Patents

Literature

38results about How to "Reduce capital risk" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method and system for processing transaction data and payment system

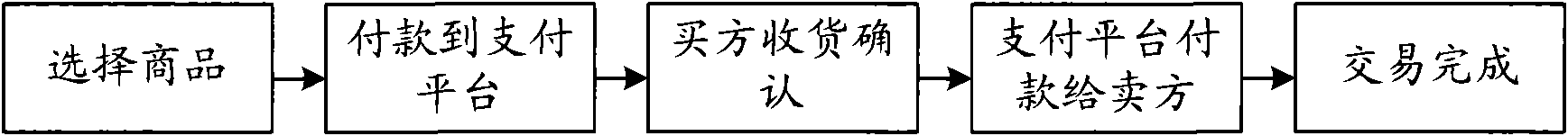

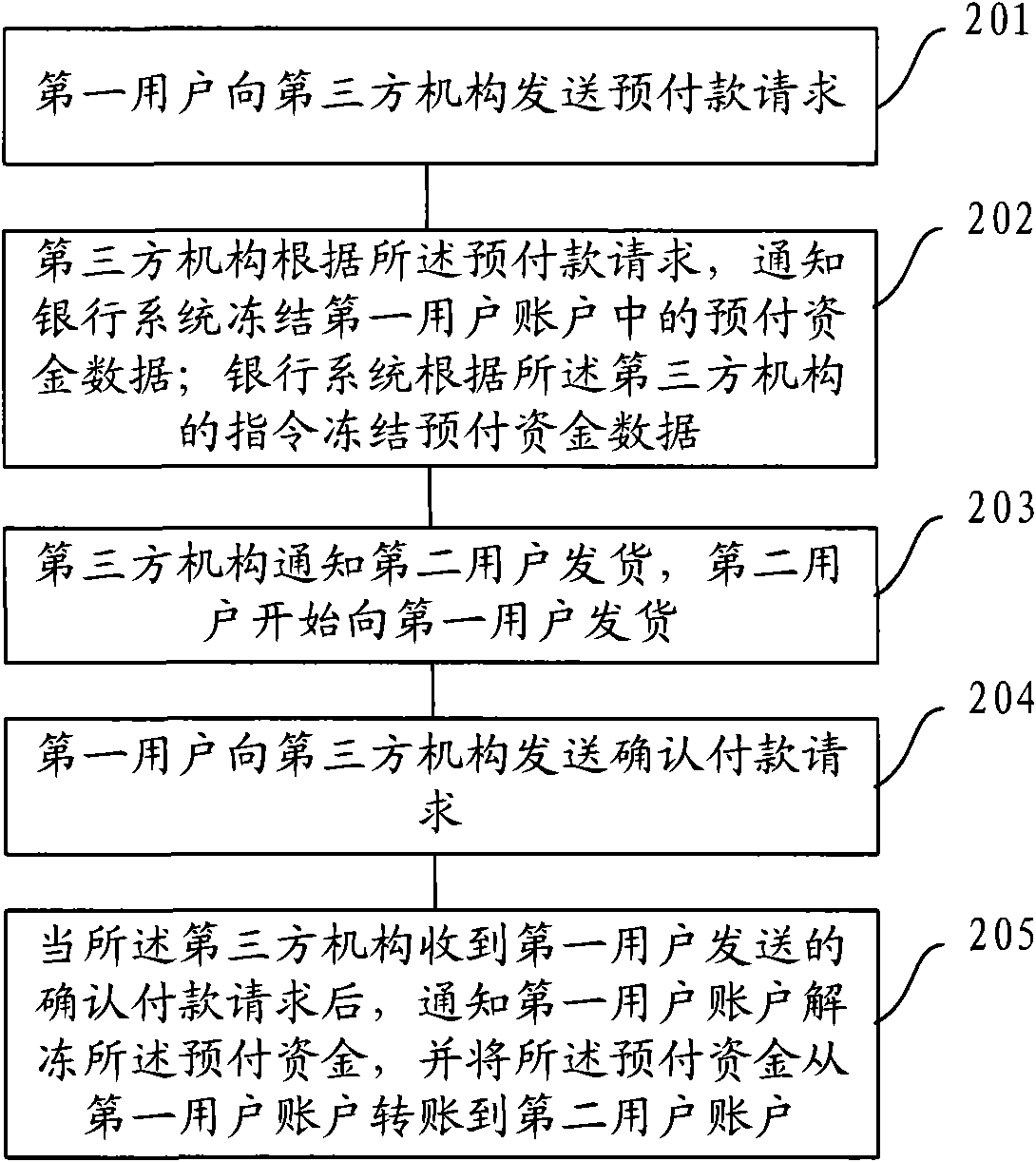

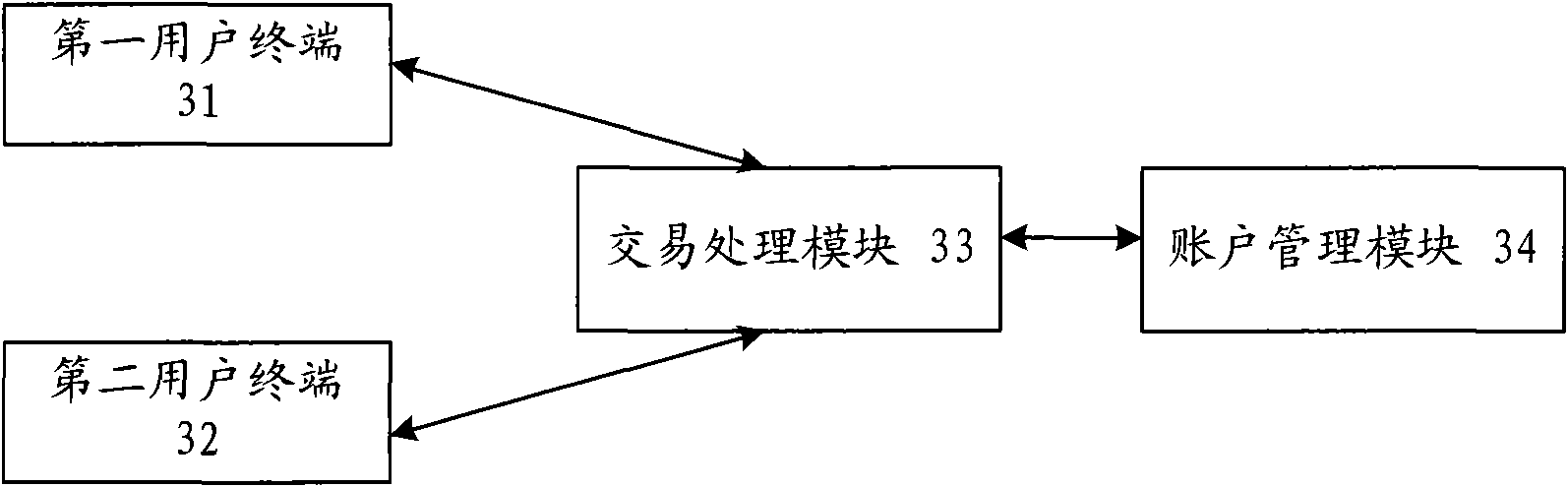

The invention discloses a method and a system for processing transaction data and a payment system, solving the problem of complicated data processing procedures and low security in the prior transaction method. The method comprises the steps: sending an advance payment request to a third party system by a first user terminal; notifying a bank system to freeze the advance fund data in a first user account by the third party system according to the advance payment request; freezing the advance fund data in the first user account by the bank system according to an instruction of the third party system; sending a confirmation payment request to the third party system by the first user terminal; and notifying the bank system to unfreeze the advance fund data by the third party system according to the confirmation payment request and transferring the advance fund data from the first user account to a second user account. The invention is unnecessary to deposit to the third party organization before the transaction is finished and only freeze the part of the fund data, thereby reducing the processing procedures of the transaction data and ensuring the security of the transaction.

Owner:CHINA UNIONPAY

A supply chain finance application method based on block chain alliance chain technology

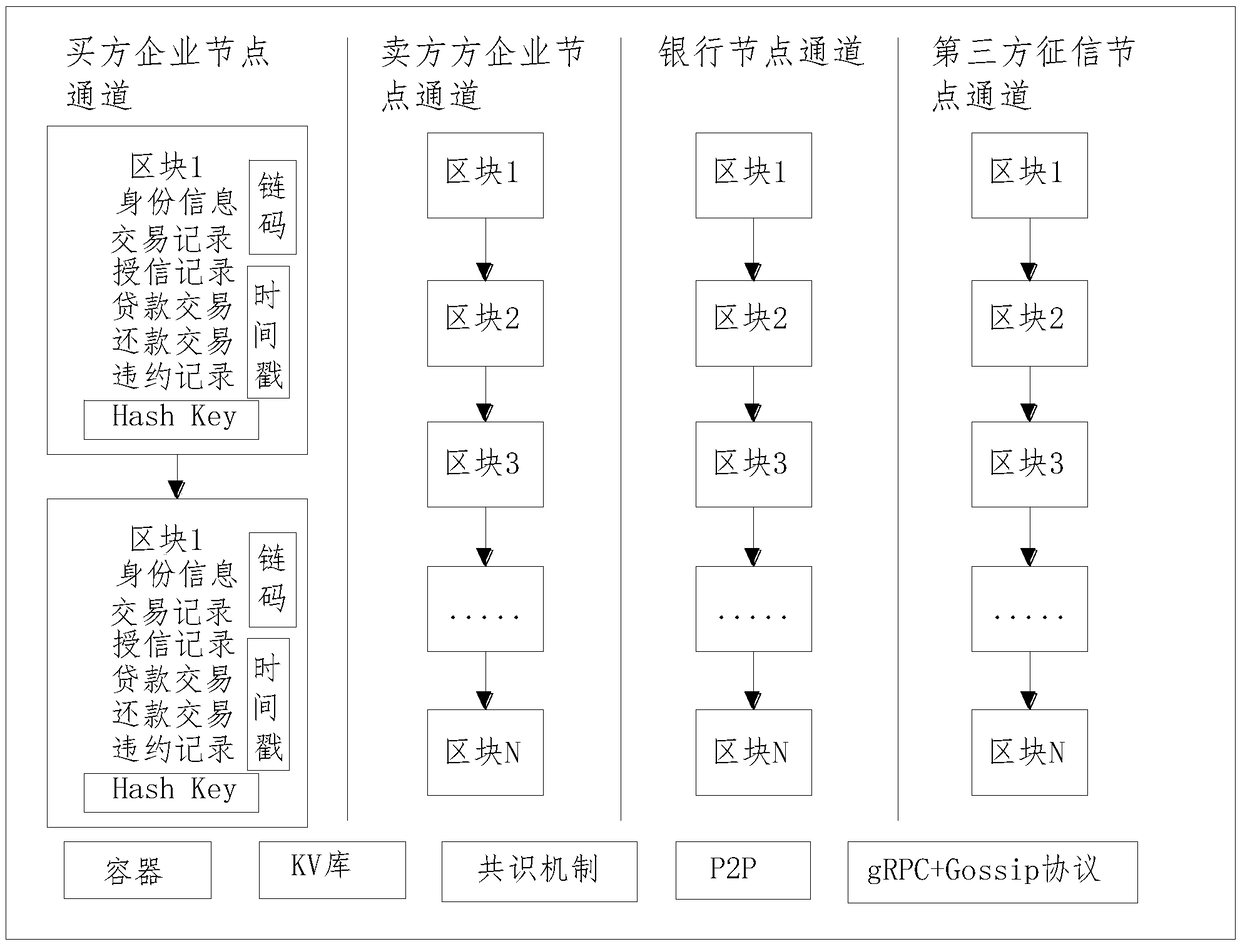

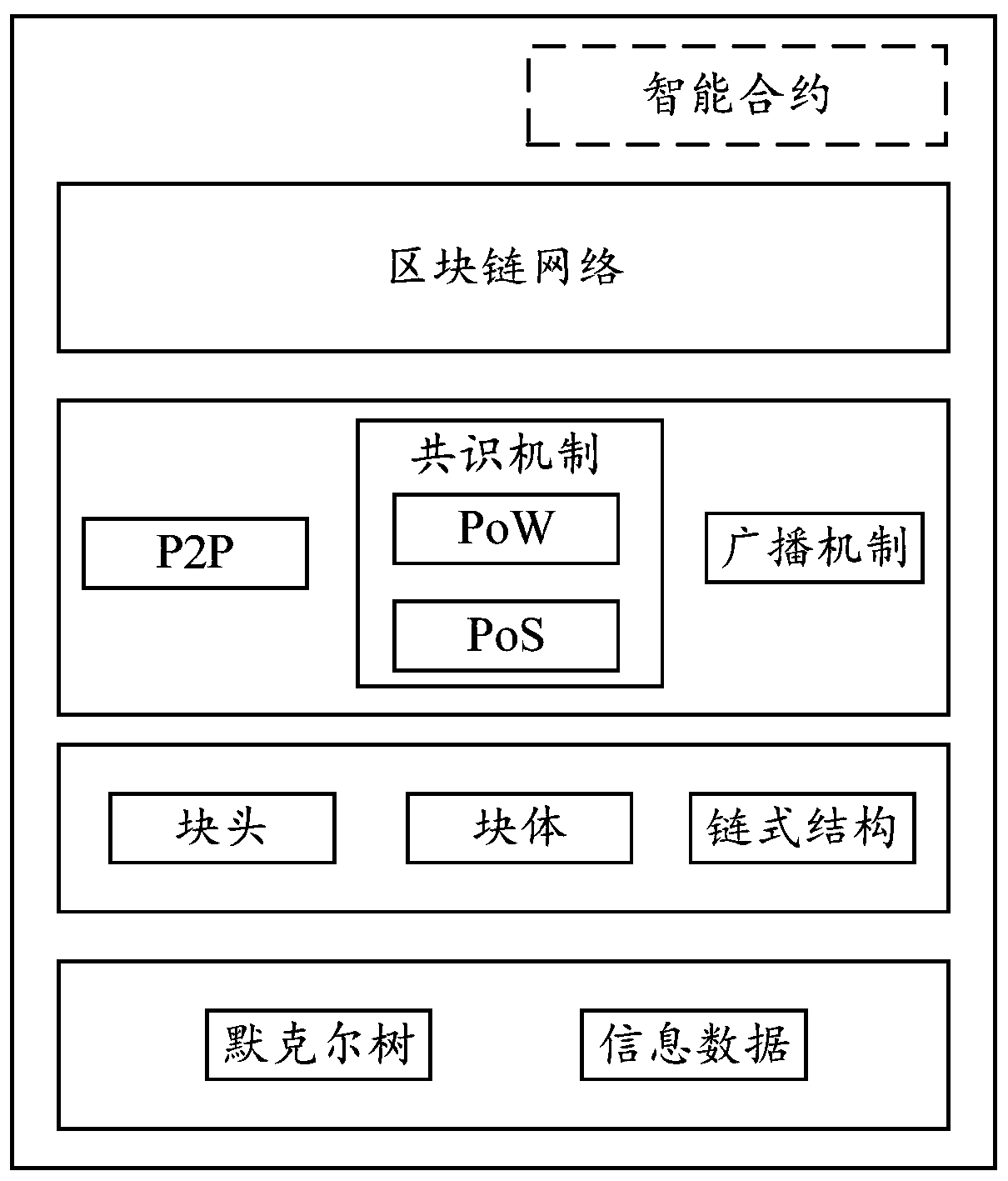

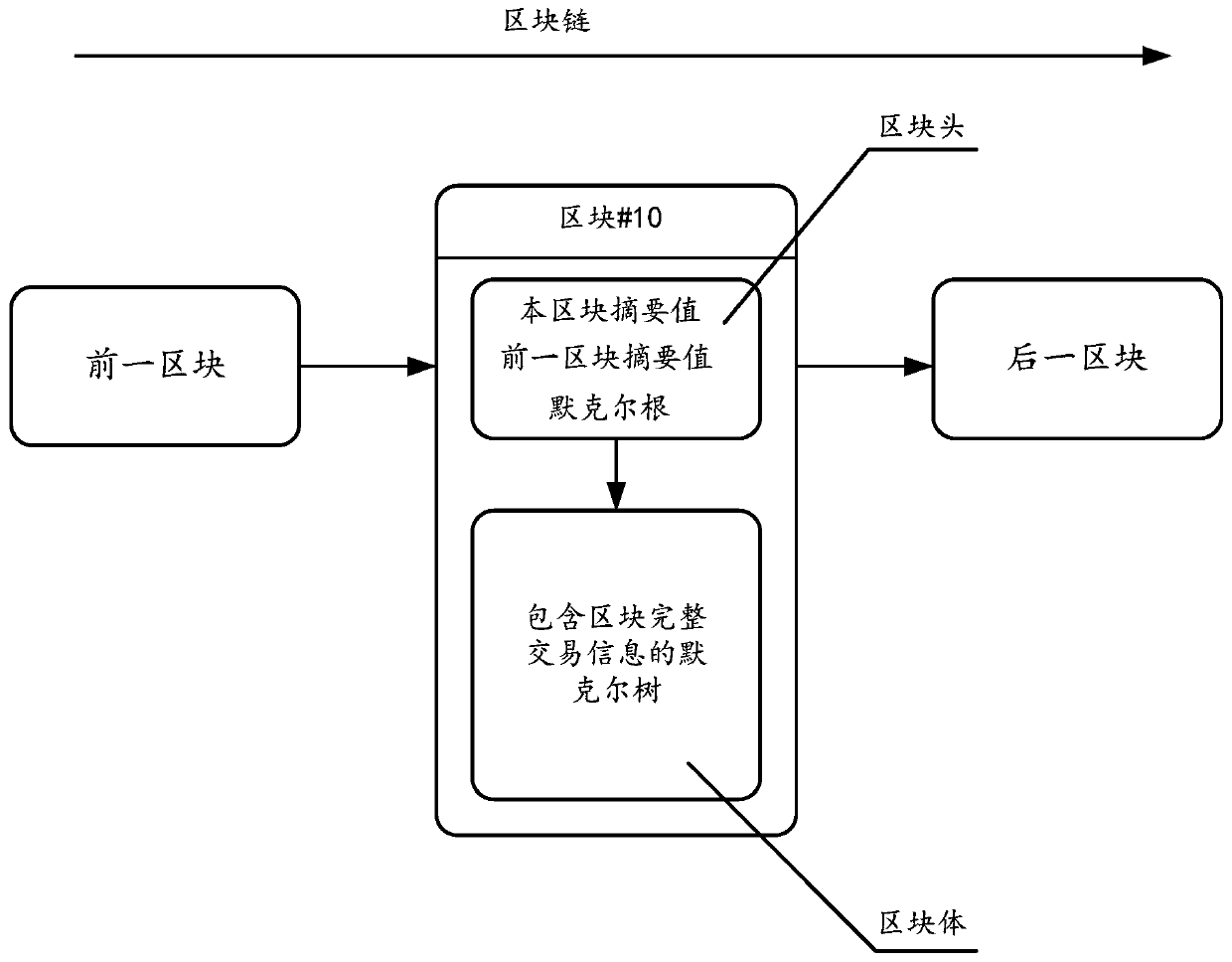

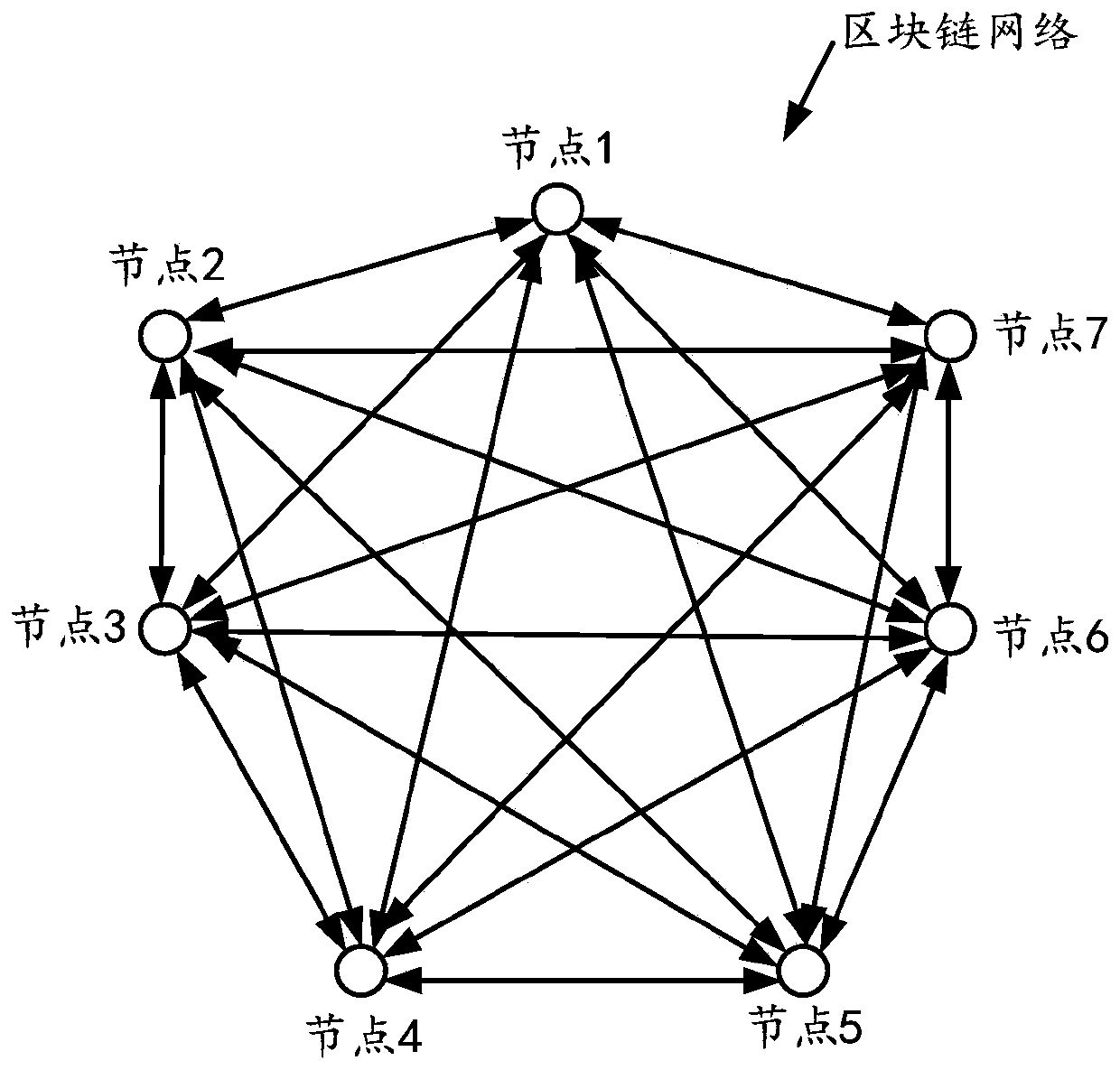

The invention discloses a supply chain finance application method based on block chain alliance chain technology Hyperledger. The whole structure of the invention is reasonable, the business data of the buyer and the seller are directly linked, the authenticity of the transaction data in the supply chain is ensured, the distrust of the data inconsistency among the parties is reduced, the complicated process and operation of the data repeated confirmation are avoided, the transparency of the transaction and the transparency of the data are ensured, and the basic guarantee is provided for effective supervision. In the supply chain financial business, the transaction data are mostly transformed into effective assets. After the whole transaction process is linked, the problem of repeated pledges of the buyer and seller enterprises to multiple parties is effectively eliminated, and the transaction safety and transparency are guaranteed. The whole process business data and related transaction data recorded by block chain super book are trustworthy, reliable and unalterable shared and distributed book system, which is guaranteed by time stamp, hash algorithm, encryption algorithm, P2P network technology, consensus algorithm and other technologies, but can not be tampered with.

