Patents

Literature

257 results about "Payment card number" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

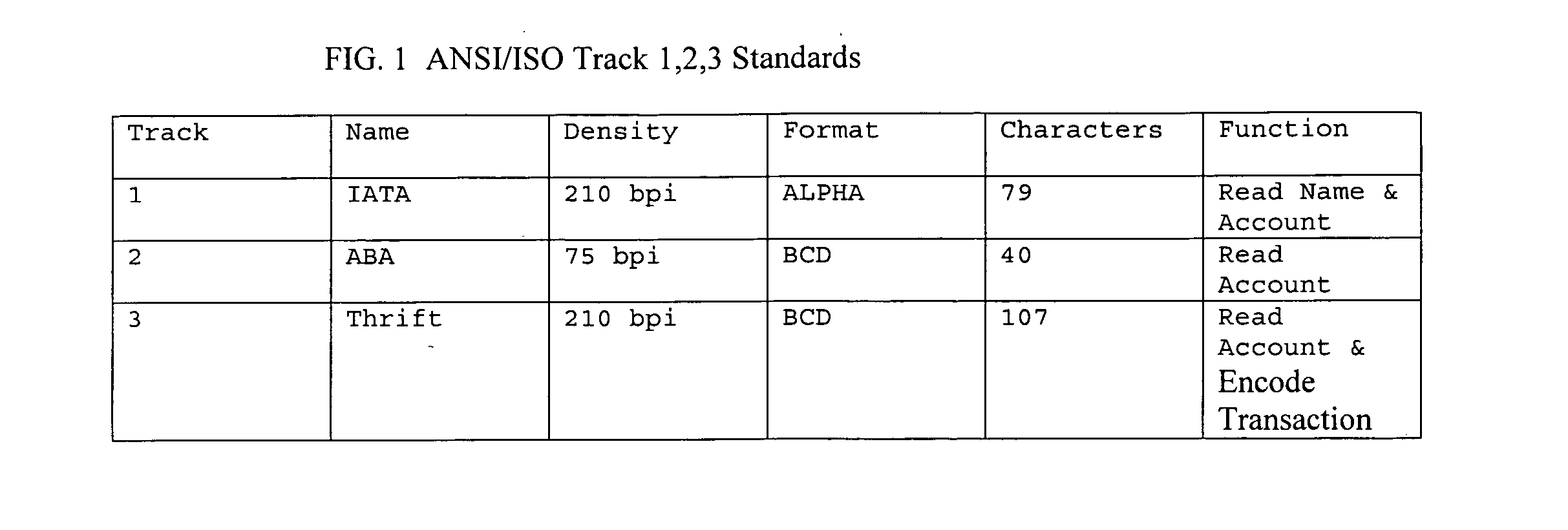

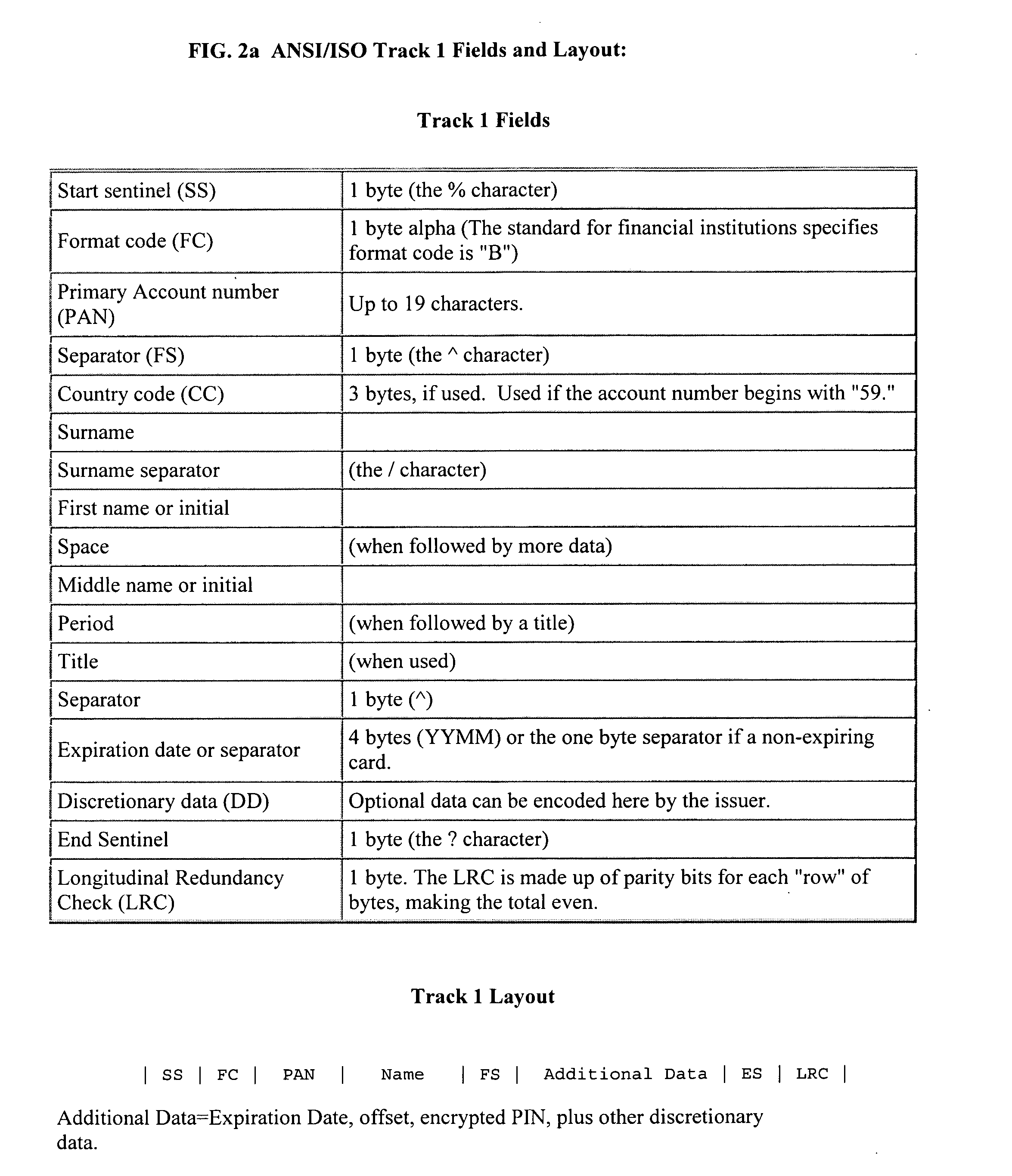

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and does not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is usually prominently embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may be imprinted on the back of the card.

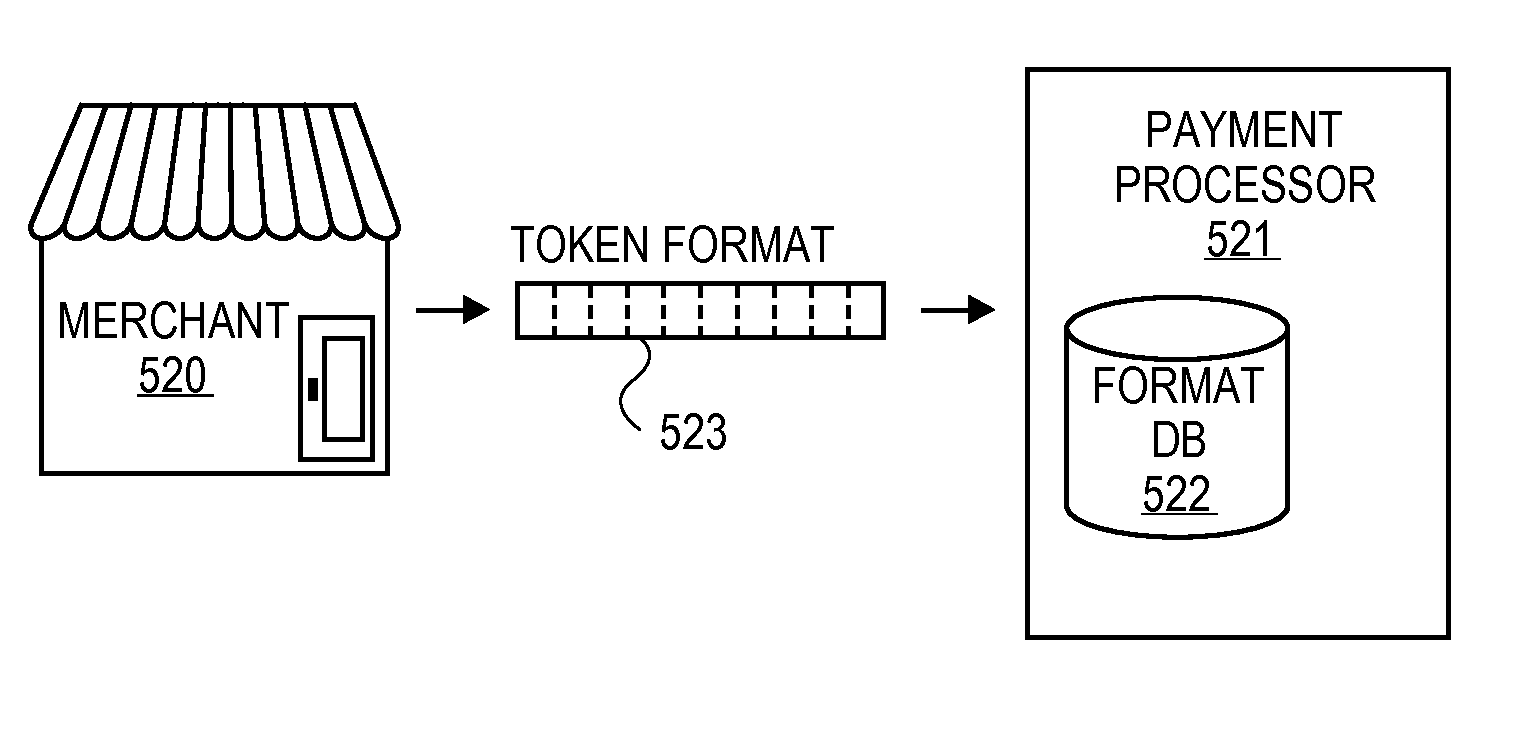

Configurable payment tokens

Methods and systems are disclosed for the generation and use of merchant-customizable token formats that define tokens that represent credit card and other payment numbers in online transactions. The tokens, which are used instead of the card numbers themselves for security, can be specified by the token format to have a certain number of characters, have certain fields reserved for major card identifiers, use encryption and / or randomization, be alphanumeric, and have other formatting. The customized tokens can be used with legacy equipment that uses longer or shorter card numbers than the standard sixteen-digit payment card number format and can be less likely to be recognized as related to card numbers by identify thieves.

Owner:VISA USA INC (US)

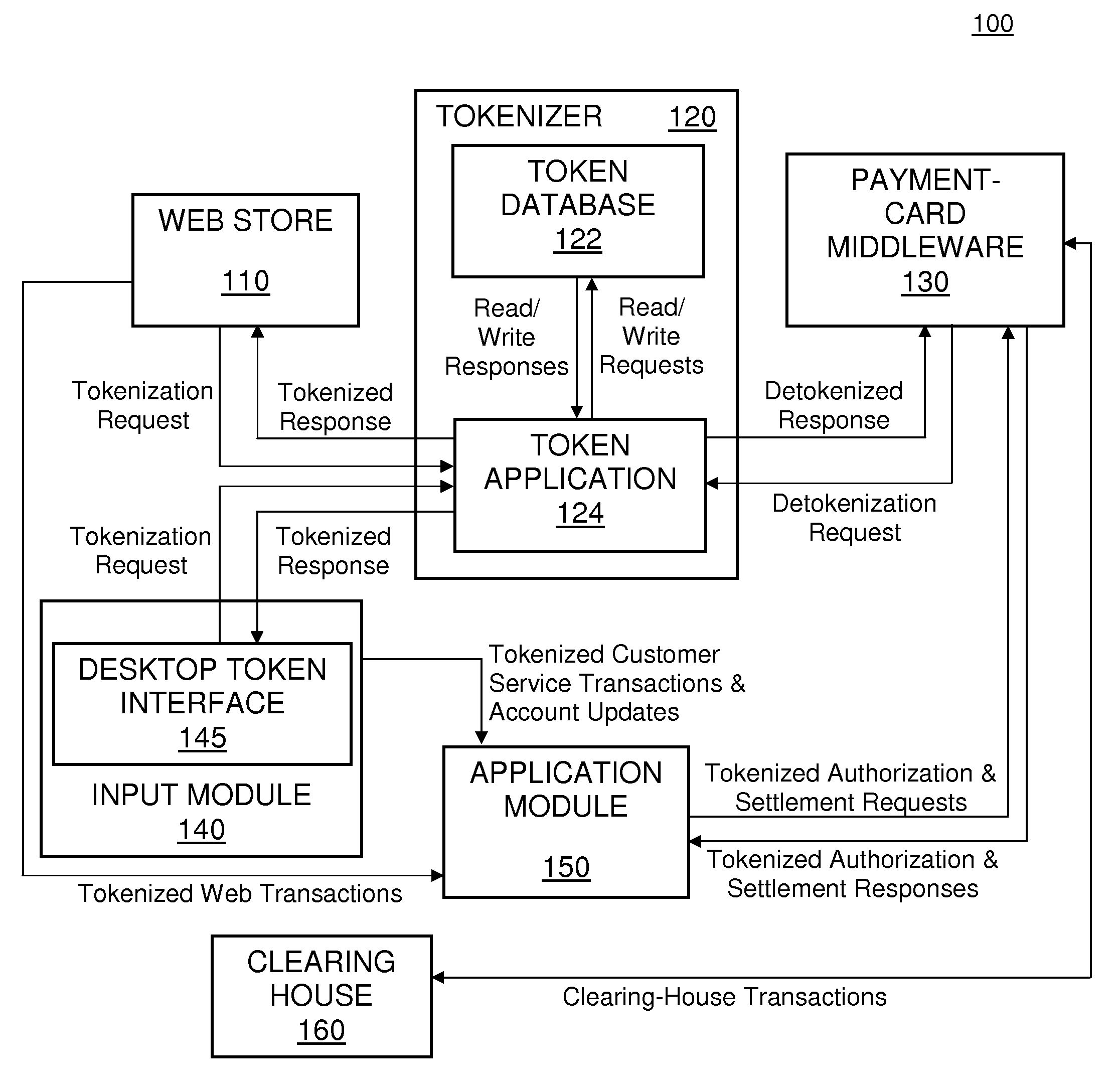

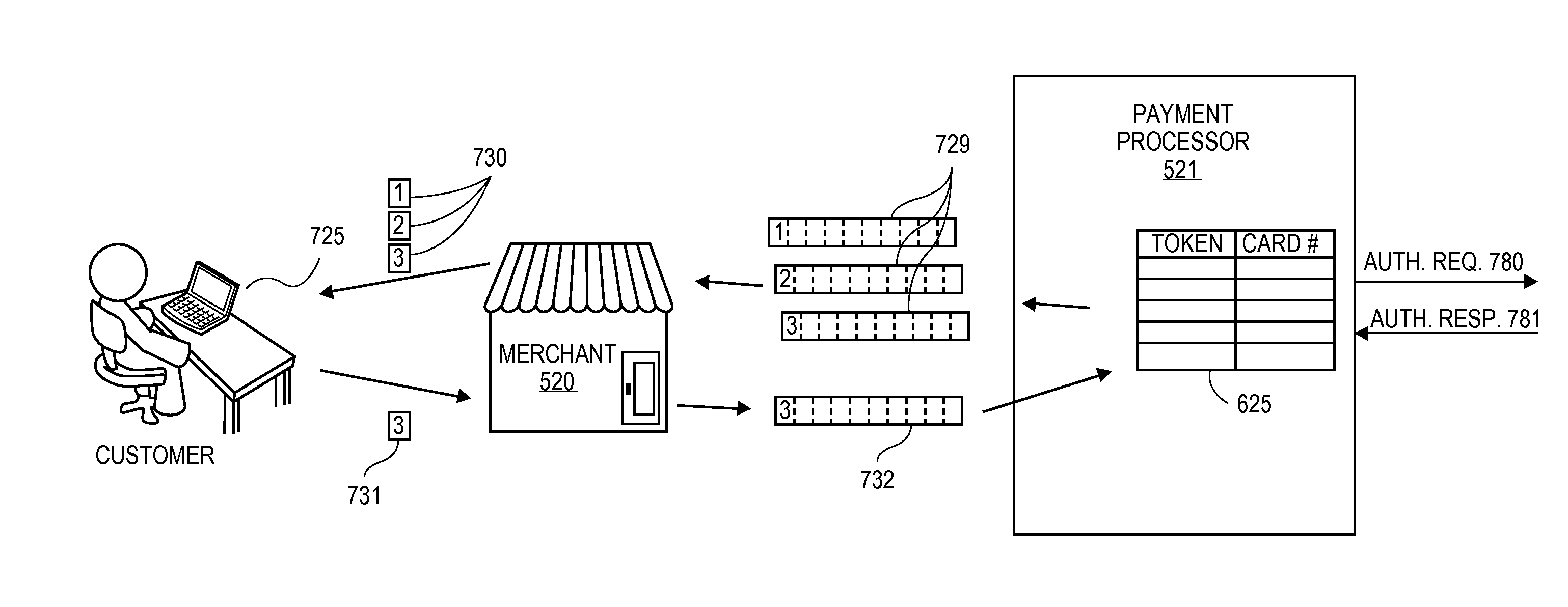

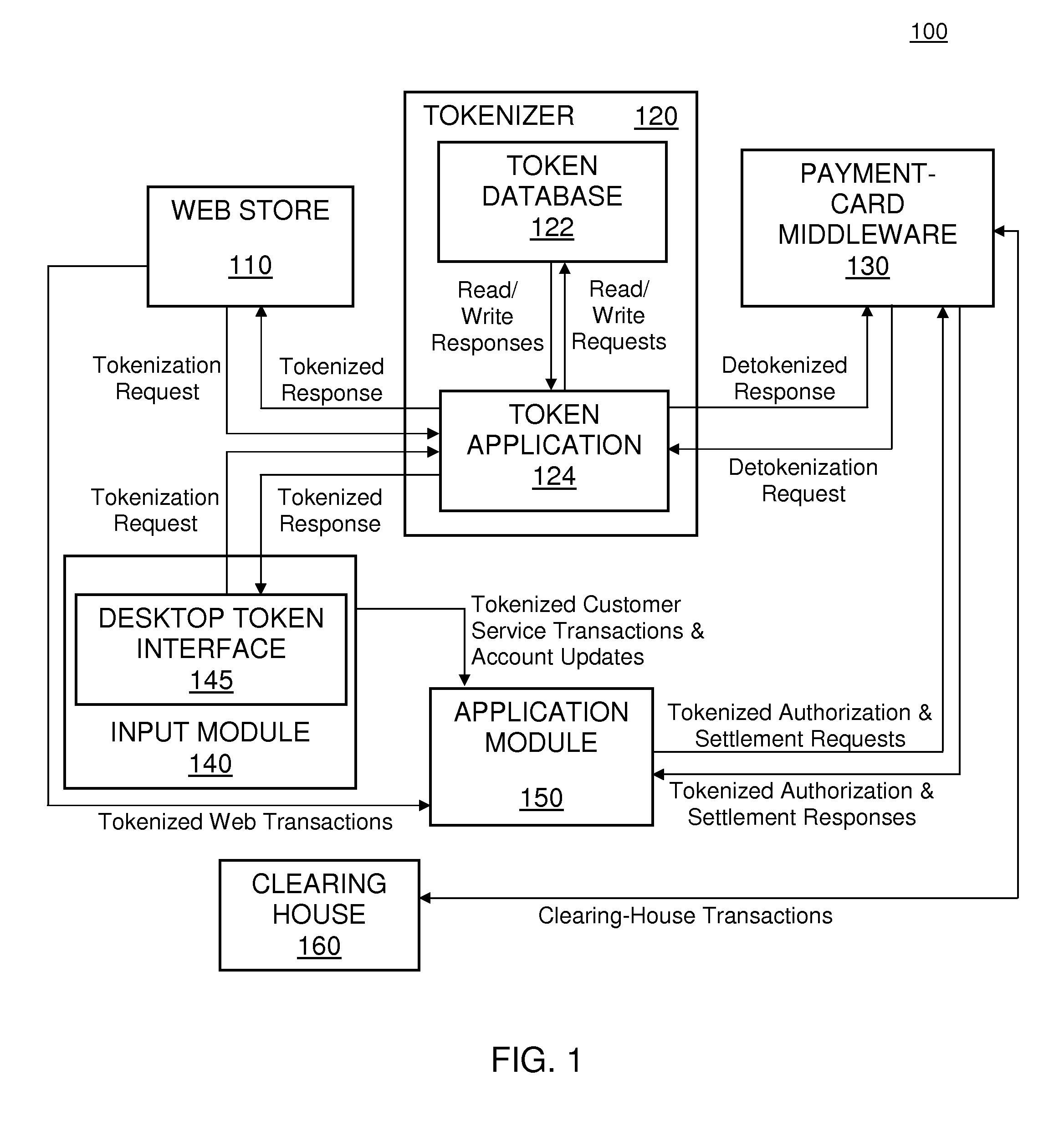

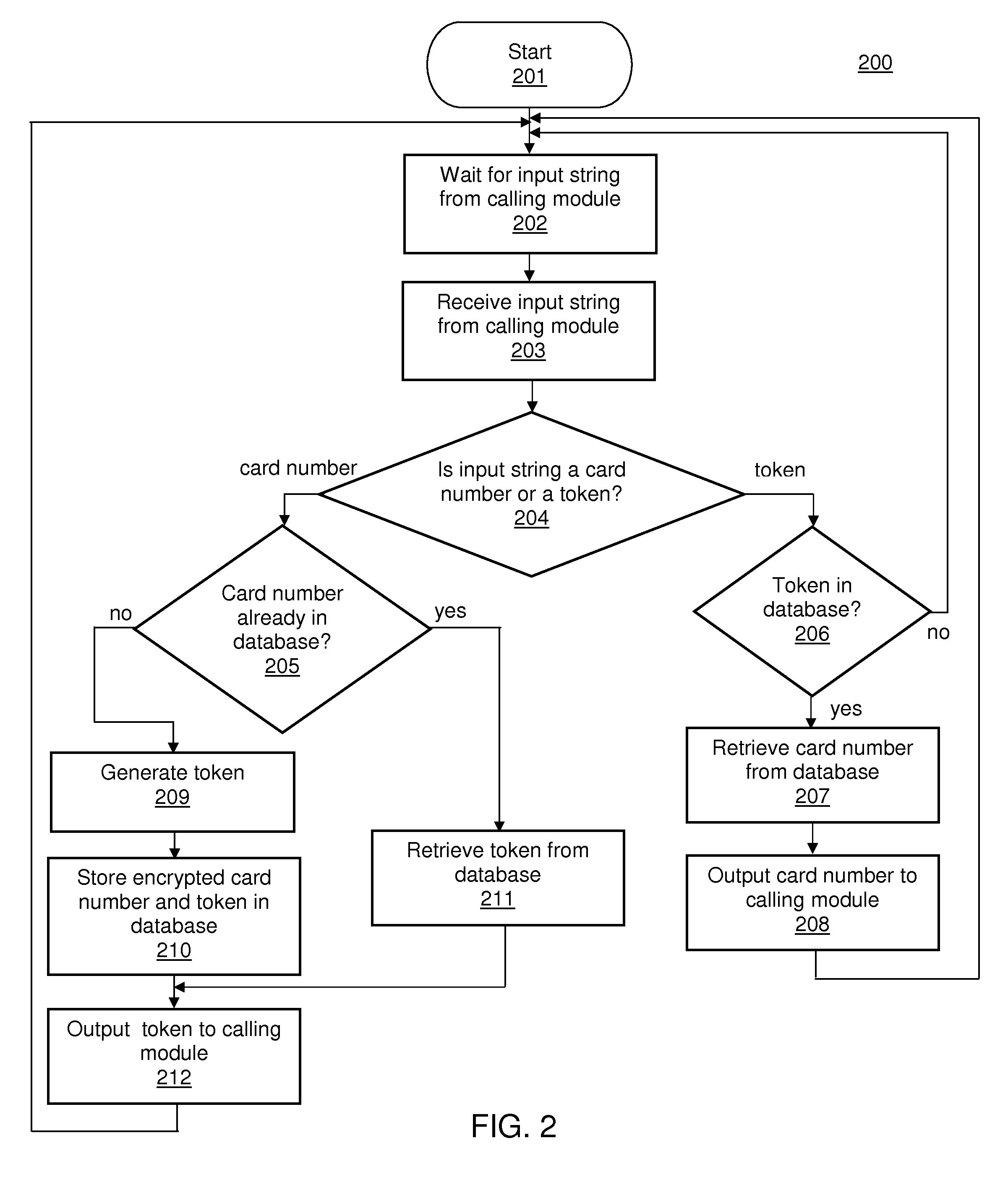

Tokenized Payment Processing Schemes

InactiveUS20110307710A1Preventing transmission of confidential informationDigital data processing detailsUser identity/authority verificationPayment card numberApplication software

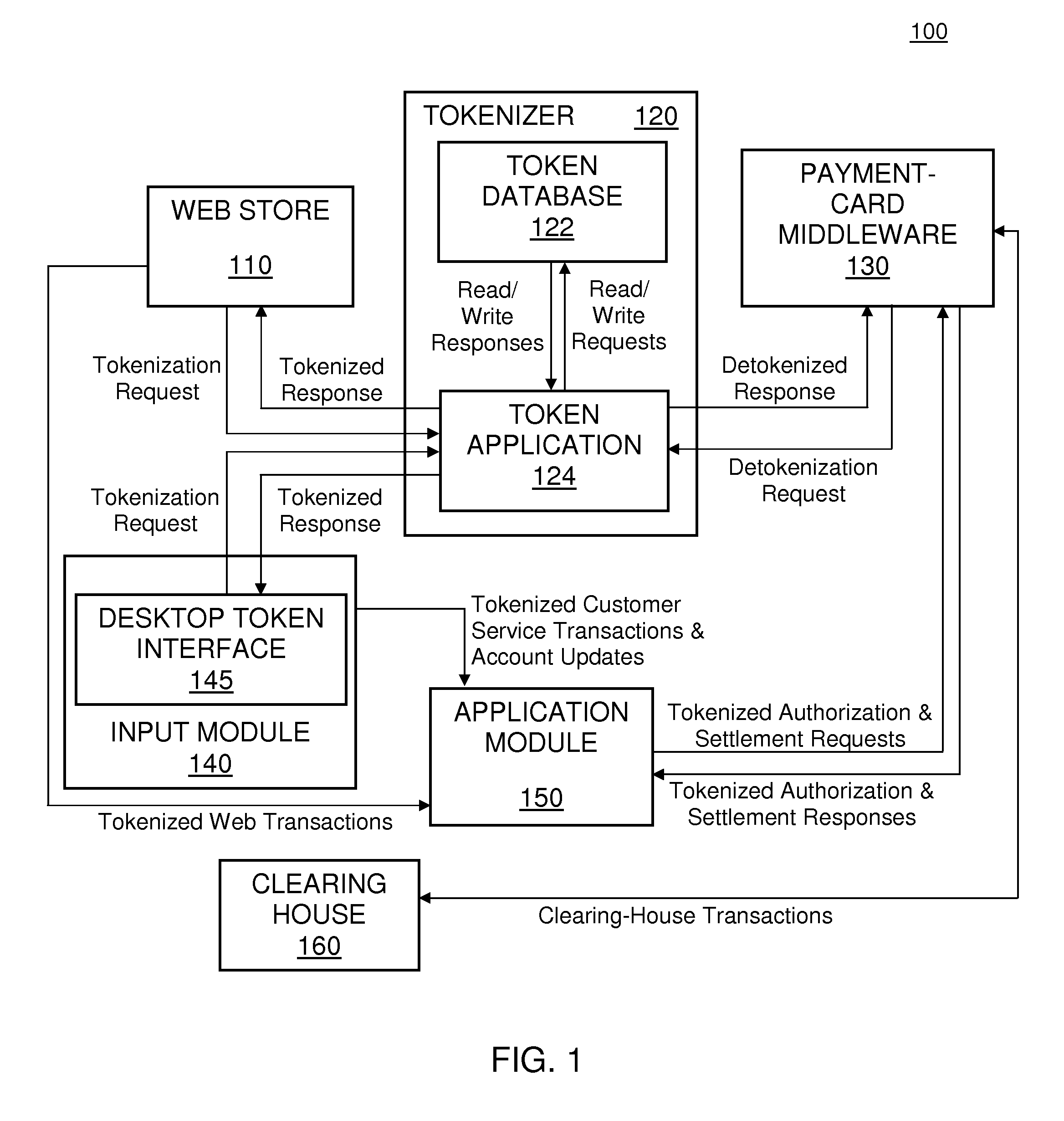

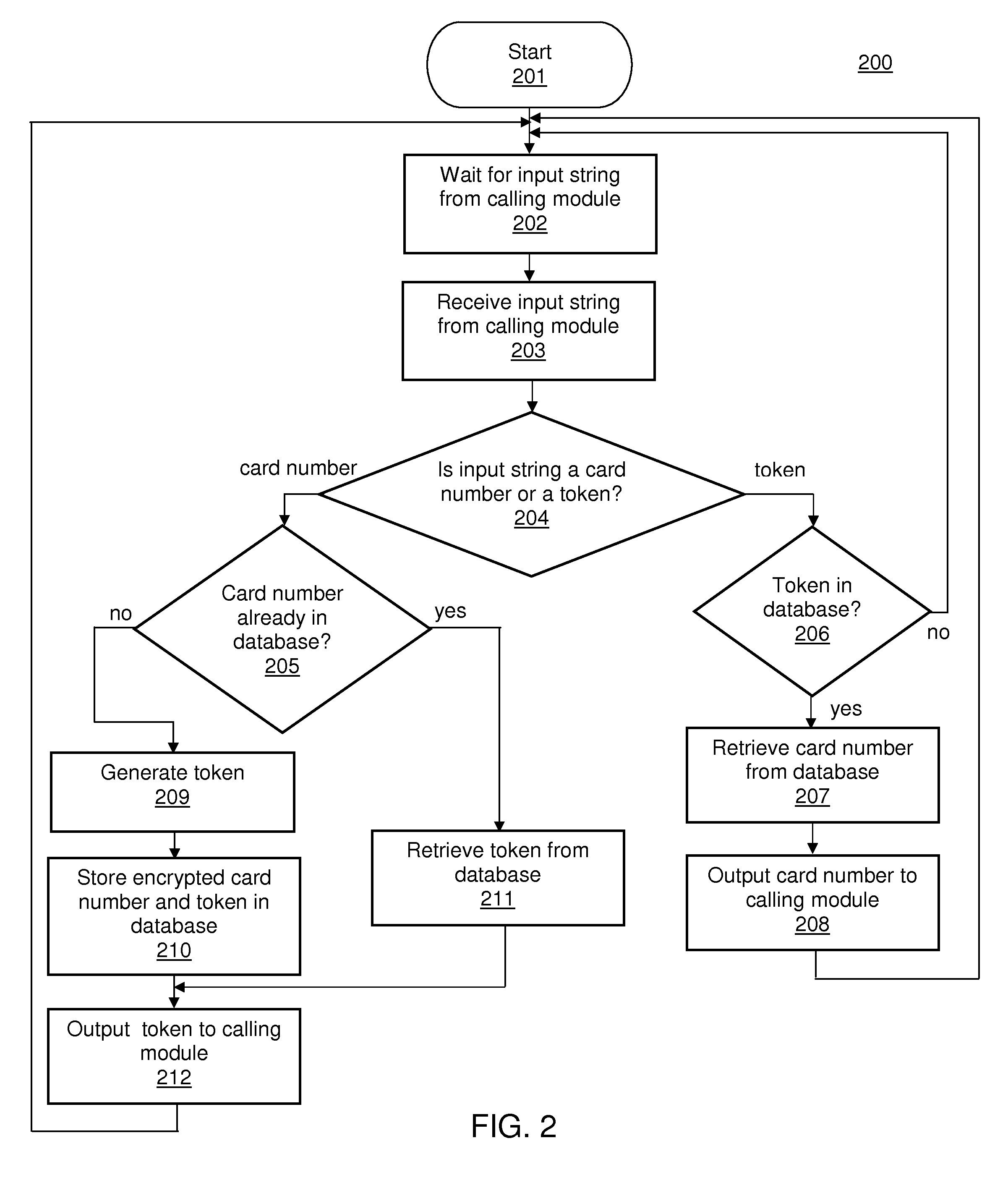

A payment processing system for accepting manually-entered payment-card numbers. Rather than entering a payment-card account number into an application module, the card number is instead captured and stored within a tokenizer prior to being sent to the application module. The tokenizer then returns a random token to the calling application as a pointer to the original payment-card number. The token has no algorithmic relationship with the original payment-card number, so that the payment-card number cannot be derived based on the token itself. Since the token is not considered cardholder data, the token may be used in an application module without the module or its connected hardware from being subject to regulatory standards compliance. Some embodiments involve browser-based schemes, and some embodiments involve PIN-entry device-based schemes.

