Dedicated risk management line of credit

a risk management and line of credit technology, applied in the field of financial services products and systems of risk management, can solve the problems of increased premiums, increased premiums, and no longer available lower deductibles

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

second embodiment

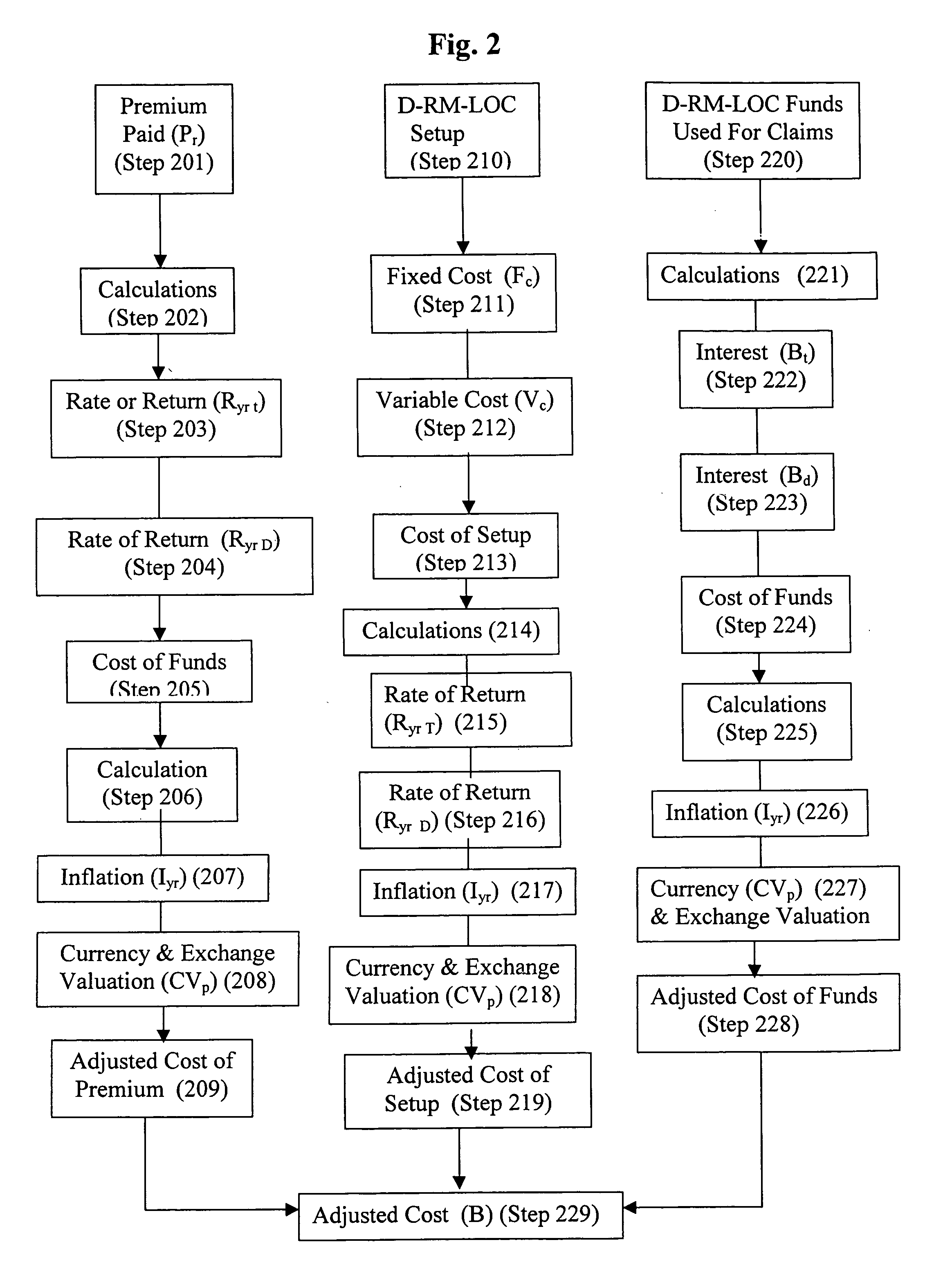

[0027] the invention is directed to a method for managing the retention of risk. This method provides an evaluation and projection of the financial impact associated with risk retention and enables calculation of the real cost to the entity of various risk retention amounts. The end results of the calculations, based on various risk retention amounts, can be compared with one another so that the entity can select the optimal (i.e. lowest annual cost) combinations of insurance premiums and retained risk. This embodiment also provides a method and apparatus for determining when a dedicated line of credit is an advantageous supplement or alternative to insurance for the entity. To that extent, the higher degree of probability associated with the claim data, the greater chance the use of this method of managing the retention of risk will reduce cost to the entity. This embodiment does not provide certainty of the amounts of claims, it merely quantifies the cost of the claims projected a...