Owner:广州立趣信息科技有限公司

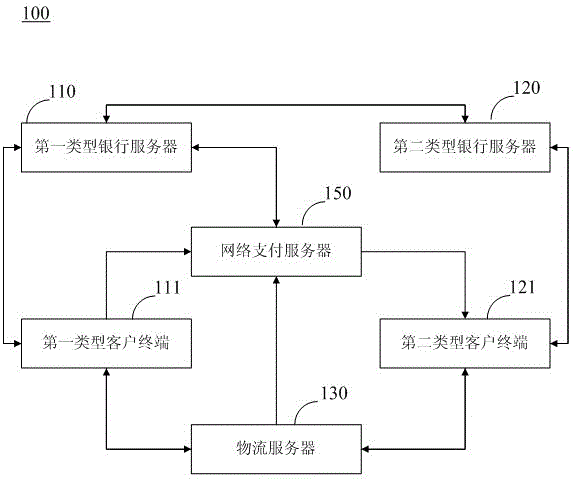

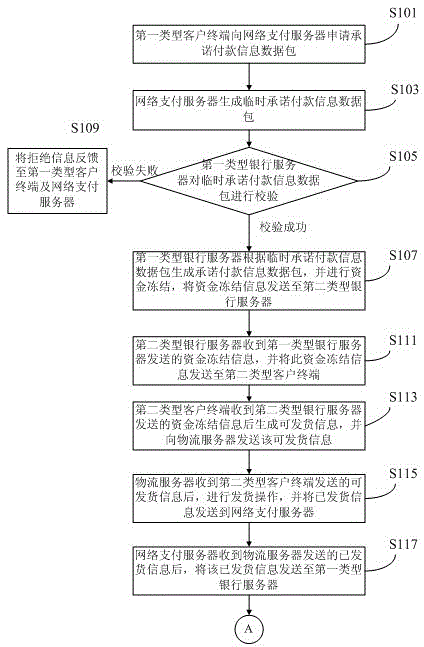

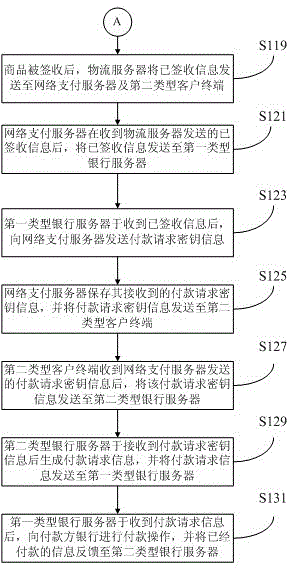

Method and system for Intenet payment

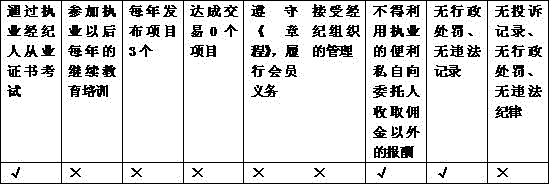

InactiveCN103827902AReduce capital riskProtect interestsFinancePayment architectureE-commerceNetwork packet

The invention is suitable for the field of electronc commerce technology, and provides a method and a system for Internet payment.The method comprises the following steps: a first type client terminal sends application information to an Internet payment server to apply a commitment payment information data package; based on the application information, the Internet payment server generates and sends a temporary commitment payment information data package to a first type bank server; the first type bank server verifies the temporary commitment payment information data package; and if verifies successively, the first type bank server generates a commitment payment information data package based on the temporary commitment payment information data package, carries out fund freezing and sends fund freezing information to a second type bank server. According to the invention, for a payment clinet, fund is just frozen and needs not to be paid, so fund risks are reduced and benefit of the payment client is ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

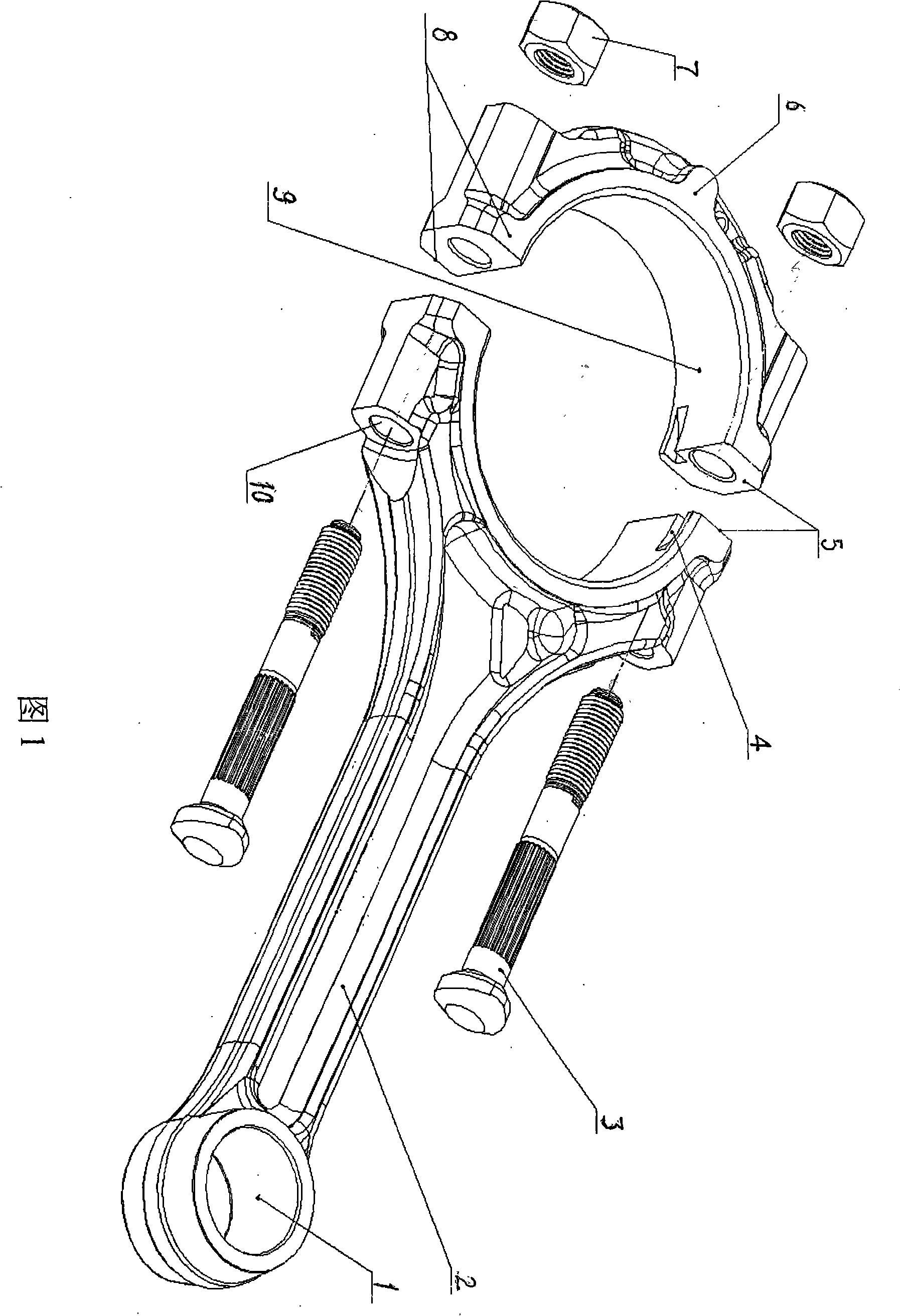

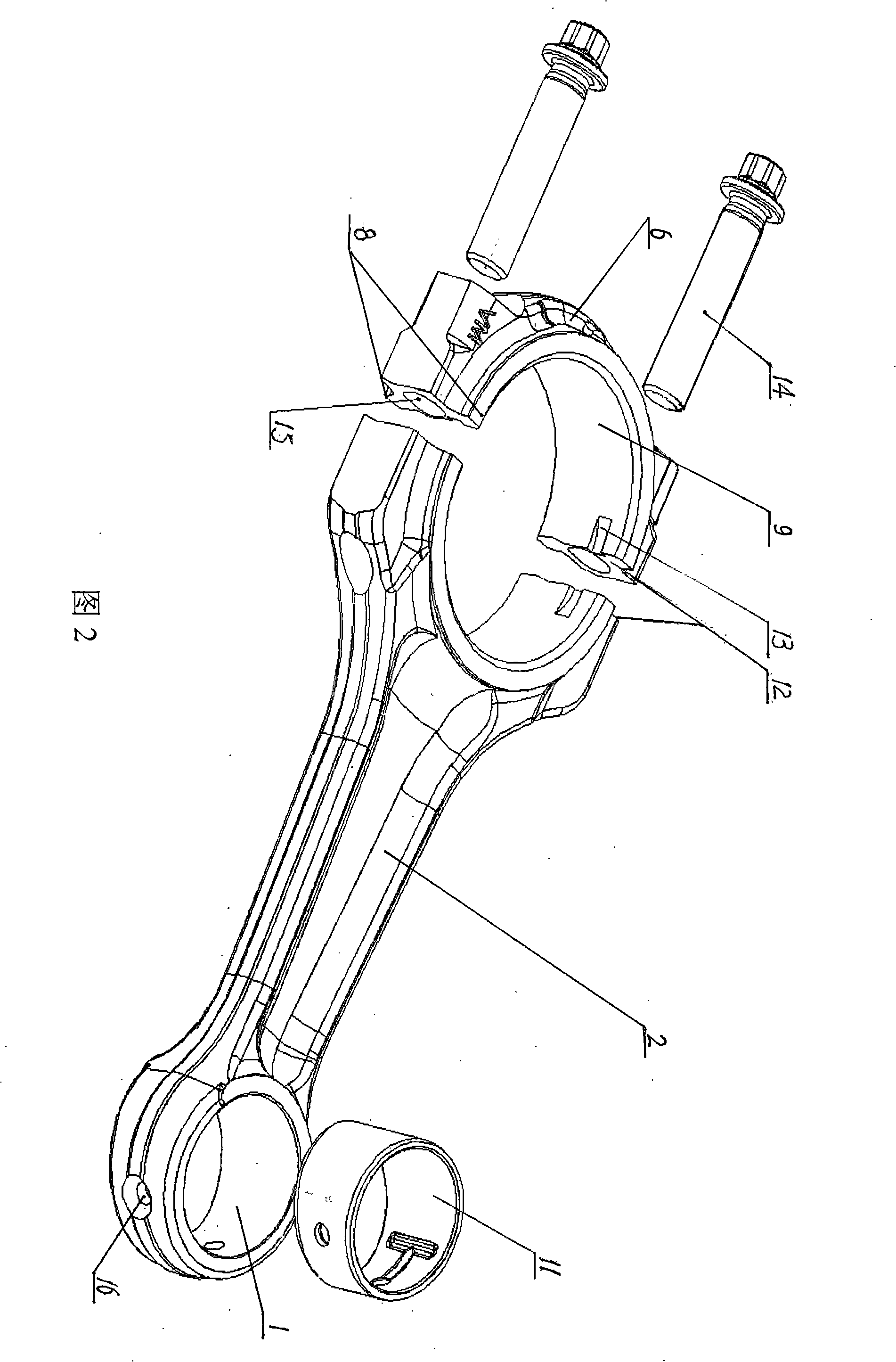

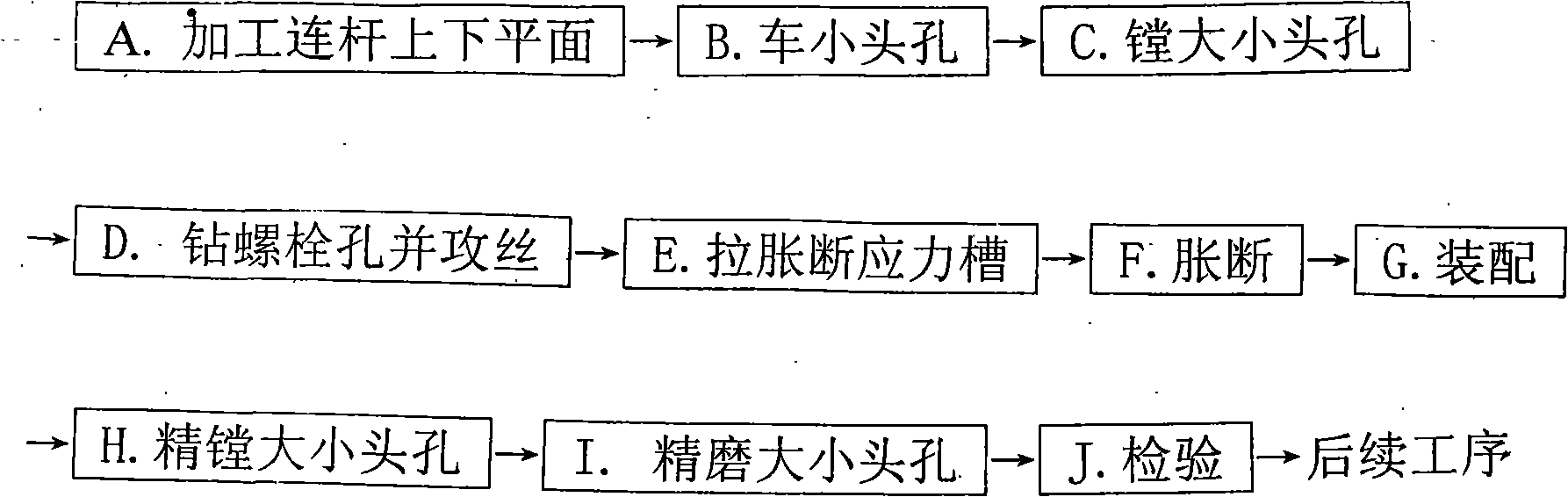

Method for processing fractured connecting rod for car engine

ActiveCN101352795AEasy to useReduce capital riskBroaching toolsPositioning apparatusDiesel engineAutomotive engine

The invention discloses an expansion-breaking processing method of a connection rod used for an automobile engine which is also applied to the processing of the connection rods of a diesel engine, a barge engine, etc. The method is mainly characterized by adopting a technical flow as follows: processing the upper plane and the lower plane of the connection rod; machining a small end hole; boring a small end hole and a big end hole; drilling a bolt hole and tapping; drawing an expansion-breaking stress slot; expansion-breaking; assembling; preciously boring the small end hole and the big end hole; preciously milling the small end hole and the big end hole, detecting, etc. Practical applications proves that the method reduces accumulated errors, thus effectively improving the use performance of a connection rod assembly; reducing working procedure and processing precision as well as improving efficiency; the method adopts a common device and a special clamp to finish the expansion-breaking processing, thus being applied to the multi-variety small-batch production of the connection rod and simultaneously reducing the investment risk.

Owner:苏垦银河汽车部件盐城有限公司

Financial leasing method based on network platform

PendingCN106570735AIncrease diversityImprove efficiencyFinanceBuying/selling/leasing transactionsInformation sharingThe Internet

The invention discloses a financial leasing method based on a network platform. The method comprises the following steps: obtaining project information submitted by a project party; importing the project information into an expert library, and obtaining the project data derived from the expert library; releasing the project data; matching a capital-party database according to the project data and pushing the project data to the matched capital party; acquiring the connection request of the capital party; acquiring the confirmation information of a project party; and completing a financial leasing transaction. The financial leasing method achieves the connection of the project party and the capital party through the Internet, processes the information of the two parties, reduces repeated intermediate links of communication, negotiation, field visit between the two parties, reduces a fund risk to a minimum due to original uneven business levels through information sharing and standardization of the transaction process, enhances communication efficiency, and reduces overall cost.

Owner:上海融资租赁经纪股份有限公司

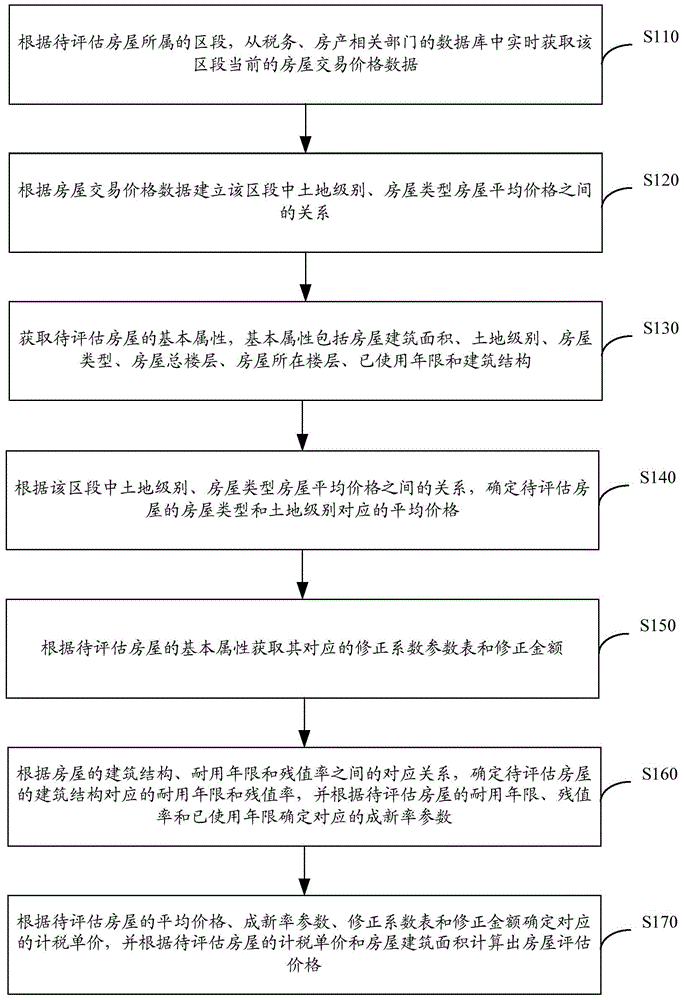

Real estate transaction tax integrated house price evaluation method

The invention discloses a real estate transaction tax integrated house price evaluation method. The method comprises the following steps: establishing the relationship among the land level, the house type and the average house price of a section according to house transaction price data; determining the average price corresponding to the house type and land level of a house to be evaluated according to the relationship among the land level, the house type and the average house price of the section; determining the service life and the residual rate corresponding to the building structure of the house to be evaluated according to the correspondence among the building structure, the service life and the residual rate of the house, and determining a corresponding newness rate parameter according to the service life, the residual rate and the serviced life of the house to be evaluated; determining a corresponding tax unit price according to the average price, the newness rate parameter, a correction coefficient table and the amount of money for correction of the house to be evaluated, and calculating the evaluated price of the house according to the tax unit price and the construction area of the house to be evaluated.