Owner:CARDCONNECT LLC

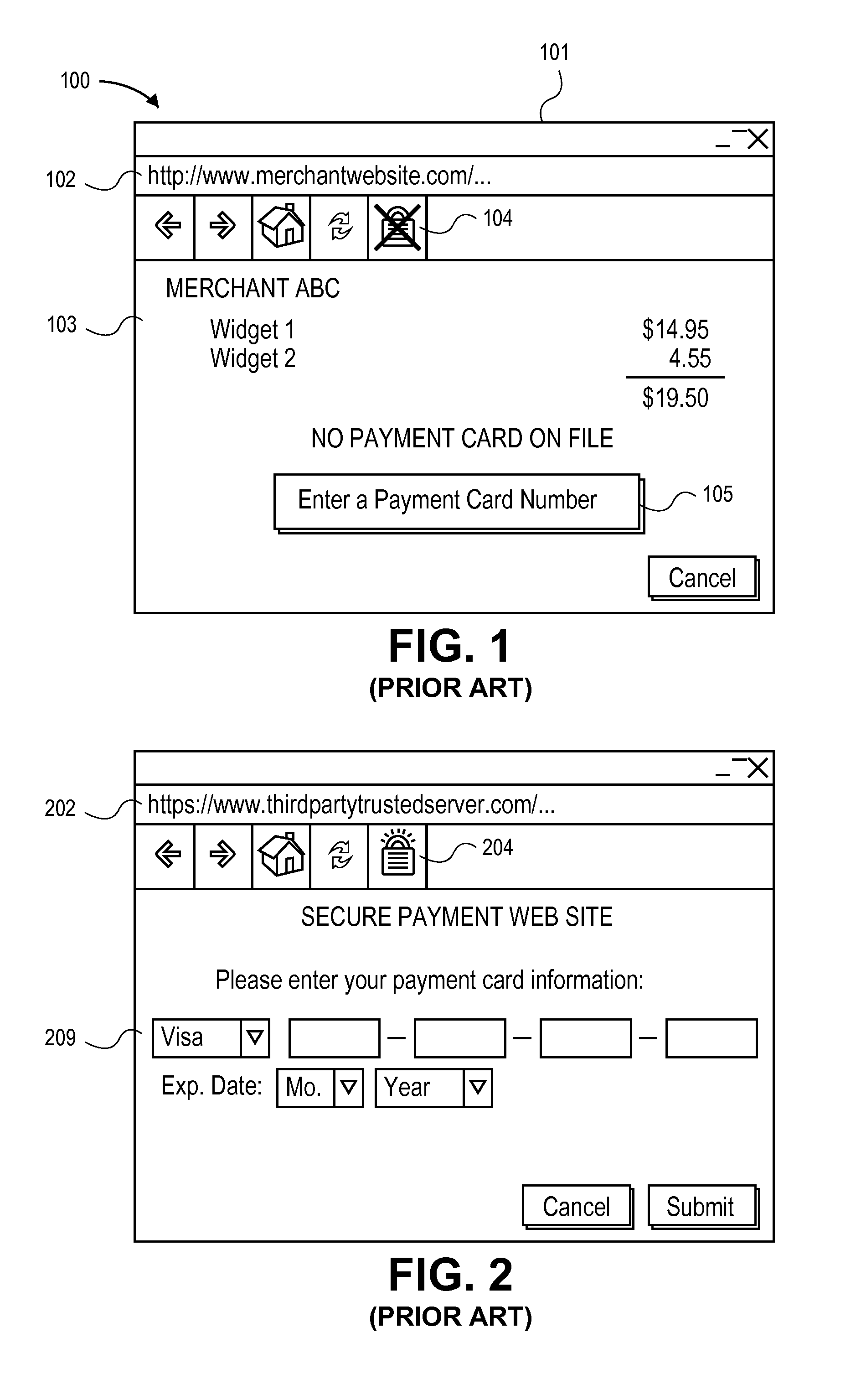

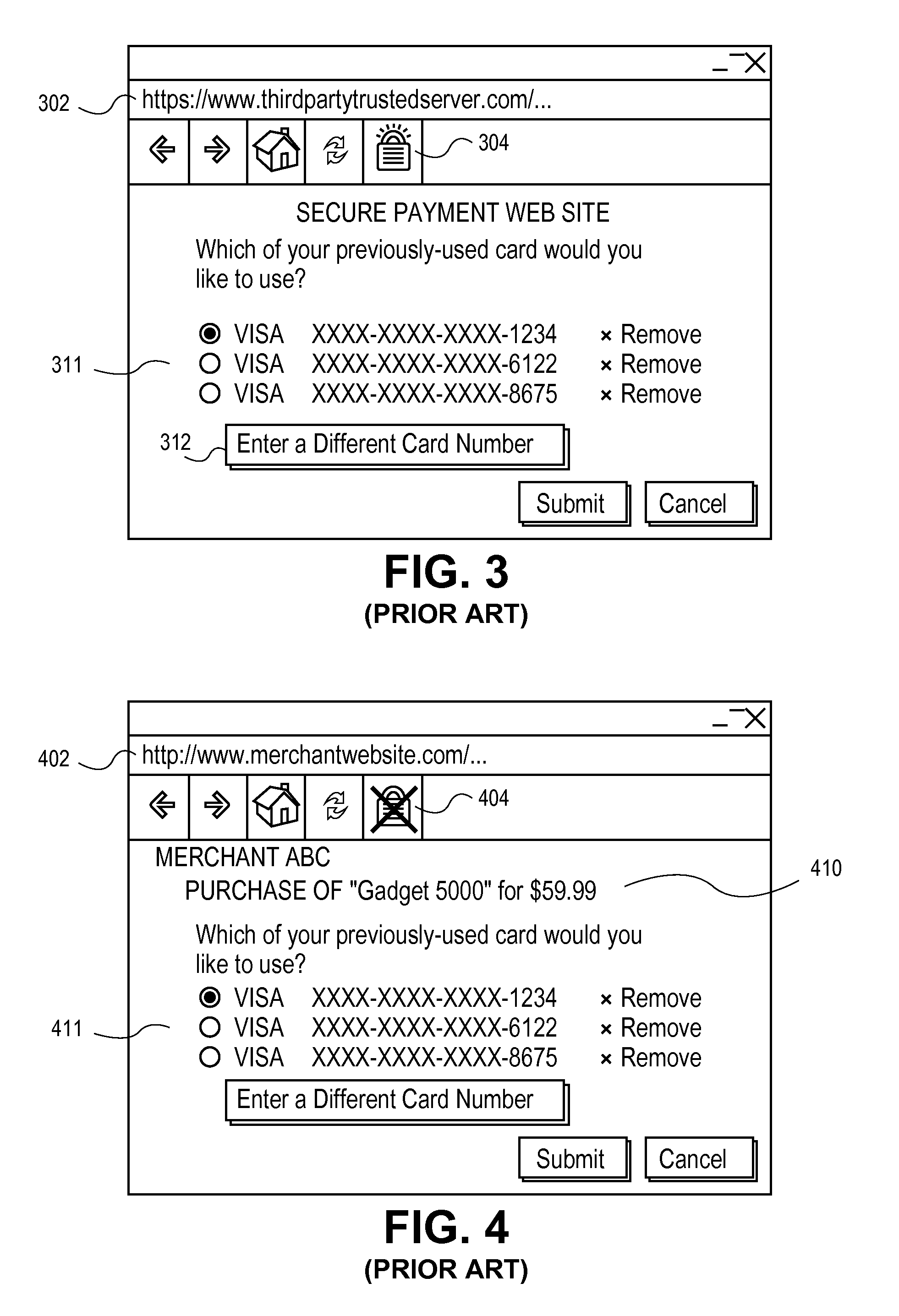

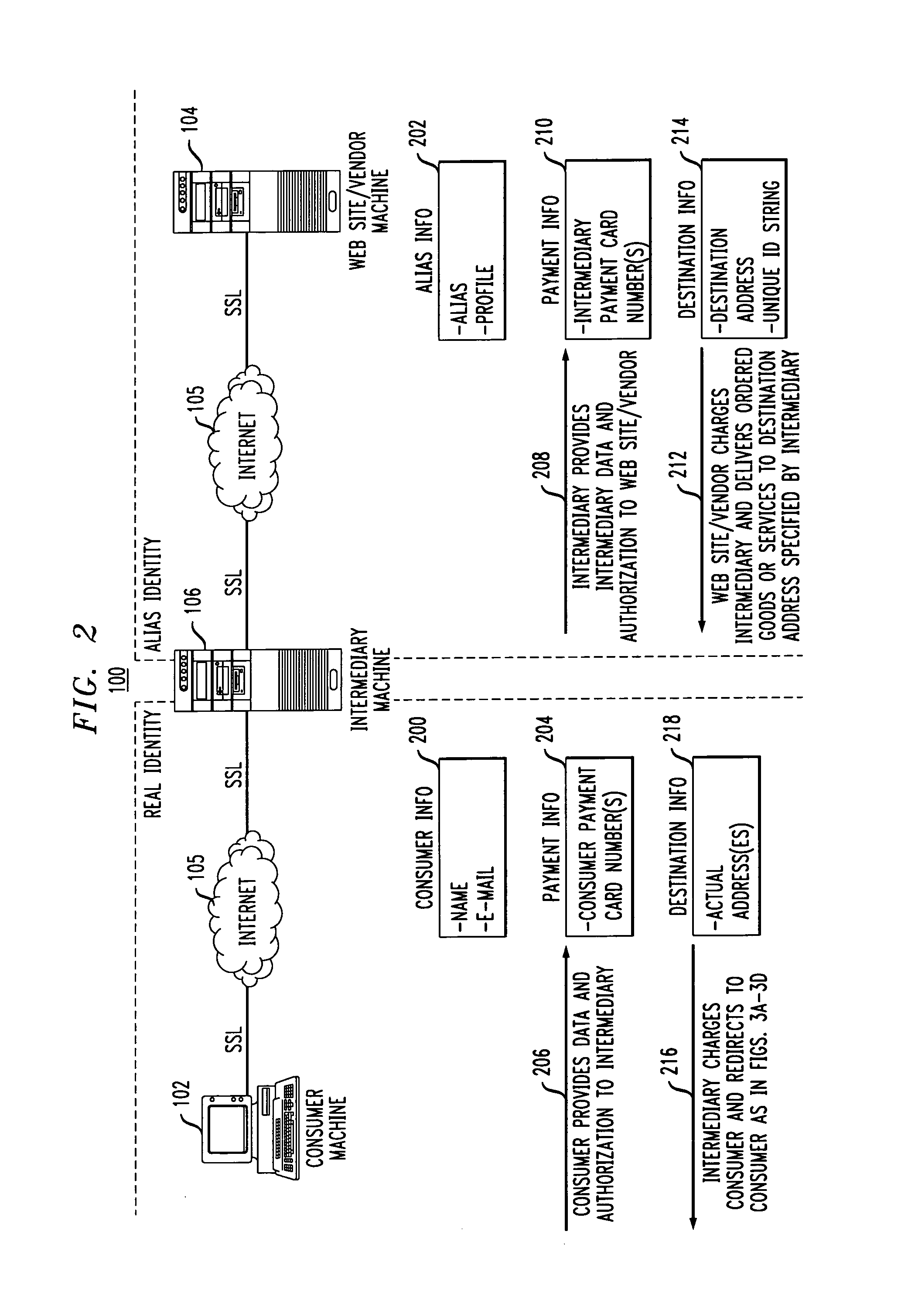

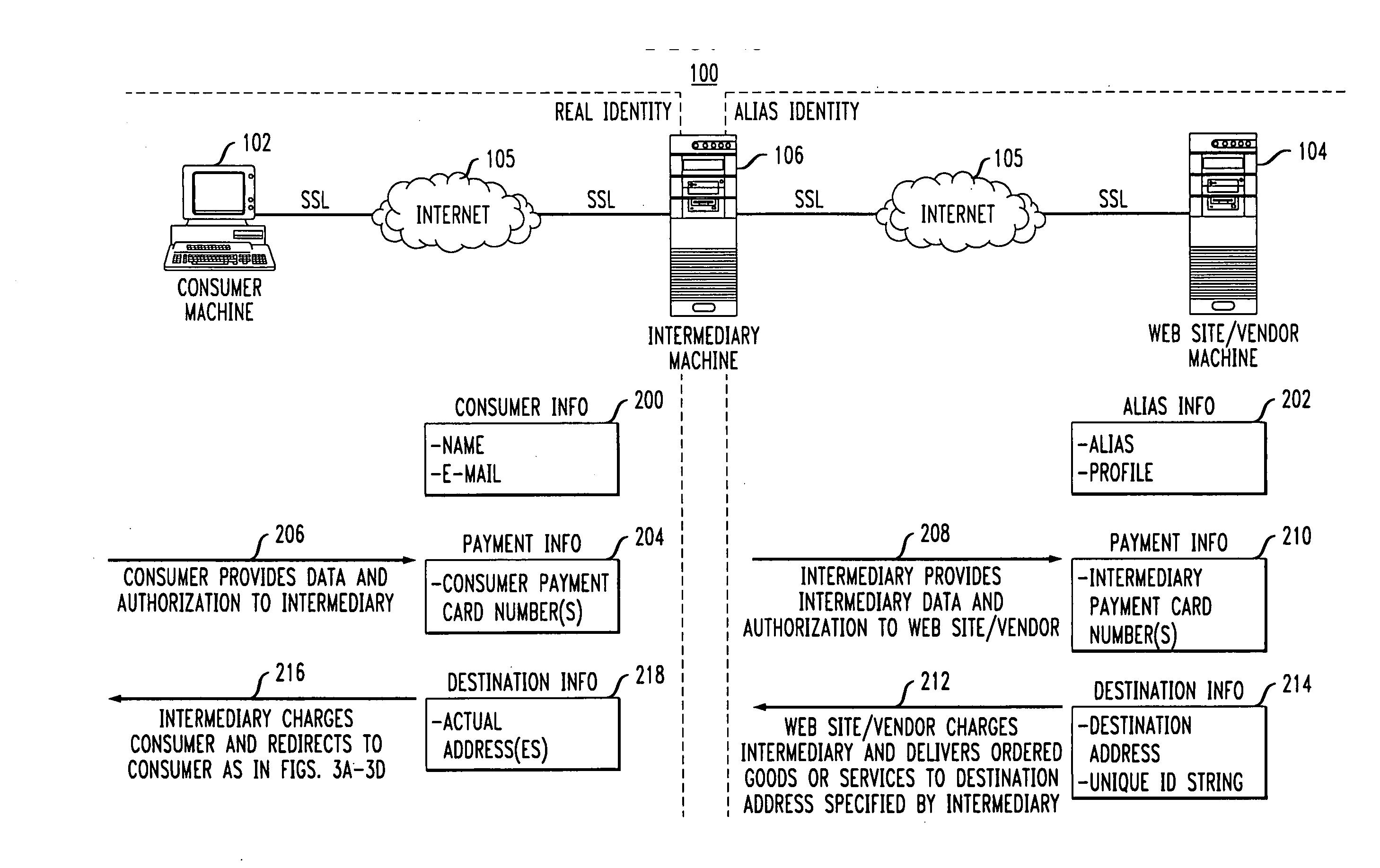

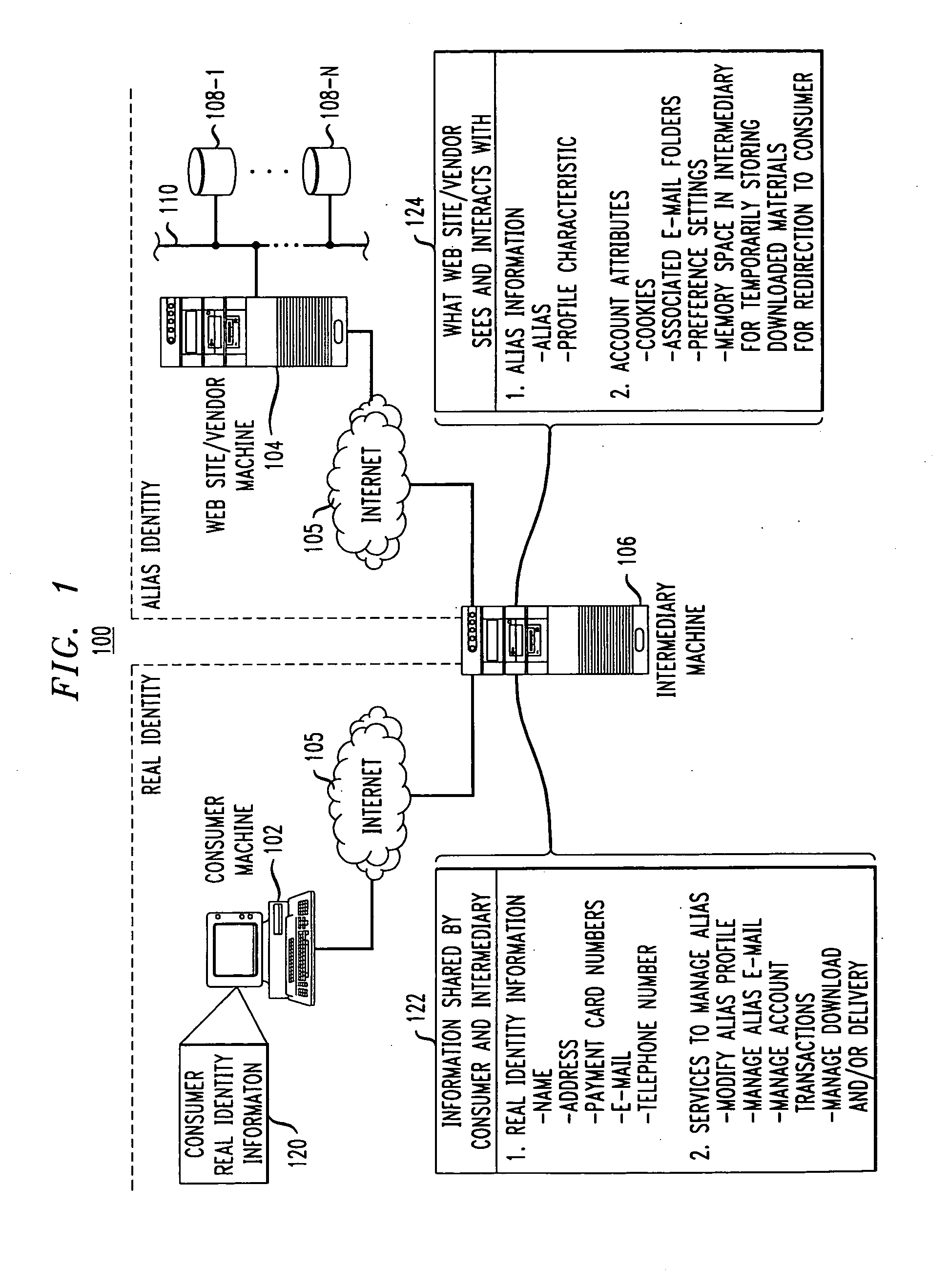

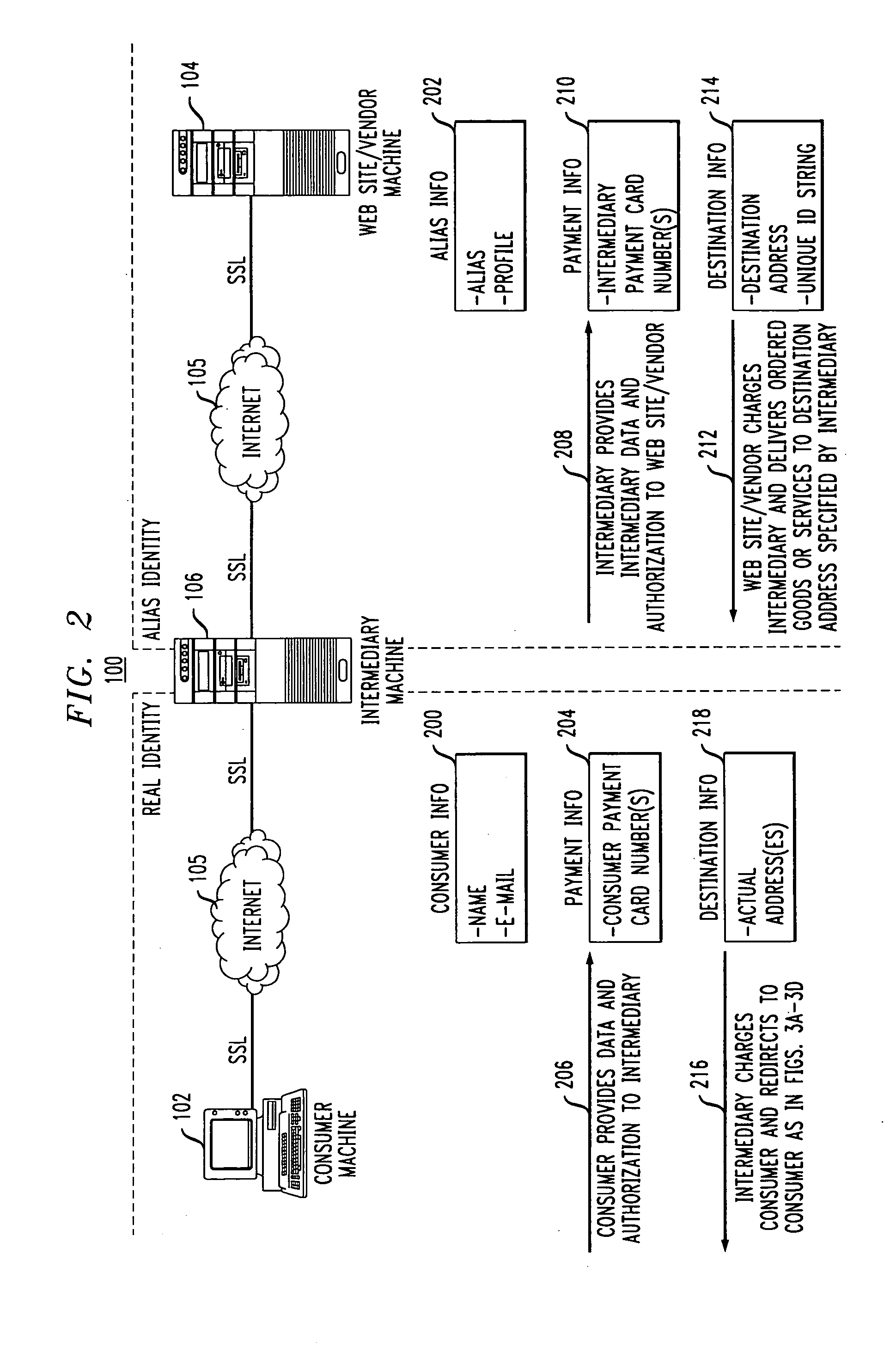

Methods and apparatus for providing user anonymity in online transactions

InactiveUS7203315B1Maintaining anonymityLimit fraud riskDigital data processing detailsMultiple digital computer combinationsWeb siteThird party

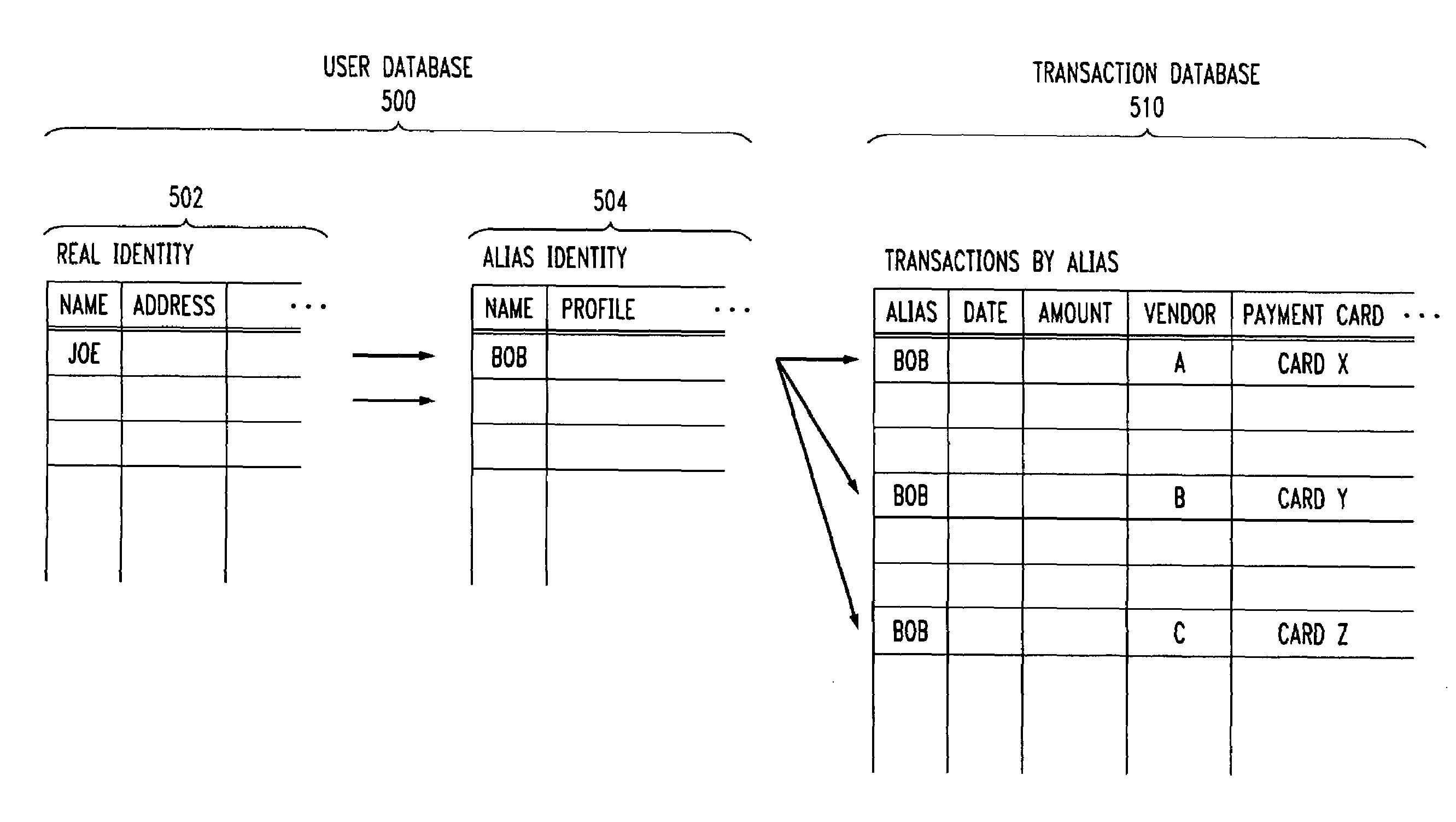

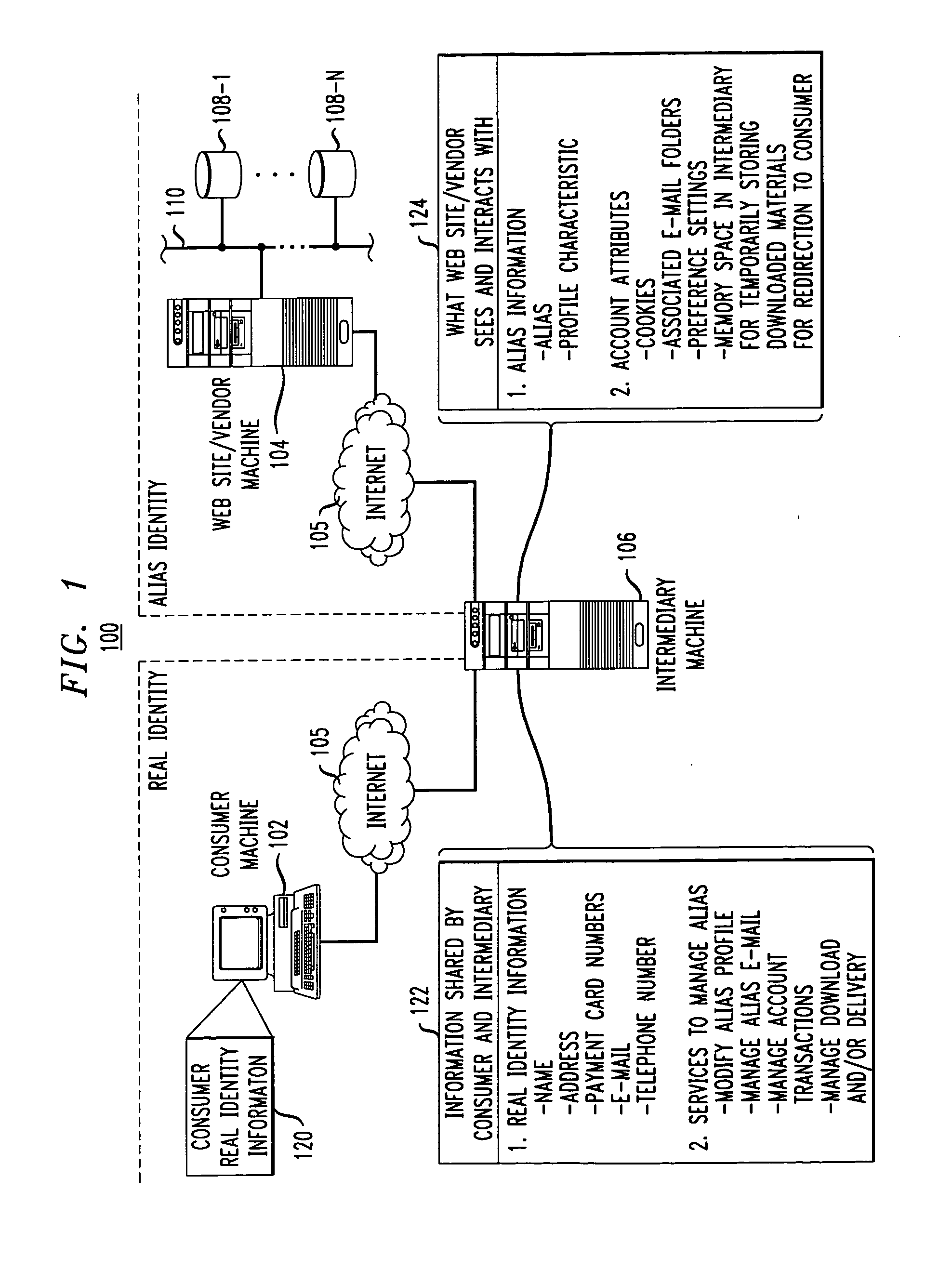

End-to-end user anonymity is provided in electronic commerce or other types of online transactions through the use of an intermediary. An intermediary machine, which may be implemented in the form of a set of servers or other type of computer system, receives communications from a consumer or other user, and generates and maintains an alias for that user. Connections between the user machine and any online vendor or other web site are implemented through the intermediary using the alias. When the user desires to make a purchase from a given online vendor, the intermediary may present the user with a number of options. For example, the user may be permitted to select a particular payment card number and real destination address as previously provided to the intermediary. The intermediary then communicates with the online vendor and supplies intermediary payment information, e.g., a payment card number associated with the intermediary rather than the user, along with appropriate authorizing information and an alias destination address, e.g., a third party physical shipping address for deliverable goods, an alias electronic address for downloadable material, etc. The online vendor charges the purchase to the intermediary, and redirects the delivery of the goods or services to the destination address provided by the intermediary. The intermediary charges the payment card number of the user, and arranges for the redirection of the delivery to the real user address. In this manner, the invention provides complete end-to-end anonymity for the user, even when the user desires to enter transactions involving purchase and receipt of deliverable goods and services.

Owner:PRIVACY LABS

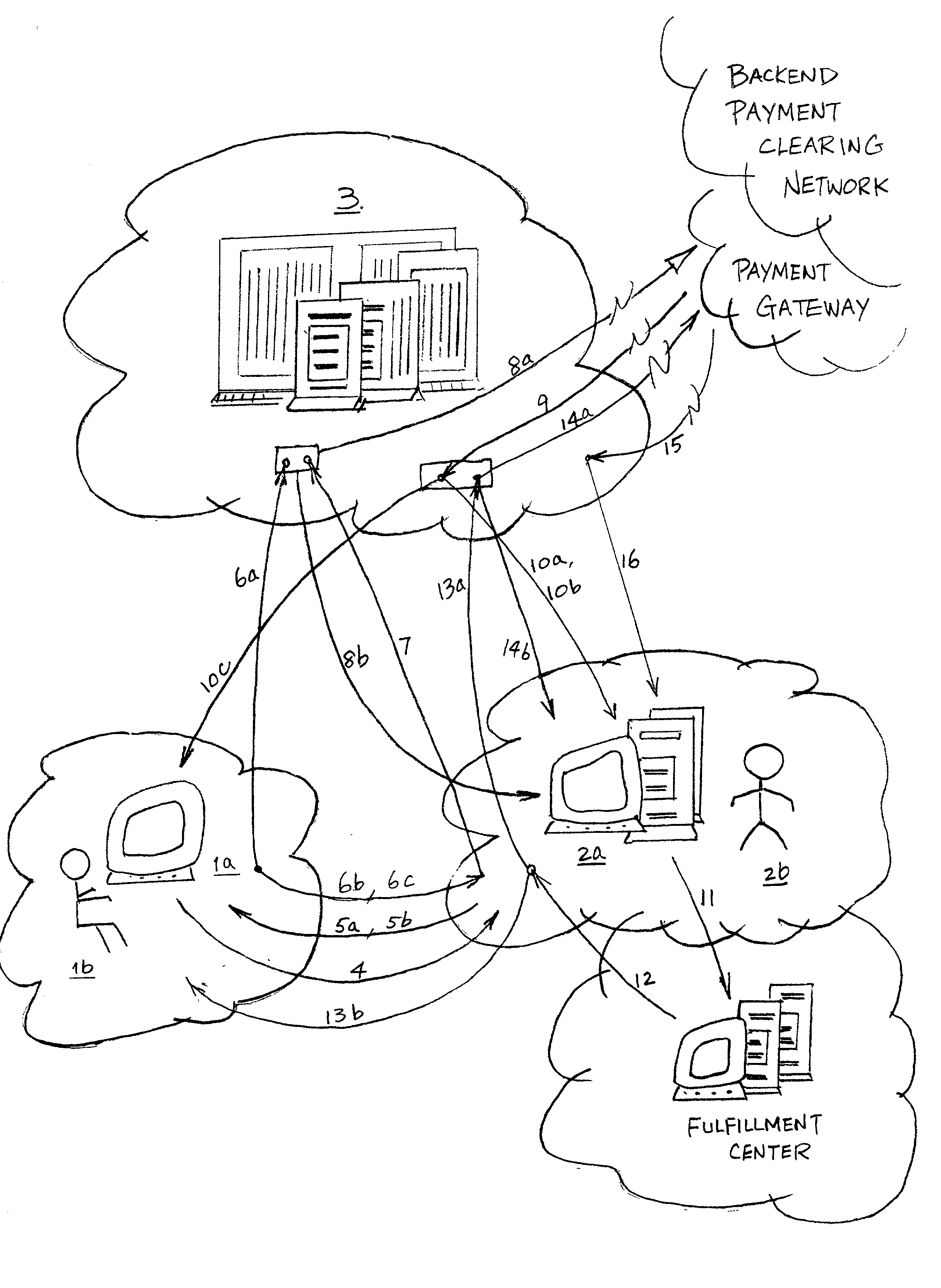

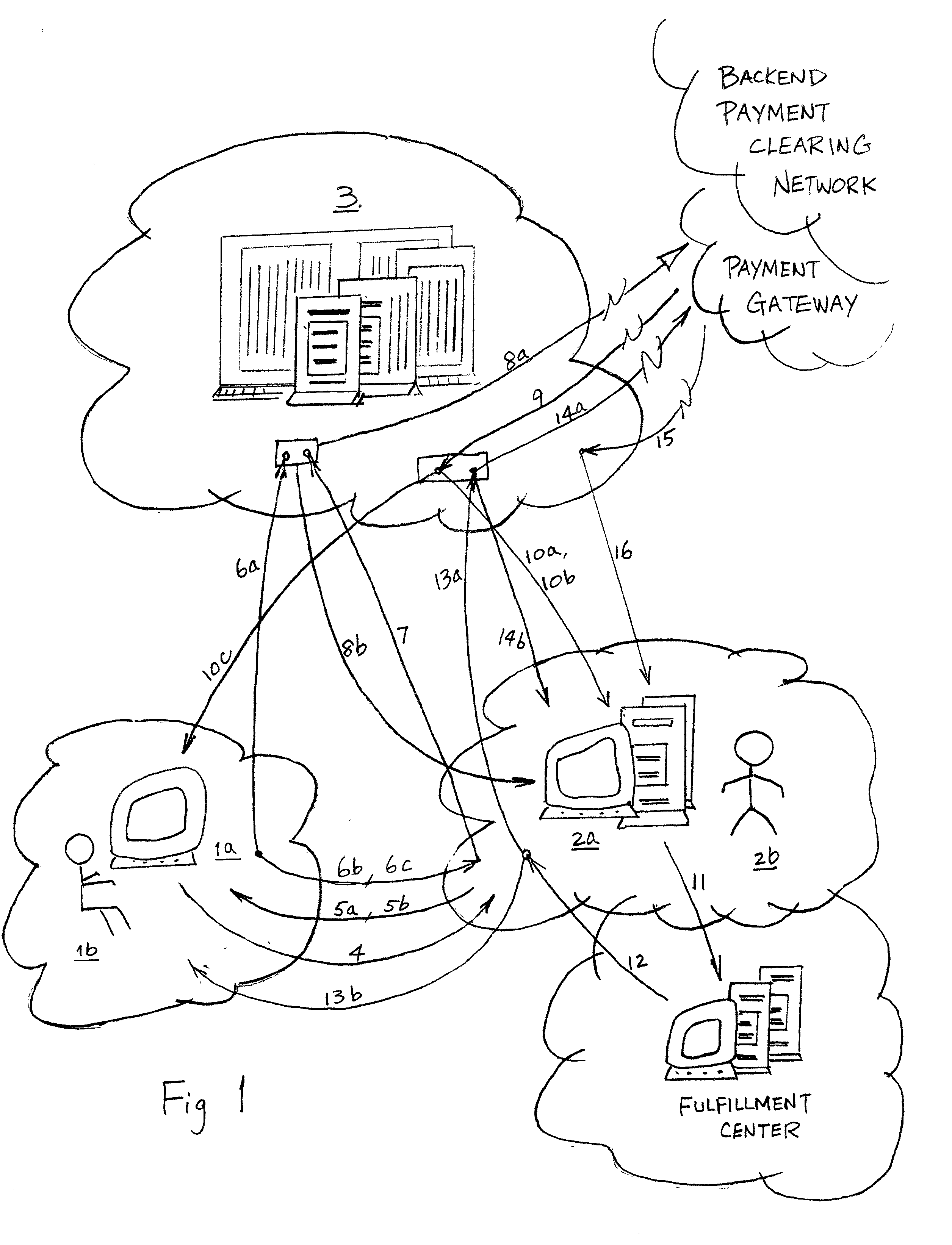

Process and method for secure online transactions with calculated risk and against fraud

