Big data analysis method and system based on consumption record

A technology of consumption records and analysis methods, applied in the field of big data analysis, can solve the problems of incomplete user credit evaluation and inability to fully obtain the original records of user credit consumption, so as to achieve accurate and comprehensive credit evaluation value, accurate confidence value, and data source full effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

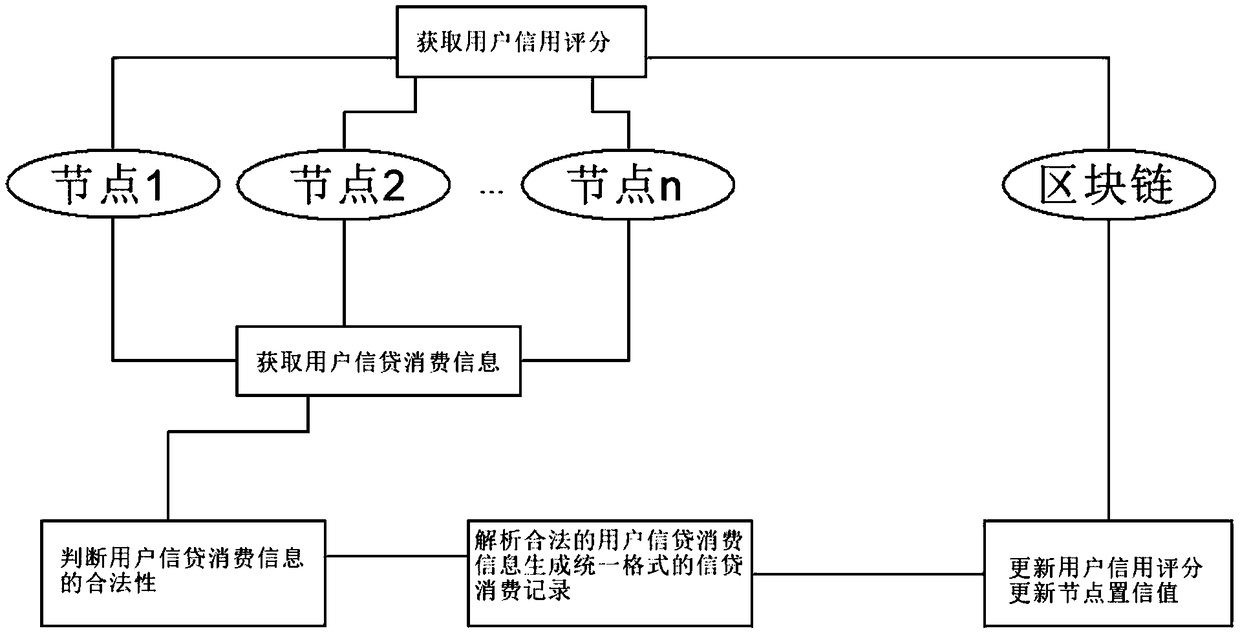

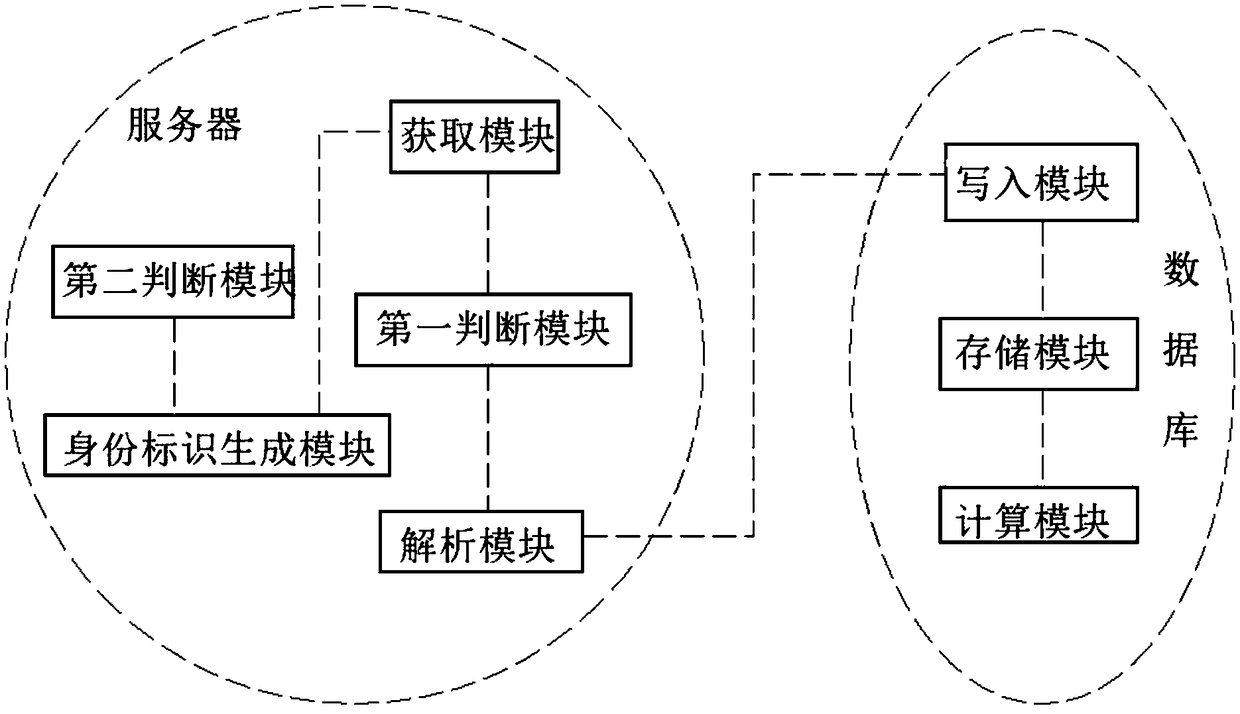

[0052] combined with figure 1 , this embodiment provides a big data analysis method based on consumption records, including:

[0053] The node obtains the user's credit consumption information. The node mainly refers to the virtual program running the same block on the credit platform, which corresponds to a server in terms of hardware;

[0054] Judging the legitimacy of user credit consumption information and analyzing the legal user credit consumption information to generate credit consumption records in a unified format. The basis for judging the legitimacy of user credit consumption information is whether the credit consumption invoice signature is legal and whether the user's identity information is legal, to avoid There are credit platform frauds, etc.;

[0055] Write credit consumption records in a unified format into the blockchain, and update user credit scores based on the credit consumption records in a unified format, write credit consumption records in a unified ...

Embodiment 2