Owner:AEROSPACE INFORMATION

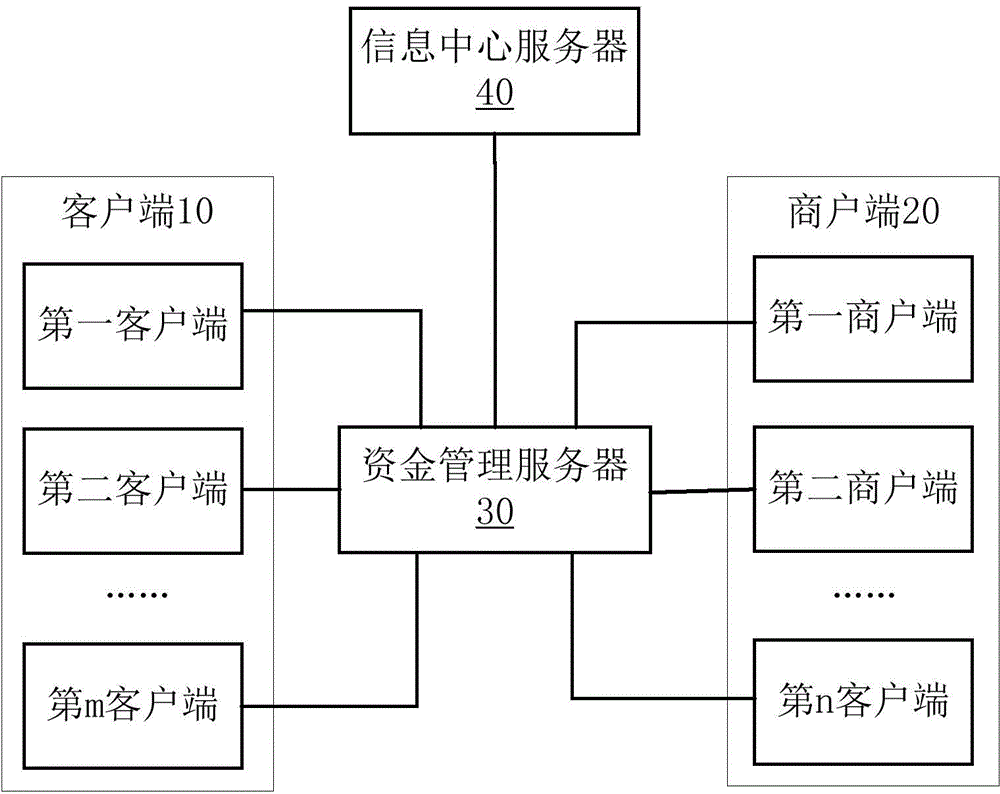

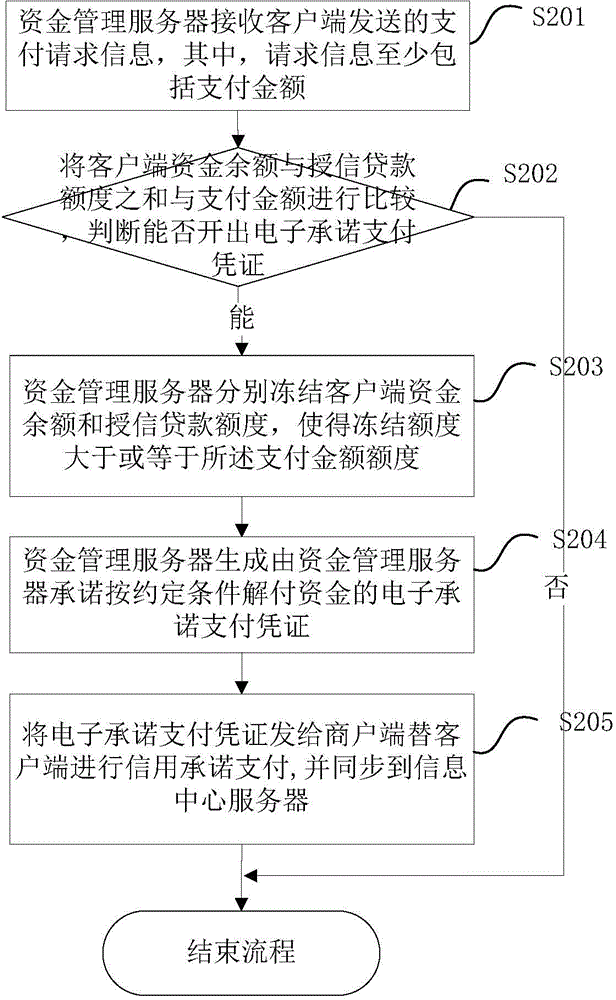

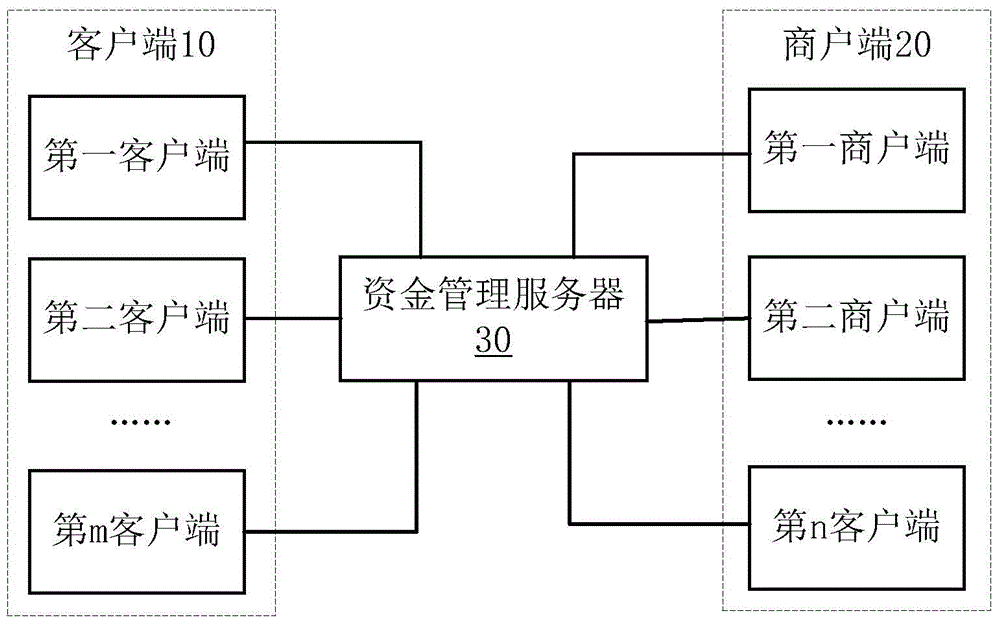

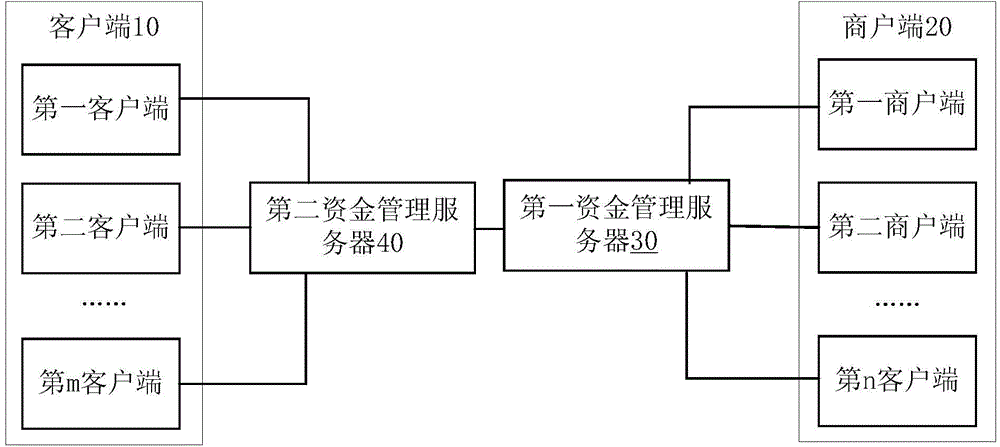

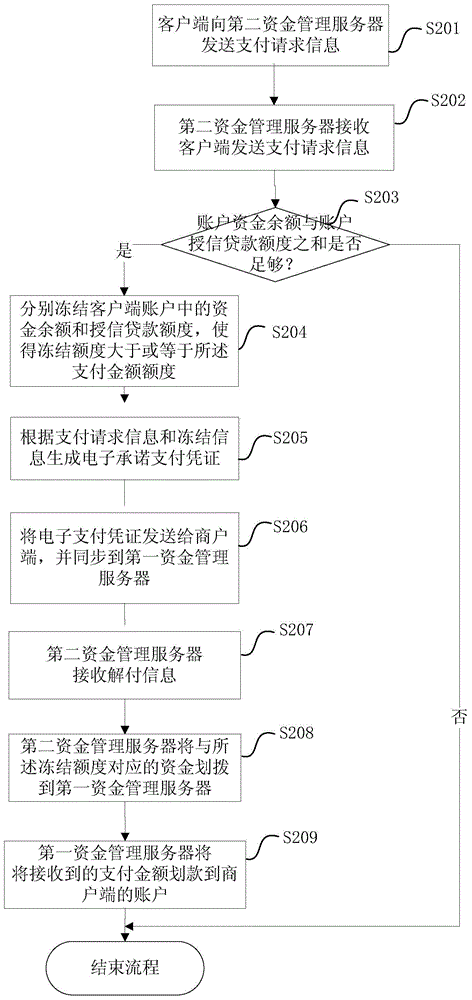

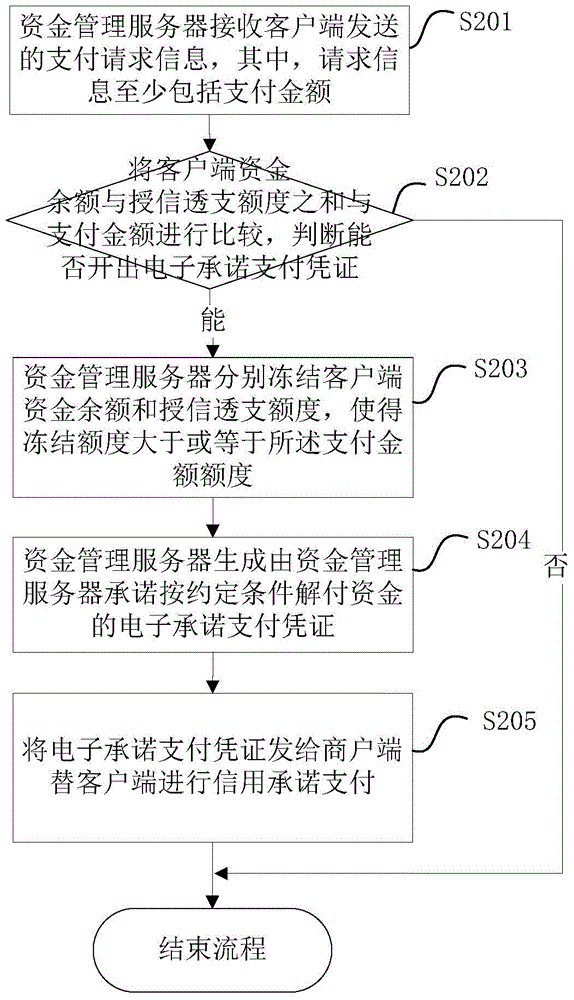

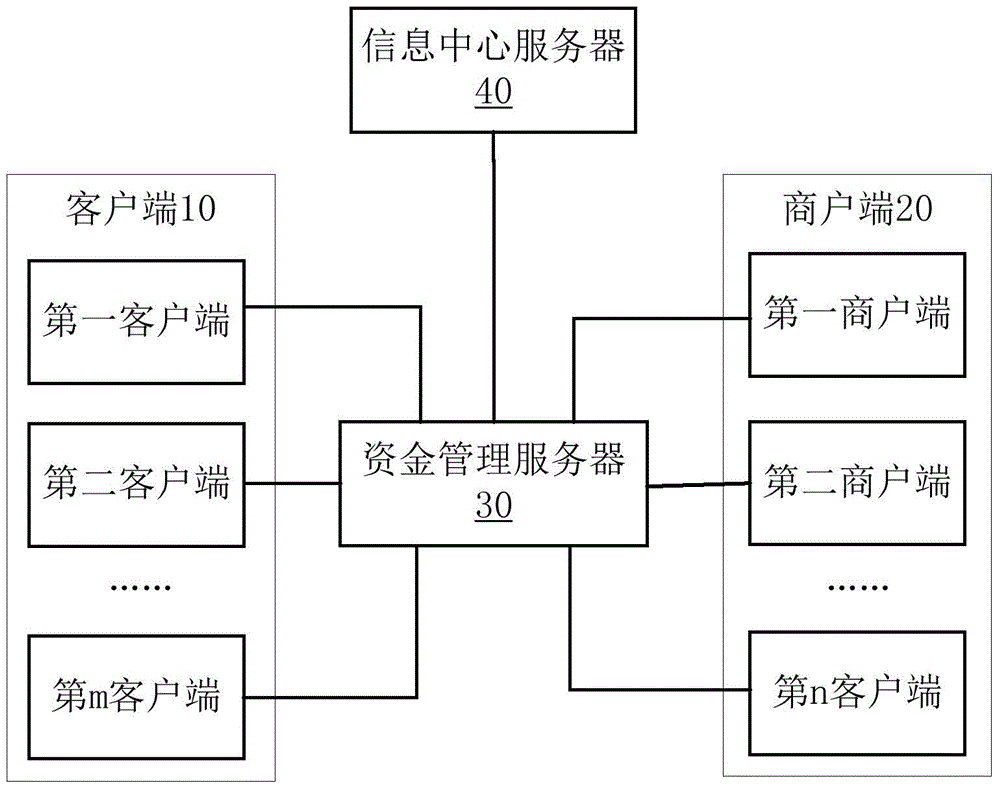

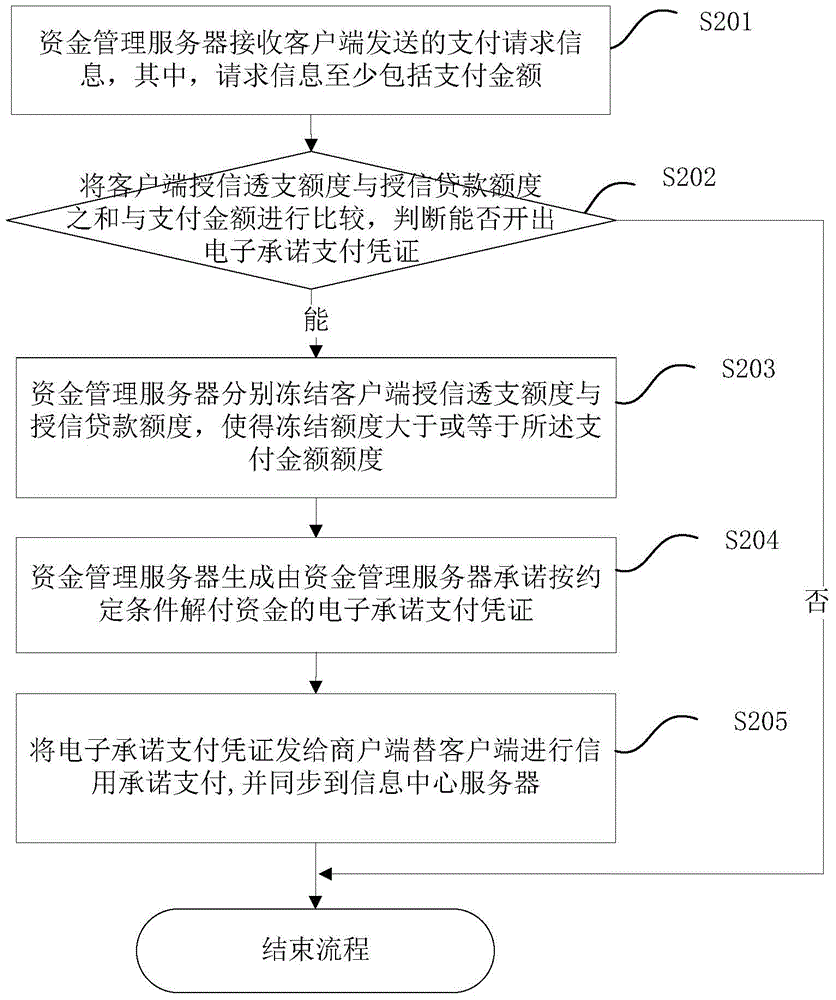

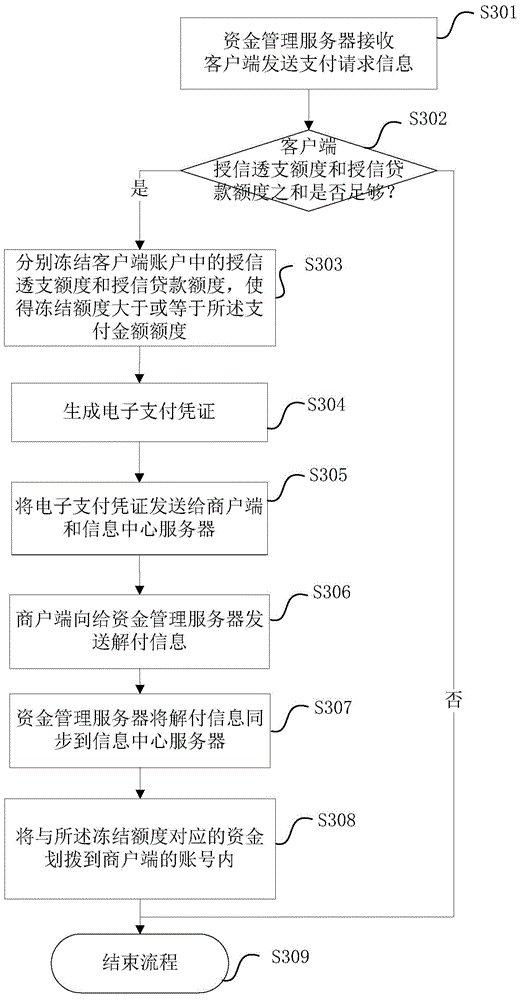

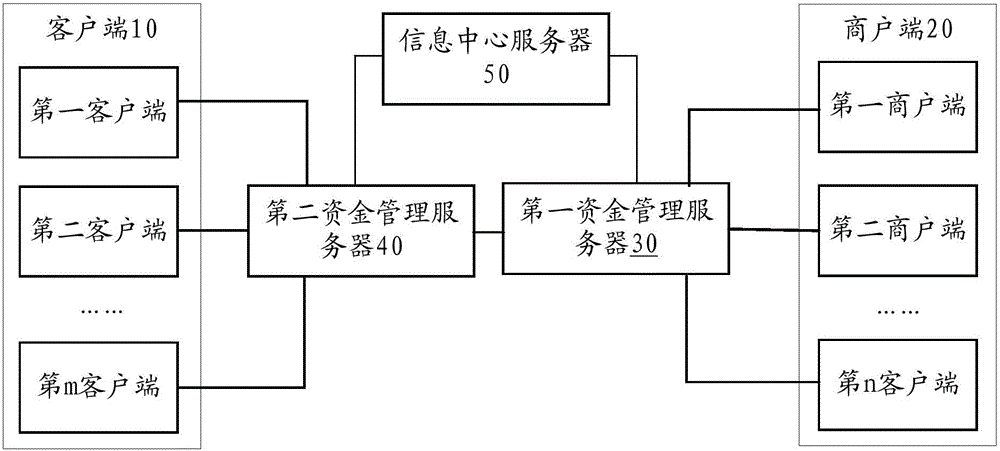

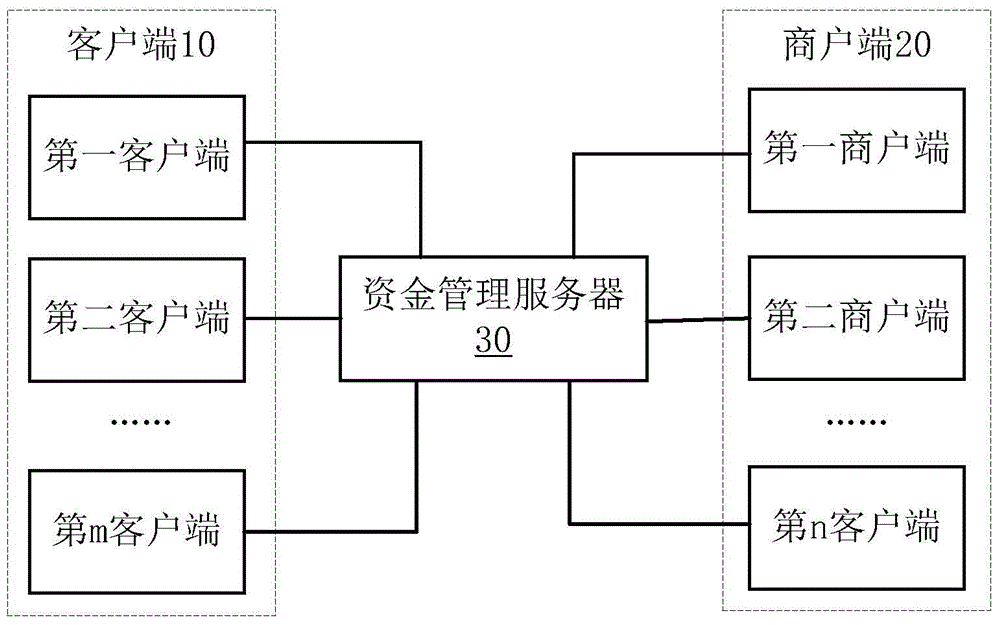

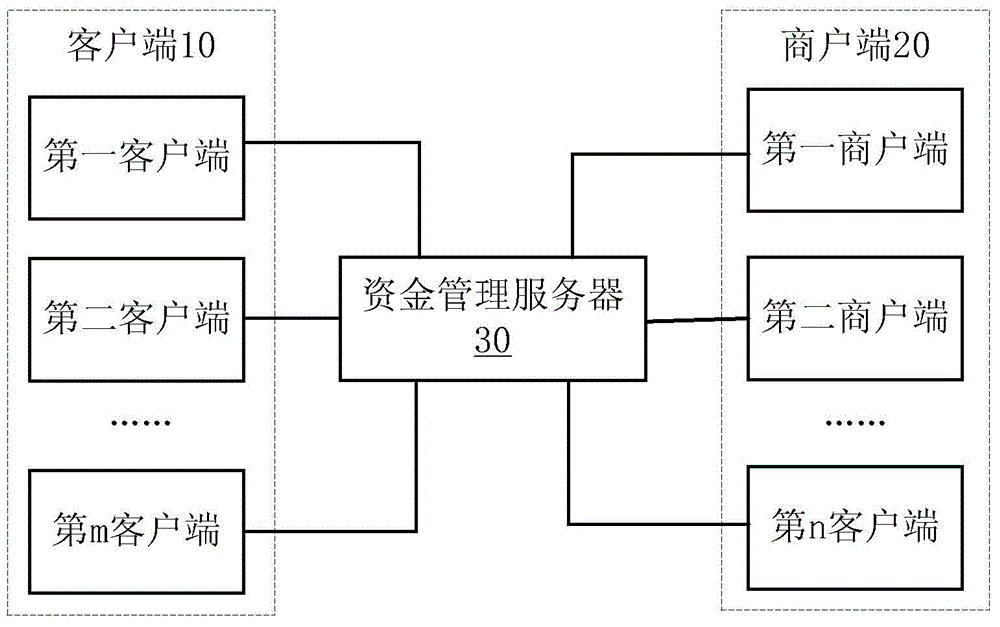

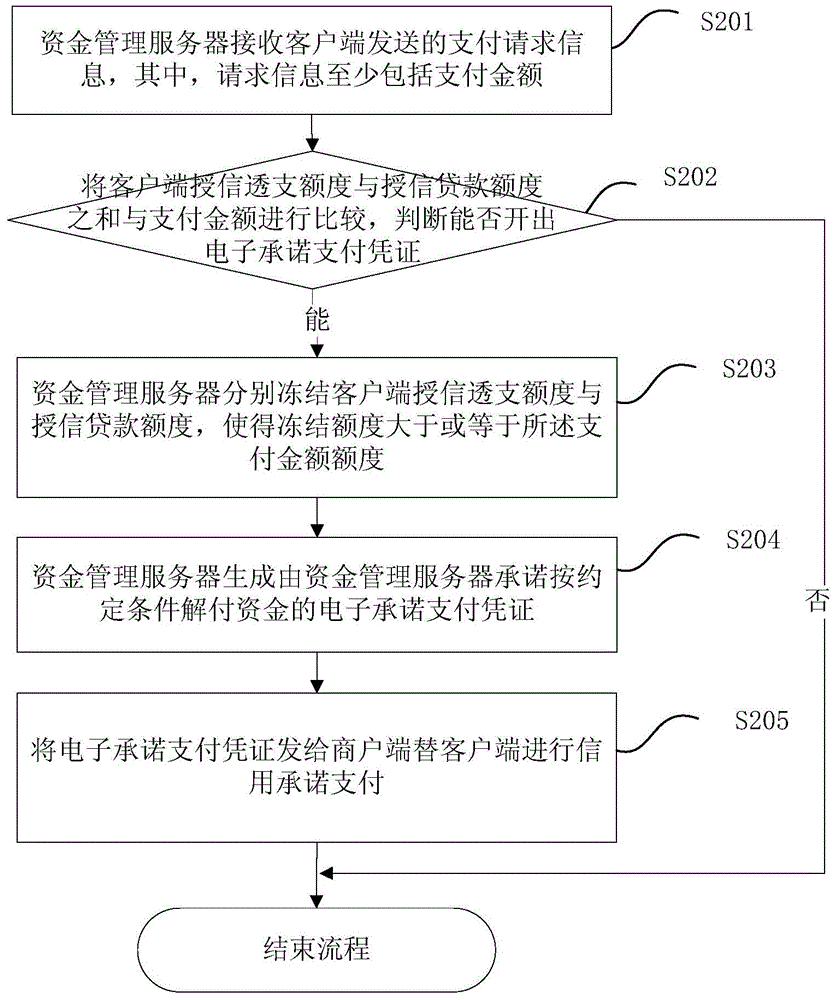

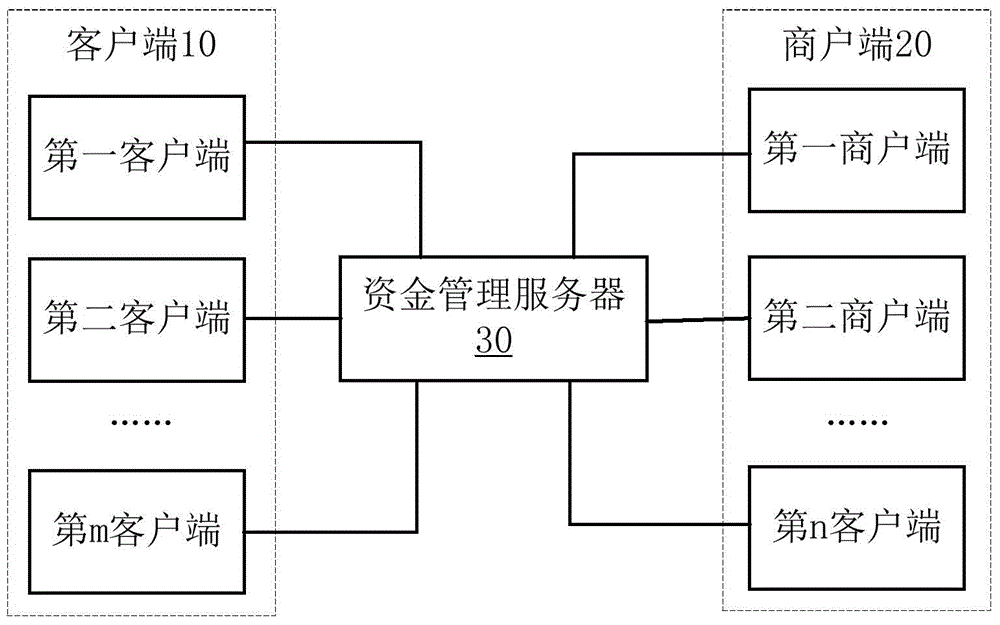

Same fund server-based payment system, method, device and server

InactiveCN106203971AReduce capital riskProtect interestsPayments involving neutral partyClient-sideE-commerce