InactiveUS20030120615A1Effectively combat fraudAlleviates payment card abuseComputer security arrangementsBuying/selling/leasing transactionsE-commercePayment card number

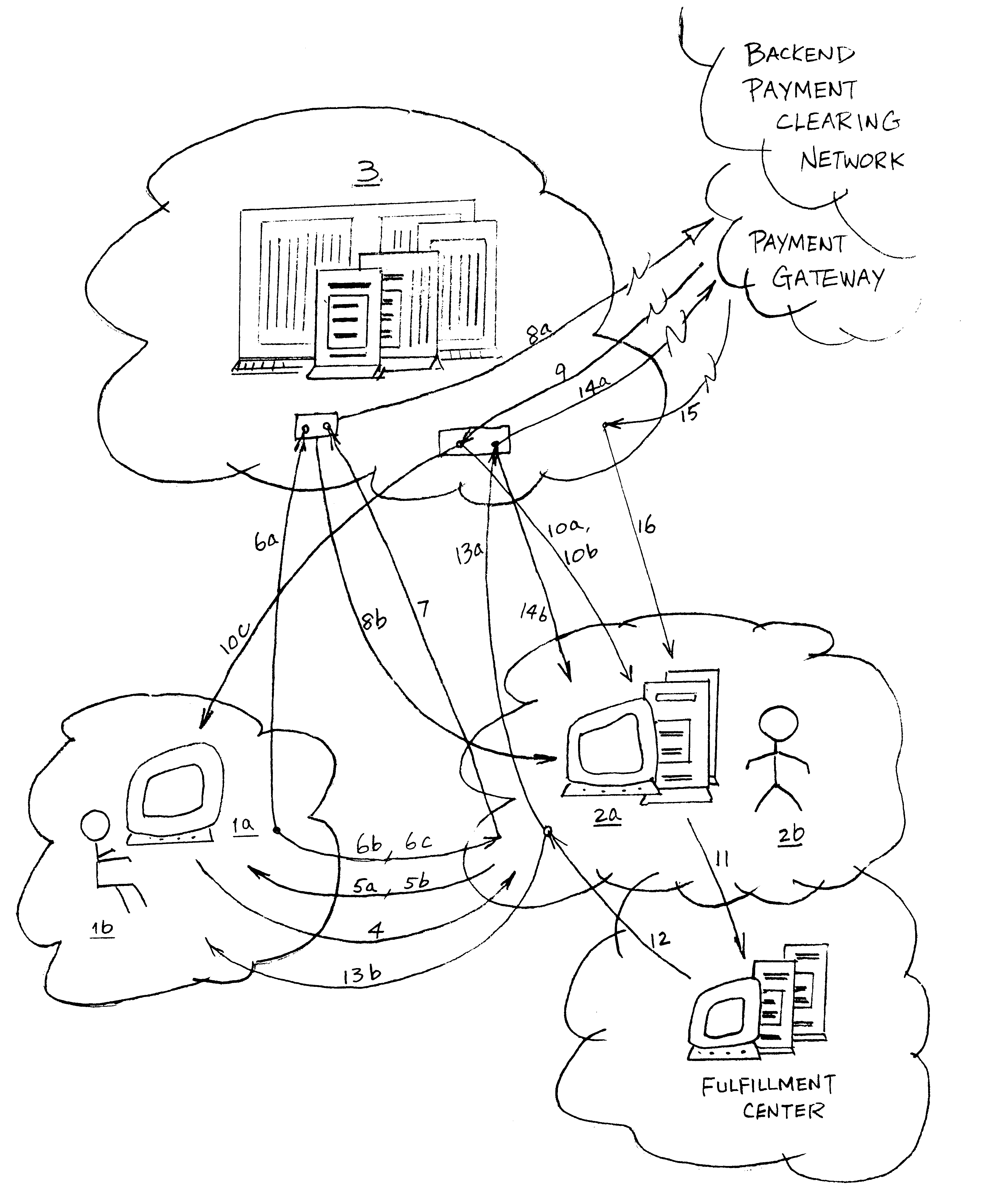

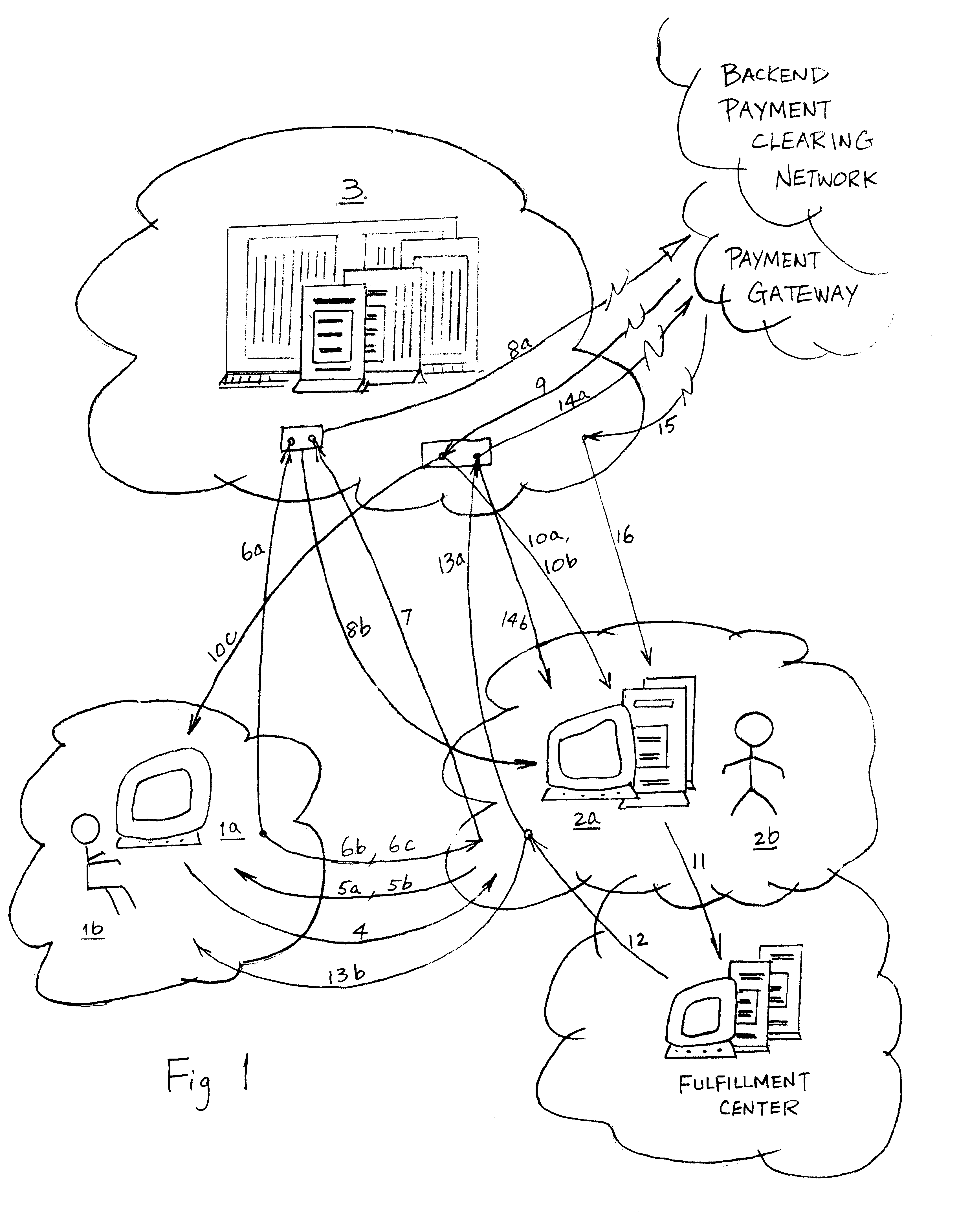

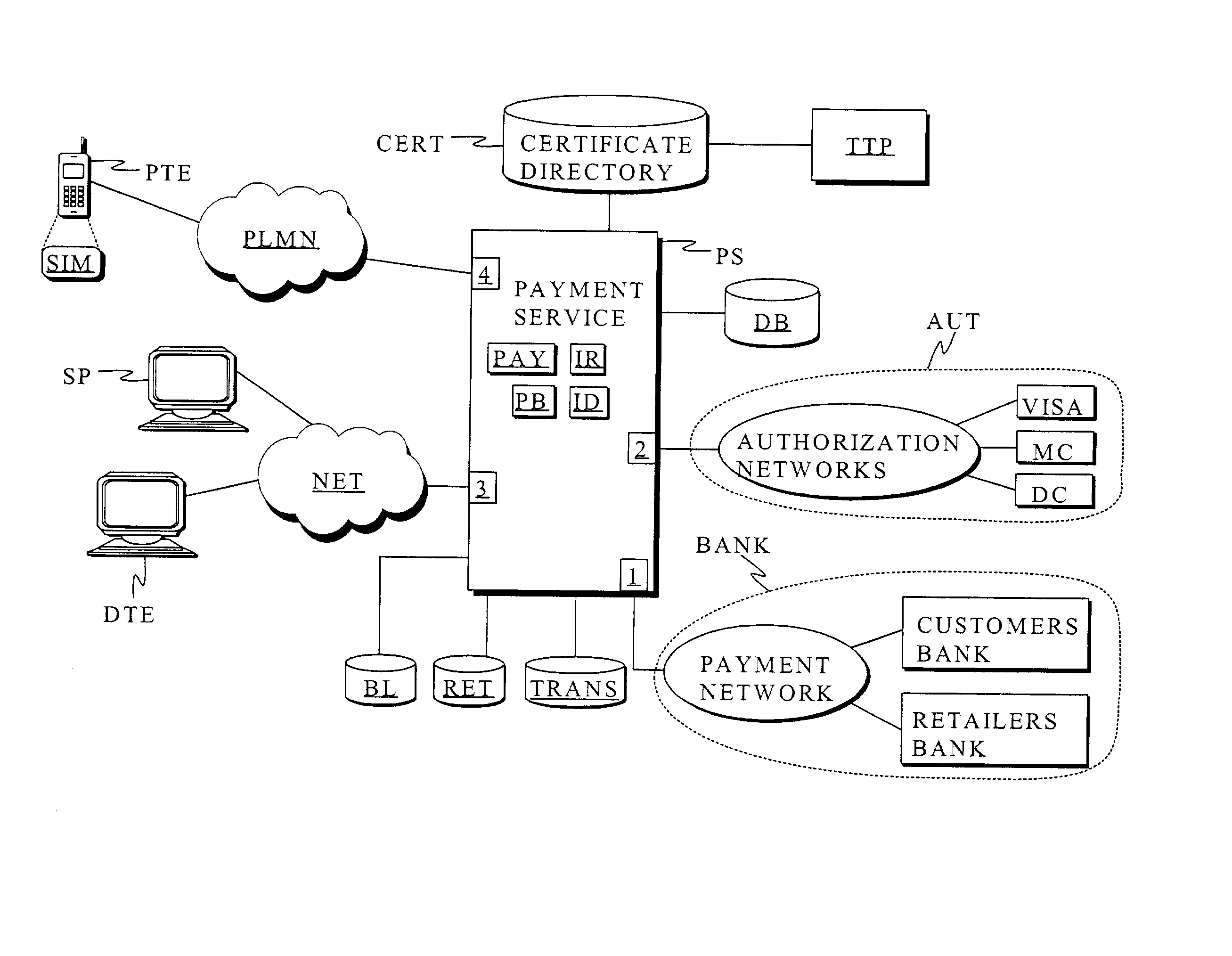

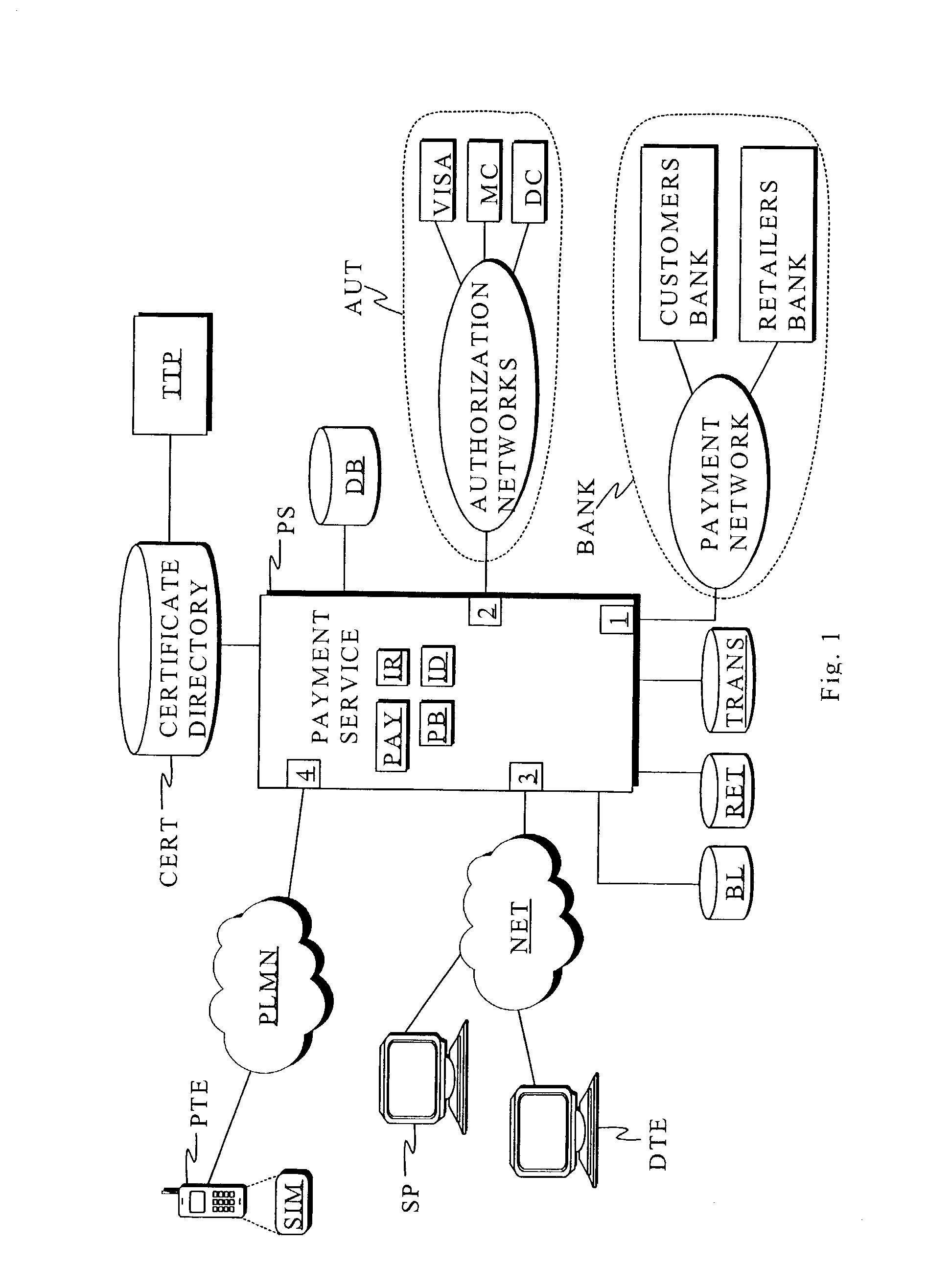

An electronic commerce process that facilitates online transactions among multiple participants, that prevents consumer fraud due to pirated payment card numbers, with calculated risk, involving at least one trusted payment card host (3), where buyer's payment card number is registered and corresponding secret keys are set up. The buyer (1b) initiates an online transaction by selecting a host from a list of hosts that served by the seller's web server (2a). Then, the buyer participant (1a) sends an order online (4), SSL encrypted. The seller participant (2a) receives and decrypts the order, confirms the availability of ordered items, assigns an orderID to the order, and sends a response (5a), SSL encrypted, to the buyer participant (1a) with the assigned orderID. The buyer participant (1a) encrypts and notifies the selected host (3) of this order and orderID, and authorizes the payment (6a) using secret keys. At the same time, the seller participant also encrypts and sends payment approval request (7) for this orderID through the host. The host (3) decrypts and matches up the orderID, retrieves the secret keys, and hashes to obtain the corresponding payment card number. The host then encrypts and send for payment authorization (8a) from the payment card issuer with the payment card number, through payment clearing network. Upon receiving and decrypting the response (9) back from the payment card issuer, the host (3) encrypts and notifies (10a) the seller participant (2a) of the card issuer's response (9) for the orderID. After fulfilling the order (11,12), the seller participant encrypts and sends for payment capturing (13a) for this order with orderID, through the host and payment network (14a,15,16).

Owner:ONLINE SECURITY PORTFOLIO

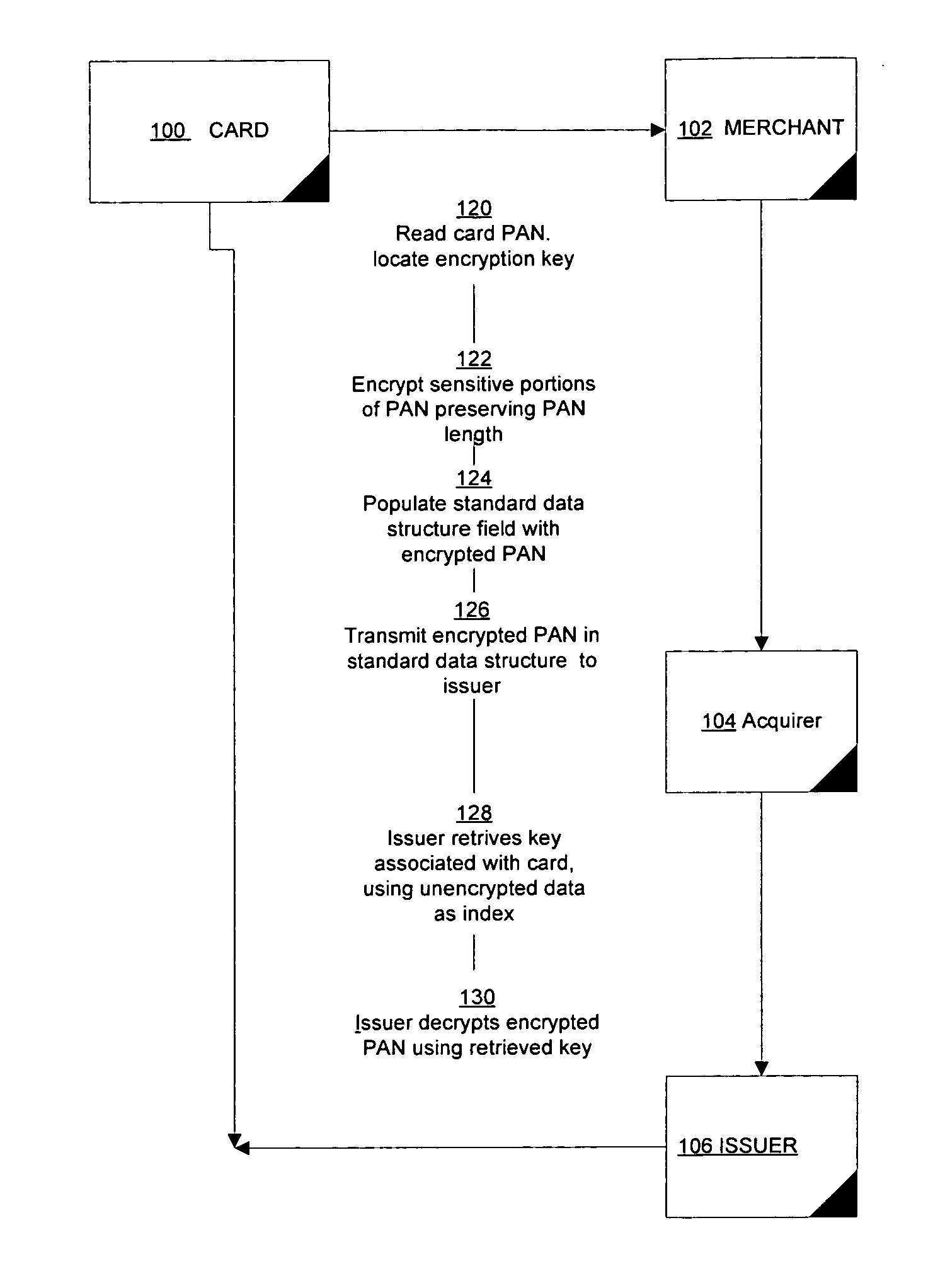

Dynamic encryption of payment card numbers in electronic payment transactions

Systems and methods are provided for secure transmission of information identifying account holders in electronic payment transactions made using payment cards or devices that are based integrated circuit chip technology. Individual cards or devices are associated with a cipher key. Information such as personal account numbers, which may be stored on the cards or devices, is encrypted using a block cipher in a variant of the cipher feedback mode. This manner of encryption preserves the length of the cleartext, and allows the ciphertext to be securely transmitted in standard data structure formats over legacy electronic payment networks.

Owner:MASTERCARD INT INC

Process and method for secure online transactions with calculated risk and against fraud

InactiveUS6847953B2Computer security arrangementsBuying/selling/leasing transactionsPaymentE-commerce

An electronic commerce process that facilitates online transactions among multiple participants, that prevents consumer fraud due to pirated payment card numbers, with calculated risk, involving at least one trusted payment card host (3), where buyer's payment card number is registered and corresponding secret keys are set up. The buyer (1b) initiates an online transaction by selecting a host from a list of hosts that served by the seller's web server (2a). Then, the buyer participant (1a) sends an order online (4), SSL encrypted. The seller participant (2a) receives and decrypts the order, confirms the availability of ordered items, assigns an orderID to the order, and sends a response (5a), SSL encrypted, to the buyer participant (1a) with the assigned orderID. The buyer participant (1a) encrypts and notifies the selected host (3) of this order and orderID, and authorizes the payment (6a) using secret keys. At the same time, the seller participant also encrypts and sends payment approval request (7) for this orderID through the host. The host (3) decrypts and matches up the orderID, retrieves the secret keys, and hashes to obtain the corresponding payment card number. The host then encrypts and send for payment authorization (8a) from the payment card issuer with the payment card number, through payment clearing network. Upon receiving and decrypting the response (9) back from the payment card issuer, the host (3) encrypts and notifies (10a) the seller participant (2a) of the card issuer's response (9) for the orderID. After fulfilling the order (11,12), the seller participant encrypts and sends for payment capturing (13a) for this order with orderID, through the host and payment network (14a,15,16).

Owner:ONLINE SECURITY PORTFOLIO

Configurable payment tokens

ActiveUS20140032419A1Buying/selling/leasing transactionsSecuring communicationCredit cardSoftware engineering

Methods and systems are disclosed for the generation and use of merchant-customizable token formats that define tokens that represent credit card and other payment numbers in online transactions. The tokens, which are used instead of the card numbers themselves for security, can be specified by the token format to have a certain number of characters, have certain fields reserved for major card identifiers, use encryption and / or randomization, be alphanumeric, and have other formatting. The customized tokens can be used with legacy equipment that uses longer or shorter card numbers than the standard sixteen-digit payment card number format and can be less likely to be recognized as related to card numbers by identify thieves.

Owner:VISA USA INC (US)

Methods and apparatus for providing user anonymity in online transactions

InactiveUS20060274896A1Avoid the needEliminate the problemDigital data processing detailsMultiple digital computer combinationsPaymentWeb site

End-to-end user anonymity is provided in electronic commerce or other types of online transactions through the use of an intermediary. An intermediary machine, which may be implemented in the form of a set of servers or other type of computer system, receives communications from a consumer or other user, and generates and maintains an alias for that user. Connections between the user machine and any online vendor or other web site are implemented through the intermediary using the alias. When the user desires to make a purchase from a given online vendor, the intermediary may present the user with a number of options. For example, the user may be permitted to select a particular payment card number and real destination address as previously provided to the intermediary. The intermediary then communicates with the online vendor and supplies intermediary payment information, e.g., a payment card number associated with the intermediary rather than the user, along with appropriate authorizing information and an alias destination address, e.g., a third party physical shipping address for deliverable goods, an alias electronic address for downloadable material, etc. The online vendor charges the purchase to the intermediary, and redirects the delivery of the goods or services to the destination address provided by the intermediary. The intermediary charges the payment card number of the user, and arranges for the redirection of the delivery to the real user address. In this manner, the invention provides complete end-to-end anonymity for the user, even when the user desires to enter transactions involving purchase and receipt of deliverable goods and services.

Owner:LIVESAY PAUL OWEN

Anonymous merchandise delivery system

Owner:ANDERSON ROY L +2

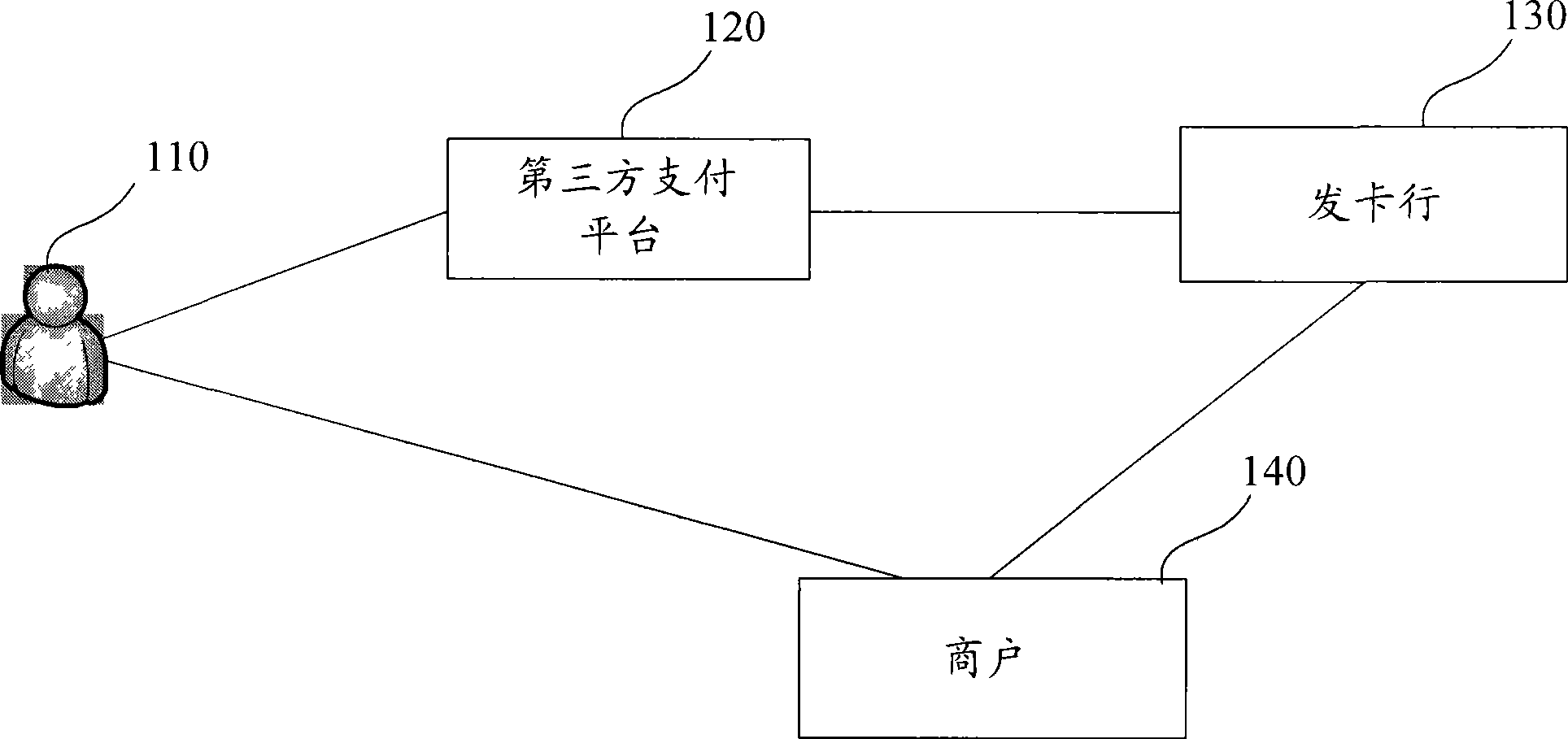

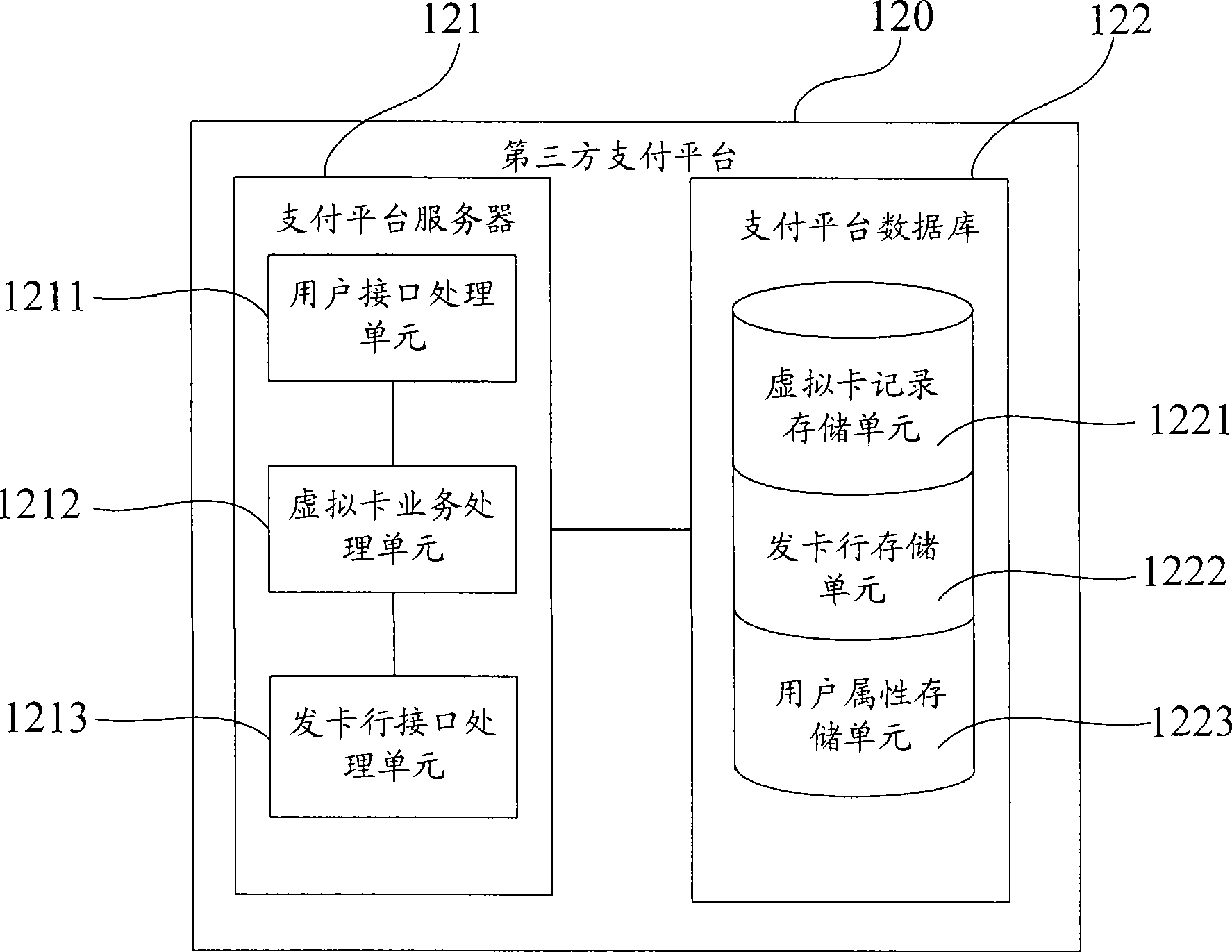

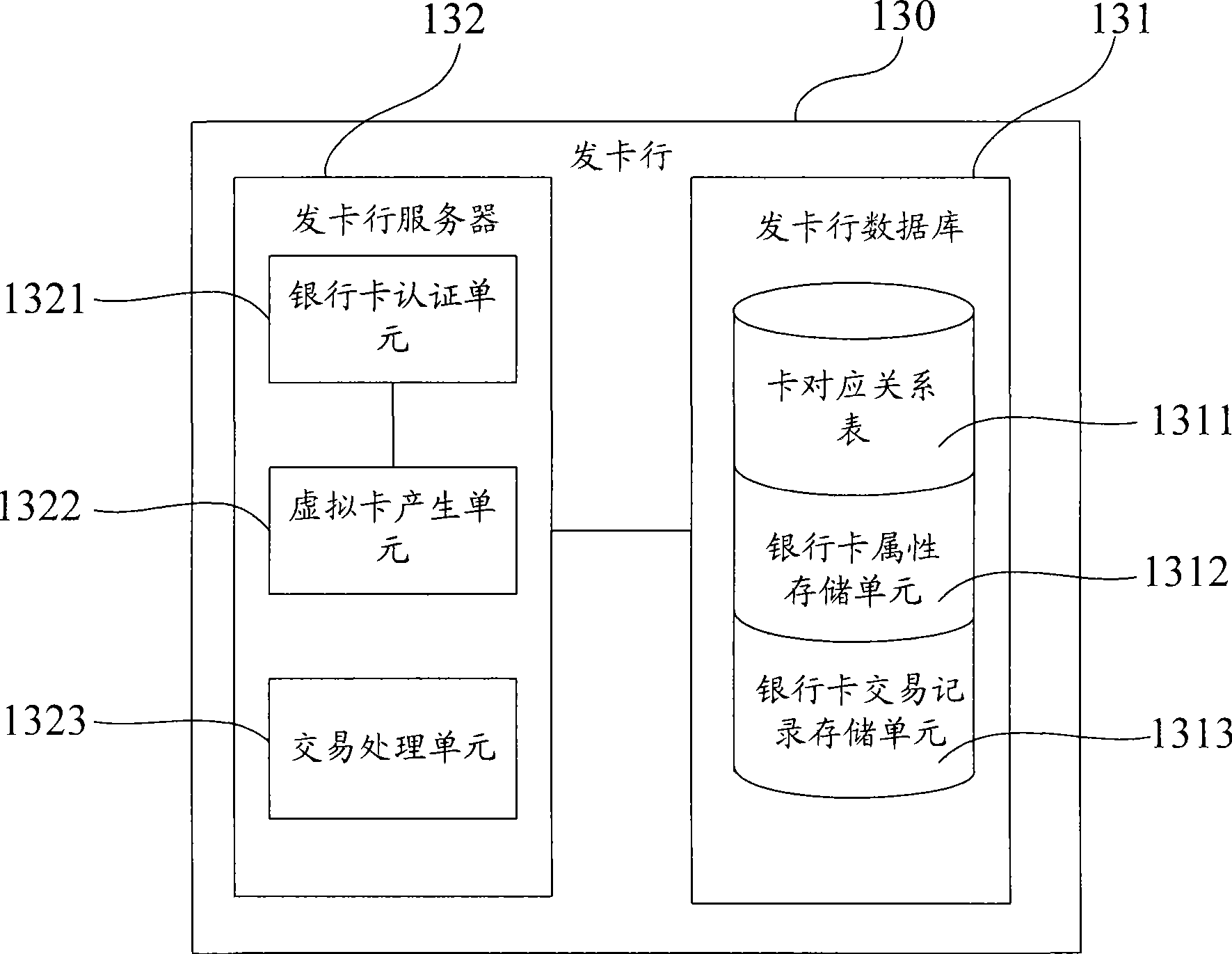

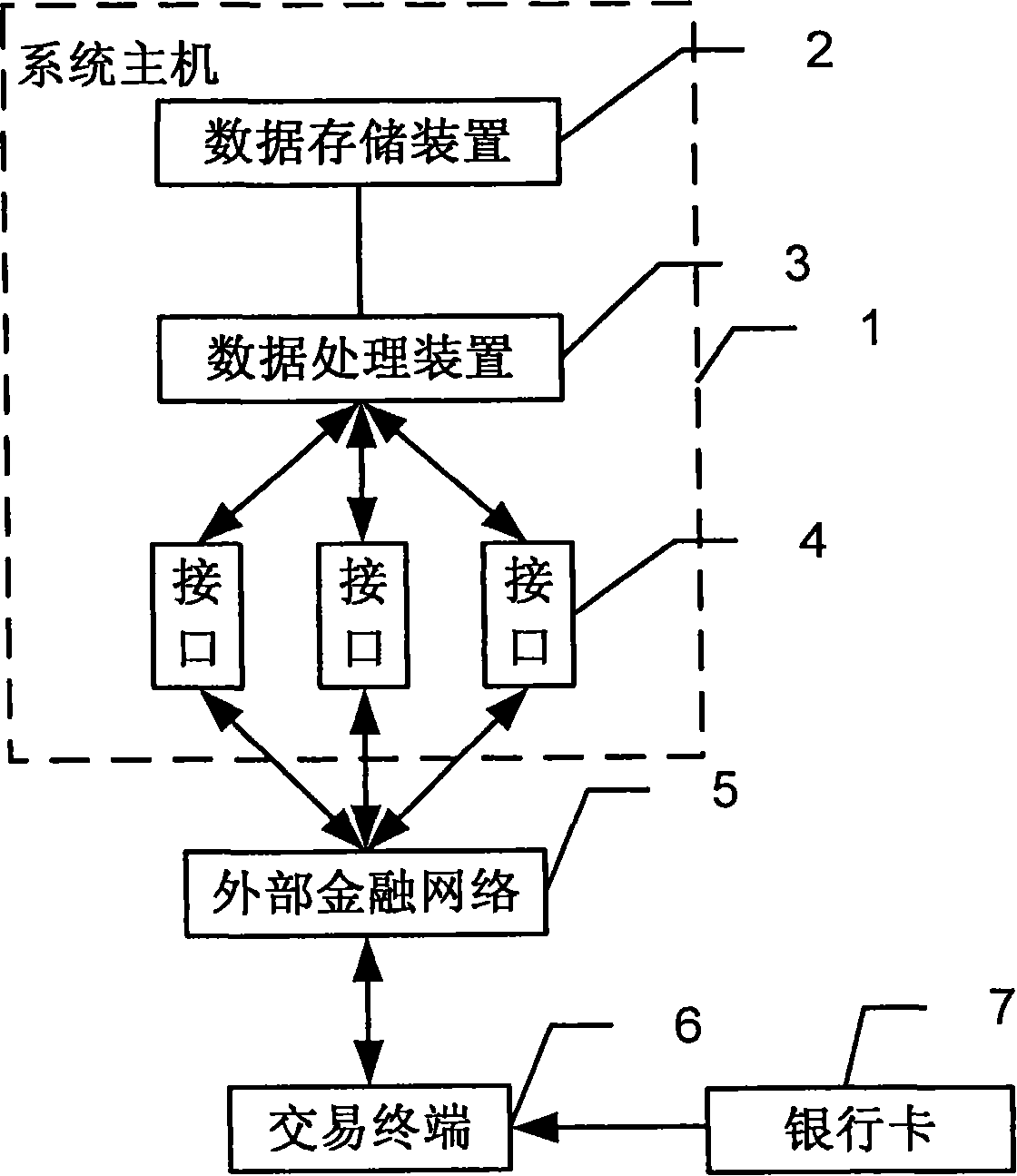

Payment method, system and payment platform capable of improving payment safety by virtual card

The invention provides a method of payment utilizing a virtual card to enhance payment safety and a system thereof, wherein, the method of payment includes the following steps : a third-party payment platform is provided; after receiving the application request of virtual card of a user, the third-party payment platform obtains the information of bank card of the user and sends the request of virtual card application to a corresponding issuing bank; the third-party payment platform returns the information of virtual card number sent by the issuing bank to the user; and when the issuing bank receives the request of payment including the information of virtual card number and payment amount, payment is successfully done, provided that the virtual card meets the service regulations of the virtual card and monetary amount on the corresponding bank card is no less than the payment amount. As the payment of the invention is carried out by the virtual card number, information security of the card can be enhanced when the bank card number and password are directly input.

