Method for arbitraging by using inherent price discrepancy of relevant finical products

A financial product and price technology, applied in finance, data processing applications, instruments, etc., can solve the problem of inconsistent price scales between futures and spot prices

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0024] A method for arbitrage using the inherent price difference of related financial products according to the present invention will be further described below in conjunction with the accompanying drawings and specific embodiments.

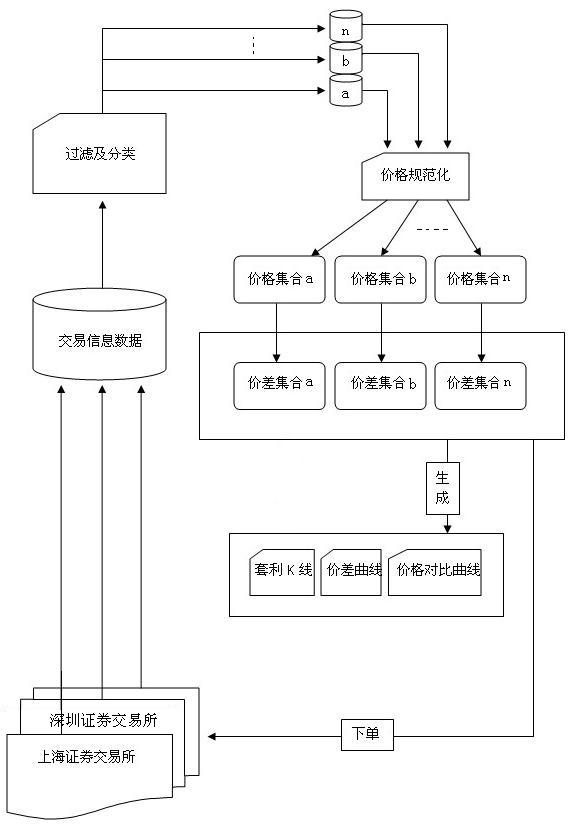

[0025] Such as figure 1 As shown, a method for arbitrage using the inherent price difference of related financial products described in this embodiment, taking stock index futures and ETF as an example, includes the following steps.

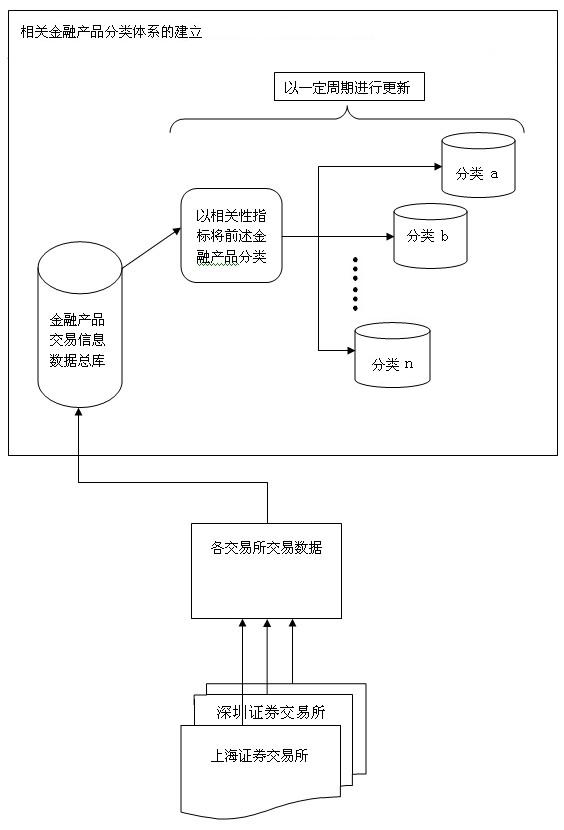

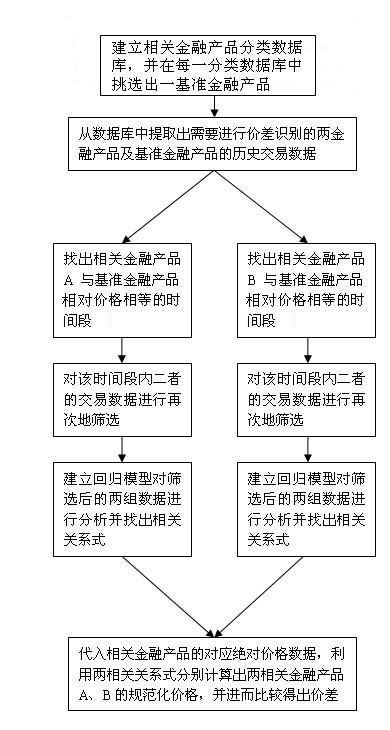

[0026] Such as figure 2As shown, first establish the required financial product classification database. First determine the sample of financial products. In this embodiment, select the sample stock index futures, commodity futures, ETF, LOF and all constituent stocks of the Shanghai and Shenzhen 300 as examples, and import the data of the historical transaction information of the aforementioned securities into the financial product transaction information general database , to extract the daily closing price ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com