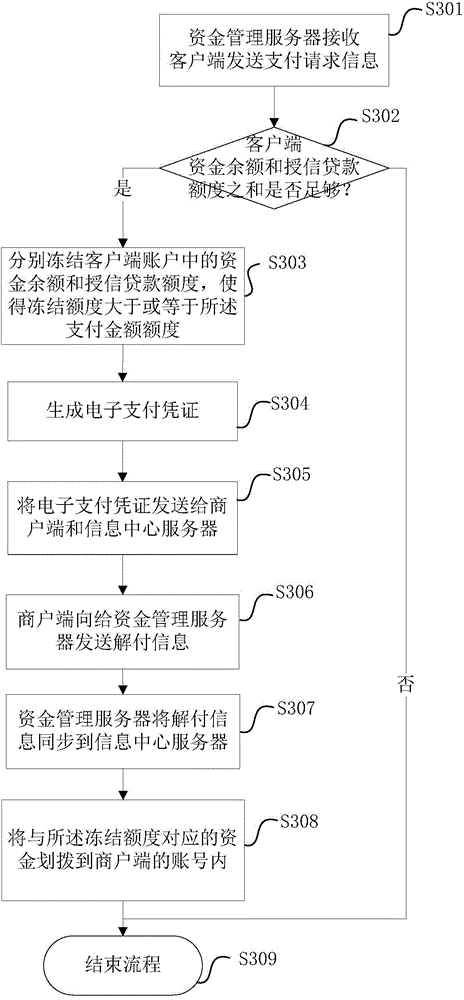

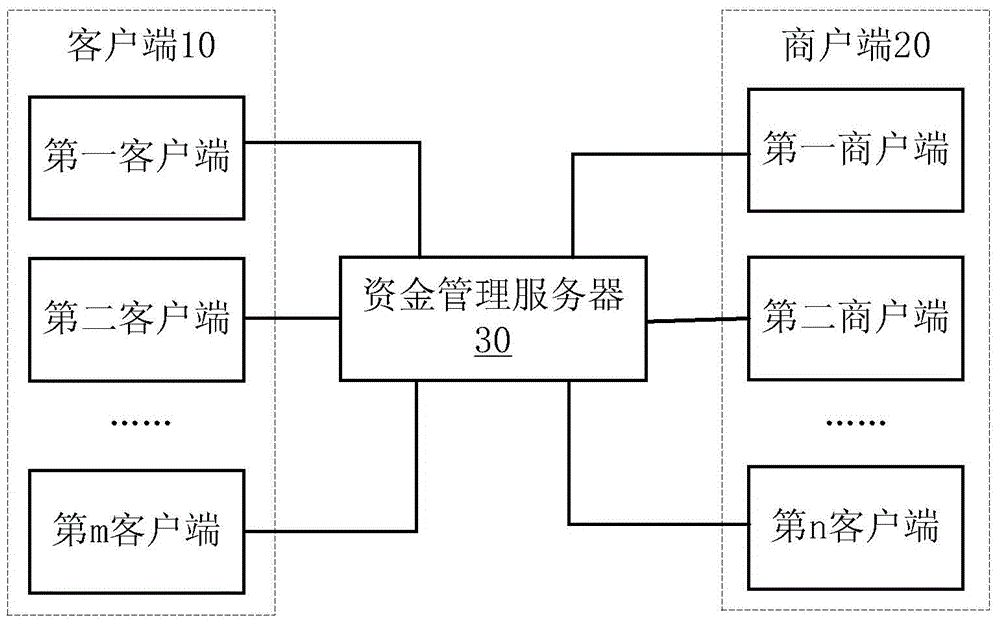

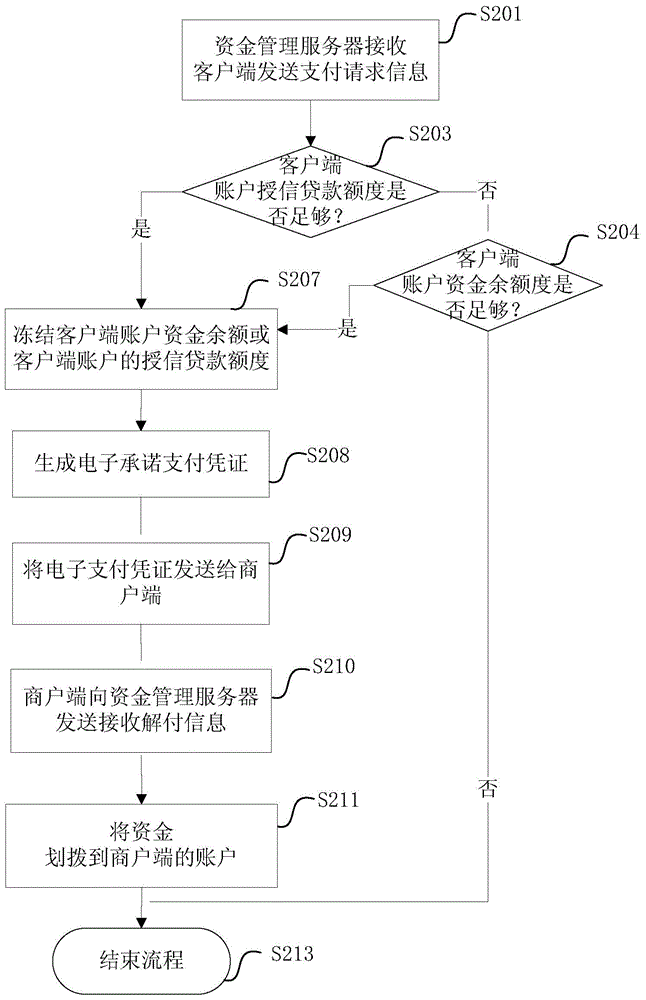

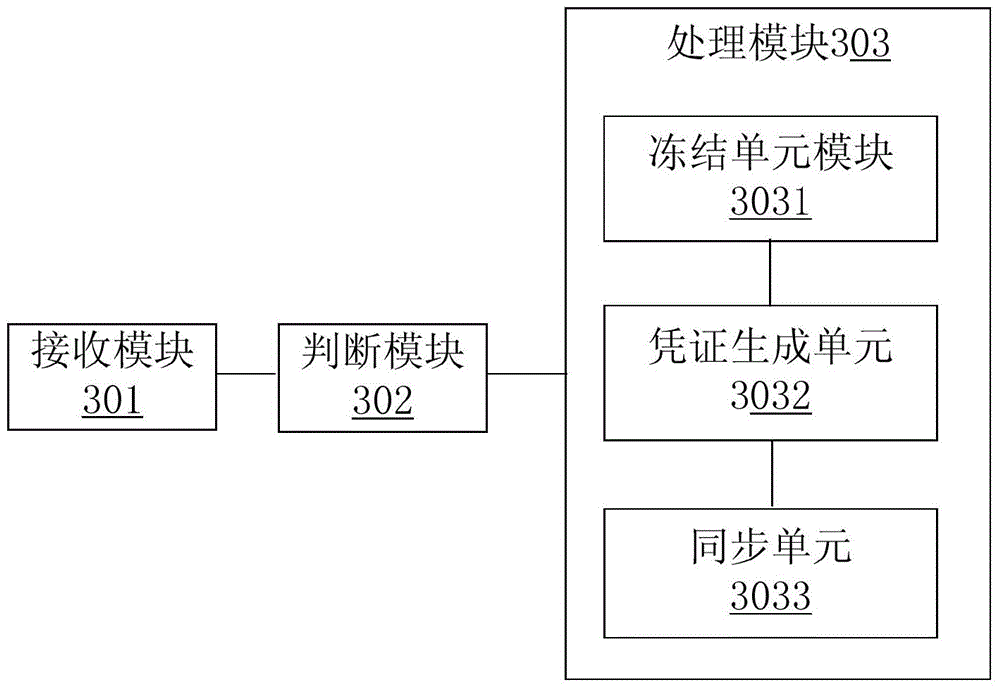

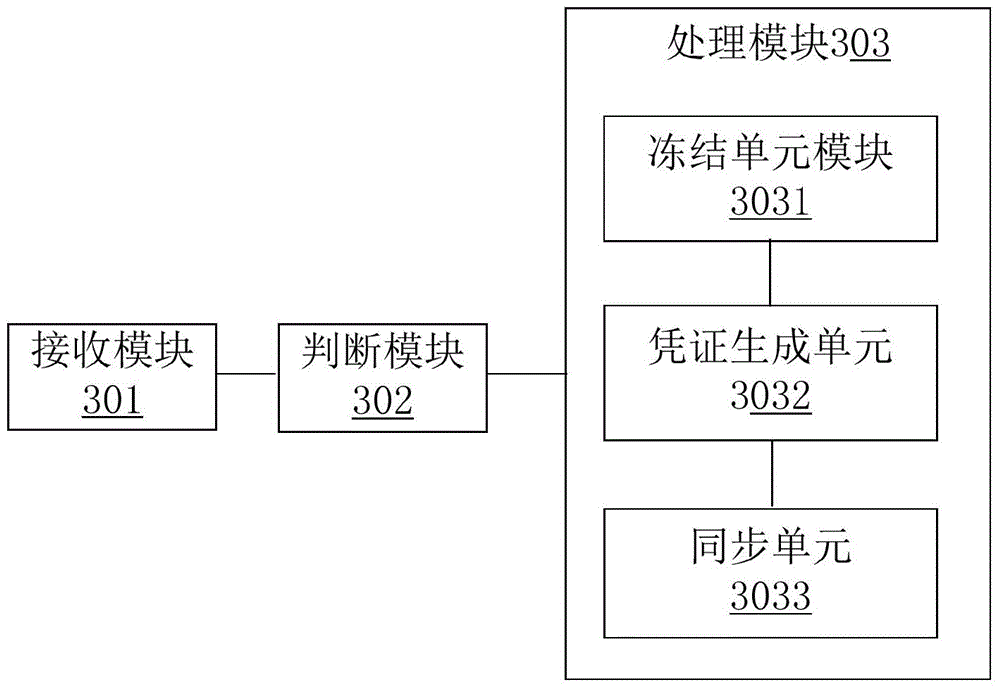

The invention discloses a same fund management server-based payment system, method, device and server, and belongs to the field of e-commerce. The method comprises the following steps of: receiving payment request information sent by a client by a fund management server; comparing the sum of a fund balance and a credit extension loan limit of the client with a payment amount, so as to judge whether an electronic underwrite document can be given or not; if the judging result is positive; respectively freezing the fund balance and the credit extension loan limit, in an account of the client, corresponding to the payment amount by the fund management server; and generating the electronic underwrite document indicating that the fund management server promises to pay the fund according to an appointed condition, sending the electronic underwrite document to a commercial tenant end to replace the client to carry out credit underwrite, and synchronizing the electronic underwrite document to an information center server. By adopting such a technical scheme, the two trading parties are supervised so that the fund risk can be reduced and then the benefits of the two trading parties are ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Data processing method based on block chain and related equipment

ActiveCN110930152AImprove service qualityReduce capital riskFinancePayment protocolsElectronic contractsBusiness enterprise

The embodiment of the invention discloses a data processing method based on a block chain. The data processing method comprises the steps: obtaining an enterprise certificate issued by an authentication center for a bank, and writing the enterprise certificate and a first abstract hash into an intelligent contract; obtaining a user certificate issued by an authentication center for the saving user, and writing the user certificate and the second abstract hash into the intelligent contract; obtaining the first transaction content, determining a third abstract hash of the large amount of depositdata, performing verification according to the enterprise certificate abstract information, and if the verification is passed, writing the large amount of deposit data, the third abstract hash and the product release transaction hash into the smart contract; and obtaining second transaction content, performing verification according to the large-amount deposit summary information, the enterprisecertificate summary information and the user certificate summary information, and if the verification is passed, writing the large-amount deposit order number, the content required to be filled in bythe large-amount deposit electronic contract, bank contract signing transaction hash and user contract signing transaction hash into the intelligent contract. Bank service quality can be improved, andfund risks of saving users can be reduced.

Owner:TENCENT TECH (SHENZHEN) CO LTD

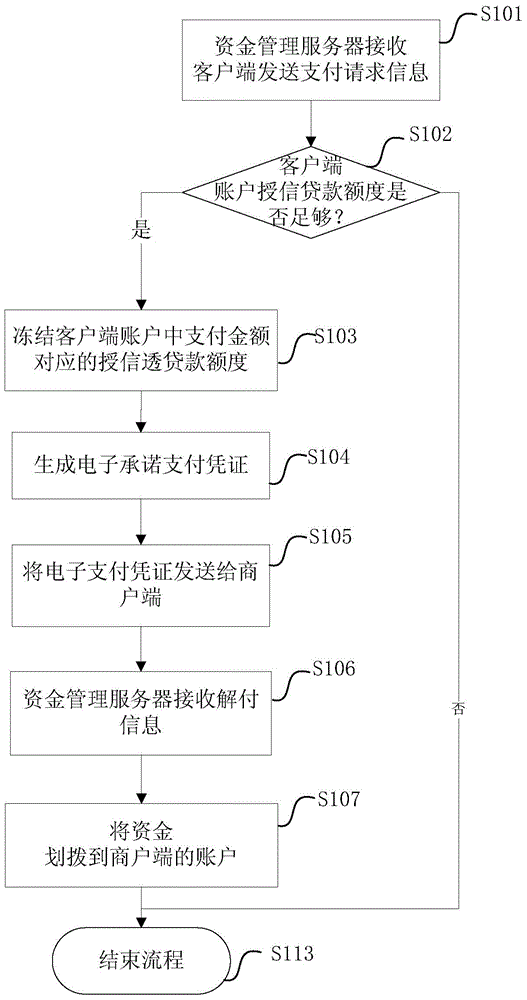

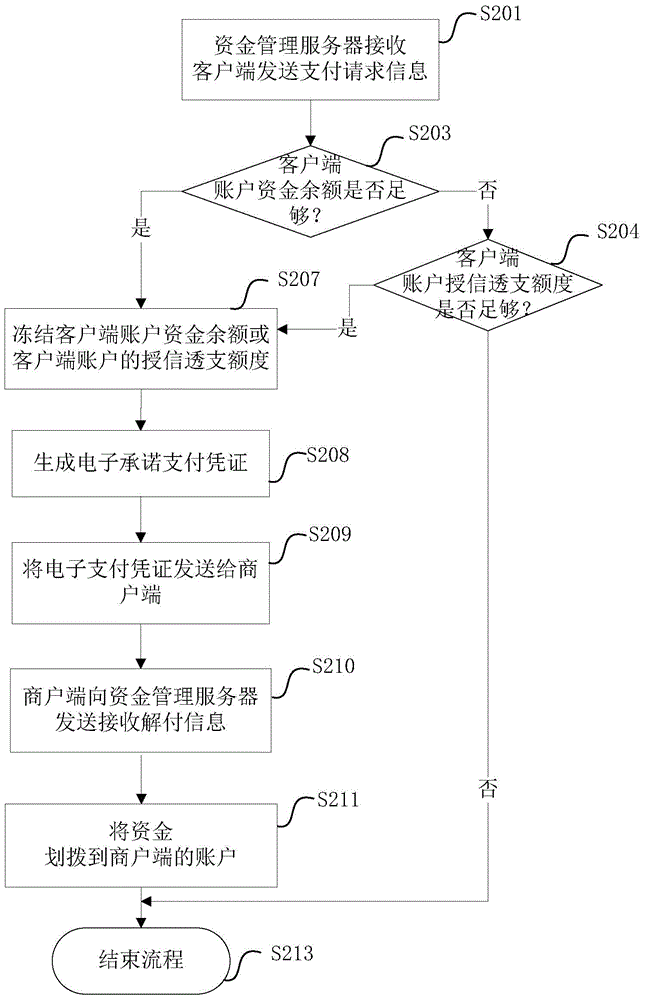

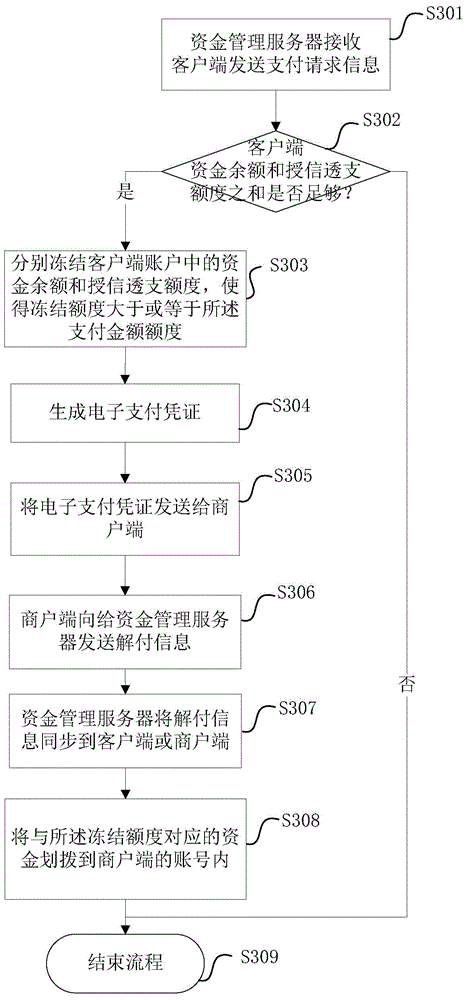

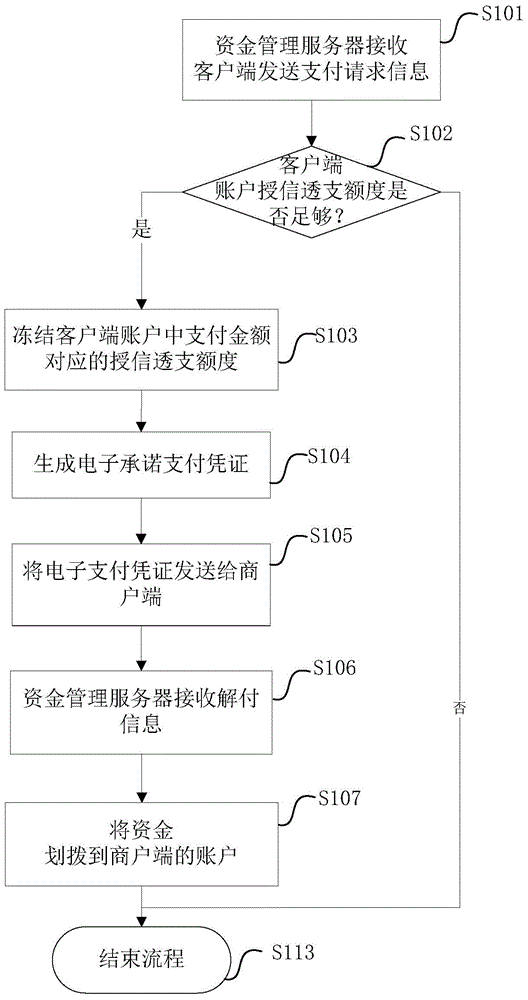

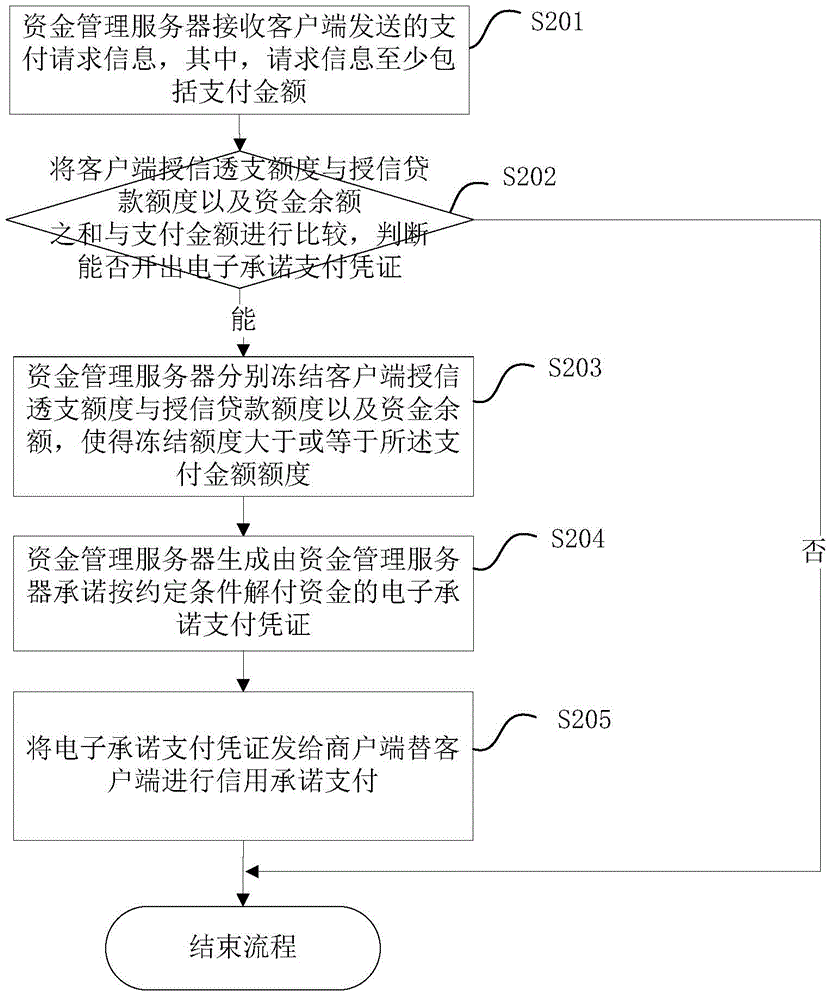

Network payment method and device, fund management server and system

InactiveCN106203986ARich businessEnsure safetyPayments involving neutral partyE-commercePayment order

The invention discloses a payment system based on the same fund management server and a payment method and device thereof and the fund management server, and belongs to the field of electronic commerce. The method comprises the steps that the fund management server receives payment request information transmitted by a client side; the account credit loan amount of the client side and payment amount are compared and whether an electronic acceptance payment order can be made is judged; the fund management server freezes the credit loan amount corresponding to the payment amount in the account of the client side if the judgment result is yes; and the electronic acceptance payment order based on which the fund management server commits to pay the fund according to the agreed conditions is generated and the electronic acceptance payment order is transmitted to a merchant side which performs credit acceptance payment for the client side. With application of the technical scheme, both transaction sides are supervised so that the risk of the funk can be reduced and the benefits of the both transaction sides can be guaranteed.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

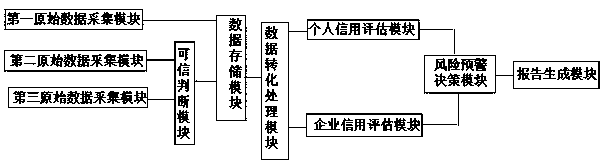

A cargo owner credit capability analysis and evaluation system

The invention discloses a cargo owner credit capability analysis and evaluation system. The cargo owner credit capability analysis and evaluation system includes an Original data acquisition module, aTrusted judgment module, a Data conversion processing module, a data storage module, a credit assessment module, a risk early warning decision module and areport generation module; the original dataacquisition module comprises a first original data acquisition module, a second original data acquisition module and a third original data acquisition module, and the credit assessment module comprises an enterprise credit assessment module and a personal credit assessment module. The invention also discloses a working process of the cargo owner credit capability analysis and evaluation system. The system is reasonable in design; the Trusted judgment module, The first original data acquisition module, the second original data acquisition module and the third original data acquisition module can ensure the credibility of data, the enterprise credit assessment module and the personal credit assessment module are used for assessing the credit of the partner, the automation degree is high, thefund risk of an enterprise is reduced, and the use effect is good.