Owner:ALIBABA GRP HLDG LTD

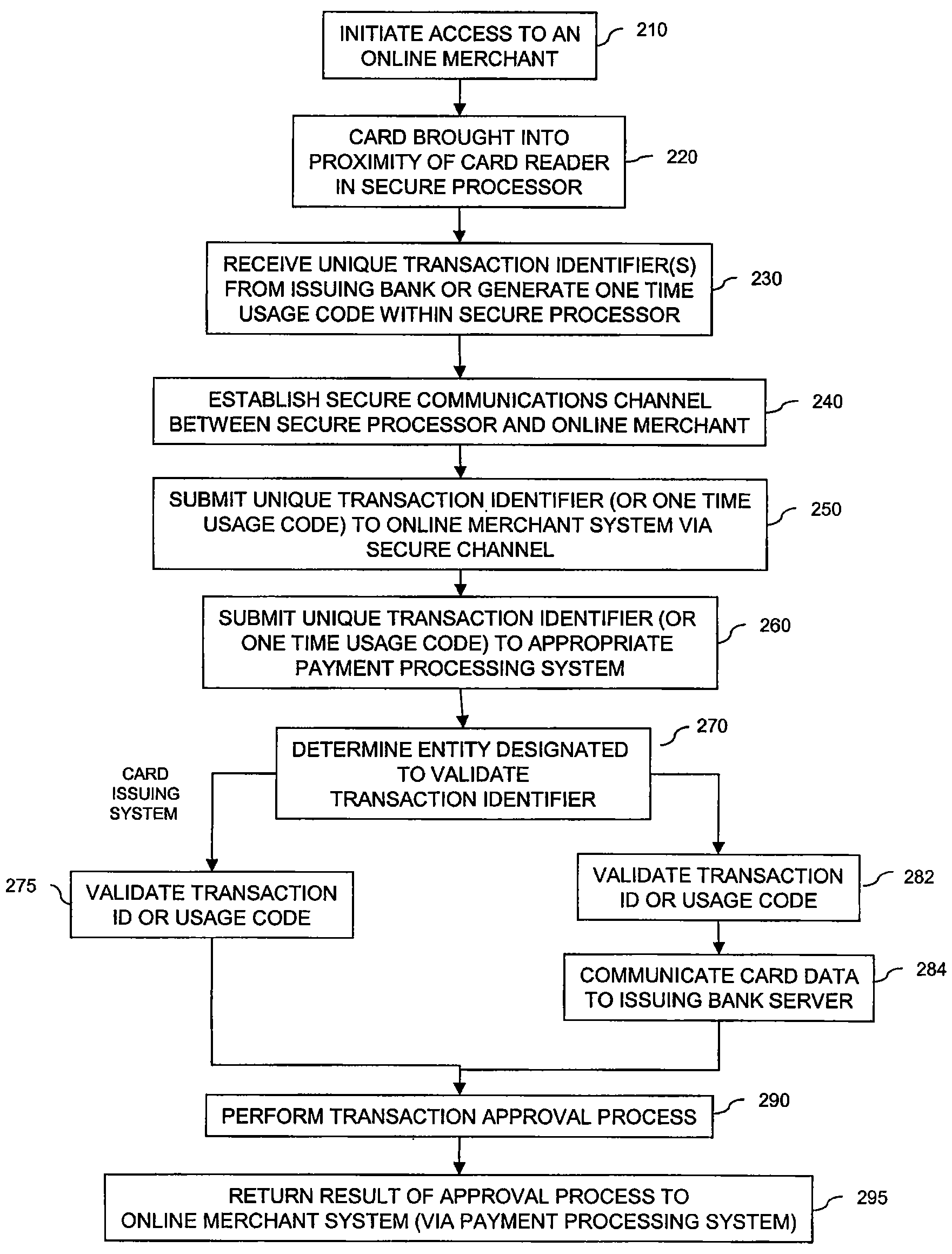

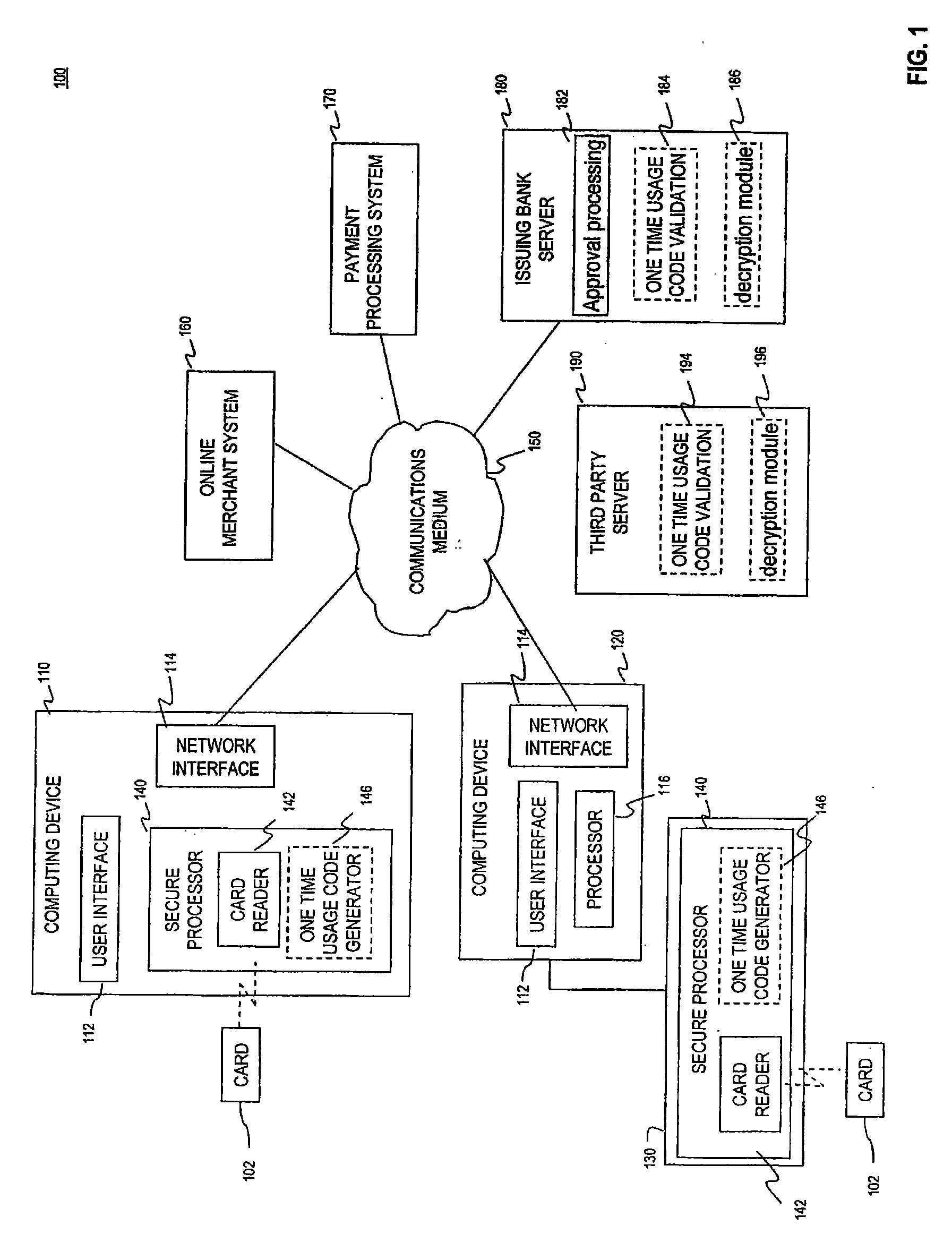

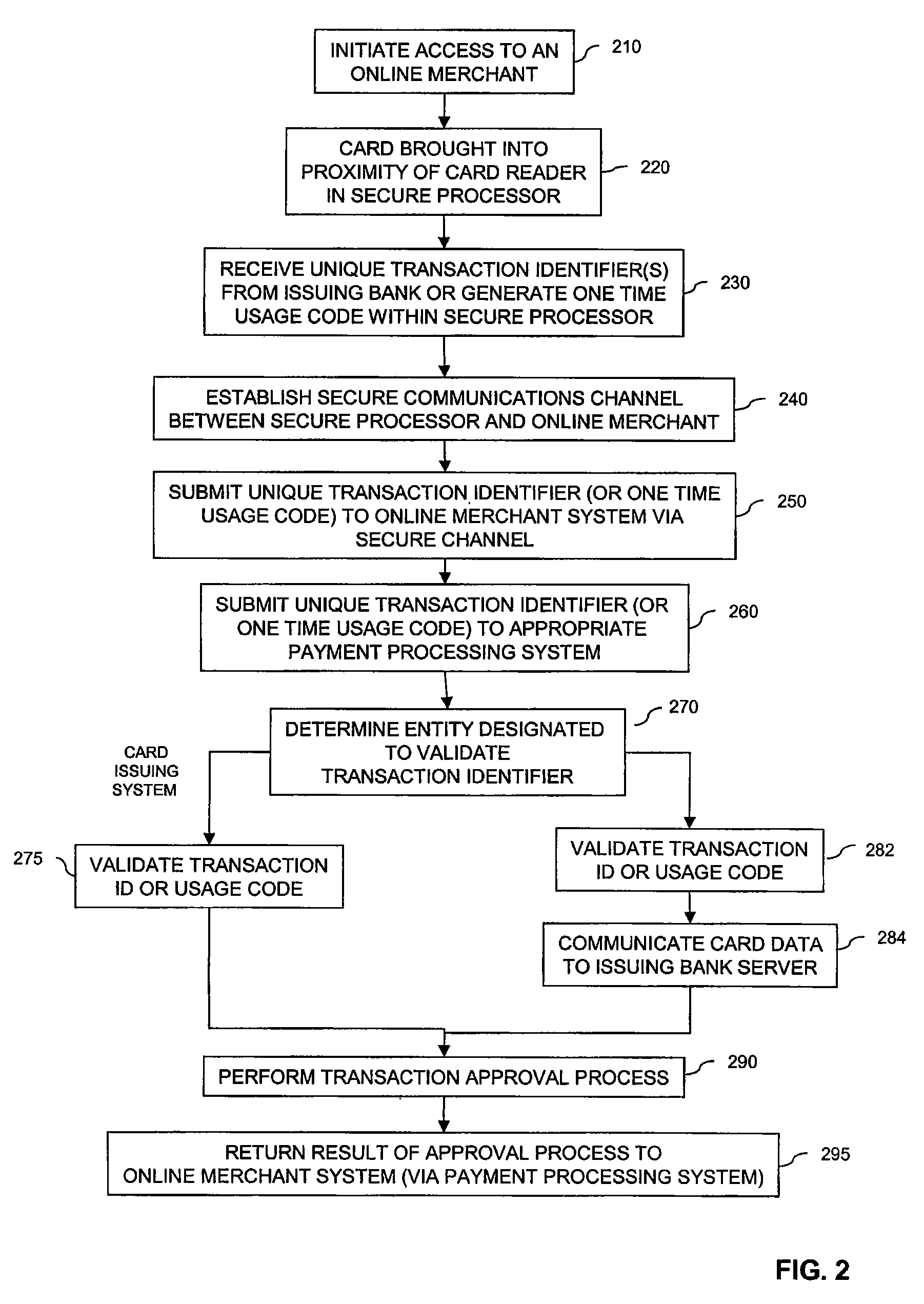

Secure Financial Reader Architecture

Methods and systems are provided for secure transaction processing. A secure processor may include an integrated wireless card reader and optionally a secure memory. When a request for payment information associated with an on-line transaction is received, the integrated wireless card reader reads data from the payment card. The secure processor may retrieve a set of transaction identifiers from the payment card issuer or optionally a trusted third party. The secure processor transmits one of the retrieve transaction identifiers to the on-line merchant instead of payment card data. The on-line merchant communicates the transaction identifier to the payment card issuer or the trusted third party for validation. Alternatively, the secure processor may encrypt the read payment card data utilizing the payment card number as the shared secret required by the cryptographic algorithm. The secure processor then forwards the encrypted payment card data to the on-line merchant.

Owner:NXP BV

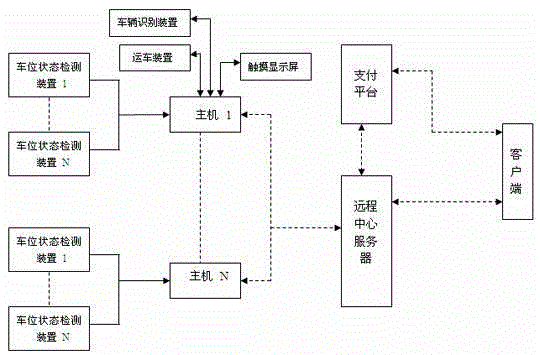

System and method for reserving parking stall in stereo parking lot and parking car

InactiveCN105047008AShorten the timeReduce use costIndication of parksing free spacesPaymentPayment card number

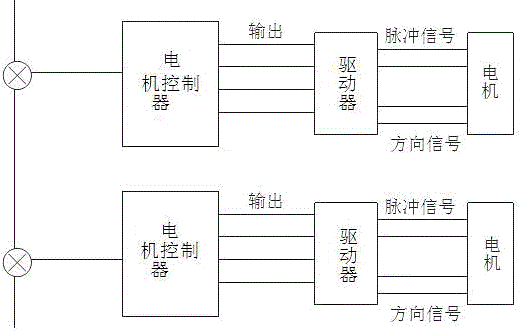

The invention discloses a system and method for reserving a parking stall in a stereo parking lot and parking a car. The system comprises a client, a remote central server, a parking stall management center, and a payment platform. The client is used for querying parking lot and parking stall information near a target area, and is bound with a cell phone number and a bank card number in order to reserve a parking stall or cancel a reserved parking stall. After a reservation is made, the remote central server sends reservation information to a matched parking stall management center. The host of the parking stall management center sends a short-message verification code to a bound cell phone by means of a short message sending module in the host and a timing module of the host begins to count time. After a car owner parks the car, the host of the parking stall management center sends fee information to the payment platform via the remote central server; the payment platform deducts the expense and sends payment success information; and finally the car owner gets back the car. The system and the method enable the car owner to locate a required parking stall and improve work efficiency.

Owner:吴建国

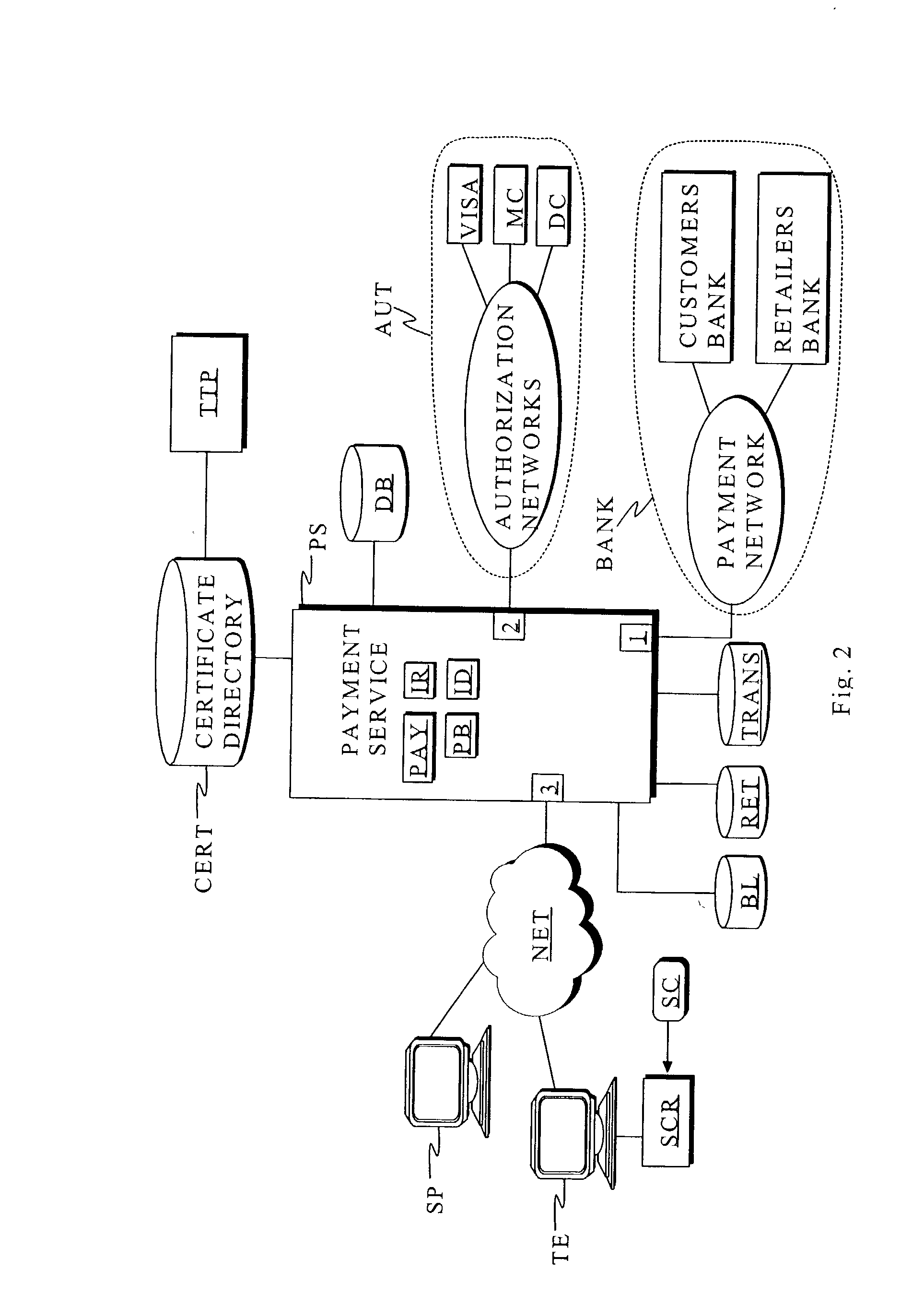

System and method for effecting secure online payment using a client payment card

InactiveUS20030069792A1Alleviate, the drawbacks and deficienciesImprove securityCredit schemesPayment circuitsThe InternetInformation networks

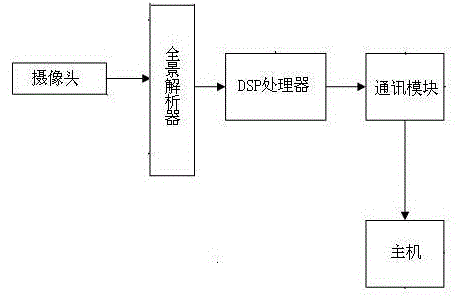

Payment using a payment card for goods and / or services ordered online via an information network such as the Internet is implemented in a notably secure manner without the need to transmit the client's payment card number over the data transmission network. A separate confirmation for effecting the payment for an order is requested from the client. The information to be confirmed is transmitted to the terminal device of the client, such as a mobile station, by means of which the client confirms the order by digitally signing the confirmation request. The digitally signed confirmation and the electronic identity information associated with the client are then returned to the payment service equipment, which verifies the client's identity, checks the validity of the client's payment card, and then transmits the necessary payment information to the payment system.

Owner:SMARTTRUST SYST

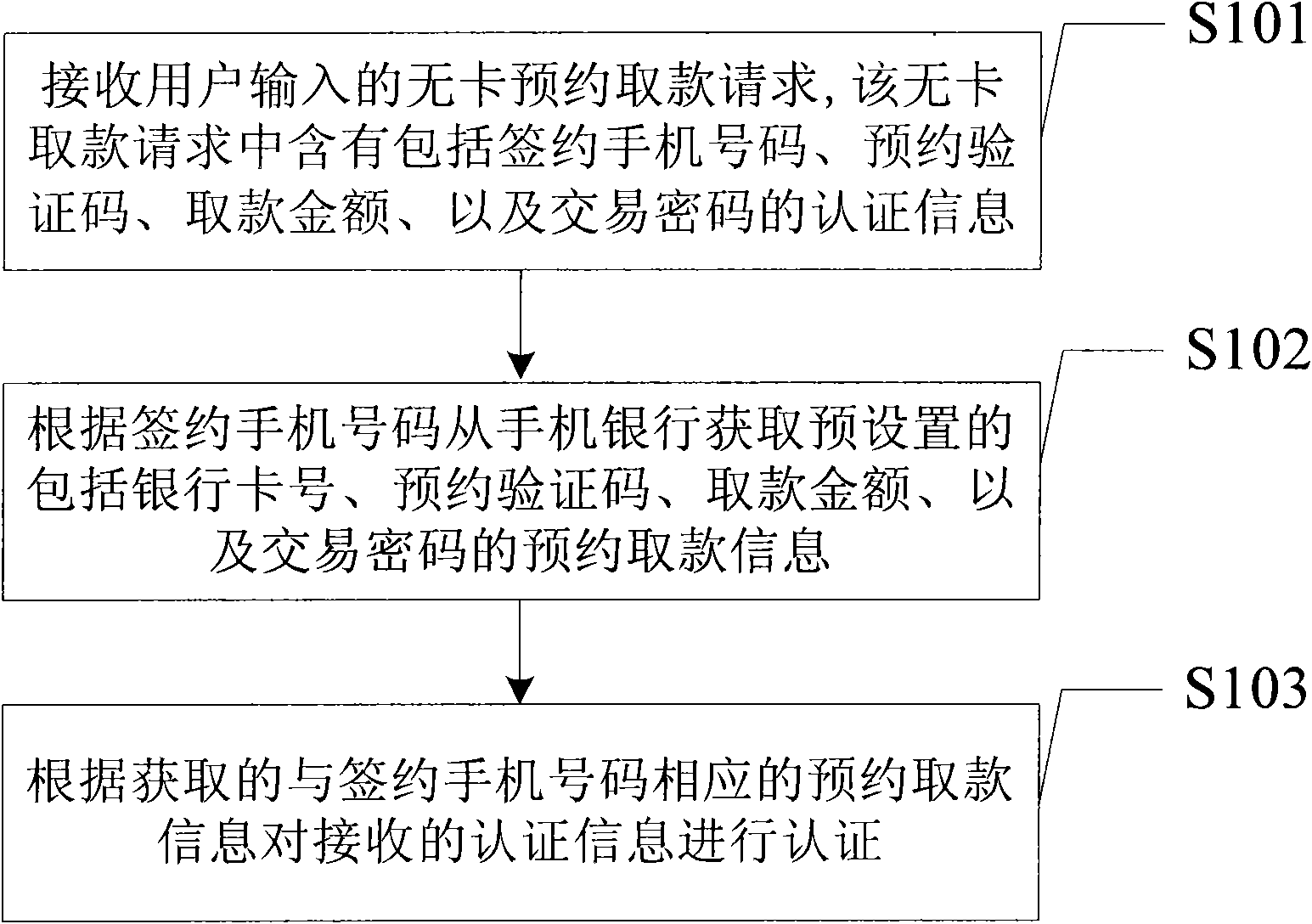

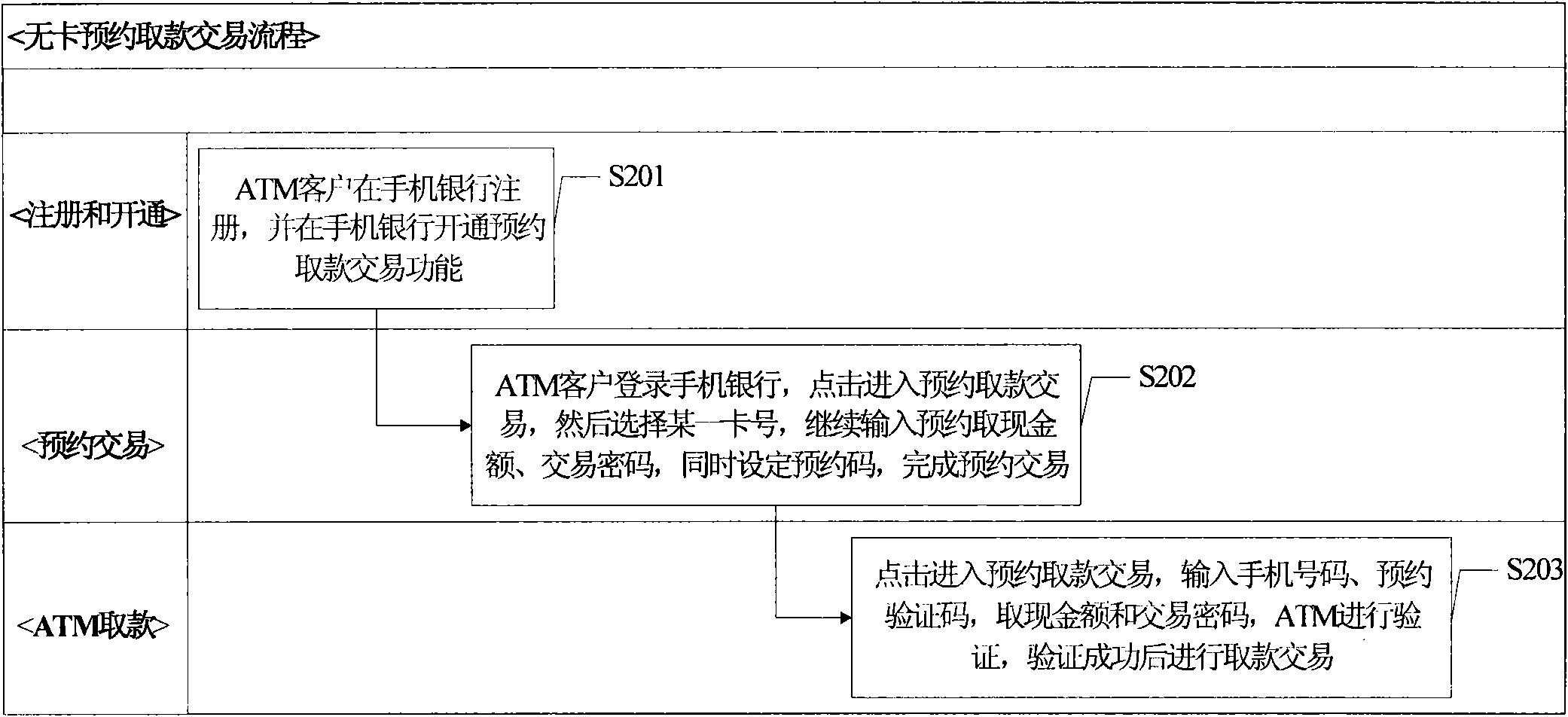

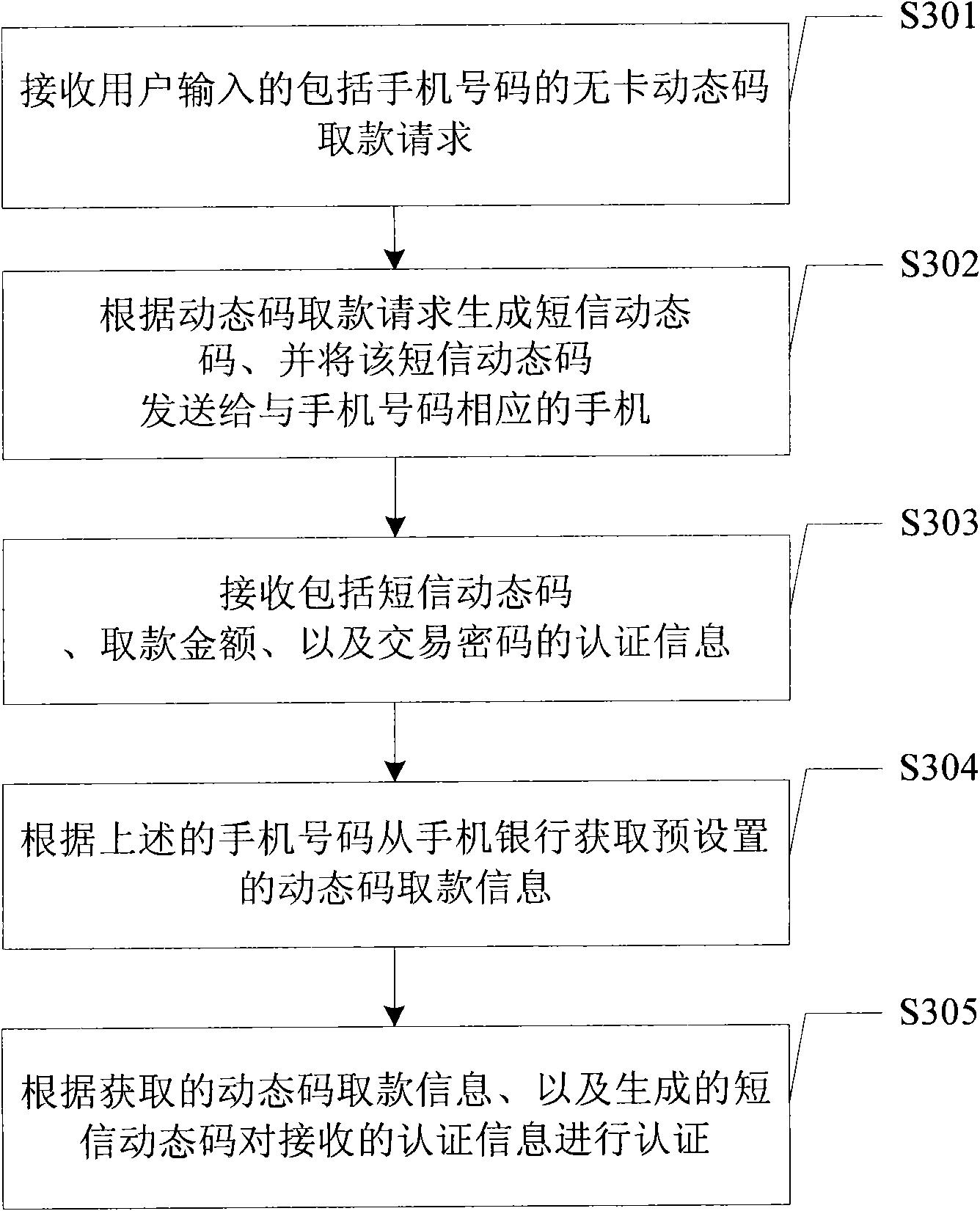

Authentication method and system based on ATM

InactiveCN101807319AOvercoming the problem of requiring bank card authenticationEasy withdrawalAcutation objectsTransmissionMobile Telephone NumberPassword

The invention provides an authentication method and an authentication system based on an ATM. The authentication method based on an ATM comprises the following steps of: receiving a user-input appointed withdrawal request including a contract mobile telephone number, an authentication code, a withdrawal sum and a trading password; acquiring preset appointed withdrawal information including a bank card number, the authentication code, the withdrawal sum and the trading password from the mobile phone bank based on the contract mobile telephone number; and authenticating the received appointed withdrawal request based on the acquired appointed withdrawal information to output the sum which is the same with the withdrawal sum in the appointed withdrawal request when the authentication is successful. The invention can overcome the problem that the bank authentication is necessary for the ATM withdrawal in the prior art, thereby facilitating the user of withdrawing money from the ATM.

