System and method for improved electronic trading

a technology of electronic trading and system, applied in the field of system and method for improving electronic trading, can solve the problems of trader losing a significant amount of money, best software tools at their trading terminals are limited in performance, and cannot be matched,

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

I. Overview

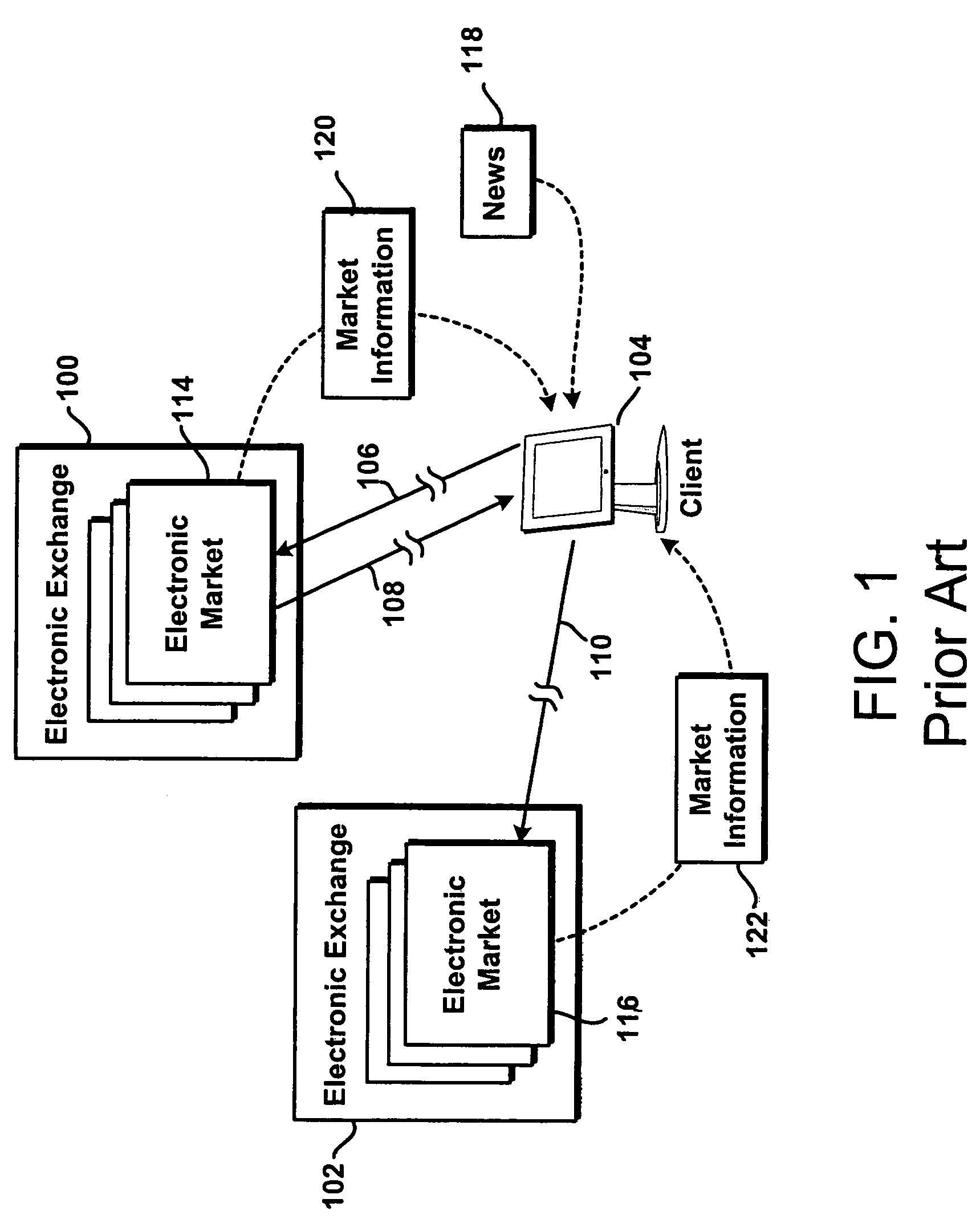

[0018] Like an open outcry exchange, a conventional electronic exchange has continued to place the burden on the traders to analyze market information in real-time and react accordingly to capitalize on an opportunity. While there is an enormous amount of information available to the trader, it is generally left up to the trader (or software at the client device) to sort through all of this information and quickly act when using a conventional electronic exchange.