Owner:深圳市大东车慧科技股份有限公司

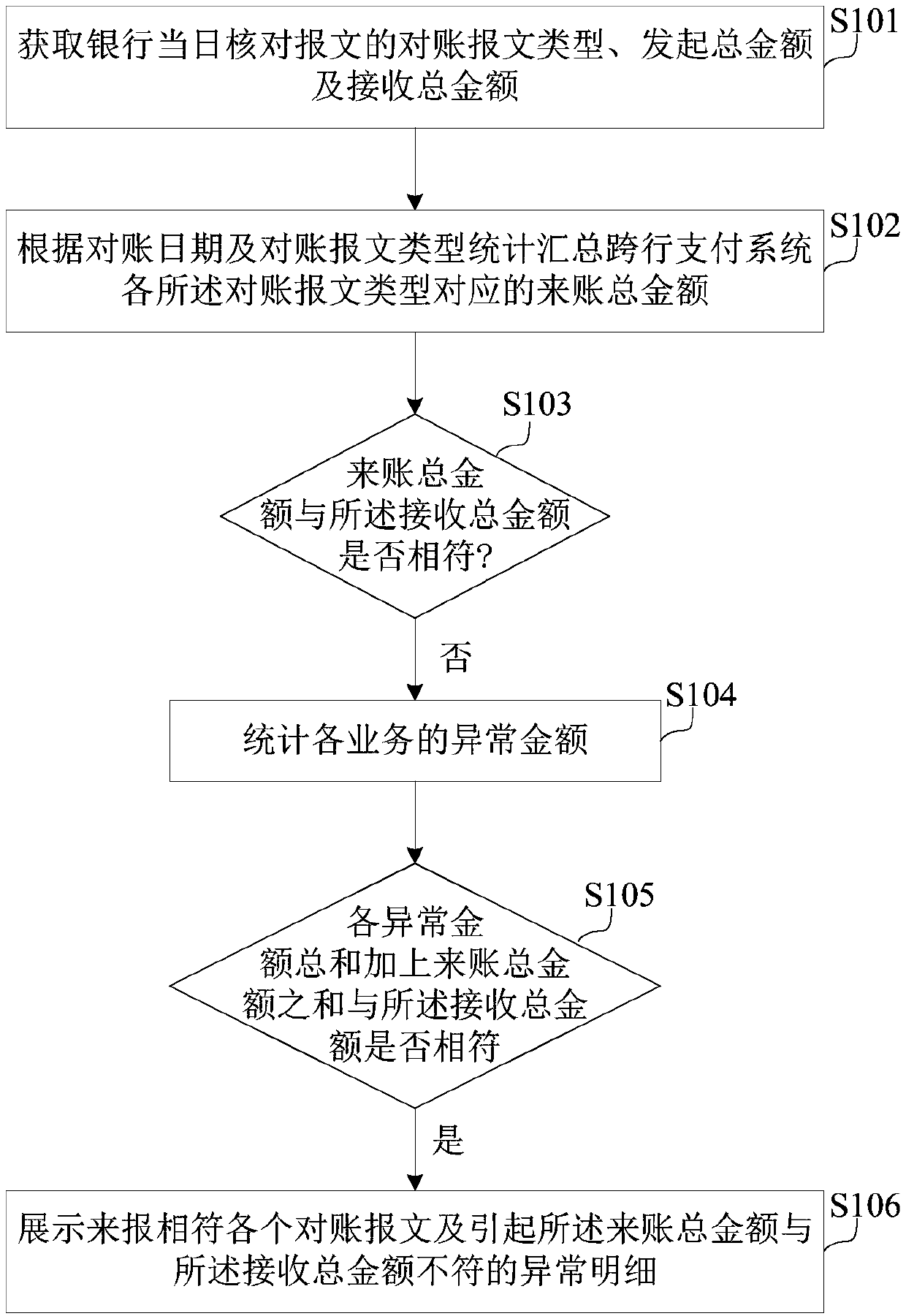

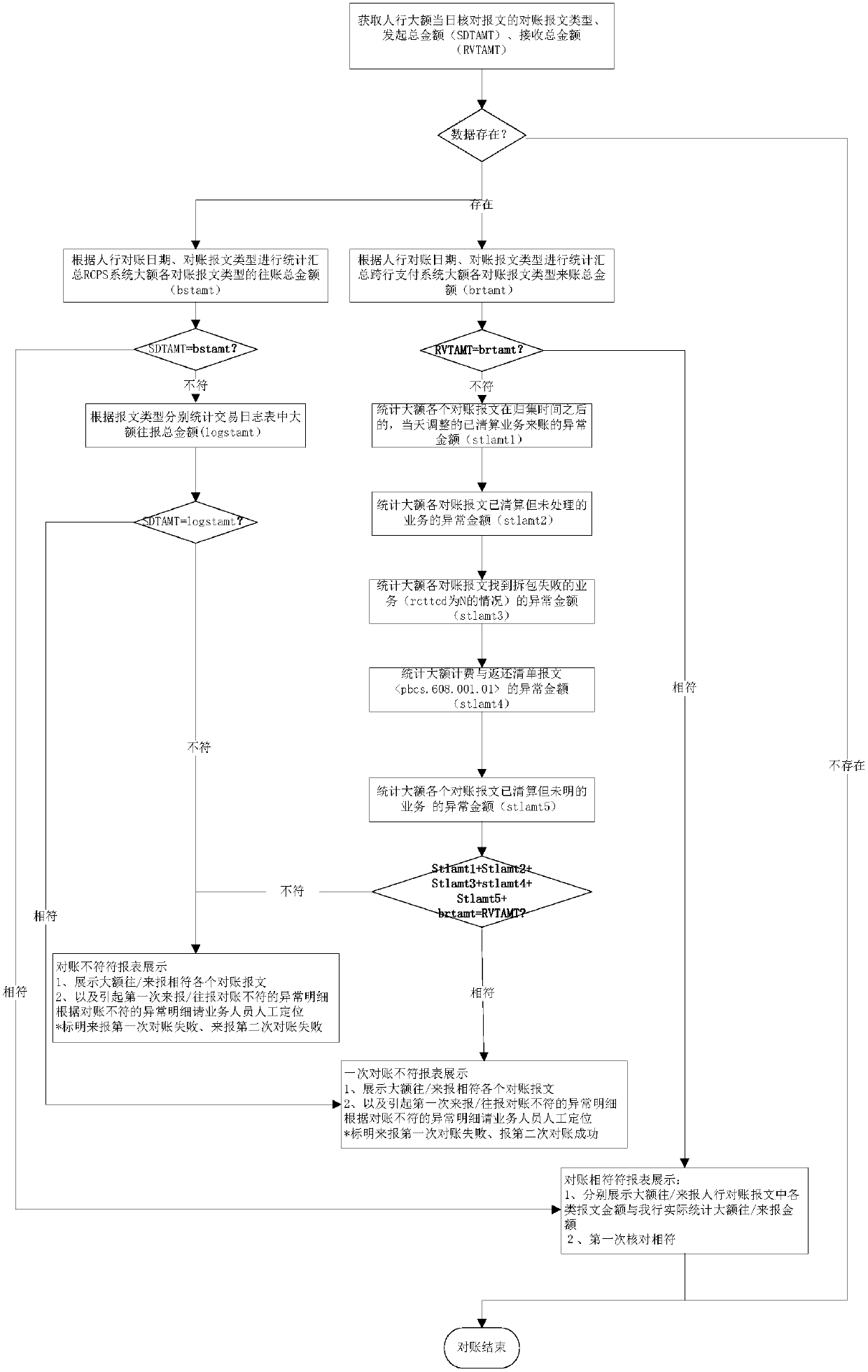

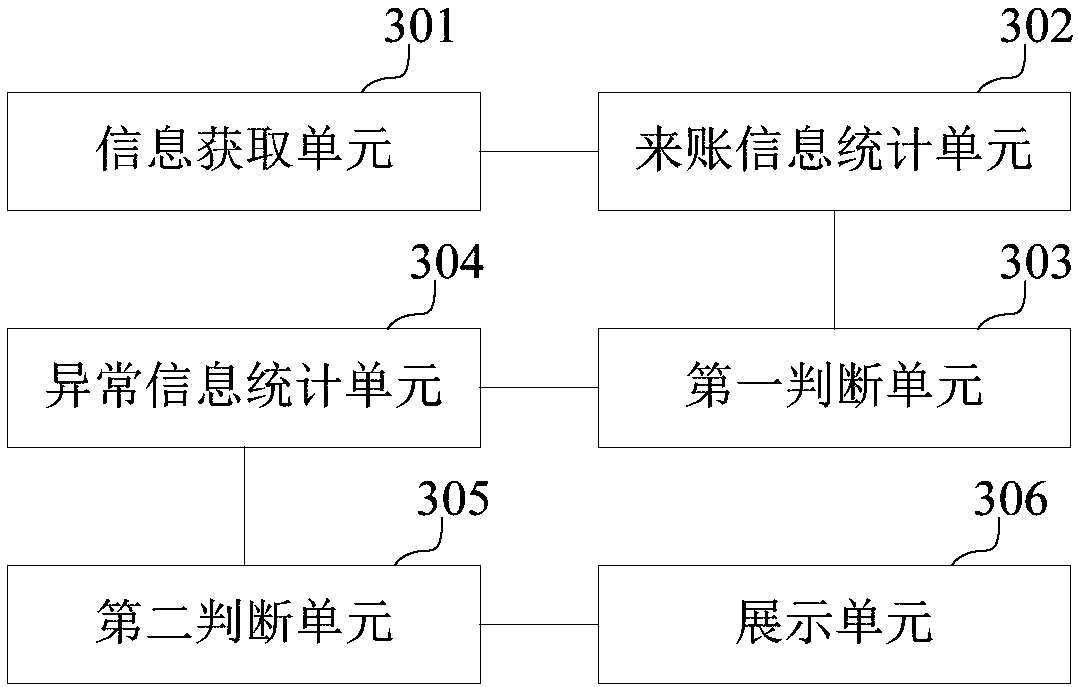

Account checking early warning method and apparatus of inter-bank payment, computer equipment, and storage medium

The invention provides an account checking early warning method and apparatus of inter-bank payment, computer equipment, and a storage medium. The early warning method comprises: an account checking message type, an aggregate initiating amount, and an aggregate receiving amount of a day checking message of a bank are obtained; according to an account checking date and the account checking messagetype, statistics and collection of aggregate vostro account amounts corresponding to all account checking message types of an inter-bank payment system are carried out; whether the aggregate vostro account amounts conforms to the aggregate receiving amount is determined; if not, statistics of abnormal amounts of all businesses is carried out; whether a sum of the sum total of all abnormal amountsand the aggregate vostro account amounts conforms to the aggregate receiving amount is determined; and if so, all account checking messages conforming to an incoming message and abnormal details causing unconformity of the aggregate vostro account amounts and the aggregate receiving amount are displayed. Analysis and positioning are carried out in different business scenes, so that factors causingaccount checking unconformity are located conveniently and rapidly and thus the fund risk of the bank is reduced.

Owner:BANK OF CHINA

Network payment method and device and money management server and system

InactiveCN106203980ARich businessEnsure safetyProtocol authorisationPayments involving neutral partyVoucherE-commerce

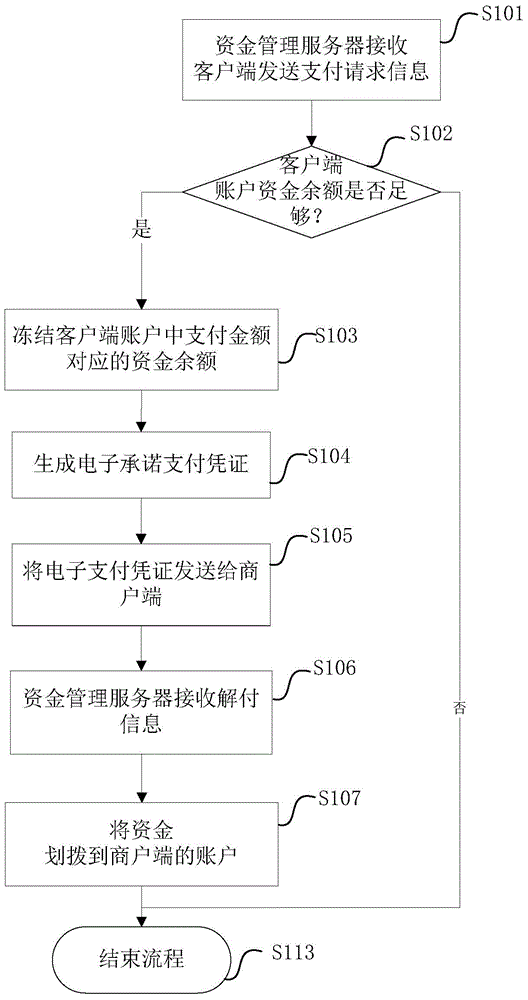

The invention discloses a payment system, a payment method therefor, a payment device therefor that are all based on the same money management server and the money management server and belongs to the field of electronic commerce. The method comprises the following steps: a money management server receives a payment request information sent from a client end, and whether an electronic committed payment voucher can be issued can be determined via comparison between client end fund balances and a payment amount; if the electronic committed payment voucher can be issued, the money management server freezes an amount, corresponding to the payment amount, of the fund balances in a client end account; the electronic committed payment voucher of the money management server committing to pay according to agreed terms is generated; the electronic committed payment voucher is sent to a merchant end so as to make credit commitment payment on behalf of the client end. Via use of the payment system, the payment method therefor, the payment device and the moneymanagement server, fund risk can be lowered while both transaction parties are supervised, and interests of both of the transaction parties can be guaranteed.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