[0059] On the basis of Embodiment 1, this implementation also includes judging the legitimacy of the node and providing a unique identity for the legal node before the node obtains the user's credit consumption information. The basis for judging the legitimacy of the node includes whether the node has credit qualifications; The platform of the block is legal by default, but when the Xinshuo Credit Platform wants to access it, the system will judge its credit qualification. When the node is legal by default, there is no need to repeat the verification.

[0060] Embodiment two

[0061] On the basis of Embodiment 1, this implementation specifically describes how to update and calculate user credit scores:

[0062] User credit consumption information includes user identity information, user credit principal a, credit interest h, borrowed credit consumption time t, normal credit consumption repayment time T, credit consumption repayment time t1 and credit consumption invoice signatur...

Embodiment 3

[0064] On the basis of Embodiment 2, in this embodiment, updating user credit scores according to credit consumption records in a unified format includes:

[0065] Acquire the correction value u of the user's credit consumption according to the credit consumption record in a unified format;

[0066] Update the user's credit score w1 according to the correction value u of the user's credit consumption and the user's initial credit score w;

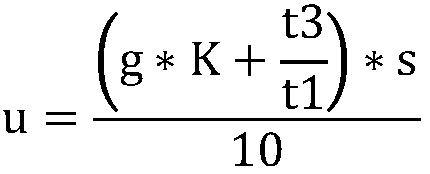

[0067] The formula for calculating the correction value u is:

[0068] (1) When t3>0, that is, when the user expires, the correction value u is calculated as follows:

[0069]

[0070] The calculation formula of the user credit score w1 is:

[0071] w1=w-u

[0072] Among them, K is the constant value corresponding to the user's accumulated overdue times g, and the range of s is 0 to 10;

[0073] (2) When t3<0, when the user has not expired, the calculation method of the correction value u is as follows:

[0074]

[0075] The calc...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com