Multi-level leverage account structure

a leverage account and multi-level technology, applied in the field of multi-level leverage account structure, can solve the problems of significant legal expenses that must be incurred, the loss of leveraged funds is greater than that of unleveraged funds, and the cost of funds is further increased, so as to achieve the effect of reducing the amount of leveraged funds and reducing the cost of funds

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

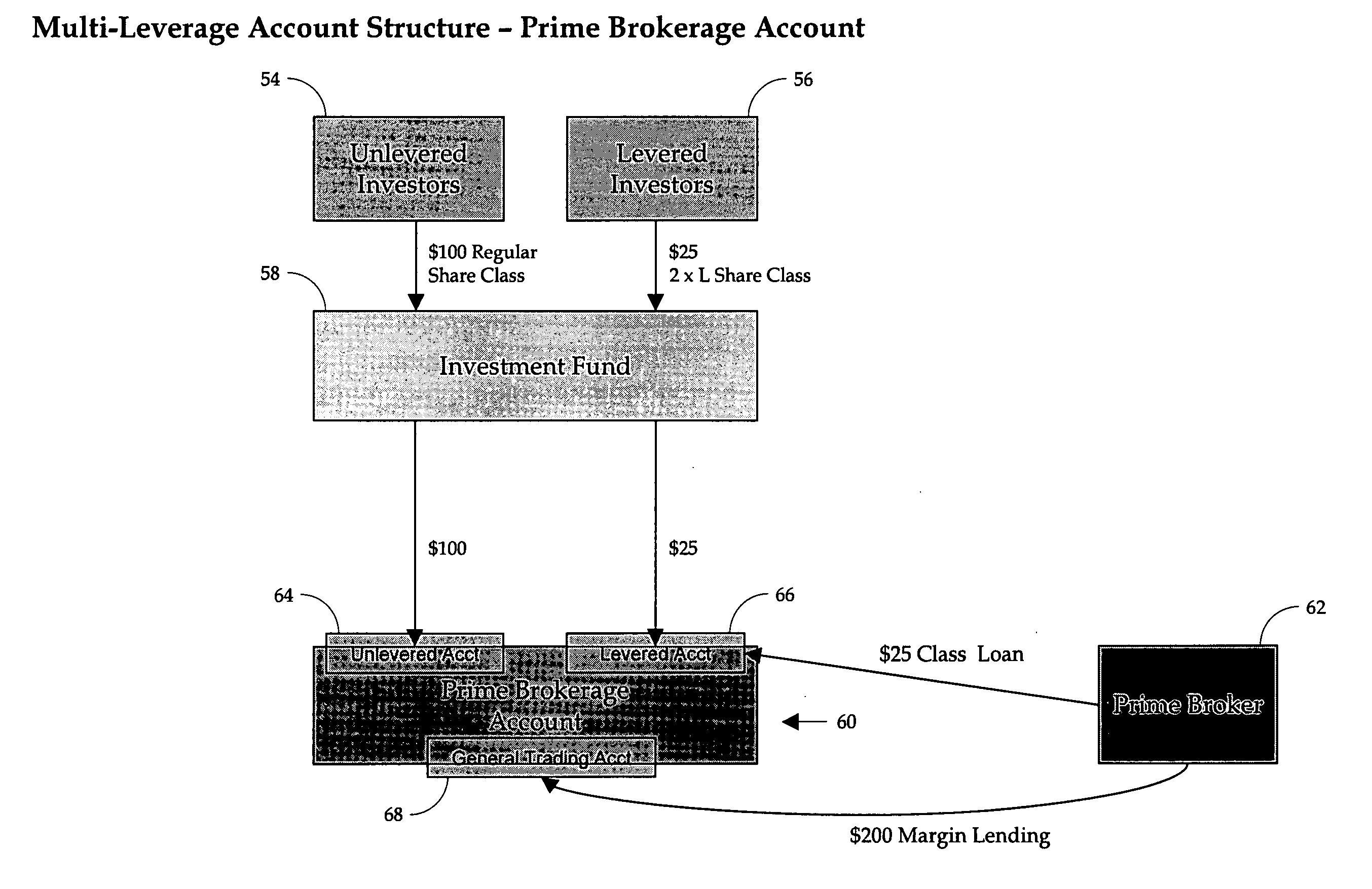