Owner:BANK OF COMMUNICATIONS

Mobile payment system and method based on bank virtual card number

InactiveCN104504565AAvoid risk of leakageImprove securityPayment protocolsPoint-of-sale network systemsIssuing bankThird party

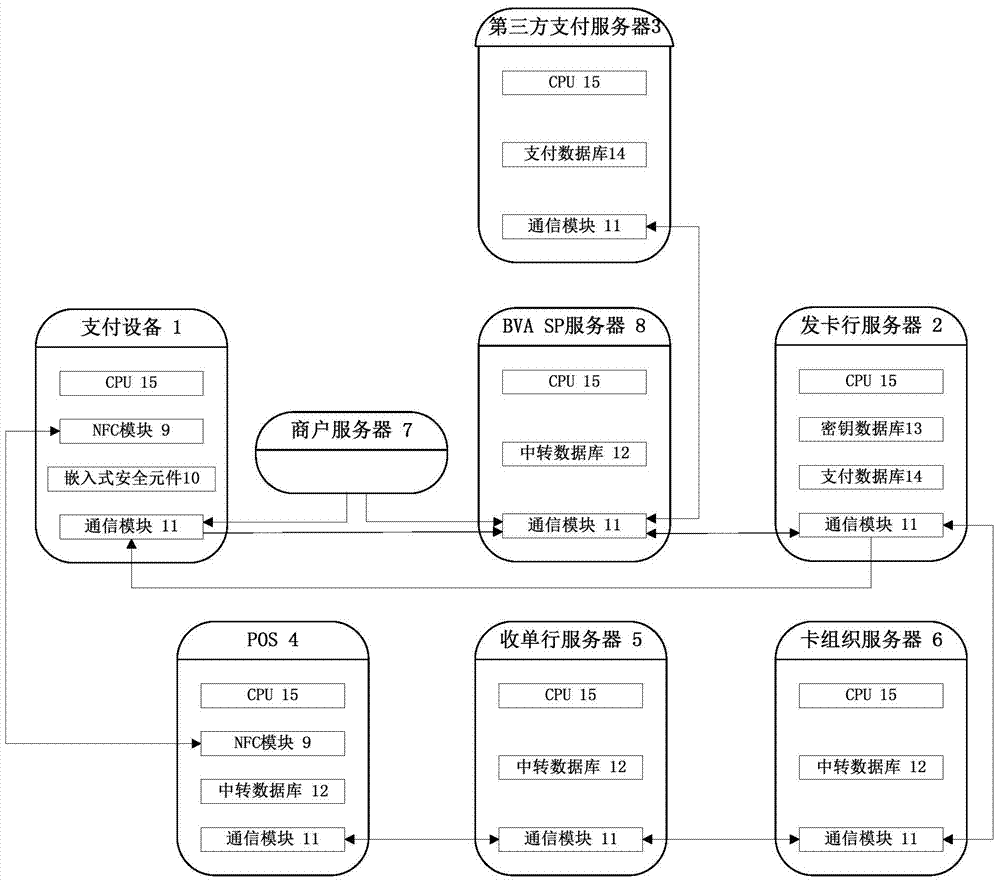

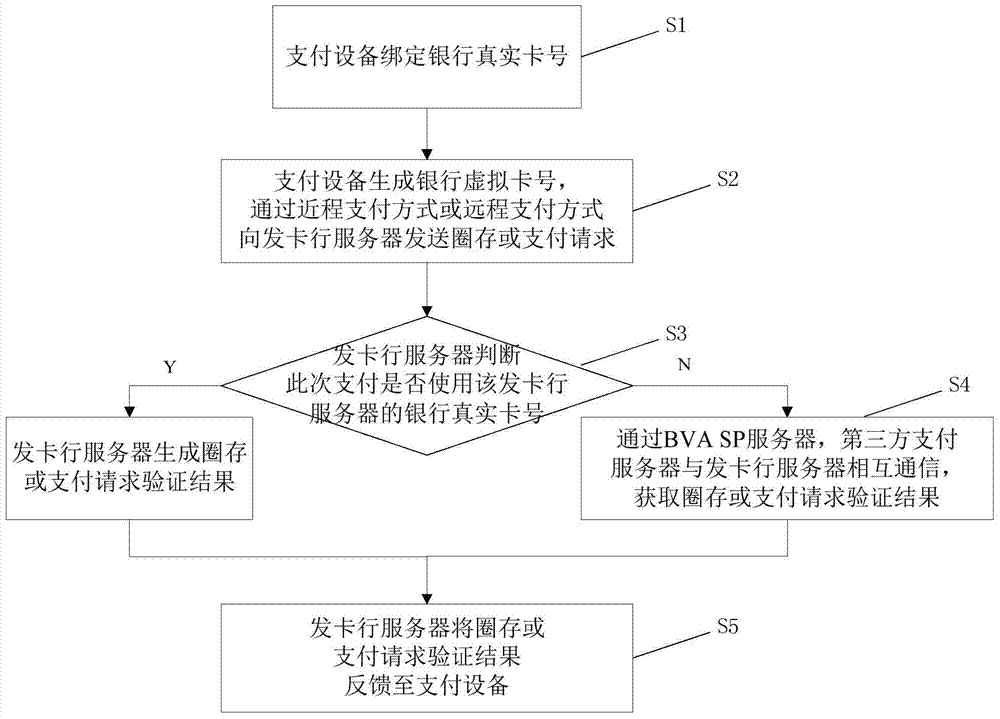

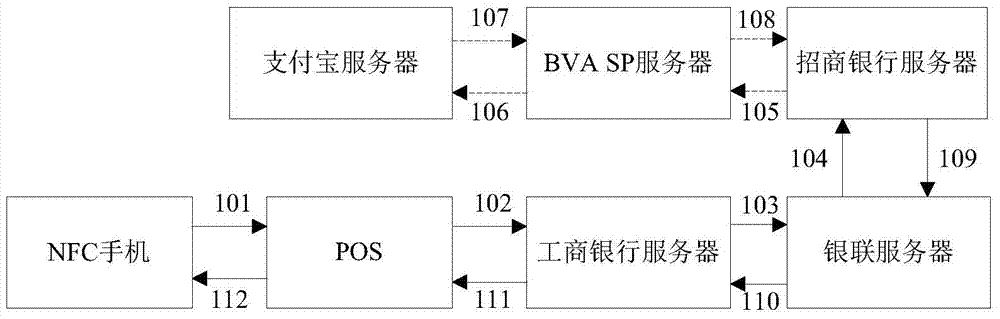

The invention relates to a mobile payment system based on a bank virtual card number. The mobile payment system based on the bank virtual card number comprises a payment device, a card issuing bank server, a third party payment server, a POS (machine point of sale machine), an acquiring bank server, a card organization server, a commercial tenant server and a BVA SP server, wherein the payment device generates the bank virtual card number used as a primary account number of a payment request or a transfer request, a payment request is sent to the card issuing bank server through transfer transmission of the POS, the acquiring bank server and the card organization server or a transfer request is sent to the card issuing bank server through transfer transmission of the BVA SP server, the card issuing bank server completes transfer or payment, and when the payment device uses a third party payment server for the payment, the card issuing bank server is communicated with the third party payment server through the transfer transmission of the BVA SP server, and completes the payment or the transfer after the payment request or the transfer request is verified. Compared with the prior art, the mobile payment system based on the bank virtual card number has the advantages of improving mobile payment safety, being strong in compatibility, facilitating operation of a user and the like.

Owner:SHANGHAI HAUKIT INFORMATION TECH CO LTD

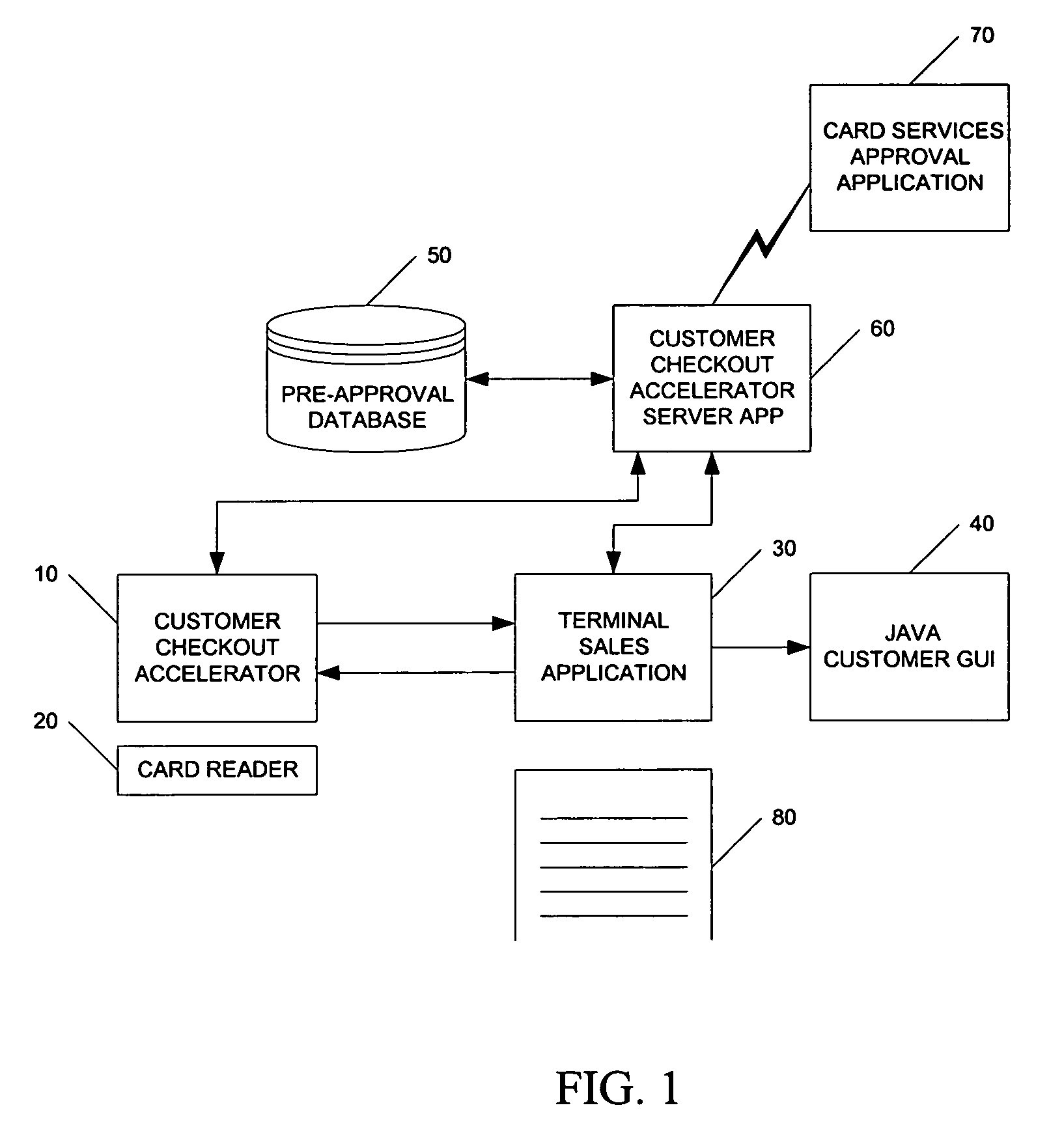

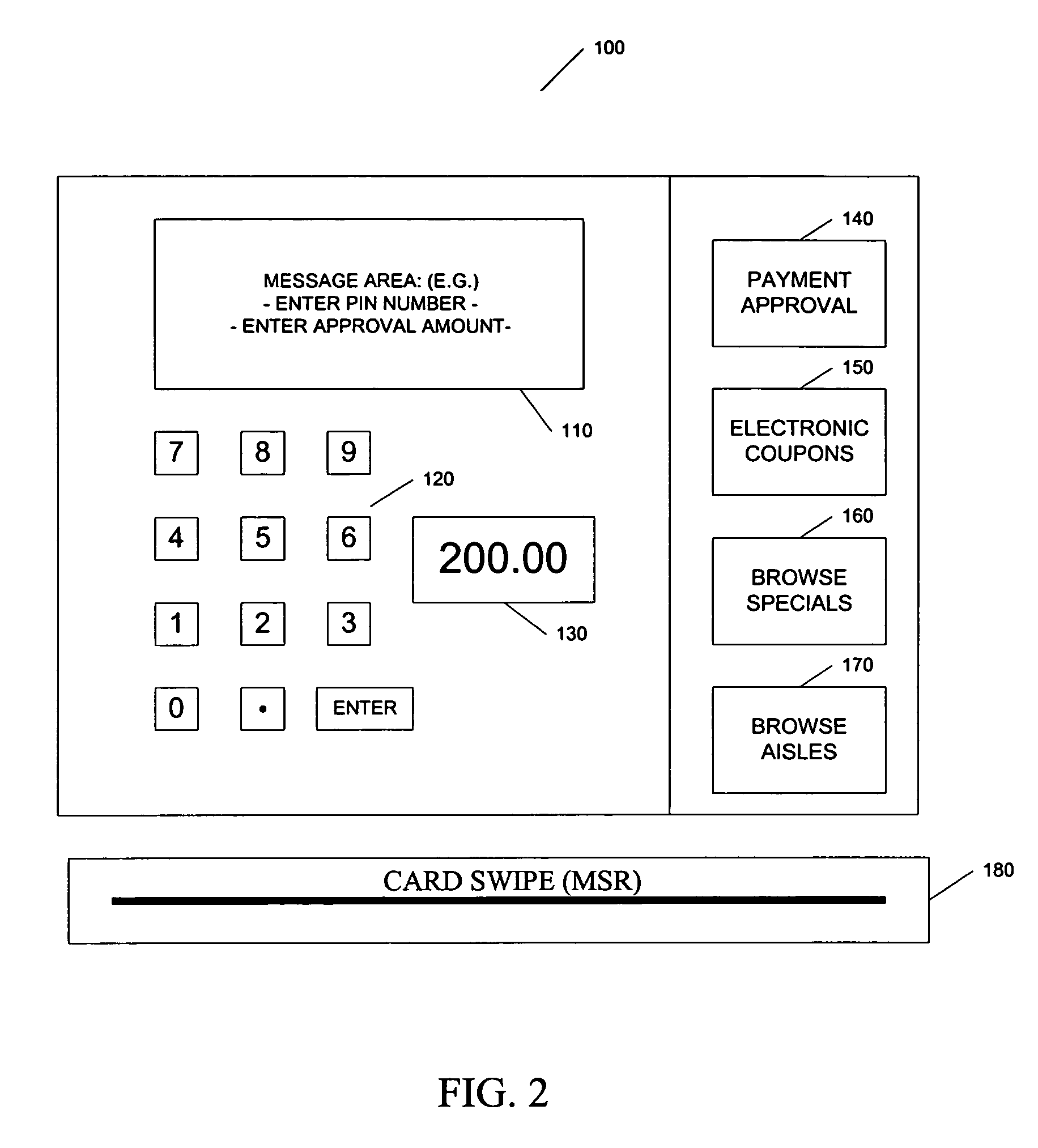

Customer checkout accelerator

InactiveUS7403907B1Improves overall checkout timeFunction increaseHand manipulated computer devicesCash registersPayment orderPayment card number

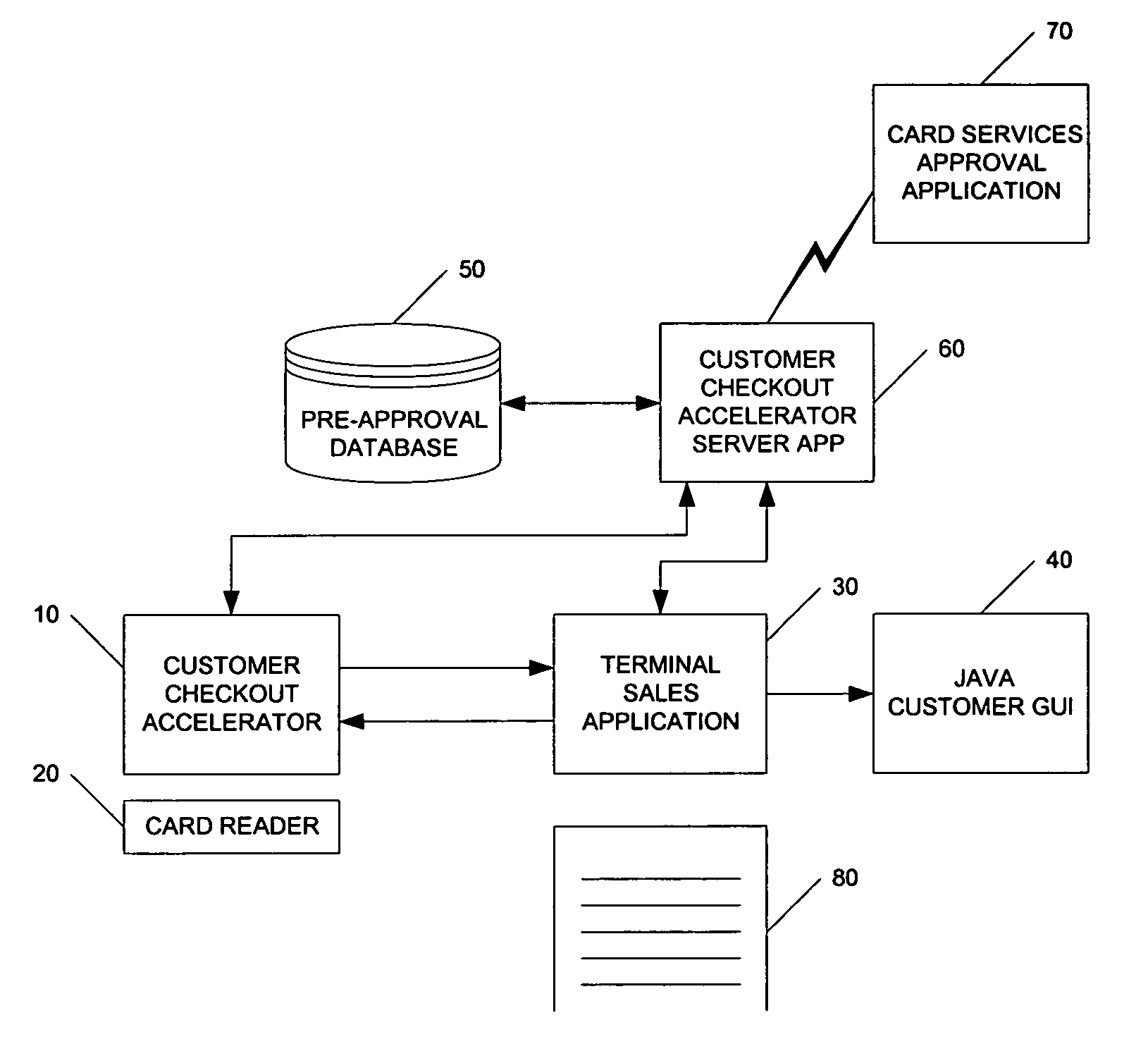

A system and method for accelerating customer sales transactions in a retail store. A customer checkout accelerator provides a customer user interface to initiate a request for a preapproval amount for a sales transaction before reaching the point of sale terminal for completion of the purchase transaction. A card reader integrated into the customer checkout accelerator reads a customer payment card number when the payment card is swiped through the reader. A customer checkout accelerator server module resident on a store controller server determines a preapproval amount for the sales transaction and transmits the request to an external card services system for payment approval. The customer checkout accelerator also provides the ability to purchase additional promotional items in the checkout lane with this process integrated into the payment preapproval process. Once payment approval is obtained from the external card services system, an entry is placed in a preapproval database associated with the customer checkout accelerator server module on the store controller server. The server module forwards the approval notification to the point of sales terminal where it is placed in a preapproval cache for use in completing the actual sale transaction.

Owner:TOSHIBA GLOBAL COMMERCE SOLUTIONS HLDG

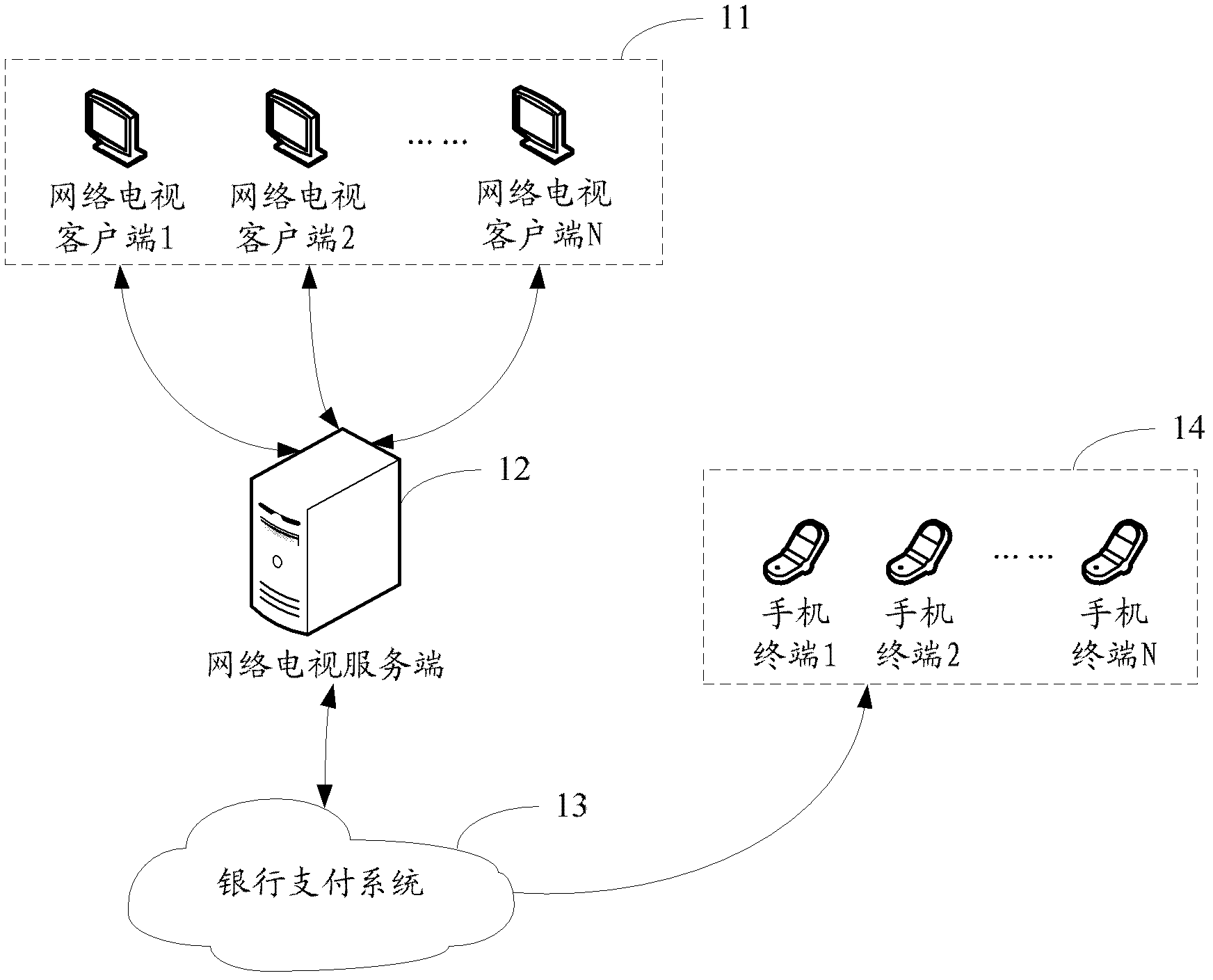

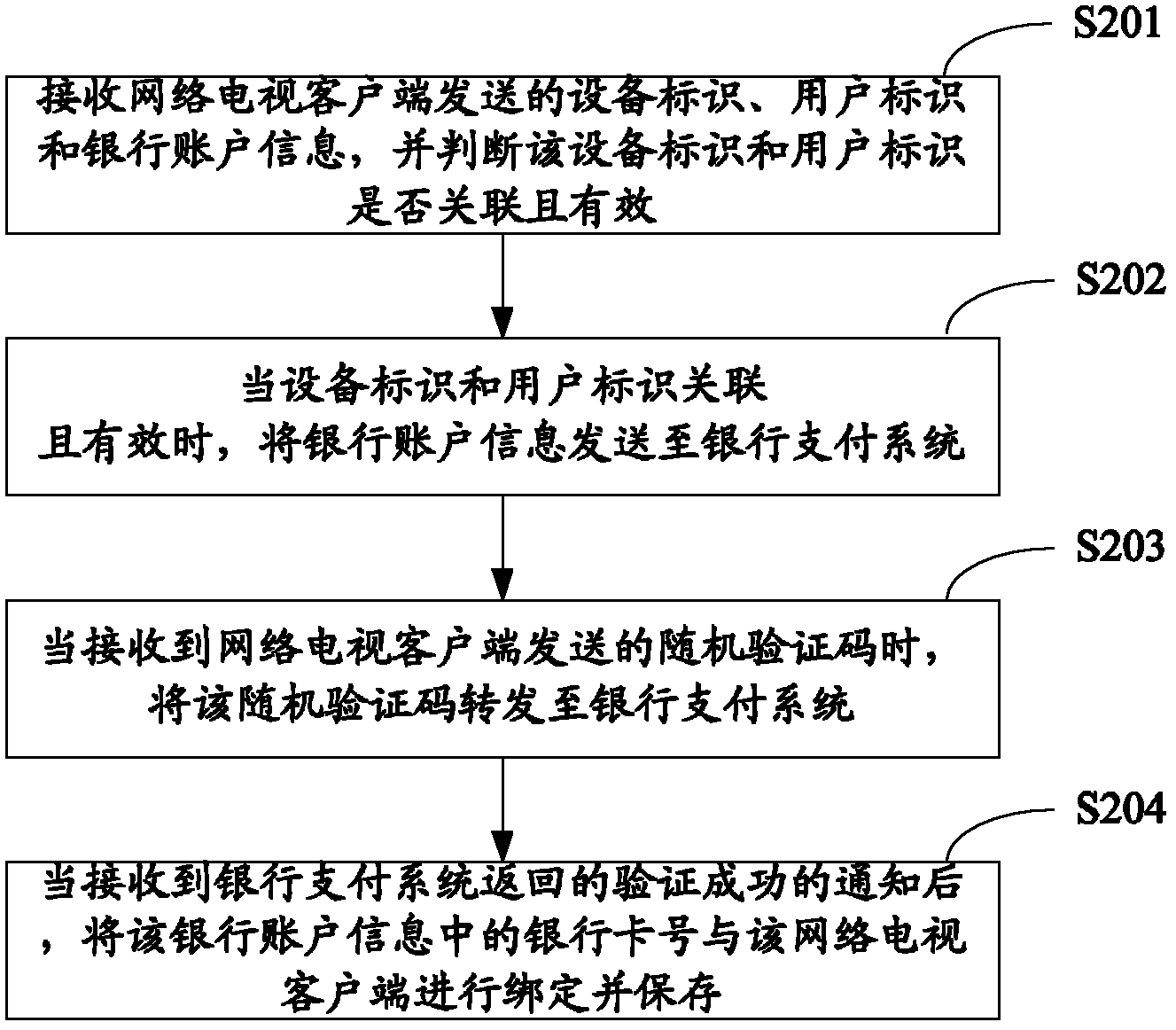

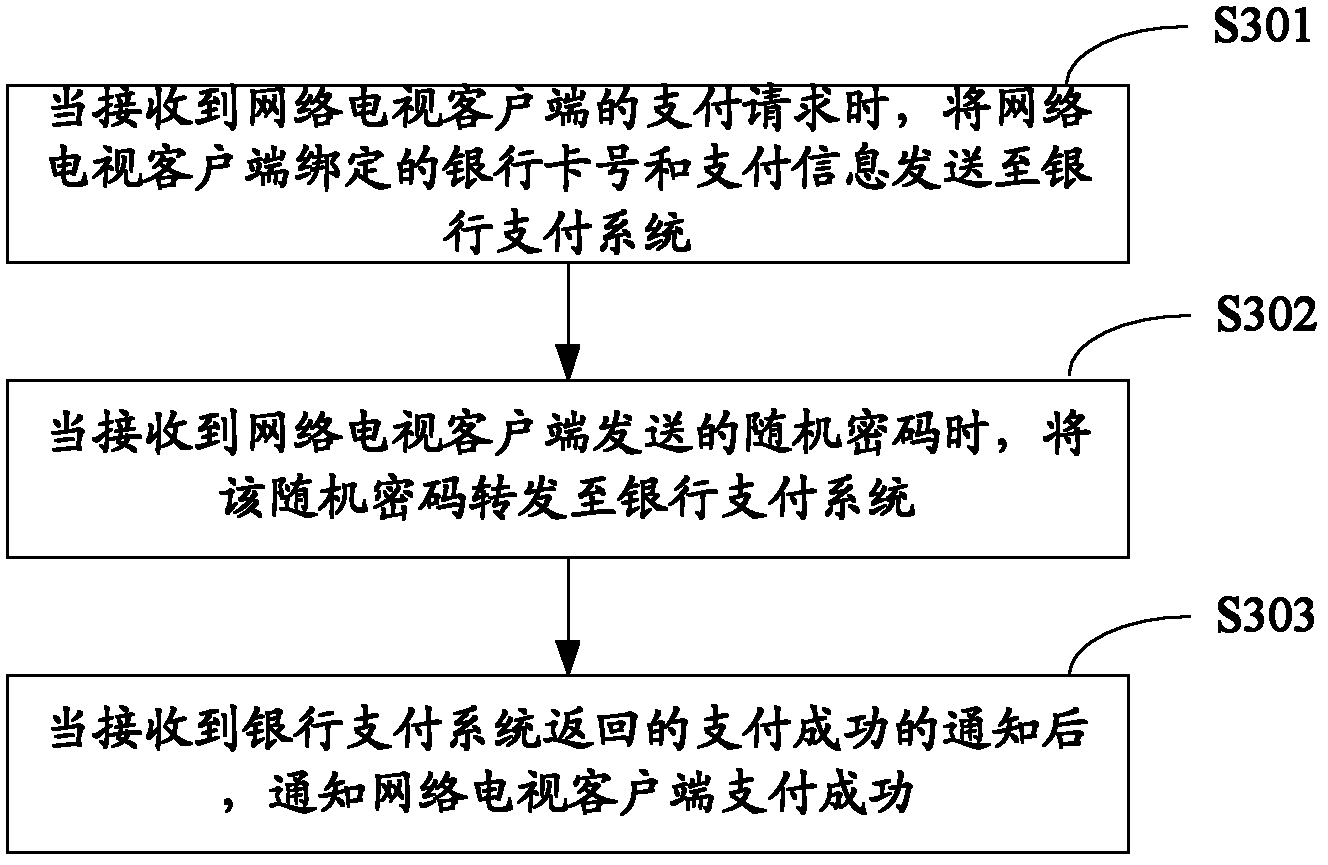

Network TV (television) online payment service based account binding method and payment method

InactiveCN102332127AAvoid double typingGuaranteed safe paymentPayment architectureBank accountUser input

The invention is suitable for the technical field of network TV (television), and provides a network TV online payment service based account binding method, payment method, account binding device, payment device, network TV server and network TV client. The account binding method comprises the following steps of: receiving bank account information sent by the network TV client, and sending the bank account information to a bank payment system; receiving a random verification code sent by the network TV client for being input by a user and sending the random verification code to the bank payment system to be verified; and binding and storing a bank card number in the bank account information and the network TV client. In the invention, the bank account information and the network TV client used by the user are bound, and a random password sent by the bank payment system is received by a phone terminal of the user to complete the payment, thereby the situation that the bank account information with numerous content is repeatedly input in the payment process is avoided, and the payment efficiency is improved under the premise of ensuring secure payment.

Owner:SHENZHEN COOCAA NETWORK TECH CO LTD

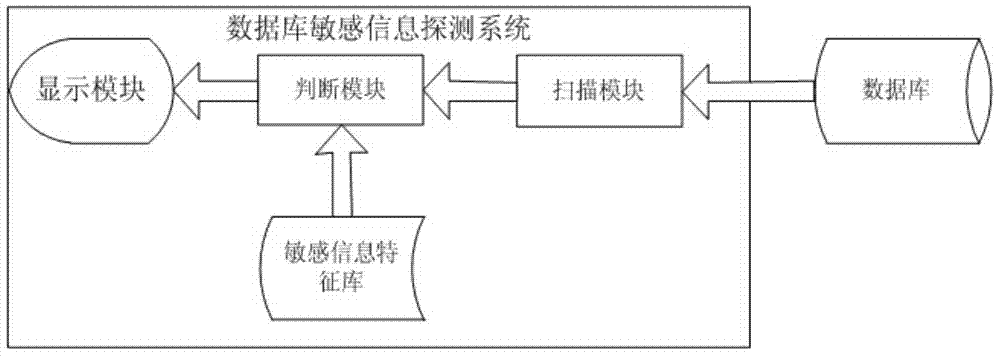

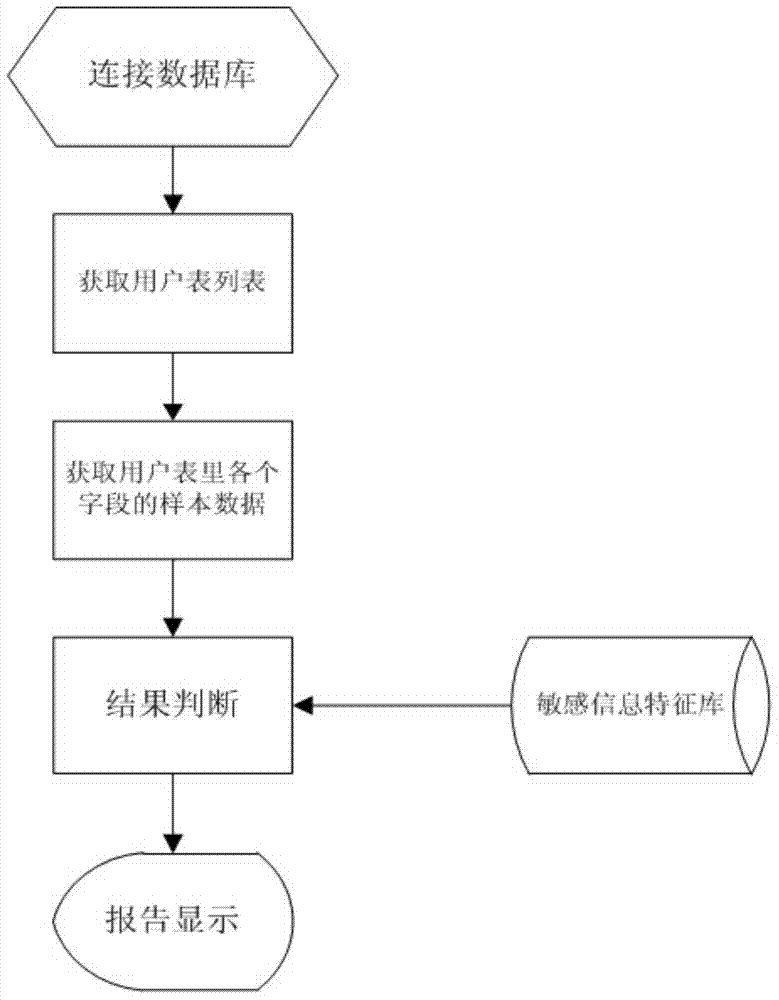

Method and system for detecting sensitive information in database

ActiveCN104123370AKey protectionKey auditSpecial data processing applicationsPayment card numberInformation security

The invention relates to the technical field of information security, and provides a method and system for detecting sensitive information in a database. The method for detecting the sensitive information in the database comprises the steps of scanning a system view of the database to acquire all user tables, extracting a part of data from each field of each user table as a sample, and carrying out analysis and matching on the samples to judge whether the sensitive information exists. The system for detecting the sensitive information in the database comprises a system table, a scanning module, a judgment module and a display module, wherein the scanning module is connected with the database, and the judgment module is connected with a sensitive information feature base, the scanning module and the display module. According to the method and system for detecting the sensitive information in the database, based on the regular expression feature base, by carrying out scanning detection on the user data in the database through the feature base, the position of the sensitive information of mobile phone numbers, bank card numbers, ID numbers, e-mail addresses and the like can be found, a detailed scanning report can be provided, and then a database administrator can carry out key protection and auditing.