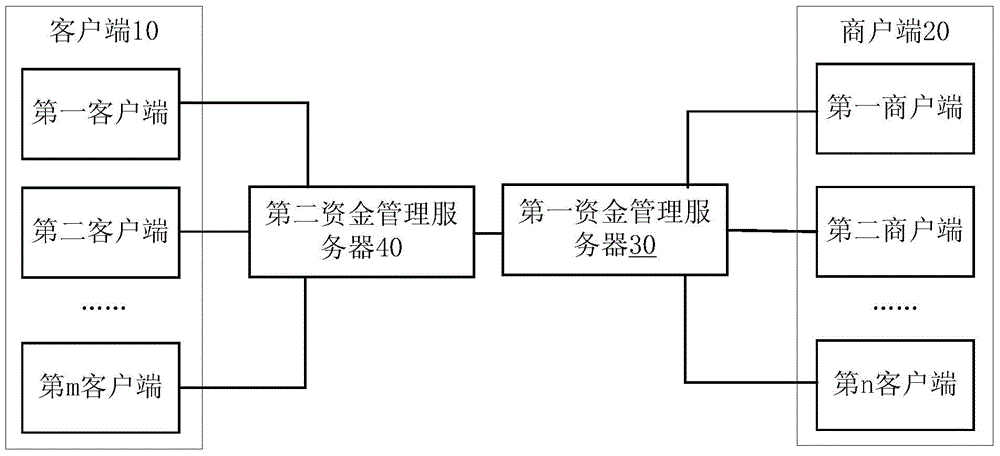

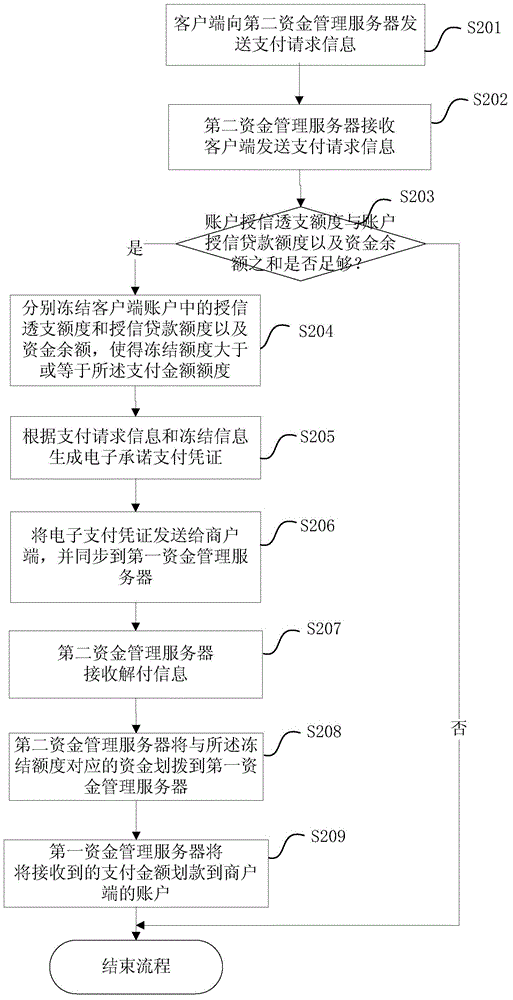

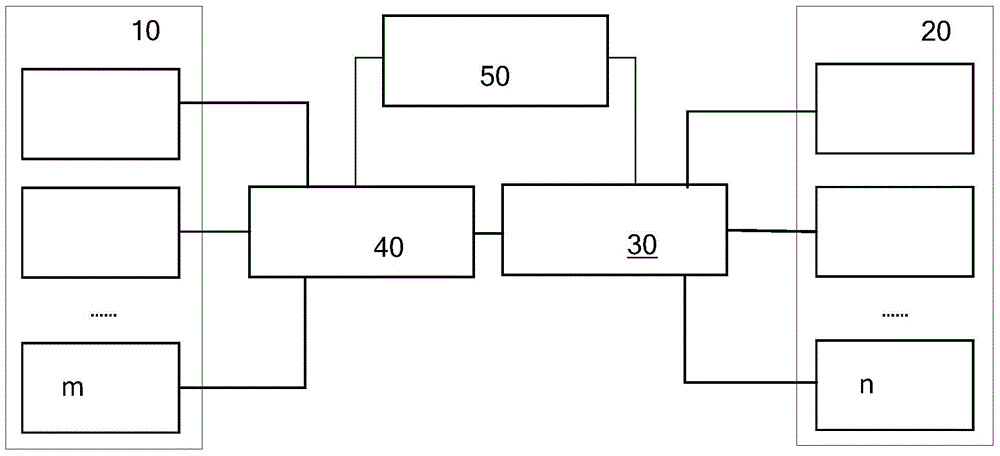

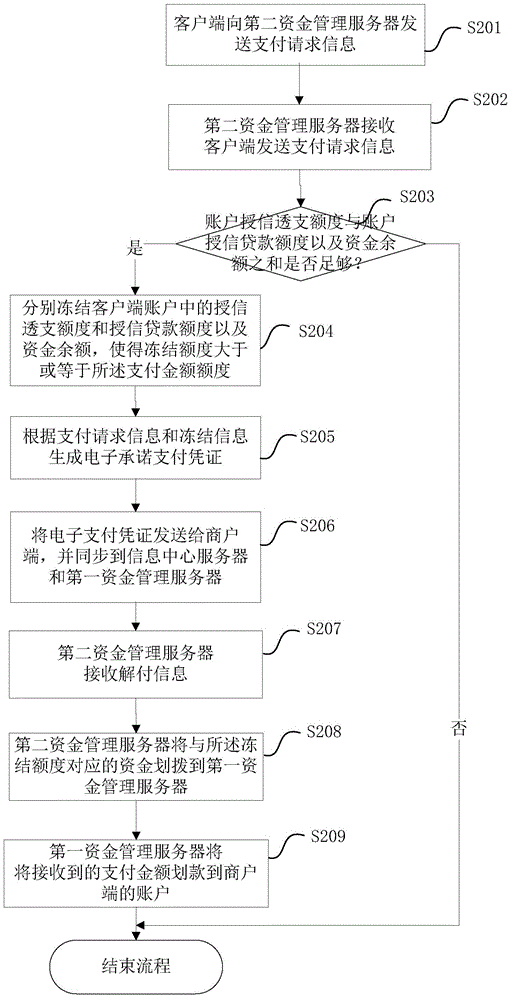

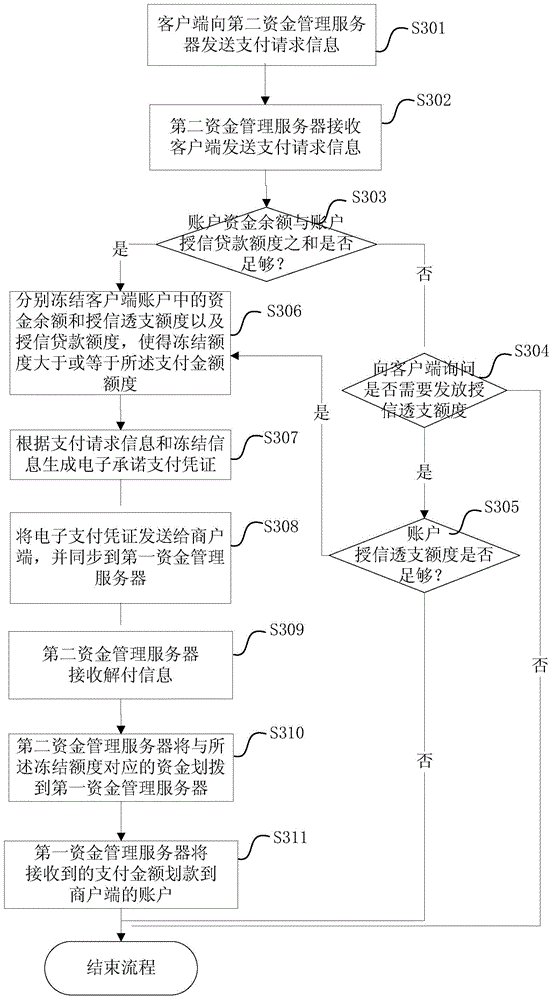

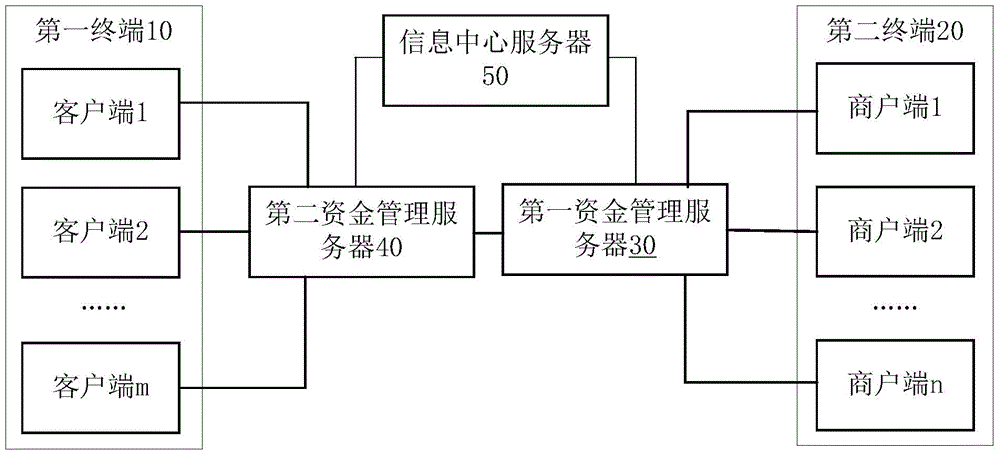

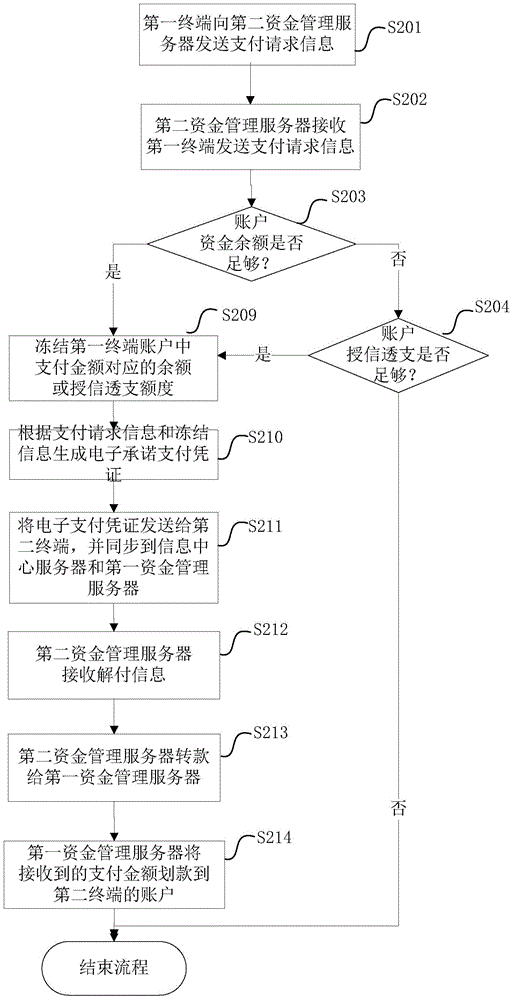

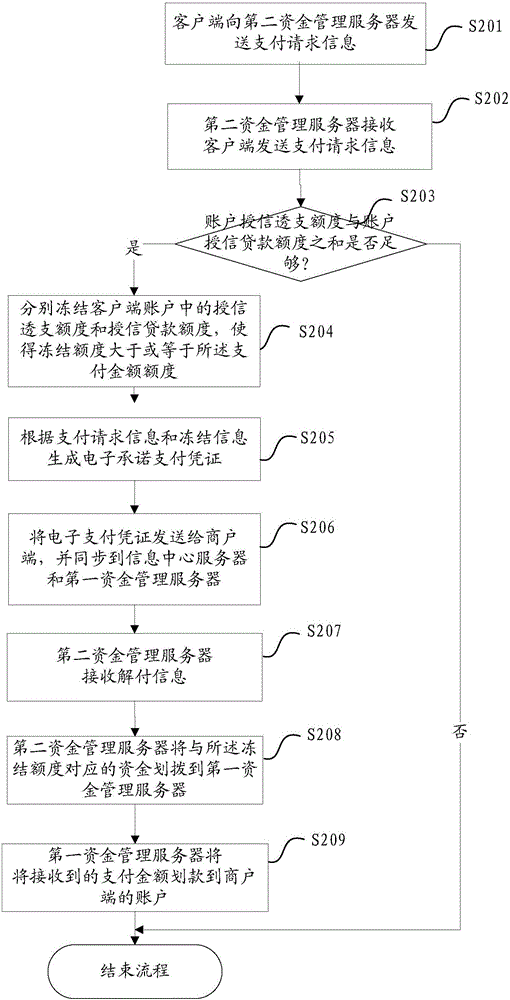

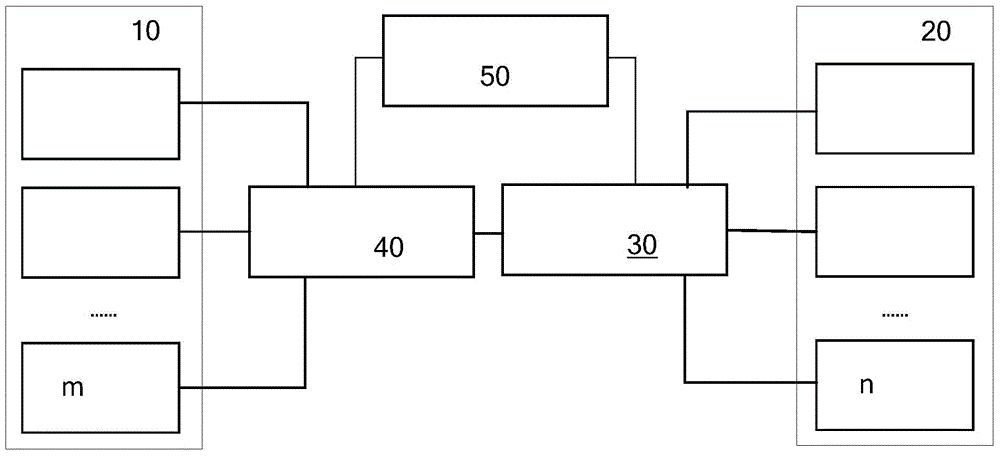

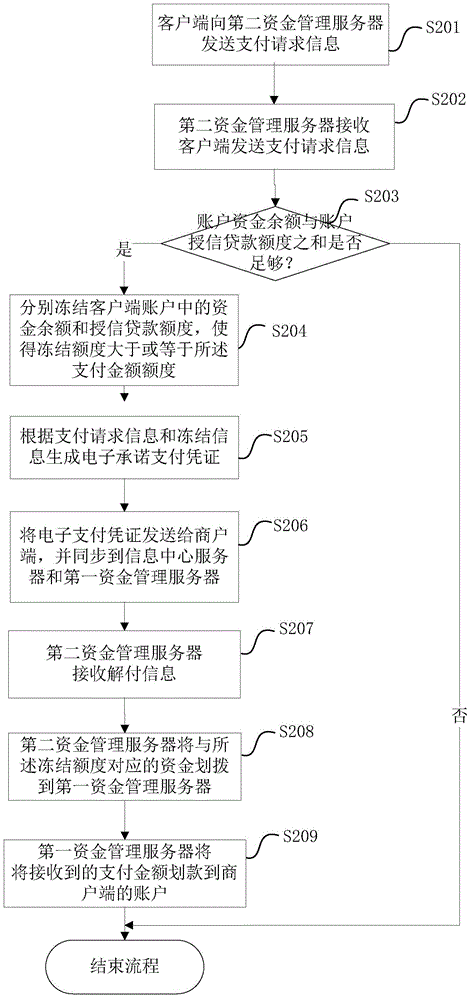

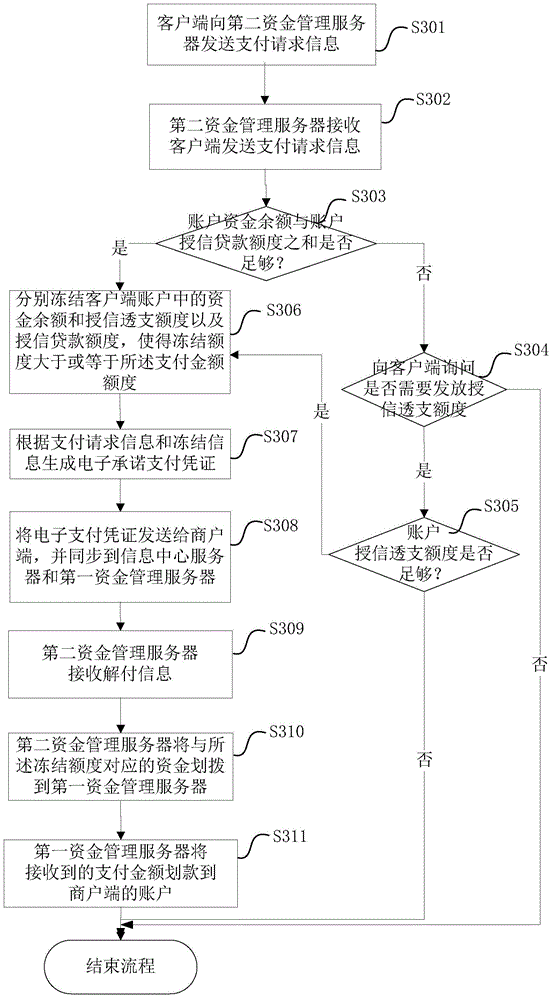

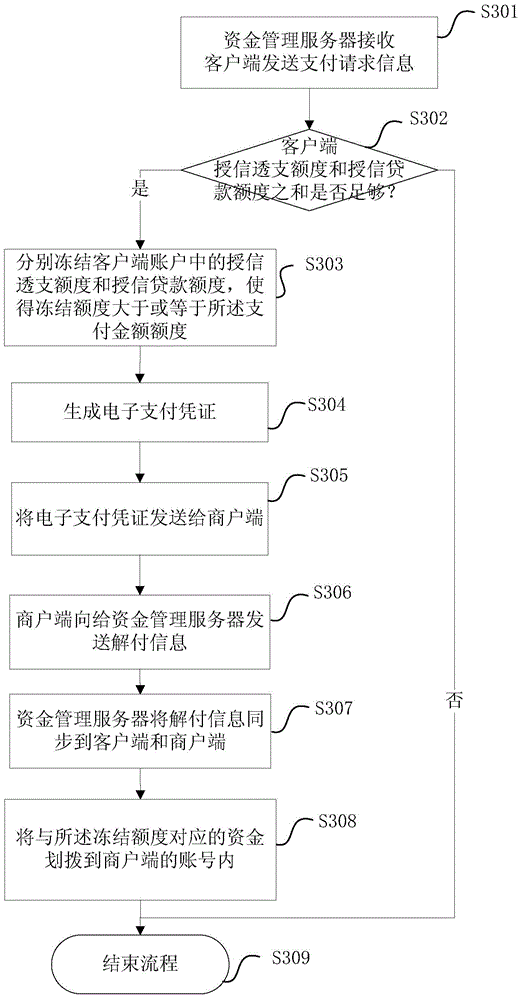

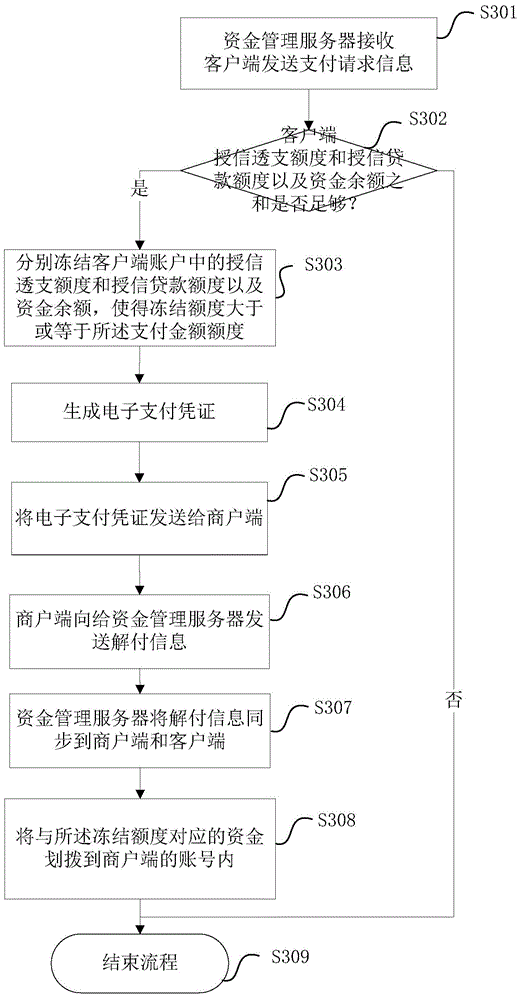

Cross-fund server payment system, method, device and servers

The invention discloses a cross-fund management server payment system, a payment method thereof, a device and servers, which belong to the field of e-commerce. The method comprises steps: a second fund management server receives payment request information sent by a client; the sum among the credit overdraft limit, the credit loan limit and the fund balance of the client is compared with the payment amount, and whether to open an electronic commitment payment voucher is judged; if yes, the second fund management server freezes the credit overdraft limit, the credit loan limit and the fund balance, corresponding to the payment amount, in a client account respectively; and an electronic commitment payment voucher for enabling the second fund management server to commit to pay the fund according to agreed terms is generated, and the electronic commitment payment voucher is sent to a merchant end for credit commitment payment on behalf of the client. By adopting the technical scheme of the invention, both sides of transaction can be supervised to reduce the fund risks, and benefits of both sides of the transaction can be ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Payment system based on cross-fund-servers, payment method and device for payment system, and server

InactiveCN106203982ARich businessEnsure safetyPayments involving neutral partyProtocol authorisationE-commerceVoucher

The invention discloses a payment system based on cross-fund-servers, a payment method and device for the payment system and a server, and belongs to the field of electronic commerce. The method comprises the steps: enabling a second fund management server to receive payment request information transmitted by a client; enabling the sum of the credit overdraft limit, credit extension loan limit and fund balance of the client to be compared with a payment amount, and judging whether an electronic payment acceptance voucher can be given or not: enabling the second fund management server to block the credit overdraft limit, credit extension loan limit and fund balance, which are corresponding to the payment amount, of the client if the electronic payment acceptance voucher can be given; generating an electronic payment acceptance voucher that the second fund management server promises to unblock the fund according to the terms of the engagement, transmitting the electronic payment acceptance voucher to a merchant terminal for credit payment for the client, and synchronizing the electronic payment acceptance voucher to an information center server. According to the technical scheme, the method carries out the supervision of two transaction sides, can reduce the fund risks, and guarantees the benefits of the two transaction sides.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Cross-fund server-based payment system, method and apparatus as well as server

InactiveCN106204015AReduce capital riskProtect interestsCredit schemesPayment protocolsE-commerceOperating system

The invention discloses a cross-fund management server-based payment system, method and apparatus as well as a server, and belongs to the field of e-commerce. The method comprises the steps of receiving payment request information sent by a client through a second fund management server; comparing a sum of a fund balance and a credit extension loan amount of the client with a payment amount and judging whether an electronic commitment payment document can be issued or not; if yes, freezing the fund balance and the credit extension loan amount, corresponding to the payment amount, in a client account by the second fund management server; and generating the electronic commitment payment document on that the second fund management server is committed to paying fund according to agreed terms, and sending the electronic commitment payment document to a merchant end for performing credit commitment payment instead of the client. With the adoption of the technical scheme, two trading parties are supervised to lower the fund risk and guarantee the benefits of the two trading parties.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

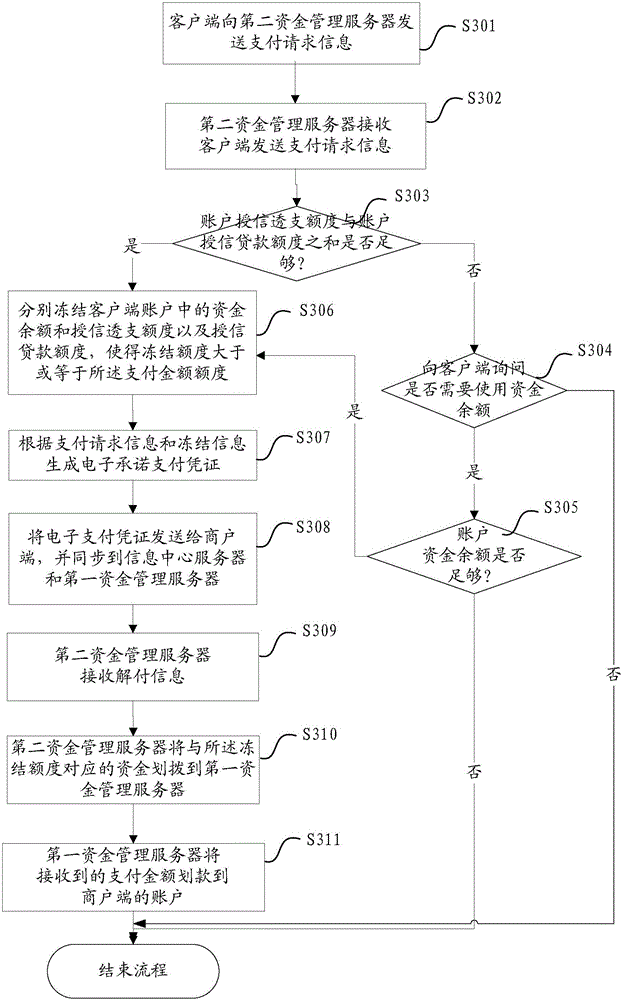

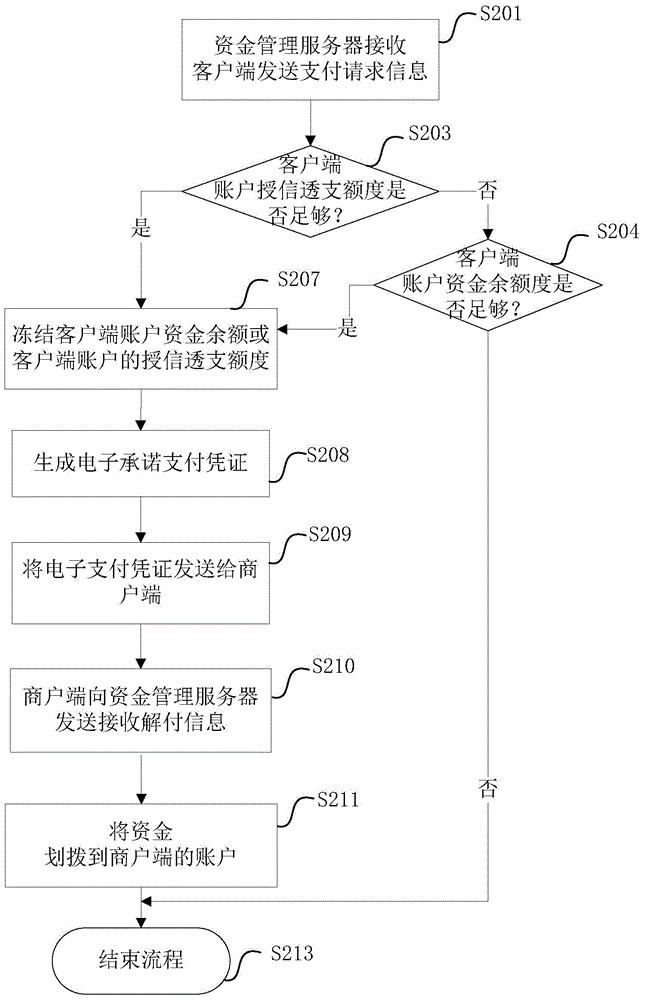

Payment system based on same fund server and payment method and device and server thereof

The invention discloses a payment system based on the same fund management server and a payment method and device and server thereof, and belongs to the field of e-commerce. The method comprises the steps that the fund management server receives payment request information transmitted by a client side; the sum of the fund balance and the credit overdraft of the client side is compared with payment account, and whether an electronic promise payment certificate can be made is judged; if the judgment result is yes, the fund management server respectively freezes the fund balance and the credit overdraft corresponding to the payment amount in the client side account; and the electronic promise payment certificate of the fund management server for promising to thaw and pay the fund according to the agreed conditions is generated, and the electronic promise payment certificate is transmitted to a merchant side to perform credit promise payment for the client side. With application of the technical scheme, the both transaction sides are supervised so that the fund risk can be reduced and the benefits of the both transaction sides can be guaranteed.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

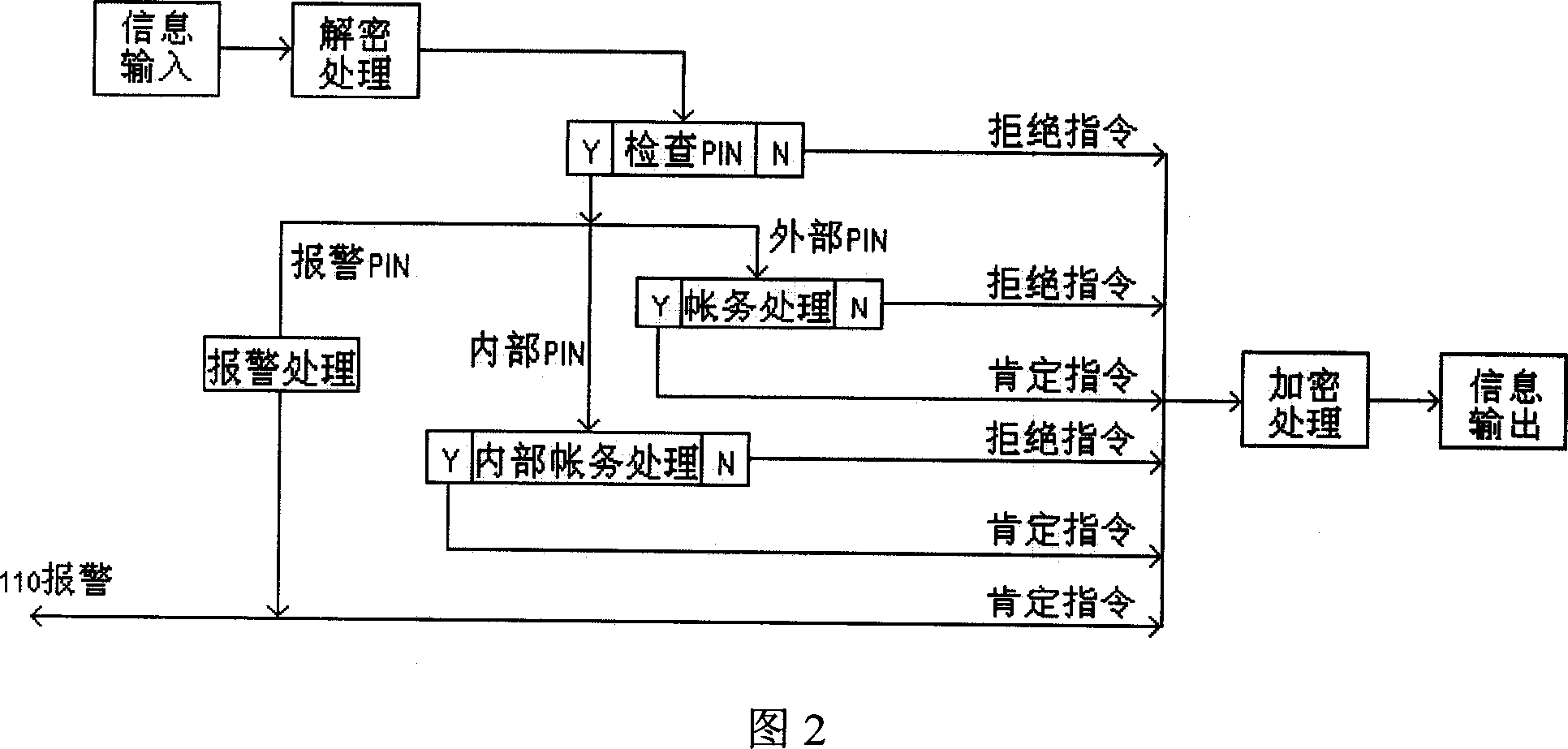

One-card-multiple-accounts bank card

InactiveCN1924939AReduce capital riskEnsure personal safetyCoded identity card or credit card actuationComputer hardwarePayment card number

This invention discloses one bank card with only one card number with multiple account number, which is located with magnetic bar to store one outer number, one inner number and bank card outside fund and inner funds information and stores one outer number, one inner number and one alarm numbers and outer funds information and inner funds information on the magnetic bar. This invention is through multiple account number and once the card is lost, the codes are stolen with only limit funds lost.

Owner:ZHEJIANG UNIV

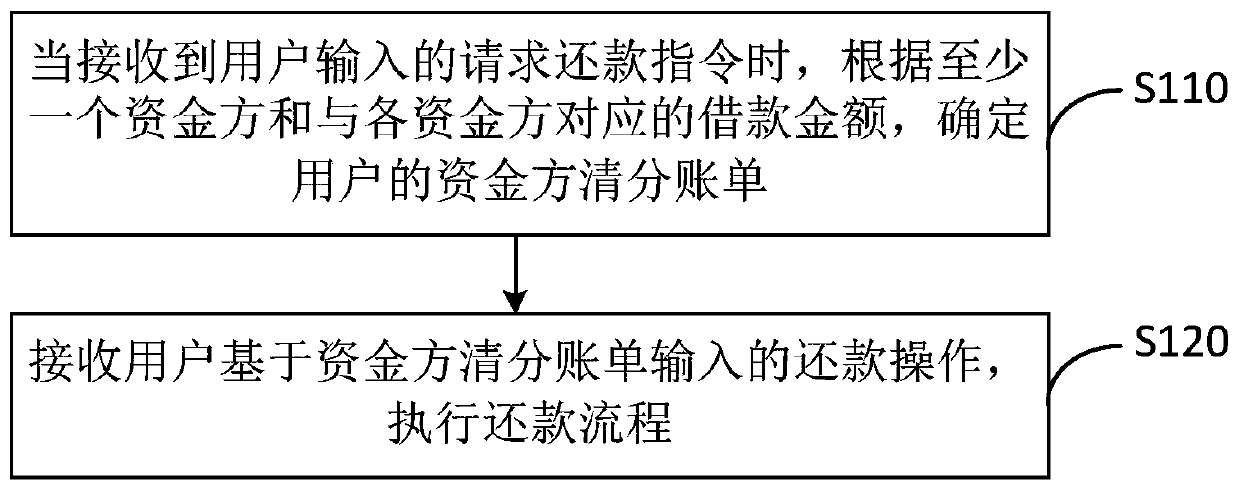

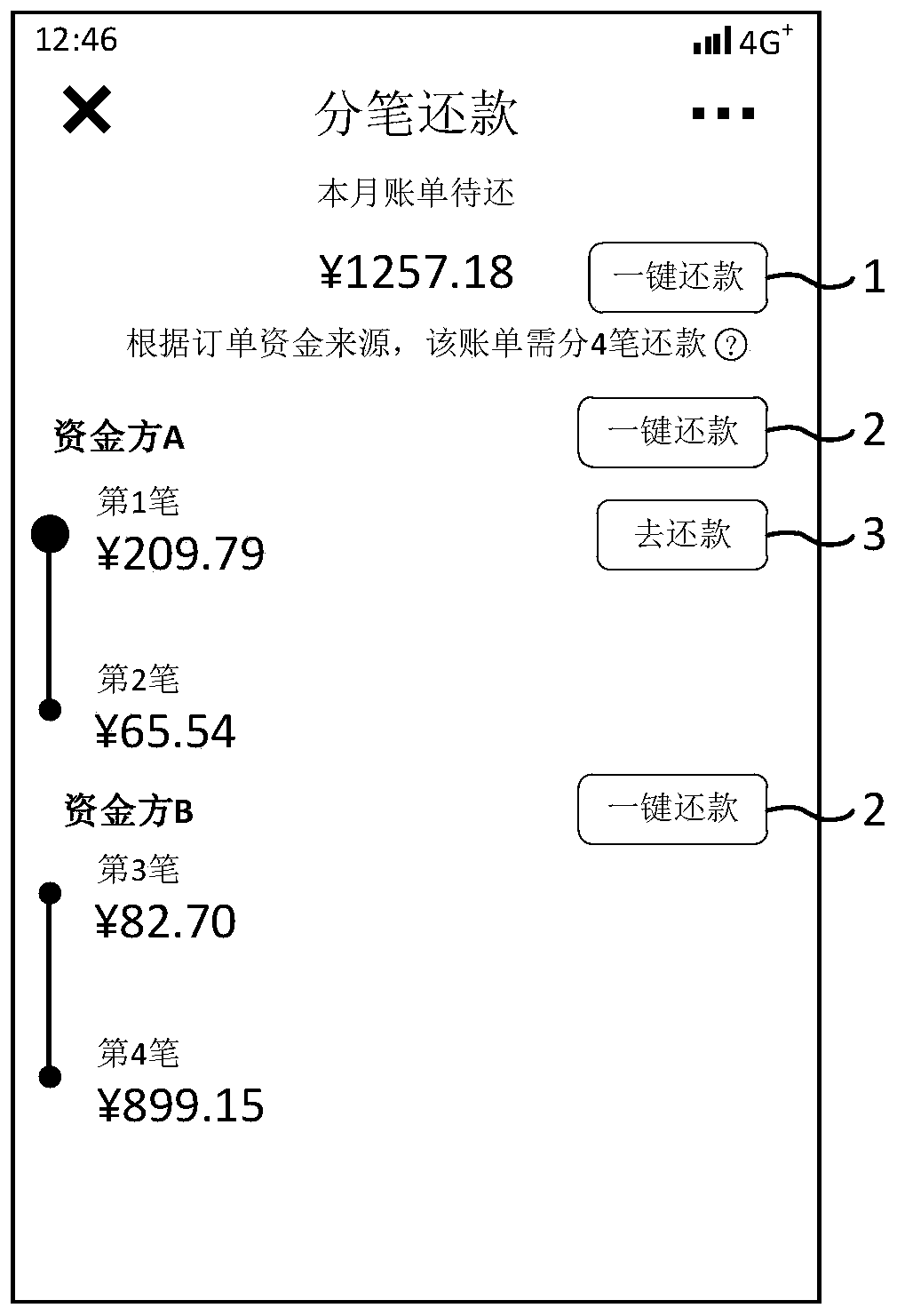

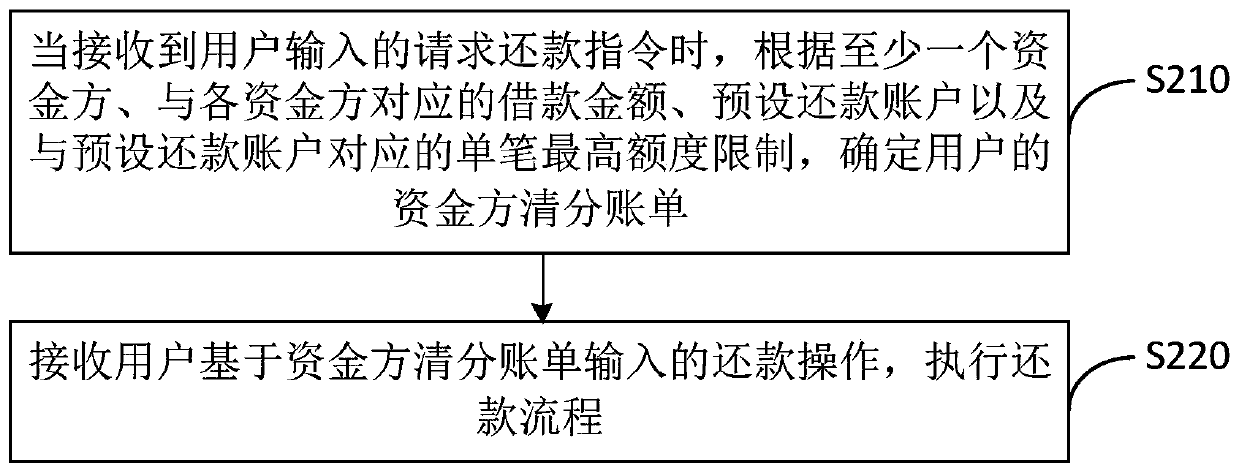

Repayment method and device, terminal equipment and storage medium

InactiveCN110930240AAddress non-compliance issuesStandardized operation modeFinanceTerminal equipmentDatabase

The embodiment of the invention discloses a repayment method and device, terminal equipment and a storage medium. The method comprises: when a repayment request instruction input by a user is received, determining a fund party clearing bill of the user according to at least one fund party and borrowing amount corresponding to each fund party, wherein the fund party clearing bill comprises at leastone amount to be repaid; and receiving a repayment operation input by the user based on the fund party clearing bill, and executing a repayment process. According to the embodiment of the invention,the repayment funds of the user are sorted according to the fund party, so that the problem that the repayment operation executed by the online loan platform is not compliant is solved, the user can directly execute the repayment operation on the fund party, the operation mode of the online loan platform is standardized, and the fund risk caused by using the online loan platform by the user is reduced.

