Management and application method of tax assessment rules

An application method and tax calculation technology, applied in the field of tax management, can solve the problems of not reaching the enterprise operation level, no tax calculation method and tax calculation rule management and use, etc. The effect of efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

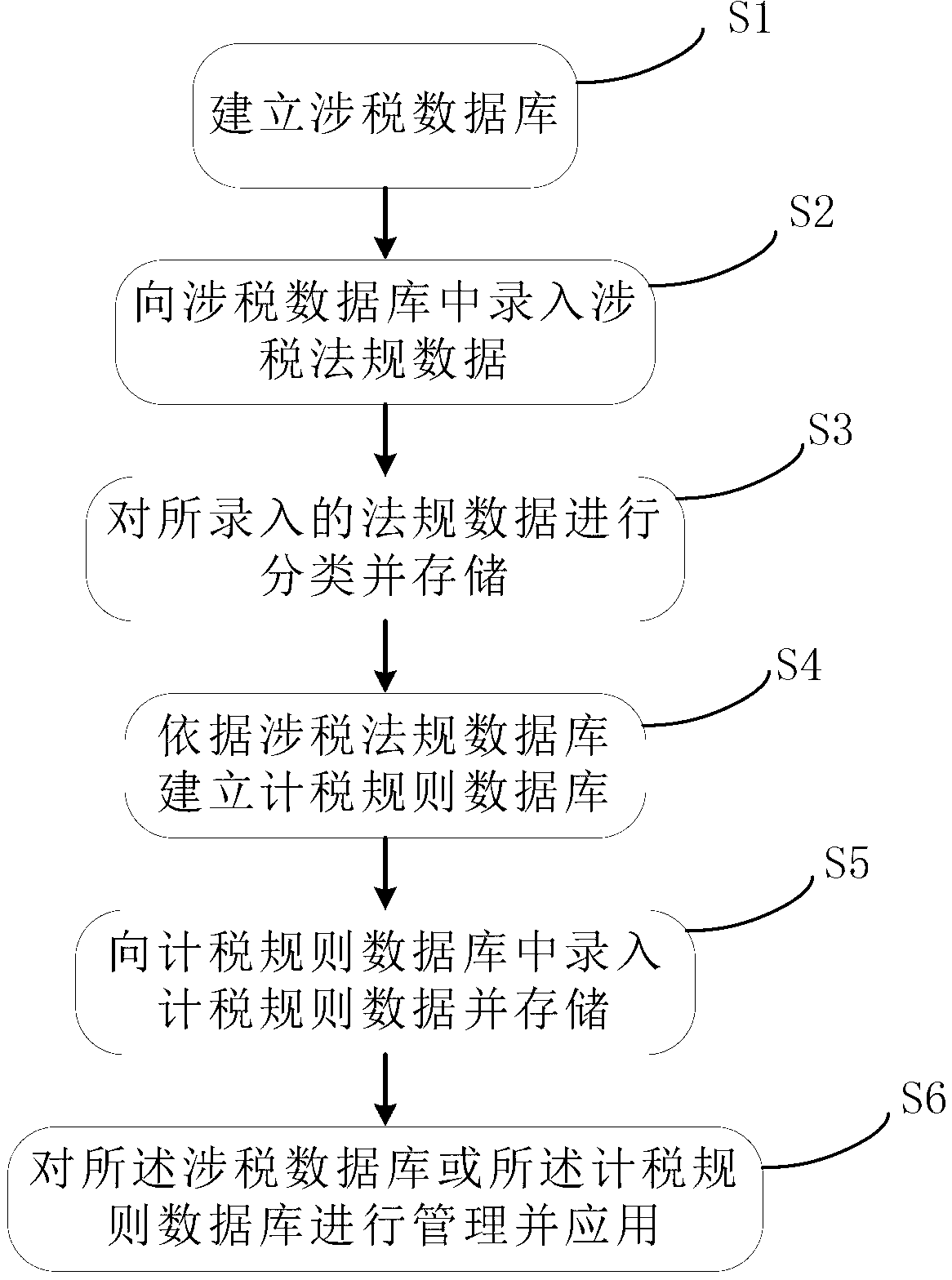

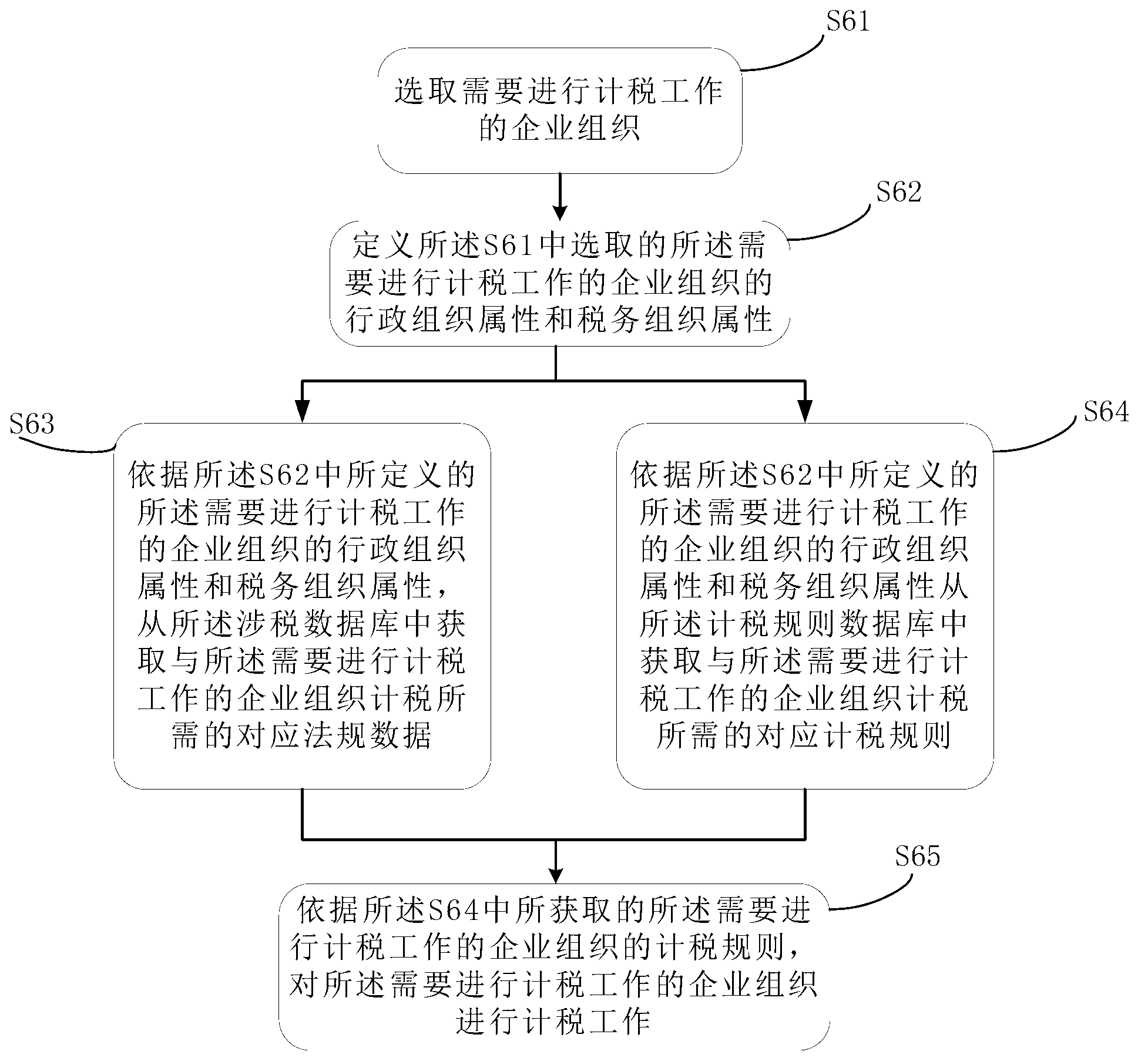

[0062] Such as figure 1 As shown, a method for managing and applying tax calculation rules provided in this embodiment includes:

[0063] S1. Establish a tax-related database;

[0064] S2. Enter tax-related laws and regulations data into the tax-related database; it should be noted that the tax-related laws and regulations data mentioned here are all laws and regulations related to the payment of taxes by enterprises, as well as various local laws and regulations on the payment of taxes and fees by enterprises Regulations or implementing rules, etc.

