Patents

Literature

40 results about "Financial impact" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A financial impact is an expense that has an an effect on a financial position that cannot be controlled. The types of events that create this type of impact are disasters, unexpected changes in market conditions, catastrophic product failures and anything else that interrupts business and over which business management has no control.

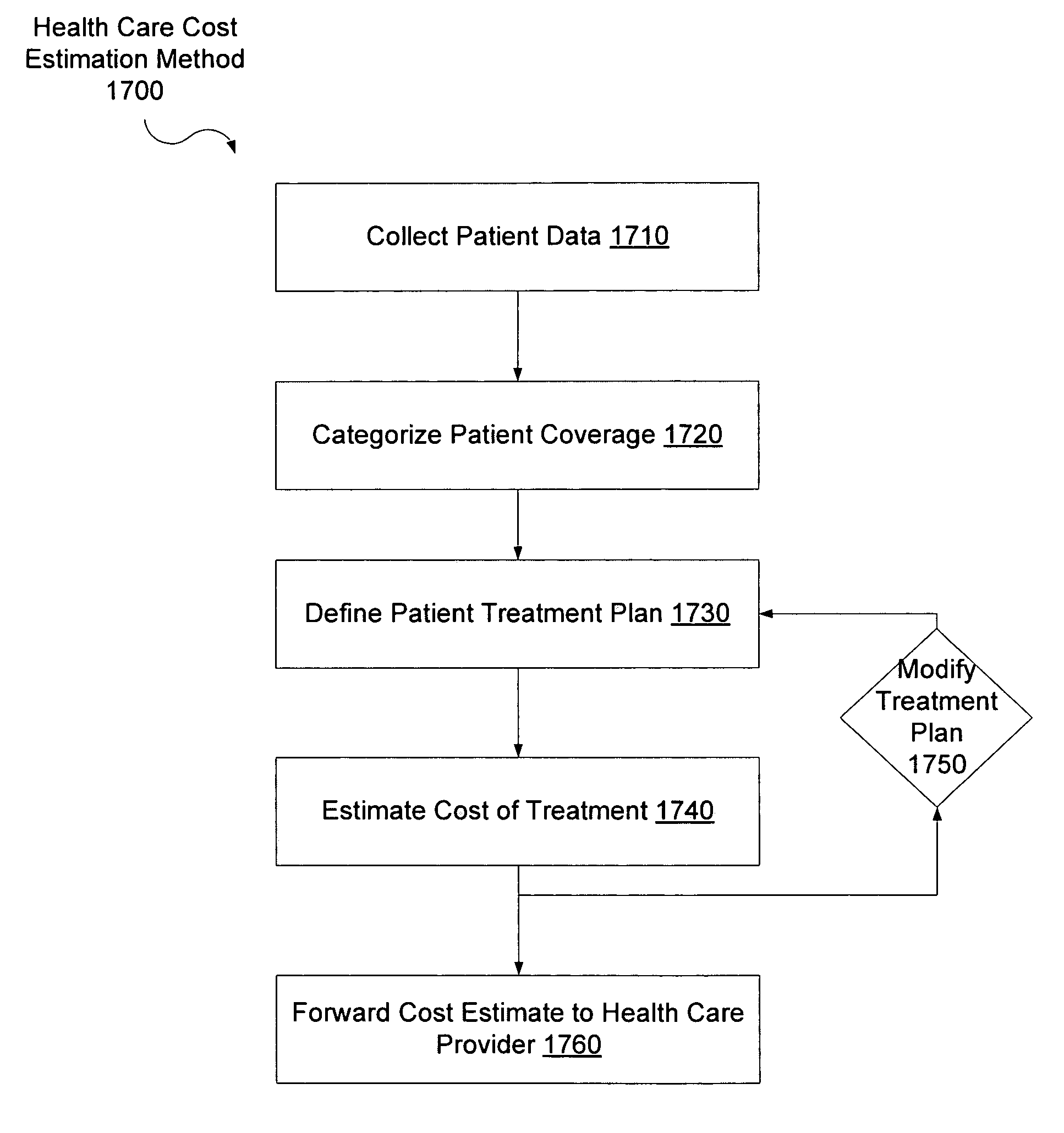

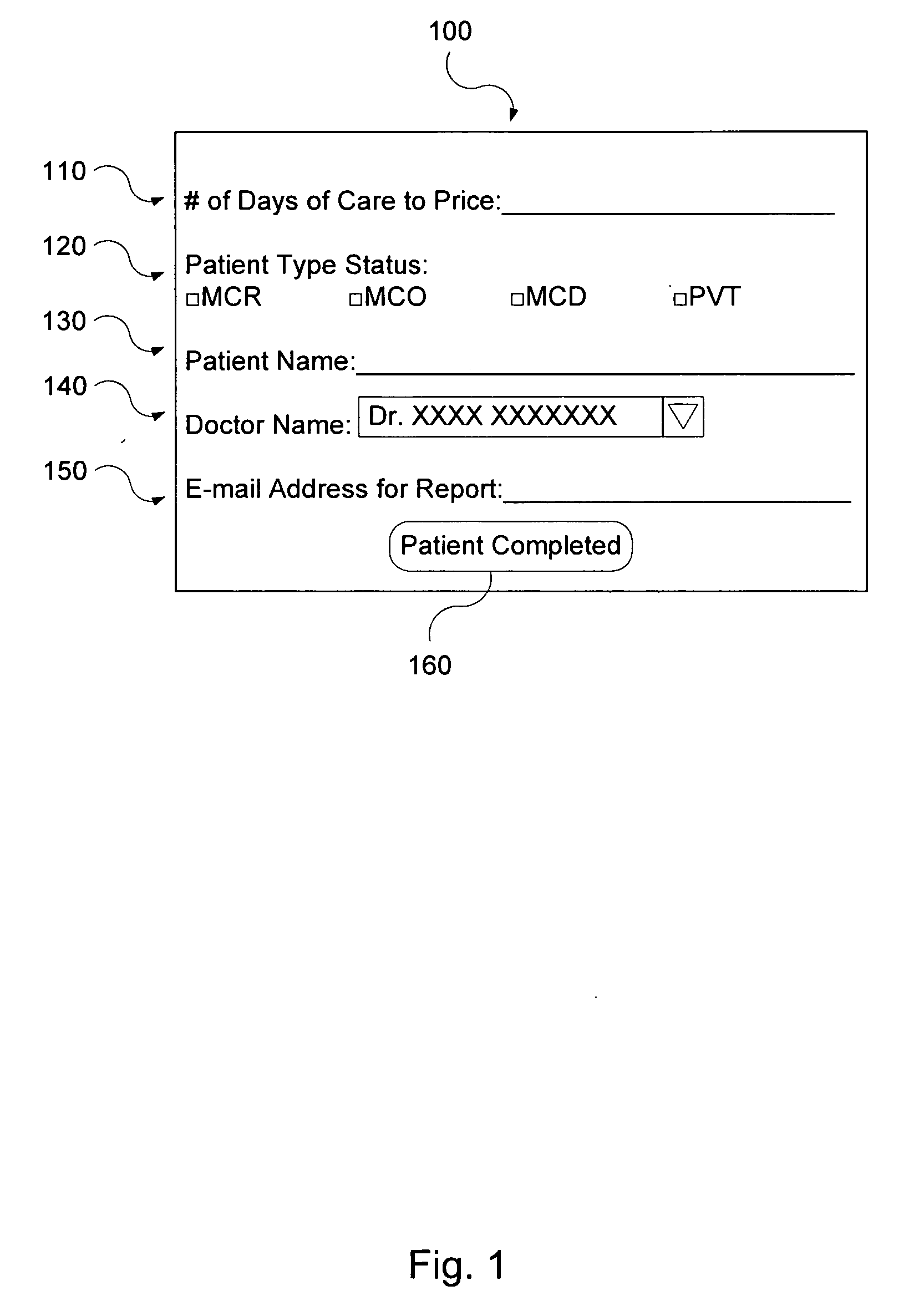

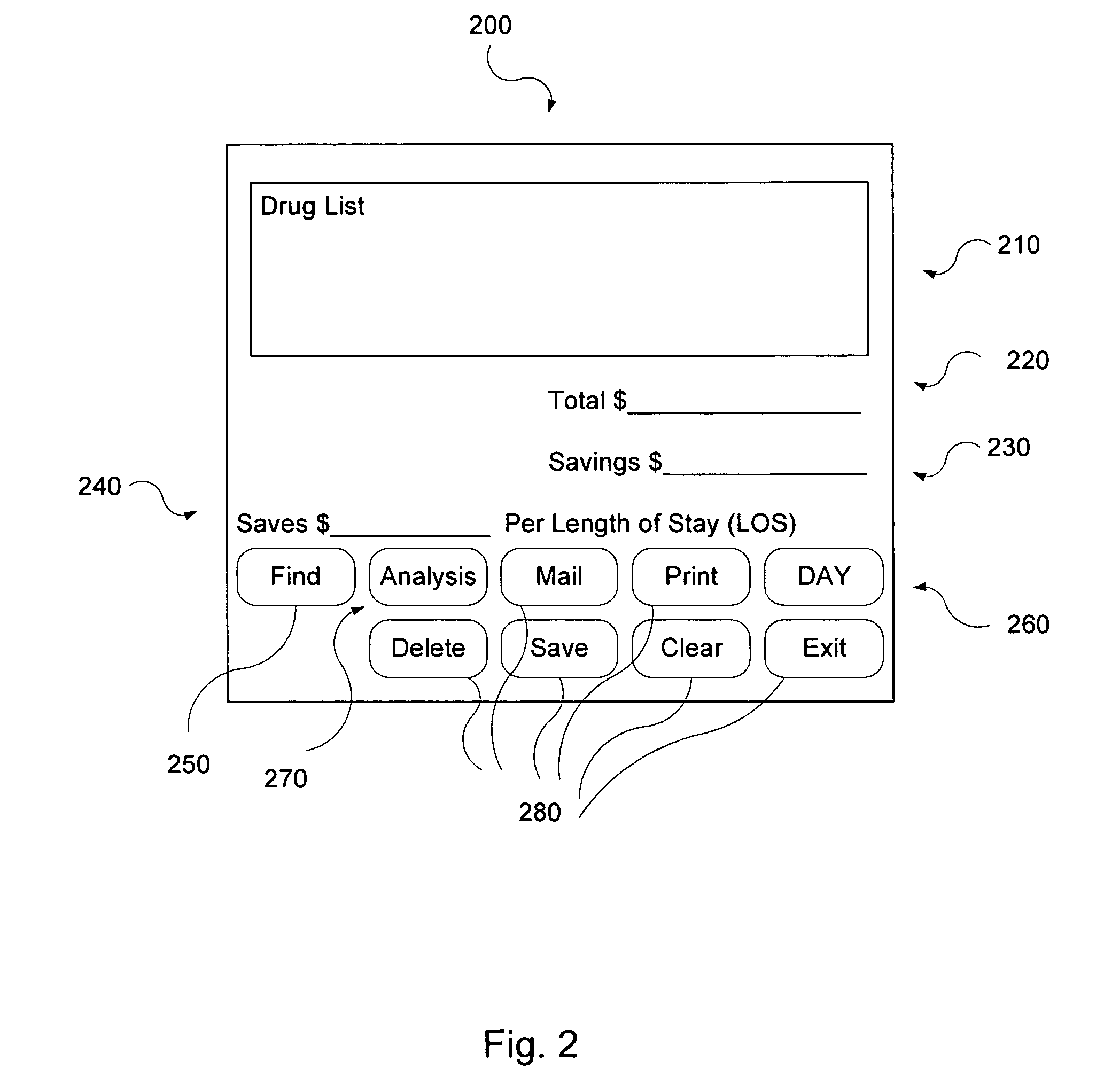

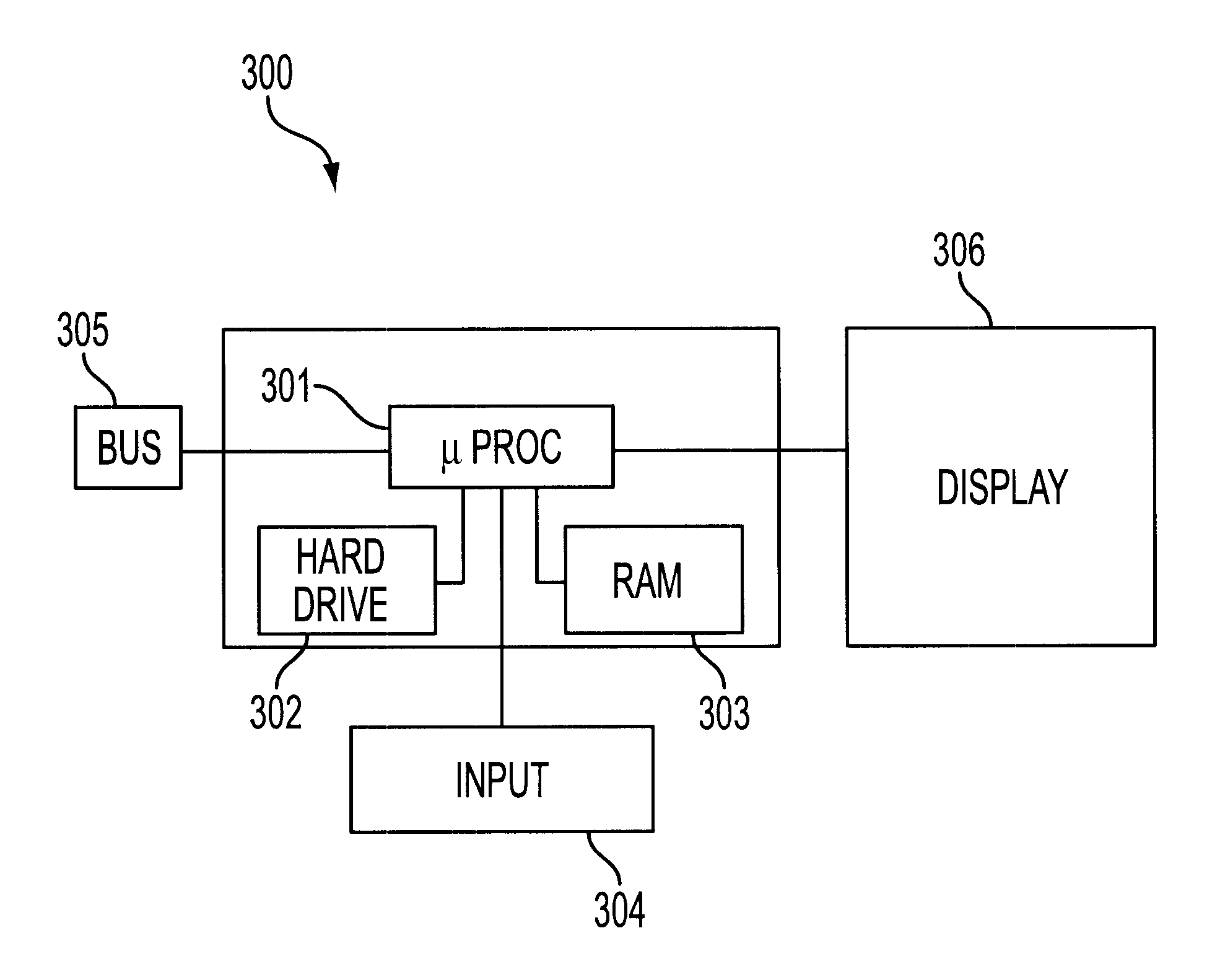

Preadmission health care cost and reimbursement estimation tool

InactiveUS20060080139A1Reduces nursing timeSpeed up admission processFinanceDrug referencesRegimenResource utilization

A cost estimation tool, preferably a handheld computer, prices and evaluates the financial impact of new residents' prior to admission. Immediate access to this information and built-in therapeutic substitution and clinical advisories provides the opportunity to optimize pharmaceutical regimens prior to admission. In addition, an abbreviated Resource Utilization Group (RUG) evaluation function provides a rapid assessment tool to project reimbursement under the Medicare Prospective Payment System (PPS). A user may enter a complete drug regimen and estimate the costs for the regimen. Similarly, managed care reimbursement from managed care organizations (MCOs) to be analyzed. Also, drug cost may be estimated through a MEDICAID Preferred Drug List database that identifies potential Non-Preferred drugs that may be non-compensable. The present invention further transmits results wirelessly to health care providers.

Owner:WOODHAVEN HEALTH SERVICES

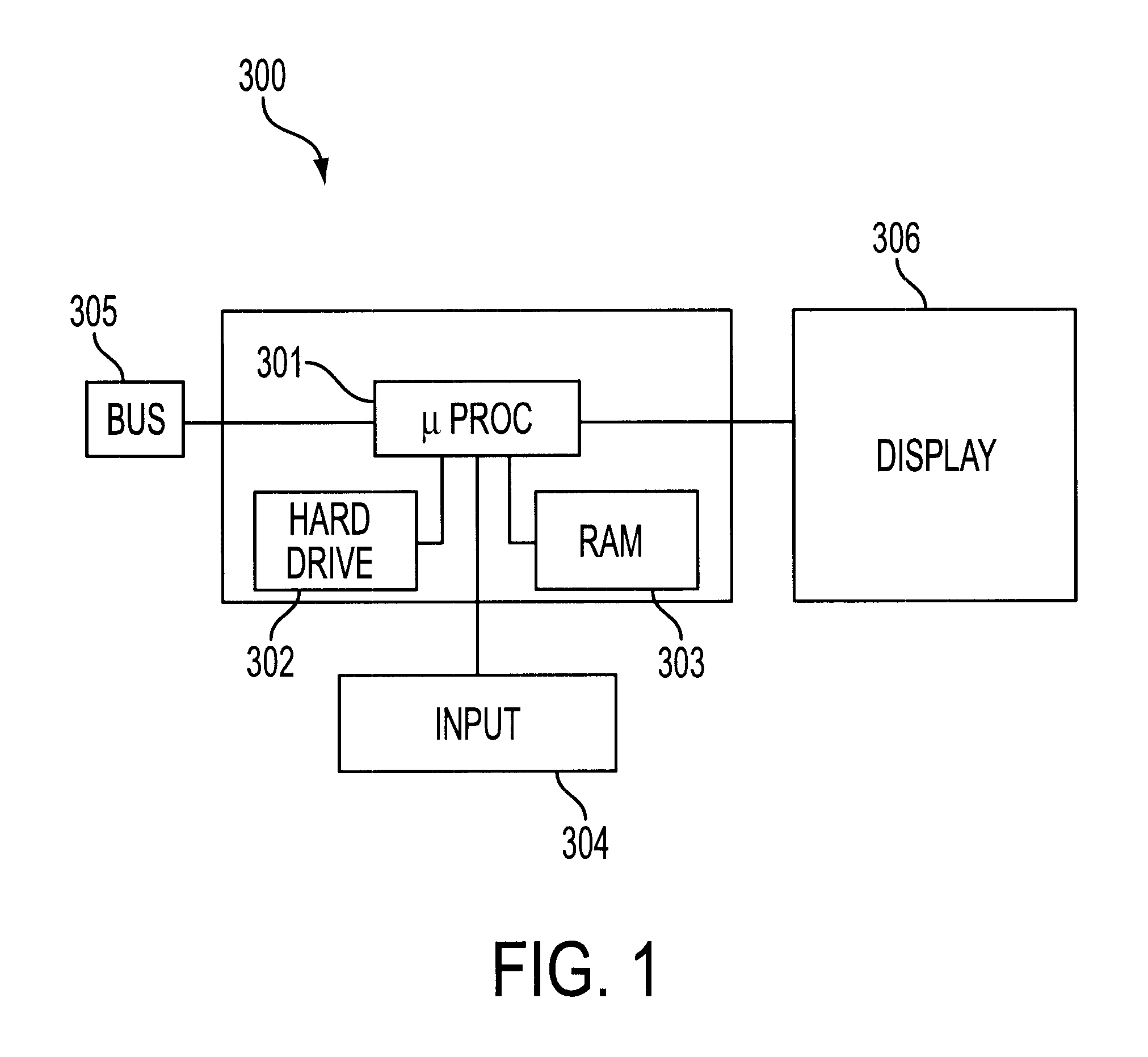

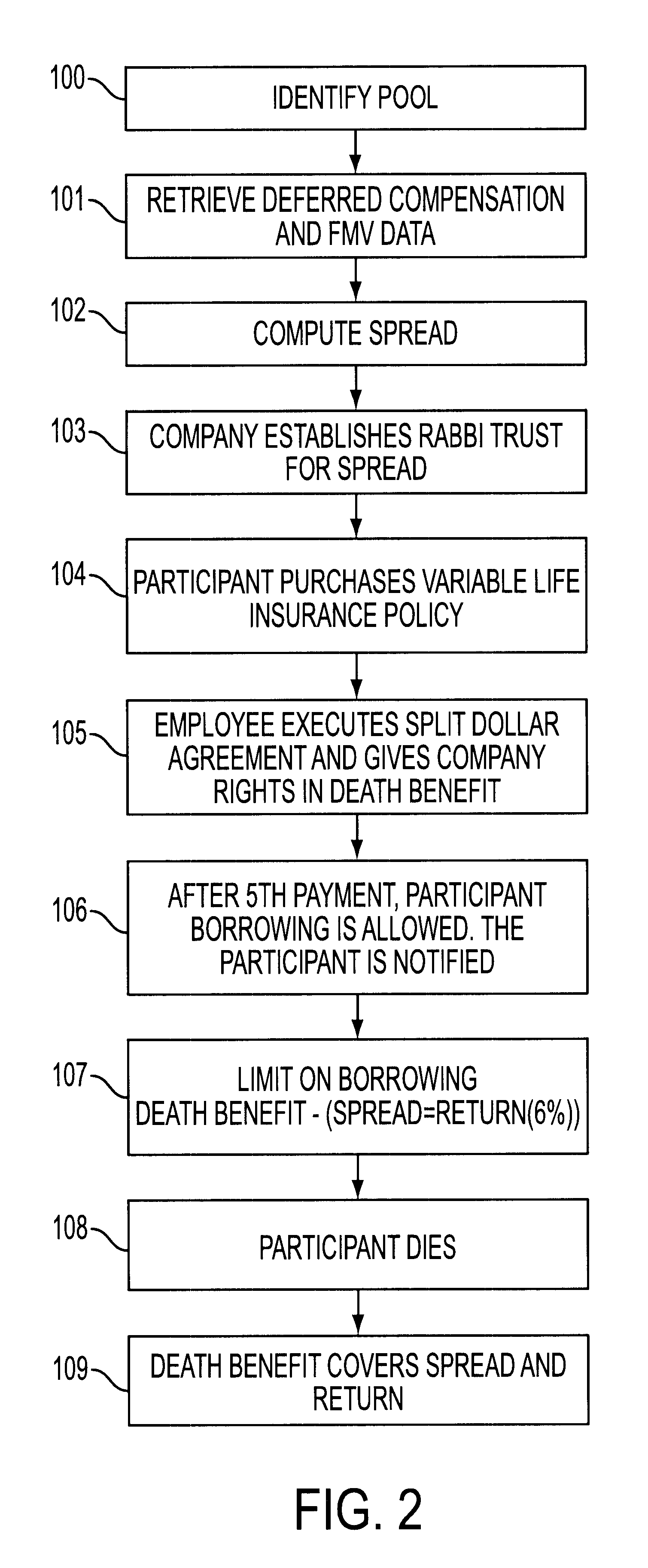

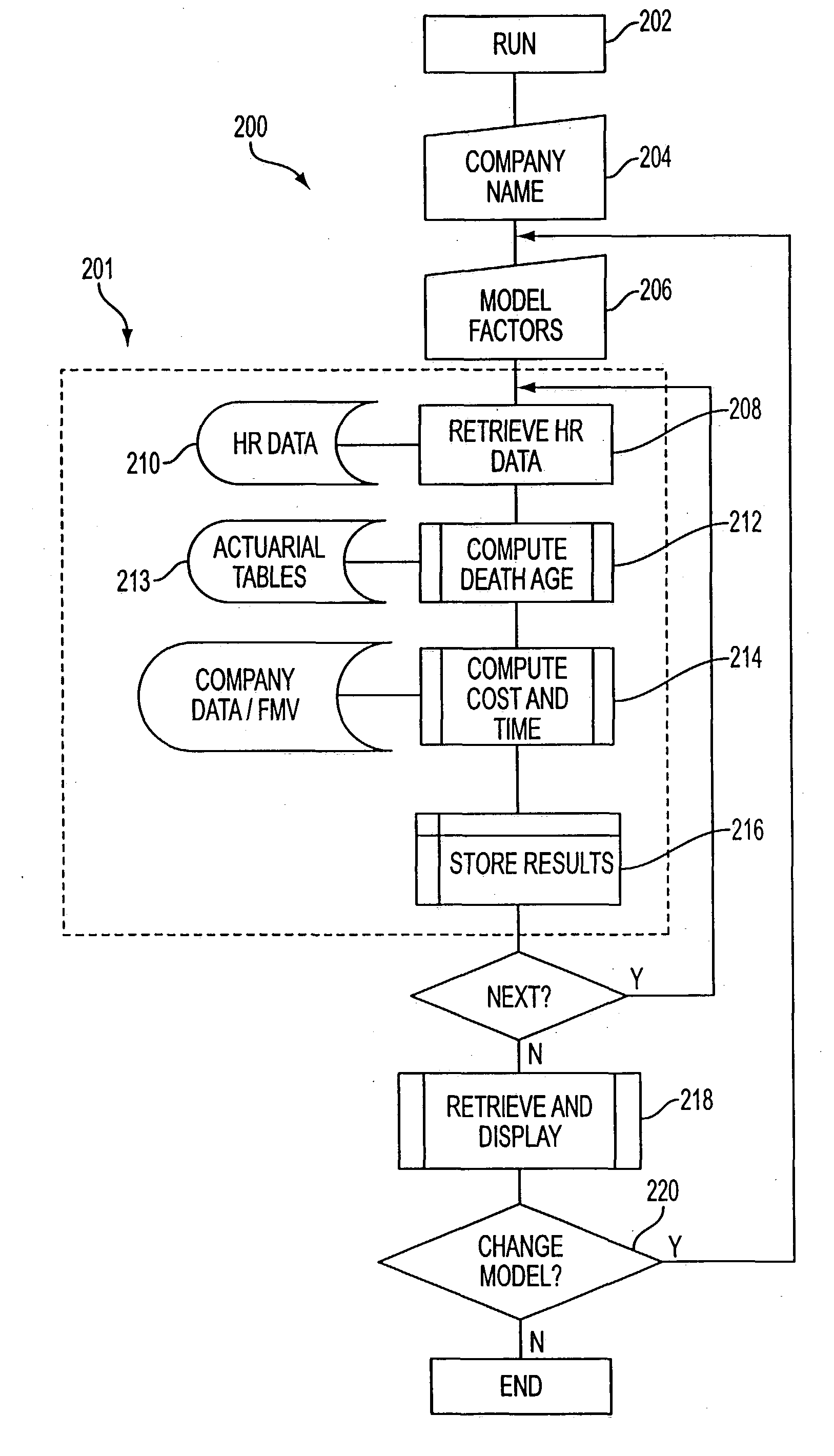

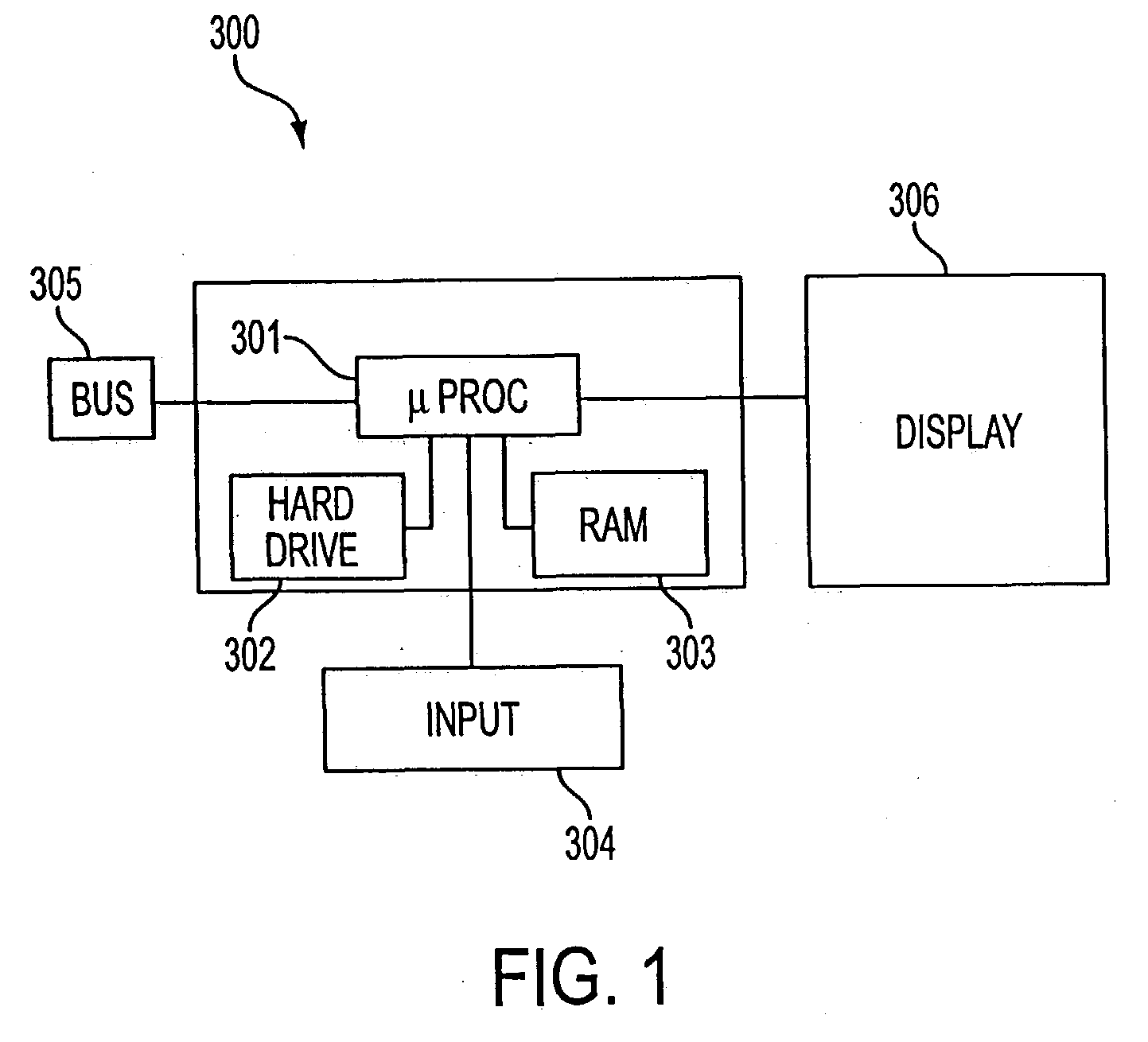

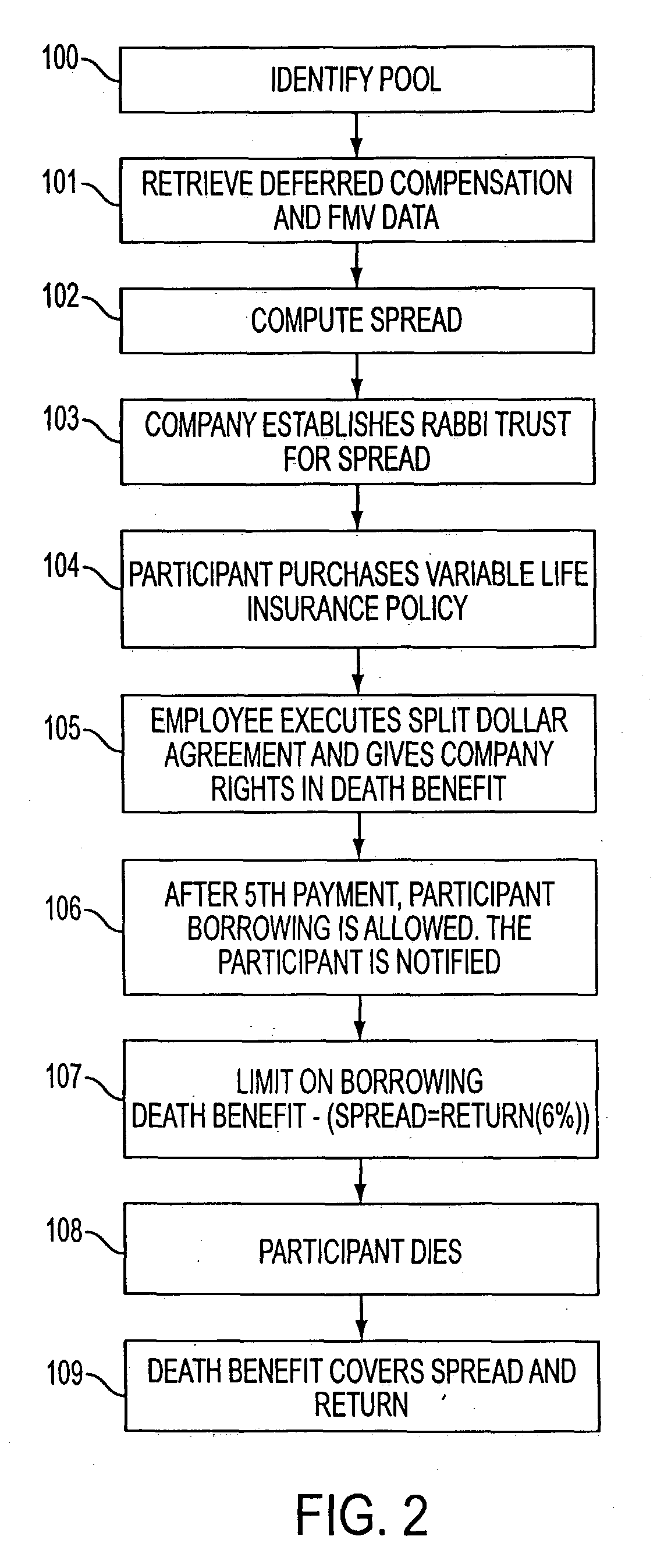

Method and apparatus for modeling and executing deferred award instrument plan

InactiveUS6609111B1Minimal impactMinimizes taxFinanceOffice automationProgram planningInsurance life

The present invention is directed to the administration of various deferred compensation programs that can effectively reduce an individual's income or estate tax by assisting a company in the identification of appropriate employees, and through the use of a novel modeling method and apparatus to implement a deferred compensation program through a novel Rabbi Trust maintenance plan that permits the employees to benefit from their deferred compensation (such as stock options or life insurance benefits), while having a minimal financial impact on the company.

