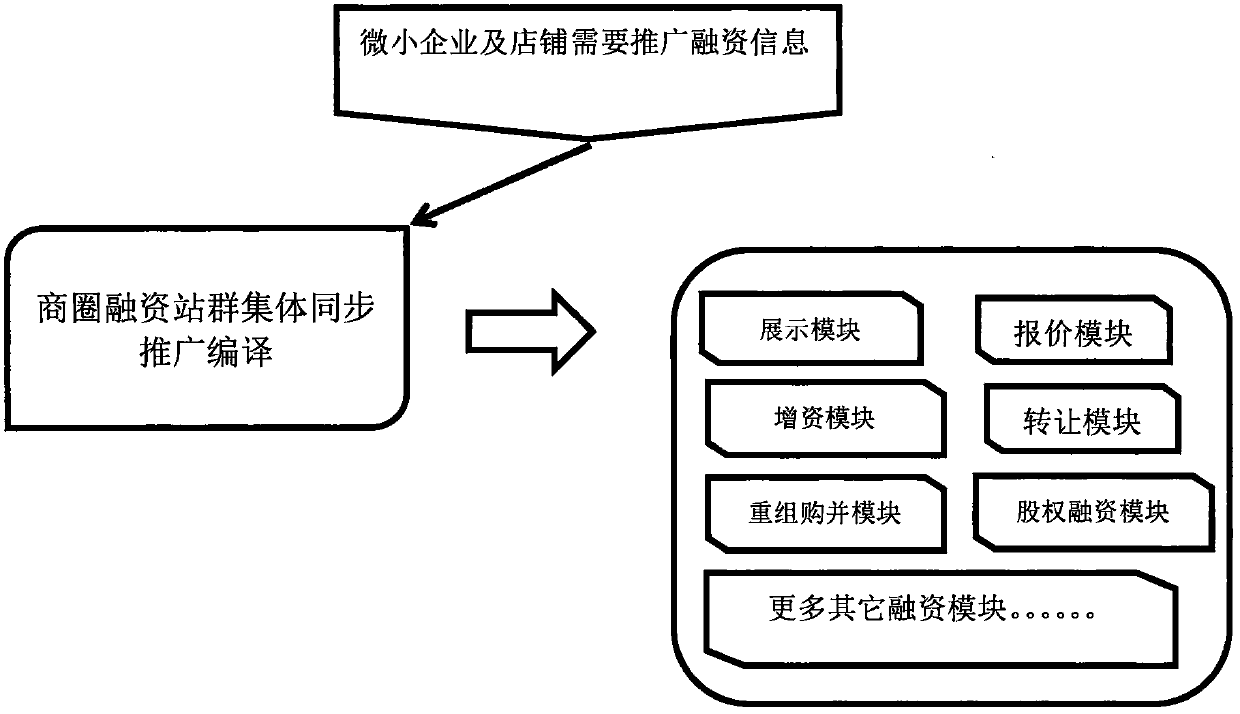

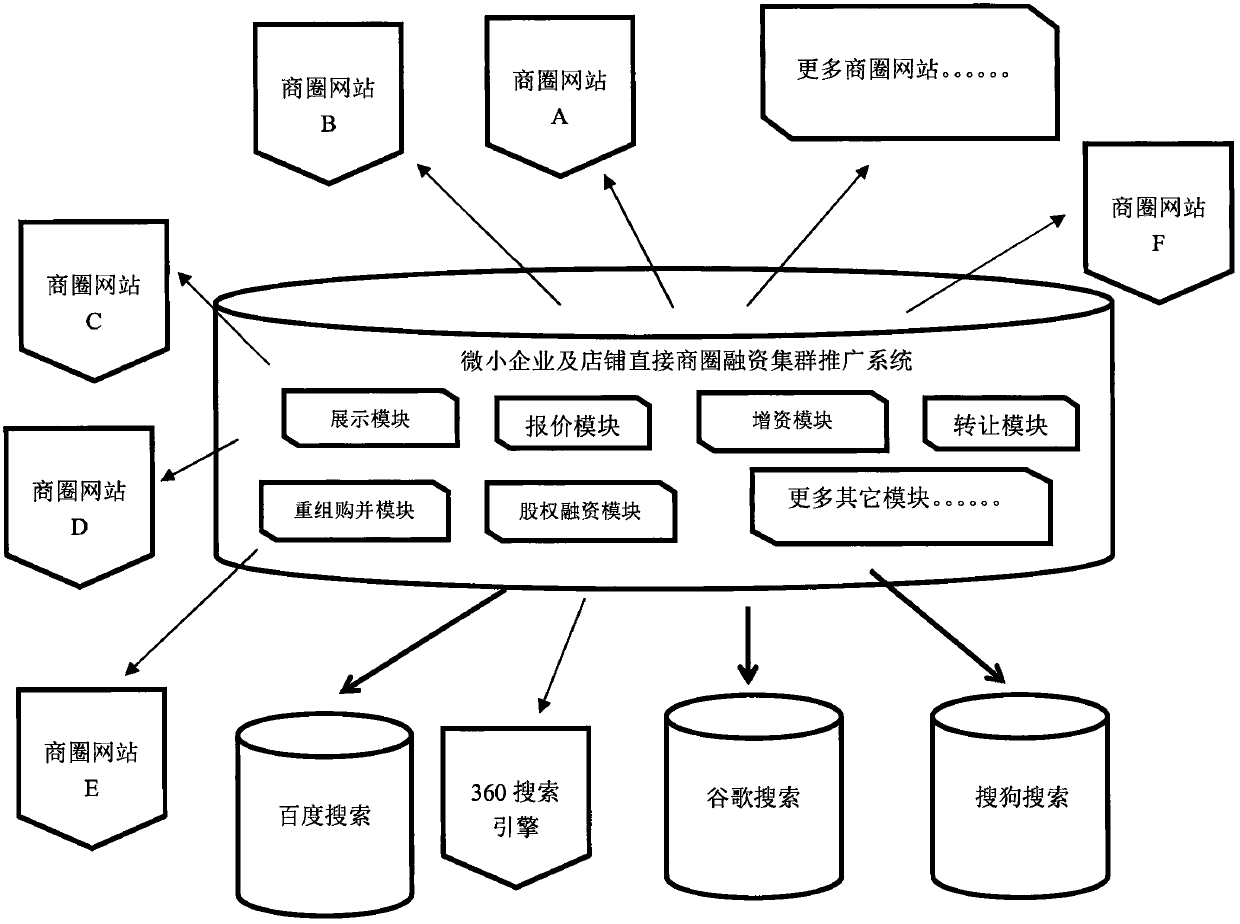

[0028] combined with figure 1 As shown, the keywords of the programming language are analyzed one by one through the code, combined and mixed, and then compiled into an executable programming language in a unified manner, so that each customer can use the group financing website group synchronous promotion technology in the business circle to achieve the search in the formul...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com