Method, device, and computer-readable storage medium for processing value-added tax invoice data

A value-added tax and data encapsulation technology, applied in the field of data processing, can solve problems such as reducing the development cost of enterprise systems, cumbersome and difficult calls to the value-added tax invoice system, and achieve the effect of solving cumbersome calls and reducing development costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0027] Specific embodiments of the present disclosure will be described in detail below in conjunction with the accompanying drawings. It should be understood that the specific embodiments described here are only used to illustrate and explain the present disclosure, and are not intended to limit the present disclosure.

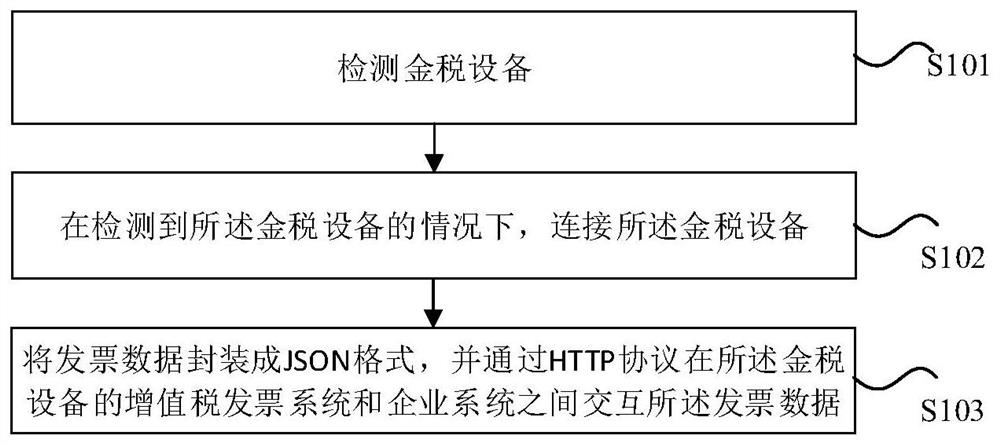

[0028] In this embodiment, a method for processing value-added tax invoice data is disclosed, figure 1 It is a flowchart of a method for processing value-added tax invoice data according to an embodiment of the present invention, such as figure 1 As shown, the process includes the following steps:

[0029] Step S101, detecting Golden Tax equipment;

[0030] Step S102, when the golden tax device is detected, connect to the golden tax device;

[0031] In step S103, the invoice data is encapsulated into JSON format, and the invoice data is exchanged between the value-added tax invoice system of the golden tax device and the enterprise system through the HTTP ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com