Owner:BELL LAWRENCE L

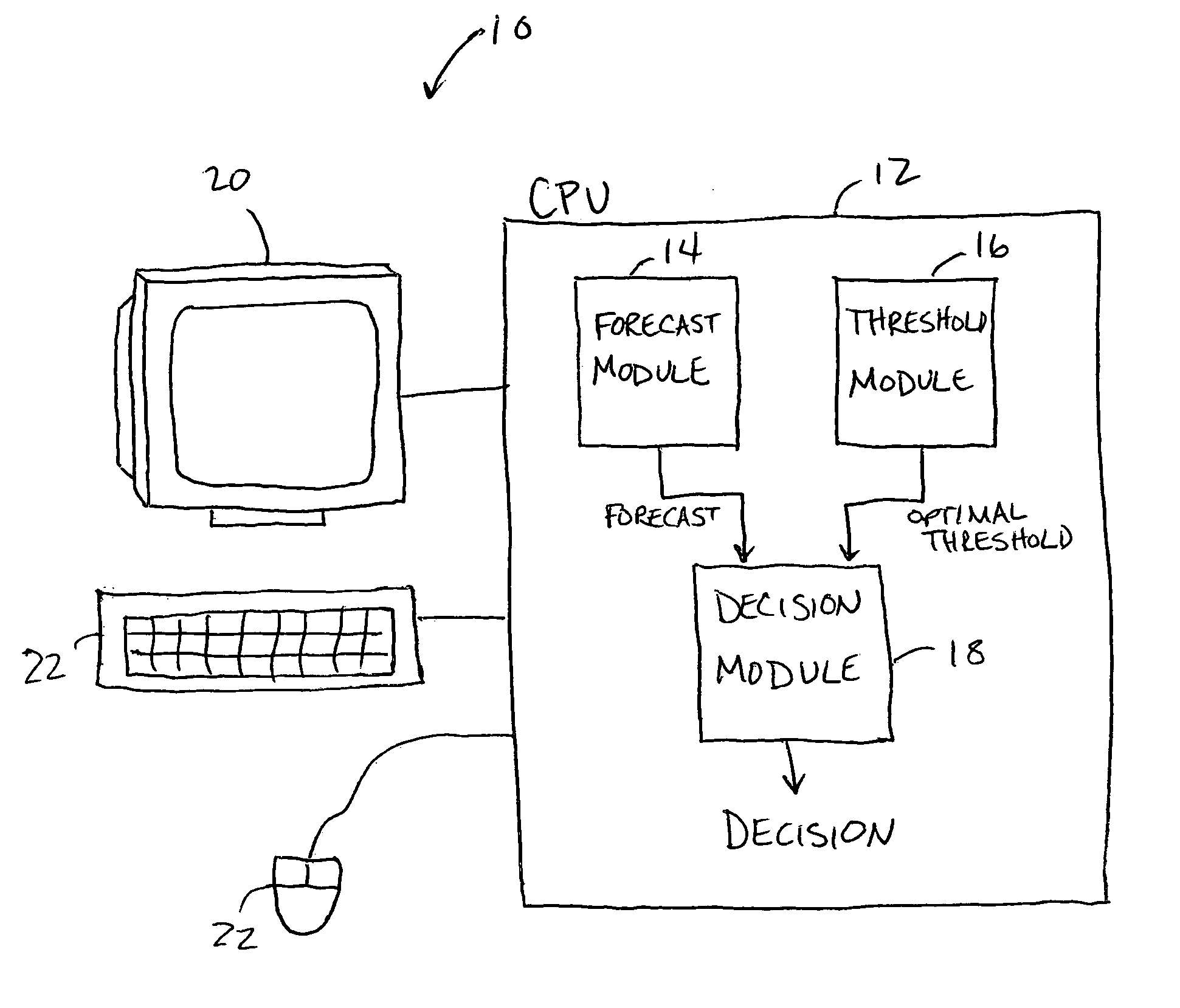

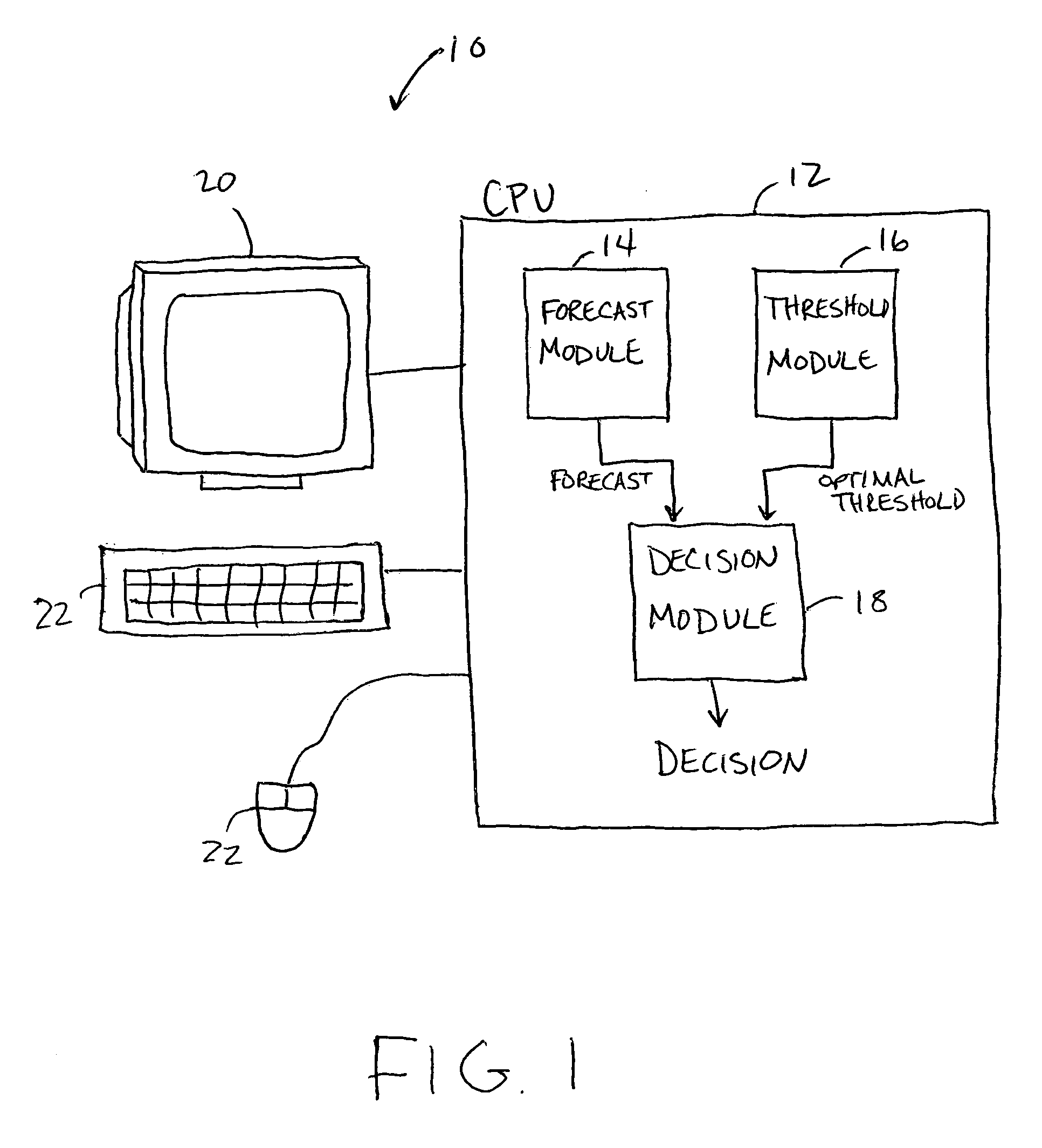

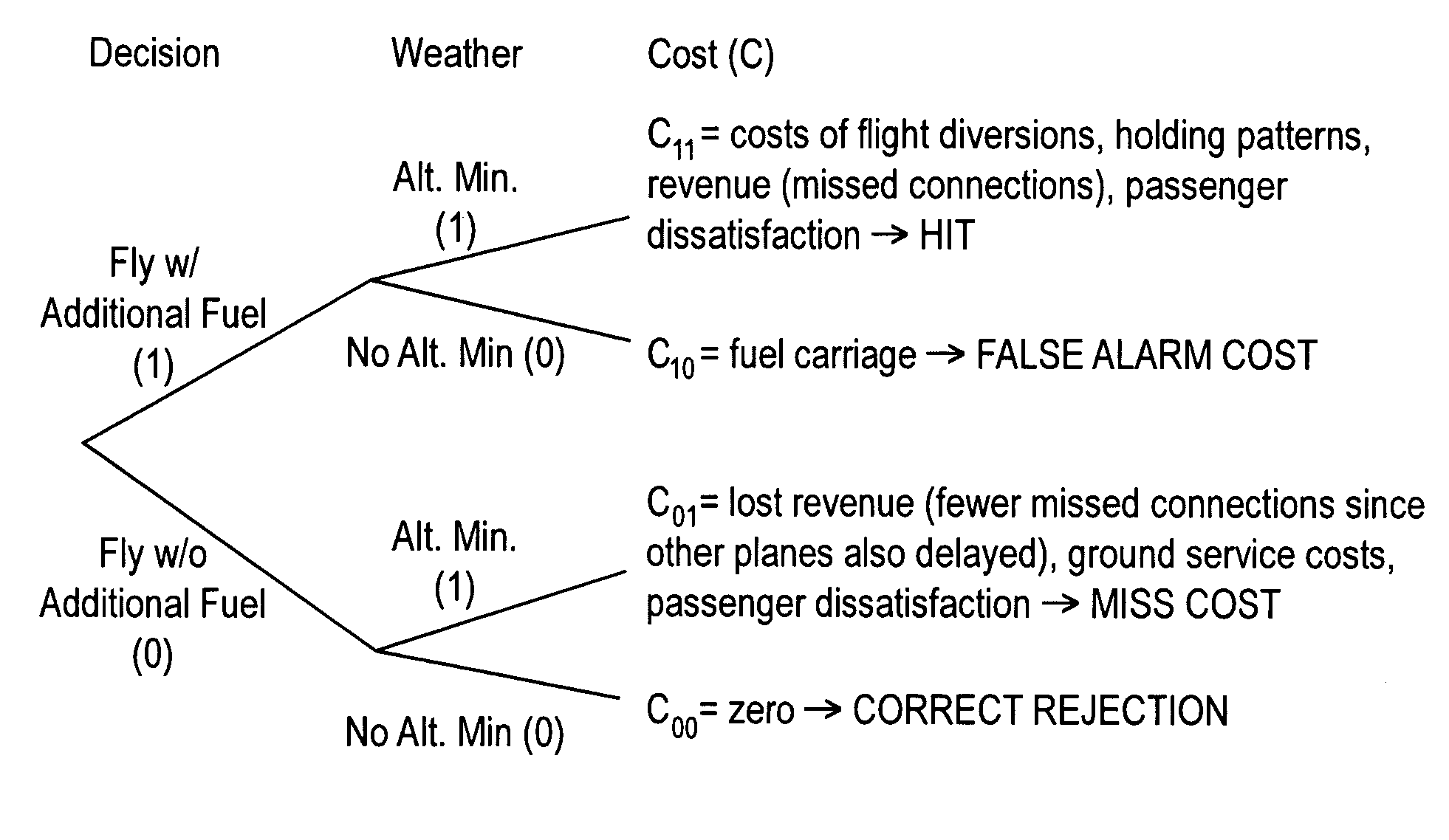

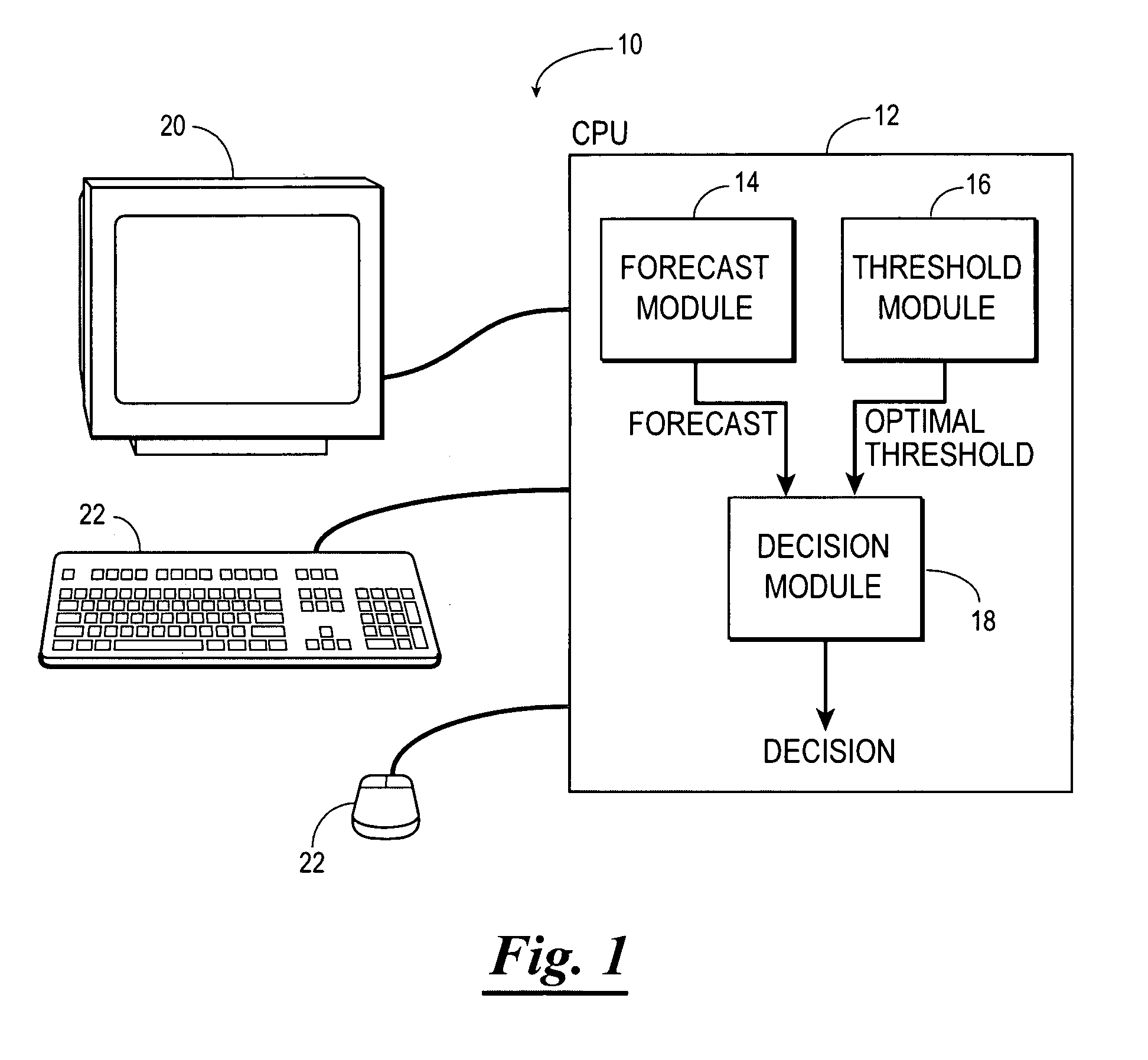

Forecast decision system and method

InactiveUS20060085164A1Increase valueGreat forecast valueAnalogue computers for vehiclesAnalogue computers for trafficVisibilityDecision system

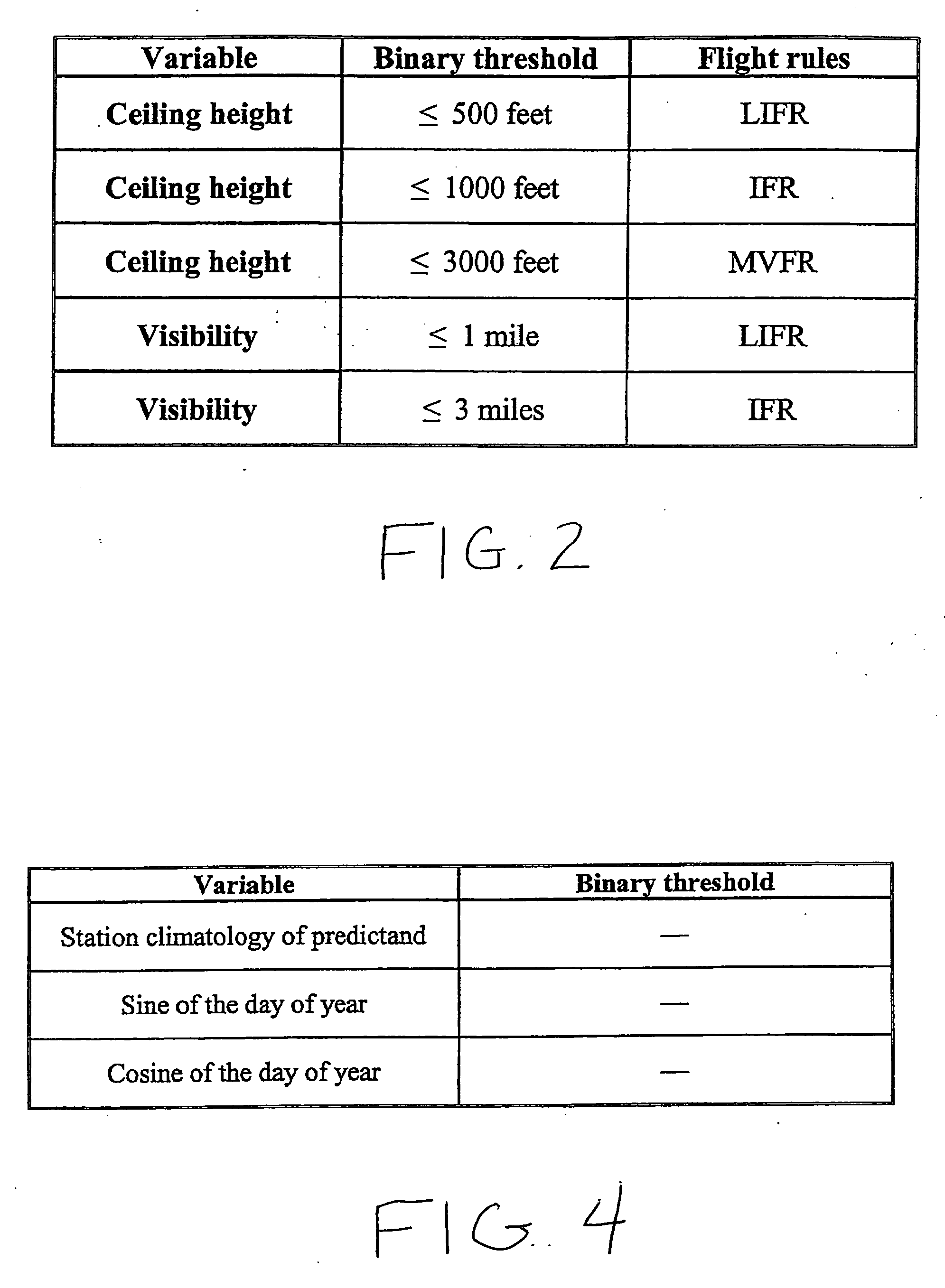

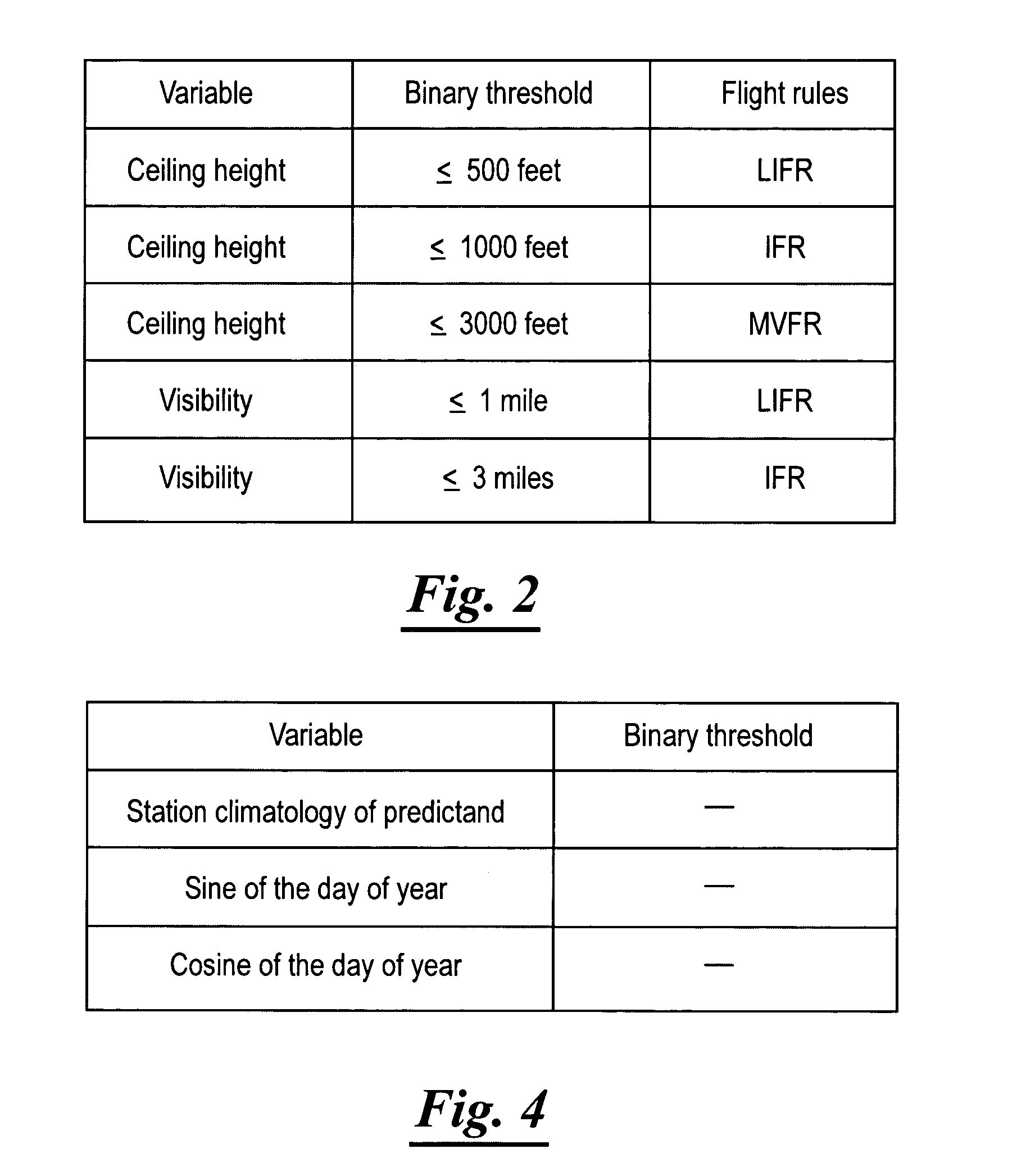

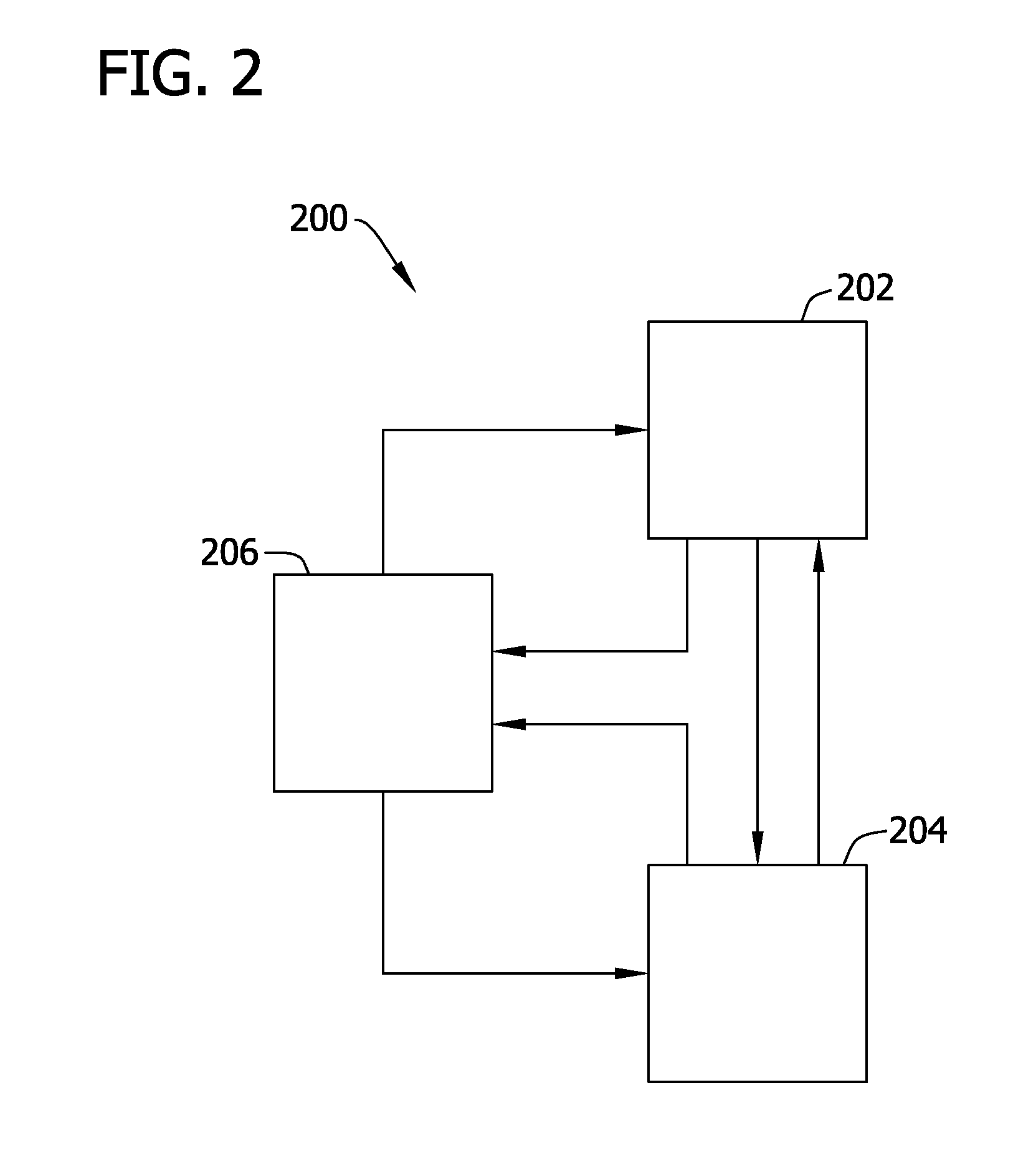

A system and method for making a decision of whether to carry additional fuel on an aircraft for a particular flight based on a forecast, such as for low visibility and ceiling. Preferably, observations-based probabilistic forecasts are utilized. The forecast probability of the weather at the planned aerodrome being below a prescribed minimum level is calculated using statistical regression analysis of past data. An optimal probability is estimated using cost parameters on an individual flight bases. If this forecast probability is greater than the optimal probability for a particular flight, then extra fuel is carried by that flight. This is in contrast to current practice whereby the same categorical forecast is applied to all flights. The combination of improved short-term forecasts and identification of optimal forecast probabilities minimizes the financial impact of errors and weather forecasts on airline operations thereby providing a superior financial outcome.