example

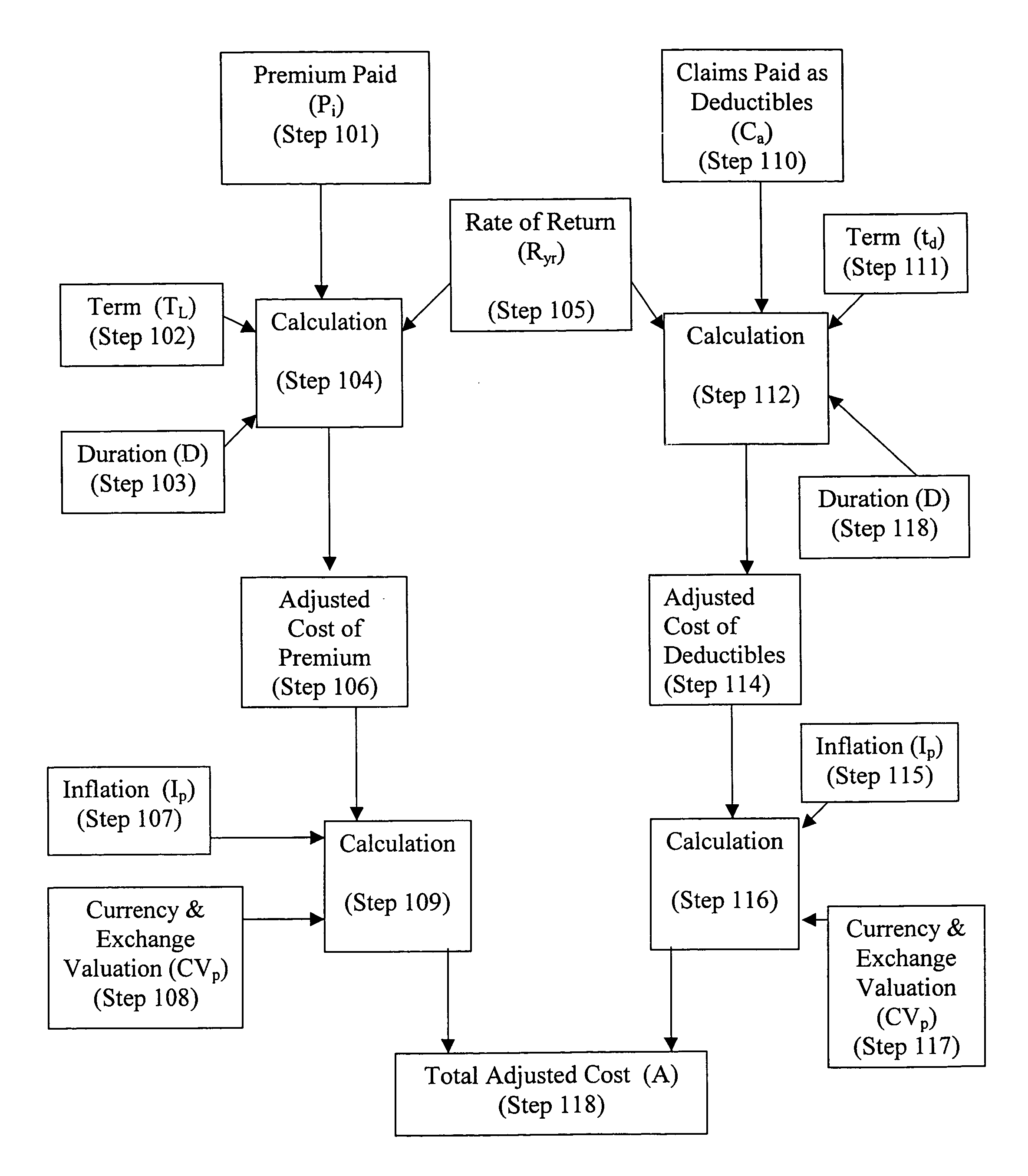

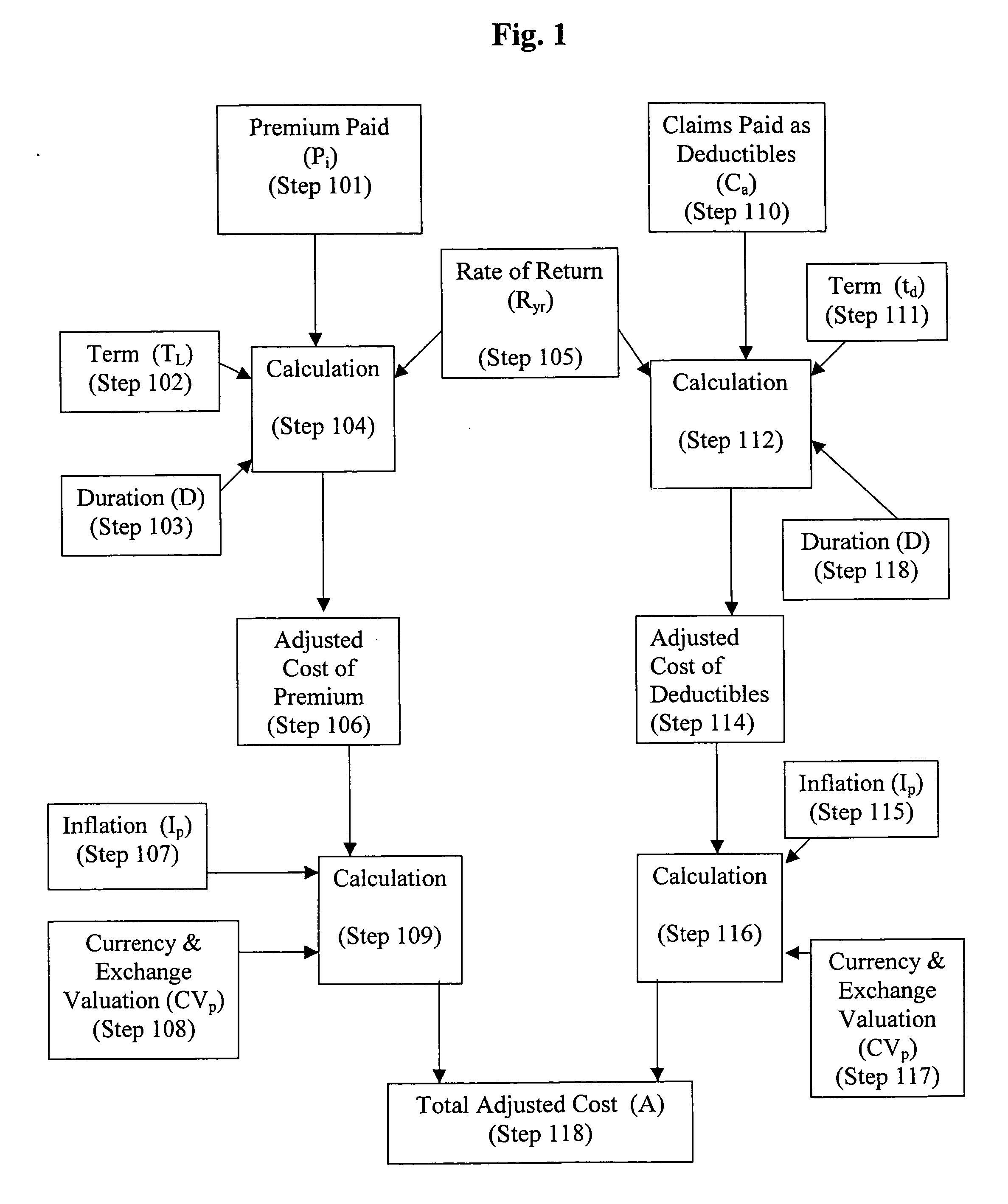

[0031] In order to provide an accurate comparison of the cost of insurance to the entity, the true cost needs to be determined over the same length of time the entity has to pay back any amounts used from the dedicated line of credit. As shown in FIG. 1, the actual cost to an entity of obtaining insurance is calculated through a number of steps. First, the entity determines the insurance premium (P.sub.i) 101 for a desired term of insurance coverage. Typically, the term of the insurance coverage is one year. However, any period of coverage could be used. As mentioned above, the entity must also determine the term of the dedicated line of credit (T.sub.L) 102 and the additional duration (D) 103 for paying back the amount used from the dedicated line of credit so that cost comparisons for use of the dedicated line of credit are equivalent.

[0032] Next, the entity estimates its rate of return (R.sub.yr) 105 from operations over the same length of time D and T.sub.L. R.sub.yr is the meas...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com