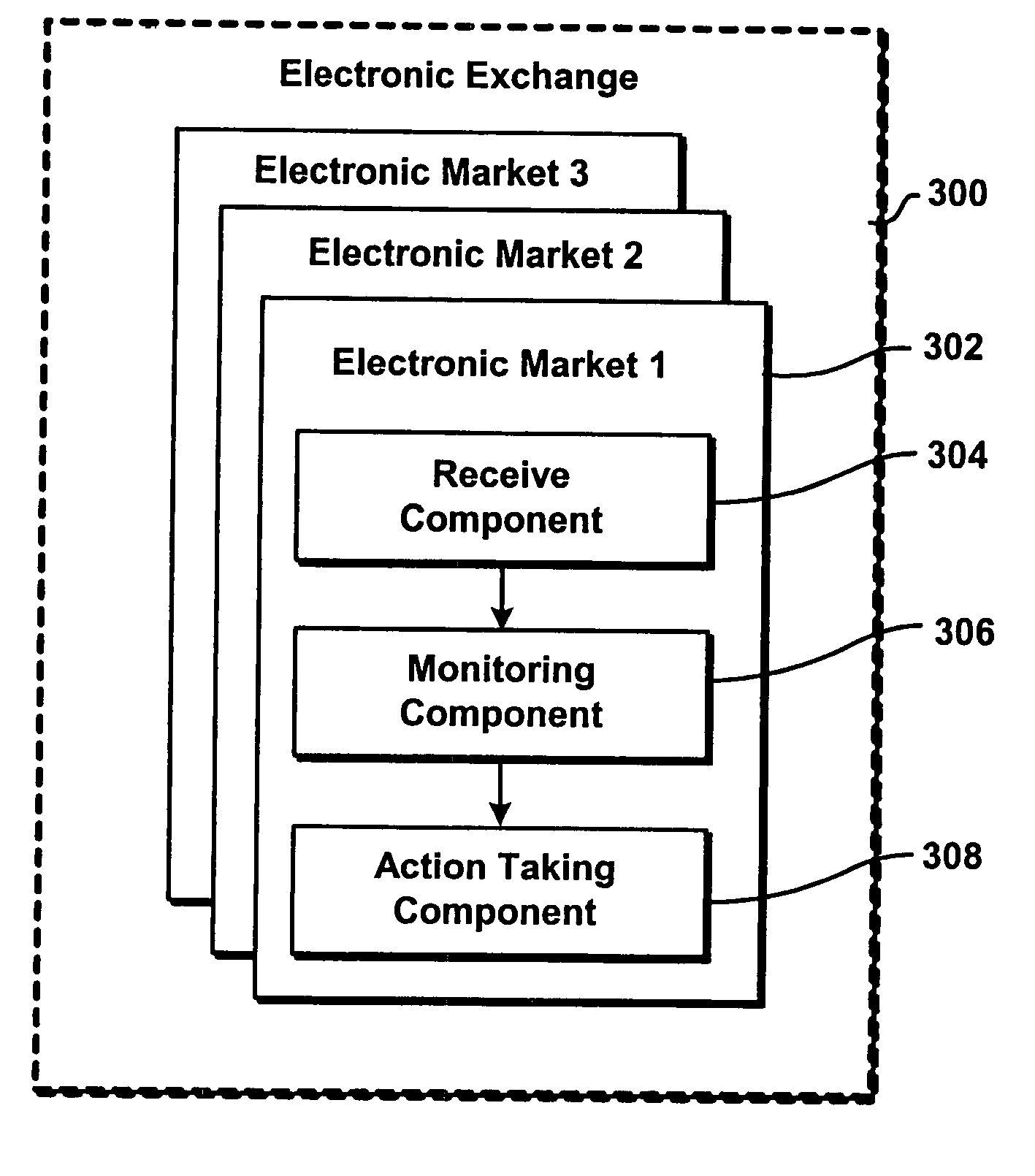

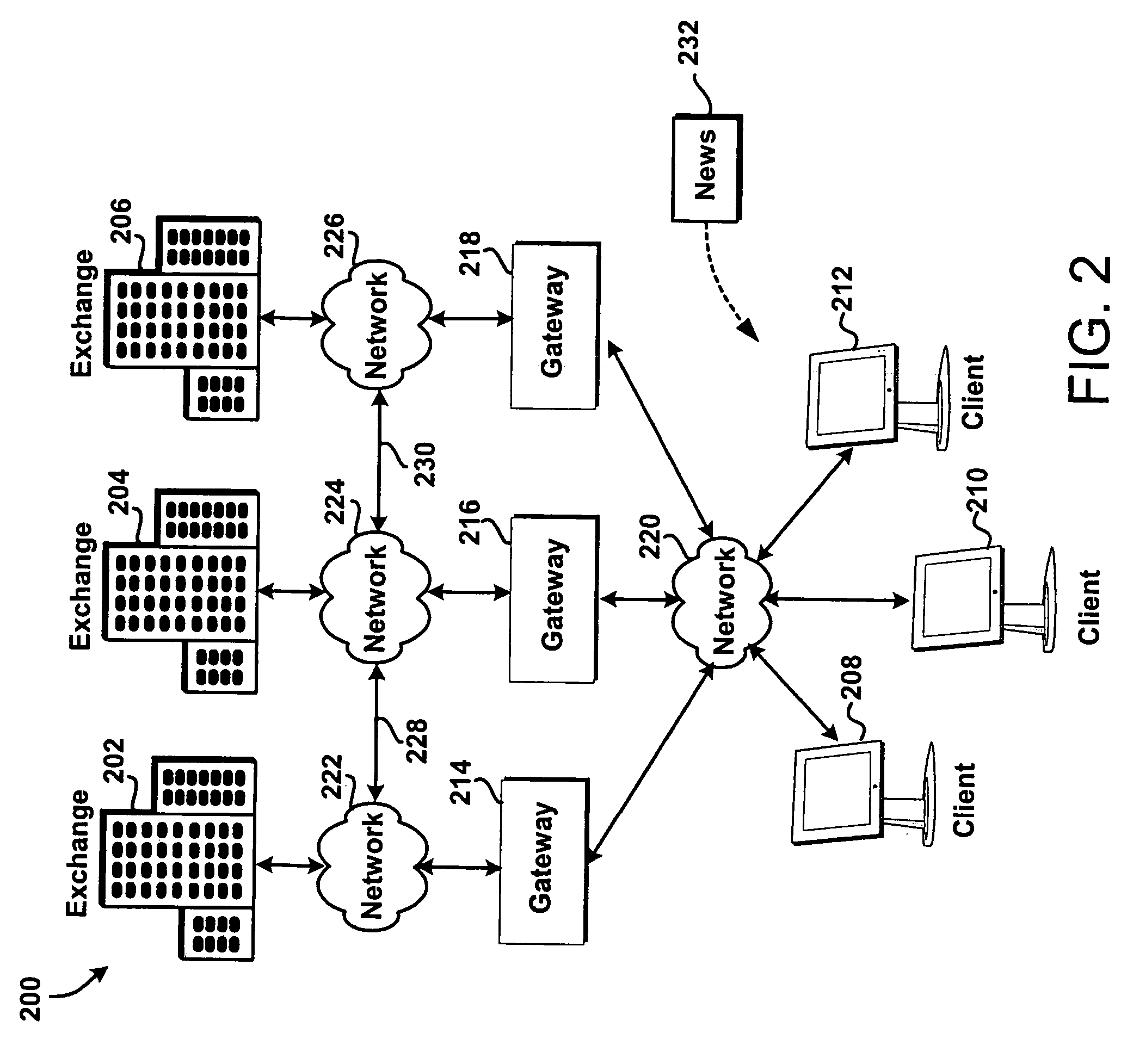

[0019] The present embodiments have transitioned some of this burden to the exchange by opening communication between the electronic markets so that the electronic market on behalf of the trader can automatically take actions. In other words, the present embodiments preferably link the electronic markets so that market information may be shared to create a more unified trading environment amongst markets and market participants. Moreover, an electronic market preferably has access to news. Using some or all of t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com