Owner:RGT UNIV OF OKLAHOMA THE BOARD THE

Domain specific return on investment model system and method of use

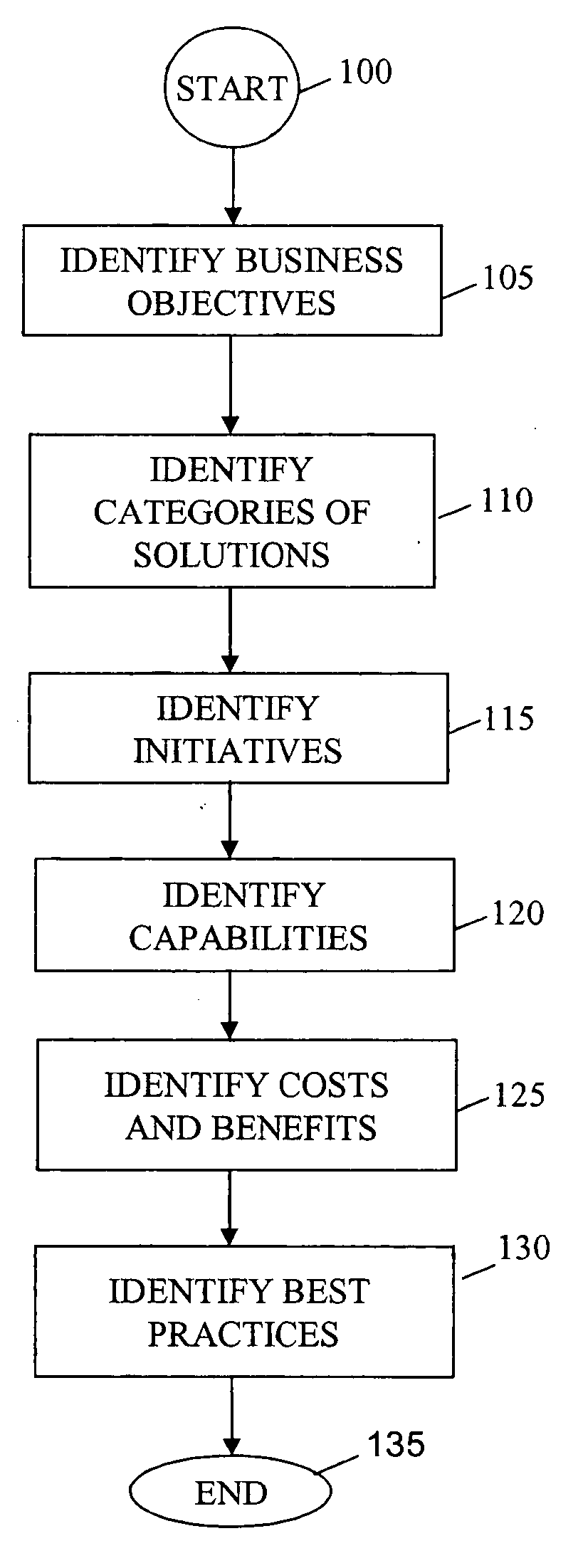

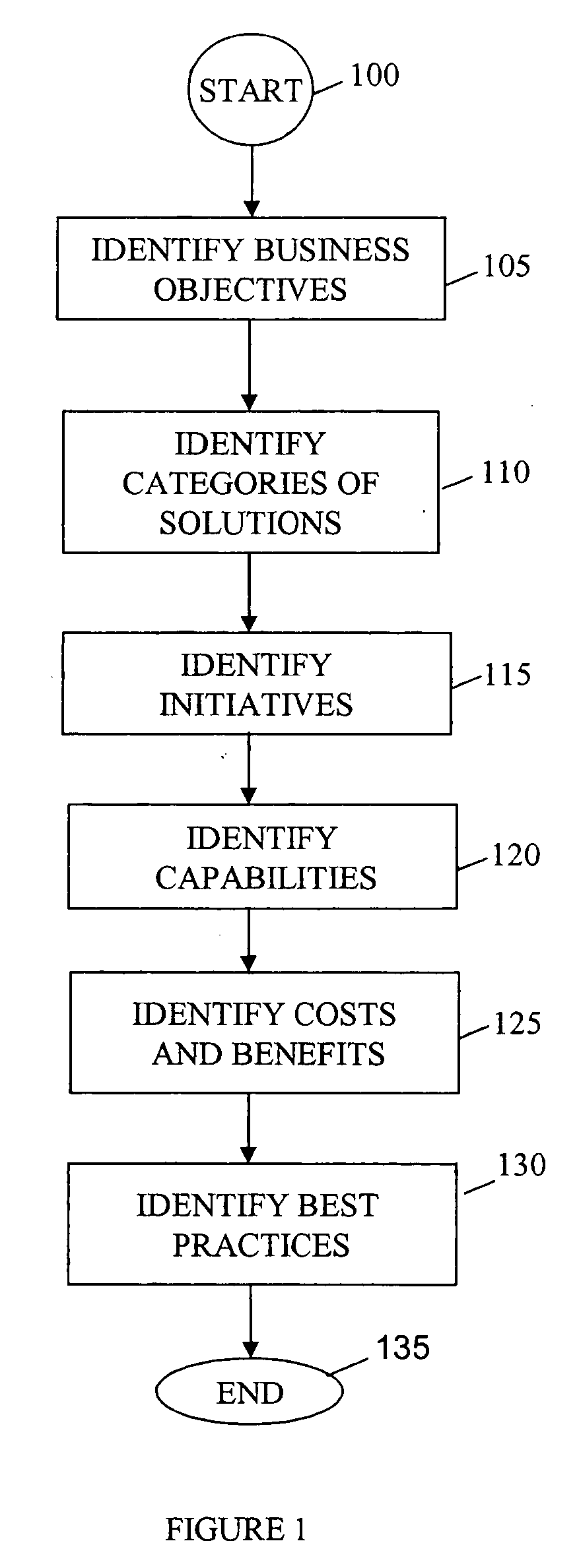

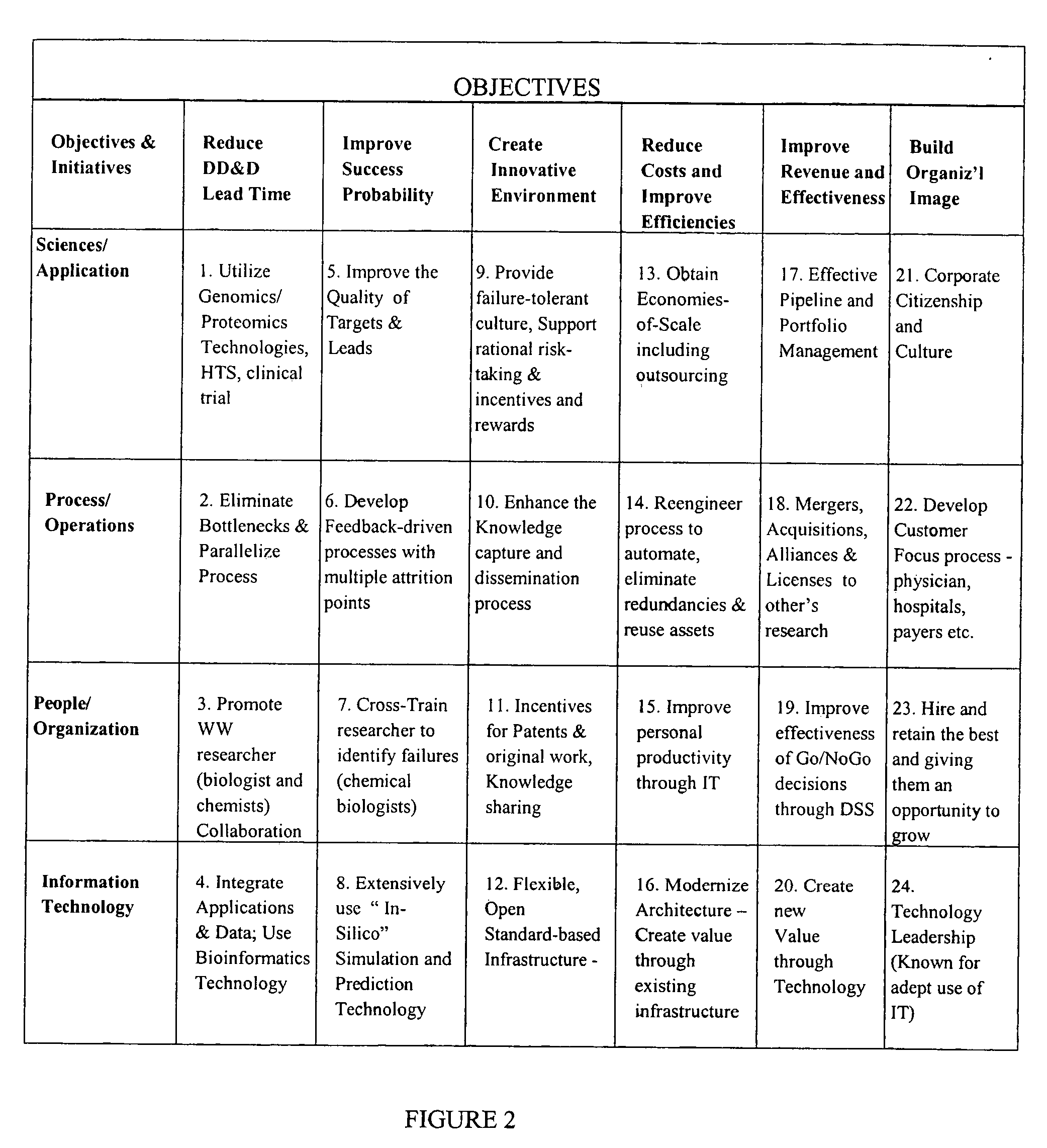

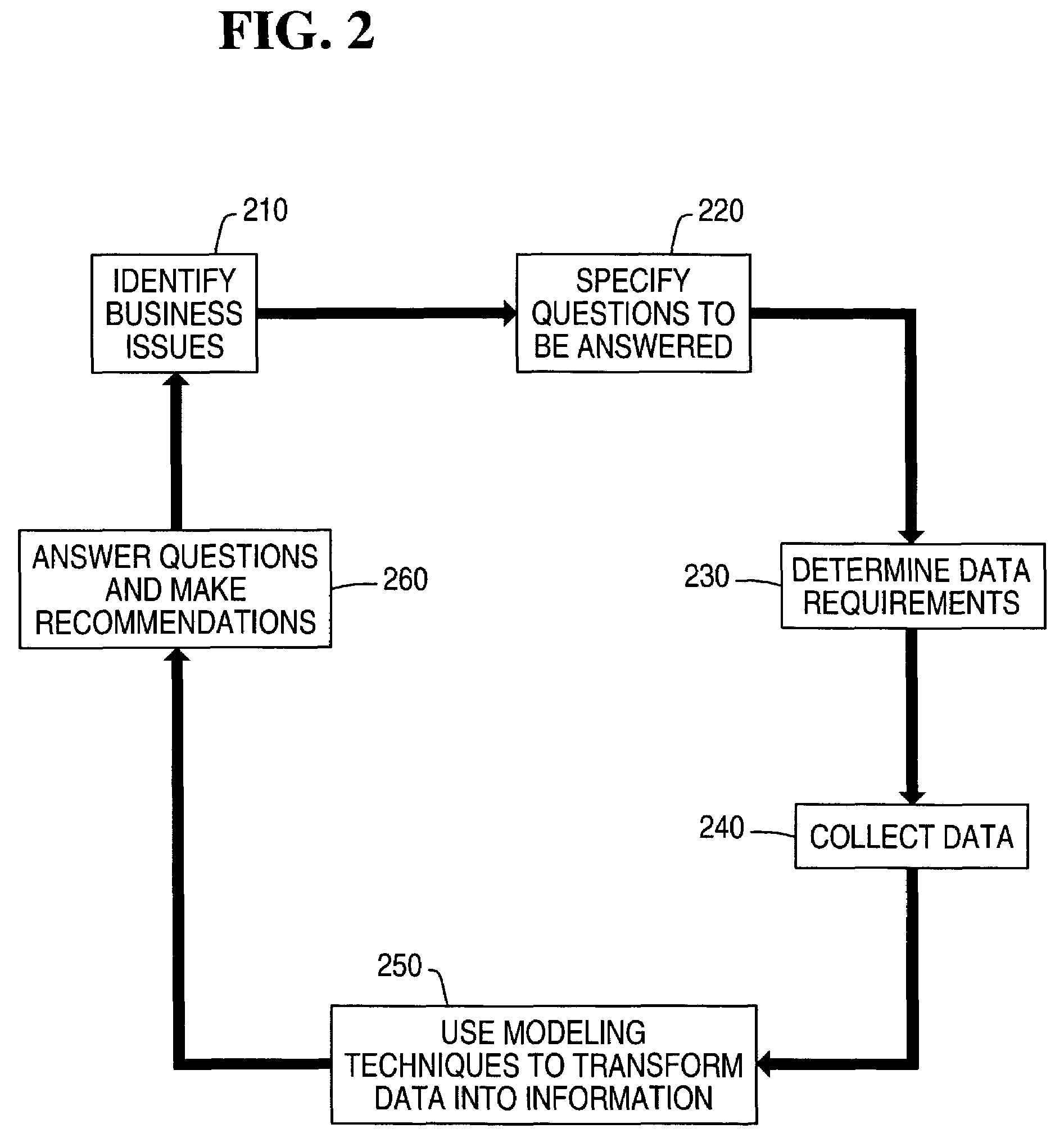

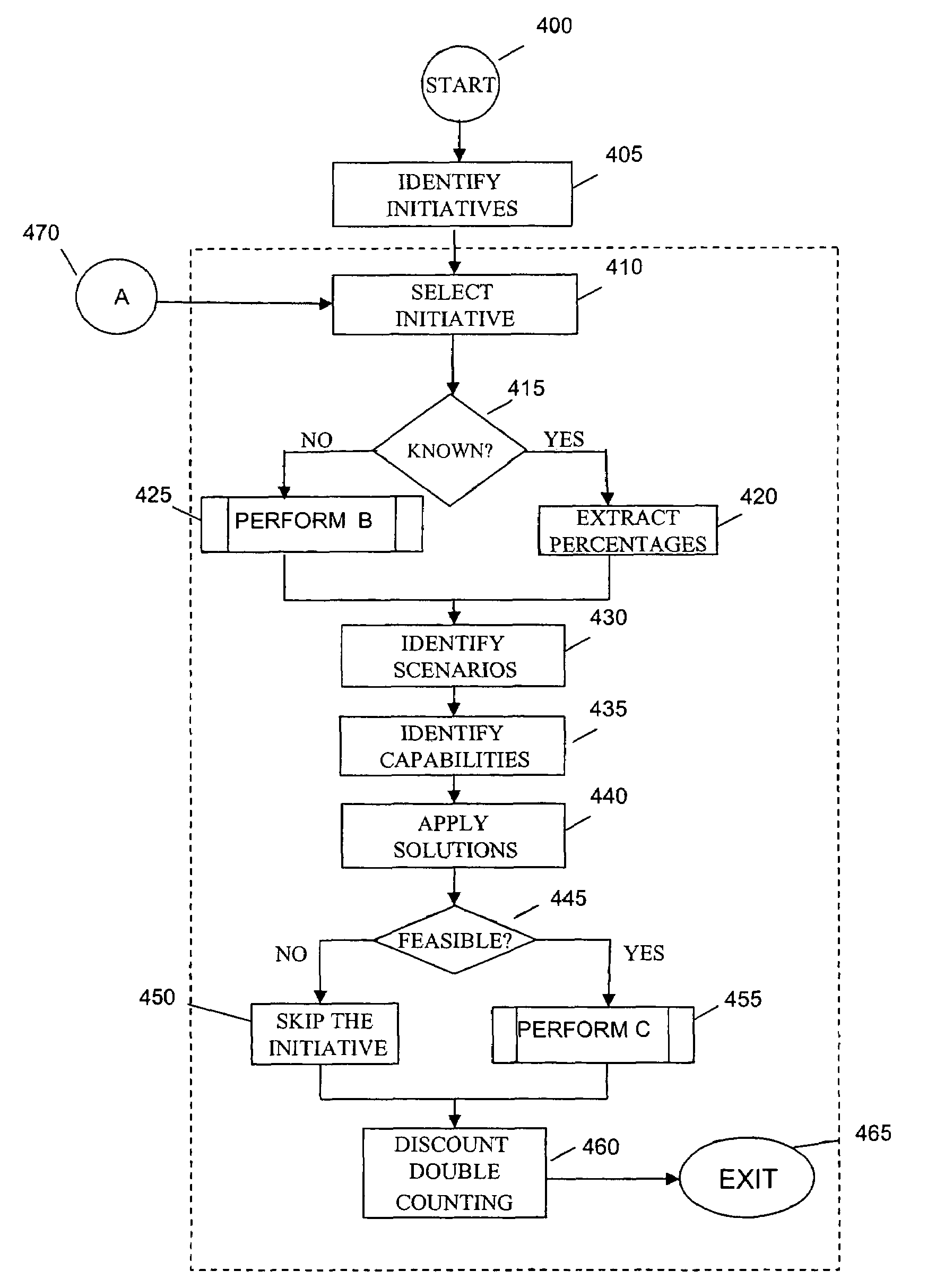

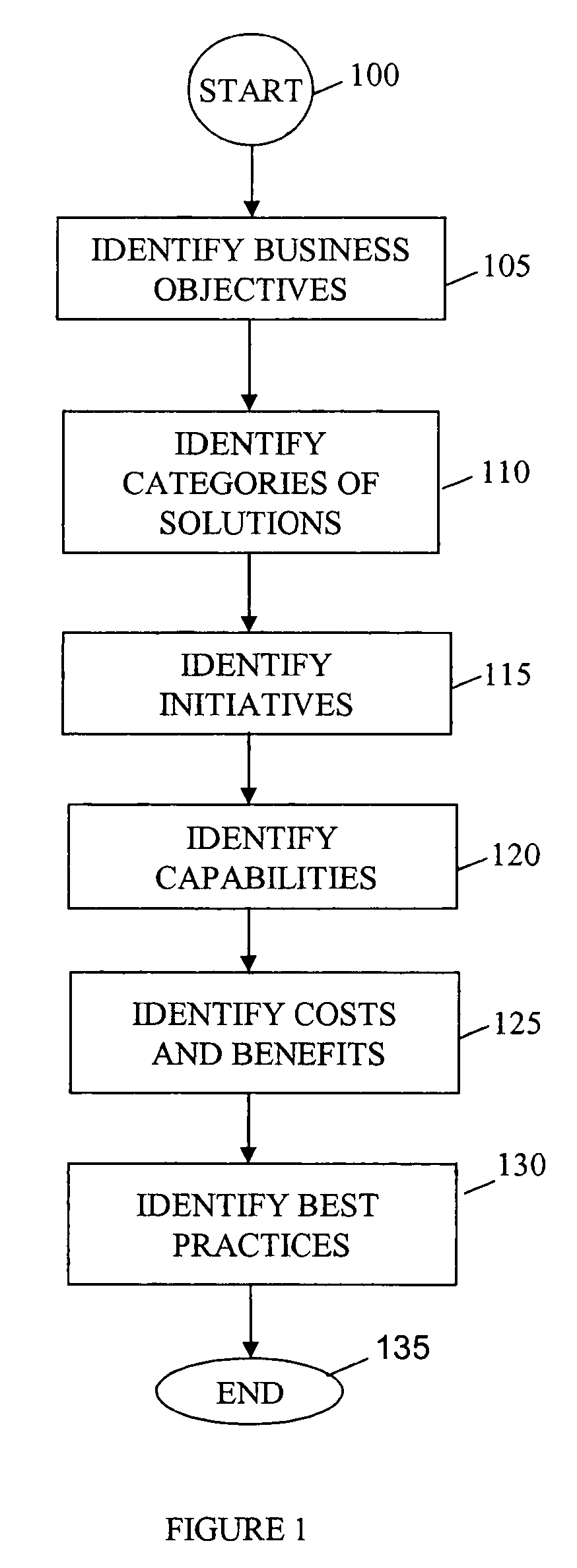

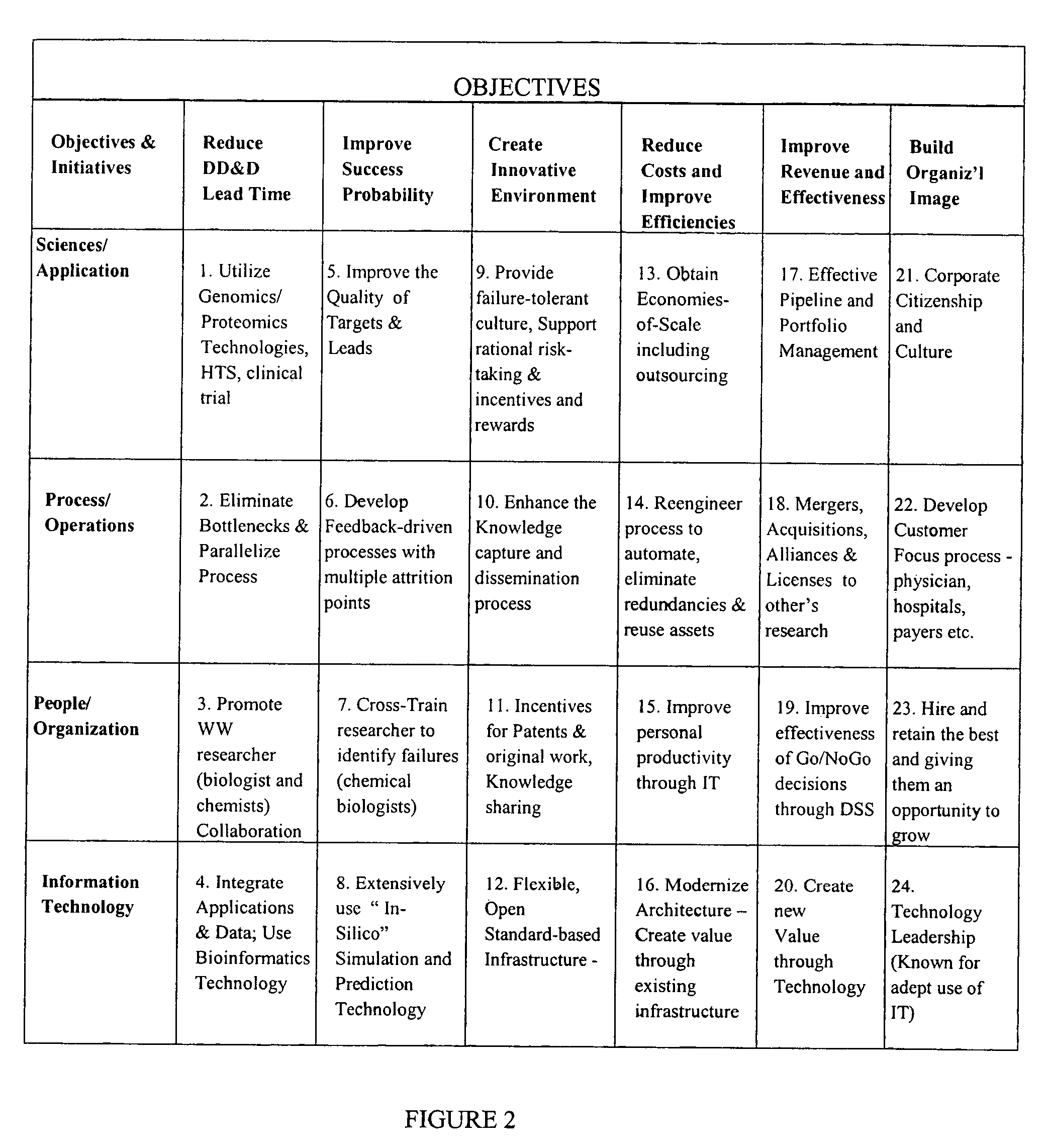

A system and method for creating and executing a business model for domain specific decisions to compare possible alternative business solutions to maximize results is provided. A domain-specific return on investment (ROI) or financial measurements model and a calculator for buying and selling information technology based solutions targeted at improving overall business efficiency and effectiveness. This may include, for example, reducing lead time, improving probability of success, creating an innovative environment, enhancing corporate image, reducing cost and improving revenues, or the like. These business objectives may be connected to the capabilities provided by vendor solutions which might be based on technology, process, people, science, or the like, typically through concrete initiatives. Alternative solution components may be quantified and used to calculate financial impacts for various solution choices.

