Post-loan early warning and monitoring system based on knowledge map technology

A knowledge map, early warning and monitoring technology, applied in the field of loan risk prevention and control system, can solve the problems of bank losses, lack of timeliness and foresight, incomplete information, etc., and achieve the effect of reducing losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] The following is further described in detail through specific implementation methods:

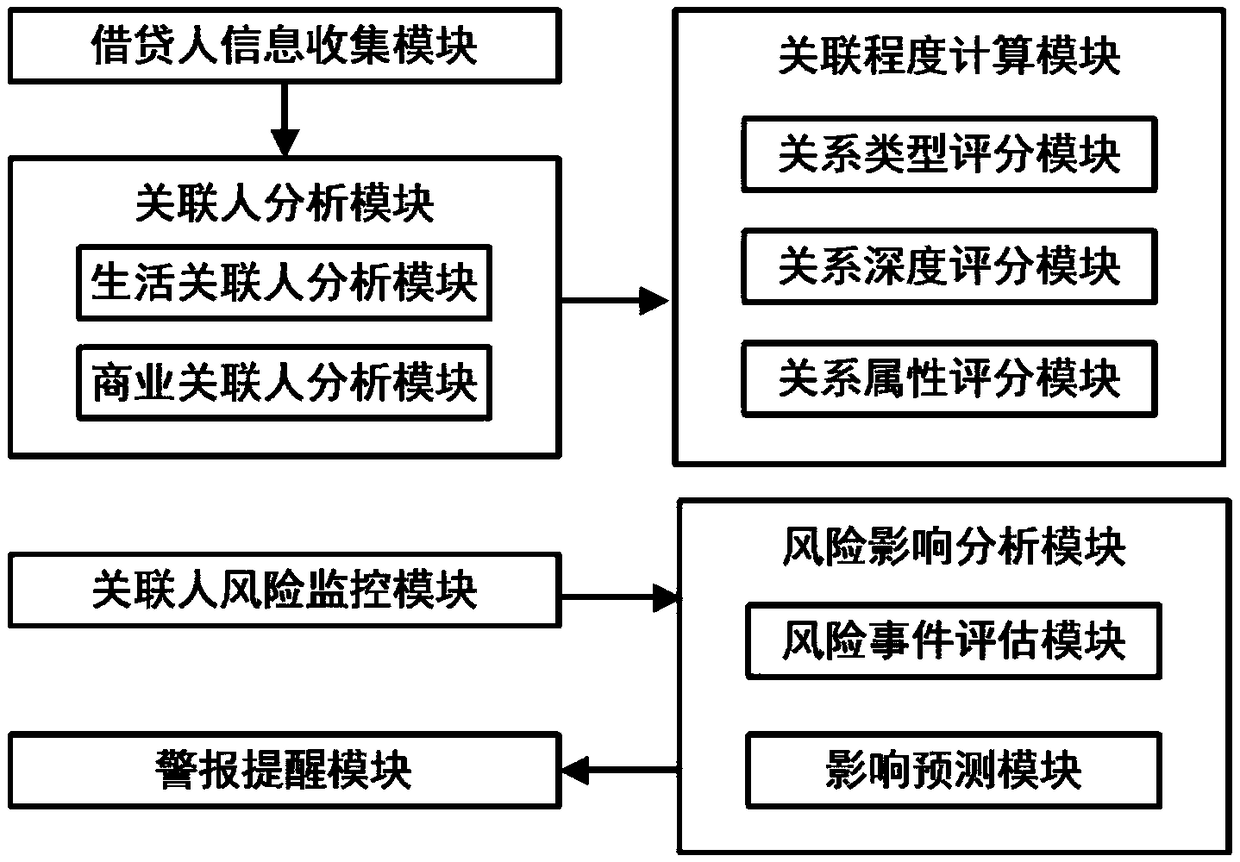

[0023] Such as figure 1 As shown, a post-loan early warning monitoring system based on knowledge graph technology in this embodiment includes a borrower information collection module, an associated person analysis module, an associated degree calculation module, an associated person risk monitoring module, a risk impact analysis module, and an alarm reminder module ,in:

[0024] The borrower information collection module is used to collect the associated information of the borrower. In this embodiment, the associated information includes basic information and business information. The basic information includes name, gender, ID number, mobile phone number, residential address, and contact information. The business information includes business scope information, business product information, business address information, Business license information and third-party e-commerce platf...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com