Repayment method and device, terminal equipment and storage medium

A preset and capital technology, applied in the field of Internet finance, can solve problems such as non-compliance in repayment operations, achieve the effect of standardizing the operation model and reducing capital risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

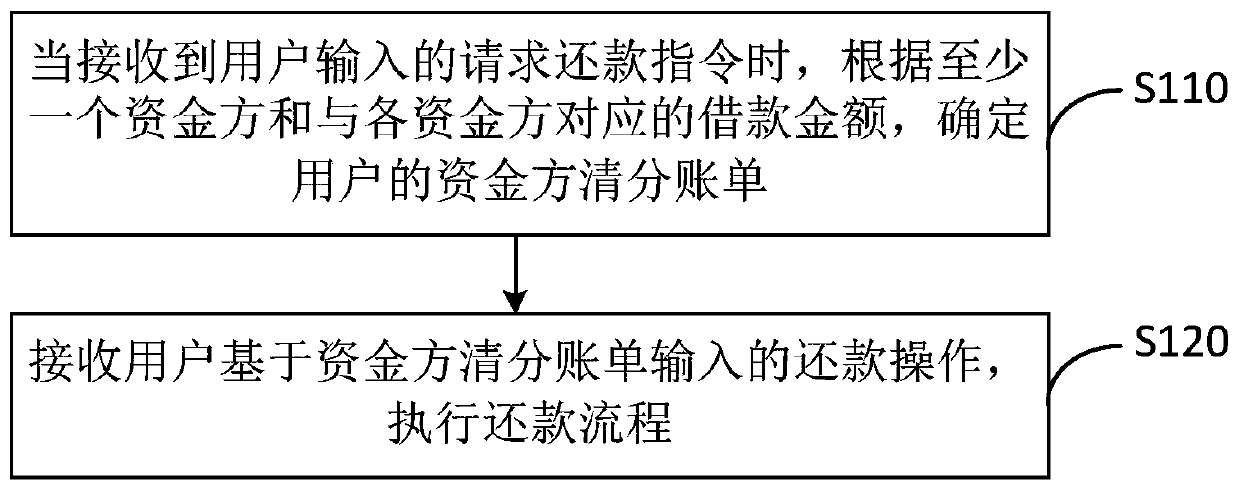

[0027] figure 1 It is a flow chart of a repayment method provided by Embodiment 1 of the present invention. This embodiment is applicable to the situation where users make repayment on the online loan platform. The method can be executed by a repayment device, which can use software and / or implemented in the form of hardware, the device can be configured in terminal equipment, such as mobile phones, ipads and computers. Specifically include the following steps:

[0028] S110. When the repayment request input by the user is received, according to at least one funder and the loan amount corresponding to each funder, determine the user's funder clearing bill, wherein the funder clearing bill includes at least one pending Repayment Amount.

[0029] Wherein, the instruction for requesting repayment includes, but is not limited to, a repayment bill and a repayment scenario input by the user. Wherein, the repayment bill refers to a bill on which a repayment operation is currently...

Embodiment 2

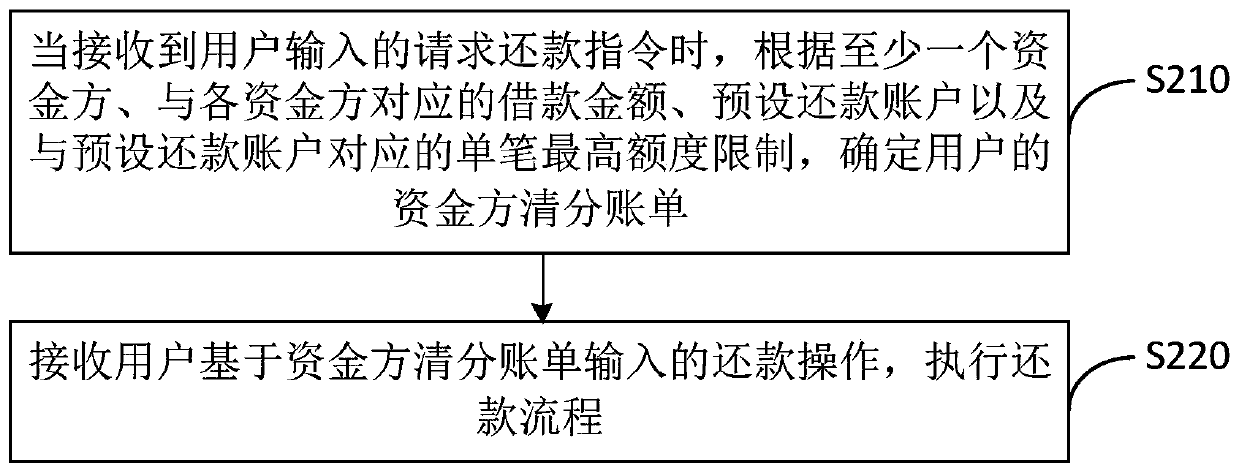

[0039] image 3 It is a flow chart of a repayment method provided by Embodiment 2 of the present invention, and the technical solution of this embodiment is further refined on the basis of the above embodiments. Optionally, according to at least one funder, the loan amount corresponding to each funder, the default repayment account, and the single maximum amount limit corresponding to the preset repayment account, determine the user's funder clearing bill.

[0040] The specific implementation steps of this embodiment include:

[0041] S210. When receiving a repayment request input by the user, determine according to at least one funder, the loan amount corresponding to each funder, the default repayment account, and the single maximum limit corresponding to the default repayment account The user's fund side clears the bill.

[0042] In one embodiment, optionally, the initial repayment account is determined according to the repayment scenario in the repayment request instruc...

Embodiment 3

[0061] Figure 6 It is a schematic diagram of a repayment device provided by Embodiment 3 of the present invention. This embodiment is applicable to the situation where the user repays the loan on the online loan platform. The device can be implemented in the form of software and / or hardware, and the device can be configured in terminal equipment, such as mobile phones, ipads and computers. The repayment device includes: a funder clearing bill determination module 310 and a repayment process execution module 320 .

[0062] Wherein, the funder clearing bill determination module 310 is configured to determine the user's funder clearing bill according to at least one funder and the loan amount corresponding to each funder when receiving a request for repayment input by the user, wherein, The funder's clearing bill includes at least one amount to be repaid;

[0063] The repayment process execution module 320 is configured to receive the repayment operation input by the user base...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com