Owner:SERVICENOW INC +1

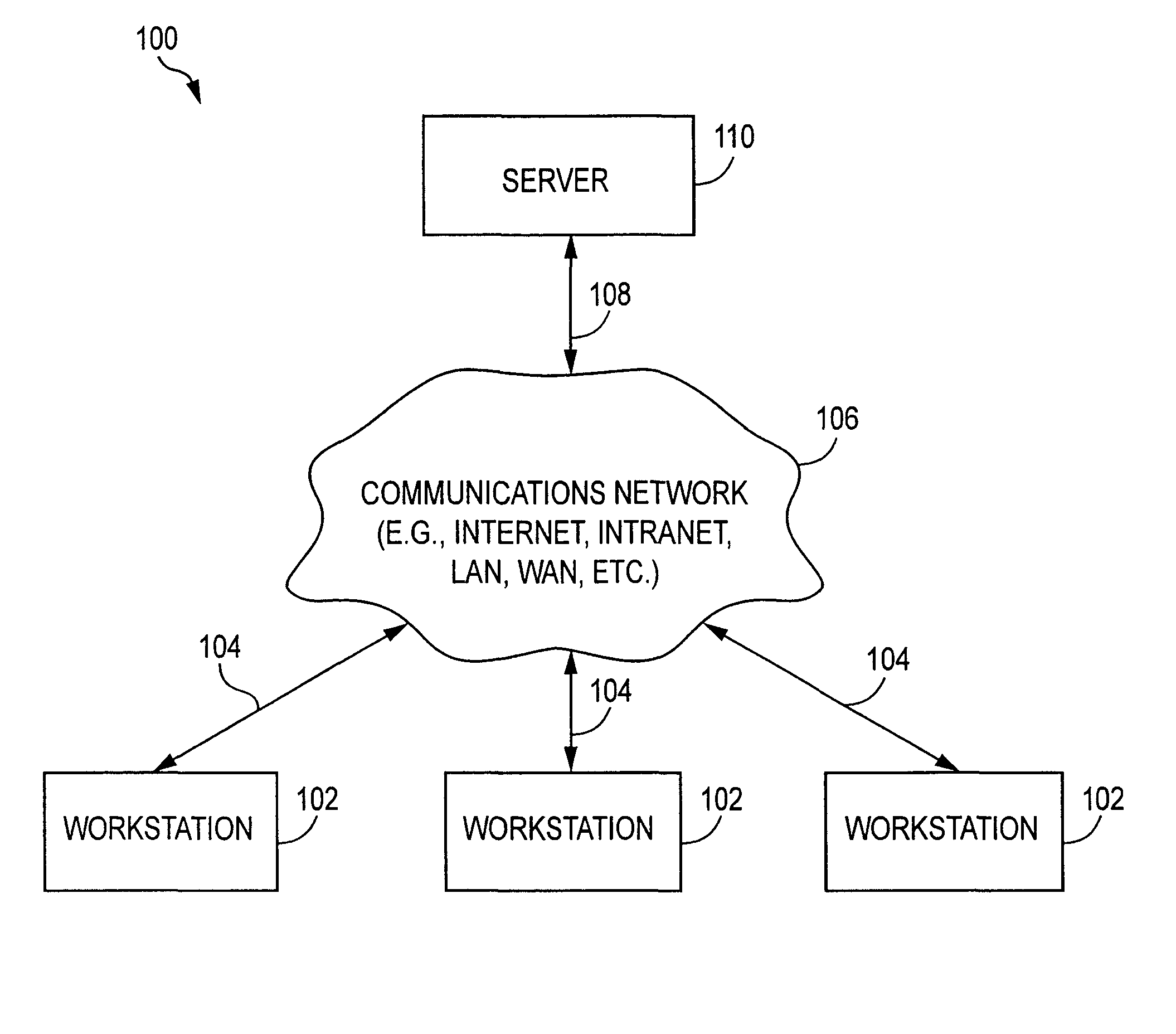

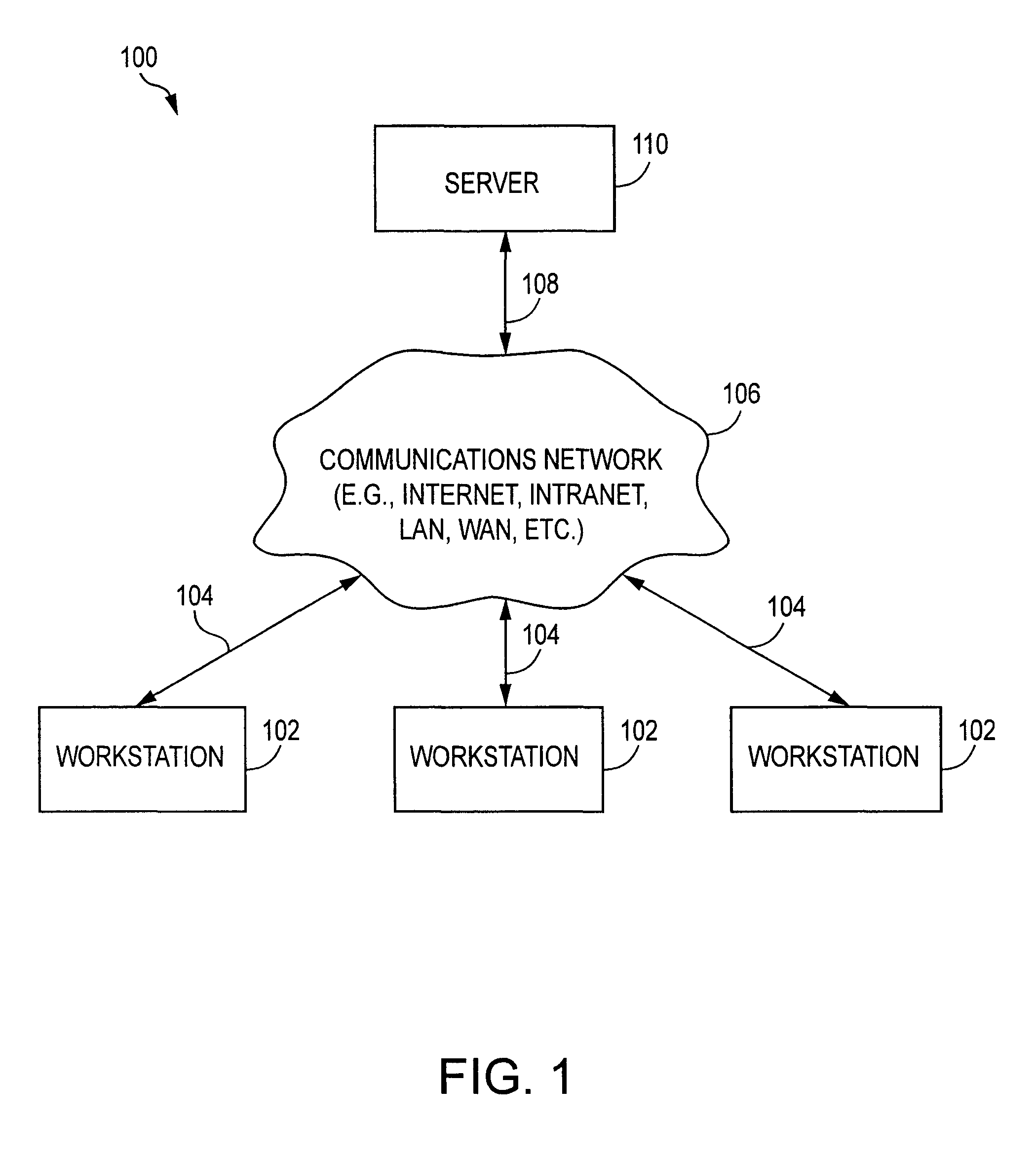

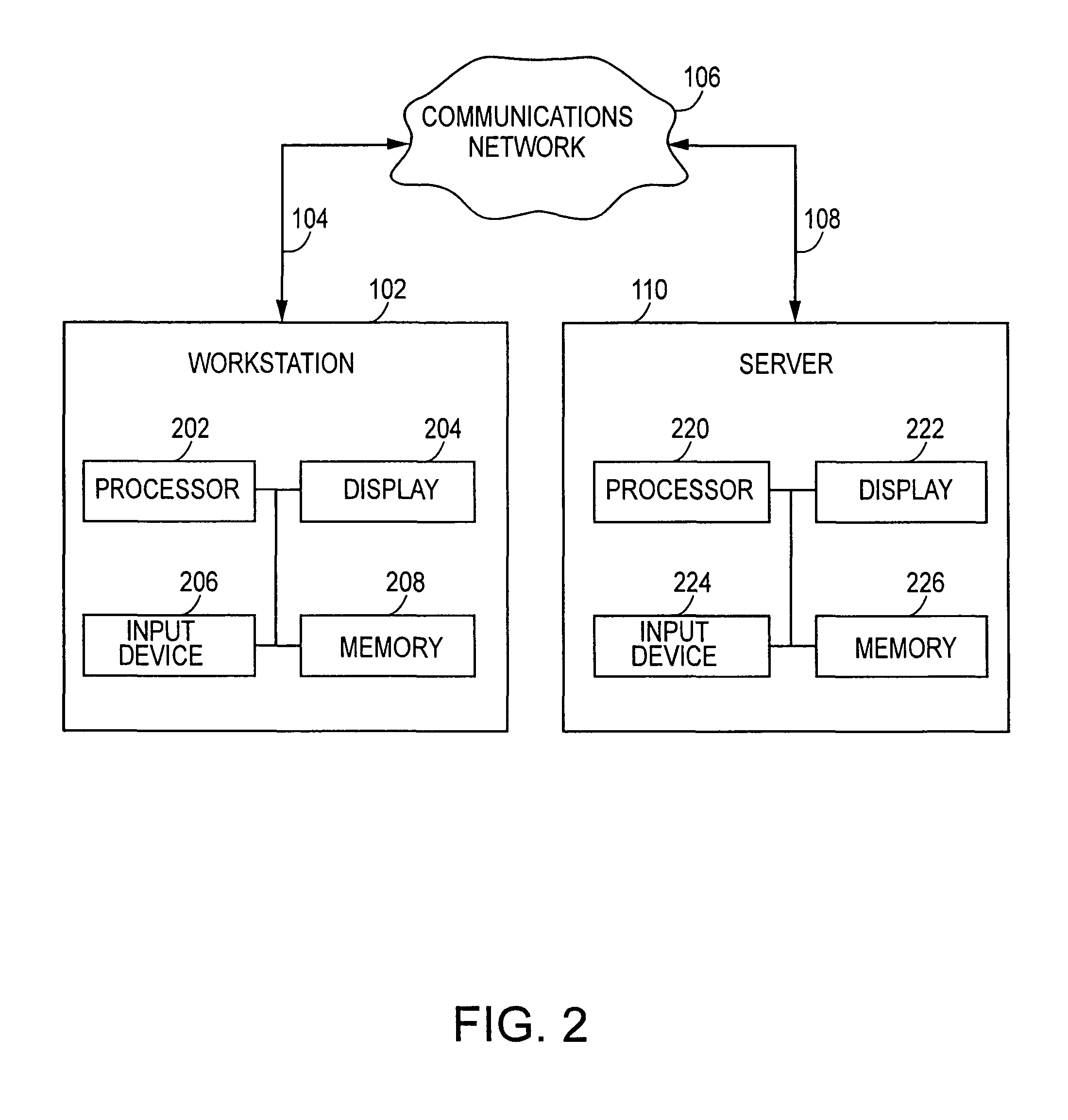

Analysis of multiple assets in view of uncertainties

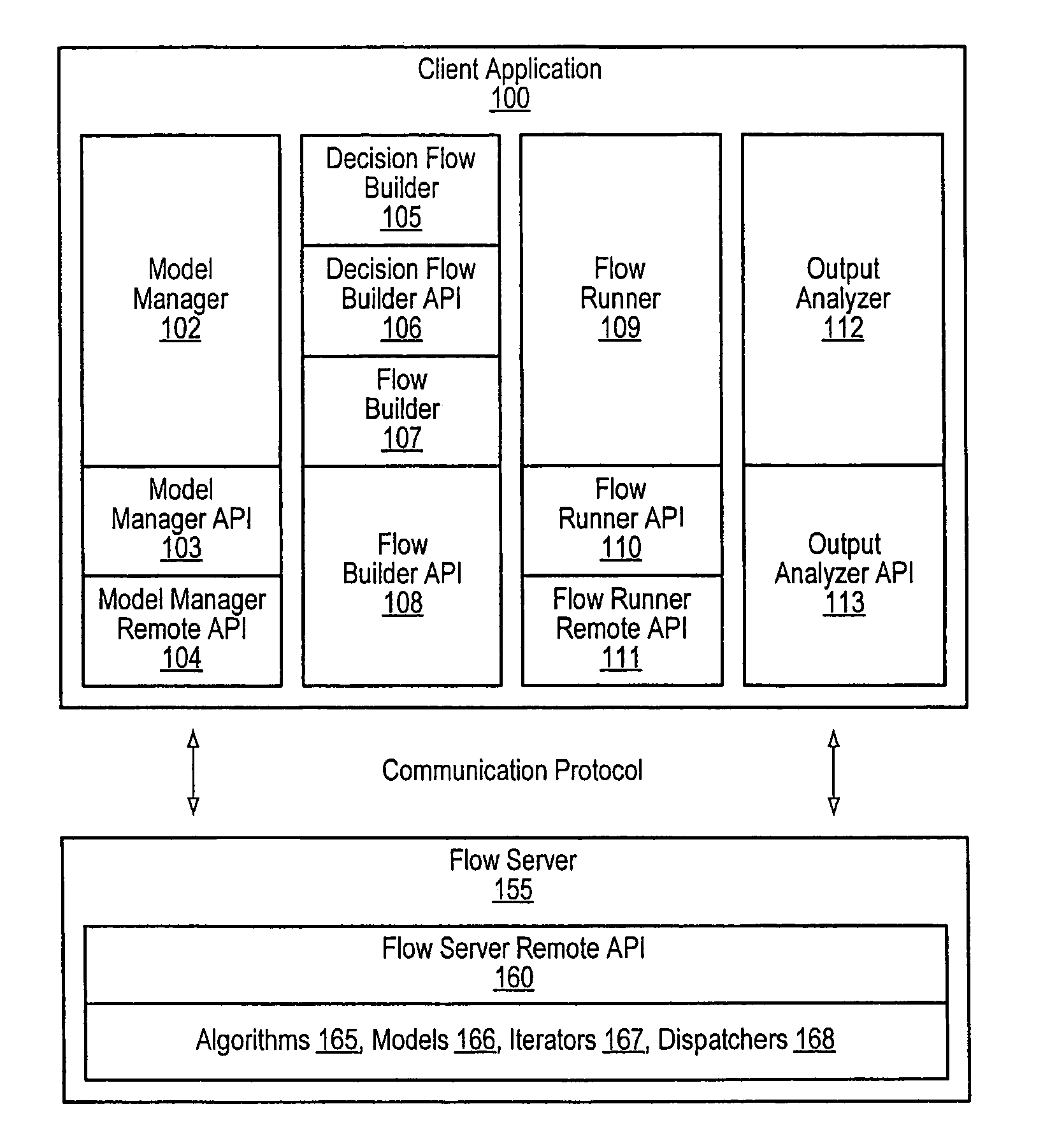

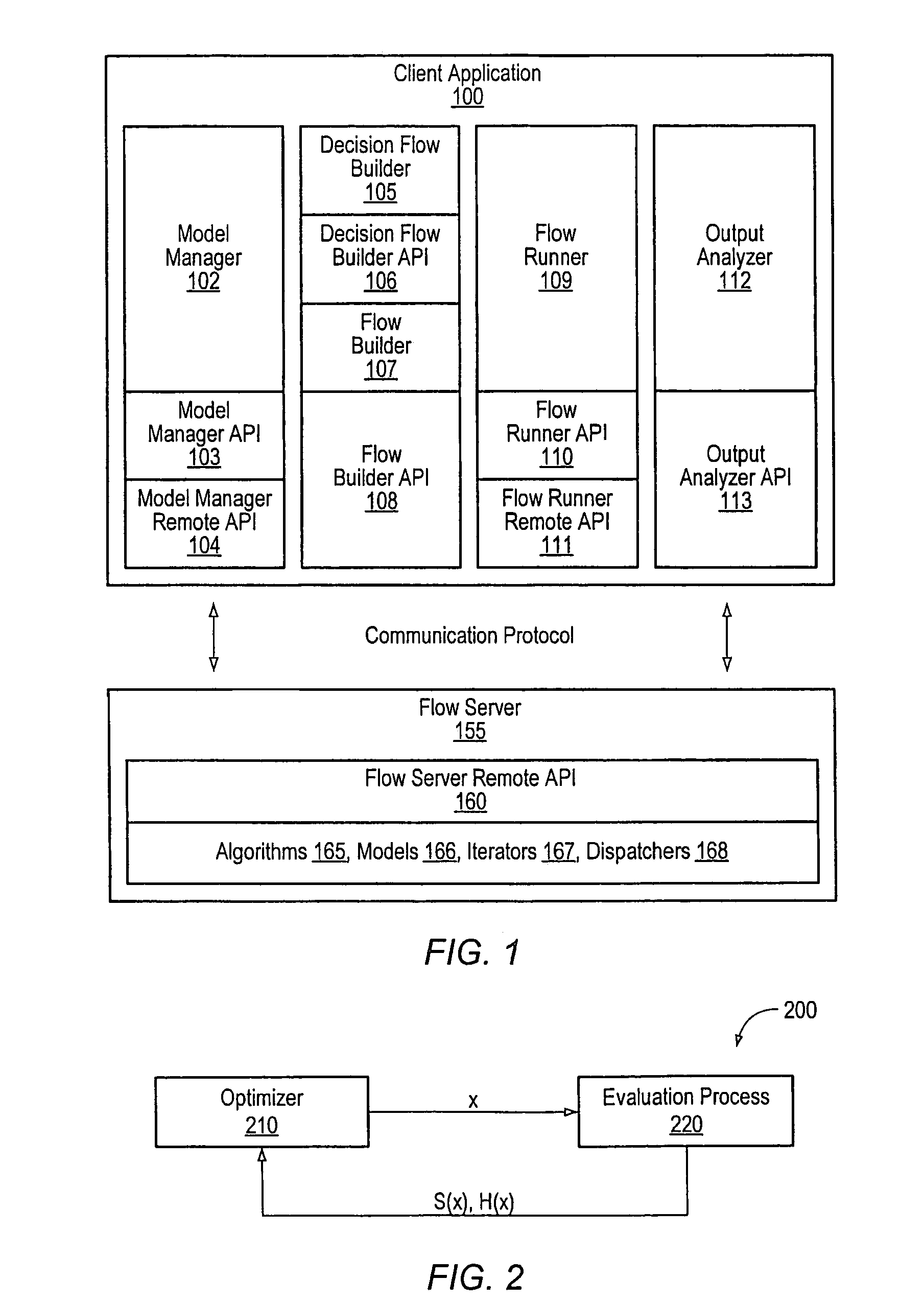

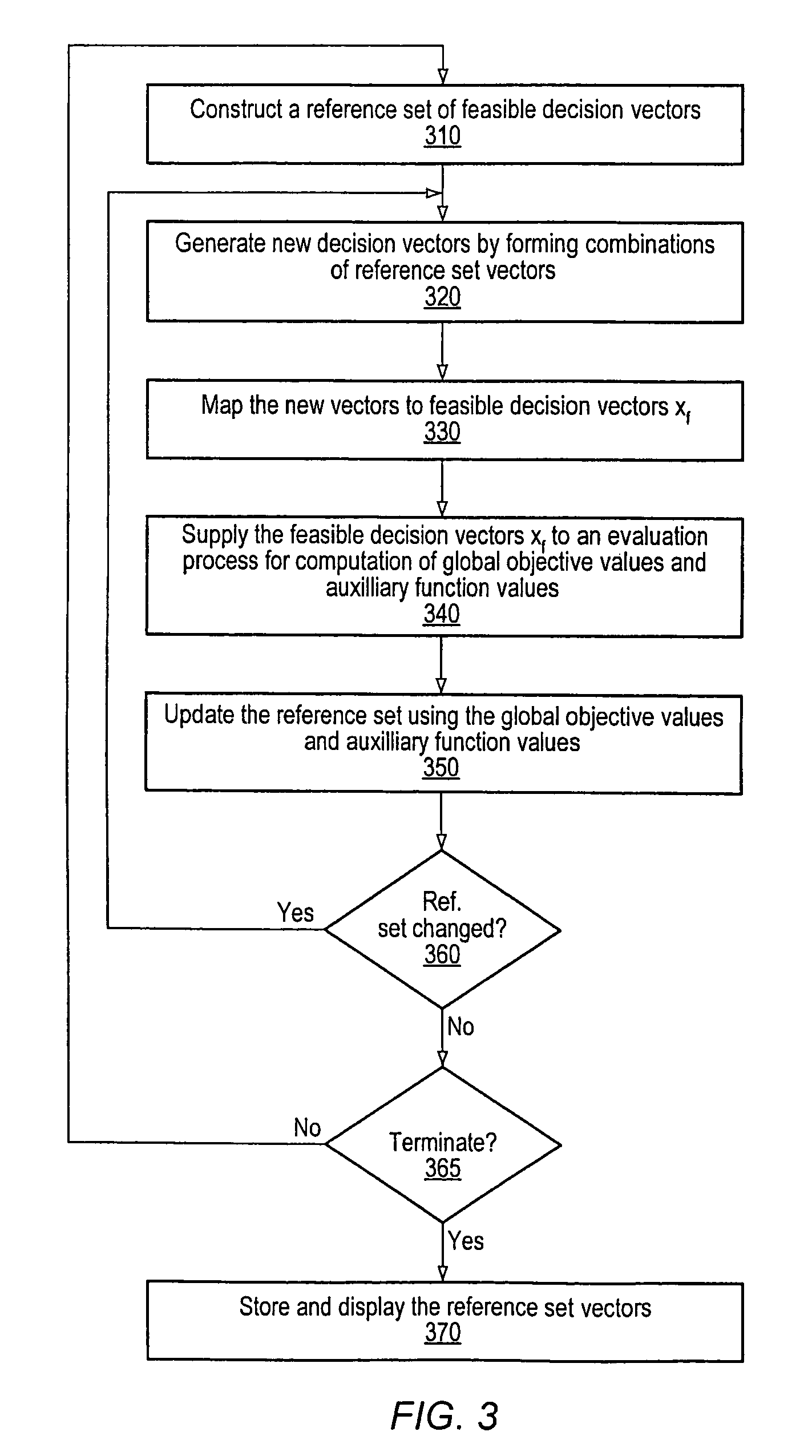

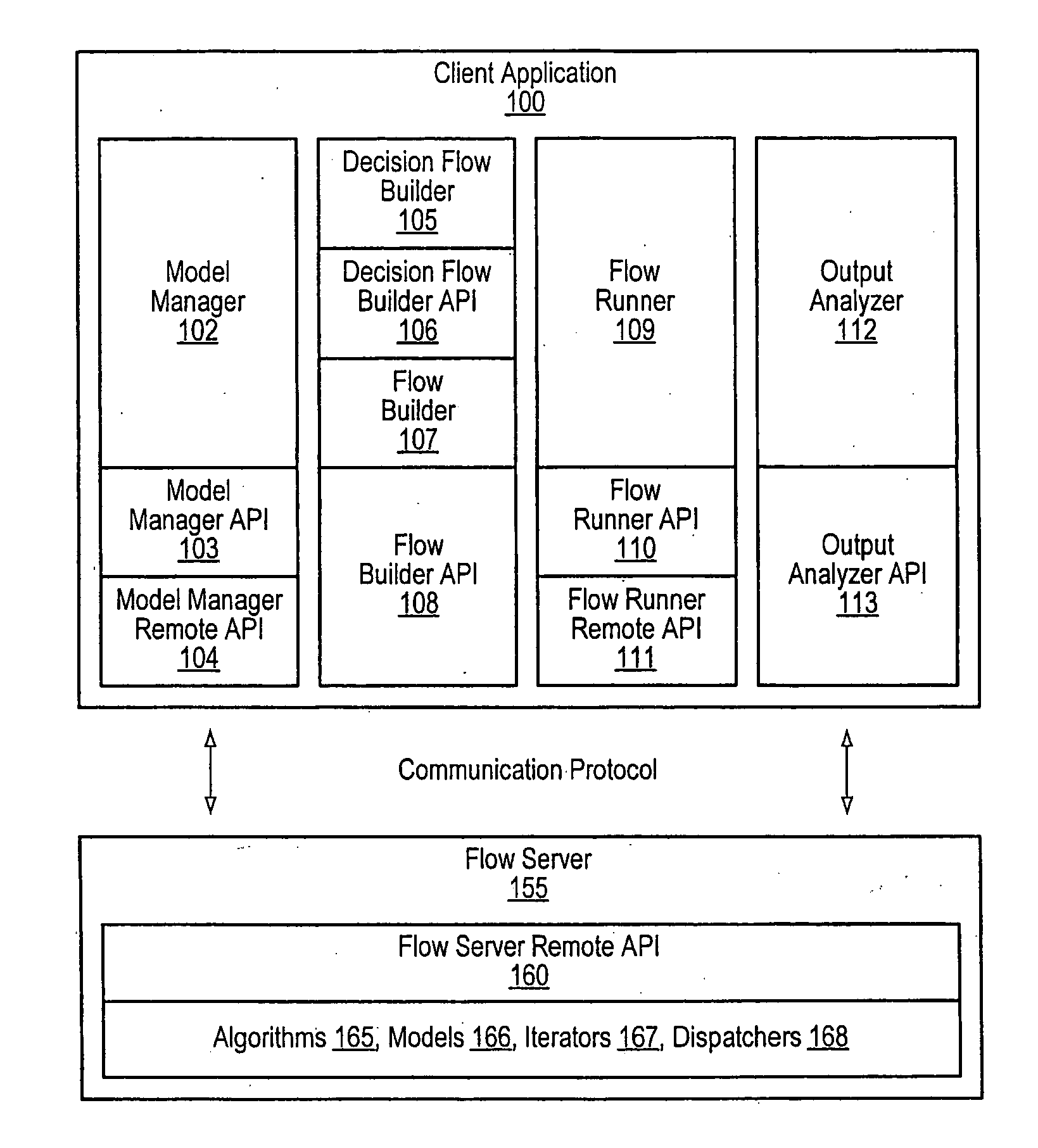

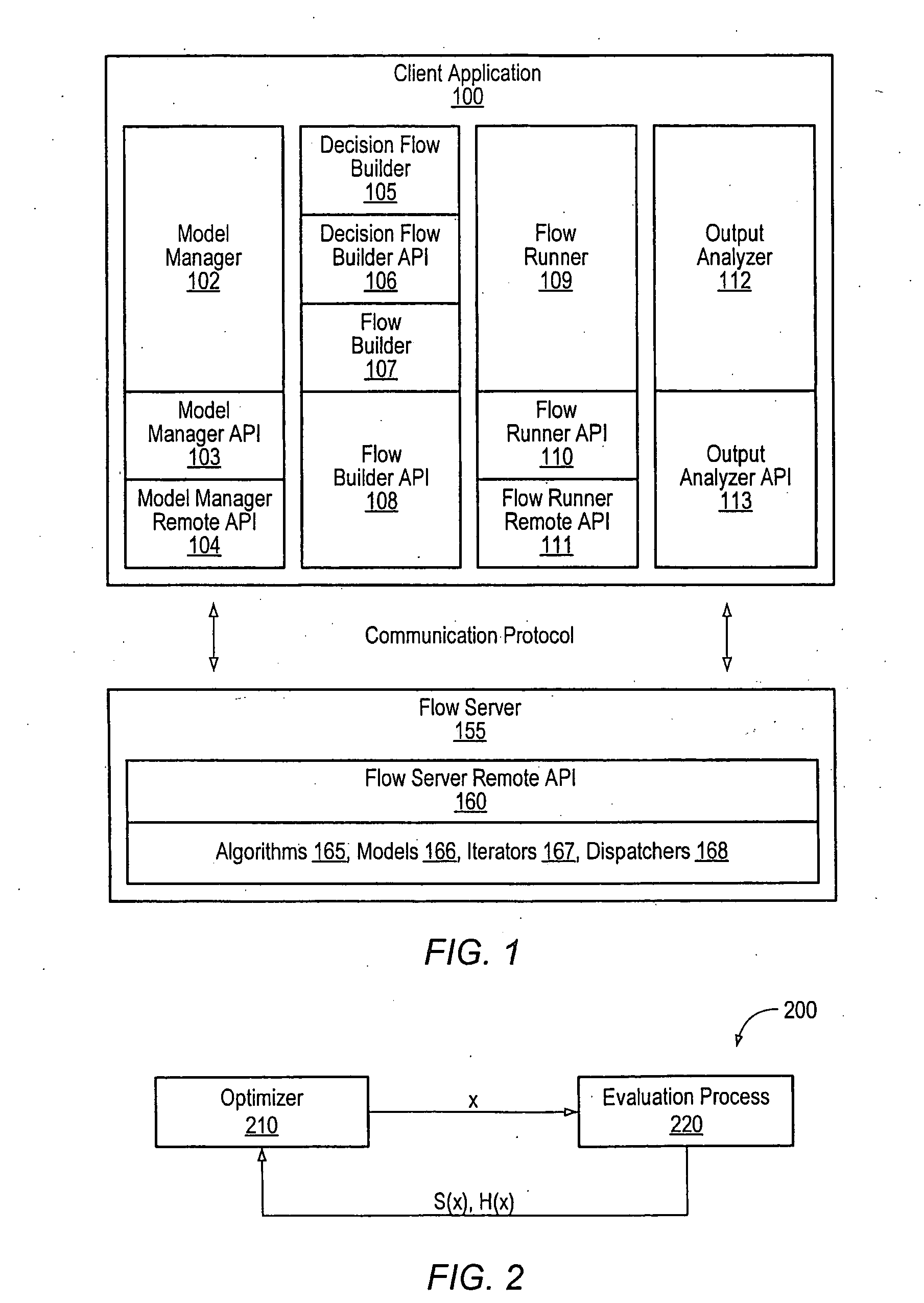

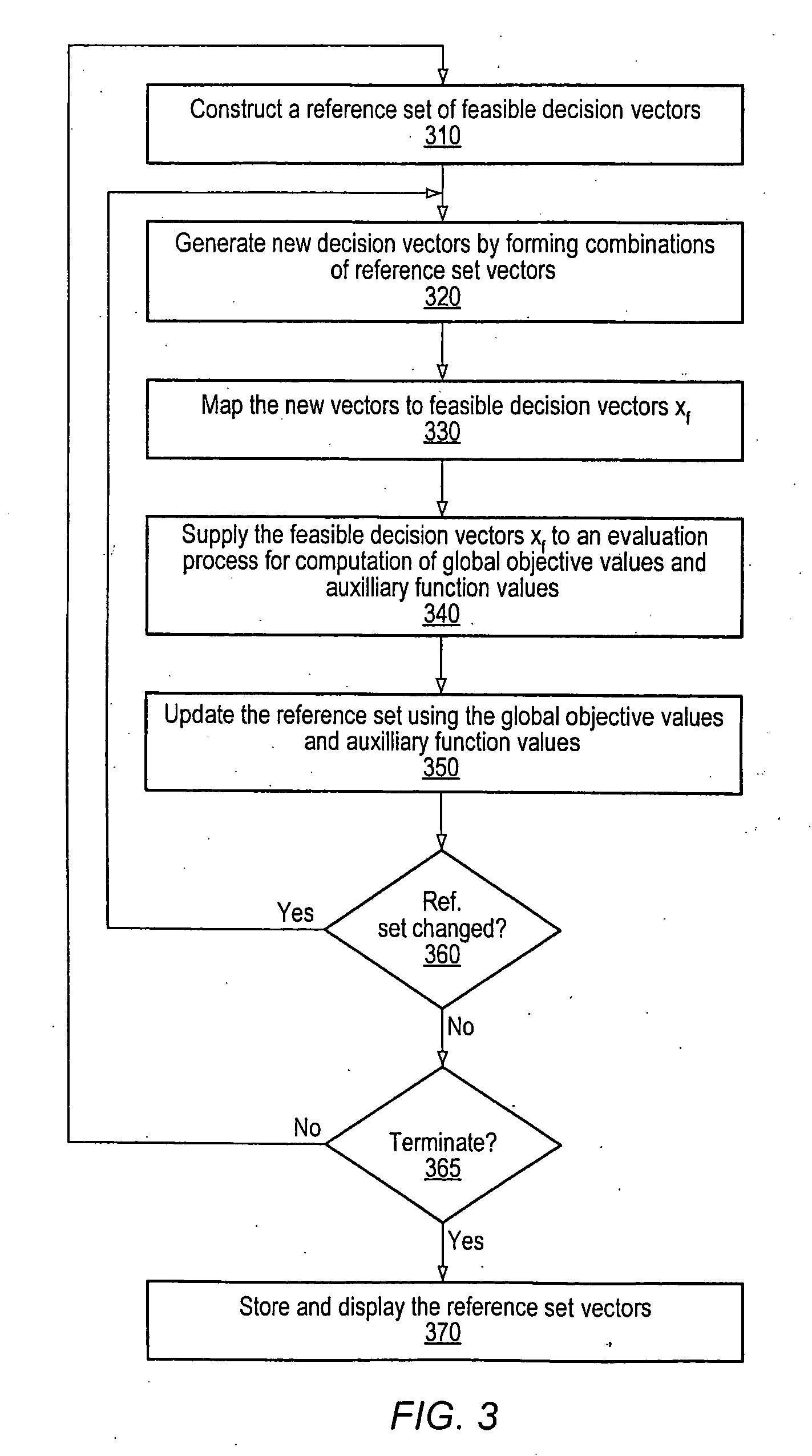

A client-server based system for building and executing flows (i.e., interconnected systems of algorithms). The client allows a user to build a flow specification and send the flow specification to the server. The server assembles the flow from the flow spec and executes the flow. A flow may be configured to analyze the impact (e.g., the financial impact) of a number of uncertainties associated with a plurality of assets. Uncertainty variables are used to characterize the uncertainties associated with the assets. An uncertainty variable associated with one asset may be functionally dependent on an uncertainty variable associated with another asset.

Owner:LANDMARK GRAPHICS

Analysis of multiple assets in view of uncertainties

A client-server based system for building and executing flows (i.e., interconnected systems of algorithms). The client allows a user to build a flow specification and send the flow specification to the server. The server assembles the flow from the flow spec and executes the flow. A flow may be configured to analyze the impact (e.g., the financial impact) of a number of uncertainties associated with a plurality of assets. Uncertainty variables are used to characterize the uncertainties associated with the assets. An uncertainty variable associated with one asset may be functionally dependent on an uncertainty variable associated with another asset.

Owner:LANDMARK GRAPHICS

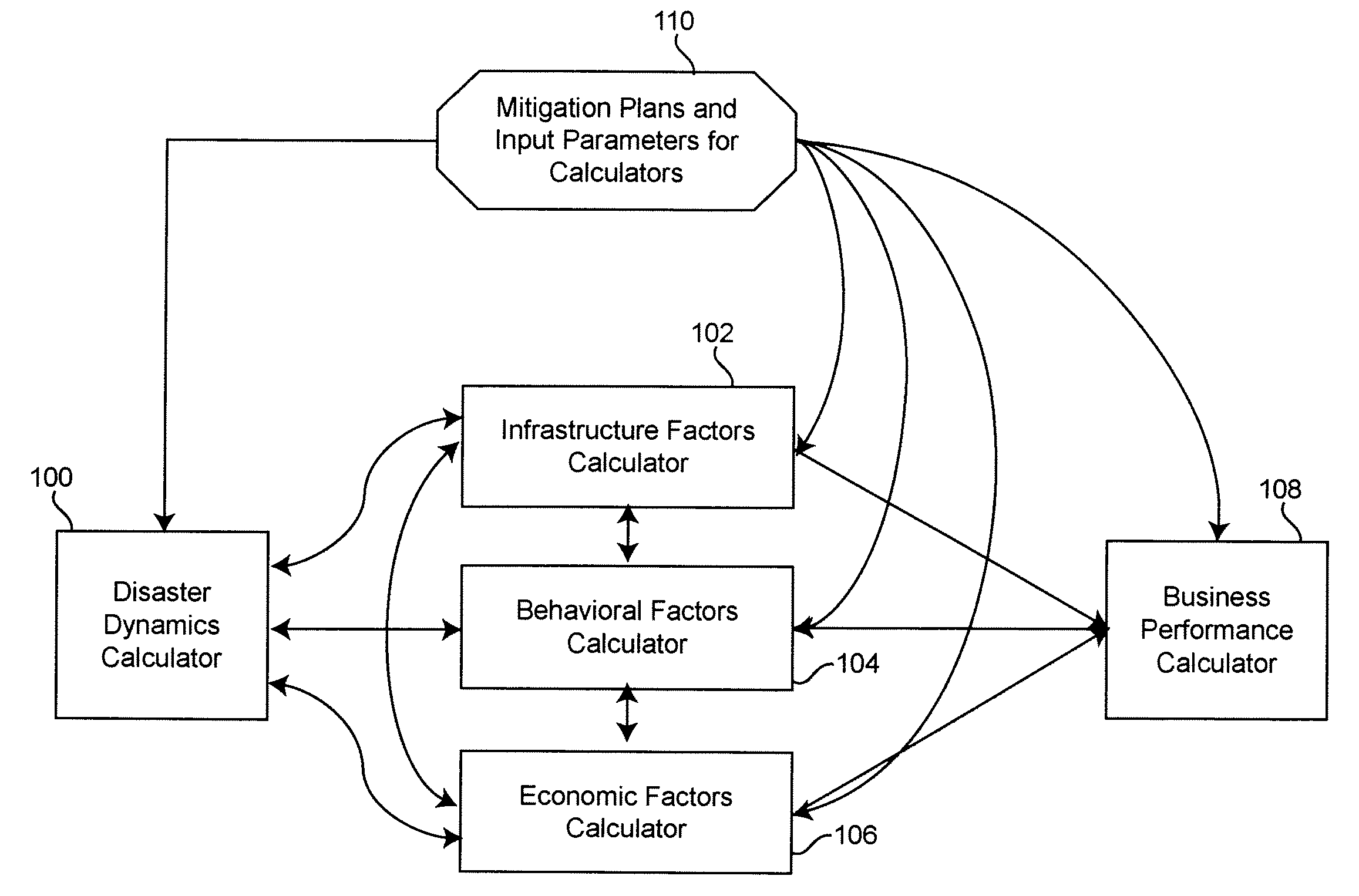

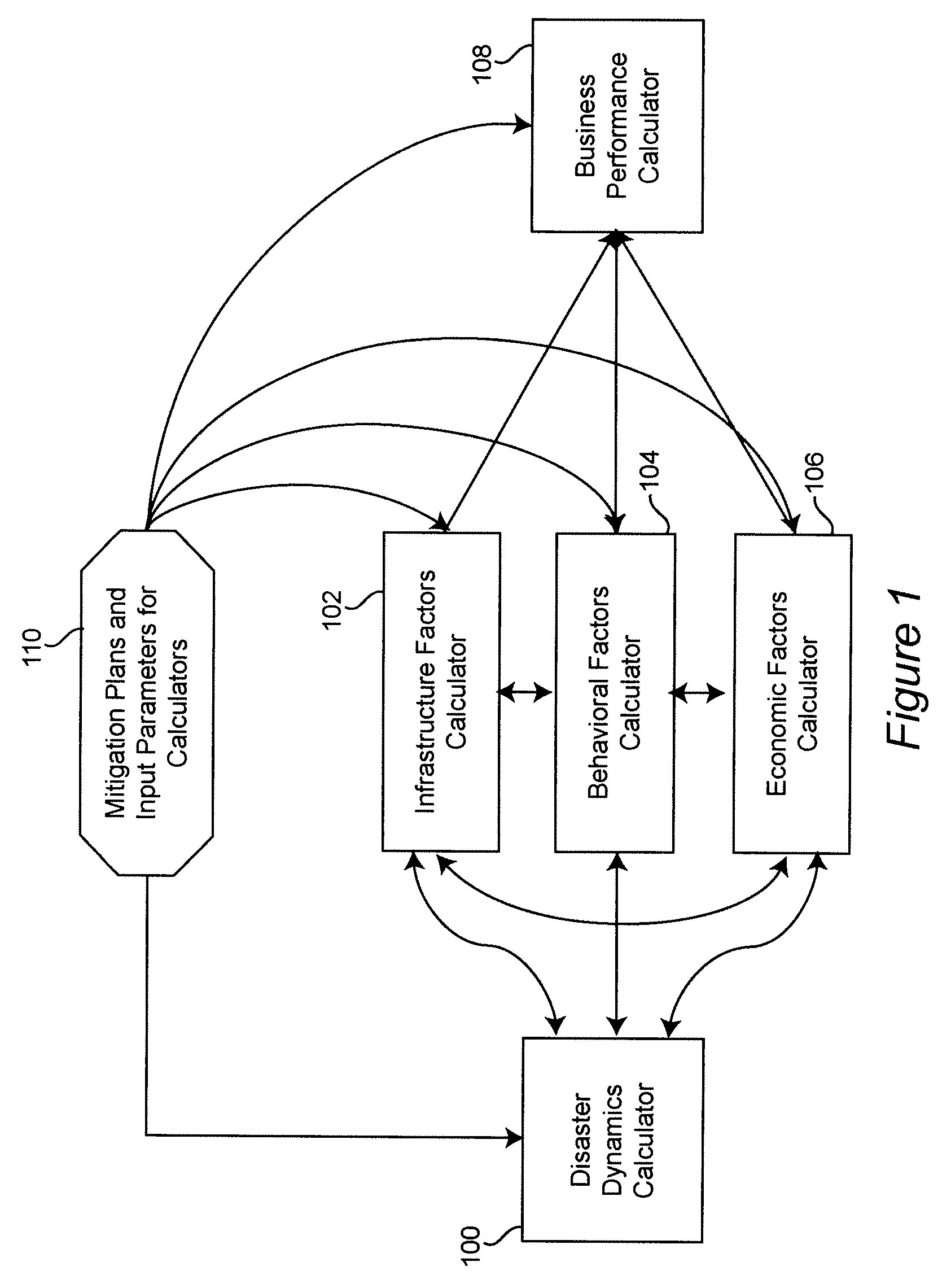

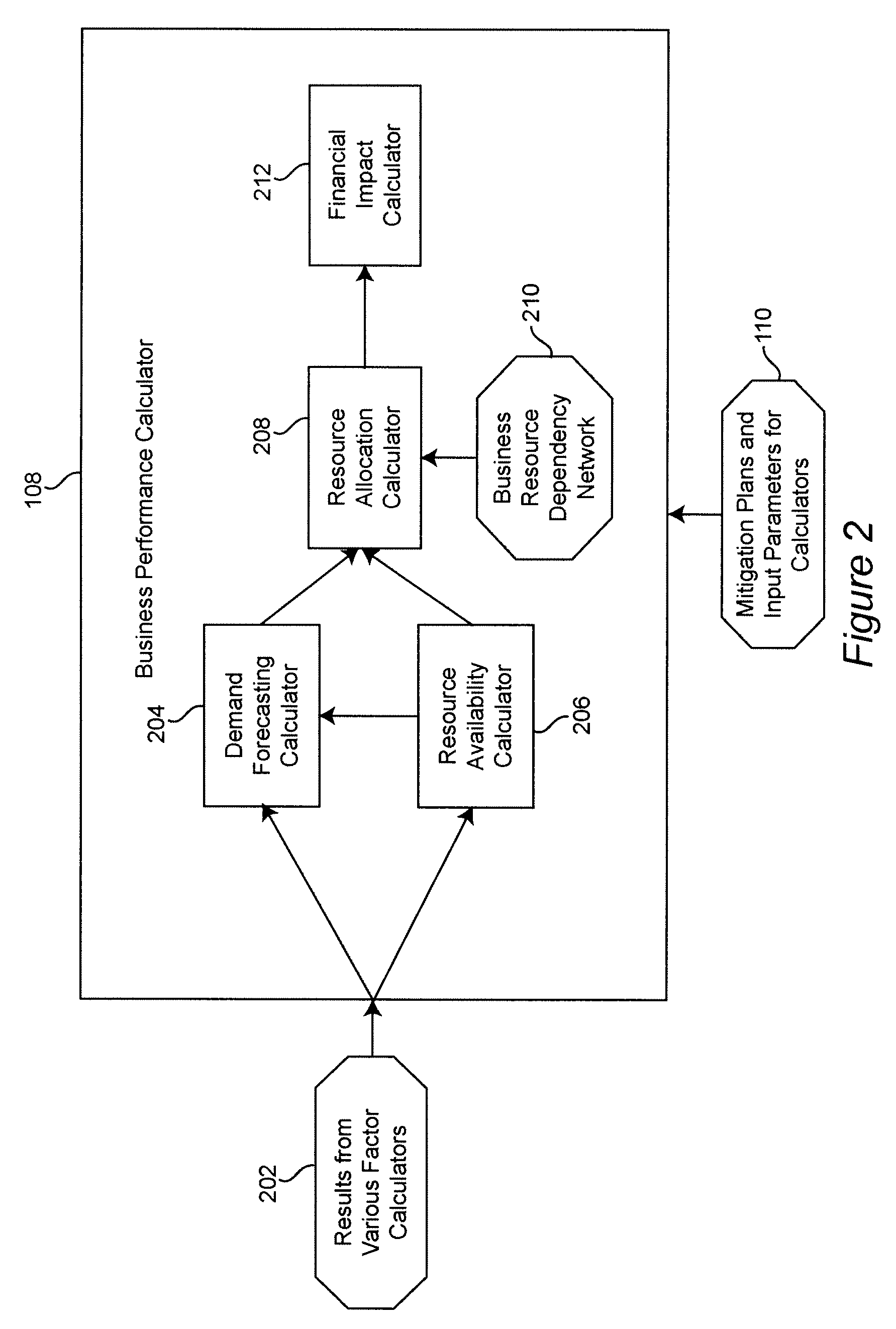

Method and System for Disaster Mitigation Planning and Business Impact Assessment

The present invention provides a method and system making it possible to reduce a description of the impact of a disaster on the world at large to measurable, firm-specific operational and financial implications. This makes it possible to bridge the divide between disaster prediction and business planning by facilitating the translation of physical and other effects of a disaster on a business into a dollars-and-cents impact. The present invention also allows a user to evaluate the costs and benefits of various disaster mitigation plans and / or policies and to understand the combined effects of multiple mitigation plans.

Owner:IBM CORP

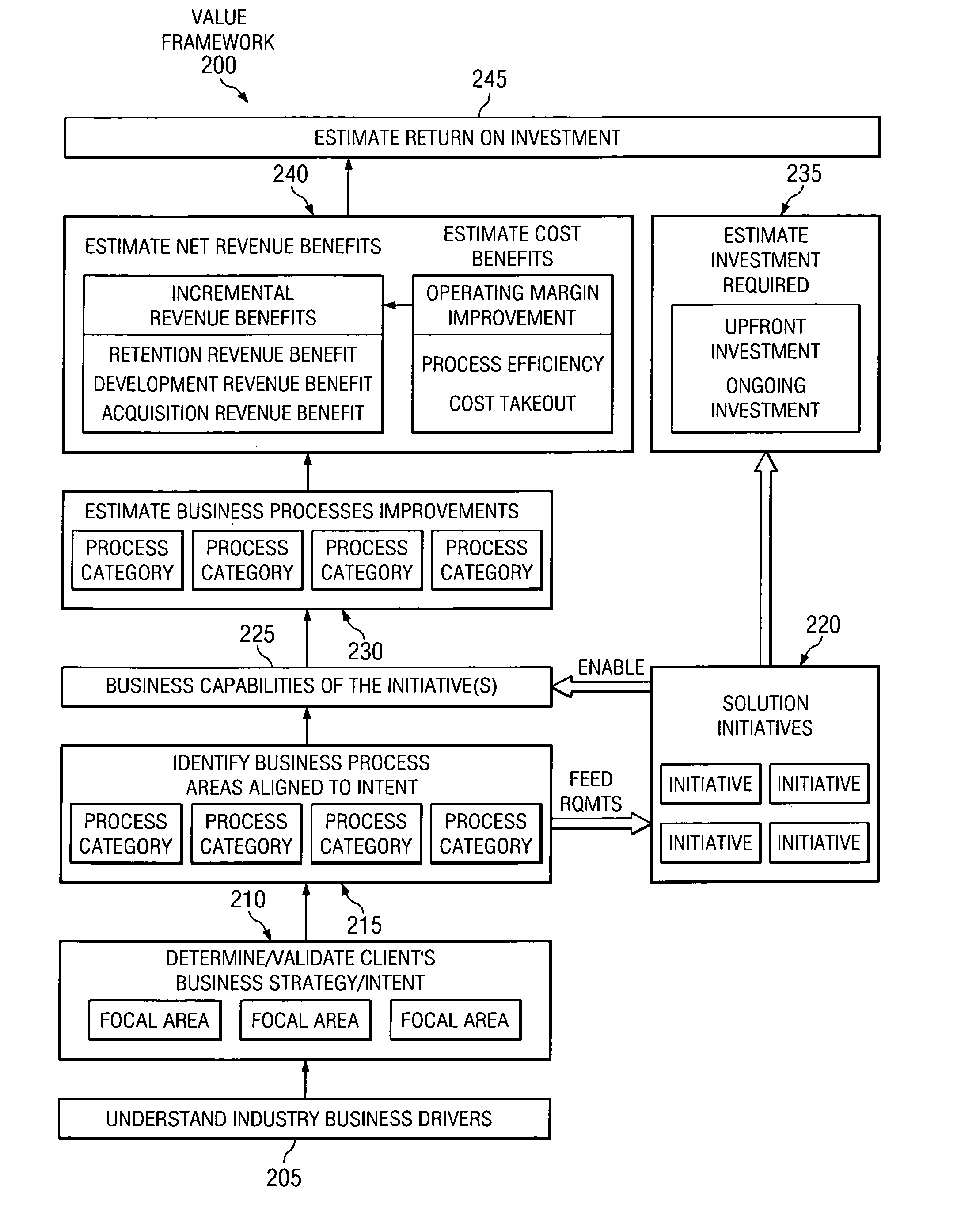

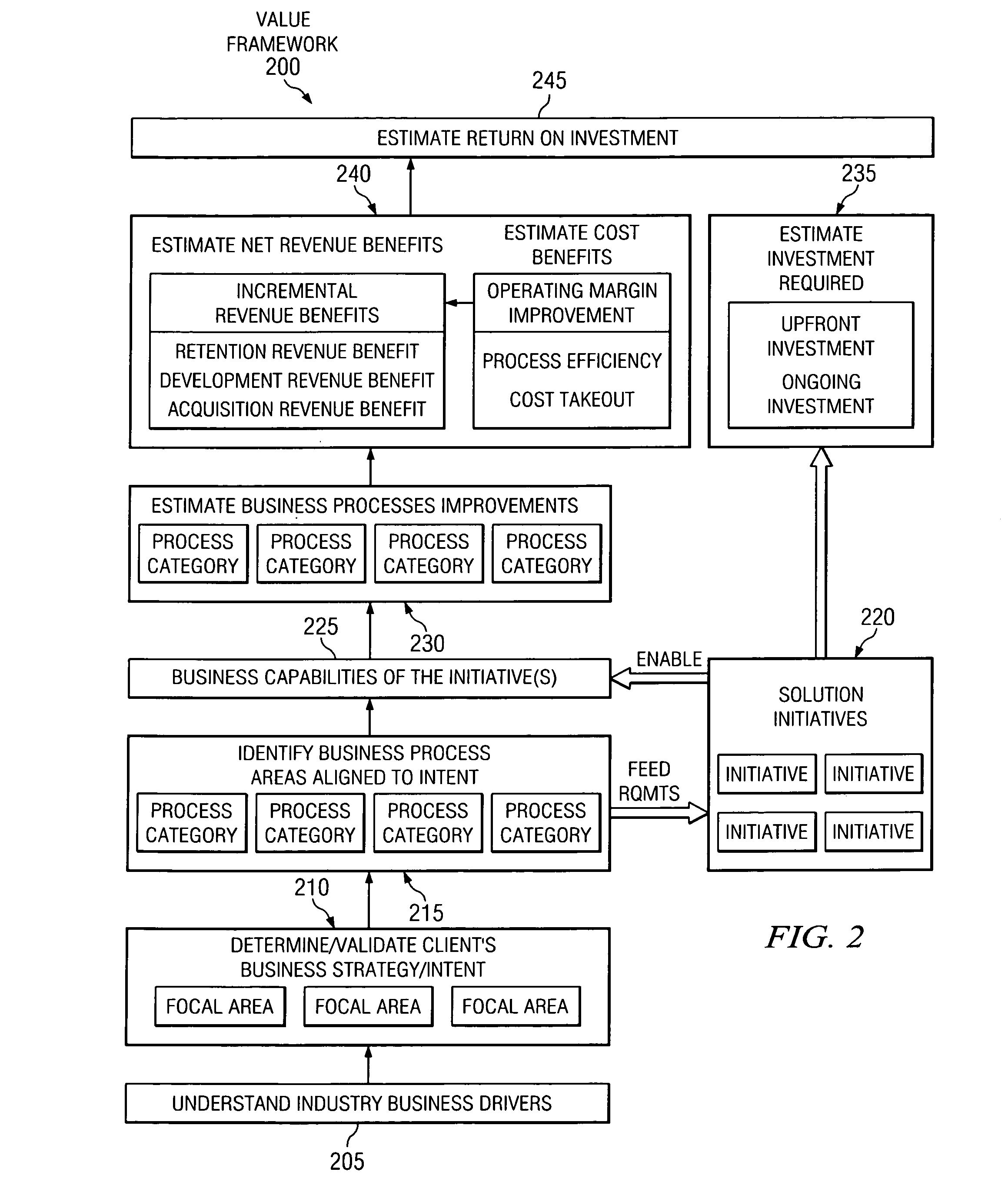

Method and apparatus for a value framework and return on investment model

InactiveUS20050137950A1Quickly and accurately estimateFinanceForecastingEnterprise architectureFinancial impact

A method and system for calculating the return-on-investments (ROI) for an enterprise architecture. The present invention discloses a unique set of metrics which provides improved accuracy for the economic and architecture for the construction of future systems. A preferred embodiment of the present invention focuses on developing process improvement assumptions associated with estimating the impact of the proposed capabilities. It includes the following components: an understanding of the client's strategic drivers, an understanding of the key business process areas, an identification of the business capabilities that a solution can offer the client, an estimation of the business processes improvements, and an estimation of the financial impact the proposed solution will have on the client. The value framework and ROI model of the present invention incorporates a client's strategic position and key processes before the benefits of a proposed solution or initiative can be estimated.