Owner:HANGZHOU ANHENG INFORMATION TECH CO LTD

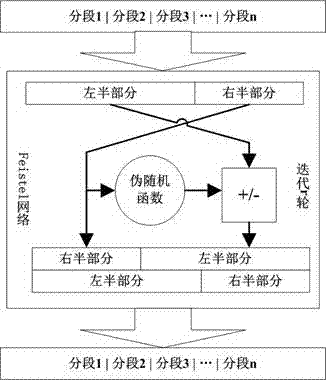

Method for encrypting format-preserved numeric type personally identifiable information

The invention discloses a method for encrypting format-preserved numeric type personally identifiable information (such as ID numbers and bank card numbers). The encryption purpose is achieved on the premise that original formats are kept unchanged. The method comprises the steps of first dividing the personally identifiable information into different data segments according to characteristics of the information and describing element sets of the segments through different integer finite fields; then connecting elements of the segments and inputting the elements into a Feistel network; finally outputting cryptograph data the same as original data in format under the effects of user-defined pseudo-random functions and modulo addition operation and modulo subtraction operation based on specified secret keys. By adopting the method, the possibility that encryption protection is performed on the numeric type personally identifiable information in a database application system is provided.

Owner:NANKAI UNIV +1

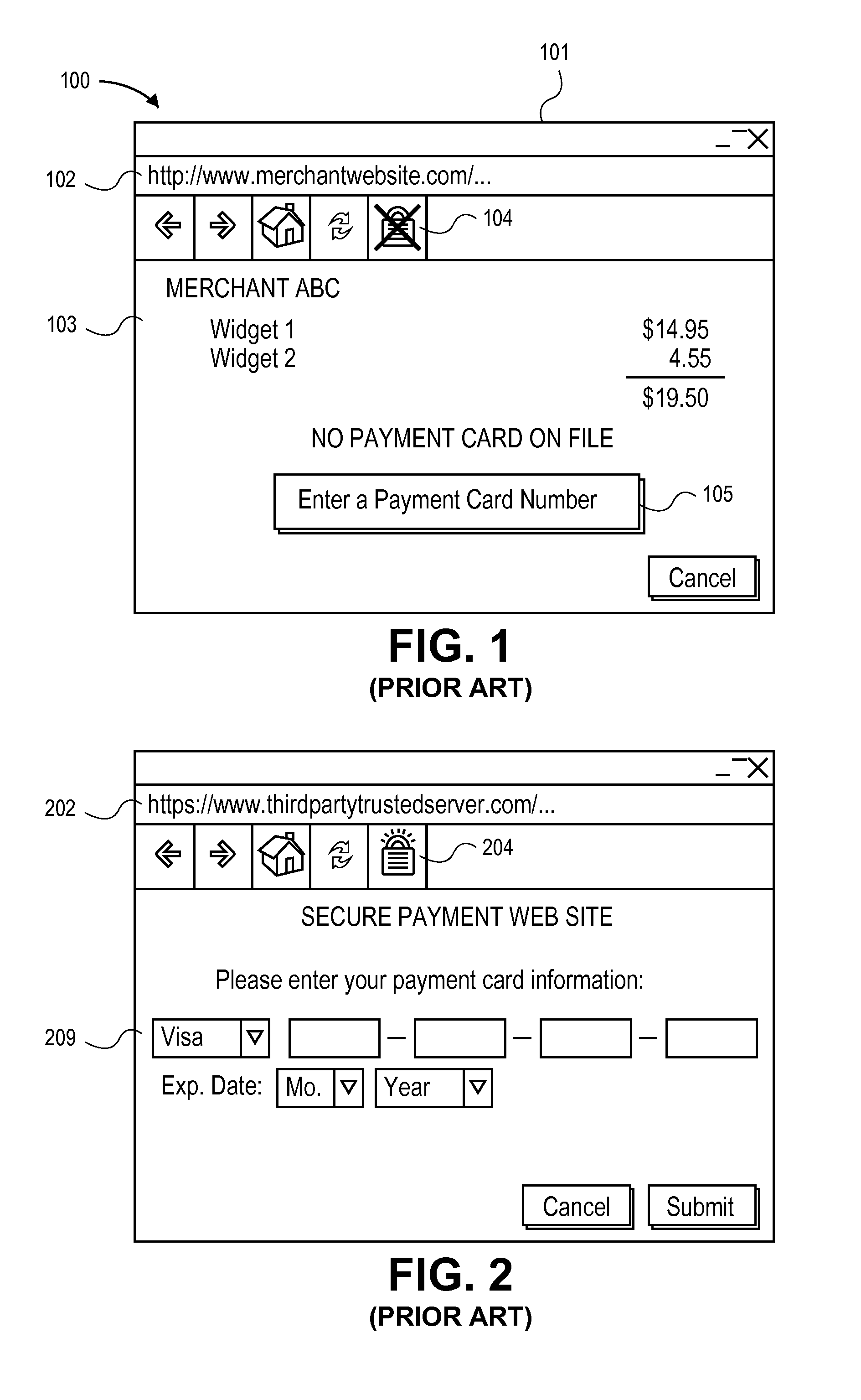

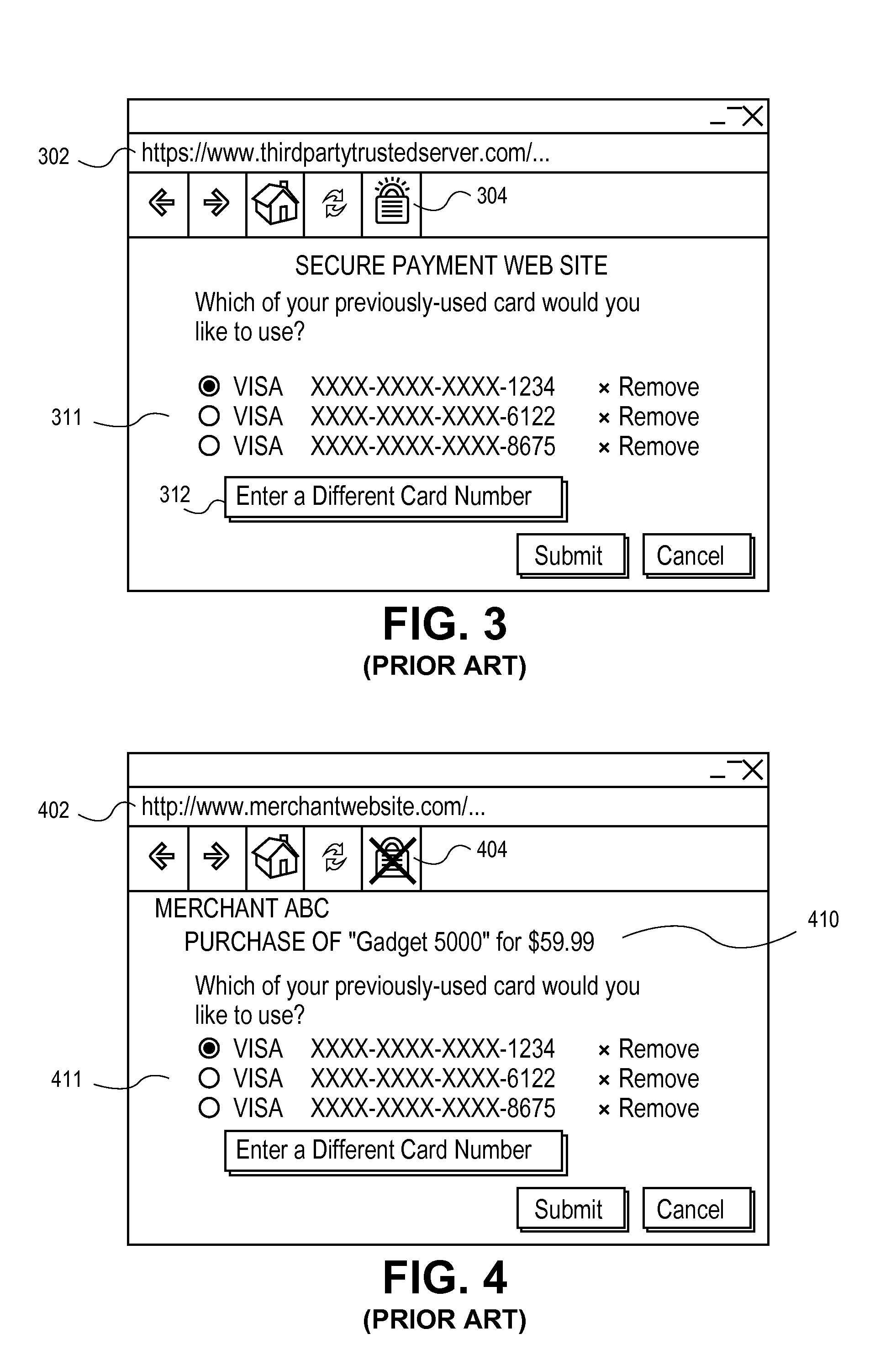

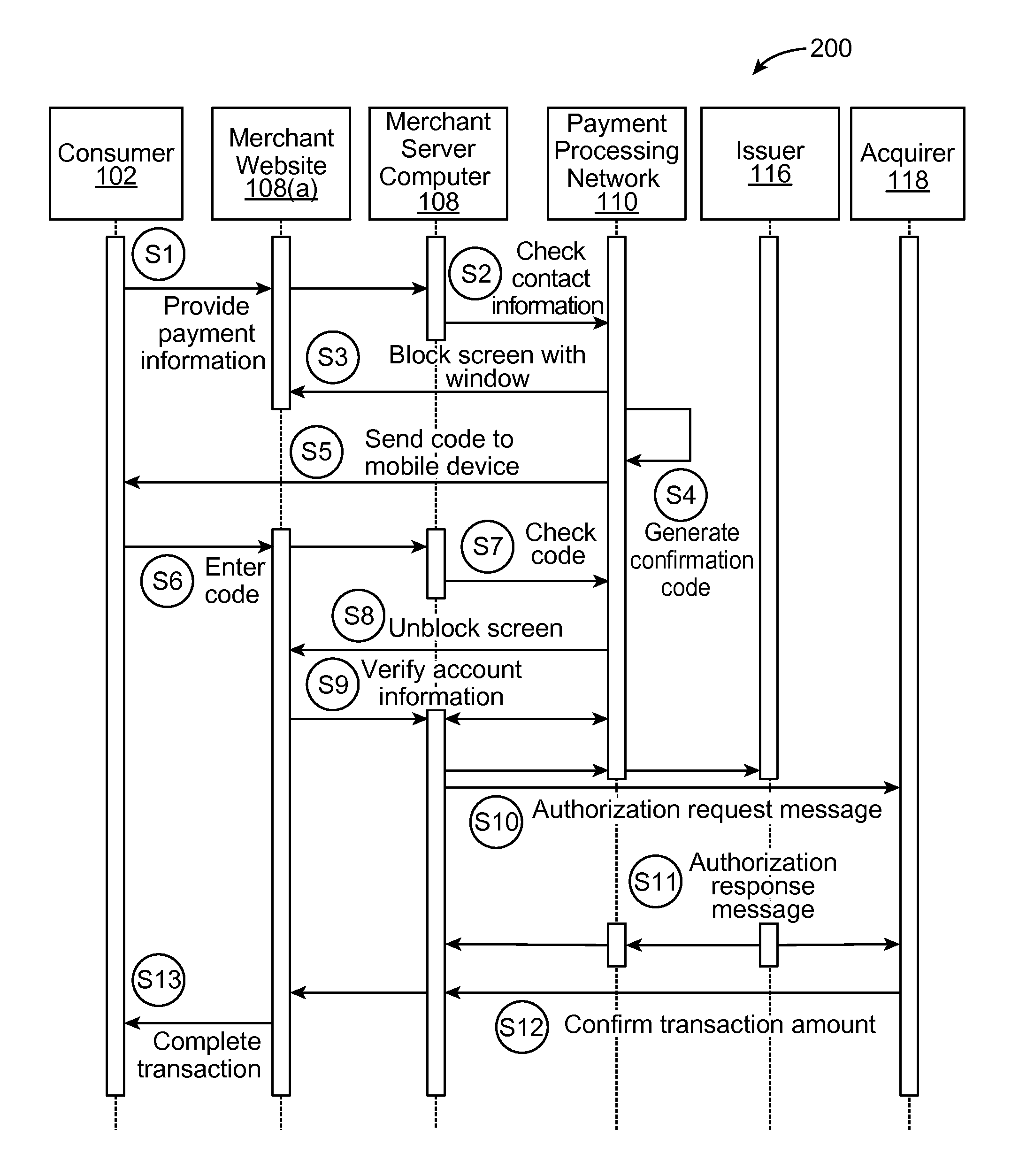

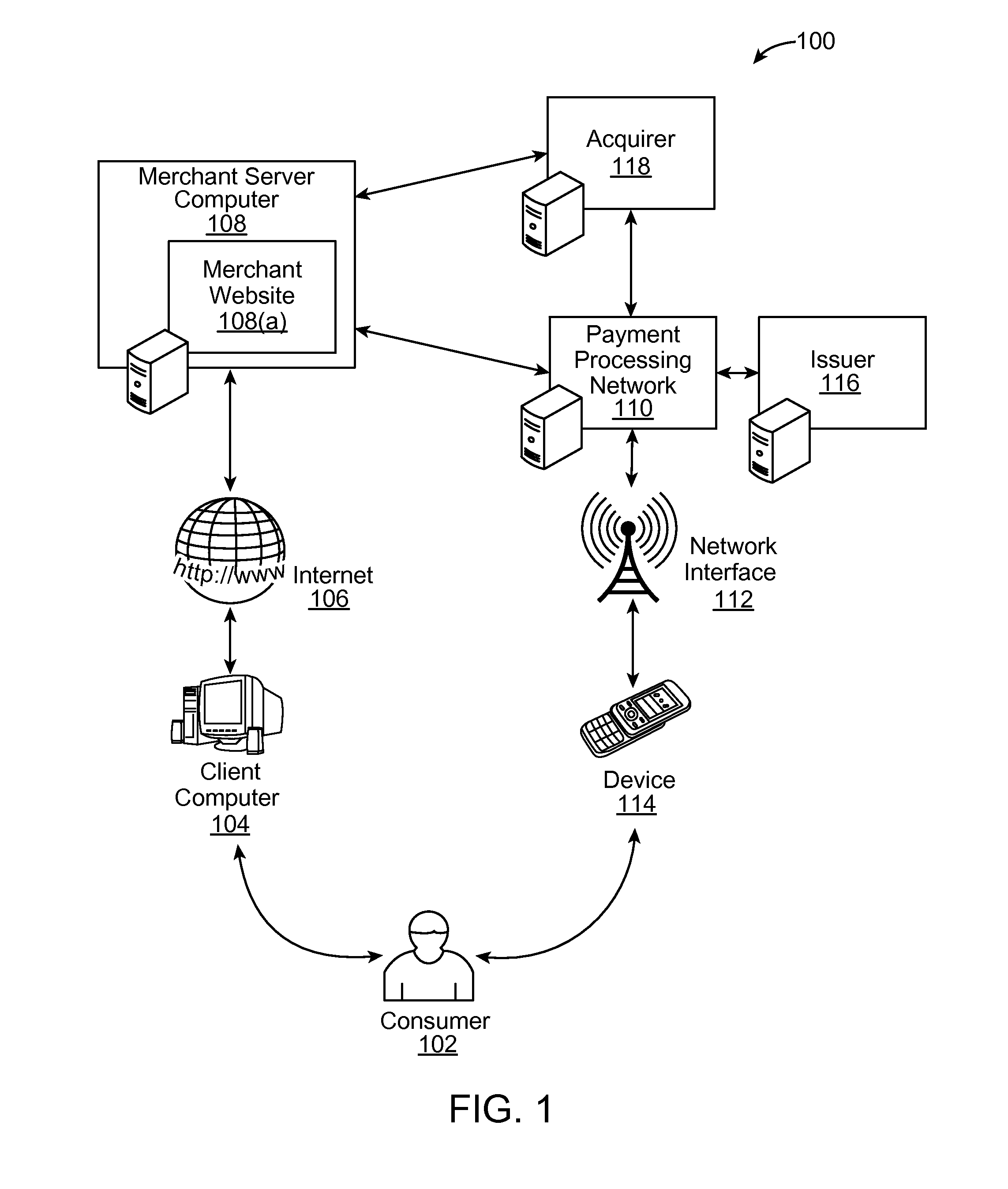

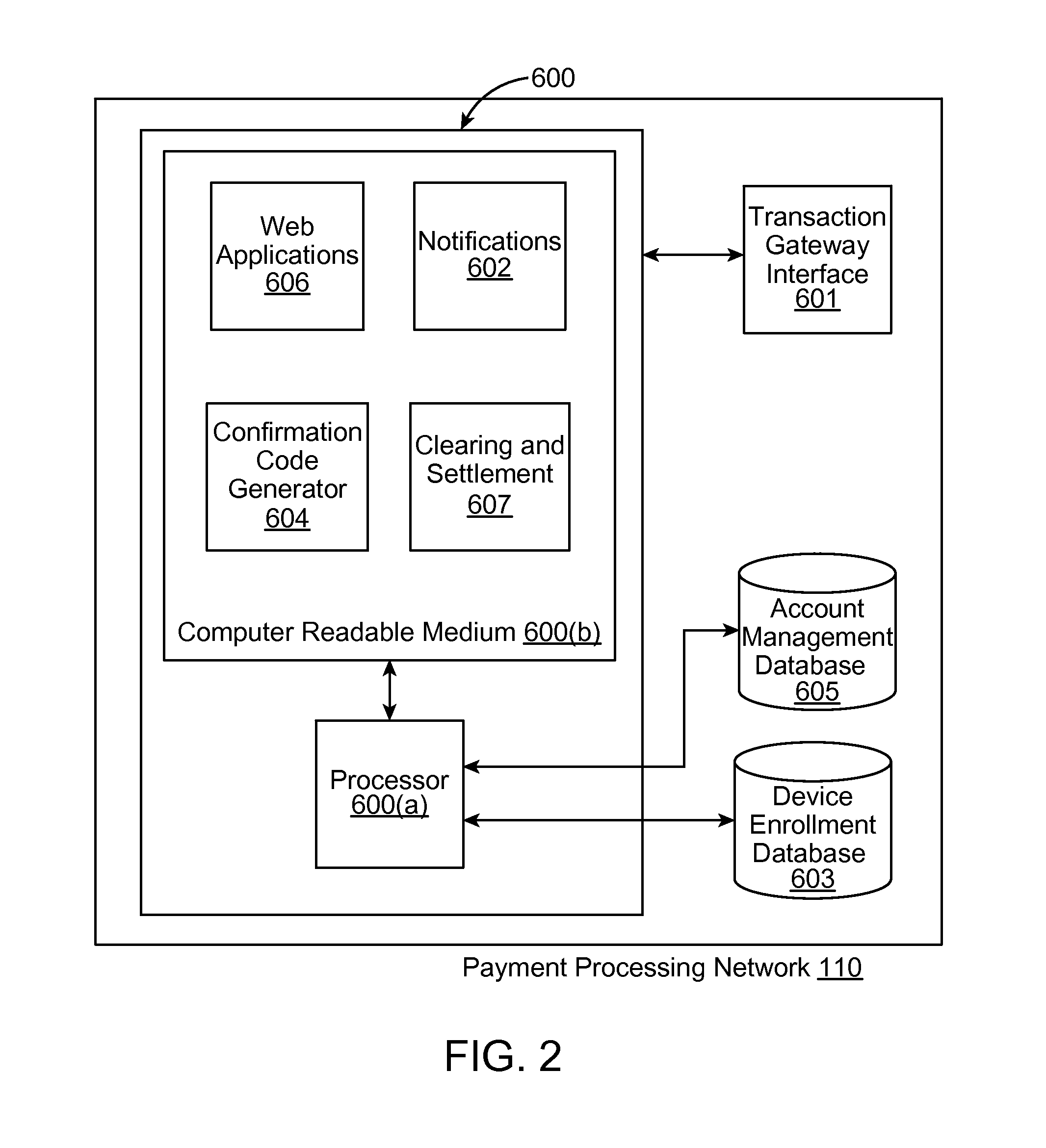

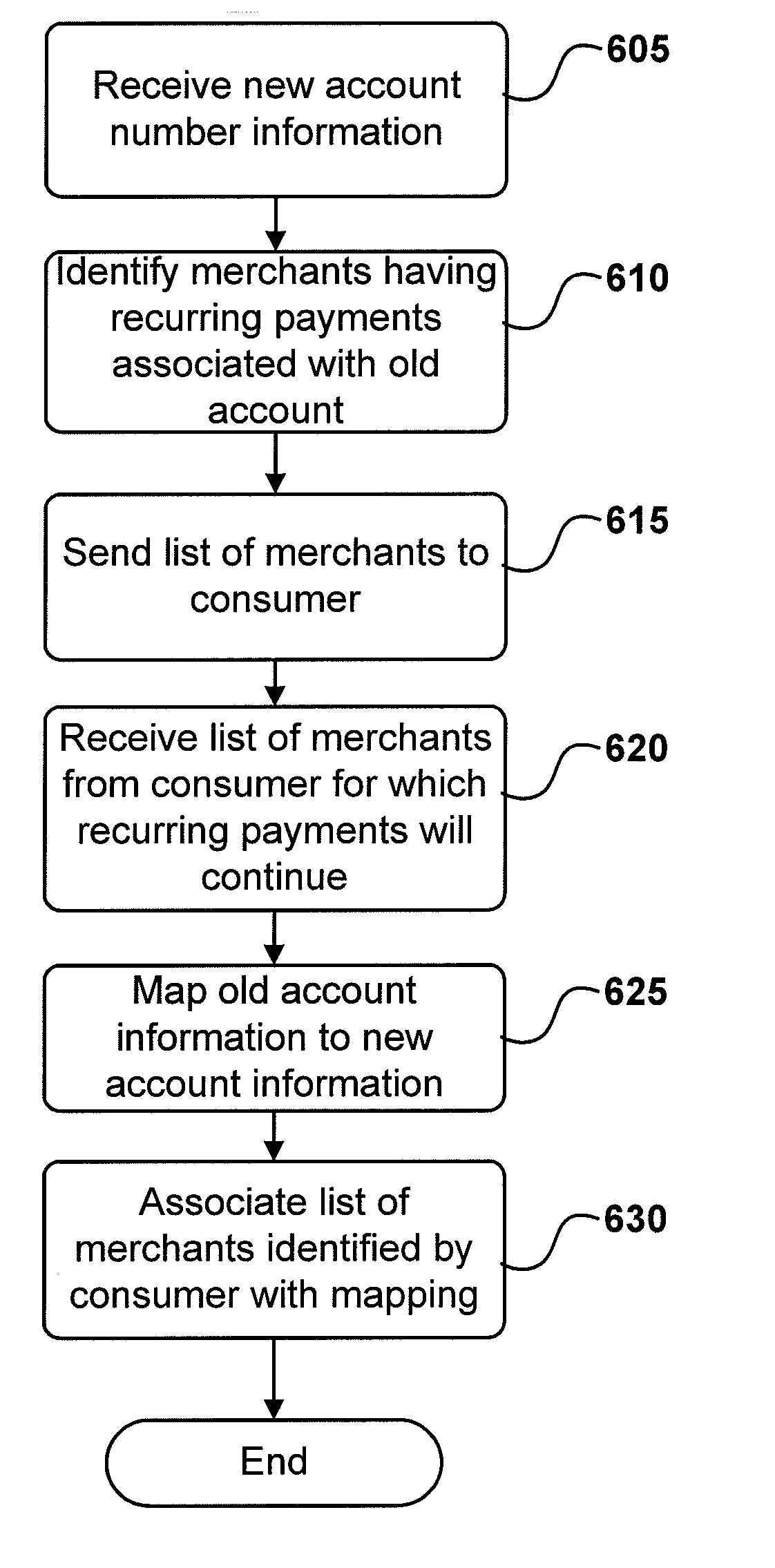

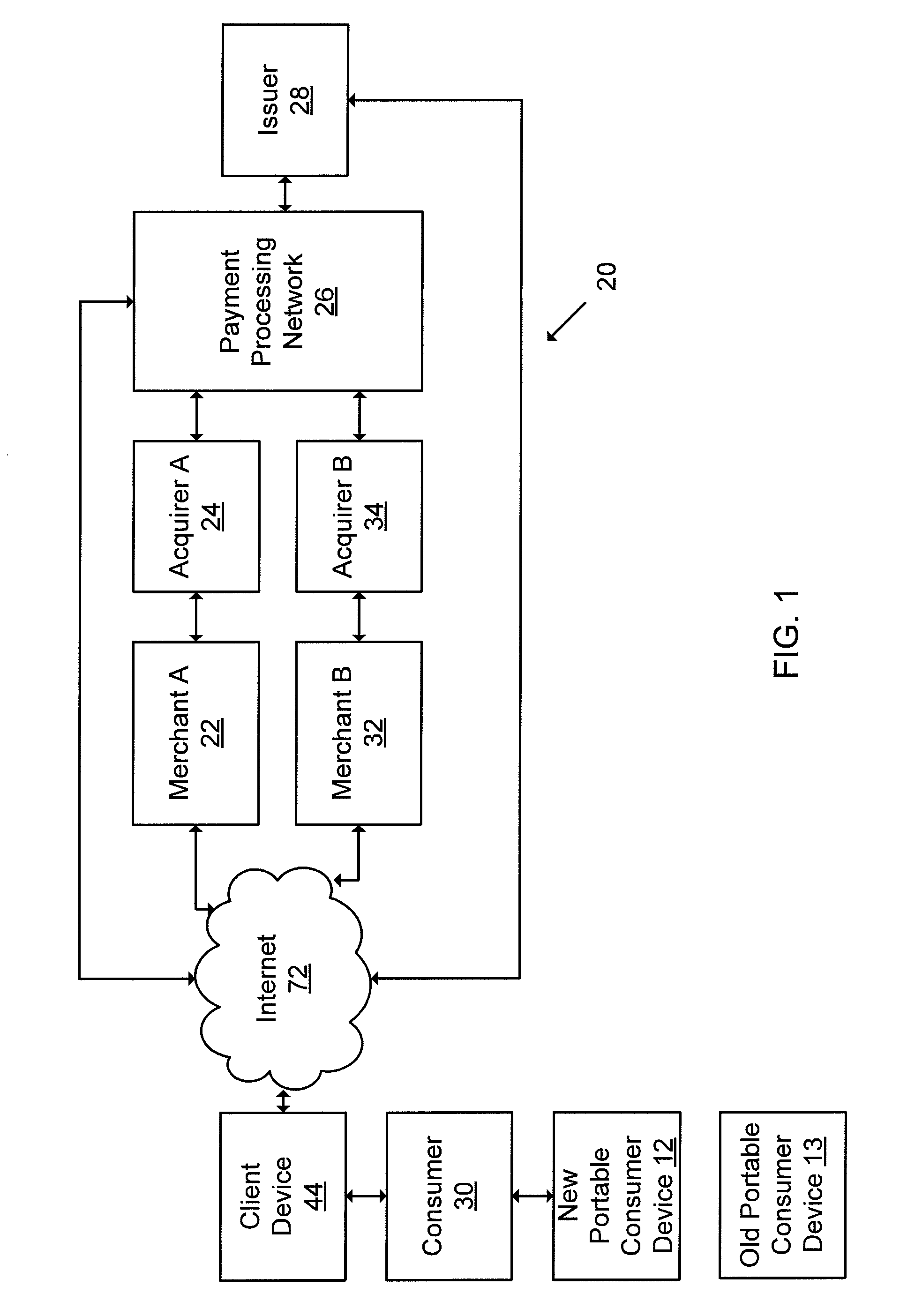

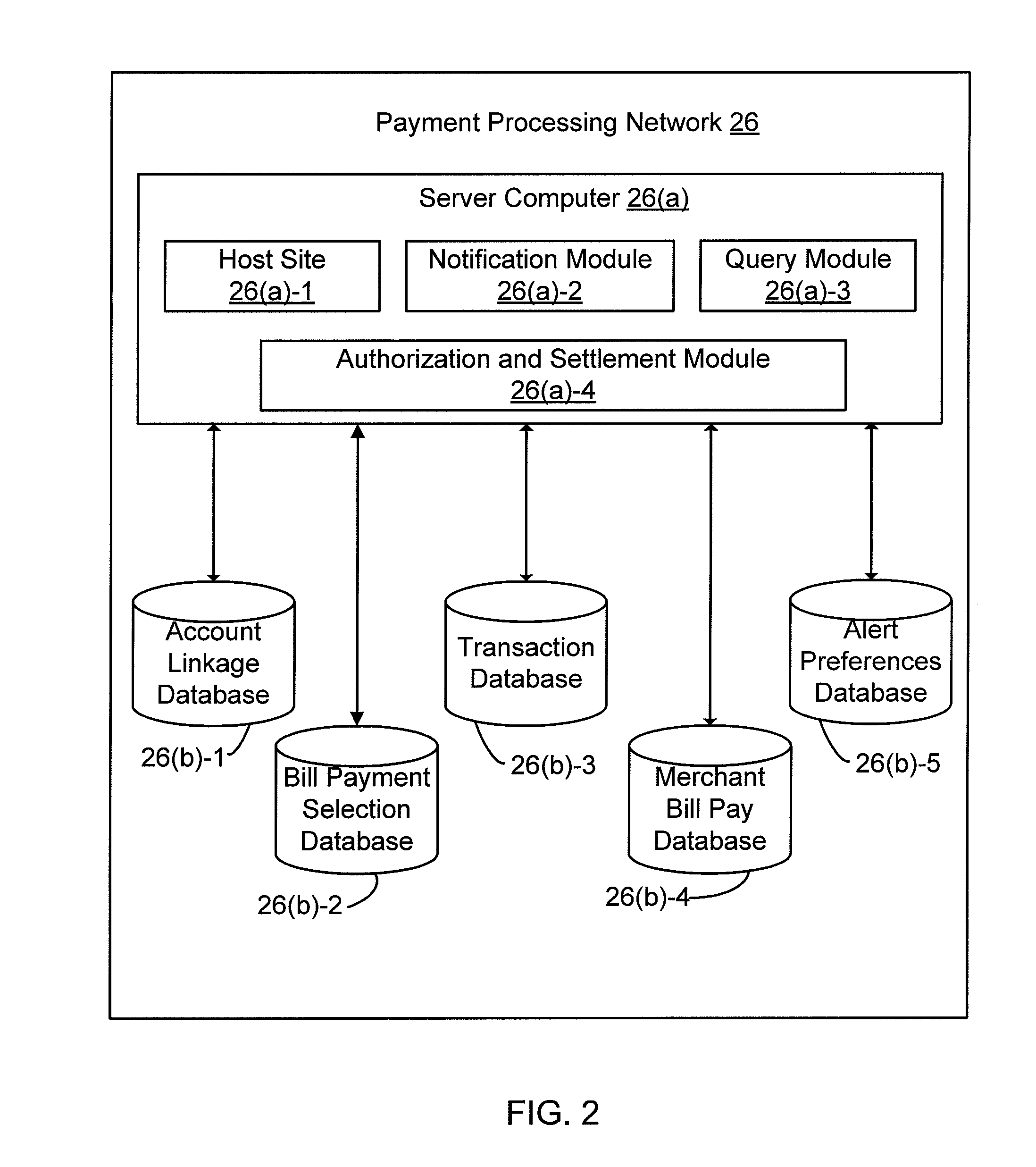

Recurring transaction processing

Techniques for processing of recurring payments are provided that allow a consumer to decide whether to update consumer account information at a merchant when a consumer is issued new account information for a payment card or the like. For example, a consumer may register with a payment processing network associated with the consumer's payment card. During registration, the consumer may indicate the payment card number and expiration date, the name of merchants that the consumer pays on a recurring basis using the payment card and the corresponding merchant website addresses, in what form the consumer would like to receive alerts (e.g. text message, email), and when to receive alerts (e.g. a particular number of days prior to the expiration date). The payment processing network sends the consumer an alert message based on the preferences indicated during registration, including the names and website links for each merchant indicated during registration. The consumer can use the alert message to access the merchant websites and update the account information for a new payment card.