Owner:SHENZHEN LEXIN SOFTWARE TECH CO LTD

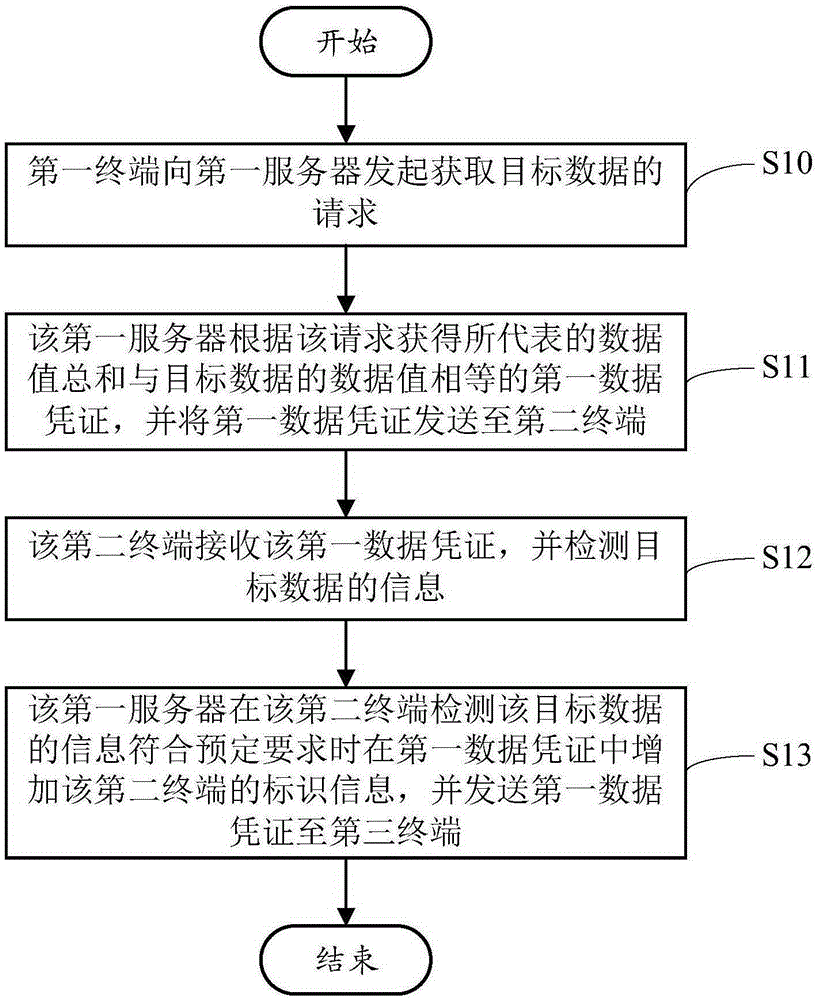

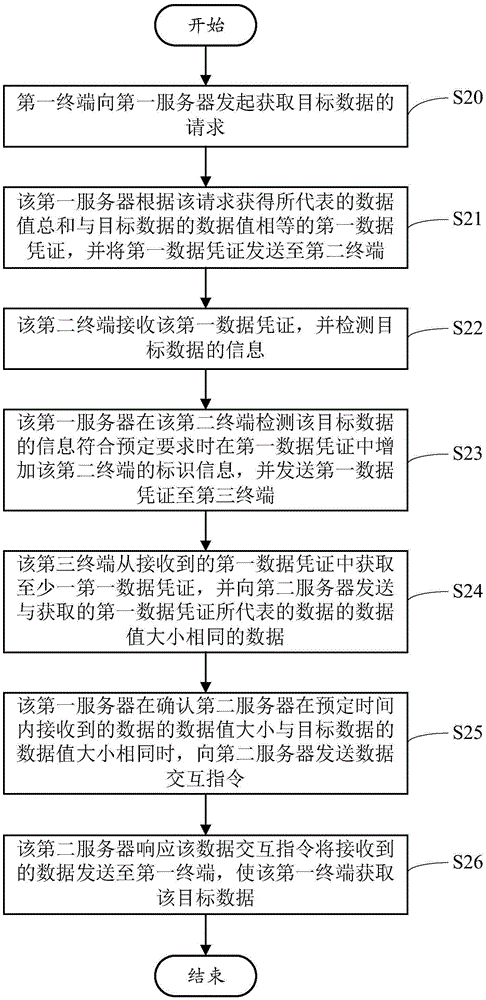

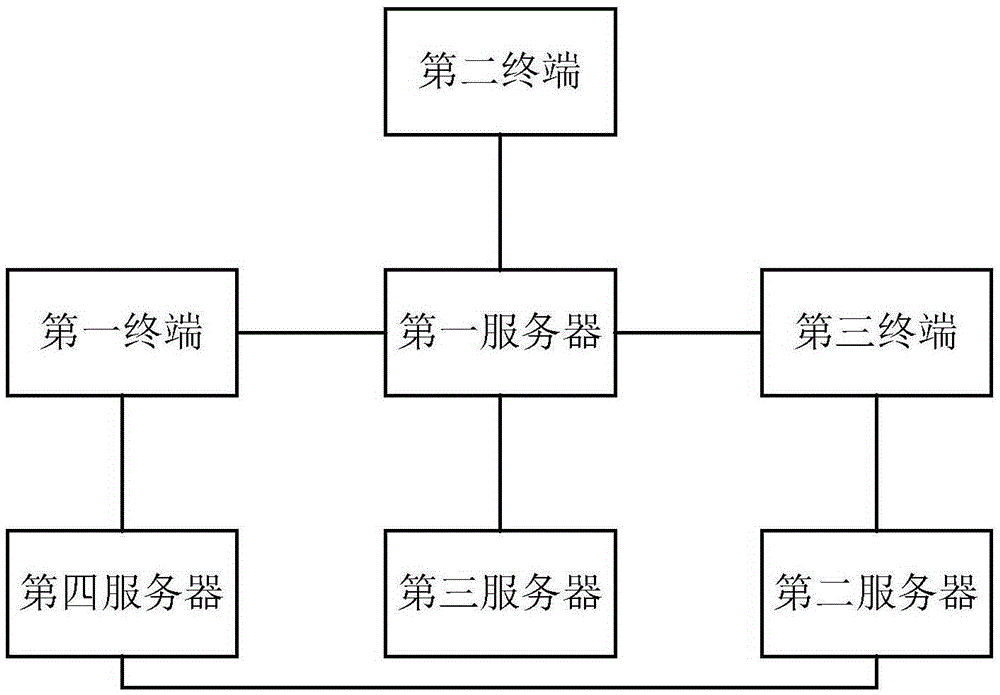

Processing method for acquiring target data, server and online financing method

InactiveCN106549900AImprove securityReduce capital riskFinanceFundraising managementTerminal equipmentComputer terminal

The invention discloses a processing method for acquiring target data, a server, terminal equipment and an online financing method. The processing method for acquiring the target data comprises the following steps that: a first terminal initiates a request of acquiring target data to a first server; the first server acquires a first data credential which represents a data value sum equal to a data value of the target data according to the request, and transmits the first data credential to a second terminal, wherein the first data credential includes information of the target data, and the information of the target data includes description information of the target data and the data value of the target data; the second terminal receives the first data credential, and detects the information of the target data; and the first server adds identification information of the second terminal in the first data credential when the second terminal detects that the information of the target data conforms to a predetermined requirement, and transmits the first data credential to a third terminal. Through adoption of the processing method, the server, the terminal equipment and the online financing method, the network data interaction security can be enhanced.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Payment system based on same server, payment method and device for payment system, and server

InactiveCN106203976ARich businessReduce capital riskPayment schemes/modelsPayments involving neutral partyE-commerceVoucher

The invention discloses a payment system based on the same server, a payment method and device for the payment system and a server, and belongs to the field of electronic commerce. The method comprises the steps: enabling a fund management server to receive payment request information transmitted by a client; enabling the sum of the credit overdraft limit and credit extension loan limit of the client to be compared with a payment amount, and judging whether an electronic payment acceptance voucher can be given or not: enabling the fund management server to block the credit overdraft limit and credit extension loan limit, corresponding to the payment amount, of the client if the electronic payment acceptance voucher can be given; generating the electronic payment acceptance voucher that the fund management server promises to unblock the fund according to the terms of the engagement, transmitting the electronic payment acceptance voucher to a merchant terminal for credit payment for the client, and synchronizing the electronic payment acceptance voucher to an information center server. According to the technical scheme, the method carries out the supervision of two transaction sides, can reduce the fund risks, and guarantees the benefits of the two transaction sides.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

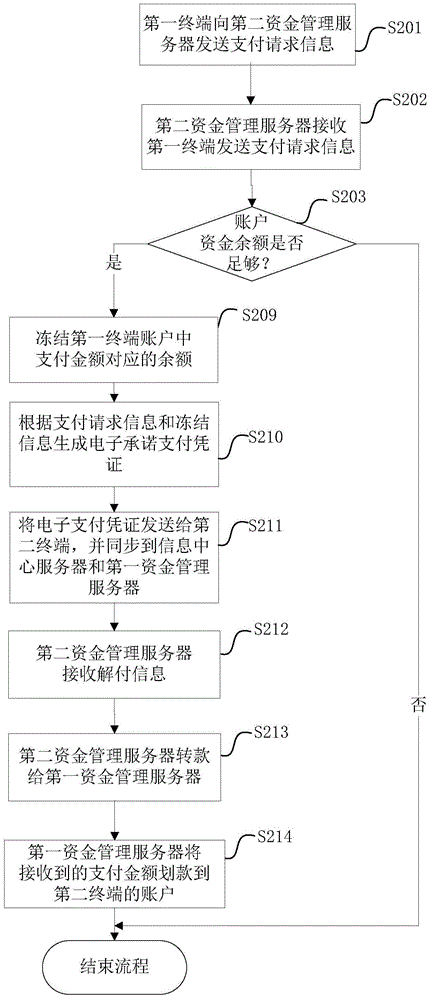

Payment system based on different fund servers, payment method thereof, device and servers

InactiveCN106204004AProtect interestsRich businessFinancePayment architectureE-commerceFinancial transaction

The invention discloses a payment system based on different fund management servers, a payment method thereof, a device and fund management servers, which belong to the field of e-commerce. The method comprises steps: a second fund management server receives payment request information sent by a first terminal; the account balance of the first terminal and the payment amount are compared to judge whether to open an electronic commitment payment voucher; if yes, the second fund management server freezes the amount, corresponding to the payment amount, in the account balance of the first terminal; and an electronic commitment payment voucher for enabling the fund management server to commit to pay the fund according to agreed terms is generated, and the electronic commitment payment voucher is sent to the second terminal for credit commitment payment on behalf of the first terminal and is synchronized to an information center server. By adopting the technical scheme of the invention, both sides of transaction can be supervised to reduce the fund risks, and benefits of both sides of the transaction can be ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Cross-fund server-based payment system, method, device and server

InactiveCN106203973ARich businessEnsure safetyProtocol authorisationPayments involving neutral partyE-commerceOperating system

The invention discloses a cross-fund management server-based payment system, method, device and server, and belongs to the field of e-commerce. The method comprises the following steps of: receiving payment request information sent by a client by a second fund management server; comparing the sum of a credit overdraft limit and a credit extension loan limit of the client with a payment amount, so as to judge whether an electronic underwrite document can be given or not; if the judging result is positive; respectively freezing the credit overdraft limit and the credit extension loan limit, in an account of the client, corresponding to the payment amount by the second fund management server; and generating the electronic underwrite document indicating that the second fund management server promises to pay the fund according to an appointed condition, sending the electronic underwrite document to a commercial tenant end to replace the client to carry out credit underwrite, and synchronizing the electronic underwrite document to an information center server. By adopting such a technical scheme, the two trading parties are supervised so that the fund risk can be reduced and then the benefits of the two trading parties are ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

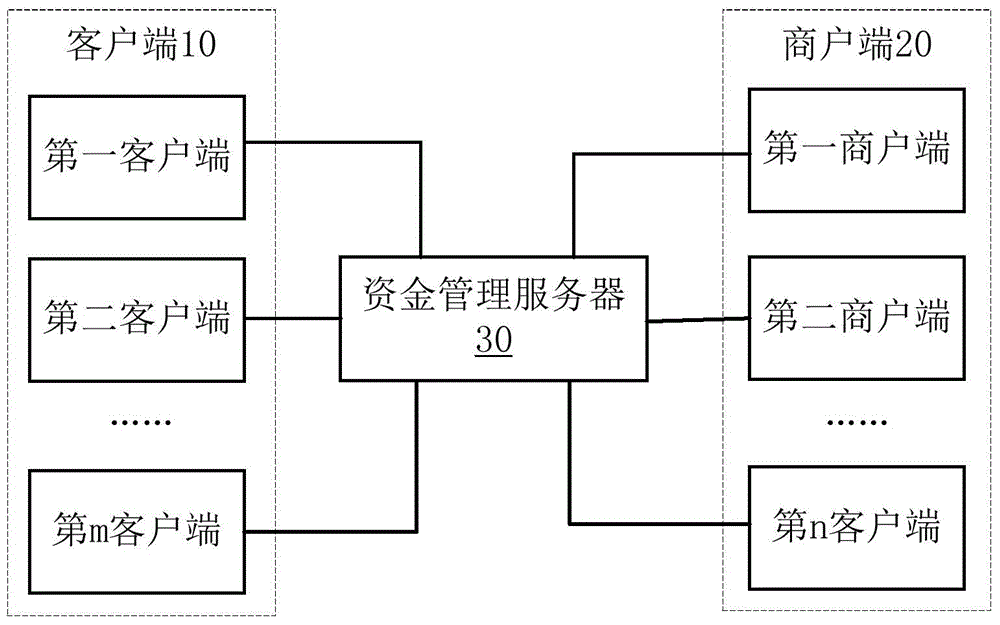

Network payment method, device and system and fund management server

The invention discloses a payment method and a payment device based on the same fund management server, and the fund management server, and belongs to the field of electronic commerce. The method comprises the following steps: the fund management server receives payment request information sent from a client side; the credit extension facility extent of a client account are compared with and a payment amount to judge whether an electronic acceptance payment order can be issued or not; if the electronic acceptance payment order can be issued, the fund management server blocks the credit extension facility extent corresponding to the payment amount in the client side account; and an electronic acceptance payment order that the fund management server promises to carry out fund solution pay according to agreed terms is generated, and the electronic acceptance payment order is sent to a commercial tenant side to carry out credit commitment payment instead of the client side. By use of the technical scheme of the invention, both transaction parties are supervised, so that fund risks can be lowered, and the benefits of both transaction parties are guaranteed.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Payment system, payment method, payment device and server based on cross-fund server

InactiveCN106203984ARich businessReduce capital riskProtocol authorisationPayments involving neutral partyPayment orderE-commerce

The invention discloses a payment system, a payment method, a payment device and a server based on a cross-fund management server, and belongs to the field of electronic commerce. The method comprises the following steps: a second fund management server receives payment request information sent from a client side; comparing the sum of the fund balance and the credit extension loan extent of a client side with a payment amount to judge whether an electronic acceptance payment order can be issued or not; if the electronic acceptance payment order can be issued, the second fund management server independently blocks the fund balance and the credit extension loan extent corresponding to the payment amount in a client side account; and the electronic acceptance payment order that the second fund management server promises to carry out fund solution pay according to agreed terms is generated, the electronic acceptance payment order is sent to a commercial tenant side to carry out credit commitment payment instead of the client side, and the electronic acceptance payment order is synchronized to an information center server. When the technical scheme of the invention is adopted, both transaction parties are both supervised to lower fund risks and guarantee benefits of both transaction parties.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Same fund server-based payment system, method, device and server

InactiveCN106203972AEnsure safetyReduce capital riskPayment schemes/modelsProtocol authorisationE-commerceComputer science

The invention discloses a same fund management server-based payment system, method, device and server, and belongs to the field of e-commerce. The method comprises the following steps of: receiving payment request information sent by a client by a fund management server; comparing the sum of a credit overdraft limit and a credit extension loan limit of the client with a payment amount, so as to judge whether an electronic underwrite document can be given or not; if the judging result is positive; respectively freezing the credit overdraft limit and the credit extension loan limit, in an account of the client, corresponding to the payment amount by the fund management server; and generating the electronic underwrite document indicating that the fund management server promises to pay the fund according to an appointed condition, and sending the electronic underwrite document to a commercial tenant end to replace the client to carry out credit underwrite. By adopting such a technical scheme, the two trading parties are supervised so that the fund risk can be reduced and then the benefits of the two trading parties are ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

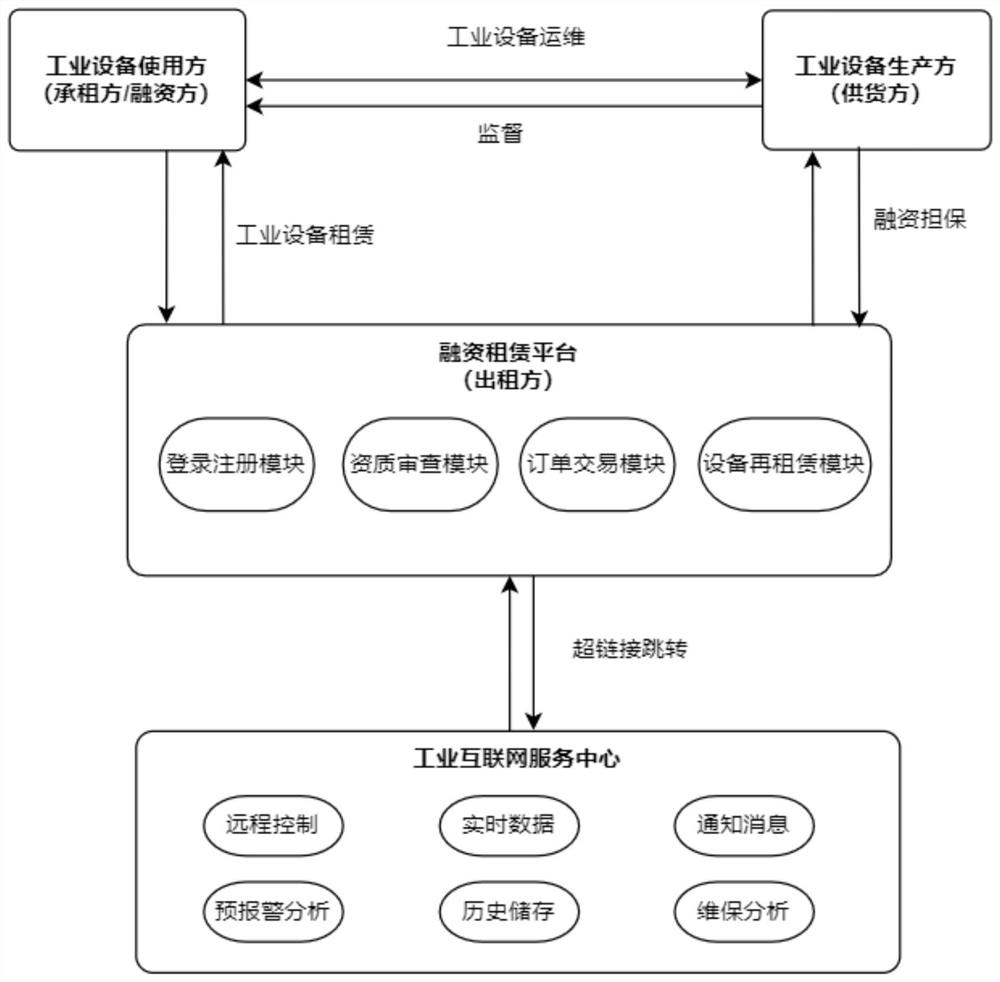

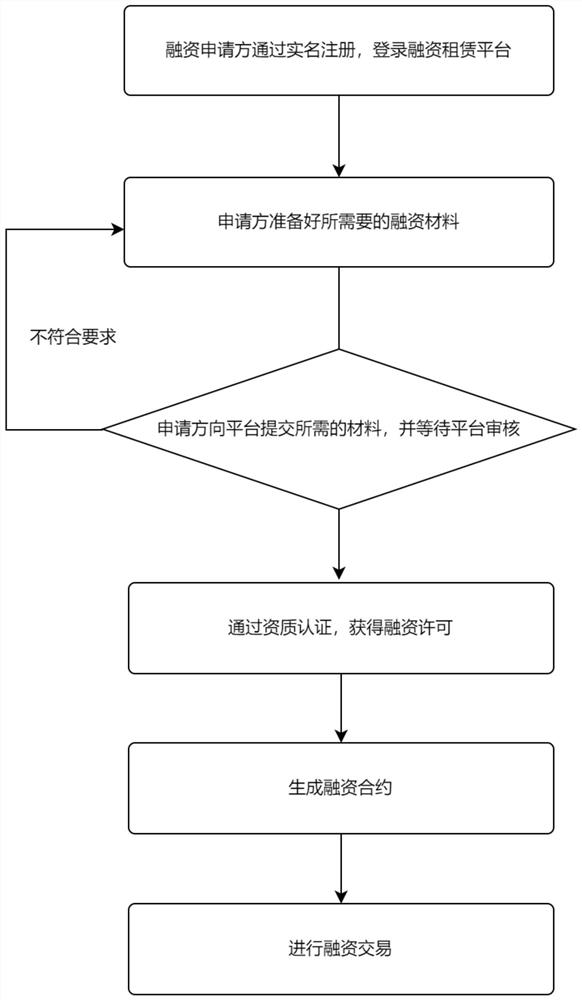

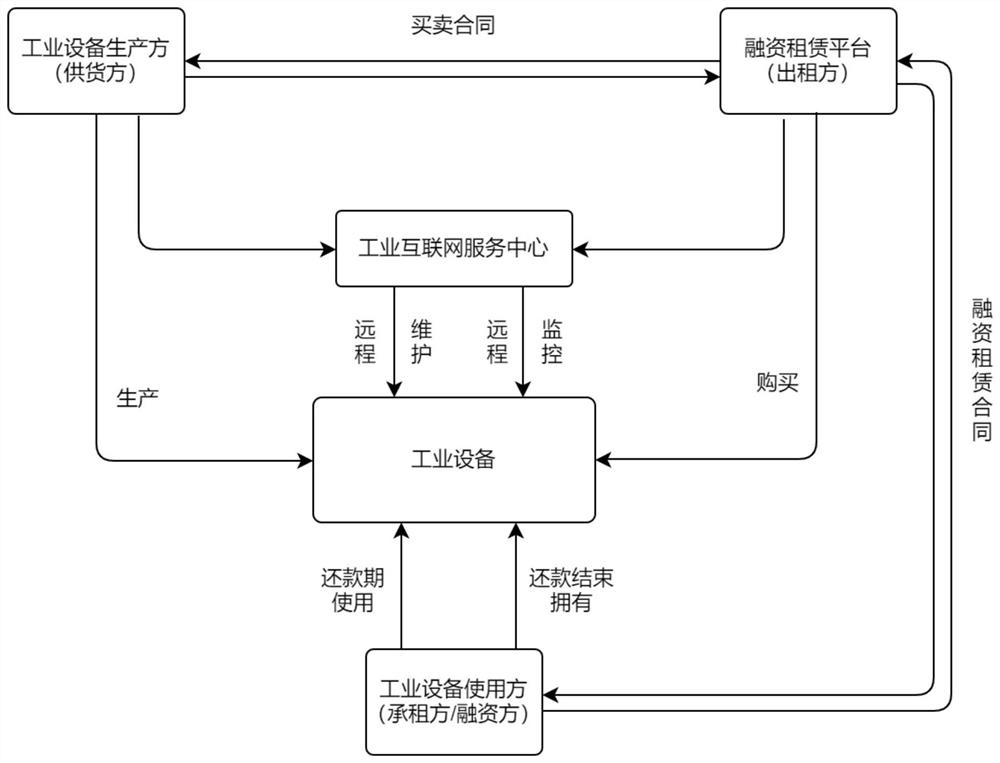

Sales and lease method of industrial equipment financing lease platform of industrial internet

