Method and system for analyzing the use of profitability of an organization

a technology of profitability and analysis method, applied in the field of methods and systems for analyzing the use of profitability of an organization, can solve the problems of unrevealing, cumbersome, tedious, etc., and achieve the effect of quick and clear analysis of the financial condition of an organization

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

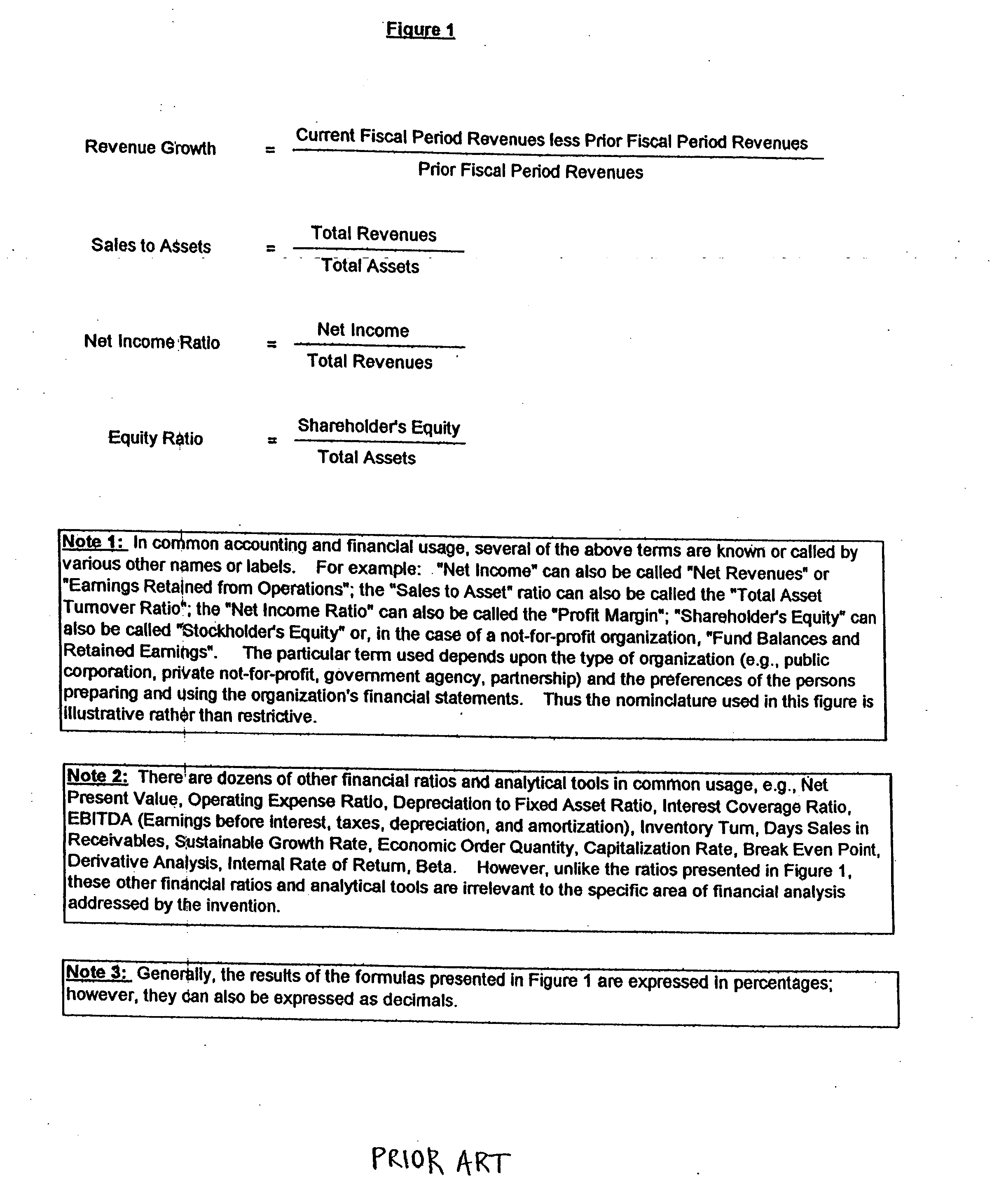

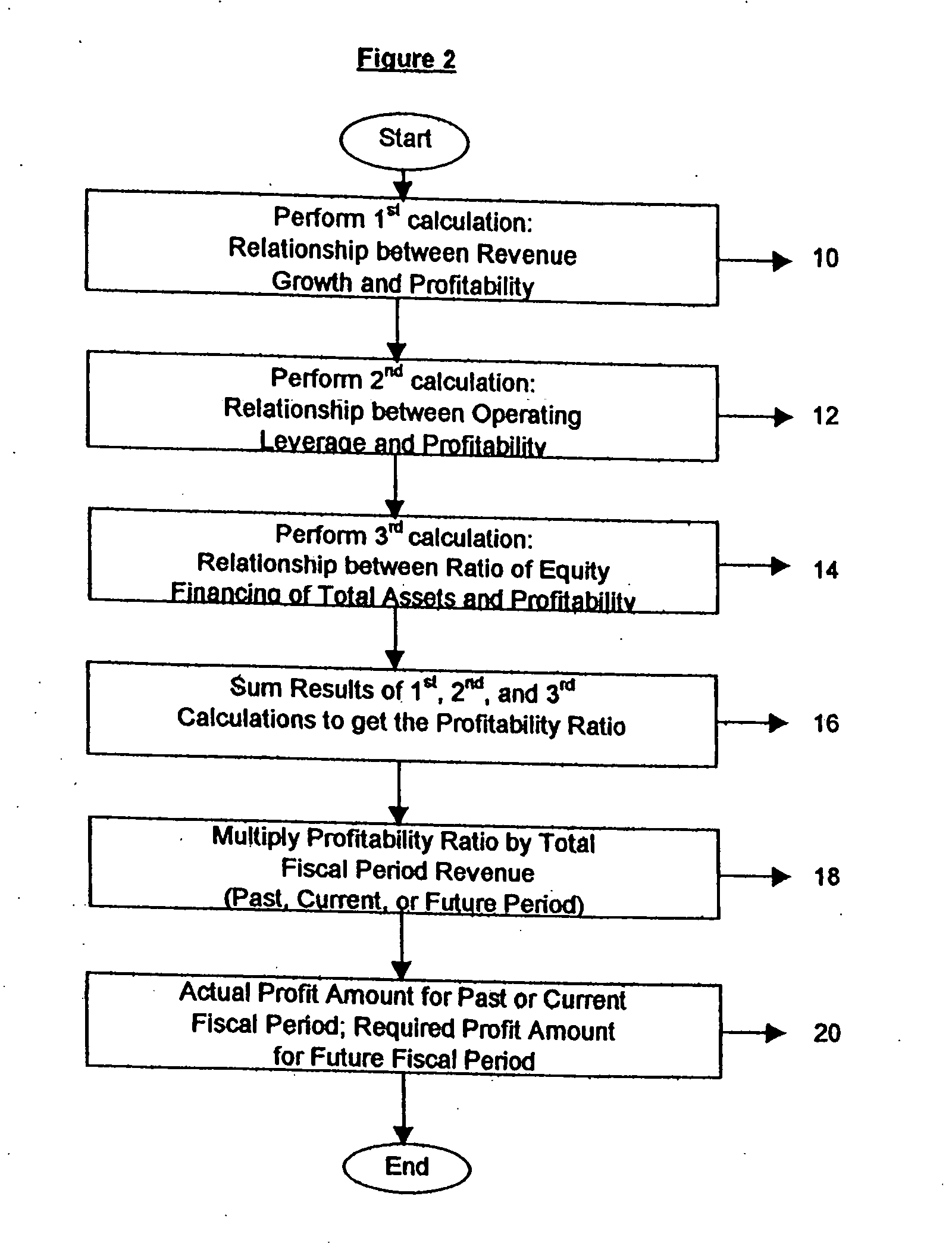

[0027] In a most basic embodiment, the method describes and analyzes the mathematical relationship of four financial concepts: revenue growth, asset support of revenue, equity financing of assets, and profitability. With reference now to the drawing figures in which like reference numerals refer to like elements throughout, a most basic embodiment of the invention is a method for analyzing the use of profitability for a past or the current fiscal period, and for calculating the level of profitability required to be achieved or maintained by an organization under a specified set of circumstances, which may vary for analysis purposes.