Owner:IBM CORP

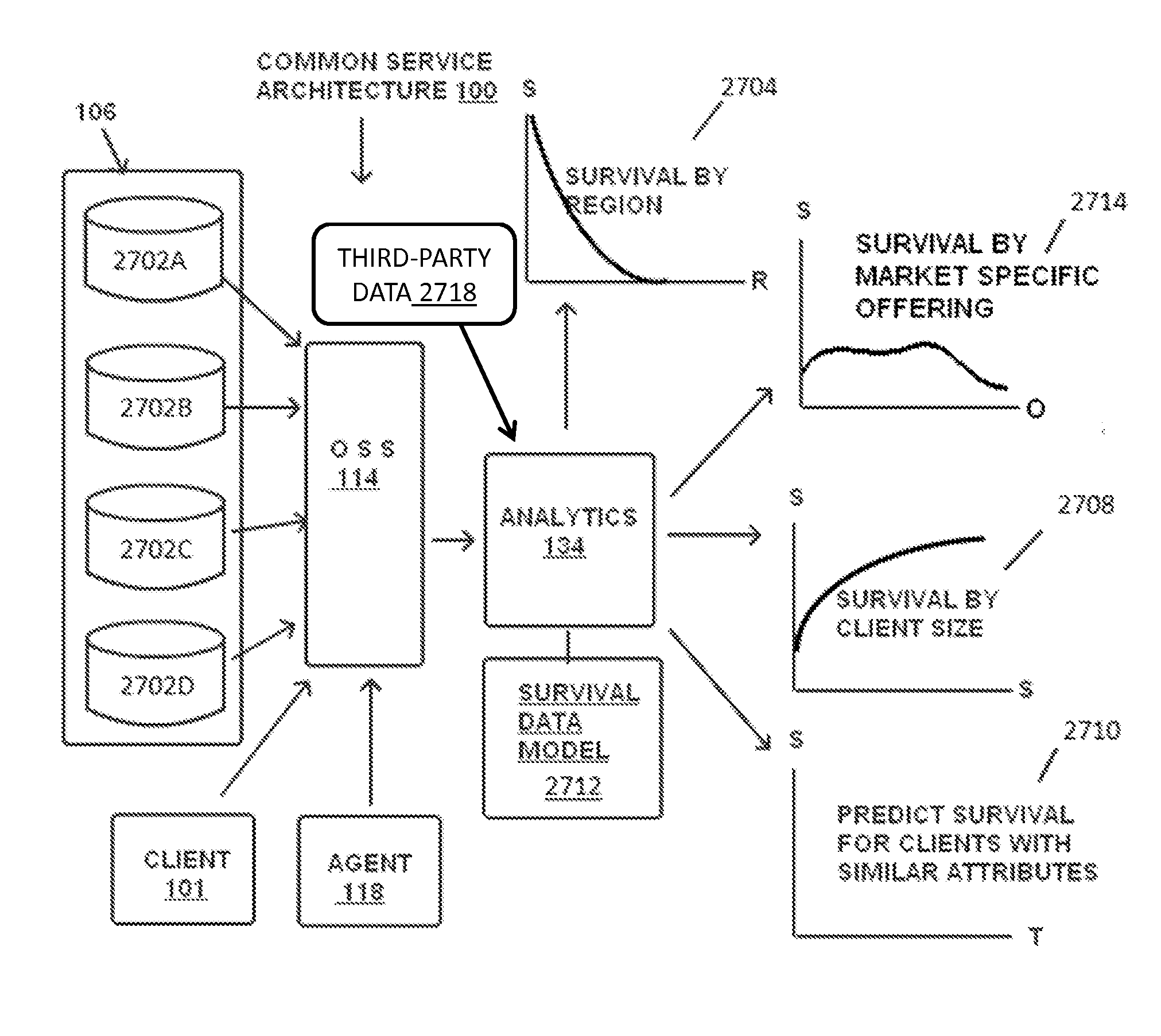

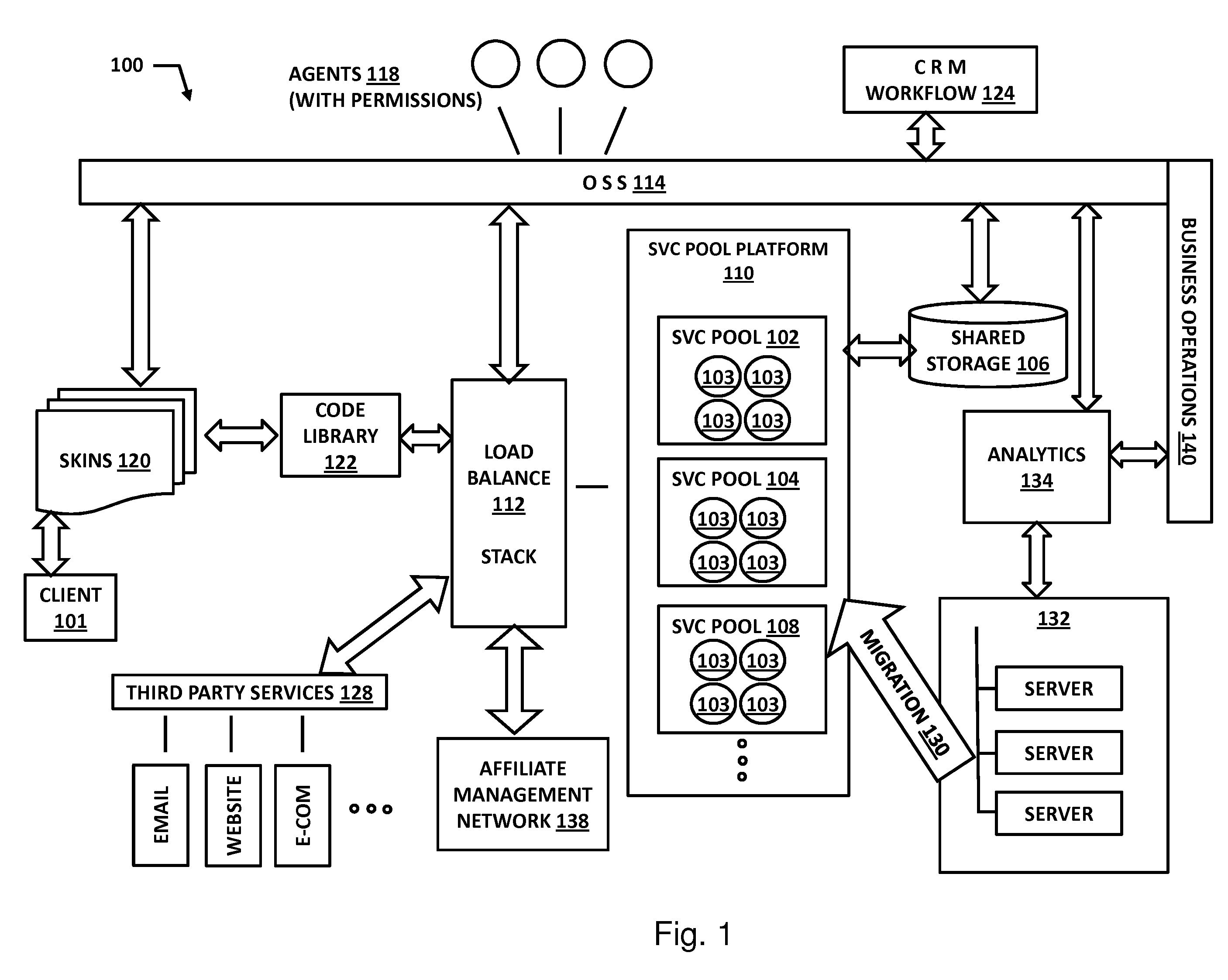

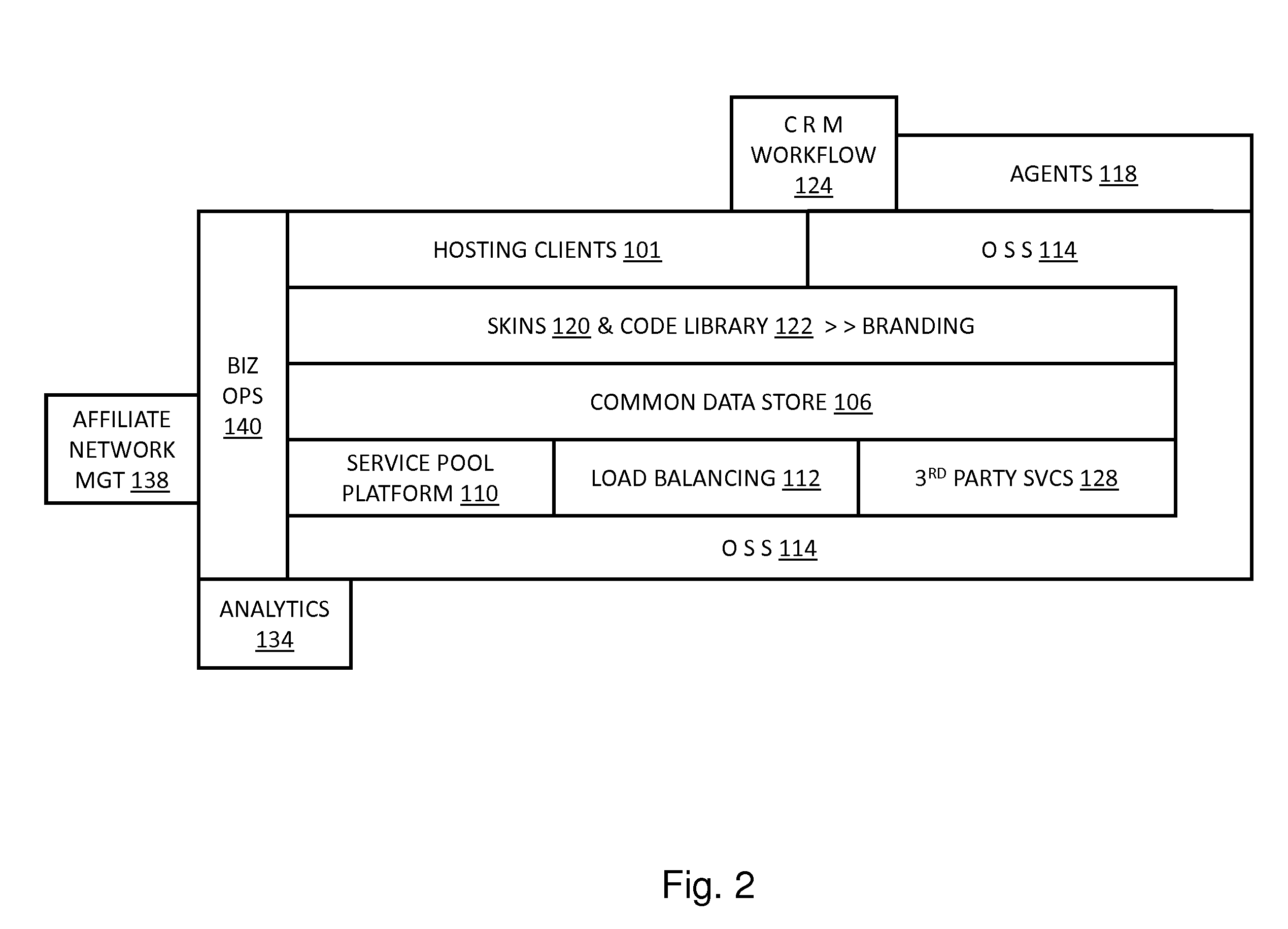

Unaffiliated web domain hosting service client financial impact analysis

InactiveUS20110178840A1Easy to storeEnhanced interactionResourcesData switching networksStatistical analysisFinancial impact

Based on usage patterns of clients who have purchased web domain offerings, using statistical analysis to determine factors that cause clients not to produce favorable financial results.

Owner:ENDURANCE INTERNATIONAL GROUP

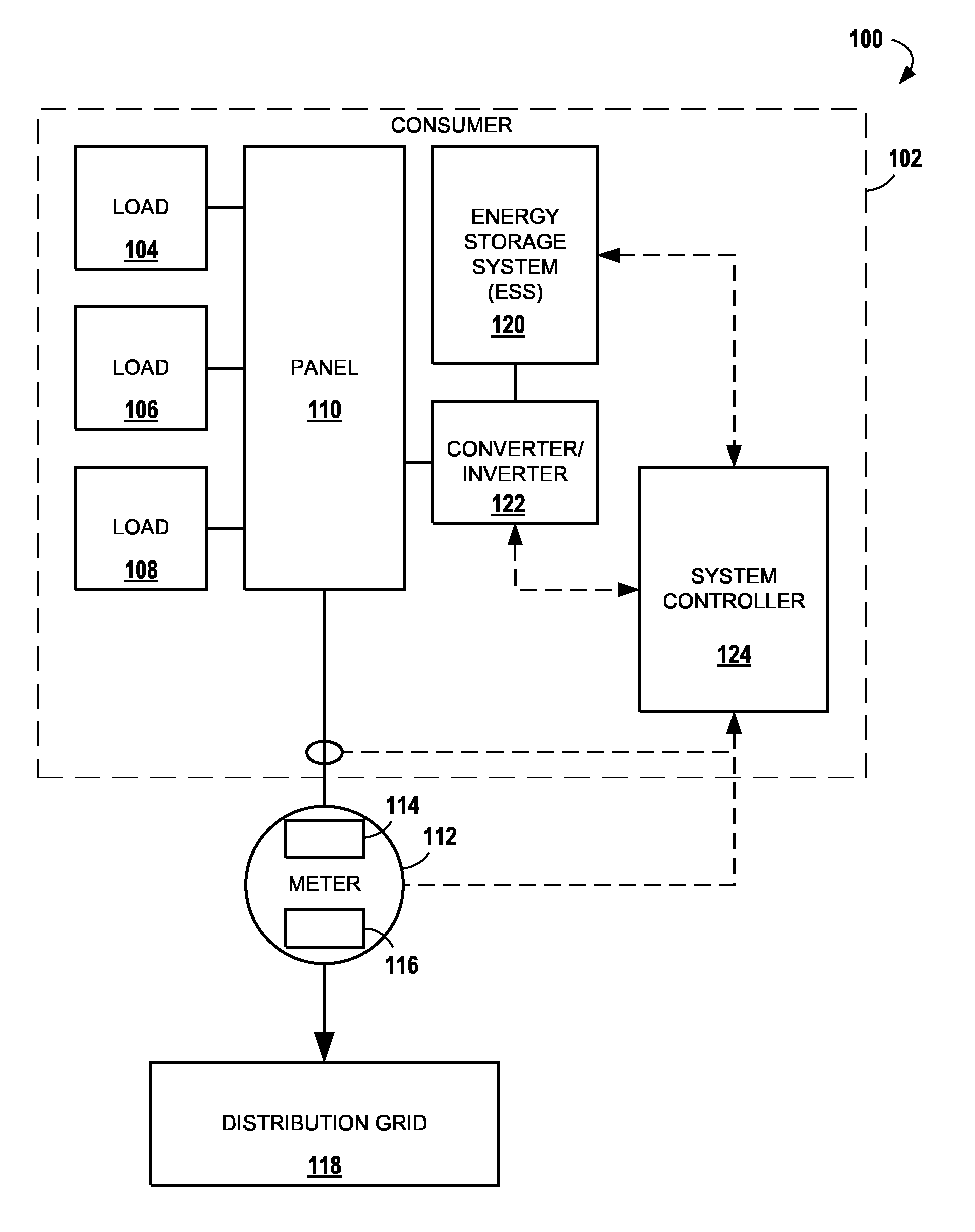

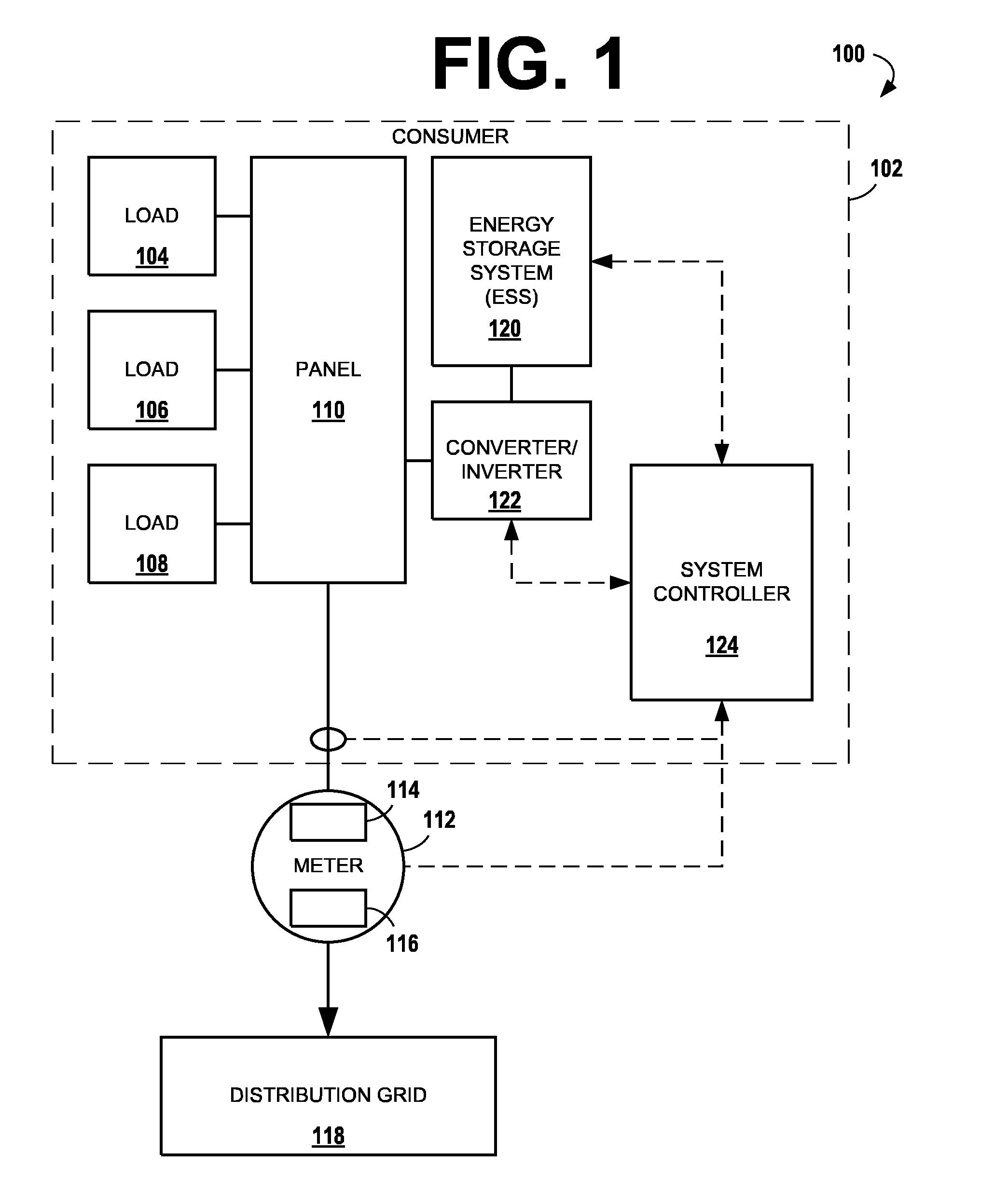

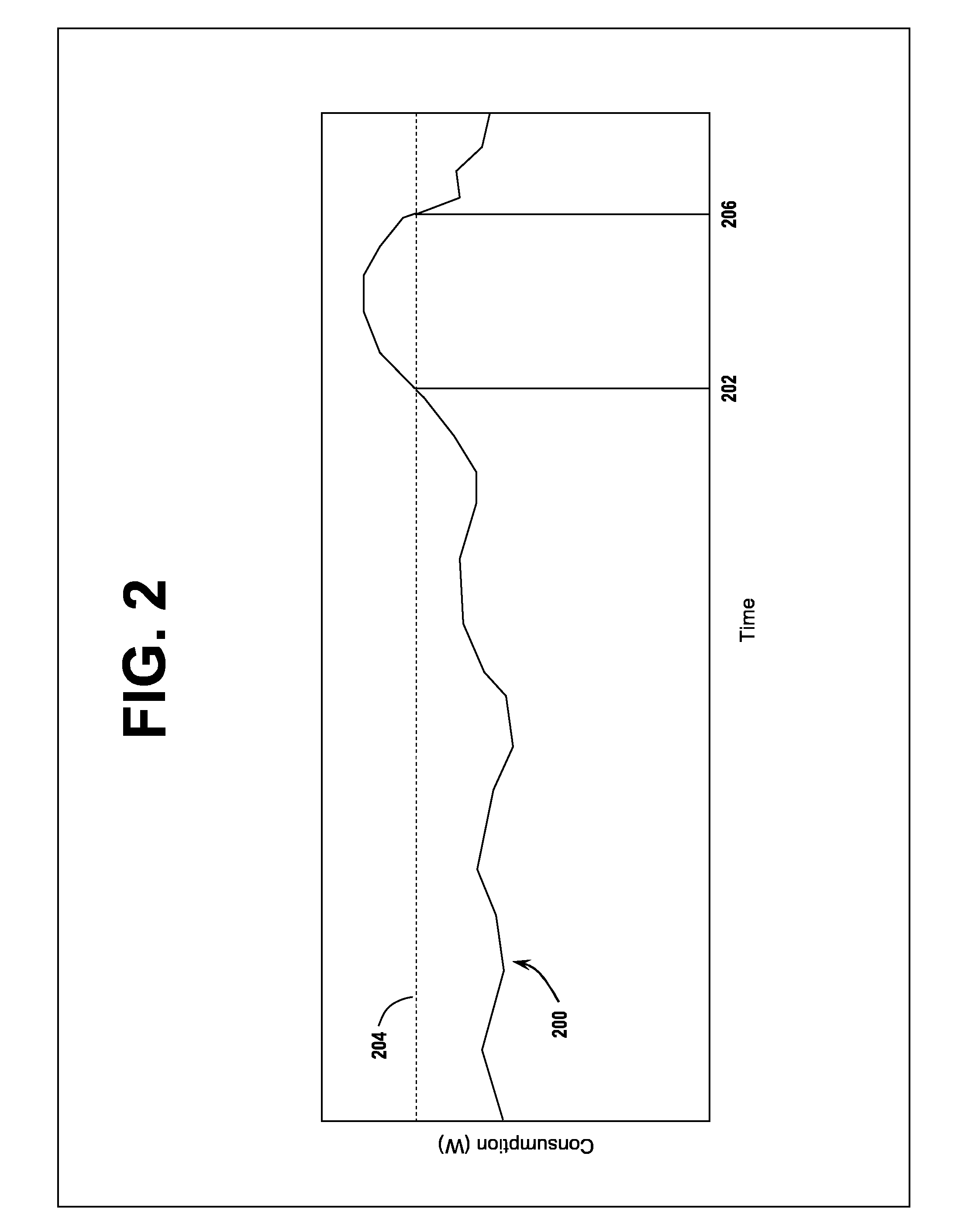

Energy management methods and systems based on financial impact

InactiveUS20140067140A1Accurate accountingMechanical power/torque controlData processing applicationsEngineeringConfidence factor

Energy management methods and systems based on financial impact are disclosed herein, wherein an energy management system at a site monitors metered energy consumption, establishes a peak consumption level, determines whether energy consumption will result in an increased peak consumption level, and if it will, calculates the financial value and costs of mitigating an increase in the peak consumption level, including an increase in demand charge prospectively avoided, and mitigates the peak in consumption to the peak consumption level using an energy storage system or other energy providing device if the value of mitigating the peak offsets the inherent costs. Embodiments may further use confidence factors or incremental changes to a peak consumption level to optimize the process and utilize energy devices to their greatest effectiveness.

Owner:ENGIE STORAGE SERVICES NA LLC

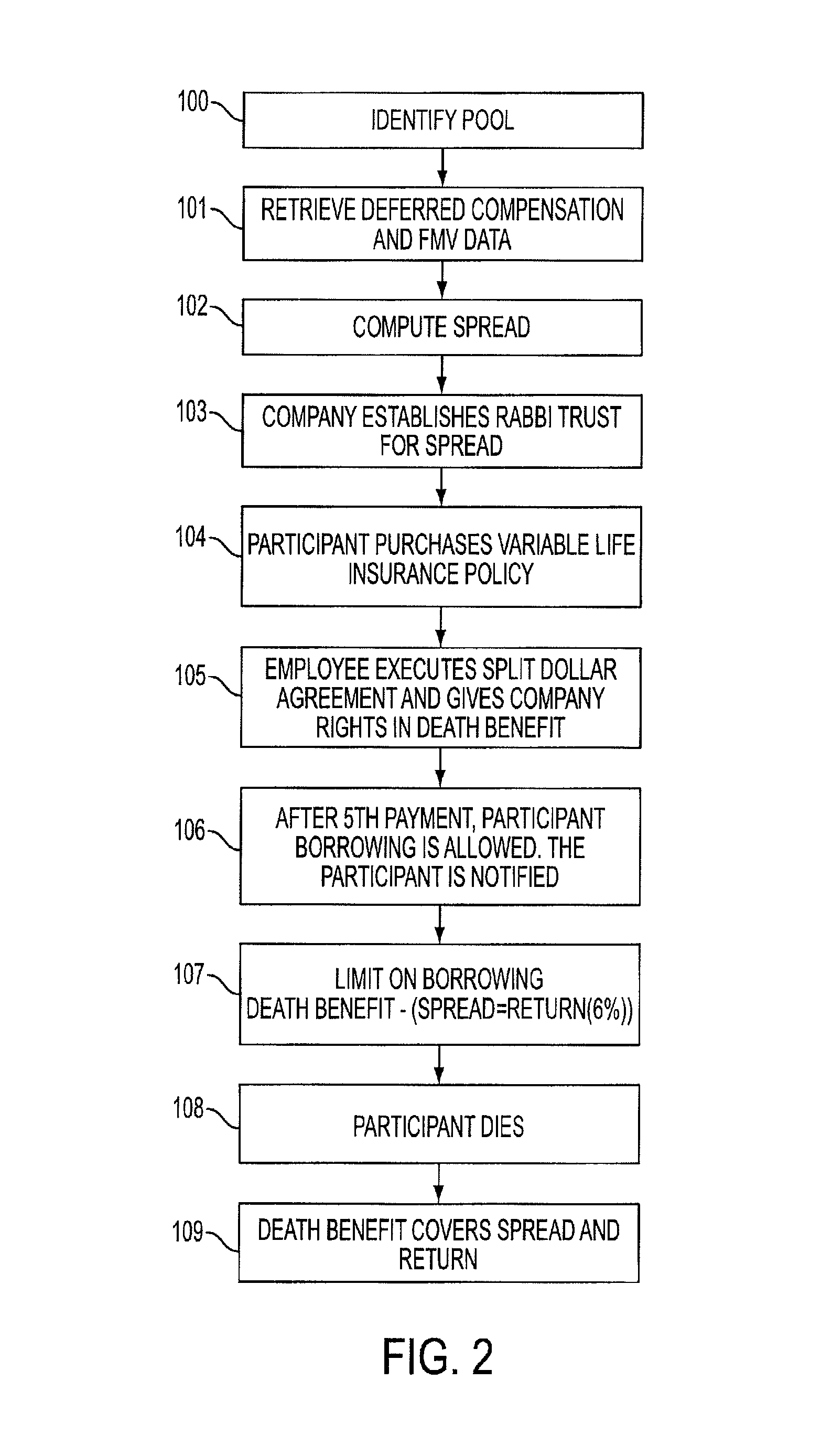

Method and apparatus for modeling and executing deferred award instrument plan

InactiveUS20060155621A1Minimal impact and chargeMinimizes taxFinanceOffice automationProgram planningSimulation

The present invention is directed to the administration of various deferred compensation LTIP and asset account programs that can effectively reduce an individual's income or estate tax by assisting a company in the identification of appropriate employees, and through the use of a novel modeling method and apparatus to implement a deferred compensation program through a novel asset account maintenance plan that permits the employees to benefit from their deferred compensation (such as stock options, Long Term Incentive Plans, deferred compensation or life insurance benefits—“THE UNIQUE SQLUTION®”), while having a minimal financial impact on the company.

Owner:BELL LAWRENCE L

Systems and methods for determining an impact on spend and/or trend for a prescription drug plan

Systems and methods for determining an impact on spend and / or trend for a prescription drug plan are provided. In response to receiving the request to analyze spend and / or trend, a prescription drug spend and / or trend application may retrieve data related to the prescription drug plan from a database. The analysis of spend and / or trend includes a determination of components of spend and / or trend having a significant impact on spend and / or trend. In one example, the spend and / or trend application may determine whether an option is available to improve at least one of the components having the significant impact on spend and / or trend. If an option is available, the impact (e.g., financial impact, member impact) of the implementation of the option on the prescription drug plan may be modeled by the spend and / or trend application.