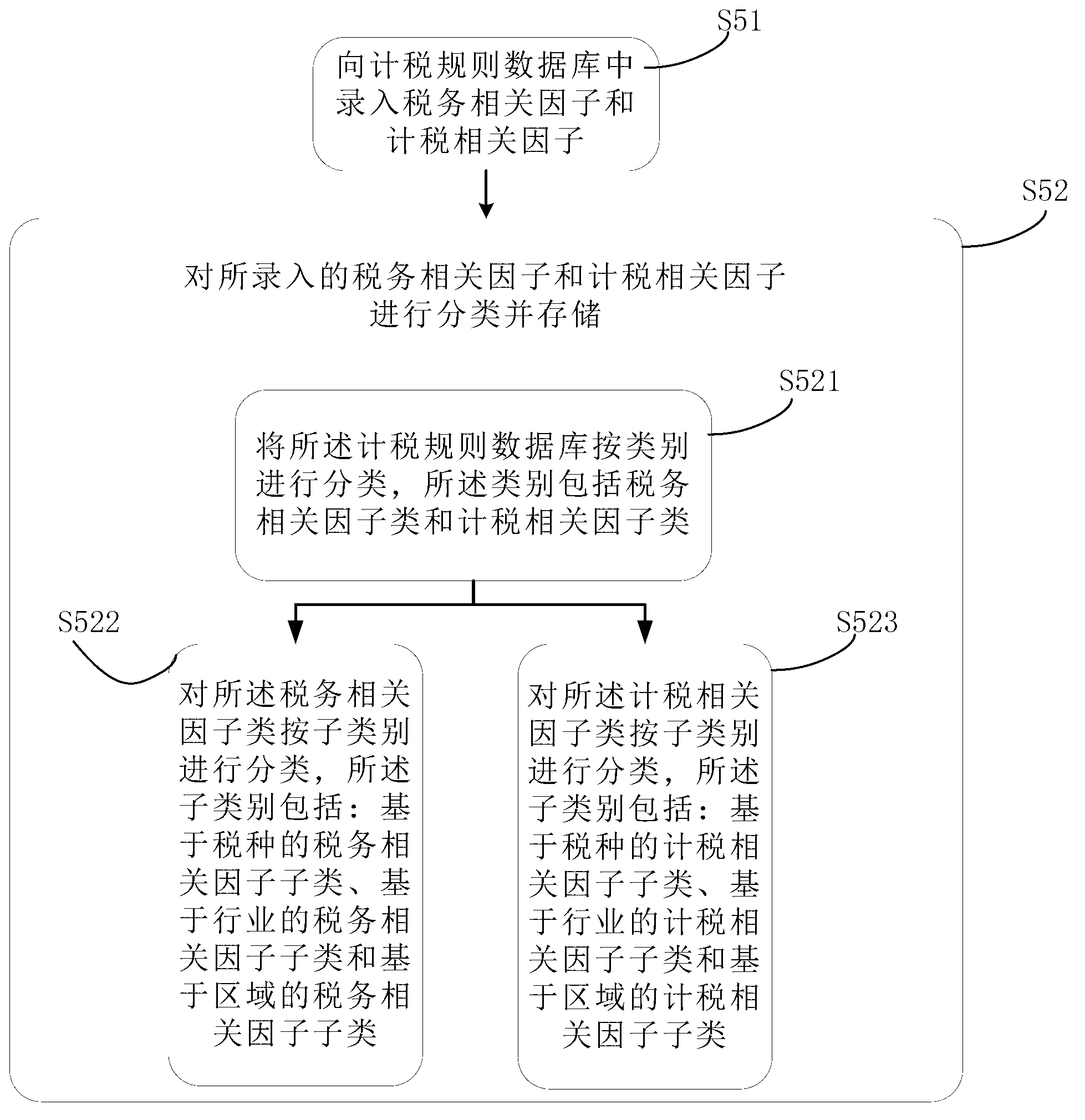

[0065] S3. Classify and store the entered regulatory data; as a preference, the classification method in S3 is to classify by category, and the categories include: tax-based regulations, industry-based regulations, and region-based regulations kind.

[0066] It should be noted that the following descriptions of "tax category", "industry" and "region" apply to the full text. The types of taxes refer to the types of taxes and f...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com