Multi-cycle installment decision making method and system

A multi-cycle and decision-making technology, applied in the computer field, can solve the problems of inability to provide services in installments to increase revenue and increase the economic burden of buyers.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

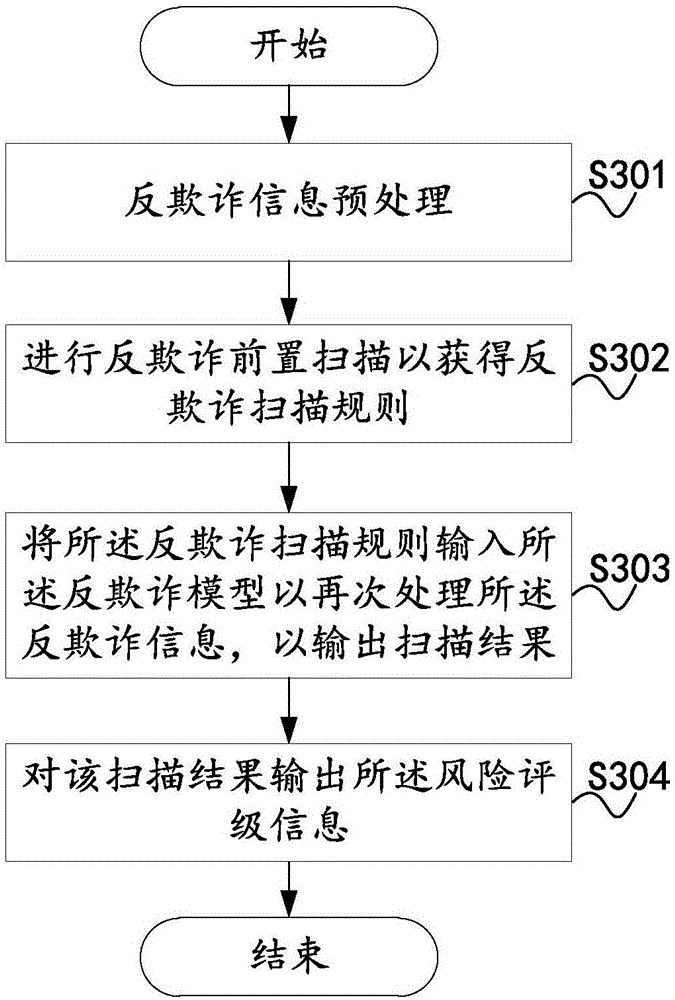

Method used

Image

Examples

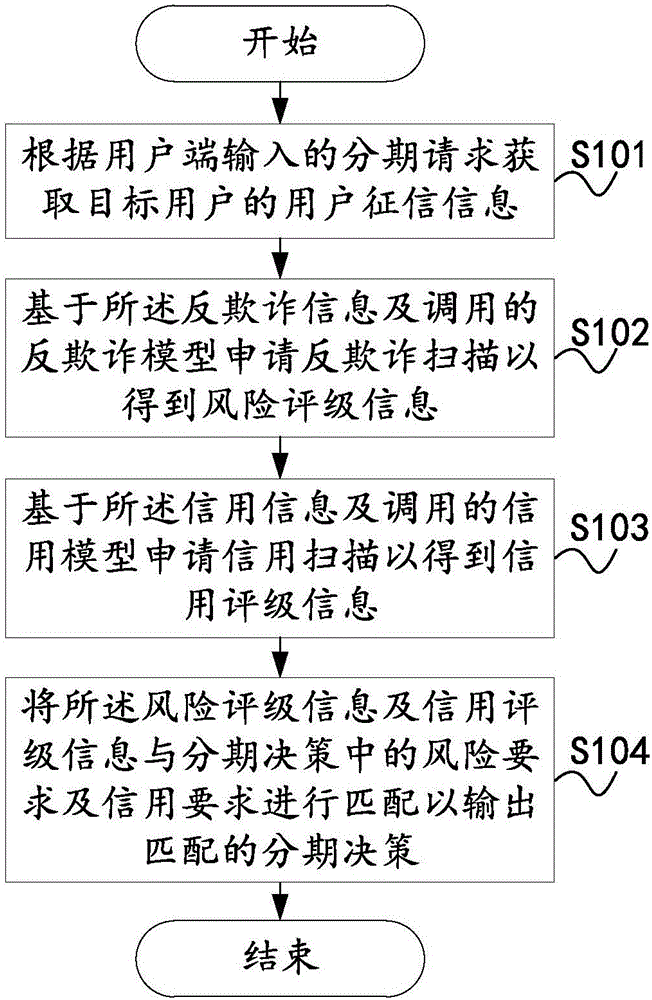

example 1

[0092] Example 1: When the server applies for anti-fraud scanning based on the anti-fraud information and the invoked anti-fraud model to obtain the risk rating of the client A as 3, applies for credit scanning based on the credit information and the invoked credit model to obtain user Terminal A has a credit rating of 2. Then the decision-making system matches the risk rating and credit rating with the risk requirement threshold and credit requirement in staged decision-making, and obtains that the risk rating 3 of client A belongs to the range of risk requirement threshold 1-4, and the credit rating 2 If it falls within the range of credit requirement thresholds 1 to 4, and the matching result output by the decision-making system conforms to plan 1, it outputs a plan of down payment of 20% and repayment of the balance in 12 months.

example 2

[0093] Example 2: When the server applies for anti-fraud scanning based on the anti-fraud information and the invoked anti-fraud model to obtain the risk rating of the client A as 3, applies for credit scanning based on the credit information and