Owner:EXPRESS SCRIPTS STRATEGIC DEV INC

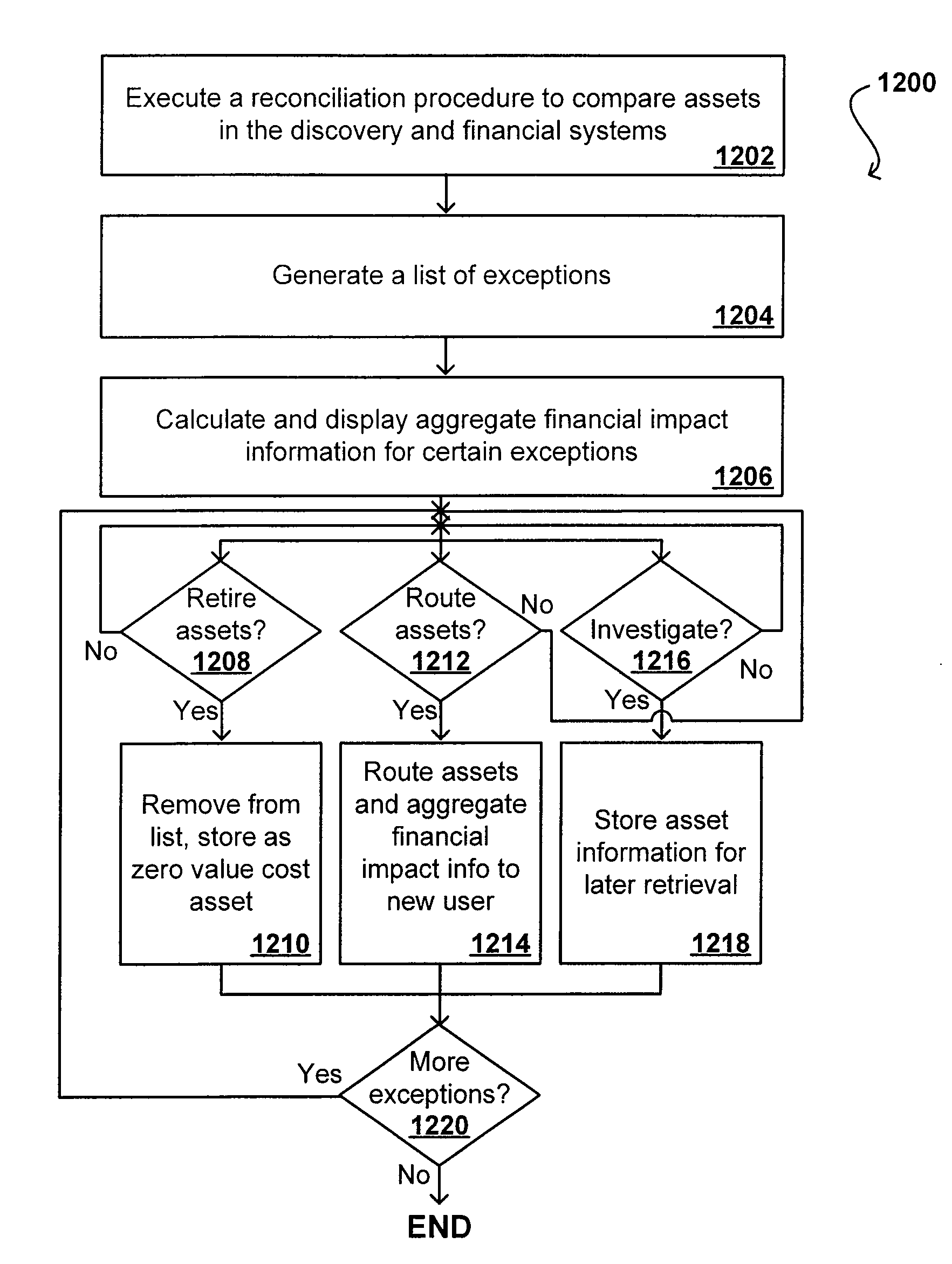

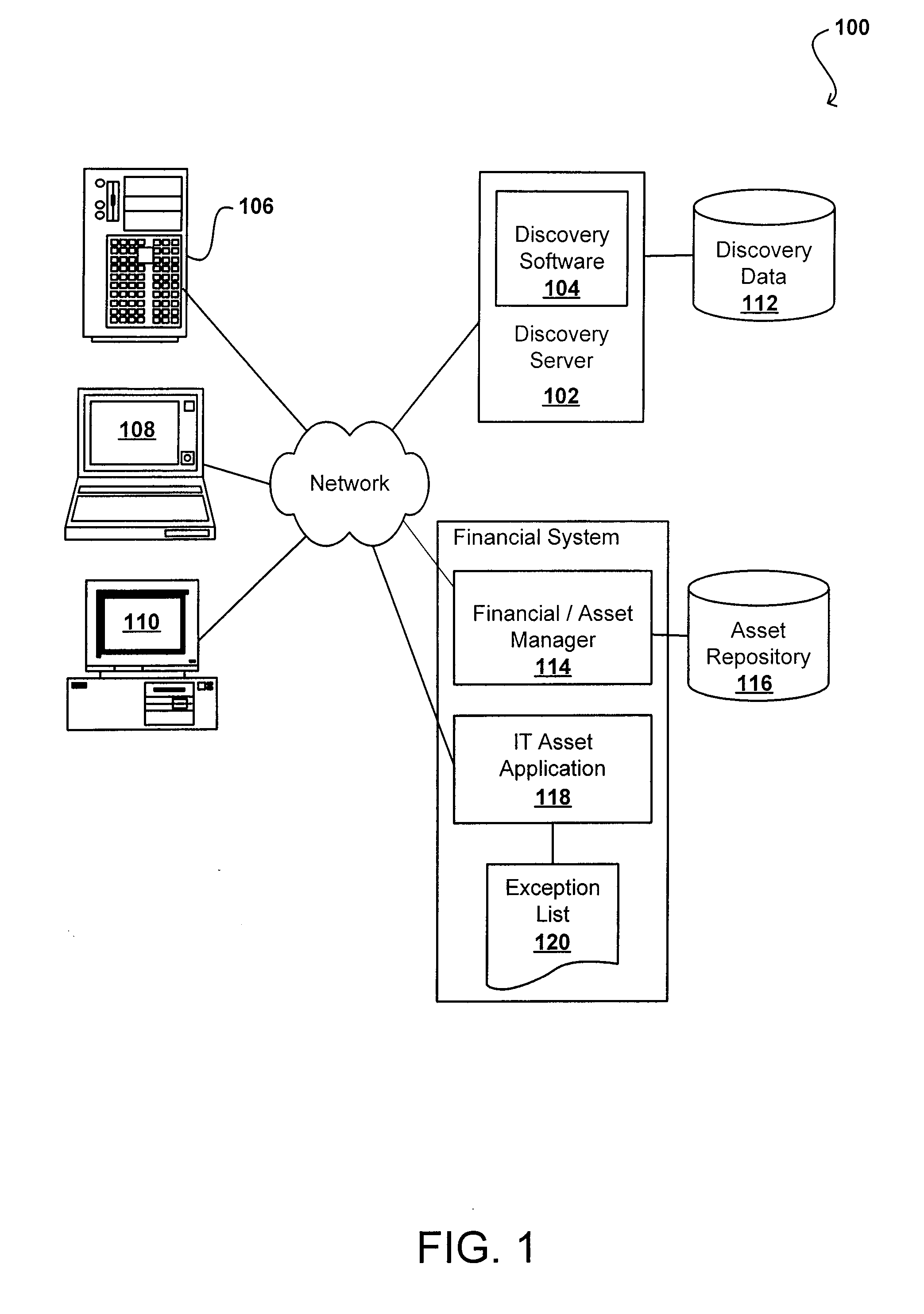

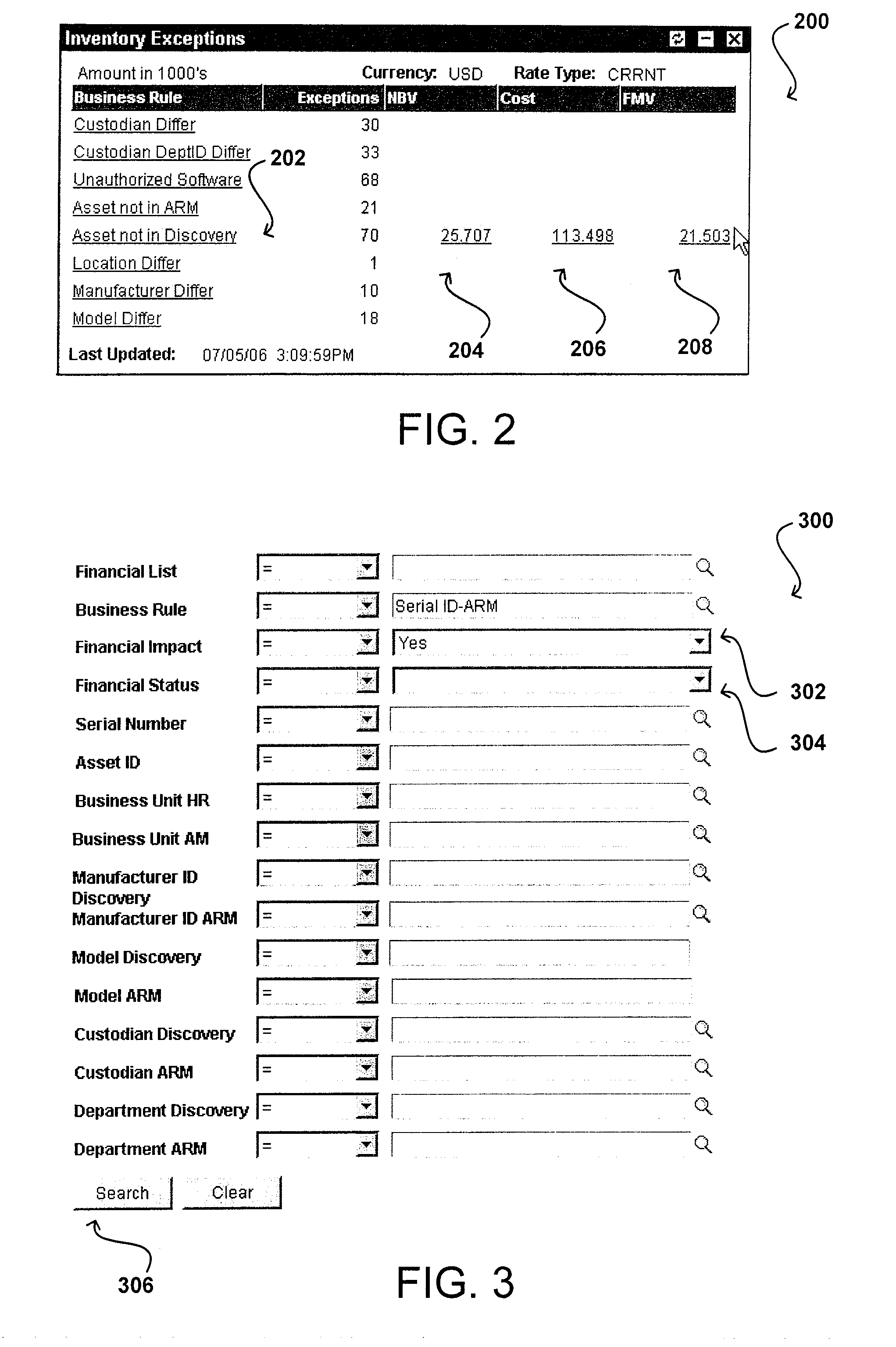

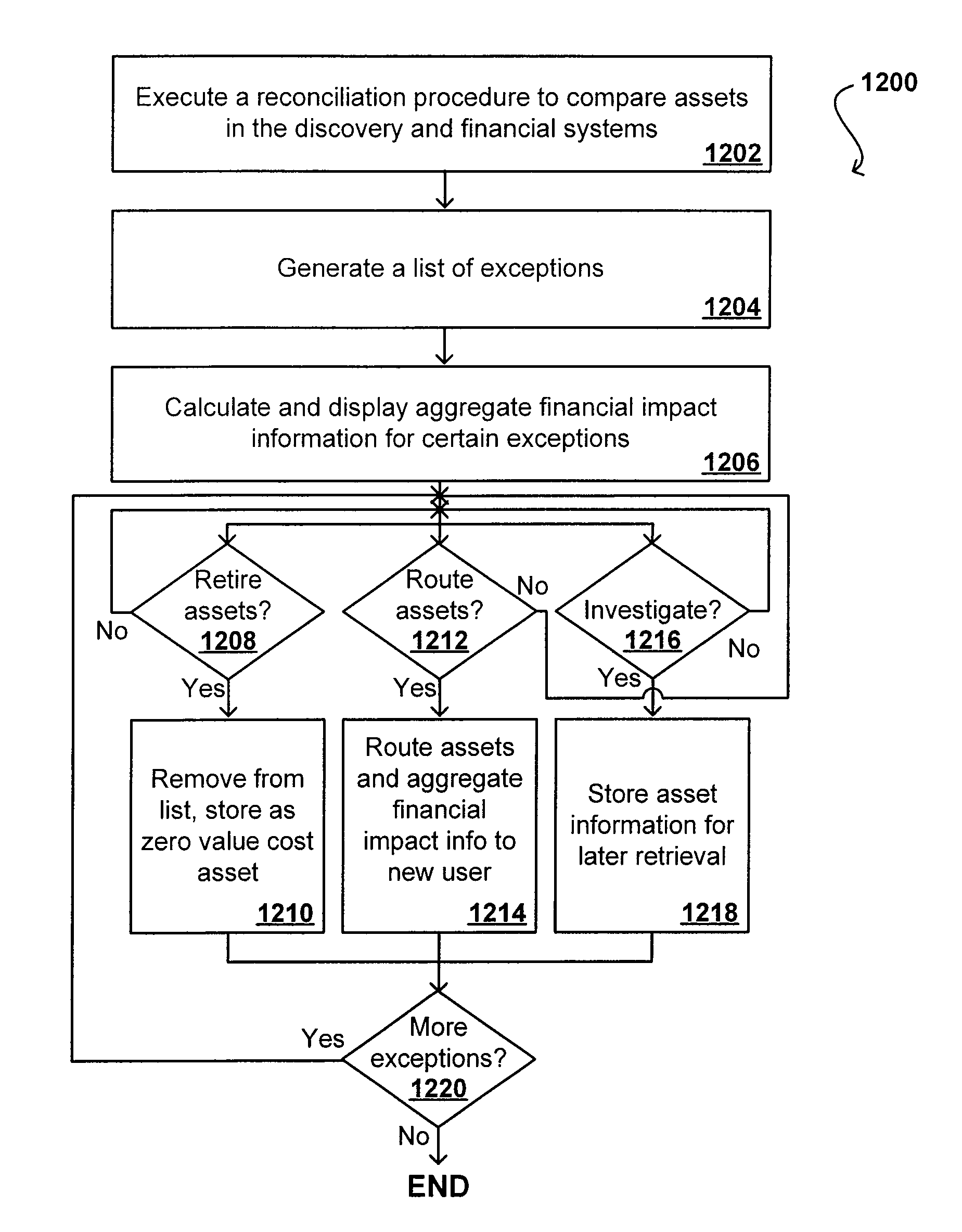

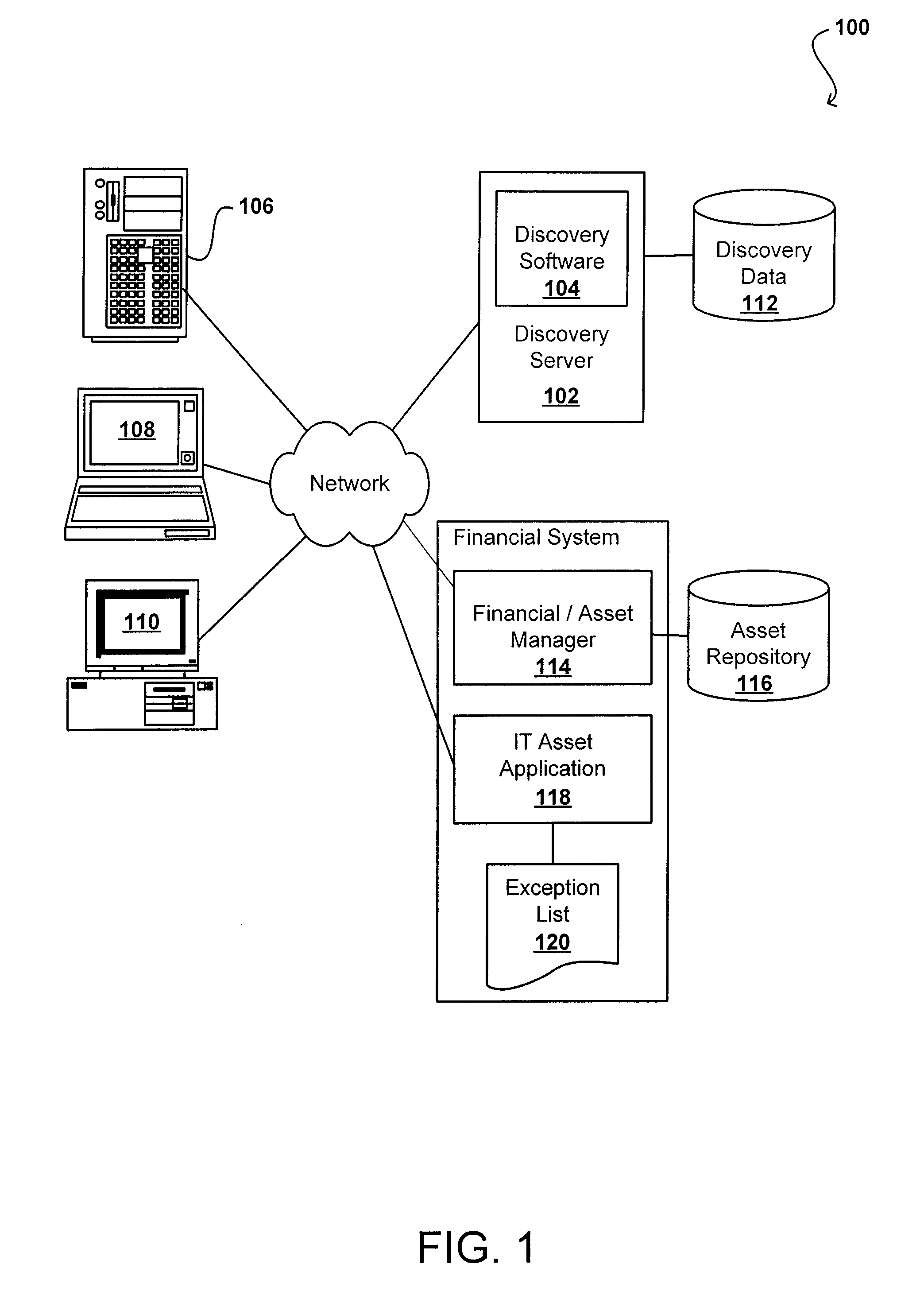

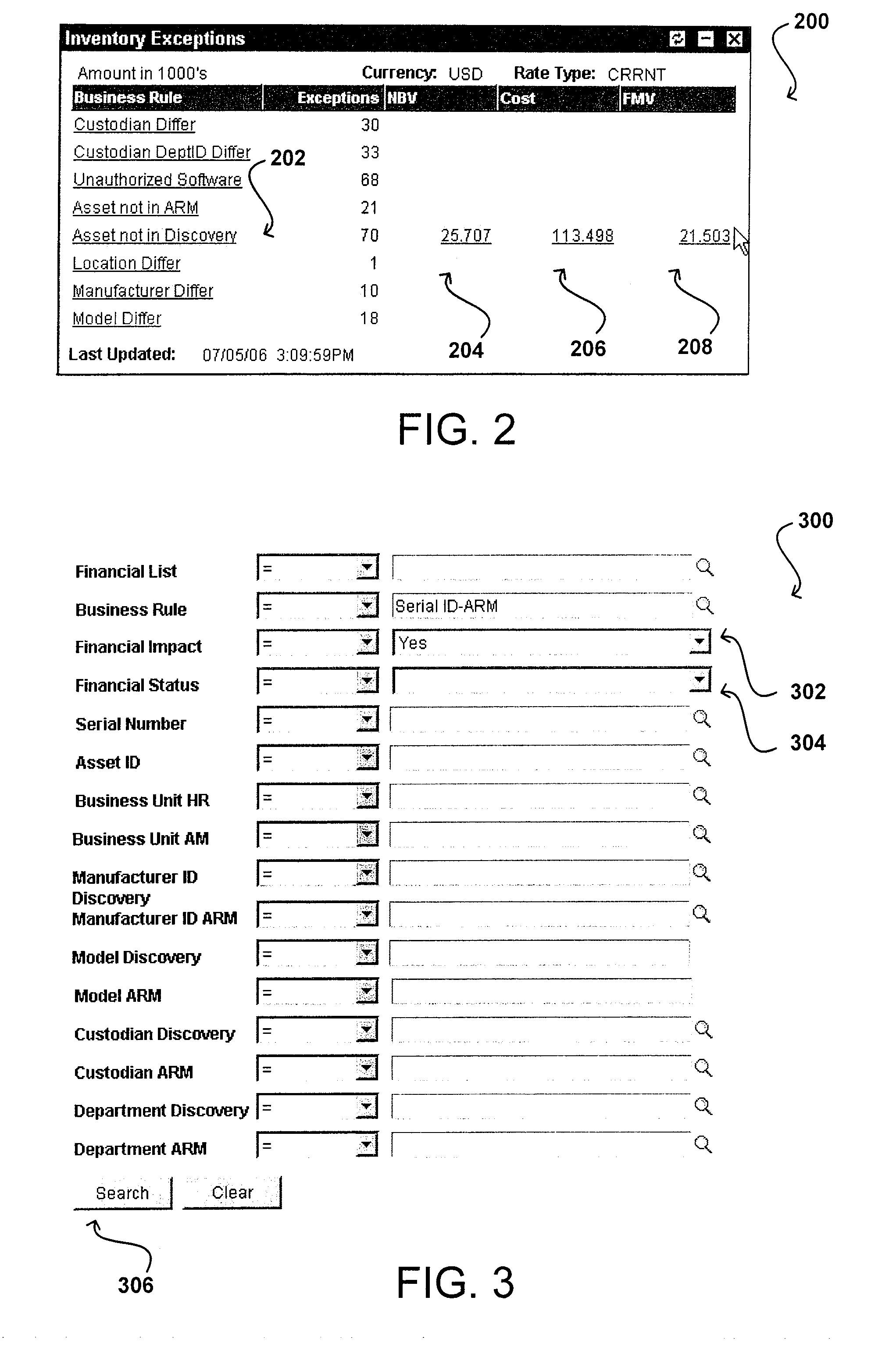

Providing aggregate forecasted impact information for physical to financial asset reconciliation

ActiveUS20090063310A1Easy to determineEasy access and viewingComplete banking machinesFinanceFinancial impactKnowledge management

A reconciliation process identifying financial assets in a financial system that do not also exist in the real world, such as is indicated in a discovery system, generates a list of exceptions that can be examined by type of exception. The list of exceptions also includes aggregate financial impact information for the exceptions, such as aggregate cost, fair market value, and net book value. An interface allows a user to view the financial impact information and better decide how to handle the assets corresponding to the exceptions, such as by retiring at least some of the assets, routing some of the exceptions to another user better able to handle the exceptions, or storing the list so that an investigation can be done into at least some of the assets. The financial impact information becomes particularly critical near quarter-end and year-end, as any material impact to the books requires timely disclosure.

Owner:ORACLE INT CORP

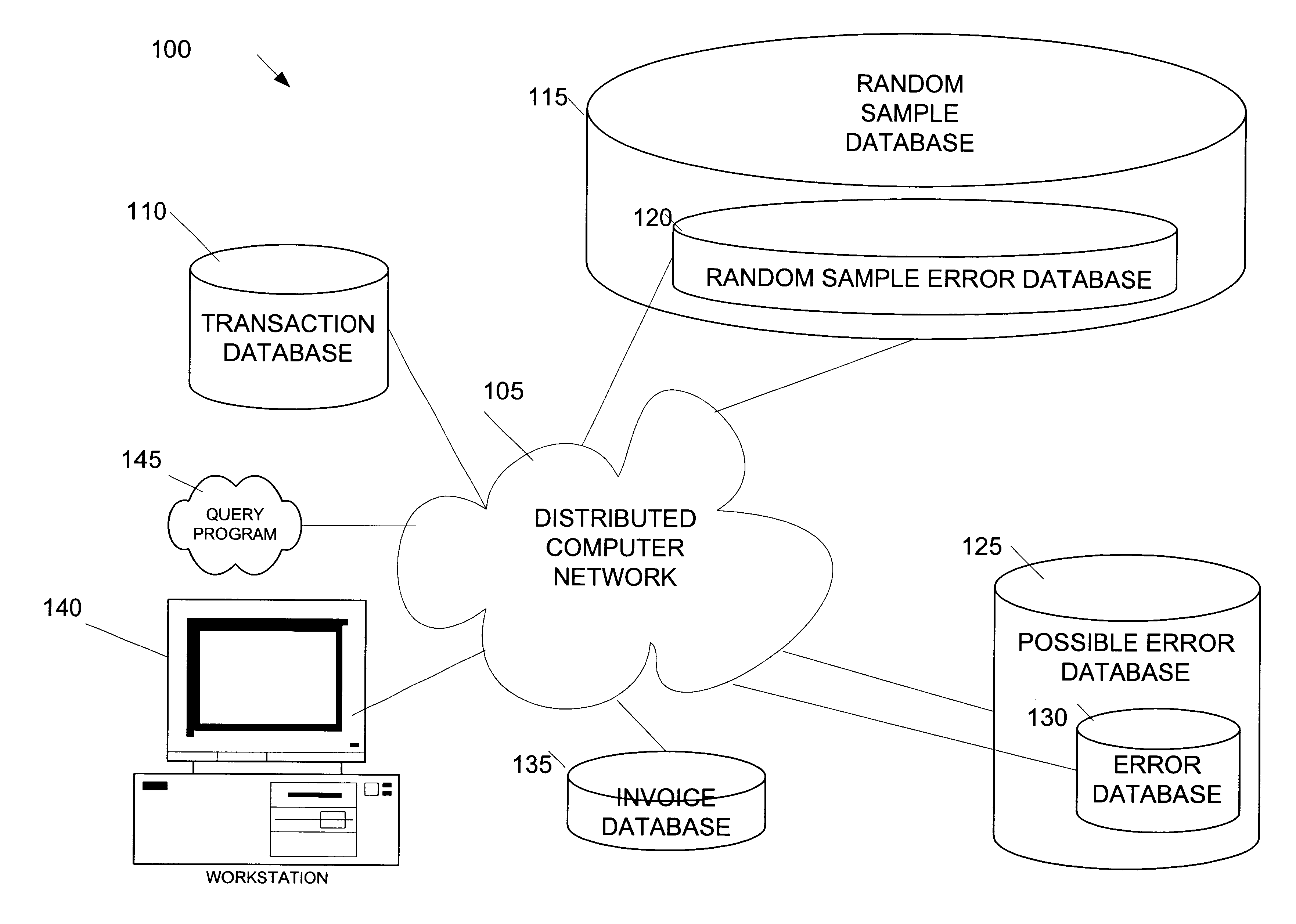

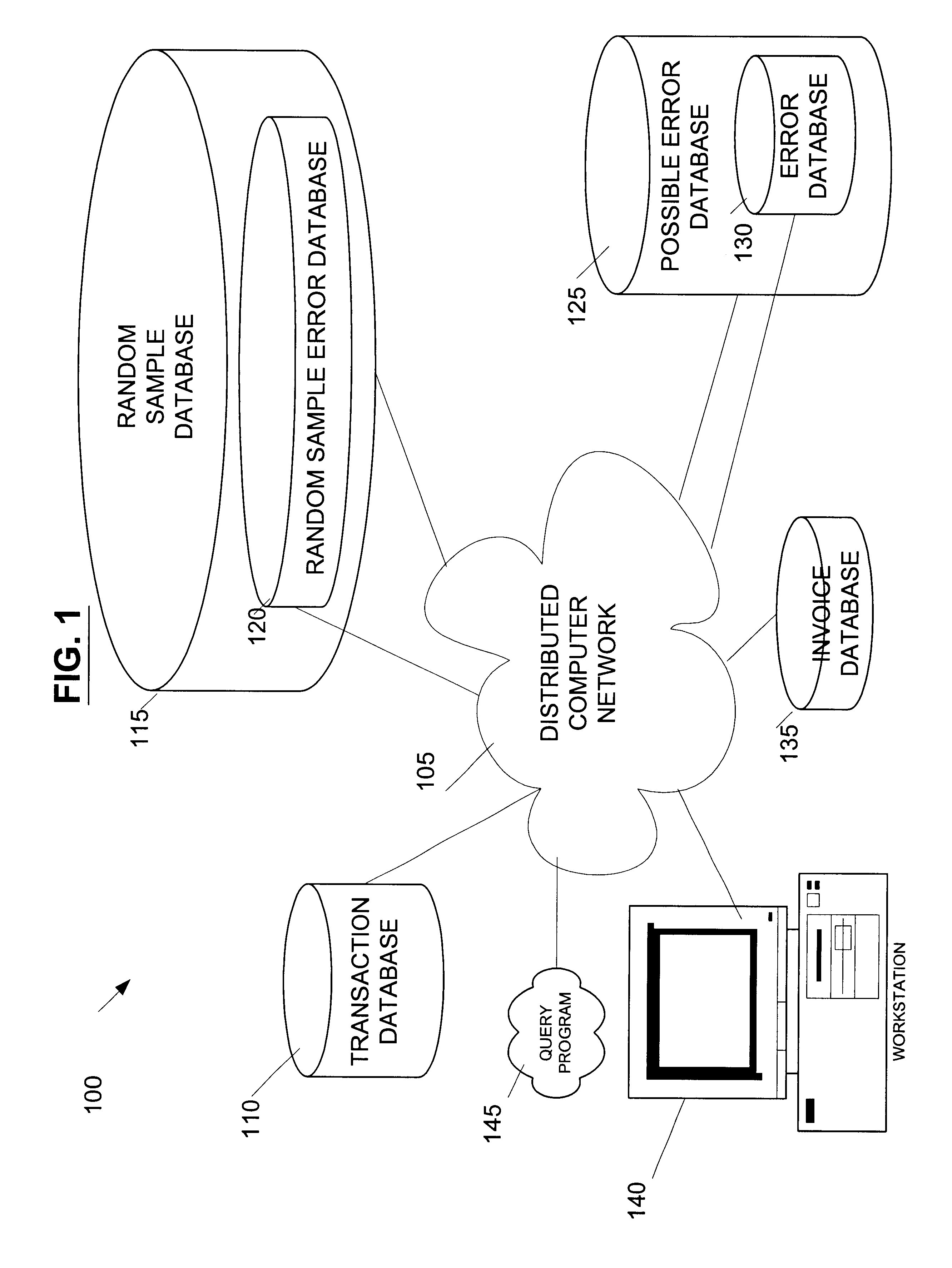

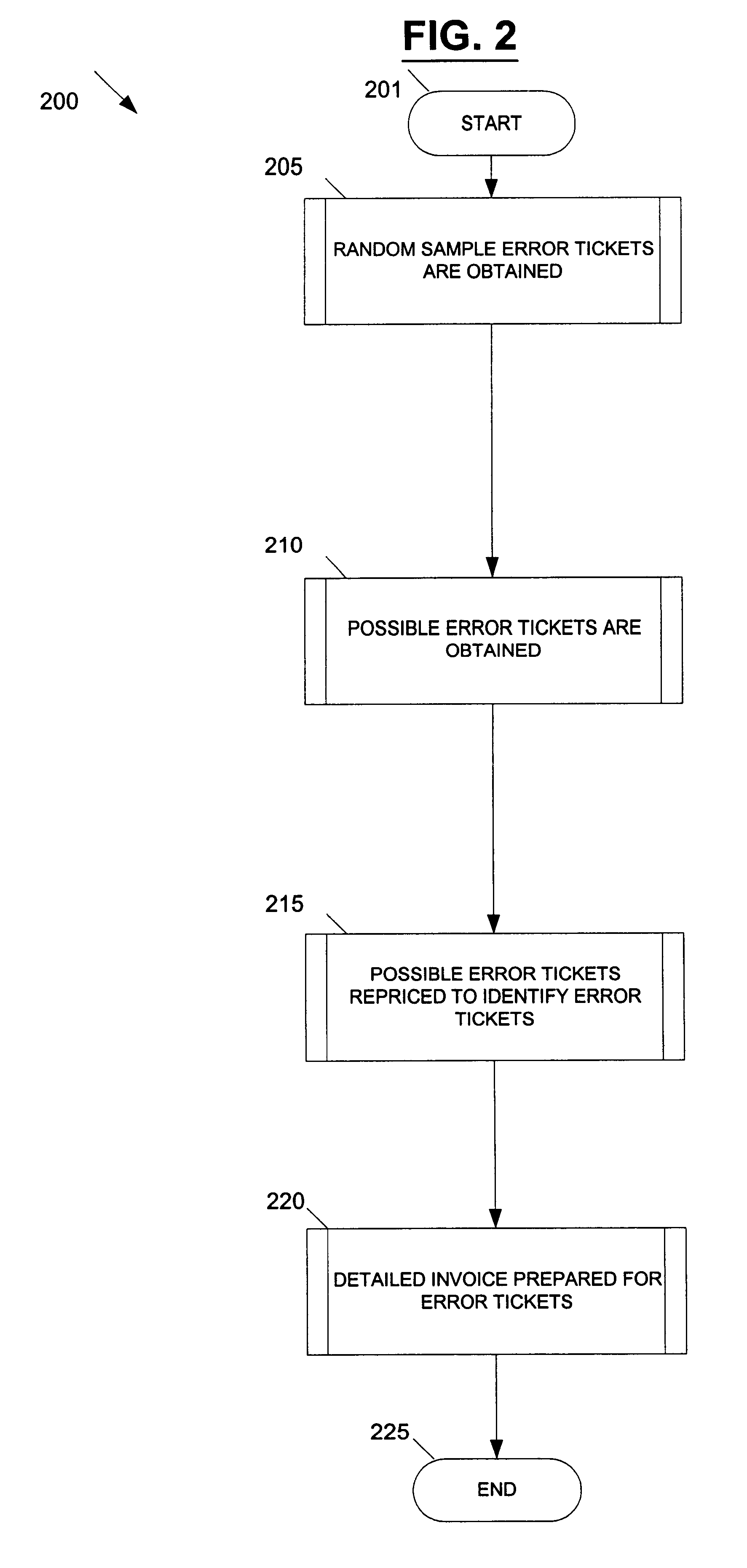

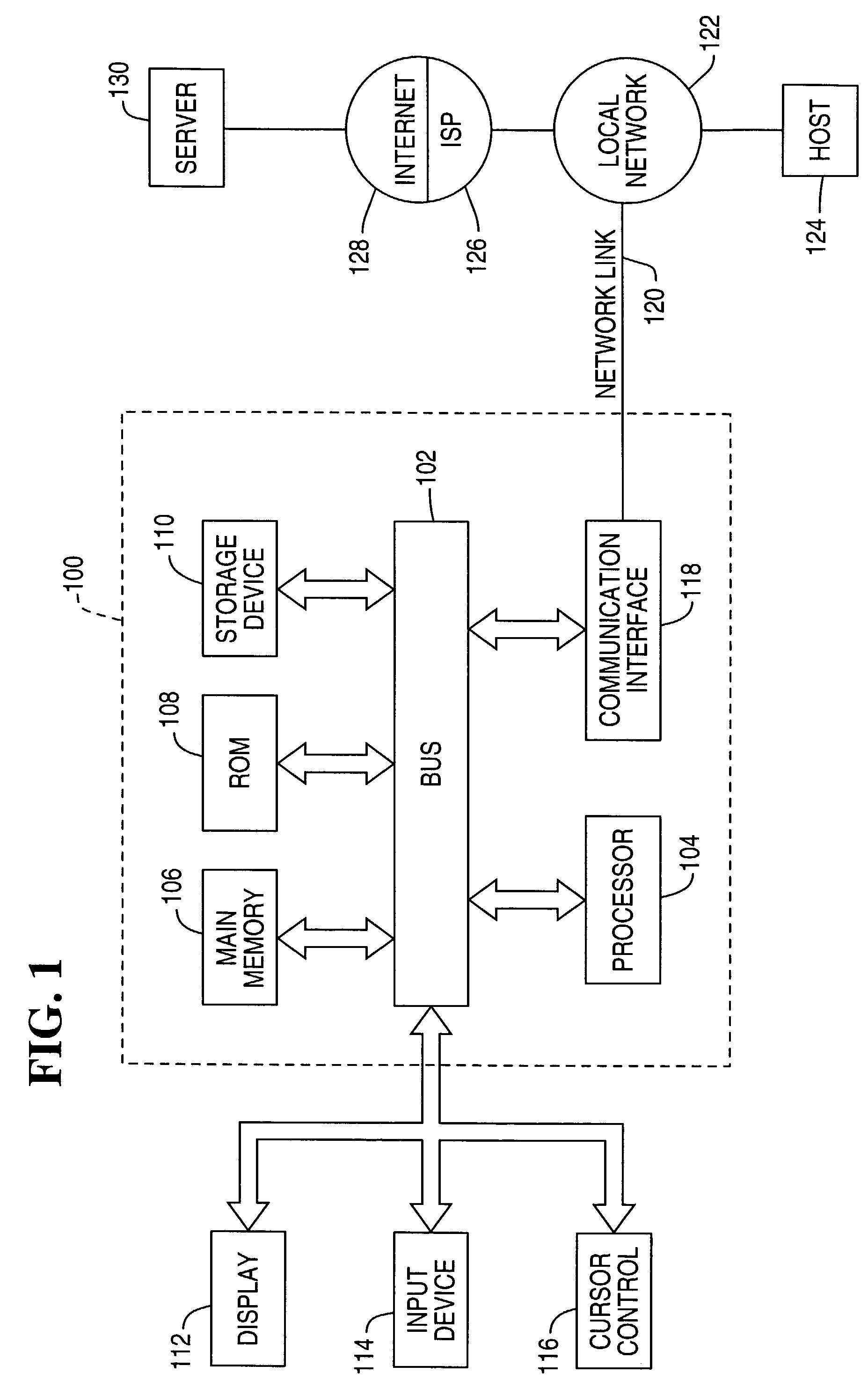

Method and system for conducting a target audit in a high volume transaction environment

InactiveUS6959287B2Efficiently focusIncrease transaction volumeComplete banking machinesFinanceHigh probabilityThe Internet

A target audit methodology to provide a transaction-based detail of errors in an environment with a high volume of transactions. The primary components comprise a distributed computer network, such as the global Internet, coupled to numerous databases and a workstation. A Random Sample Query is used to pull a statistically valid sample from a general population of transactions to identify initial transaction errors. The initial transaction errors are analyzed to determine parameters for identifying other similar errors with a high probability of occurrence within the total population of transactions. A Possible Error Query is designed to retrieve these specific error types and is processed against the population of transactions. The results of the Possible Error Query are assigned financial impact and detailed for the client by individual transaction in an invoice.

