Construction method of database based on credit report

A construction method and credit report technology, applied in the field of credit risk management, can solve problems such as data waste, ineffective use, and restrictions on the development of financial institutions, and achieve the effect of improving efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] In order to make the technical means, creative features, goals and effects achieved by the present invention easy to understand, the present invention will be further described below in conjunction with specific diagrams.

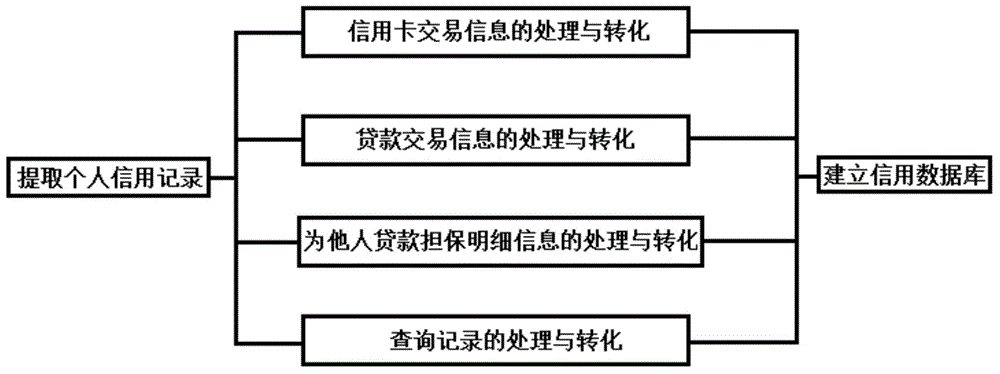

[0033] refer to figure 1 A method for constructing a database based on a credit report, comprising a server, the server comprising a computing engine, a storage subsystem coupled with the computing engine, and storing a database based on a credit report on the storage subsystem; the method for constructing the database is as follows:

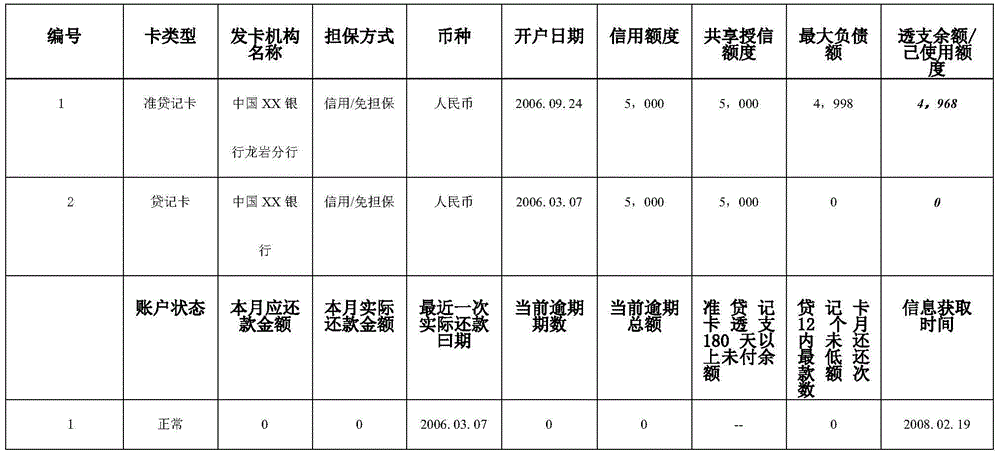

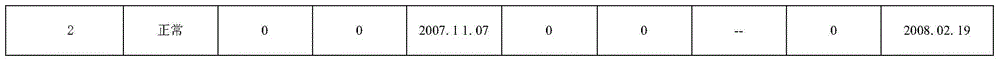

[0034] 1) Extract personal credit record information through the server; credit record information includes credit card transaction information, loan transaction information, detailed information on loan guarantees for others, and inquiry records of individual credit record information inquired by banks;

[0035] 2) Process and convert credit card transaction information through the calculation engine; process and conv...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com