the invoked credit model to obtain user Terminal A has a credit rating of 6. Then the decision-making system matches the risk rating and credit rating with the risk requirement threshold and credit requirement in staged decision-making, and obtains that the risk rating 3 of client A belongs to the range of risk requirement threshold 1-4, and the credit rating 6 If it falls within the range of the credit requirement threshold of 5-8, and the matching result output by the decision-making system conforms to the second plan, then output a plan of down payment of 40%, and repay the balance in 9 months.

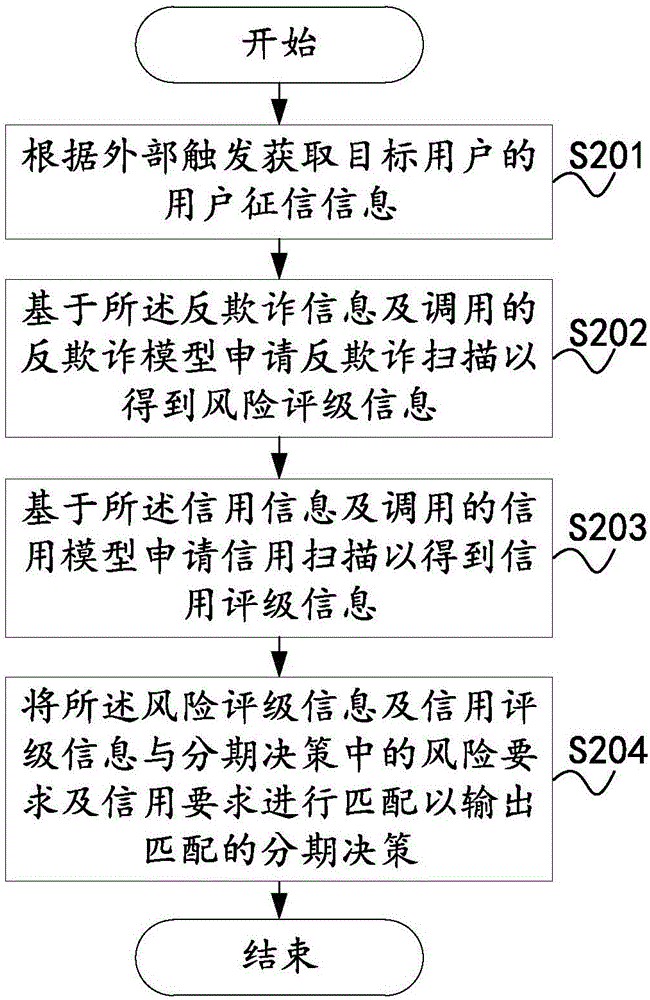

example 3

[0094] Example 3: When the server applies for anti-fraud scanning based on the anti-fraud information and the invoked anti-fraud model to obtain the risk rating of the client A as 6, applies for credit scanning based on the credit information and the invoked credit model to obtain user Terminal A has a credit rating of 2. Then the decision-making system matches the risk rating and credit rating with the risk requirement threshold and credit requirement in staged decision-making, and obtains that the risk rating 6 of client A belongs to the range of risk requirement threshold 5-8, and the credit rating 2 If it falls within the range of credit requirement thresholds 1 to 4, and the matching result output by the decision-making system conforms to Plan 3, it outputs a plan of down payment of 40% and repayment of the balance in 9 months.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com