Owner:DELTA AIR LINES

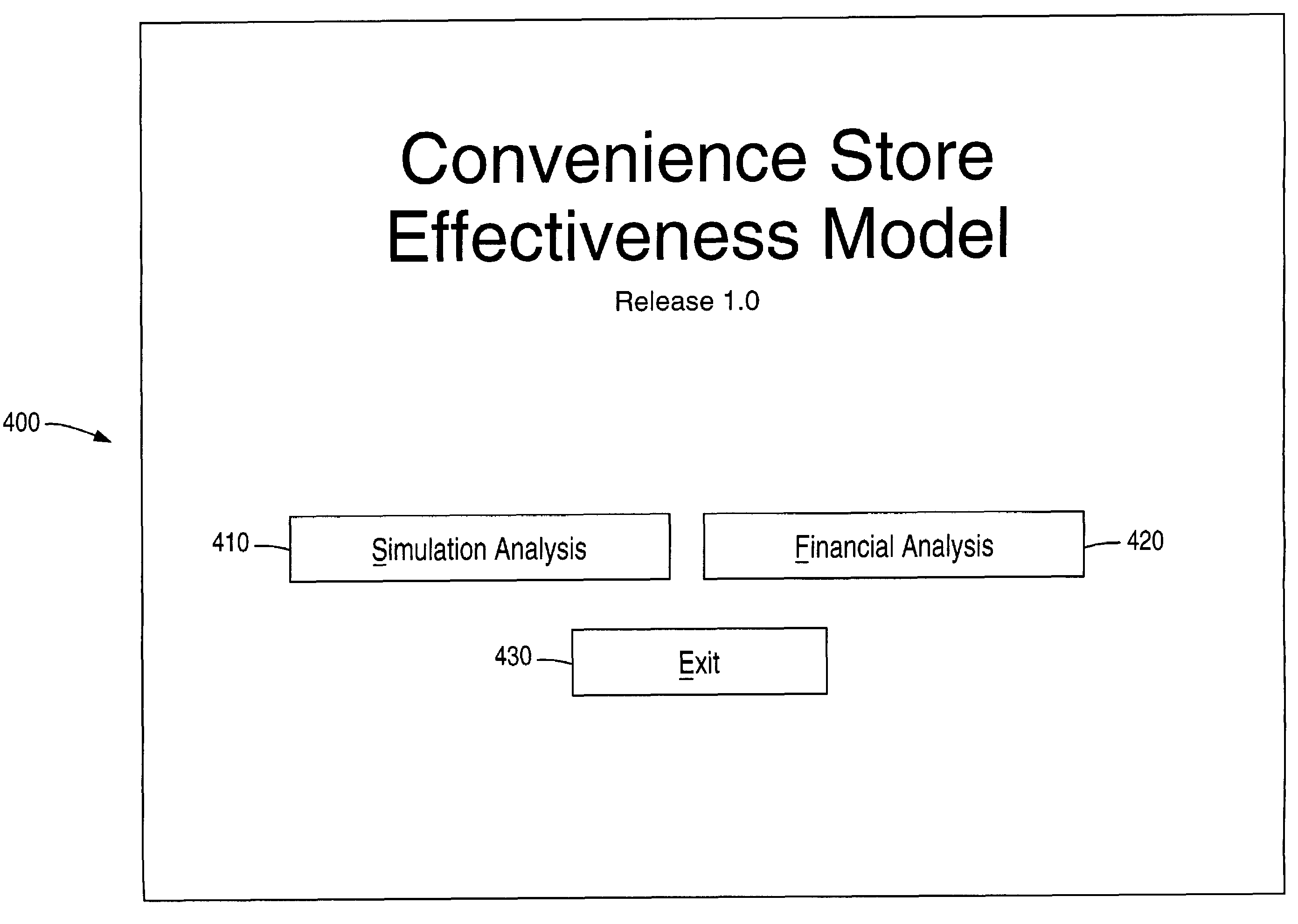

Convenience store effectiveness model (CSEM)

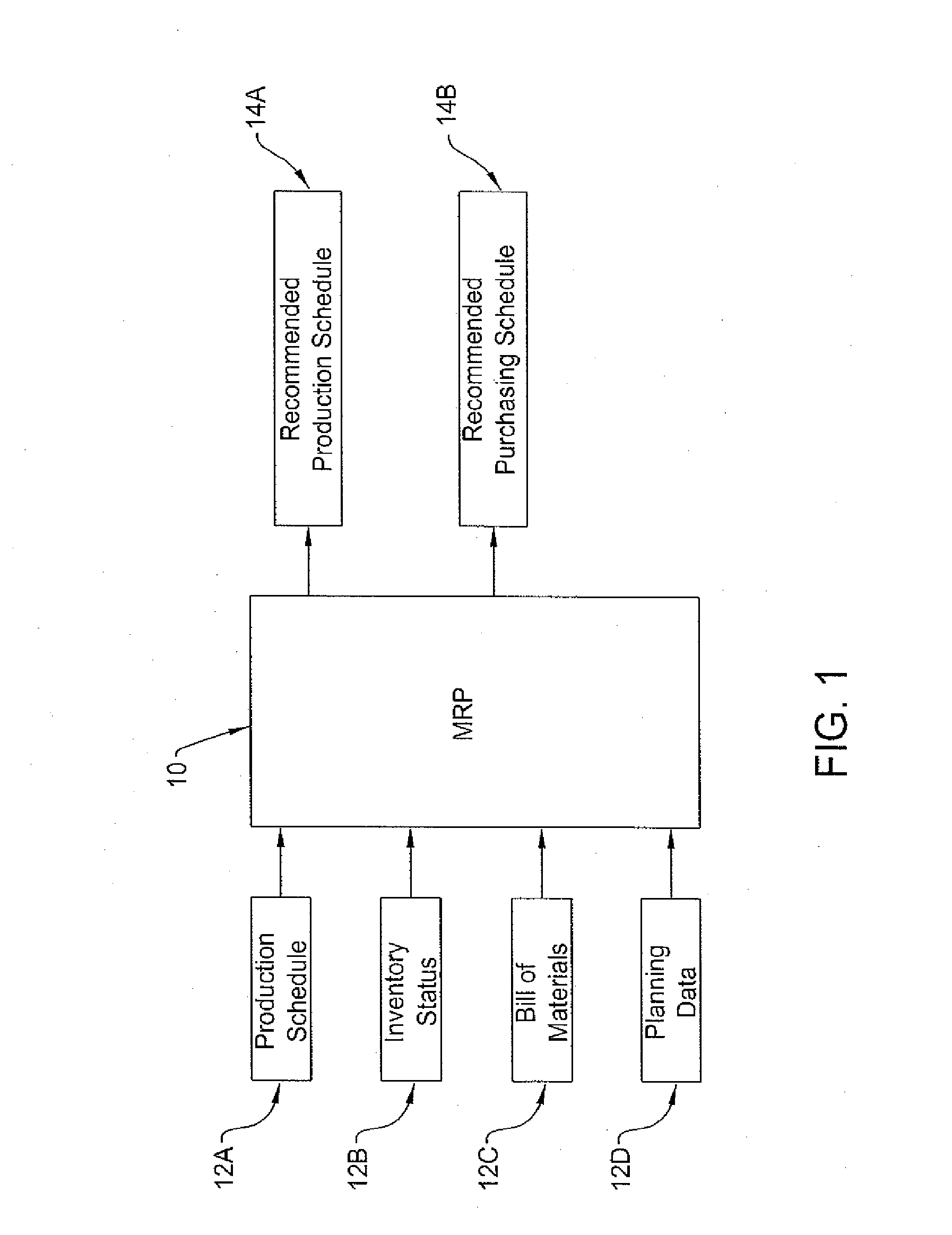

Convenience Store Effectiveness Model (CSEM) is a self-contained PC application to quantitatively predict operational and financial impact of changes to Convenience Store (CStore) and Financial Services Center (FSC) operations. CSEM includes Simulation Analysis Module and Financial Analysis Module. Simulation Analysis Module includes FSC model and CStore model. CStore model predicts the effect of an unlimited number of changes in store design, customer demand patterns, and checkout procedures on store performance. Financial Analysis Module creates a Profit and Loss (P&L) statement showing cash flows, Net Present Value (NPV), and Internal Rate of Return (IRR) for deploying FSCs using simulation results or user input values. An analyst can use CSEM to provide a sound and quantified basis for developing a business case for investing in new technologies, i.e., FSC, or other design and procedure changes in a convenience store environment.

Owner:NCR CORP

Domain specific return on investment model system and method of use

A system and method for creating and executing a business model for domain specific decisions to compare possible alternative business solutions to maximize results is provided. A domain-specific return on investment (ROI) or financial measurements model and a calculator for buying and selling information technology based solutions targeted at improving overall business efficiency and effectiveness by reducing lead time, improving probability of success, creating an innovative environment, enhancing corporate image, and reducing cost and improving revenues. These business objectives are connected to the capabilities provided by vendor solutions which are based on technology, process, people, science, or the like, typically through concrete initiatives. Solution components are quantified and used to calculate financial impacts for solution choices.

Owner:SERVICENOW INC +1

Providing aggregate forecasted impact information for physical to financial asset reconciliation

ActiveUS7945490B2Easy to determineEasy access and viewingComplete banking machinesFinanceFinancial impactKnowledge management

Owner:ORACLE INT CORP

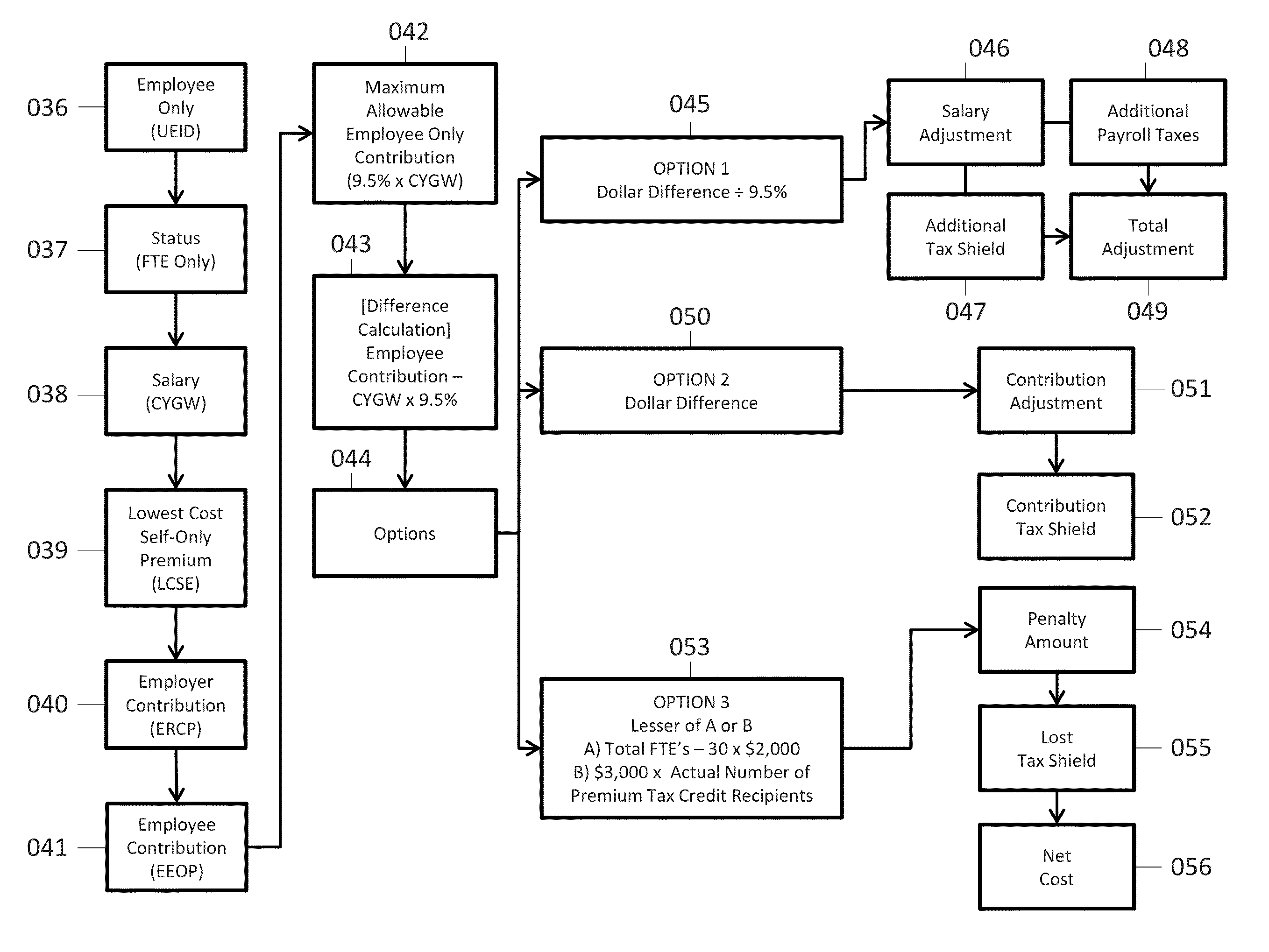

Health quant data modeler with health care real options analytics, rapid economic justification, and affordable care act enabled options

InactiveUS20140180714A1Promote rapid adoptionFinanceHealth-index calculationRisk profilingData modeling

The present invention is applicable in the fields of finance, health care, employee benefits, math, and business statistics and was originated to provide real health-care decision analysis, risk analysis, and option analytics to corporate entities and individual participants, the need for which has arisen from what is collectively known as the Affordable Care Act (Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act of 2010). The present version of the Health Quant Data Modeler (HQDM) accounts for updates made necessary by the implementation of the Affordable Care Act, including additional applications for modeling, simulating, and analyzing the financial impact of the health-care real options for corporate entities with a minimal set of input assumptions for the purposes of a rapid economic justification and analysis.

Owner:MUN JOHNATHAN C

Forecast decision system and method

InactiveUS7305304B2Increase valueReliable estimateAnalogue computers for vehiclesFinanceAerodromeRegression analysis

A system and method for making a decision of whether to carry additional fuel on an aircraft for a particular flight based on a forecast, such as for low visibility and ceiling. Preferably, observations-based probabilistic forecasts are utilized. The forecast probability of the weather at the planned aerodrome being below a prescribed minimum level is calculated using statistical regression analysis of past data. An optimal probability is estimated using cost parameters on an individual flight bases. If this forecast probability is greater than the optimal probability for a particular flight, then extra fuel is carried by that flight. This is in contrast to current practice whereby the same categorical forecast is applied to all flights. The combination of improved short-term forecasts and identification of optimal forecast probabilities minimizes the financial impact of errors and weather forecasts on airline operations thereby providing a superior financial outcome.

Owner:RGT UNIV OF OKLAHOMA THE BOARD THE

Methods and systems for selecting a workscope for a system

A server for use in selecting a workscope for a system includes a prediction tool configured to identify a plurality of workscopes for the system, wherein each workscope defines a plurality of maintenance activities for a plurality of components of the system. The server also includes a financial model tool coupled to the prediction tool, and an analyzer tool coupled to the prediction tool and the financial model tool. The financial model tool is configured to receive the plurality of workscopes and determine an expected financial impact of the maintenance activities of each workscope for a plurality of future maintenance events. The analyzer tool is configured to receive the plurality of workscopes from the prediction tool, receive the expected financial impact of the maintenance activities from the financial model tool, and determine an expected effect of each workscope during a predefined time interval that includes the future maintenance events.

Owner:GENERAL ELECTRIC CO

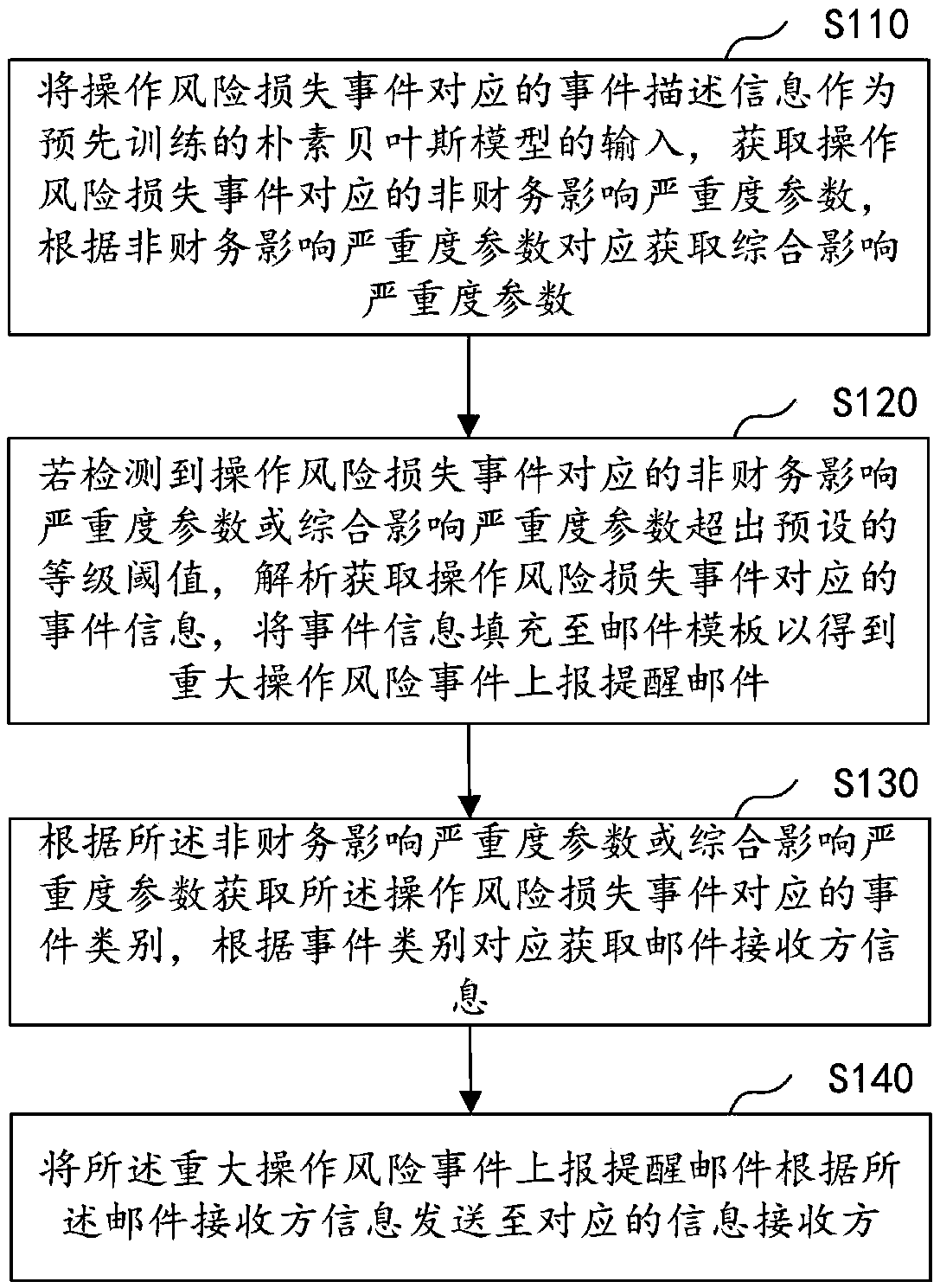

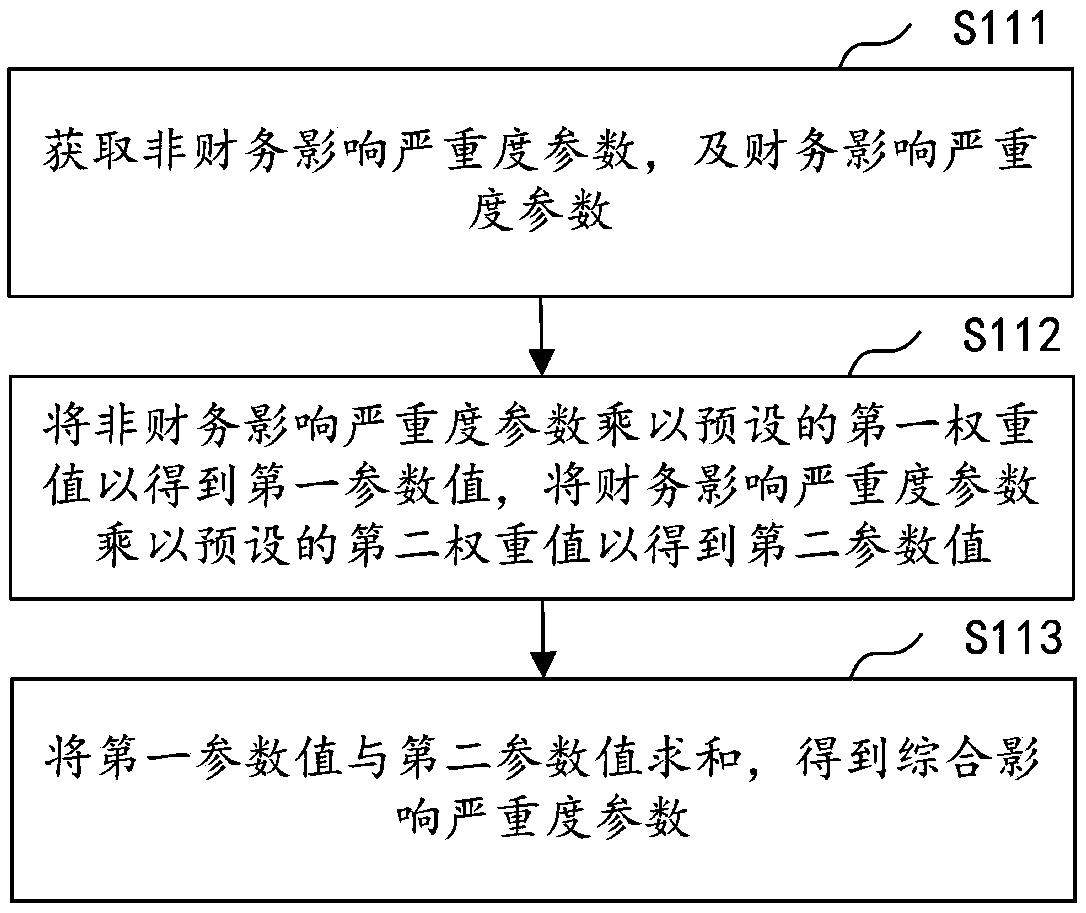

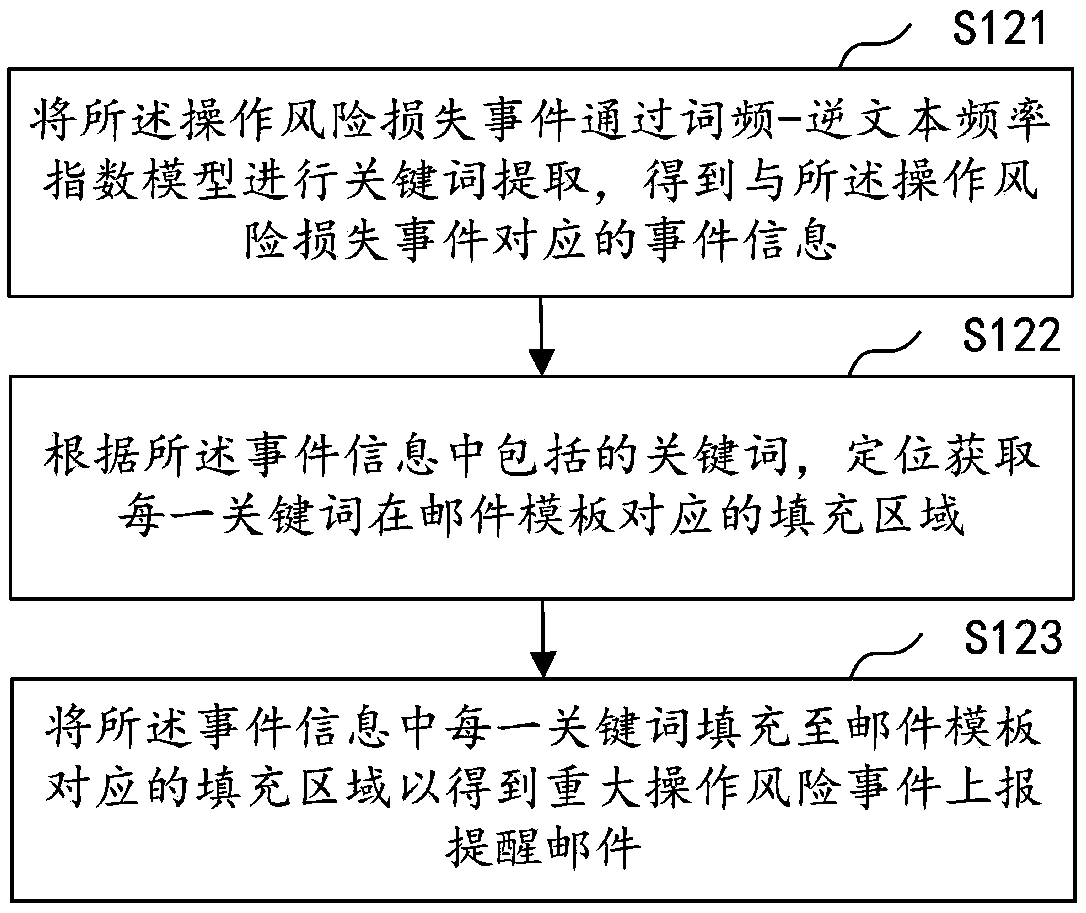

Mail pushing method and apparatus of risk events, computer device and storage medium

ActiveCN109474515ARealize intelligent judgmentCharacter and pattern recognitionData switching networksFinancial impactComputer science

The invention discloses a mail pushing method and apparatus of risk events, a computer device and a storage medium. The method comprises the following steps: correspondingly obtaining a non-financialimpact severity parameter or a comprehensive impact severity parameter by operating a risk loss event, when the non-financial impact severity parameter or the comprehensive impact severity parameter exceeds a preset level threshold, obtaining corresponding event information according to an operation risk loss event, filling the event information in a mail template to obtain a major operation riskevent reporting reminding mail, obtaining mail receiver information according to an event category corresponding to the operation risk loss event, and sending the major operation risk event reportingreminding mail to a corresponding information receiver according to the mail receiver information. By adoption of the method, the intelligent judgment on the non-financial impact severity parameter orthe comprehensive impact severity parameter is achieved, and when the non-financial impact severity parameter or the comprehensive impact severity parameter exceeds the level threshold, the major operation risk event reporting reminding mail is automatically filled and is sent to the receiver so as to notify the receiver for processing.

