Bank-and-taxation interaction system construction method based on blockchain

A technology of interactive system and construction method, which is applied in the construction of a blockchain-based banking and tax interactive system, which can solve the problems of information data asymmetry and tampering, and achieve the effect of protecting the commercial secrets of banks.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] The present invention will be described in detail below in conjunction with the accompanying drawings and embodiments.

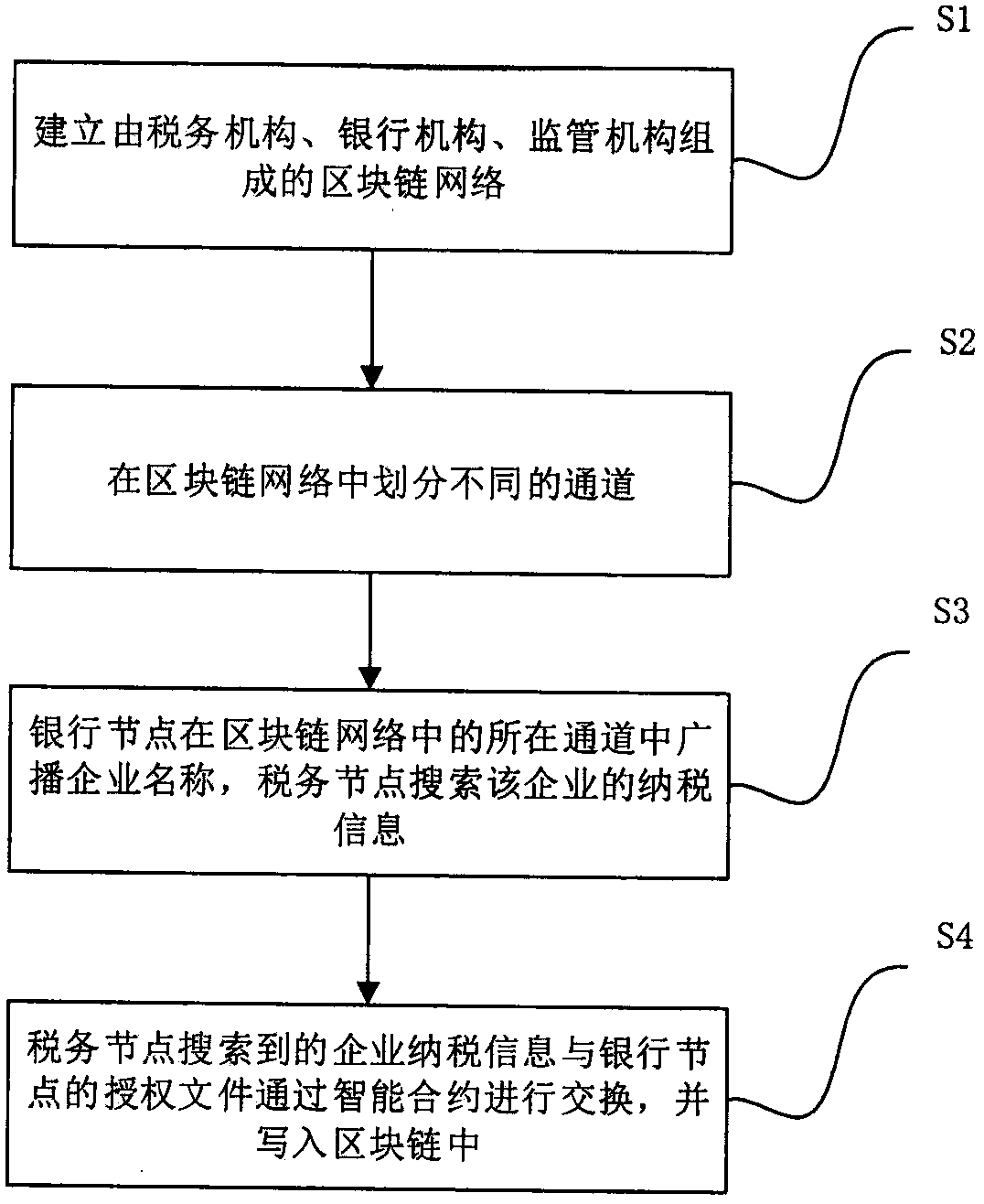

[0033] Such as figure 1 As shown, a method for constructing a blockchain-based bank-tax interactive system includes the following steps:

[0034] Step S1: Establish a blockchain network composed of tax agencies, banking agencies, and regulatory agencies. The specific implementation is as follows:

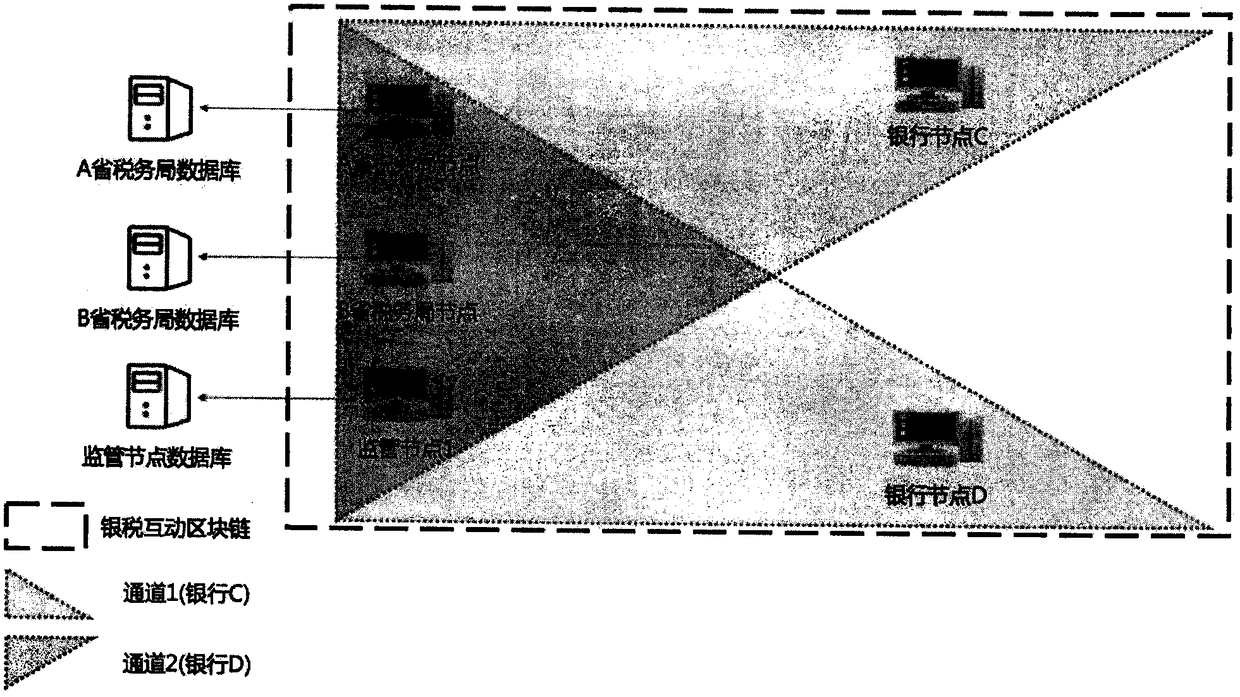

[0035] S11: The management department of the State Administration of Taxation joins the blockchain network as the supervisory node 1, and the blockchain network assigns supervisory keys to the supervisory node 1;

[0036] S12: The tax bureau of province A and the tax bureau of province B join the blockchain network as the tax node of province A and the tax node of province B respectively. The information of the provincial tax node and the tax node of province B is written into the blockchain;

[0037] S13: Bank C and Bank D submit application materials t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com