Cross-fund server-based payment system, method, device and server

A payment system and server technology, applied in the payment system, payment system structure, payments involving neutral parties, etc., can solve the problem of difficulty in ensuring the security of funds, and achieve the effect of promoting network transactions, optimizing credit mechanisms, and protecting interests

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

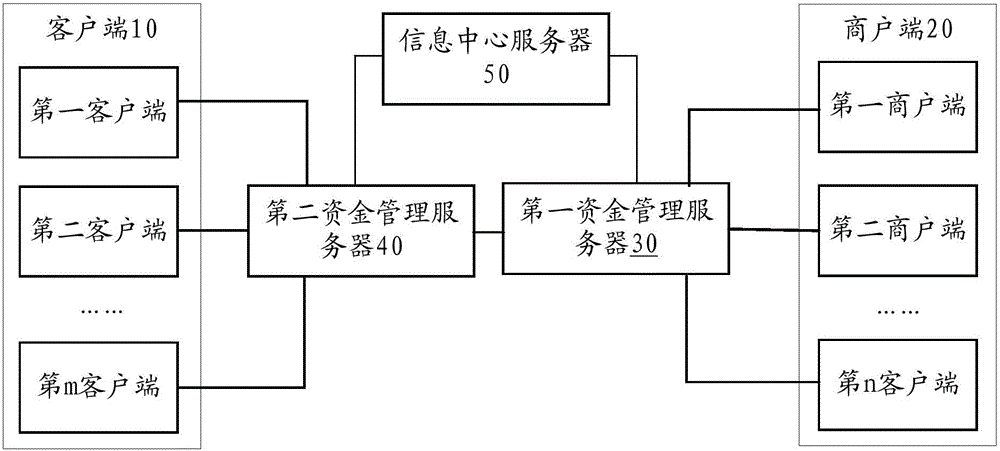

[0029] like figure 1 As shown, the embodiment of the present invention provides a payment system based on a cross-fund server, which includes at least one client terminal 10, at least one merchant terminal 20, an information center server 50, and a first fund management server 30 and a first fund management server 30 connected to each other. Two fund management servers 40, wherein:

[0030] The client terminal 10 is connected to the second fund management server 40, and is configured to send payment request information to the second fund management server 40, wherein the payment request information includes the payment amount.

[0031] Specifically, the client 10 is suitable for the payer (buyer), including smart devices such as mobile phones, personal computers, and PADs. The account information of the client 10 is filled in when the user registers and stored in the fund management service and / or information center server. In the database, the account information of the clie...

Embodiment 2

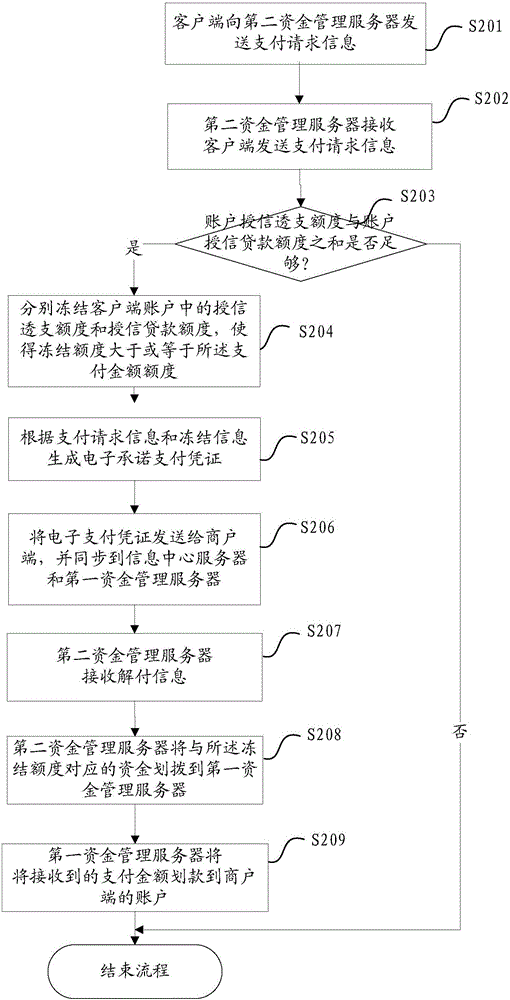

[0044] like figure 2 As shown, a cross-fund server-based payment method provided by an embodiment of the present invention is applied to a fund management server, and the method includes the following steps:

[0045] S201. The client sends payment request information to the second fund management server, where the payment request information includes a payment amount.

[0046] Specifically, the payment request information received by the second fund management server includes: merchant information, product information and payment amount, and may also include client information (such as customer ID). Wherein, the merchant information can directly be the merchant's payment account number, or can uniquely identify the merchant's information (such as the merchant ID), and the second fund management server can search the bank account information corresponding to the merchant from the database according to the unique identifier of the merchant. In a specific application, the accou...

Embodiment 3

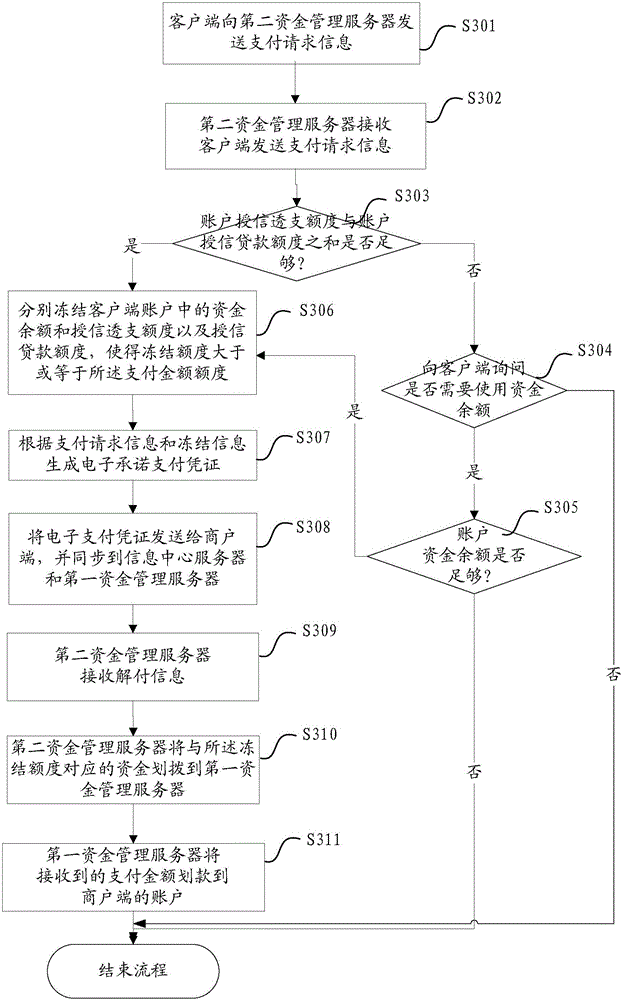

[0061] like image 3 As shown, a payment method for a credit overdraft line and a credit loan line provided by a preferred embodiment of the present invention is applied to figure 1 In the shown payment system based on cross-fund server, the method includes the following steps:

[0062] S301. The client sends payment request information to the second fund management server, where the payment request information includes at least a payment amount.

[0063] Wherein, the payment request information is composed of multiple data packets, at least including merchant information, product information and payment amount. Can also include client information (such as client ID). Wherein, the merchant information can directly be the merchant's payment account number, or can uniquely identify the merchant's information (such as the merchant ID), and the fund management server can search the bank account information corresponding to the merchant from the database according to the unique i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com