Owner:VISA INT SERVICE ASSOC

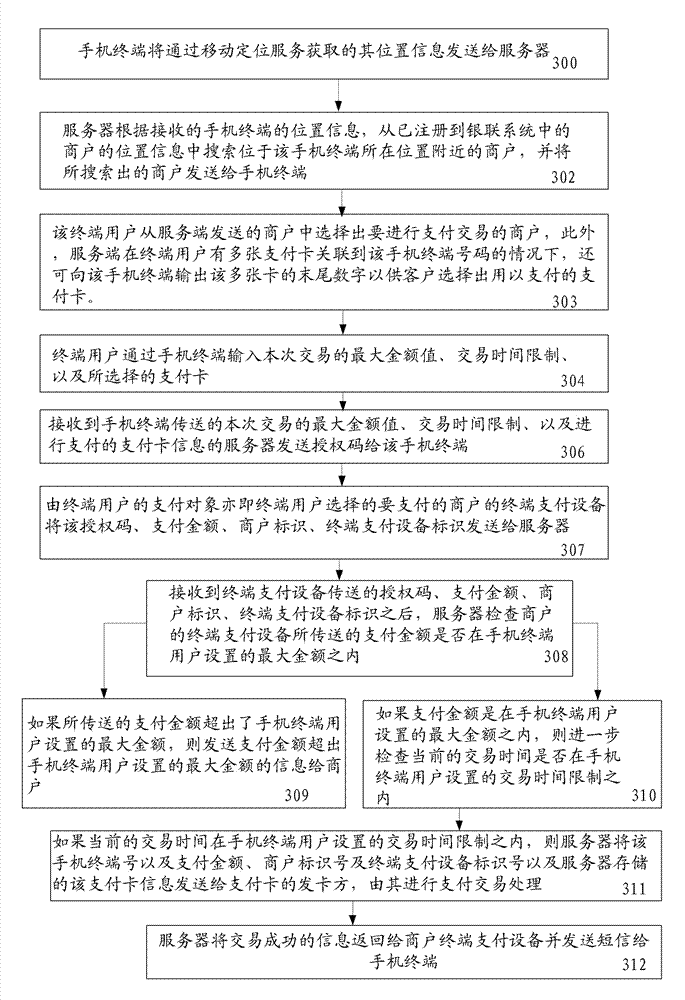

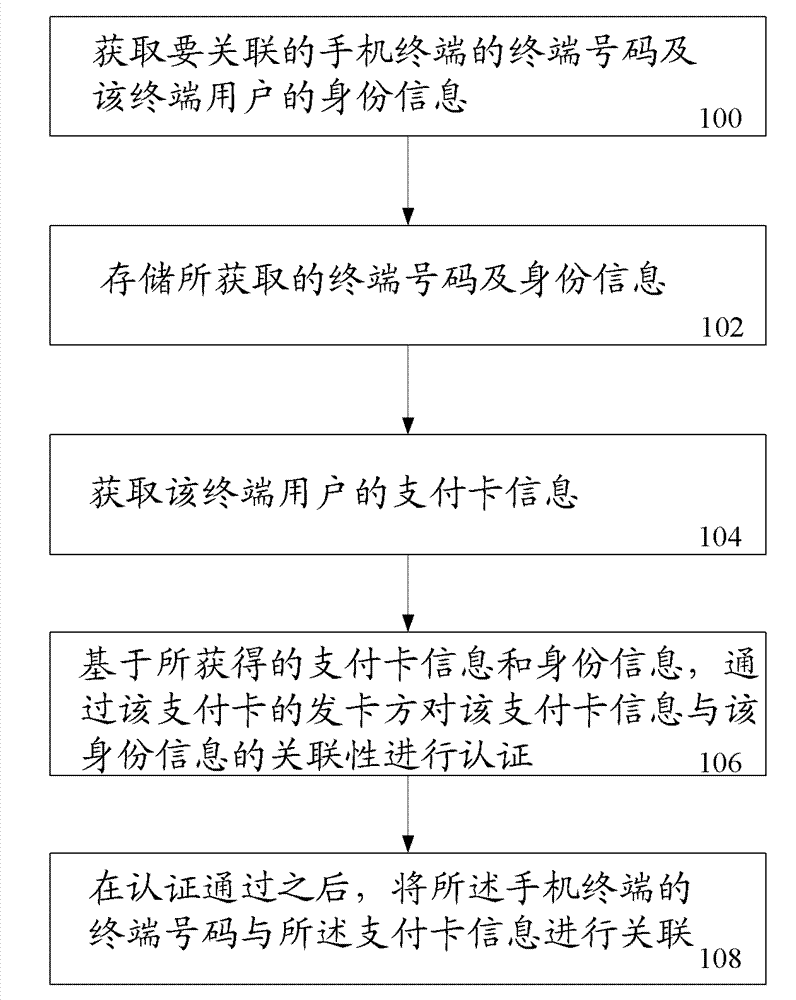

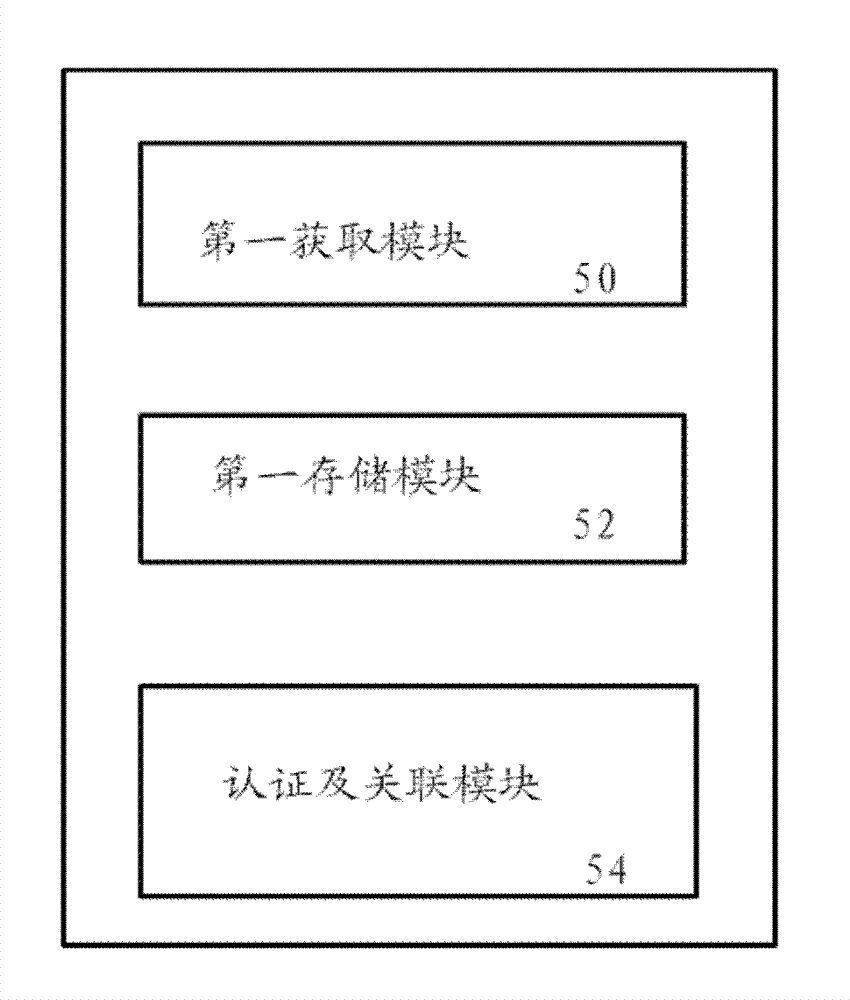

Cell phone terminal onsite paying method and system based on mobile positioning service

A cell phone terminal onsite paying method and system based on mobile positioning service is provided; the method and system connects a cell phone terminal number with payment card information of a cell phone terminal user in advance, and registers the terminal payment equipment users to a server-side based on the mobile positioning service in advance; according to the cell phone position information obtained by the mobile positioning service, a terminal payment equipment user close to the cell phone terminal is selected from the registered terminal payment equipment users, and the select result is sent to the cell phone terminal so as to choose a transaction user; the server-side sends an authorization code to the cell phone terminal after the transaction user and transaction set information are received; the terminal payment equipment sends the authorization code and transaction related information to the server-side, and sends the transaction related information and payment card information connected with the cell phone terminal number to a card releasing party of the payment card after the authorization code is received, thereby facilitating follow up processing. The method and system can realize cell phone onsite payment without needing the cell phone terminal user to input a payment card number and a password, thereby improving safety.

Owner:CHINA UNIONPAY

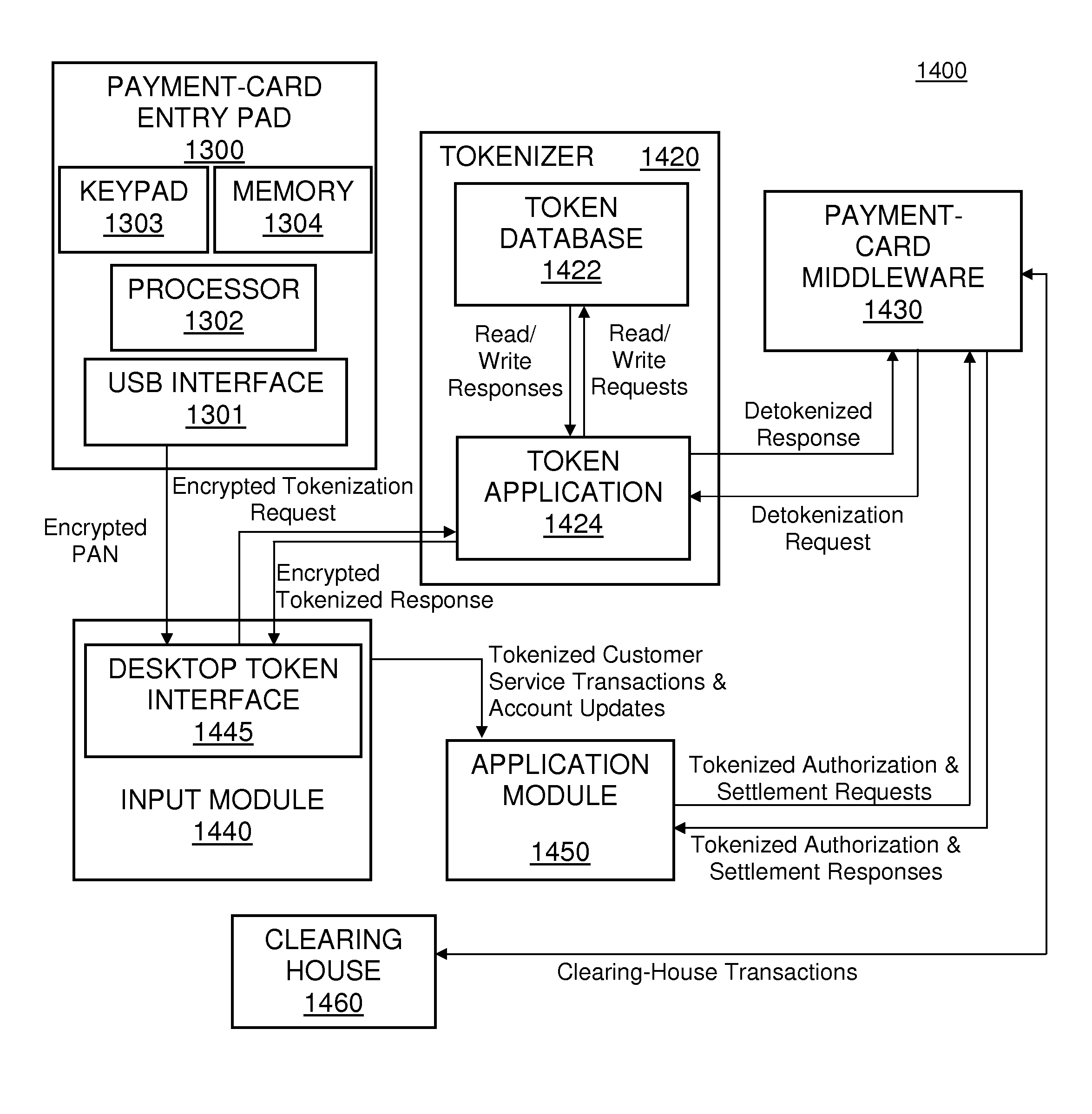

Tokenized payment processing schemes

InactiveUS8763142B2Preventing transmission of confidential informationDigital data processing detailsUnauthorized memory use protectionPayment card numberApplication module

A payment processing system for accepting manually-entered payment-card numbers. Rather than entering a payment-card account number into an application module, the card number is instead captured and stored within a tokenizer prior to being sent to the application module. The tokenizer then returns a random token to the calling application as a pointer to the original payment-card number. The token has no algorithmic relationship with the original payment-card number, so that the payment-card number cannot be derived based on the token itself. Since the token is not considered cardholder data, the token may be used in an application module without the module or its connected hardware from being subject to regulatory standards compliance. Some embodiments involve browser-based schemes, and some embodiments involve PIN-entry device-based schemes.

Owner:CARDCONNECT LLC

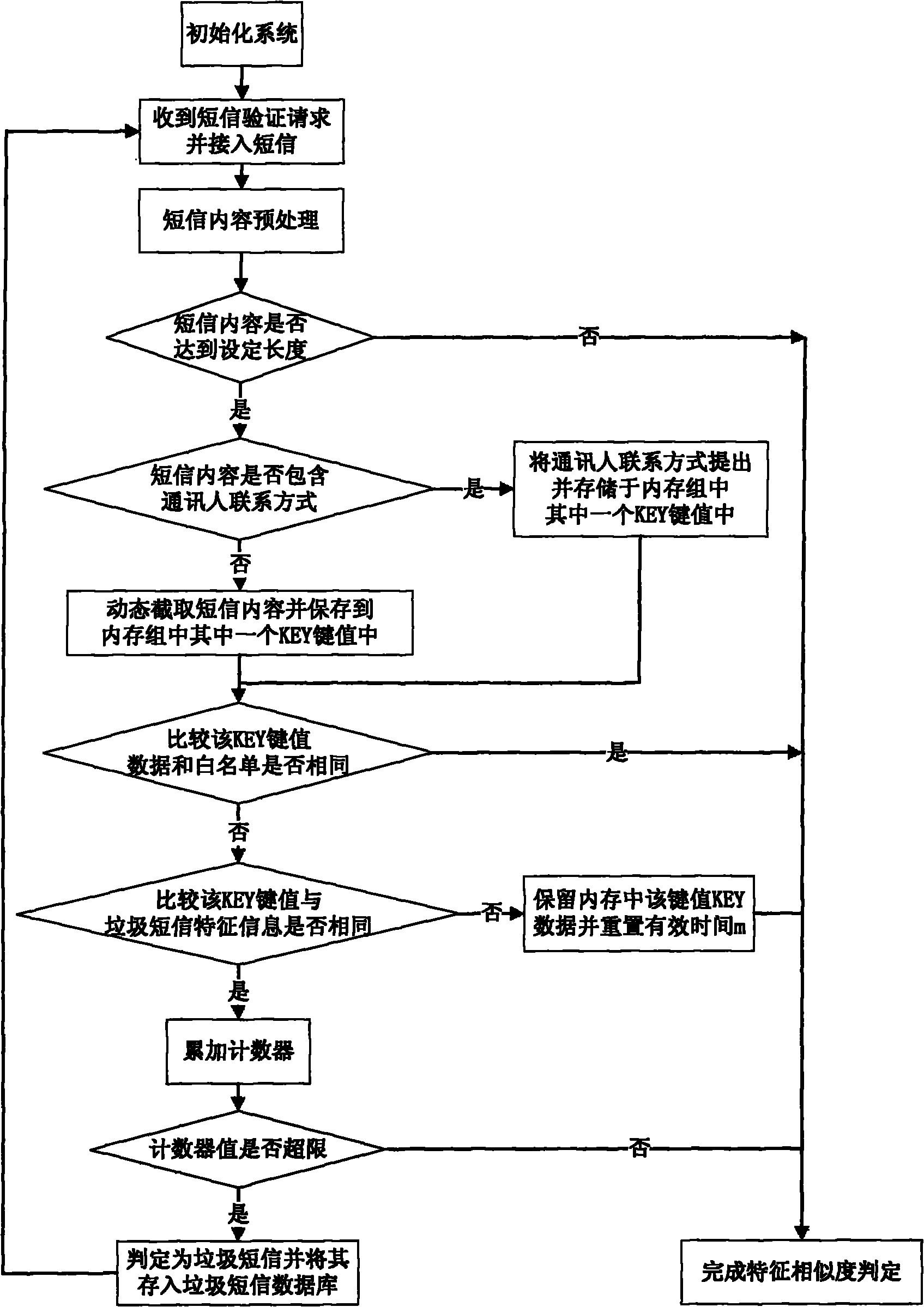

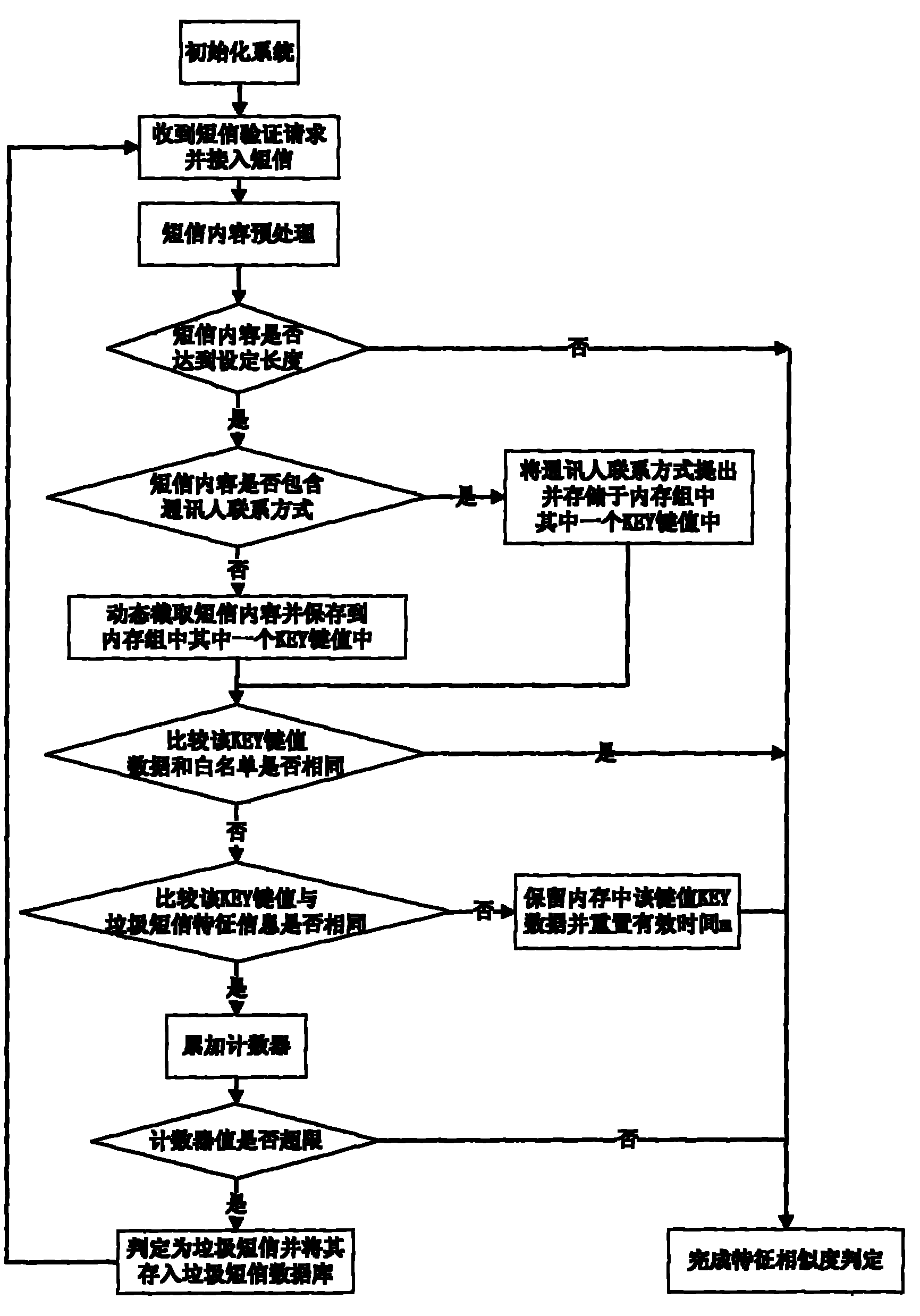

Garbage short message interception method based on characteristic similarity

ActiveCN102045652AImplement fuzzy matching text recognitionMessaging/mailboxes/announcementsComputer hardwareInformation function

The present invention provides a garbage short message interception method based on the characteristic similarity, which realizes a garbage short message interception method capable of only determining whether a short message is group sending garbage information by tracking the appearance probability of specific similar characteristic information in short message contents at a period of time, includes two filtering algorithms respectively for two modes of appearing contact information (like a telephone number, a web address and a bank card number) of a communication person in the short message content and not appearing a contact information, intercepts communication contact person content and dynamic random short message content after the pretreatment for converting special characters in short message text, then performs similarity comparison with the contents in database and counting, and regards the short message with an exceeding number of corresponding content as garbage short message, and adds the short message content into garbage short message characteristic information content data, so that the method not only realizes the fuzzy matching text identification, but also possesses the intelligent learning identification garbage information function.

Owner:广州彩讯数字技术有限公司

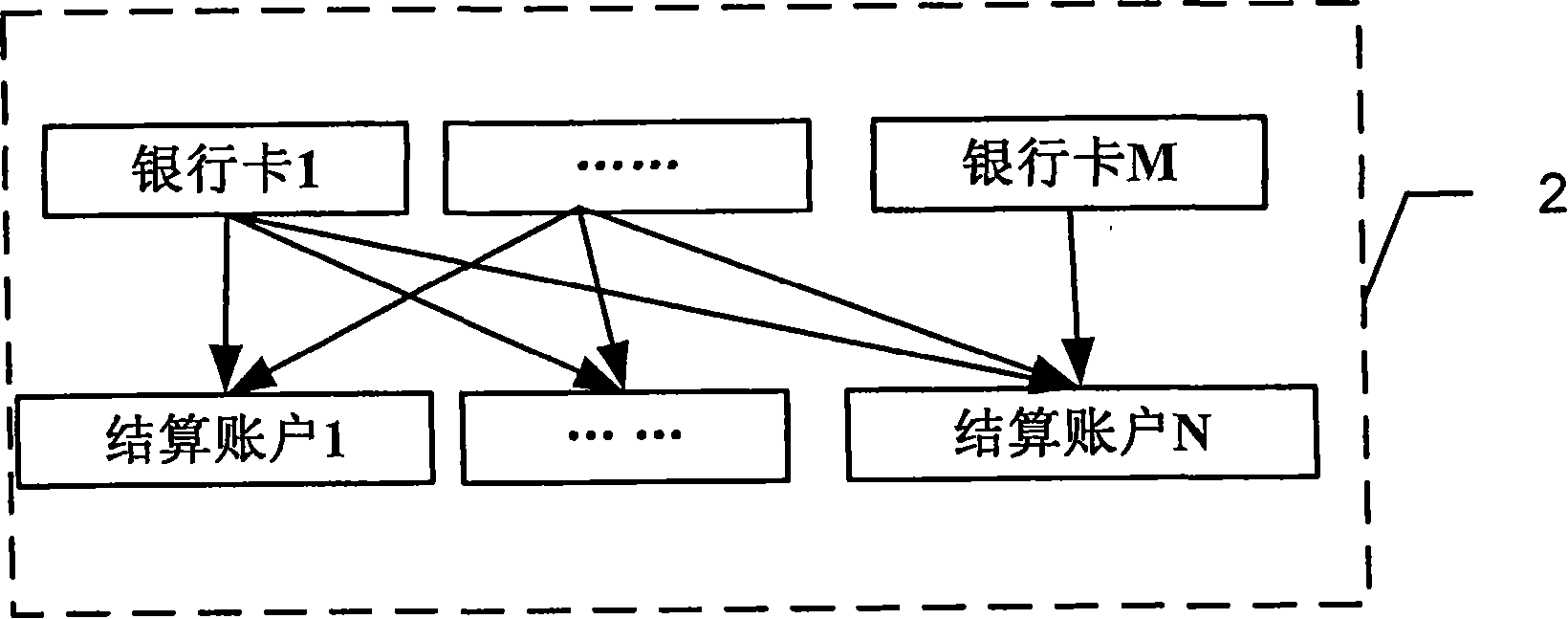

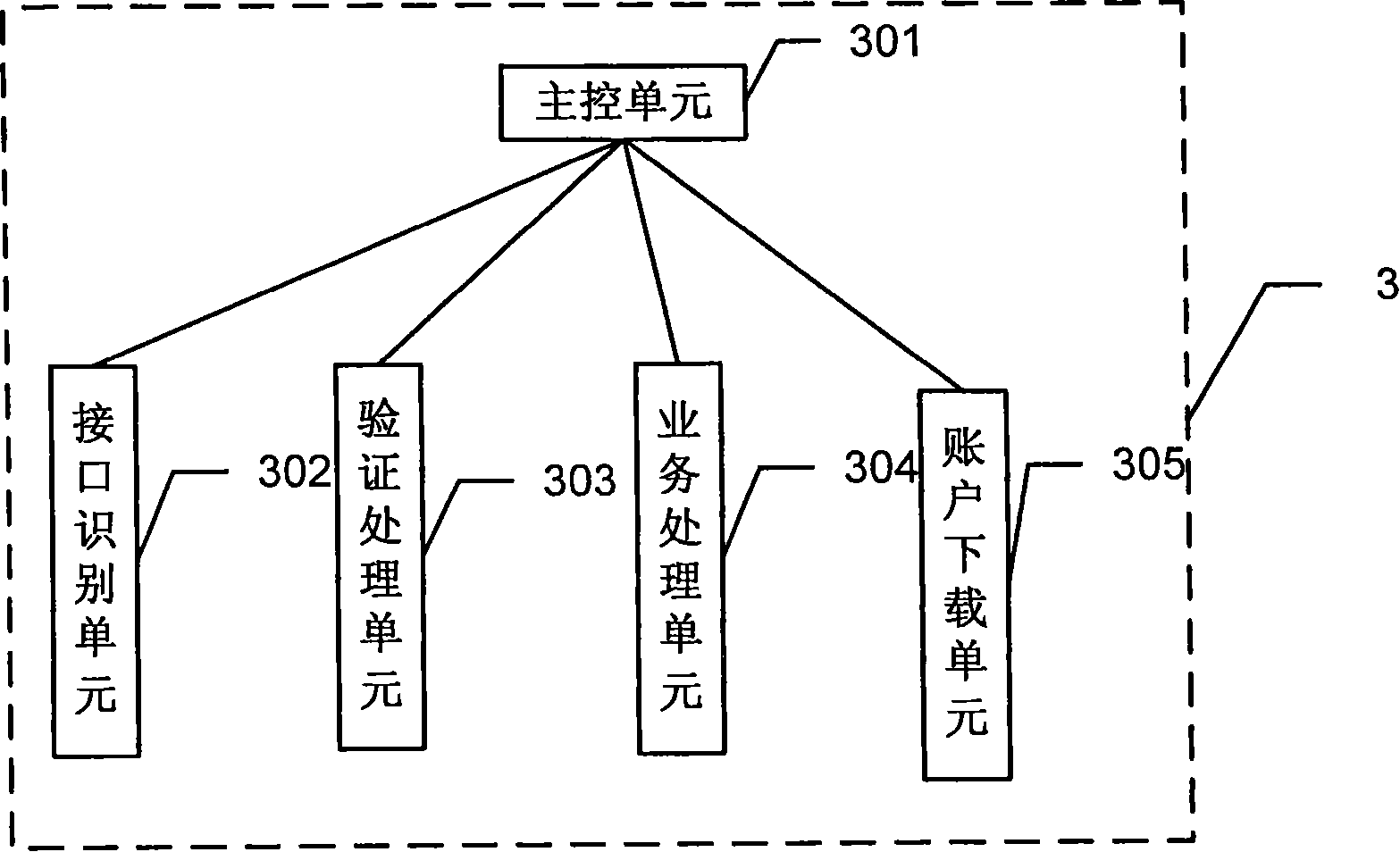

Method and system for enterprise customer to perform financing settlement and management

InactiveCN101251916AImprove handling efficiencyImprove satisfactionFinancePayment architectureFinancial transactionPayment card number

The invention discloses a system and a method for enterprise customers to make fund settlement and management. To solve the problem that in the prior art, a plurality of bank cards are mutually matched to make finance operation aiming at the multi-settlement account of the enterprise, a method for enterprise customers to make fund balance and management is provided. The invention is characterized in that: a multi-to-multi corresponding relation is established between a bank card number and a settlement account number of the enterprise, a file of the corresponding relation between the bank card number and the settlement account number is established; when the customer initiates a transaction request through the bank card, the information of at least one settlement account which has a corresponding relation with the bank card is returned to the customer for the customer to select a settlement account to be operated. The system and the method have the advantages that: the efficiency of financial work of the enterprise can be improved through the multi-to-multi matching mode between the bank card and the settlement account of the enterprise; the setting of the authority specifies the function range of financial personnel, which assures the safety of the account of the enterprise.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

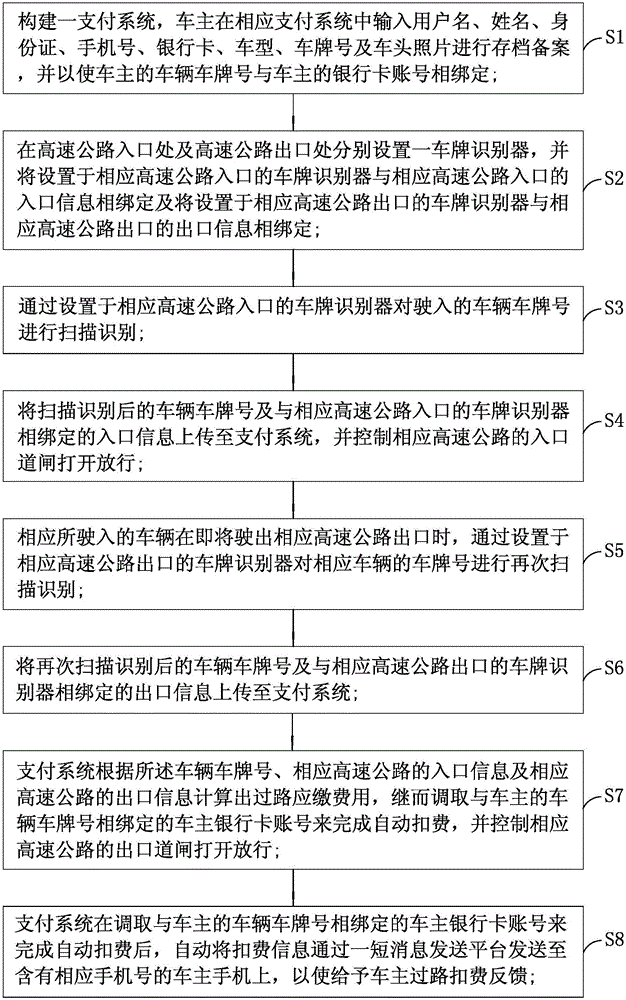

Highway toll collection method based on vehicle license plate recognition

InactiveCN107180455ALower service costsSave time and costTicket-issuing apparatusRoad vehicles traffic controlPayment card numberCollection methods

The invention discloses a highway tolling method based on license plate recognition; comprising the steps of: constructing a payment system, and the owner of the vehicle enters the user name, name, ID card, mobile phone number, bank card, vehicle type, license plate number and front photo of the vehicle in the payment system for archiving, And make the owner's vehicle license plate number bound with the owner's bank card account; bind the license plate recognizer at the entrance of the expressway with the entrance information and bind the license plate recognizer at the exit of the expressway with the exit information; through the license plate recognizer at the entrance of the expressway Scan the license plate number of the entering vehicle; transmit the scanned vehicle license plate number and entrance information to the payment system; scan the vehicle license plate number again through the license plate recognizer installed at the exit of the expressway; send the scanned vehicle license plate number and exit The information is transmitted to the payment system; the payment system calculates tolls based on the vehicle license plate number, entrance information and exit information, and automatically deducts the toll from the bank card account of the owner. Effect: the invention greatly reduces the cost and makes the use effect good.

