System for managing a stable value protected investment plan

a value protection investment and investment plan technology, applied in the field of stable value protection investment plan management system, can solve the problems of reducing the benefits of highly compensated employees (hce), restricting the manner in which these plans can be funded, and traditional methods of providing information quarterly or annually have proved to be unacceptabl

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

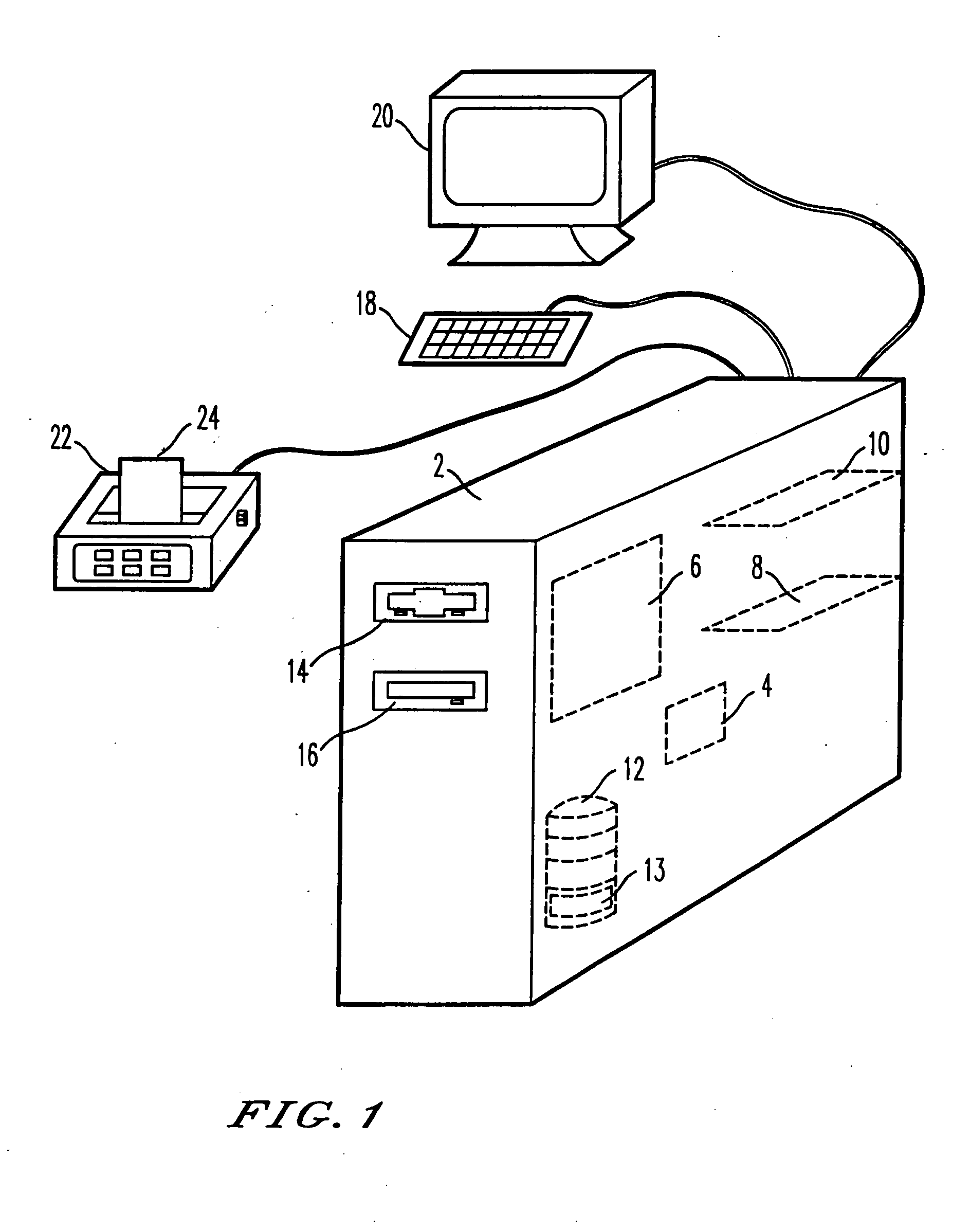

[0049] Referring now to the drawings, wherein like reference numerals designate identical or corresponding parts throughout the several views, FIG. 1 is a view showing an embodiment of the system of the present invention. Within a computer 2, there are provided: a central processing unit for a memory subsystem 6, a fax / modem card 8, an automated voice response unit 10, a digital storage means 12, a low density removable medium storage means (e.g., a floppy disk drive) 14 and a high density removable medium storage means (e.g., compact disc drive or tape drive) 16. Furthermore, keyboard 18 and monitor 20 are connected to the computer system 2 for inputting and outputting data, respectively. An additional printer 22 for printing reports 24 is also provided.

[0050] The heart of the computer system 2 is the central processing unit 4 which can comprise any one of the commercially available central processing units (e.g., Intel 80x86, Motorola 680x0, Power PC, etc.) to direct and coordina...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com