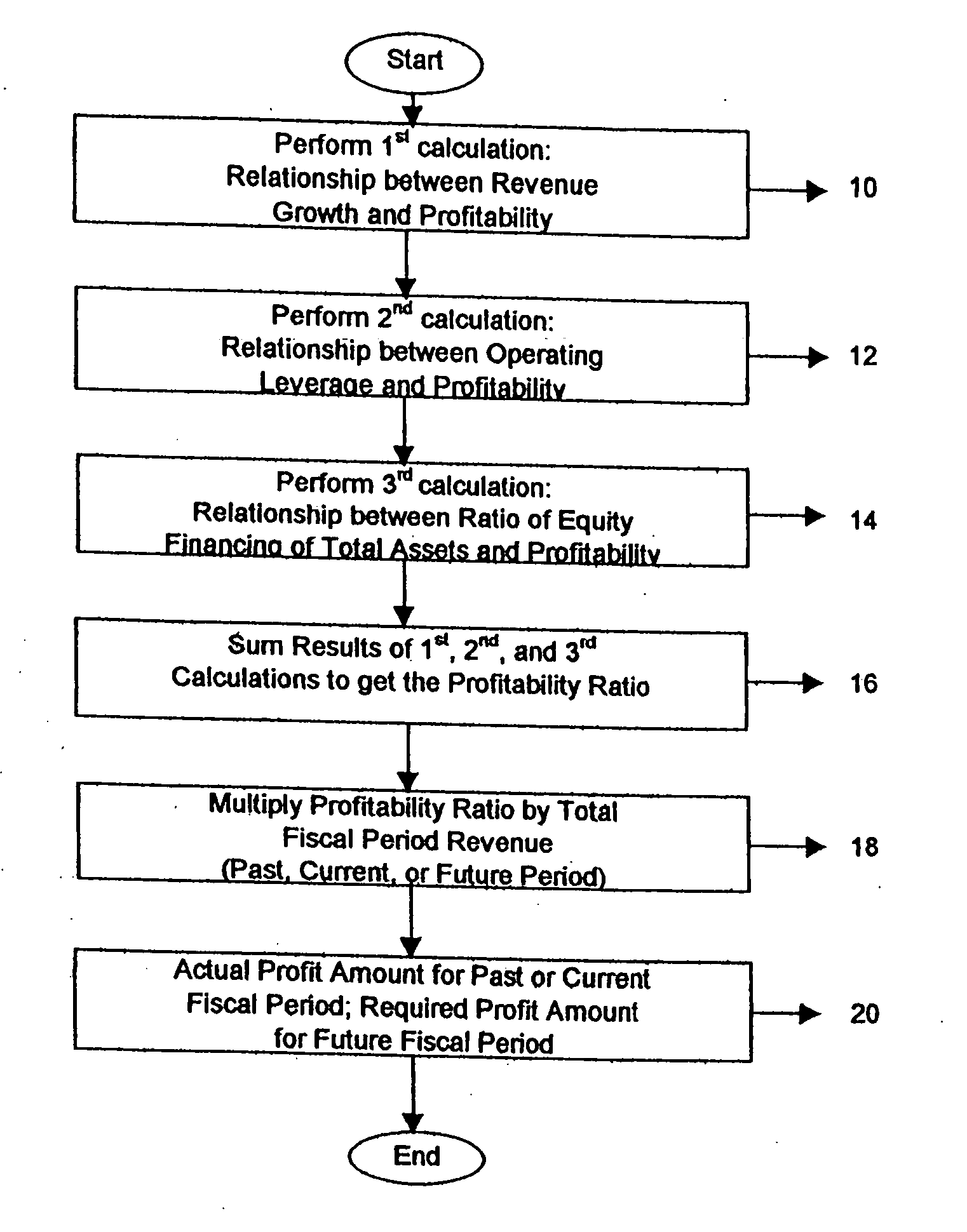

[0028] As shown in FIG. 2, the invention comprises the steps of performing a first calculation 10 to determine the impact of revenue growth, or a change in revenue growth, on profitability of the subject organization; performing a second calculation 12 to determine the impact of a change in operating leverage on profitability of the subject organization;...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com