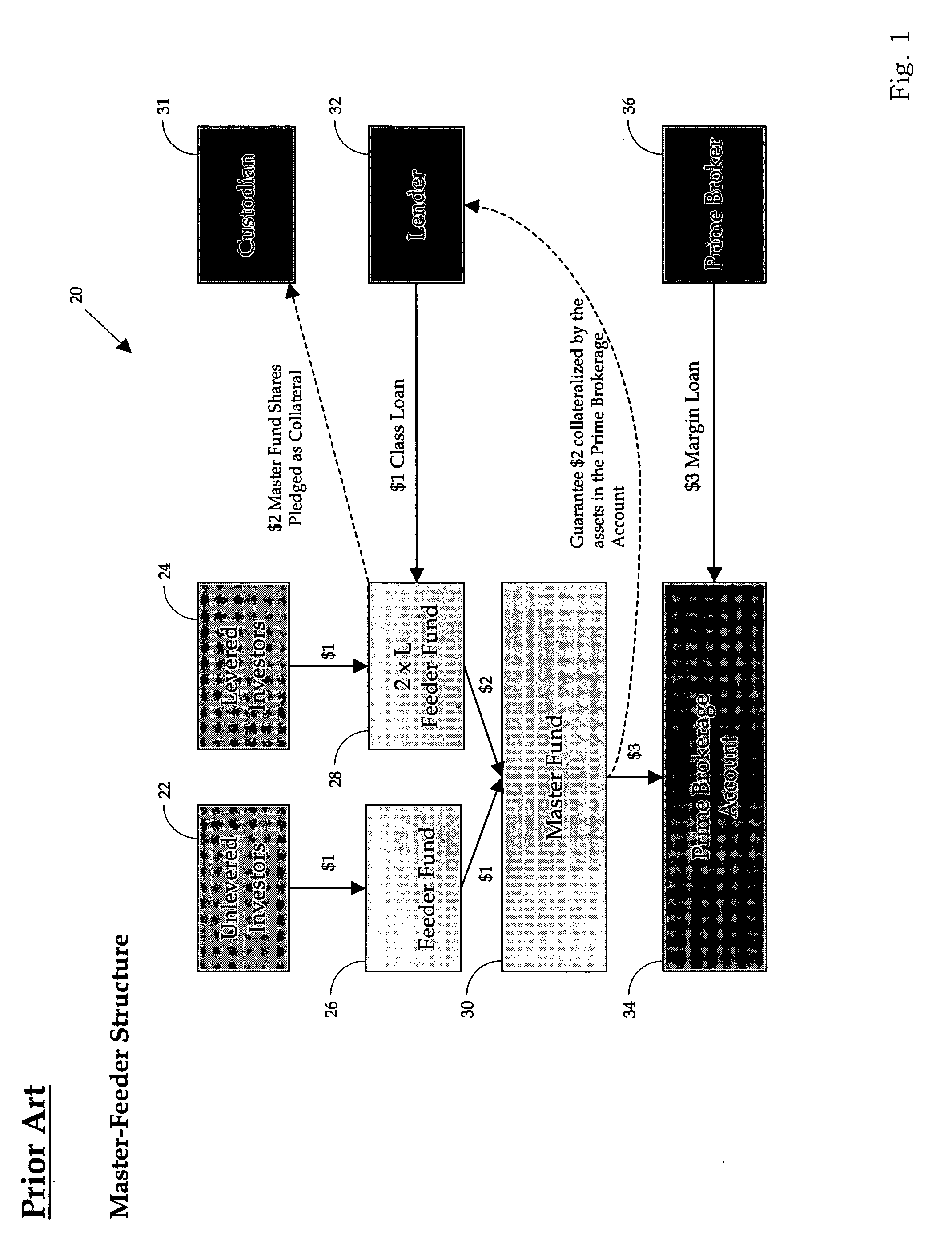

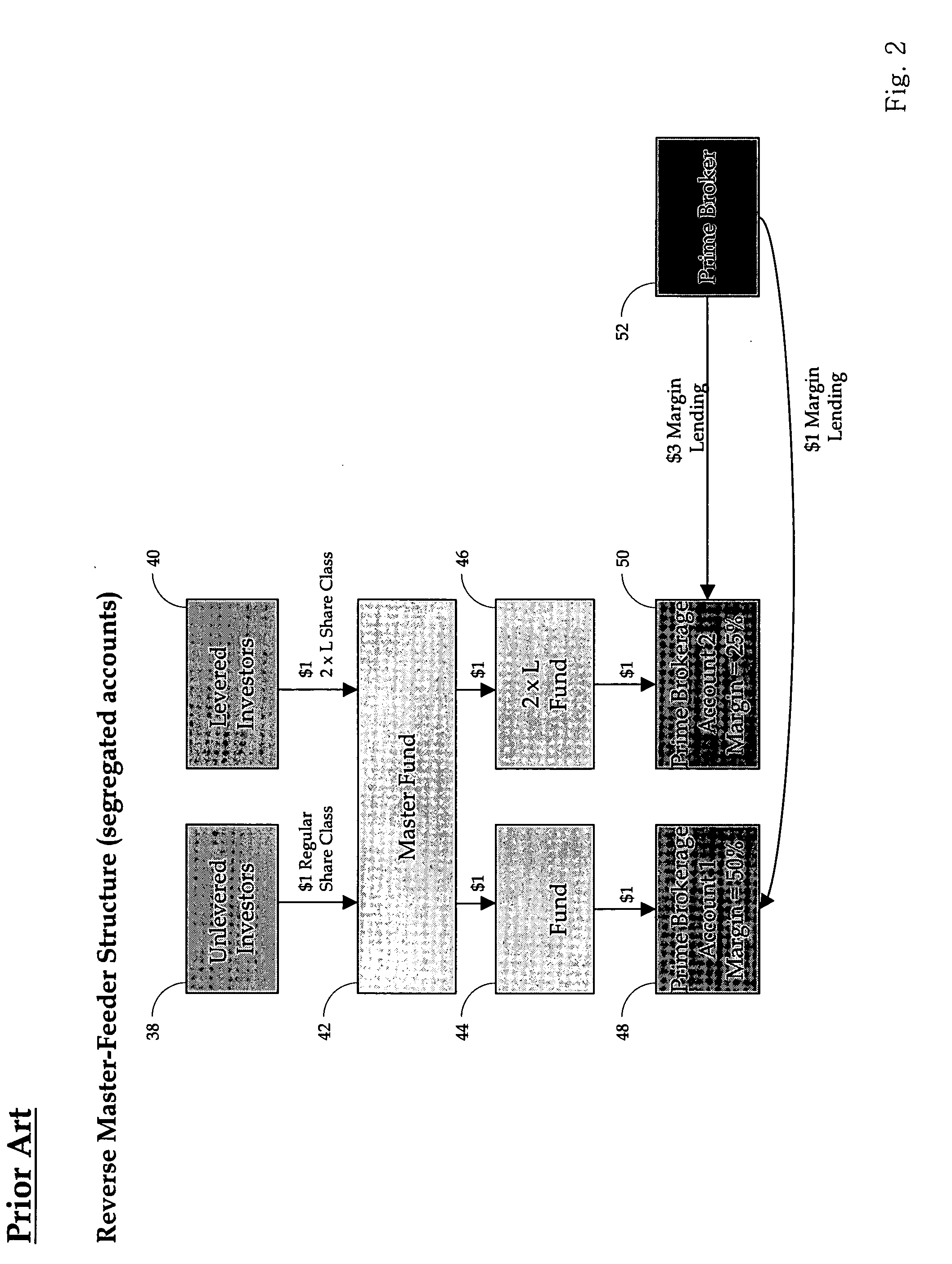

[0022]The present invention relates to an investment structure for an investment fund for multiple classes of investors for the purpose of buying, selling and investing in securities, commodities, and / or other investment products. The fund may borrow amounts in the normal course of its investing. Leverage may be used to enable the fund to enhance its returns, but also may result in greater losses, as profits and losses will increase in proportion to the degree of leverage used.

[0023]In addition to amounts borrowed at the fund level, the fund will employ a second class of leverage on an investor by investor (or class by class) basis, offering varying amounts of leverage to the different investors or investor classes.

[0024]As used herein, investors are classified as either “levered investors” or “unlevered investors.” Levered investors are further classified based upon the amount of additional leverage the investor would like the fund to utilize. For example, the fund may be formed wi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com