InactiveCN114549141AImprove efficiencyReduce financial costsOffice automationBuying/selling/leasing transactionsIndustrial equipmentThe Internet

The invention belongs to the technical field of industrial equipment sales, financing and leasing, and particularly relates to a sales and leasing method of an industrial equipment financing and leasing platform of an industrial internet, and the sales and leasing method of the industrial equipment financing and leasing platform of the industrial internet comprises a financing and leasing platform and an industrial internet service center. The financing leasing platform comprises a login registration module, a qualification examination module, an order transaction module and an equipment re-leasing module, an industrial internet service center system is introduced on a traditional financing leasing platform, so that an industrial equipment owner can monitor equipment in real time and know real information of the industrial equipment, and the information of the industrial equipment can be displayed in real time. Therefore, the problems of fund turnover and financing leasing on-time loan delivery of the industrial equipment producer and the industrial equipment purchaser are solved, and the purposes of increasing the order trading volume and improving the overall efficiency are achieved. And meanwhile, the financing leasing platform is combined with the industrial internet service center to realize the financing process, so that the financing service is more intelligent.

Owner:苏州点联智控科技有限公司

Same fund server-based payment system, method, device and server

InactiveCN106203974AProtect interestsReduce capital riskPayments involving neutral partyE-commerceComputer science

The invention discloses a same fund server-based payment system, method, device and server, and belongs to the field of e-commerce. The method comprises the following steps of: receiving payment request information sent by a client by a fund management server; comparing the sum of a credit overdraft limit, a credit extension loan limit and a fund balance of the client with a payment amount, so as to judge whether an electronic underwrite document can be given or not; if the judging result is positive; respectively freezing the credit overdraft limit, the credit extension loan limit and the fund balance, in an account of the client, corresponding to the payment amount by the fund management server; and generating the electronic underwrite document indicating that the fund management server promises to pay the fund according to an appointed condition, and sending the electronic underwrite document to a commercial tenant end to replace the client to carry out credit underwrite. By adopting such a technical scheme, the two trading parties are supervised so that the fund risk can be reduced and then the benefits of the two trading parties are ensured.

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

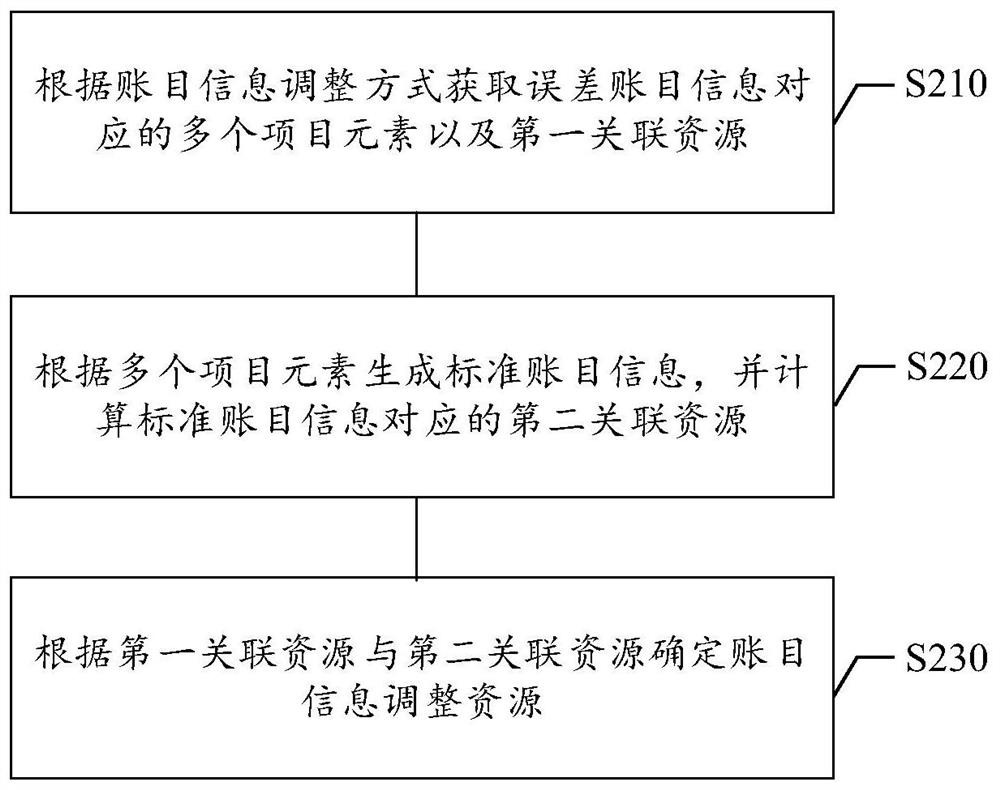

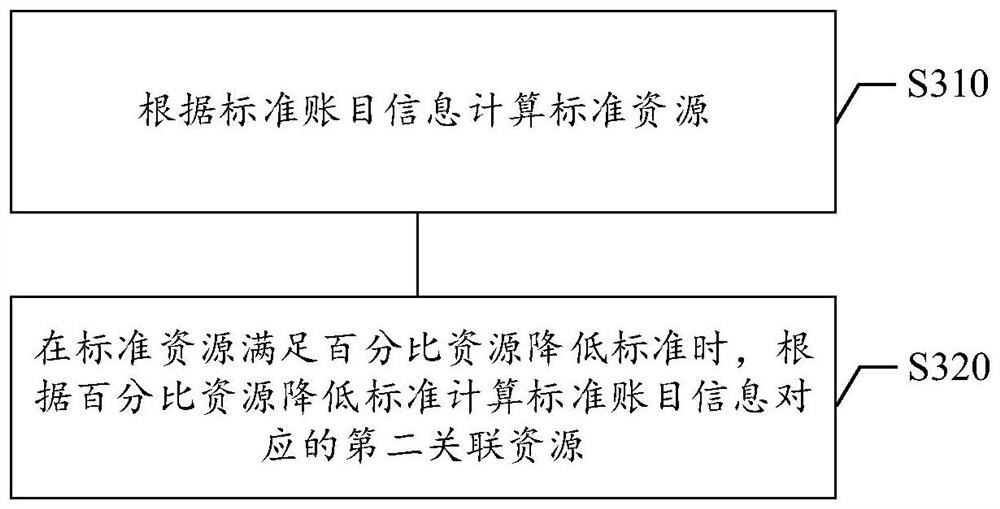

Information processing method, information processing device, storage medium and electronic equipment

PendingCN113379522ASave time and costImprove collection efficiencyFinanceInformation processingEngineering

The invention relates to the field of computers, in particular to an information processing method, an information processing device, a computer readable storage medium and electronic equipment. The method comprises the steps: acquiring a plurality of item elements and first associated resources corresponding to error account information according to an account information adjustment mode; generating standard account information according to the plurality of project elements, and calculating a second associated resource corresponding to the standard account information; and determining account information adjustment resources according to the first associated resources and the second associated resources. Therefore, the problem of low account adjusting efficiency is solved.

Owner:BEIJING JINGDONG ZHENSHI INFORMATION TECH CO LTD

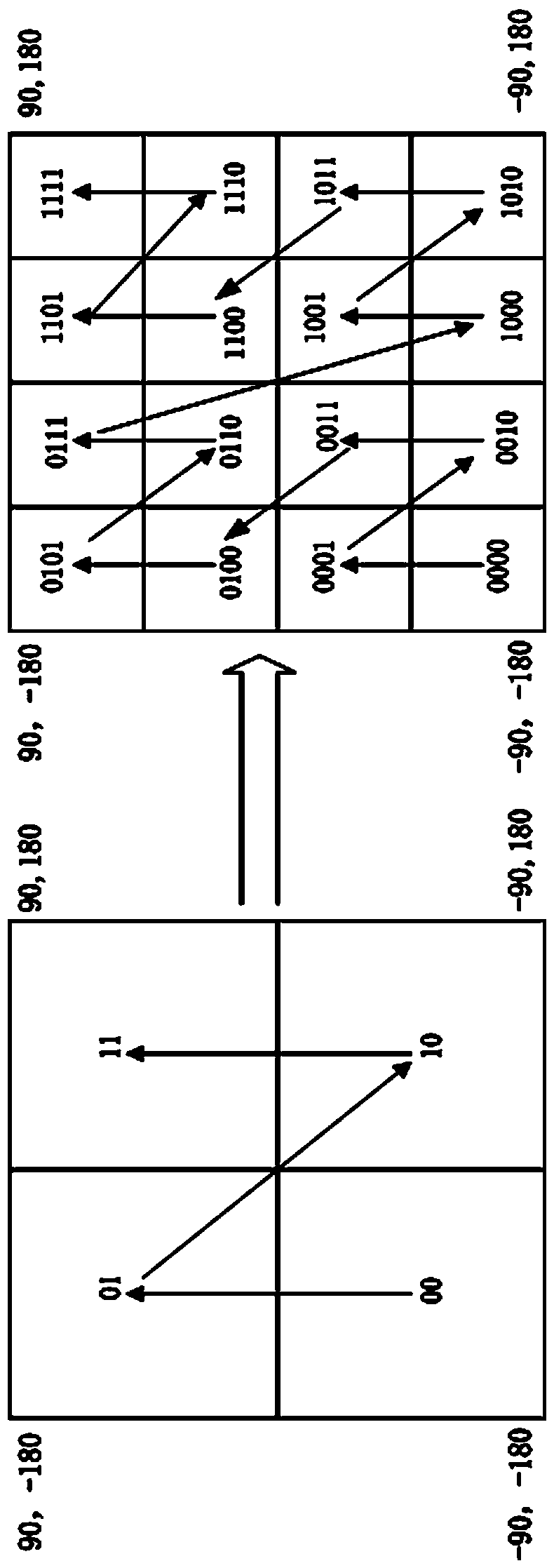

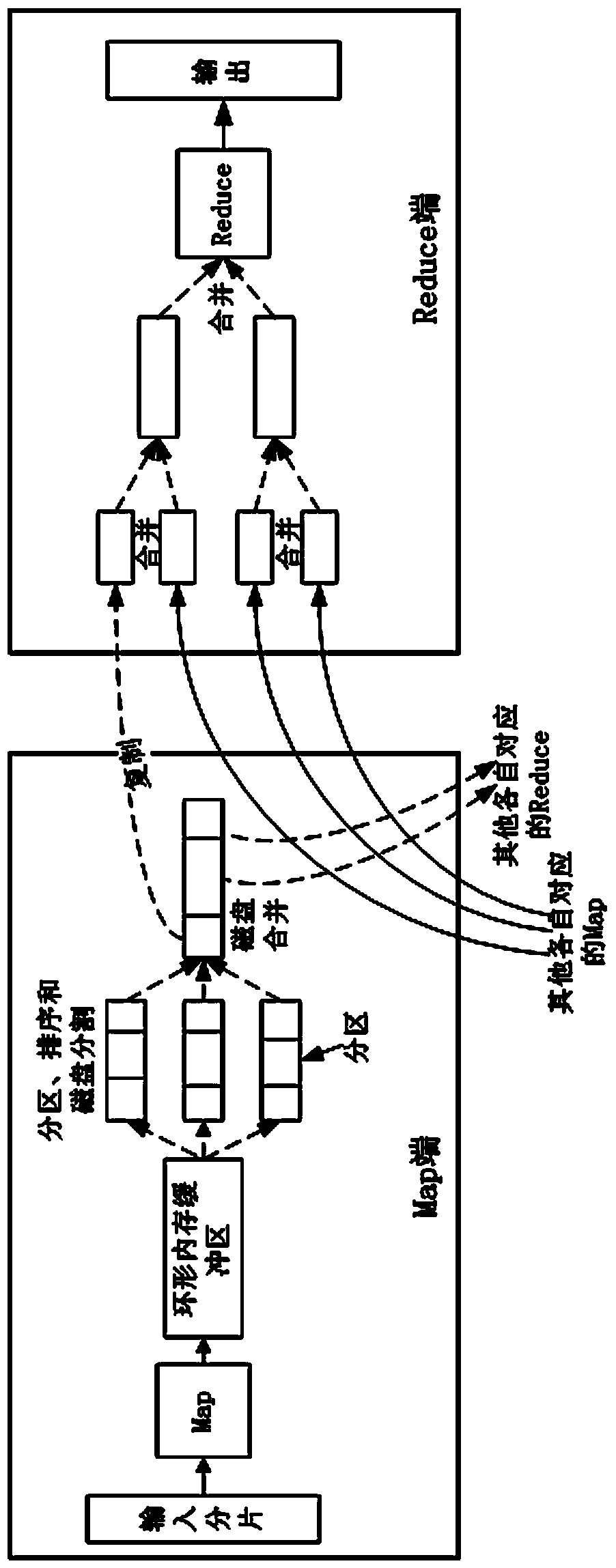

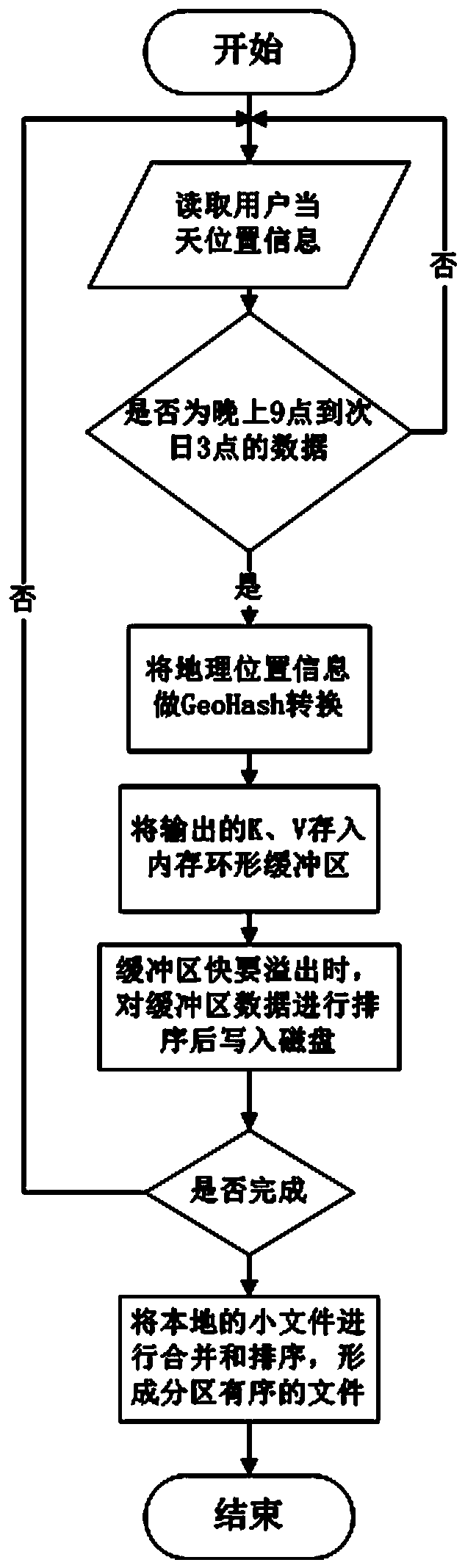

A method of location analysis

ActiveCN106372213BImprove efficiencyReduce IO loadGeographical information databasesSpecial data processing applicationsGeographic siteDistributed File System

A location analysis method of the present invention relates to the field of LBS analysis, in particular to a user family and work location analysis method based on MapReduce and GeoHash algorithms under big data. Location analysis is realized by completing two MapReduce tasks. The first MapReduce task converts the two-dimensional geographic location information of the user into GeoHash codes on the day, counts the number of times each user enters the same GeoHash code, that is, the location area code, and encodes the GeoHash Statistical information is output to the distributed file system HDFS; the second MapReduce task reads the intermediate results, that is, the GeoHash coding statistics saved on the previous day and the current day, filters outdated data, and merges the coding statistics saved on the previous day and the current day for location analysis , output the user's location information and new intermediate results.

Owner:TIANZE INFORMATION IND

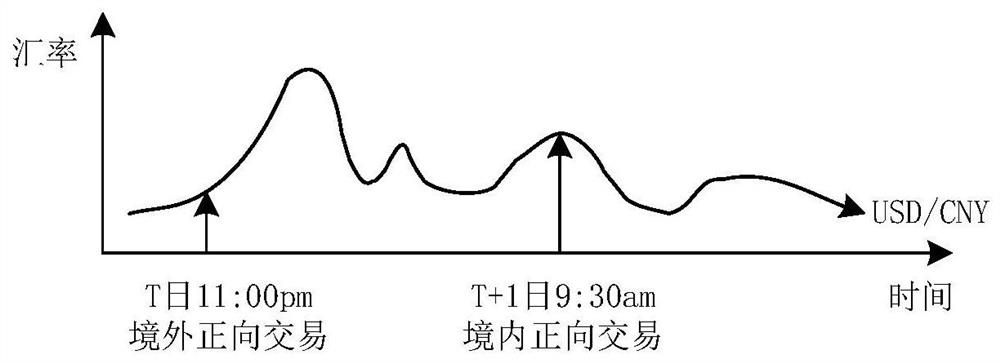

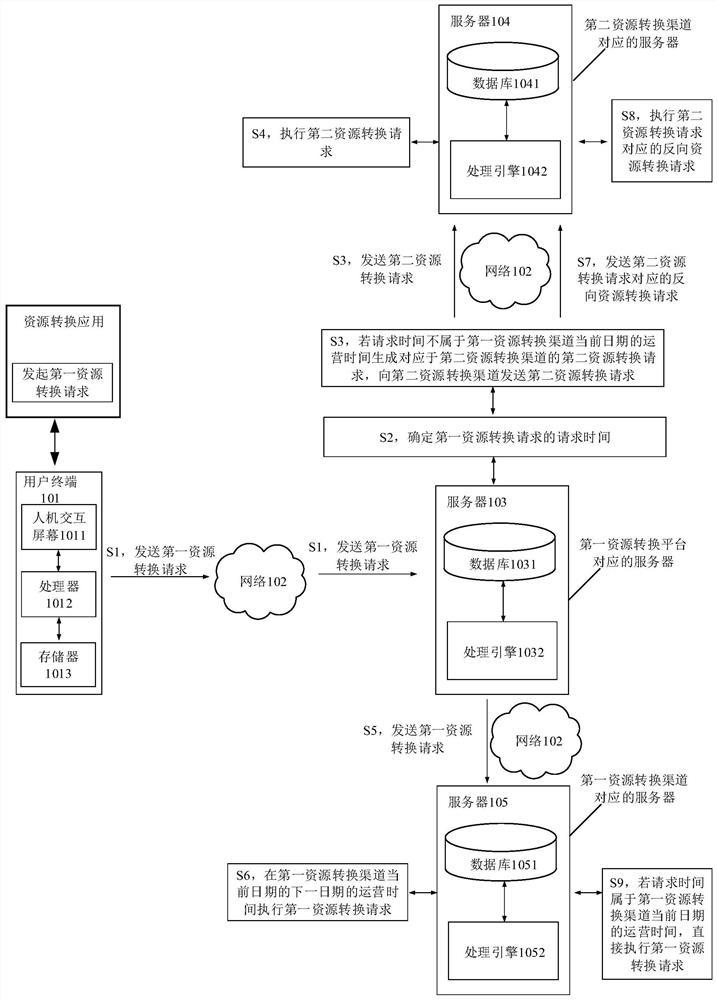

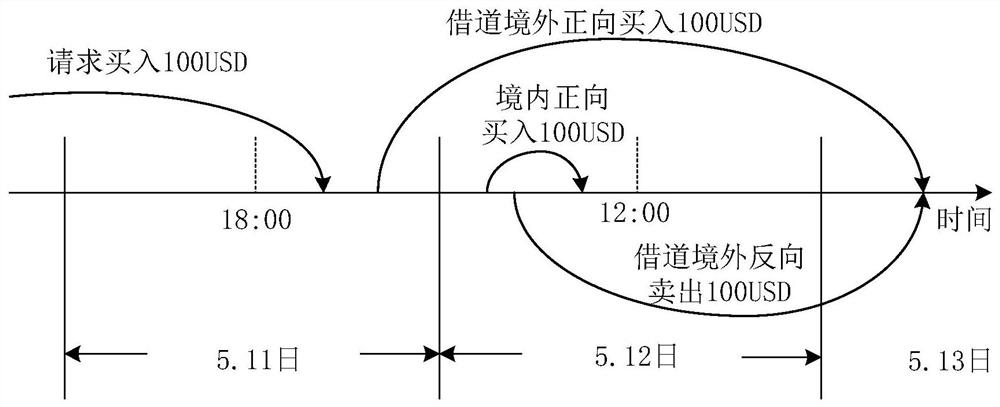

Resource conversion method and device, electronic equipment and storage medium

PendingCN114445209AReduce capital riskImprove securityFinanceResourcesComputer networkIndustrial engineering

The embodiment of the invention discloses a resource conversion method and device, electronic equipment and a storage medium, and can be applied to the fields of cloud technology, big data and the like. The method comprises the following steps: acquiring a first resource conversion request corresponding to a first resource conversion channel through a first resource conversion platform; determining request time corresponding to the first resource conversion request; if the request time corresponding to the first resource conversion request does not belong to the operation time of the current date of the first resource conversion channel, a second resource conversion request corresponding to a second resource conversion channel is generated based on the first resource conversion request, and the request time of the second resource conversion request belongs to the operation time of the second resource conversion channel; executing the second resource conversion request through the second resource conversion channel; executing the first resource conversion request at the operation time of the next date of the current date of the first resource conversion channel; and executing a reverse resource conversion request corresponding to the second resource conversion request through the second resource conversion channel.

Owner:TENCENT TECH (SHENZHEN) CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com