Credit evaluation method and system based on dynamic development trend

A technology for credit evaluation and development trends, applied in data processing applications, instruments, calculations, etc., can solve problems such as unscientific evaluation methods, long evaluation cycles, and inability to reflect credit development trends and laws, so as to improve supervision efficiency and reduce supervision. cost, the effect of improving credit awareness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0045] Below in conjunction with specific embodiment, further illustrate the present invention, should be understood that these embodiments are only used to illustrate the present invention and are not intended to limit the scope of the present invention, after having read the present invention, those skilled in the art will understand various equivalent forms of the present invention All modifications fall within the scope defined by the appended claims of the present application.

[0046] The present invention provides a credit evaluation method based on dynamic development trend, comprising the following steps:

[0047] S1: Determine the subjective weight and objective weight, and obtain the enterprise credit evaluation score and credit rating;

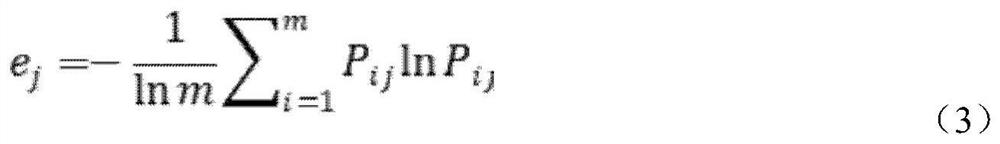

[0048] S2: Introduce the concept of time degree, calculate the maximization of time weight vector information entropy, and determine the time weight of credit evaluation;

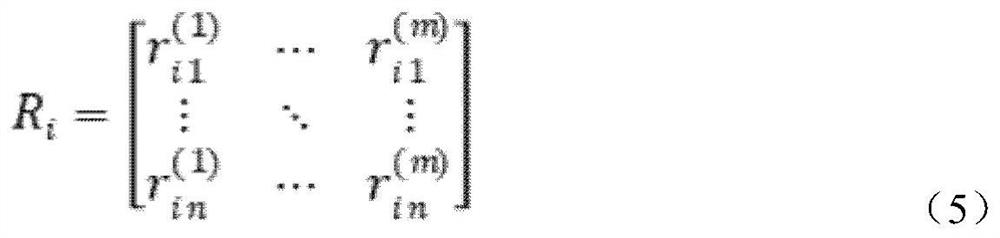

[0049] S3: Calculate the degree of membership of each eva...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com