Credit risk evaluation method and credit risk evaluation system

A risk assessment system and technology for risk assessment, applied in the fields of instruments, finance, data processing applications, etc., can solve problems such as incomplete information, inaccessible data, and difficulty in distinguishing the authenticity of data, so as to improve the accuracy of assessment and assessment efficiency, High usability effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0023] In the following description, specific details such as specific system structures and technologies are presented for the purpose of illustration rather than limitation, so as to thoroughly understand the embodiments of the present invention. It will be apparent, however, to one skilled in the art that the invention may be practiced in other embodiments without these specific details. In other instances, detailed descriptions of well-known systems, devices, circuits, and methods are omitted so as not to obscure the description of the present invention with unnecessary detail.

[0024] In order to illustrate the technical solutions of the present invention, specific examples are used below to illustrate.

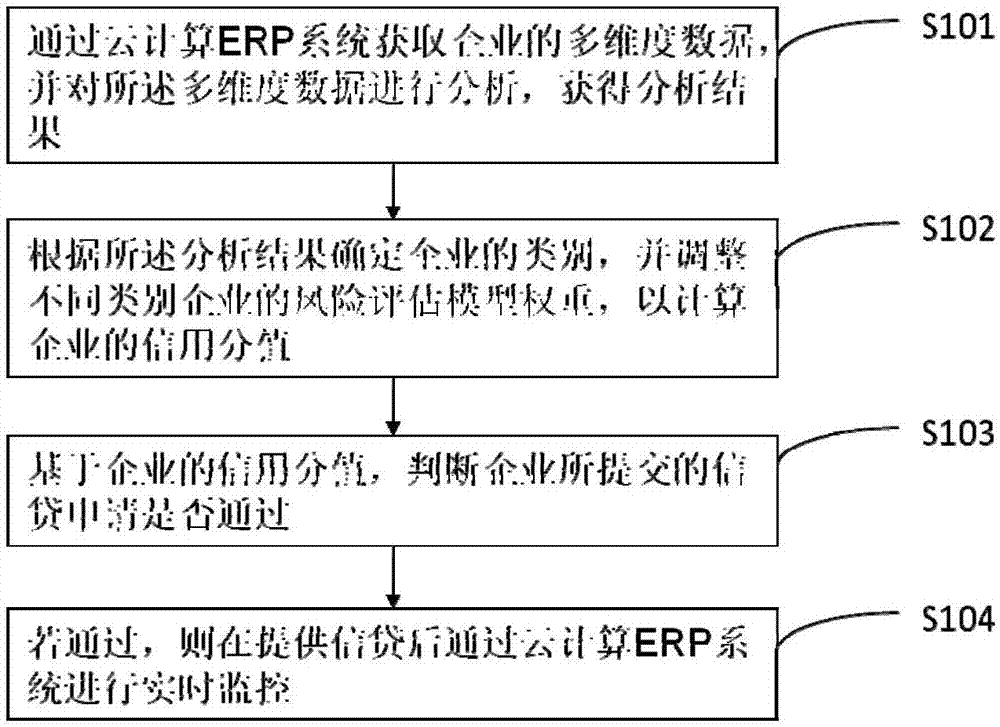

[0025] figure 1 It is a schematic diagram of the implementation flow of a credit risk assessment method provided in Embodiment 1 of the present invention. As shown in the figure, the method may include the following steps:

[0026] In step S101, the multi-dimensional ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com