Digital dynamic trackless security identity authentication method

An identity authentication and dynamic technology, applied in data processing applications, instruments, calculations, etc., can solve the problems of cardholders' personal data copying, embezzlement, troublesome money loss, etc., and achieve high competitiveness, low use cost, and reduced operation Cost and Risk Effects

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0020] The present invention mainly provides a high-security device that does not need to show personal data and account numbers at all, but can accurately display the correct identity of the cardholder, the payment amount and the identity of the payee, and effectively prevent the payer’s personal data from being stolen or fraudulently used. Digital dynamic trackless security identity authentication method.

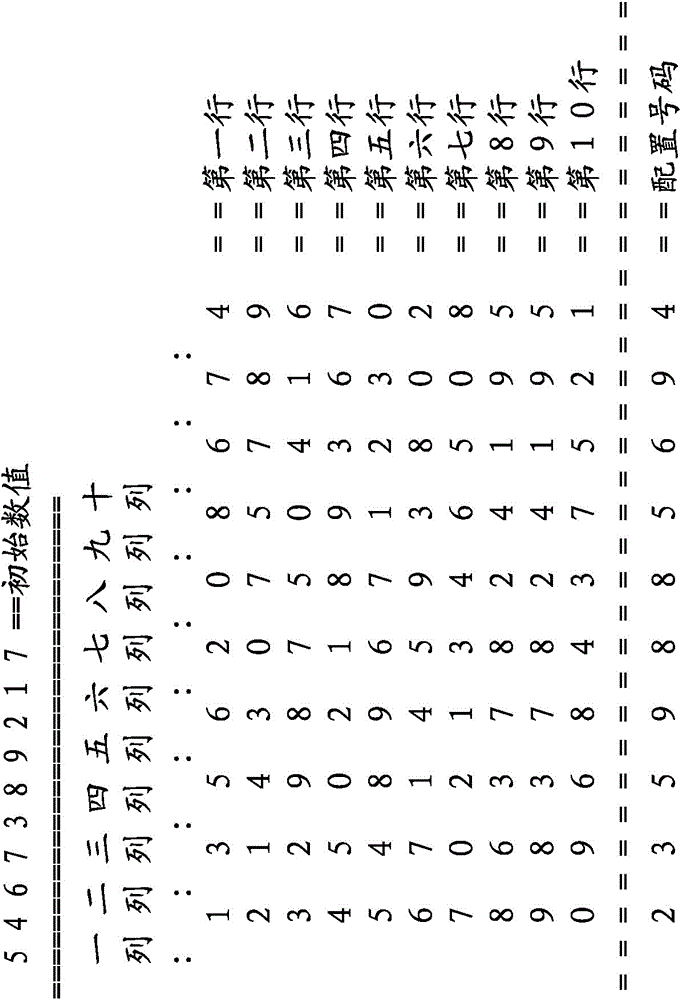

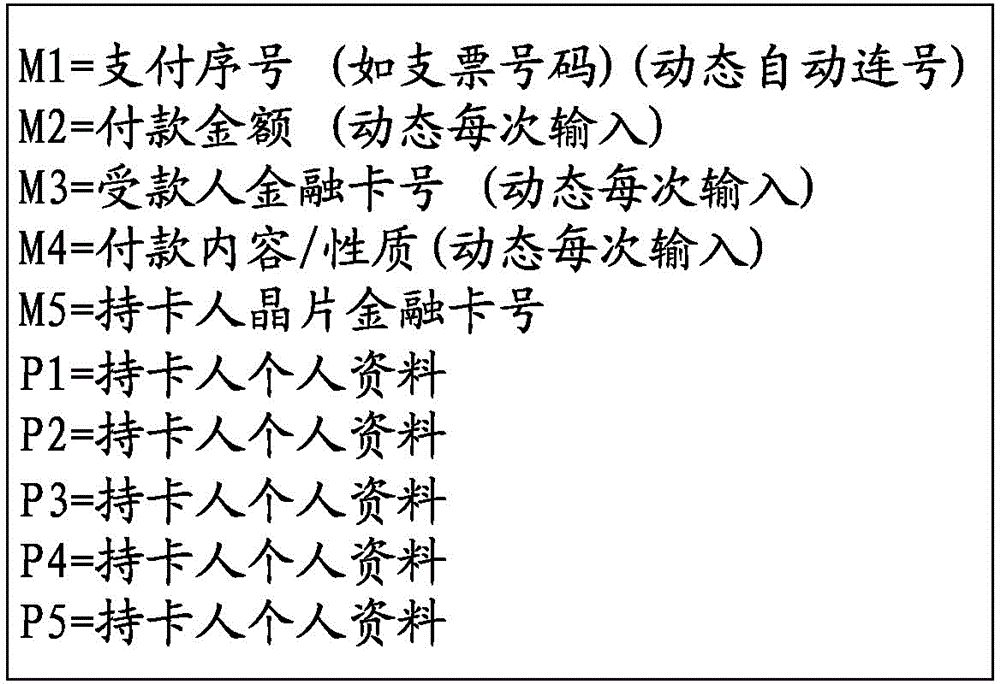

[0021] First, the cardholder first applies to the card issuer for a chip financial card containing a chip. A calculation formula recognized by the card issuer is built in the chip financial card, and the settings are configured separately for each cardholder. Multiple configuration numbers are combined Dynamic calculation elements, dynamic calculation procedures, and dynamic keys (formed by personal data, payment amount, payee card number, payment content, etc.) generated by dynamic irregular payment sequence numbers, and the configuration number is hidden and stored by th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com