Owner:刘洪文

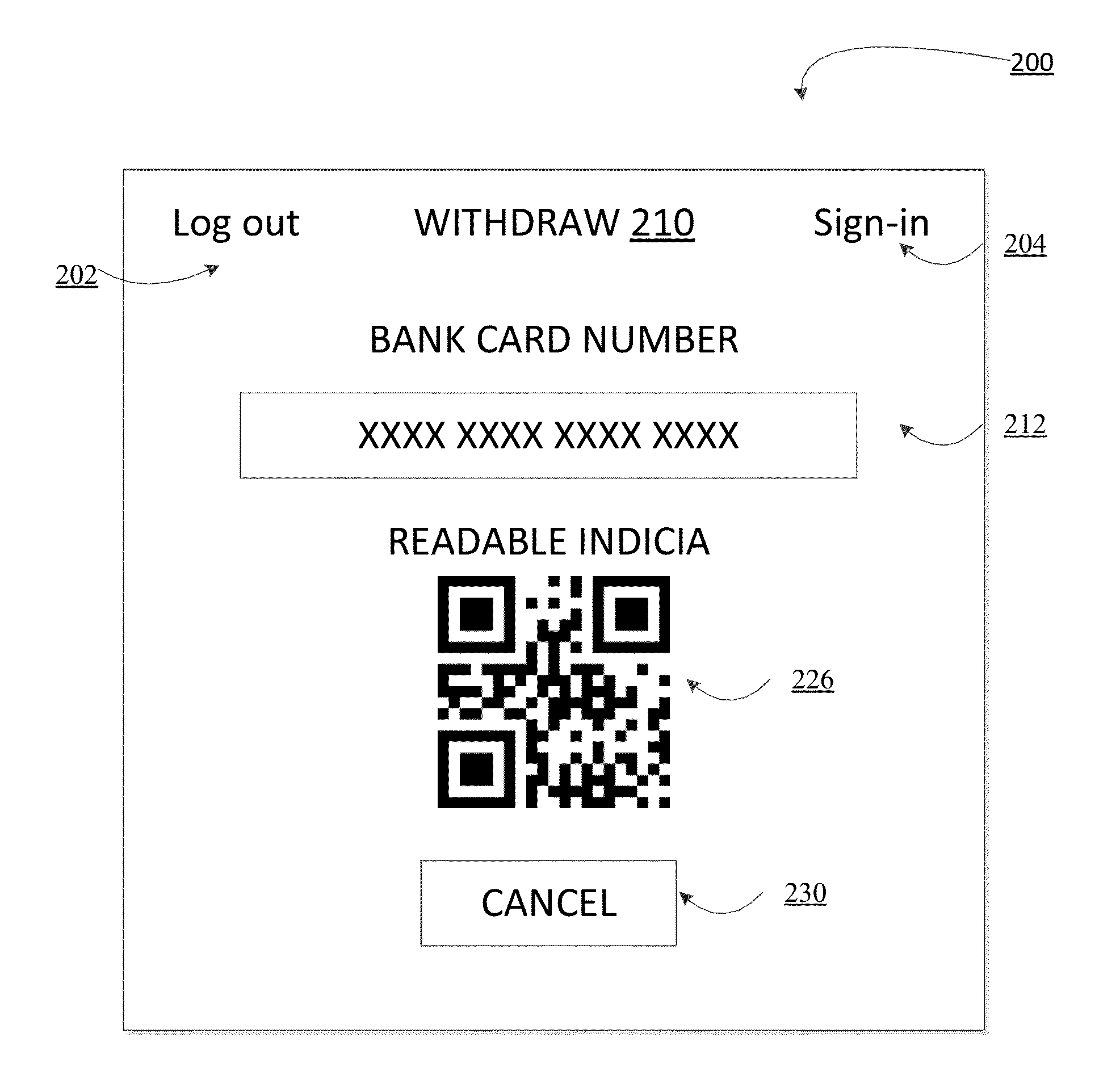

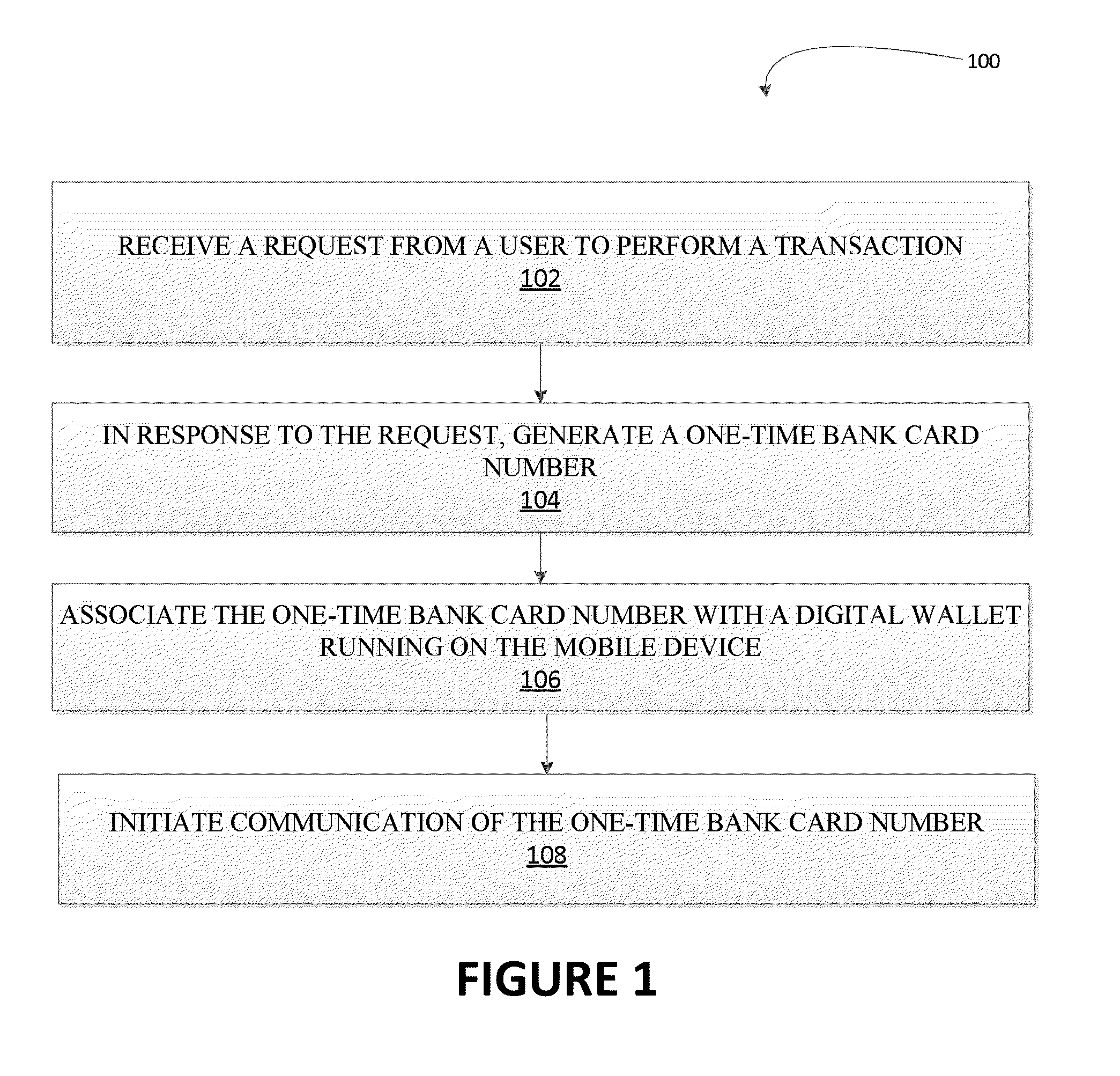

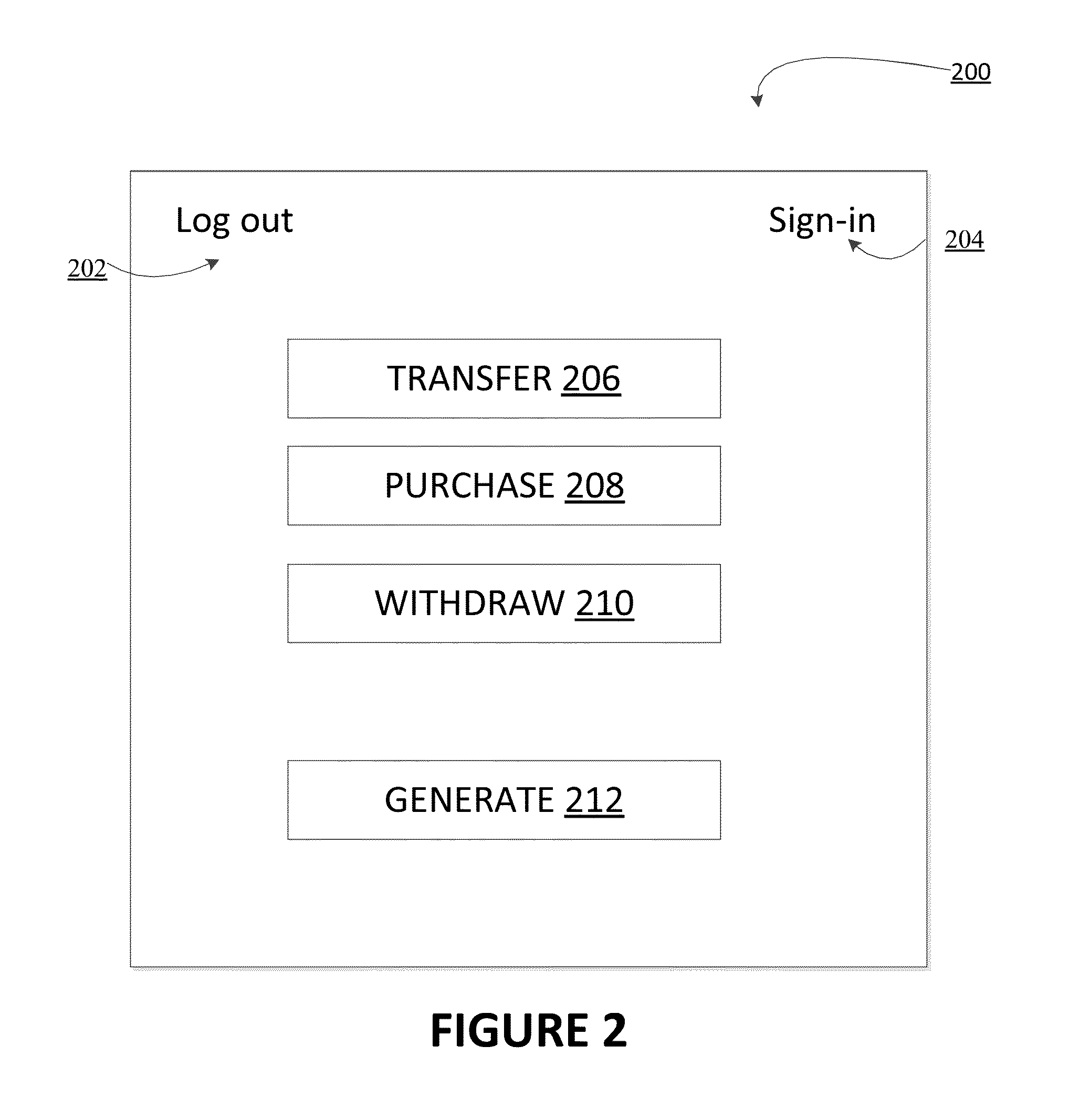

Mobile one-time card number generator for ATM usage

Embodiments are directed to a mobile bank card number generator for digital wallet. Embodiments receive a request from a user to perform an ATM transaction on an account owned by the user; in response to the request to perform an ATM transaction, generate a one-time bank card number associated with the account owned by the user; generate a readable indicia based at least in part on the one-time bank card number; and initiate communication of the readable indicia to an ATM, wherein the ATM receives a user authentication credential from the user, a bank system validates the user authentication credential and in response to validating the user authentication credential, approves the ATM transaction for the user's account.

Owner:BANK OF AMERICA CORP

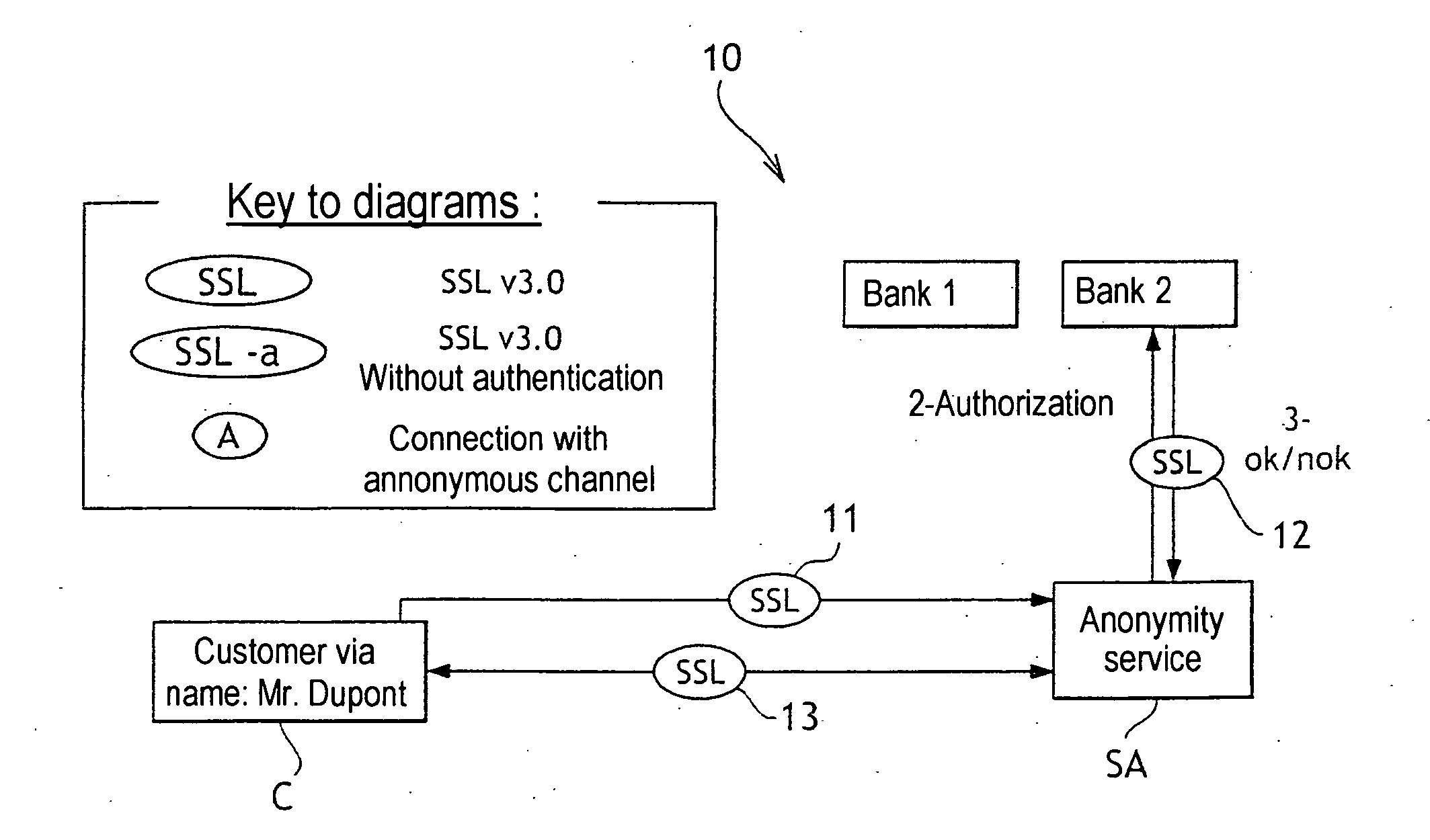

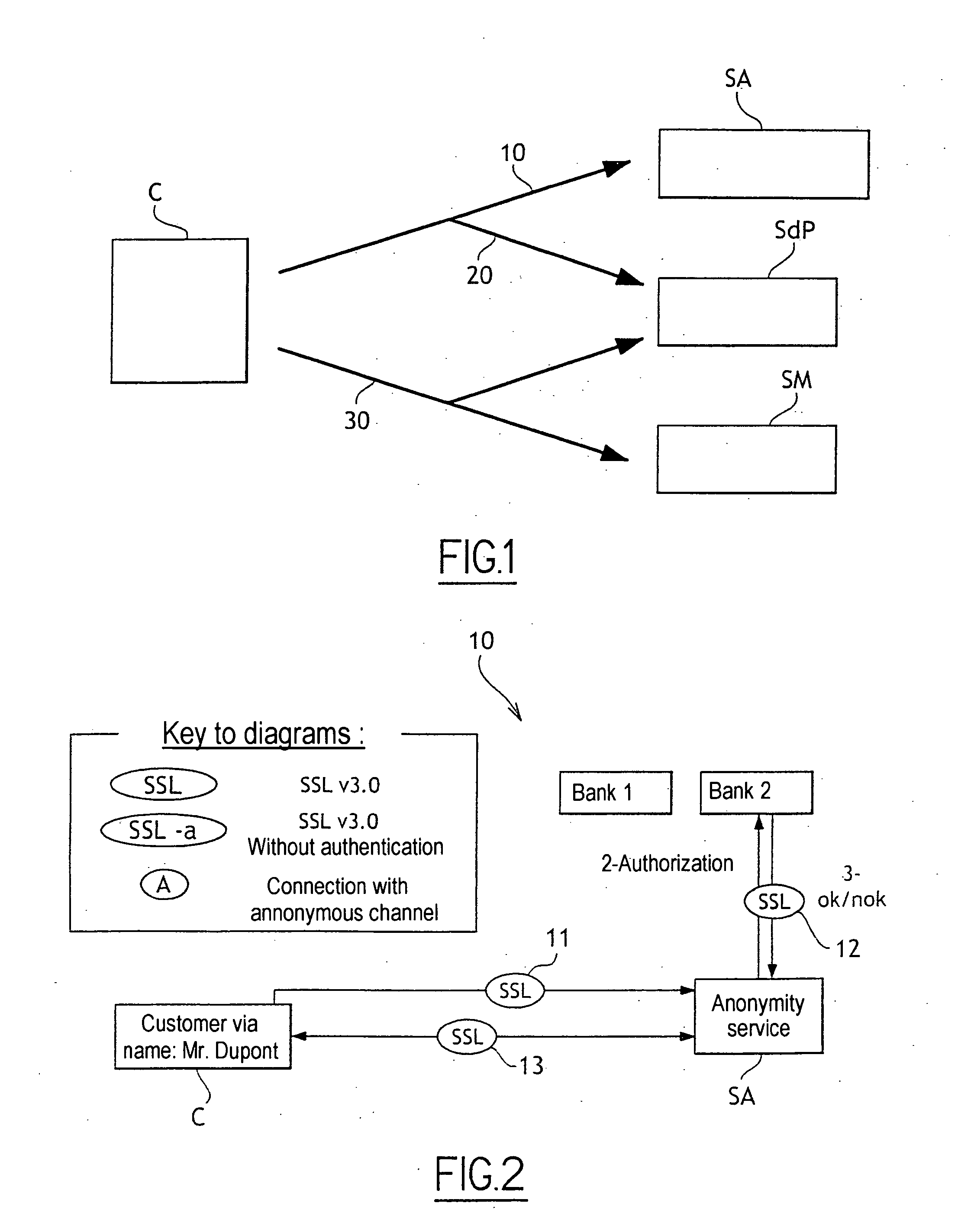

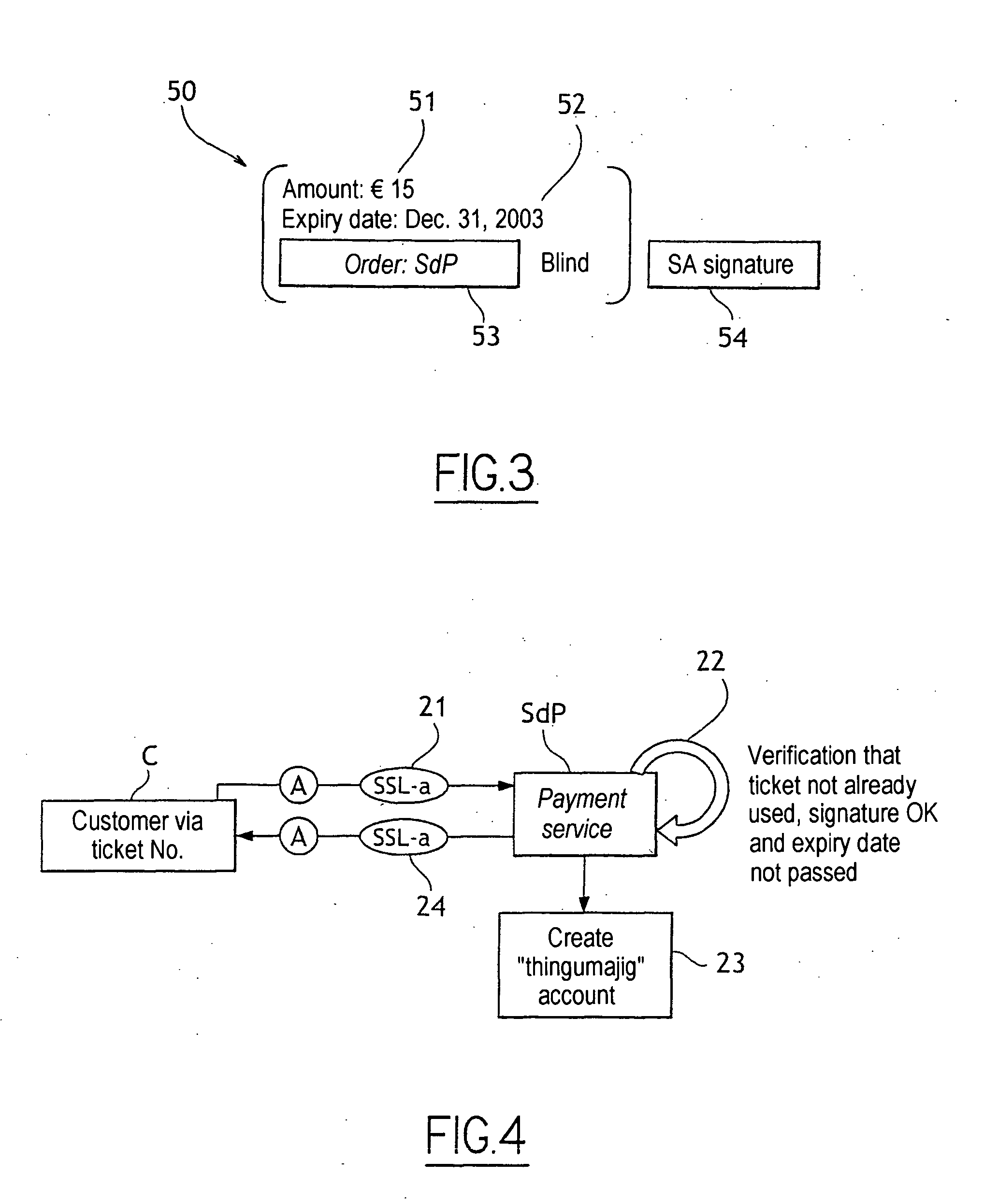

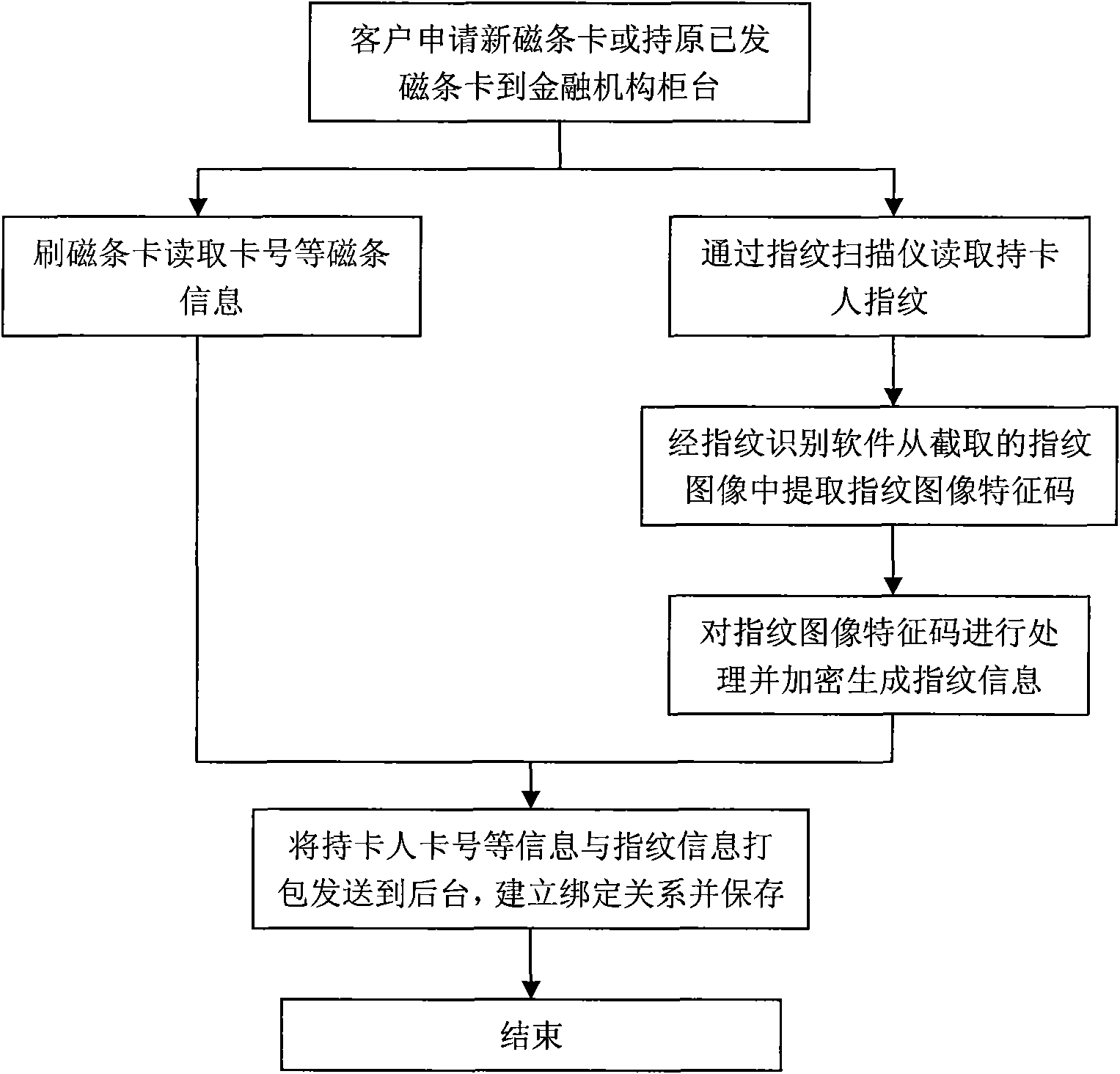

Anonymous and Secure Internet Payment Method and Mobile Devices

An anonymous and secure on-line payment system and method based on the partially blind signature cryptographic method with revocable anonymity. To this end, an Anonymity Server (SA) enables the Customer (C) to acquire on-line anonymous payment means on the basis of a protocol that does not enable the Anonymity Server to link the payment means to the Customer (C). The Payment Server (SdP) comprises means for opening an anonymous account using the anonymous payment means (50). A Customer (C) can make an on-line purchase from a Merchant Site (SM) without having to give a bank card number and remaining anonymous to the merchant and more generally to any entity present in the transaction or absent therefrom. However, this anonymity may be revoked by a trusted entity in the event of fraud on the Customer. Finally, a Customer can make payments when on the move.

Owner:FRANCE TELECOM SA

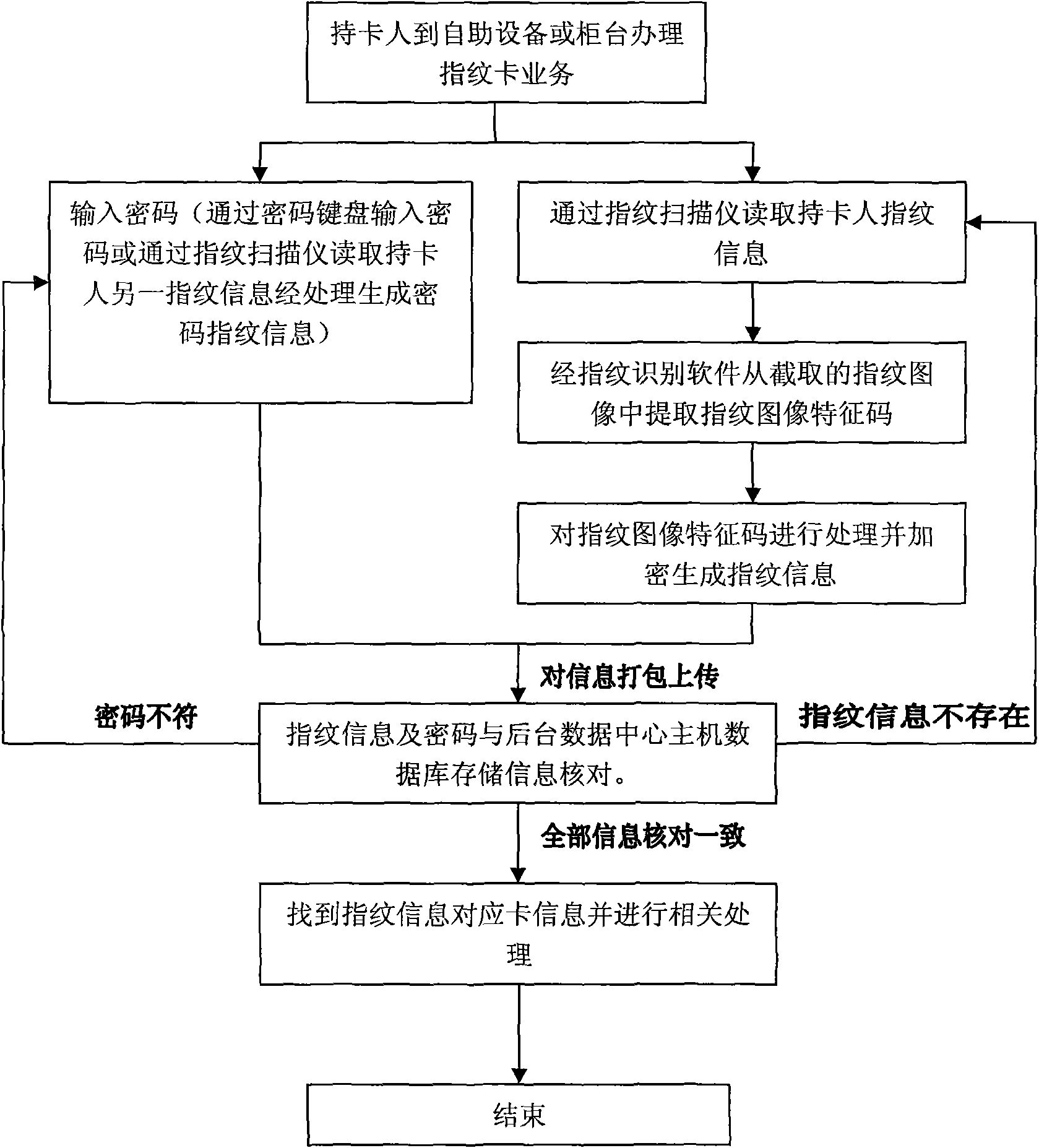

Bank client transaction system

InactiveCN101894423AImprove securityEasy transactionComplete banking machinesAcutation objectsPasswordNetworked system

The invention relates to a bank client transaction system and a method for making a transaction by using the client transaction system. The bank client transaction system comprises counter equipment or a self-service bank machine client program, a network system, a background processing system and a database, wherein a bank background database stores client fingerprint information, and the fingerprint information of each client uniquely corresponds to a back card number; the bank counter equipment or a self-service bank machine fingerprint recognizer reads the client fingerprint information; the client fingerprint information is processed by the client program and transmitted to a background through a network system; and the background processing system compares the fingerprint information with the client fingerprint information stored in the database by unpacking and deciphering, searches for a corresponding bank card number and relevant card information if the fingerprint information is accordant with the client fingerprint information and further verifies a password to finish a relevant transaction. The thought of the conventional card transaction safety is changed skillfully, and the fingerprint information is related to the card number, so that the conventional physical card is eliminated, and the bank card use safety of a client is greatly enhanced without making any change on the conventional client card.

Owner:张剑

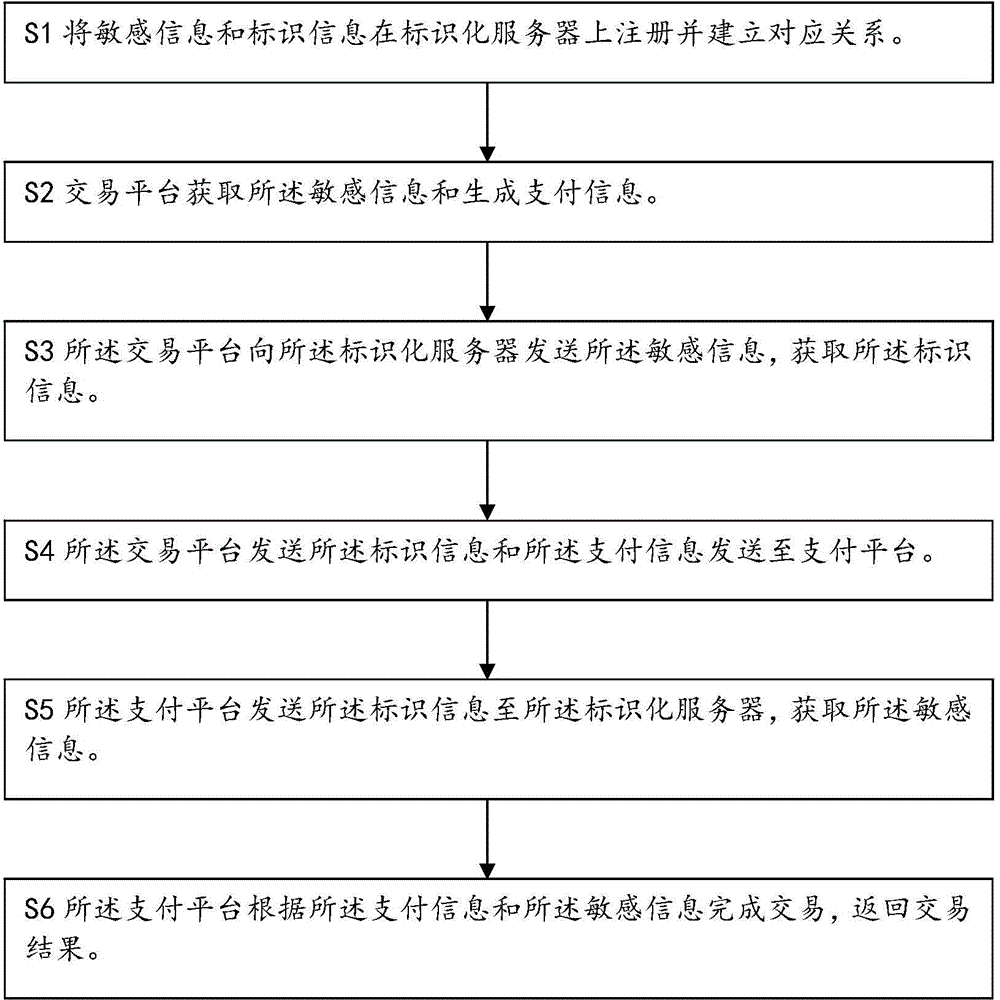

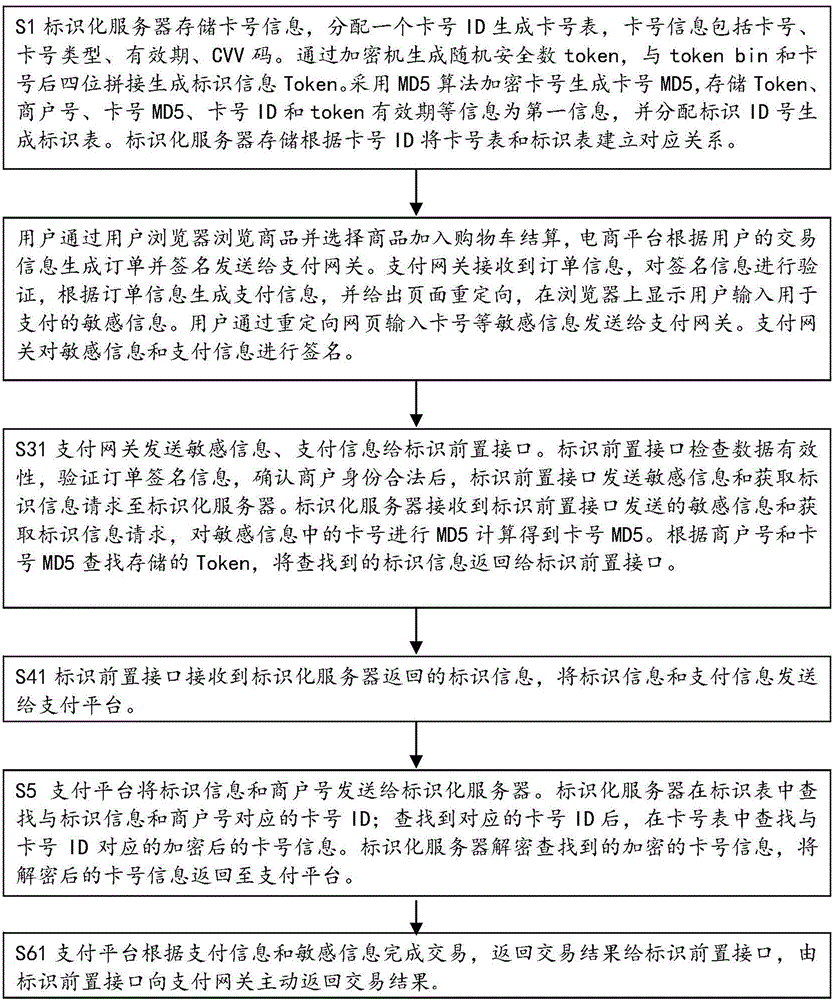

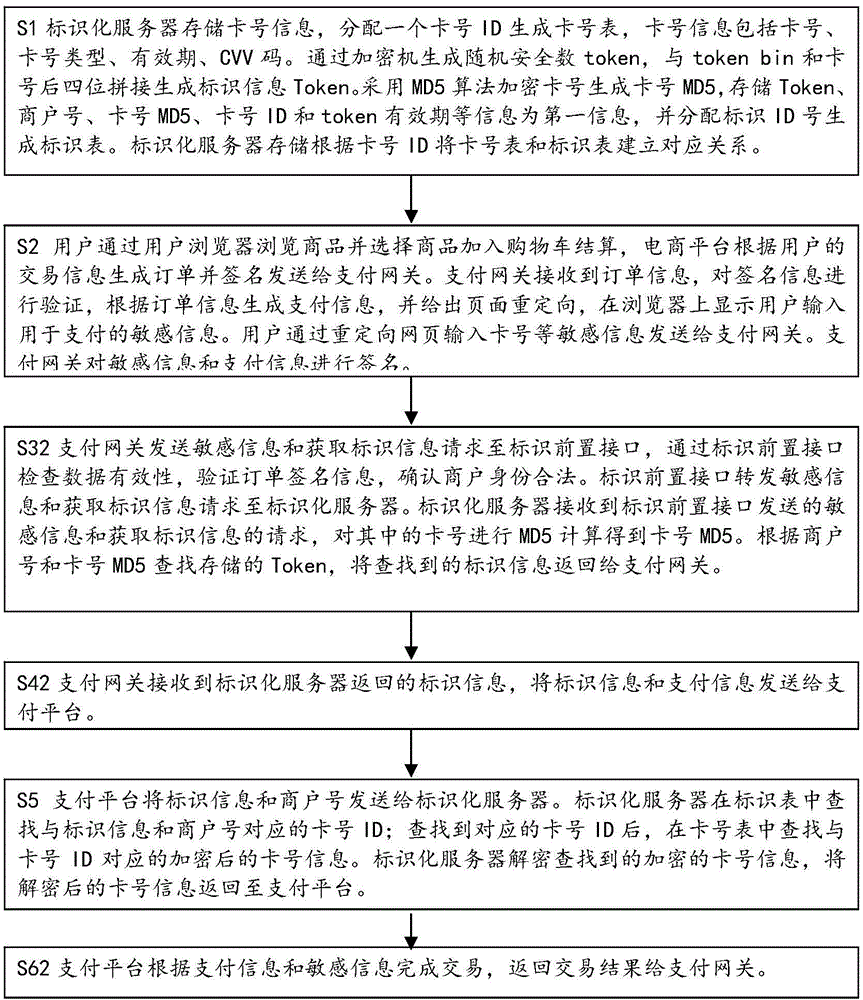

Payment method and payment system by sensitive information identification

ActiveCN104361490ATo achieve identificationEliminate key custodyProtocol authorisationProcess identificationPayment card number

The invention provides a payment method by sensitive information identification. The payment method includes: S1, registering sensitive information and identification information on an identification server and establishing a corresponding relation between the sensitive information and identification information; S2, enabling a transaction platform to acquire the sensitive information and generate payment information; S3, enabling the transaction platform to send the sensitive information to the identification server so as to acquire the identification information; S4, enabling the transaction platform to send the identification information and the payment information to a payment platform; S5, enabling the payment platform to send the identification information to the identification server so as to acquire card number information; S6, enabling the payment platform to complete transaction according to the payment information and the card number information and return a transaction result. The payment method has better technical advantages that network security payment is performed by sensitive information identification, an adopted identification is compatible with a data structure of an existing bank card number, and band card payment process identification can be achieved by existing merchant systems and payment systems only by changing a few ports.

Owner:SHANGHAI PEOPLENET SECURITY TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com