Owner:PING AN TECH (SHENZHEN) CO LTD

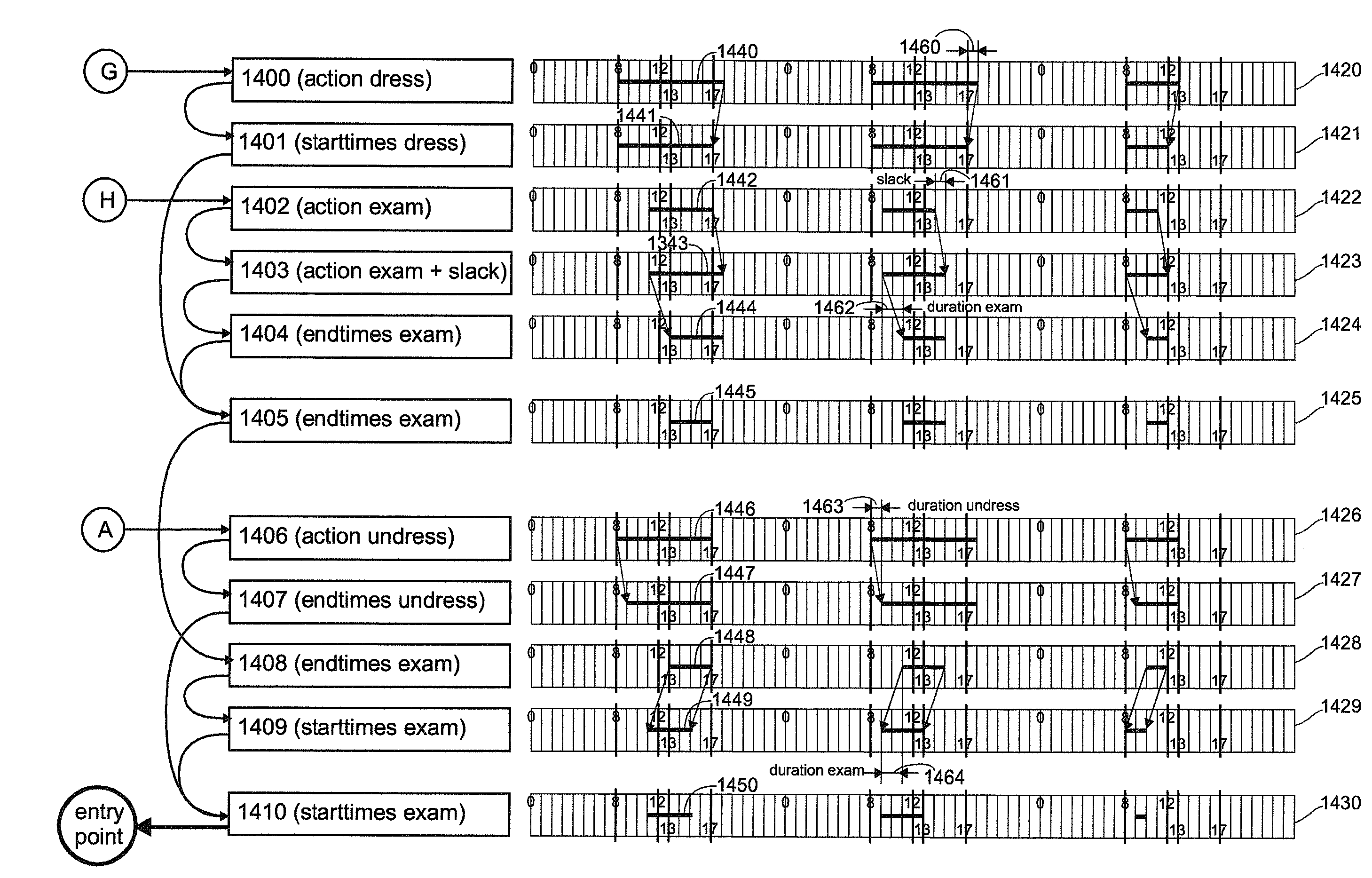

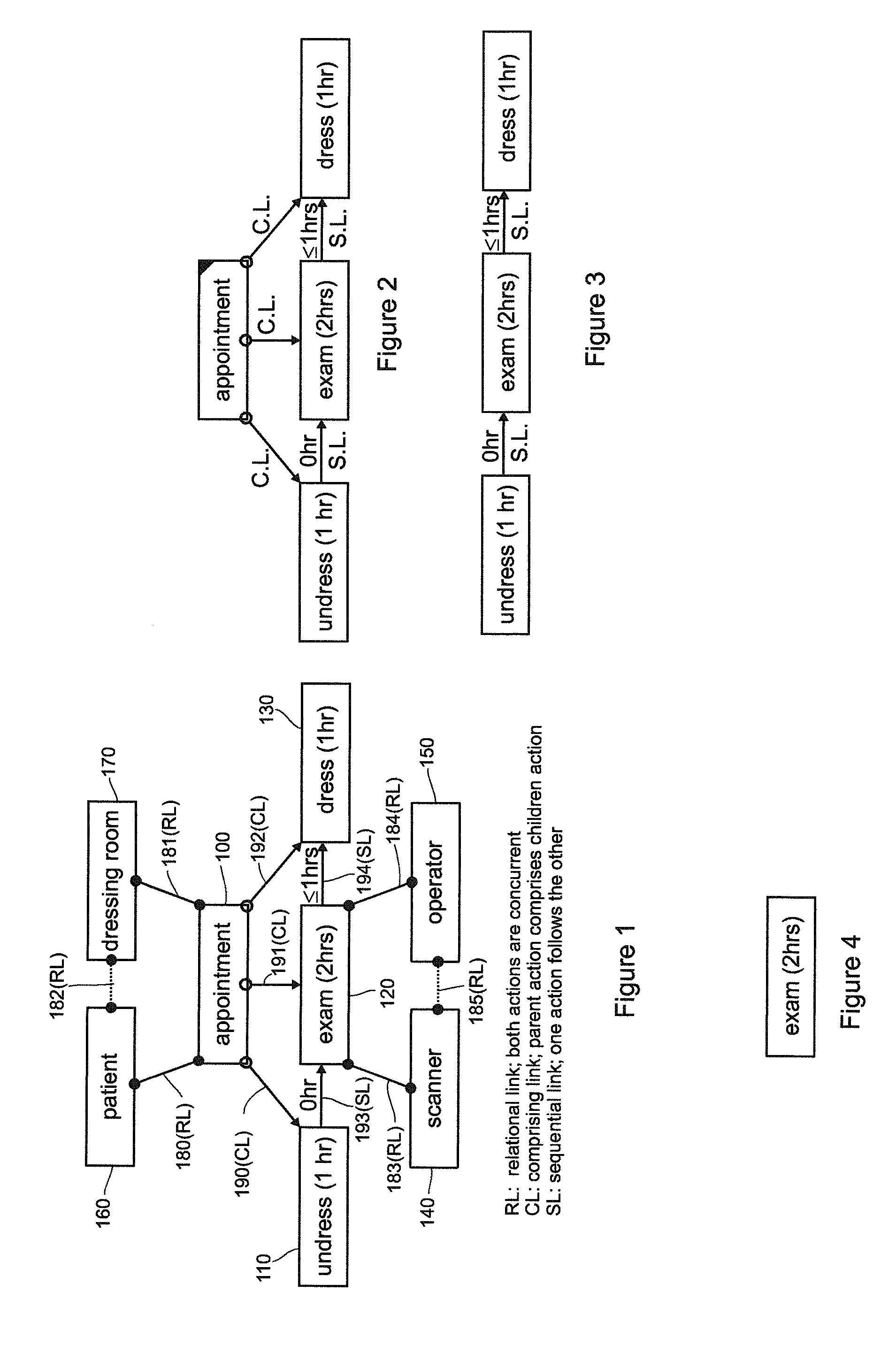

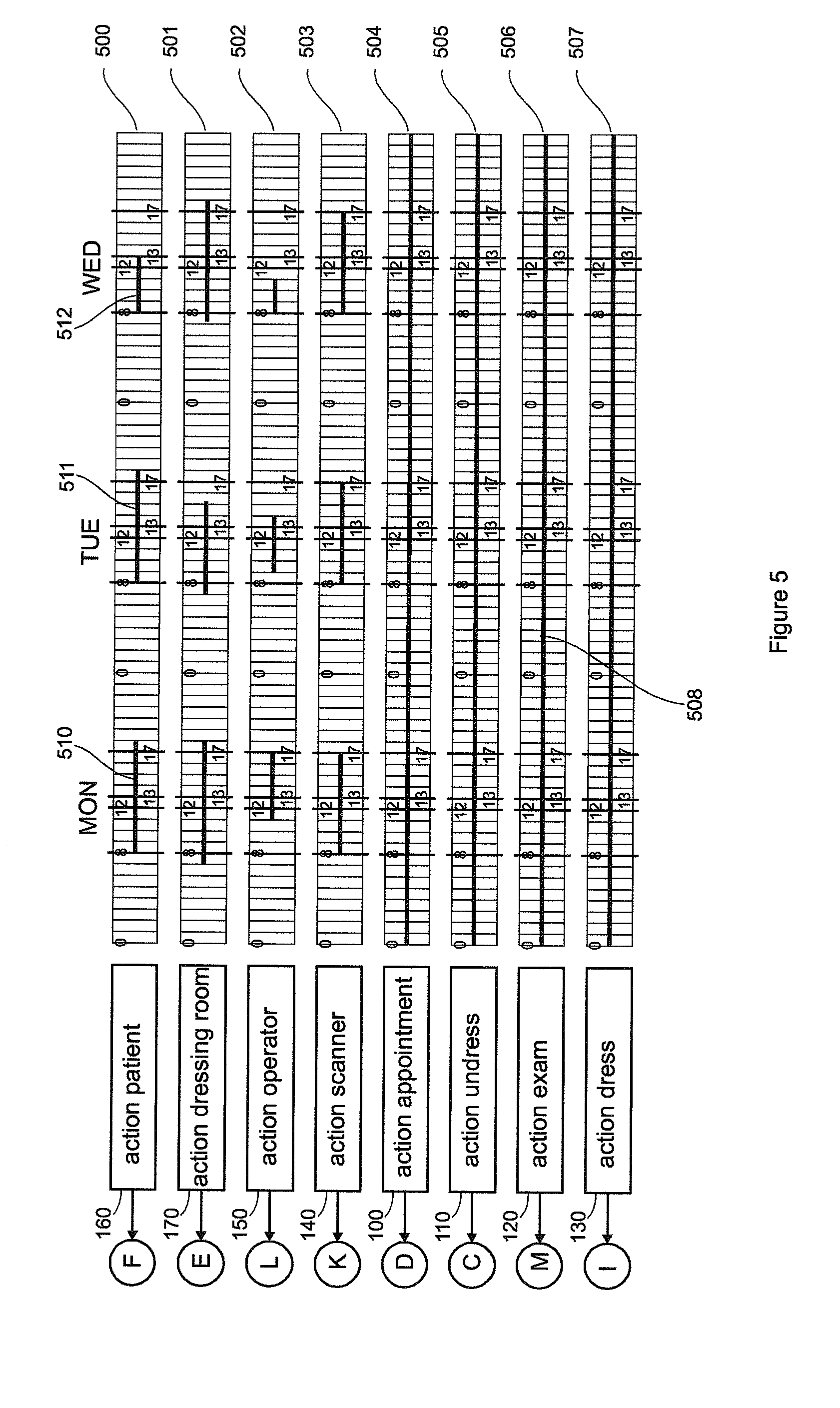

Optimized Appointment Scheduling Method

An appointment scheduling method wherein available time slots for an appointment are ranked according to the result of a balancing of importance factors adhered by an enterprise to weights associated with the available time slots such as efficiency of use of resources, urgency of examination, financial impact etc.

Owner:AGFA HEALTHCARE INC

Method and Apparatus for Modeling and Executing Deferred Award Instrument Plan

Administration of various deferred award instrument plan and asset account programs that can effectively provide economically efficient benefits by assisting an Employer in the identification of appropriate employees, and through the use of a novel modeling method and apparatus to implement a deferred award instrument program through a novel employee welfare benefit / deferred compensation / EWB / OPEB asset account maintenance plan that permits the employees to benefit from their deferred award incentive program (such as stock options, Long Term Incentive Plans, deferred compensation, EWB / OPEB, life insurance benefits), while having a minimal financial impact on the Employer.

Owner:BELL LAWRENCE L

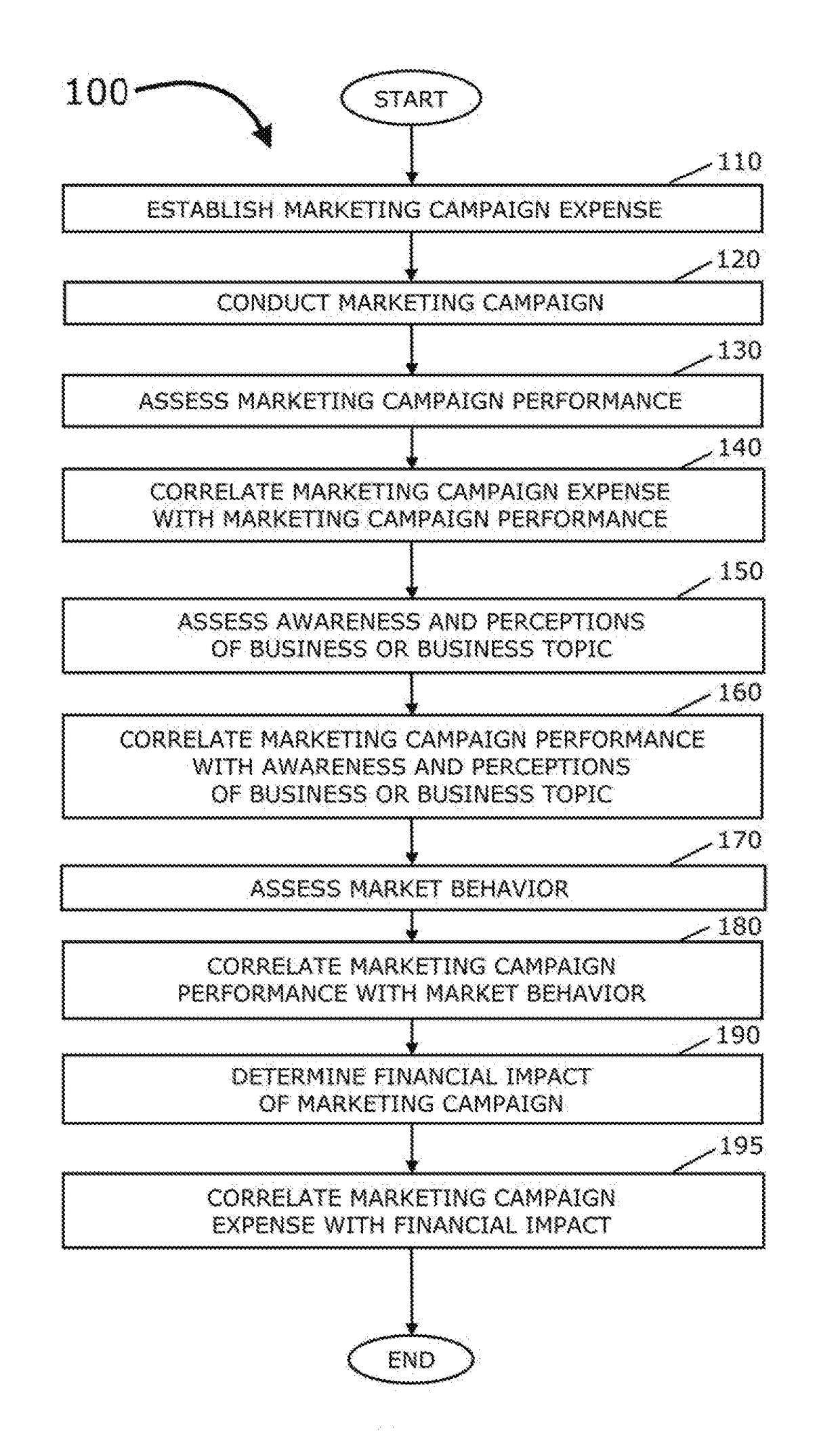

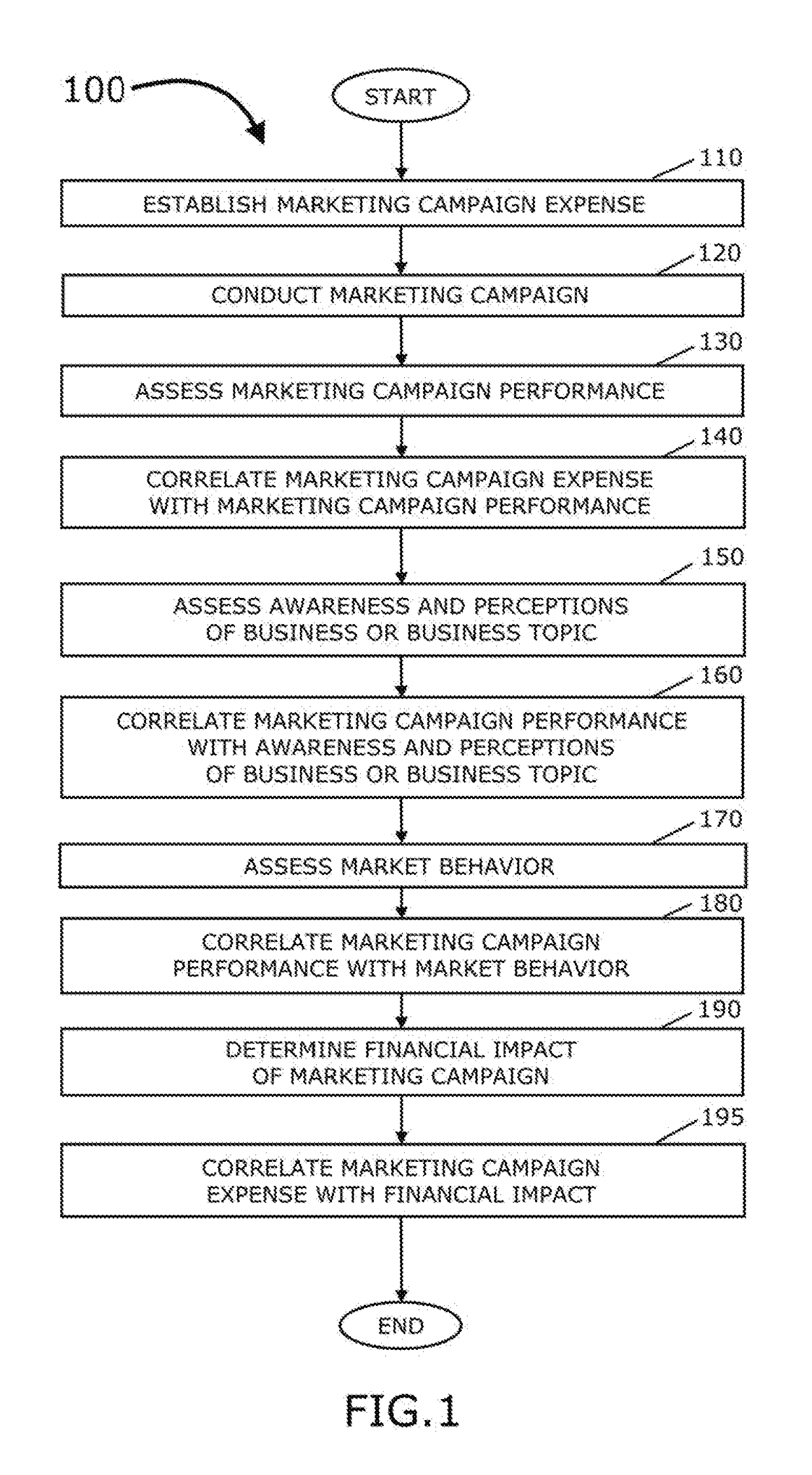

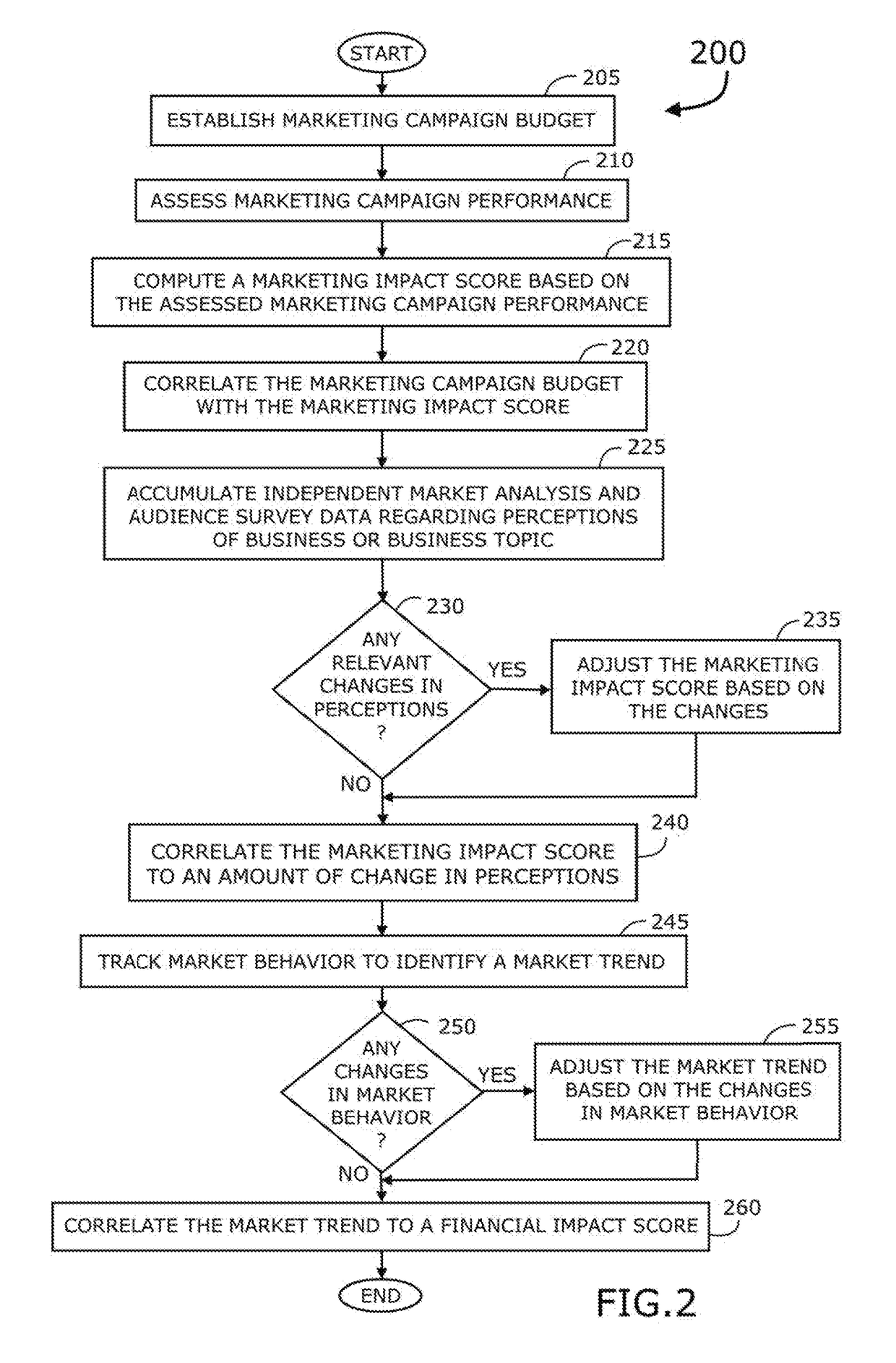

System and methods for connecting marketing investment to impact on business revenue, margin, and cash flow and for connecting and visualizing correlated data sets to describe a time-sequenced chain of cause and effect

An investment impact value chain connection and visualization system that connects marketing investment over time to financial impact and methods for connecting marketing investment to impact on business revenue, margin and cash flow and for connecting and visualizing correlated data sets to describe time-sequenced chains of cause and effect in the connection between marketing investment and financial impact are disclosed. The system and the methods deliver comprehensive, full scope assessment of marketing's contribution to revenue, margin, and cash flow via correlations between marketing stimuli and demand generation, deal expansion and sales velocity outcomes.

Owner:STOUSE MARK DUCROS

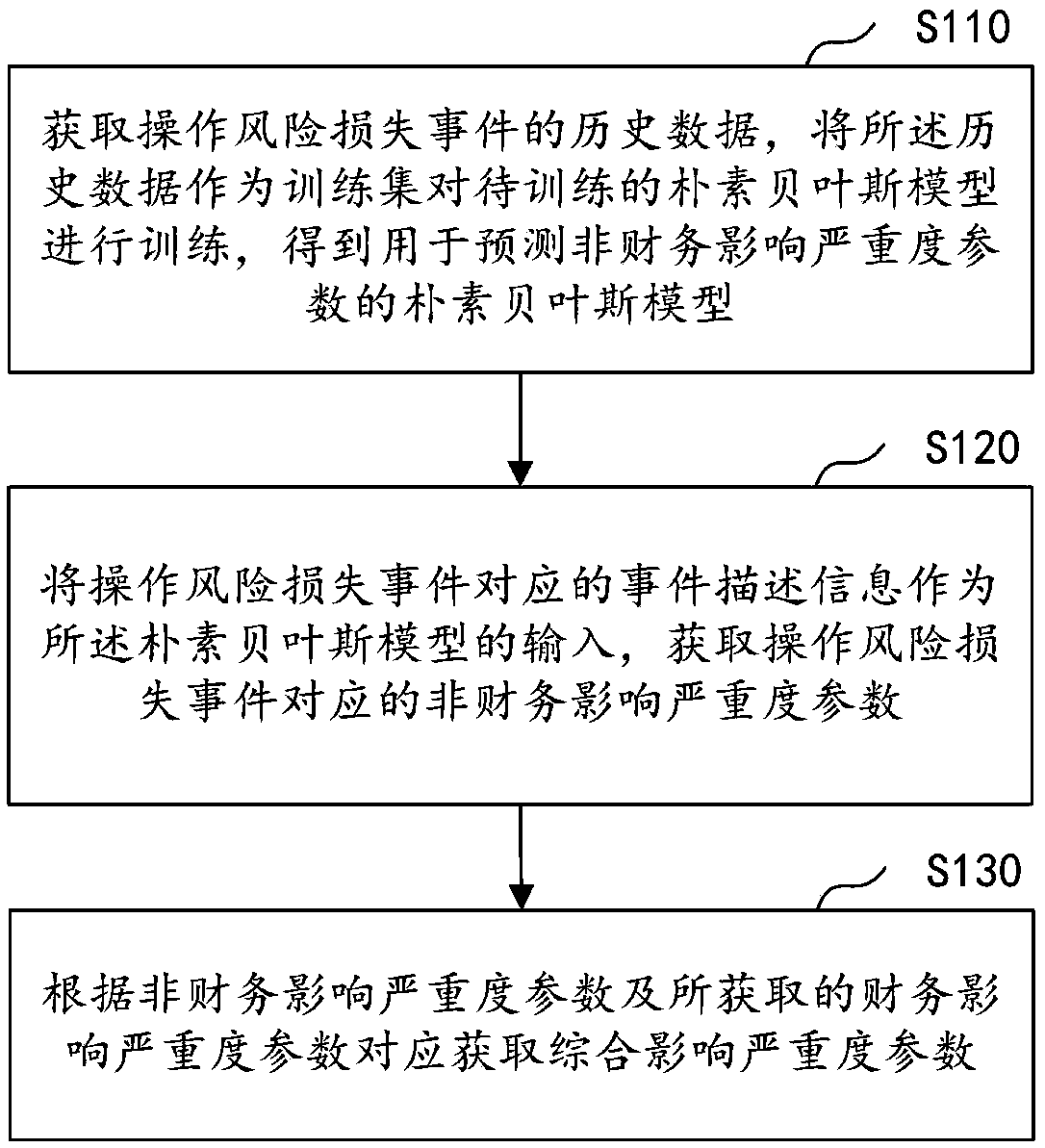

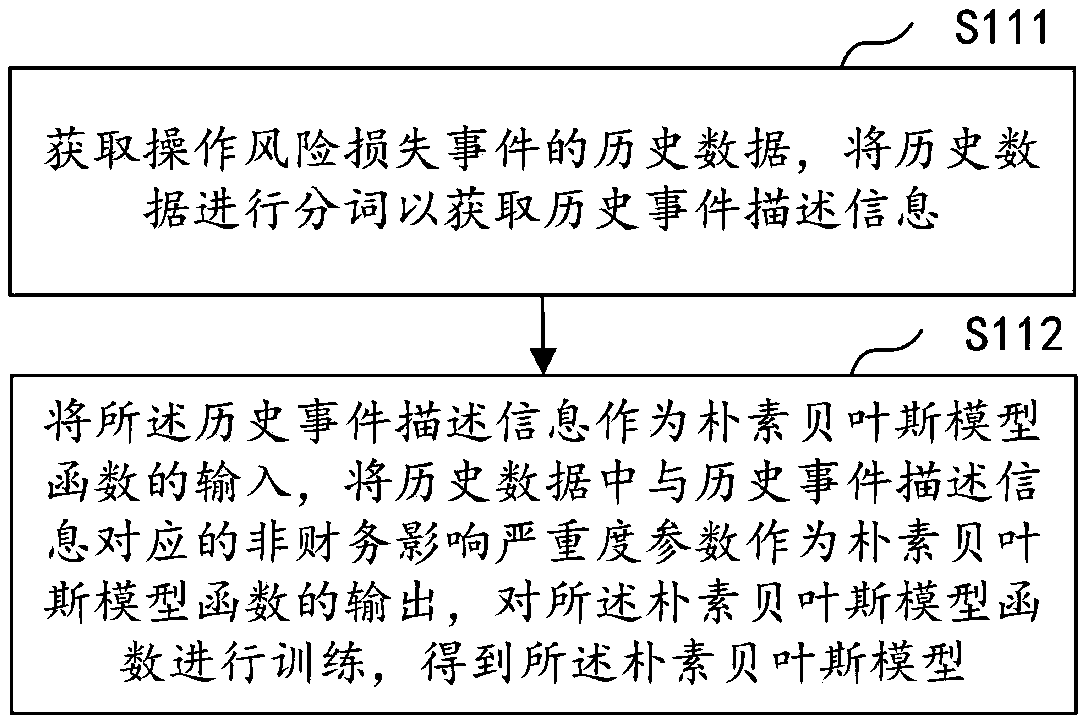

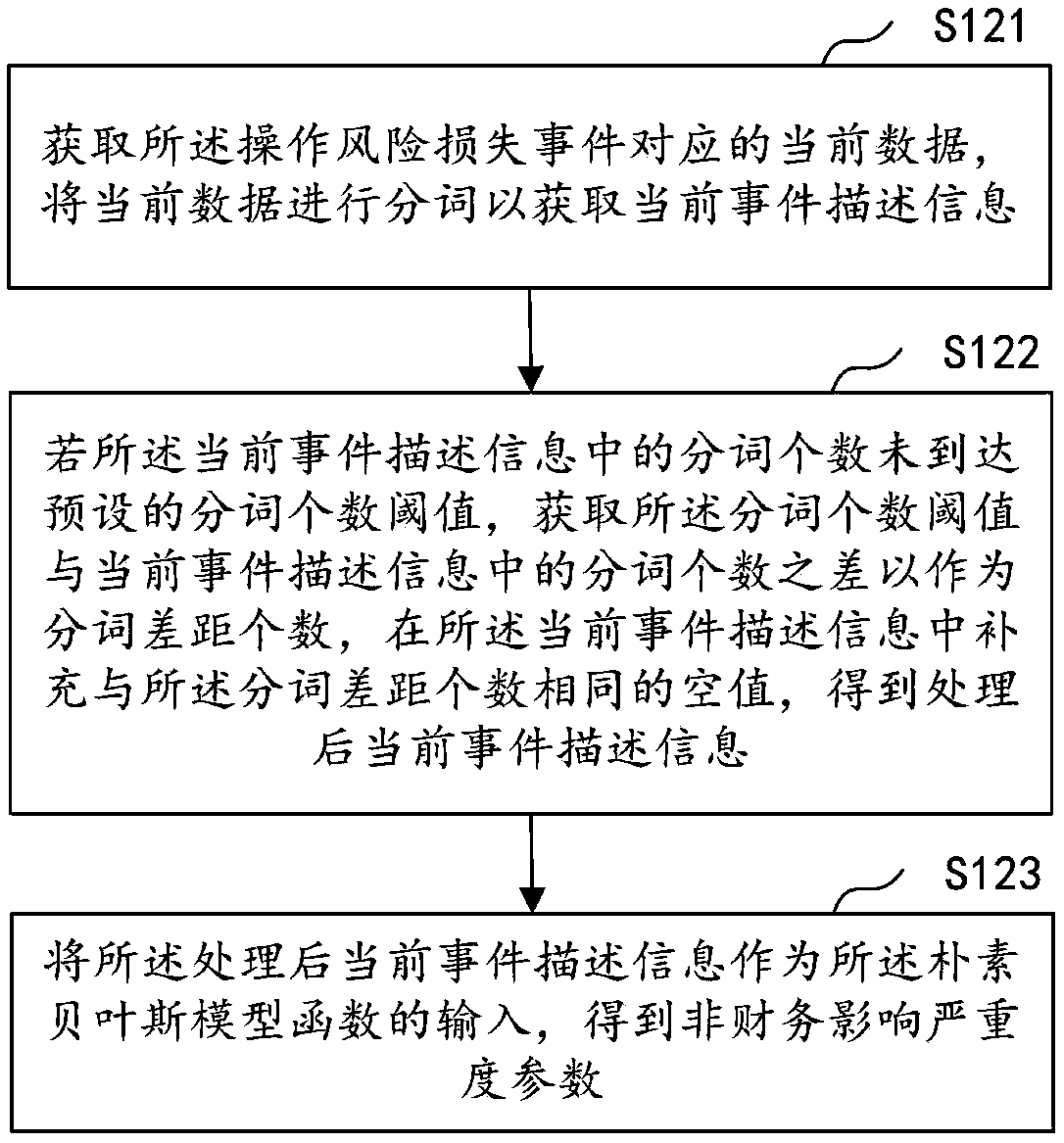

Risk event risk estimation method and device, computer equipment and storage medium

PendingCN109492911ATimely risk assessmentTimely processingFinanceCharacter and pattern recognitionEstimation methodsFinancial impact

The invention discloses a risk estimation method and device for a risk event, computer equipment and a storage medium. According to the method, historical data of an operation risk loss event is usedfor training a naive Bayes model to be trained; and obtaining a naive Bayes model used for predicting the non-financial influence severity parameter, taking the event description information corresponding to the operation risk loss event as the input of the naive Bayes model, and obtaining the non-financial influence severity parameter corresponding to the operation risk loss event. According to the method, automatic calculation and intelligent prediction of the non-financial influence severity parameter corresponding to the operation risk loss event are achieved, risk estimation can be conducted on the operation risk loss event in time, and the risk event can be processed in time conveniently.

Owner:PING AN TECH (SHENZHEN) CO LTD

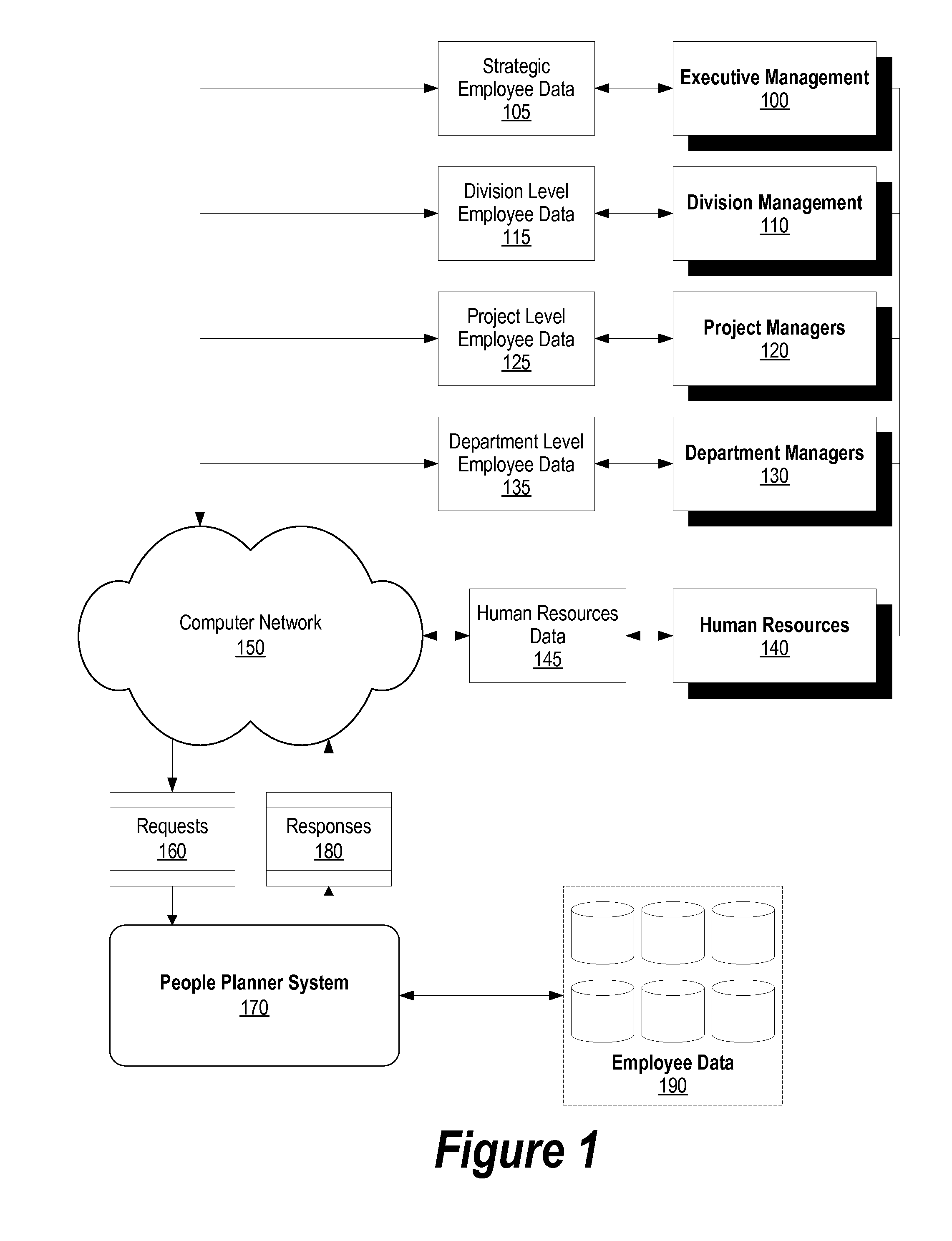

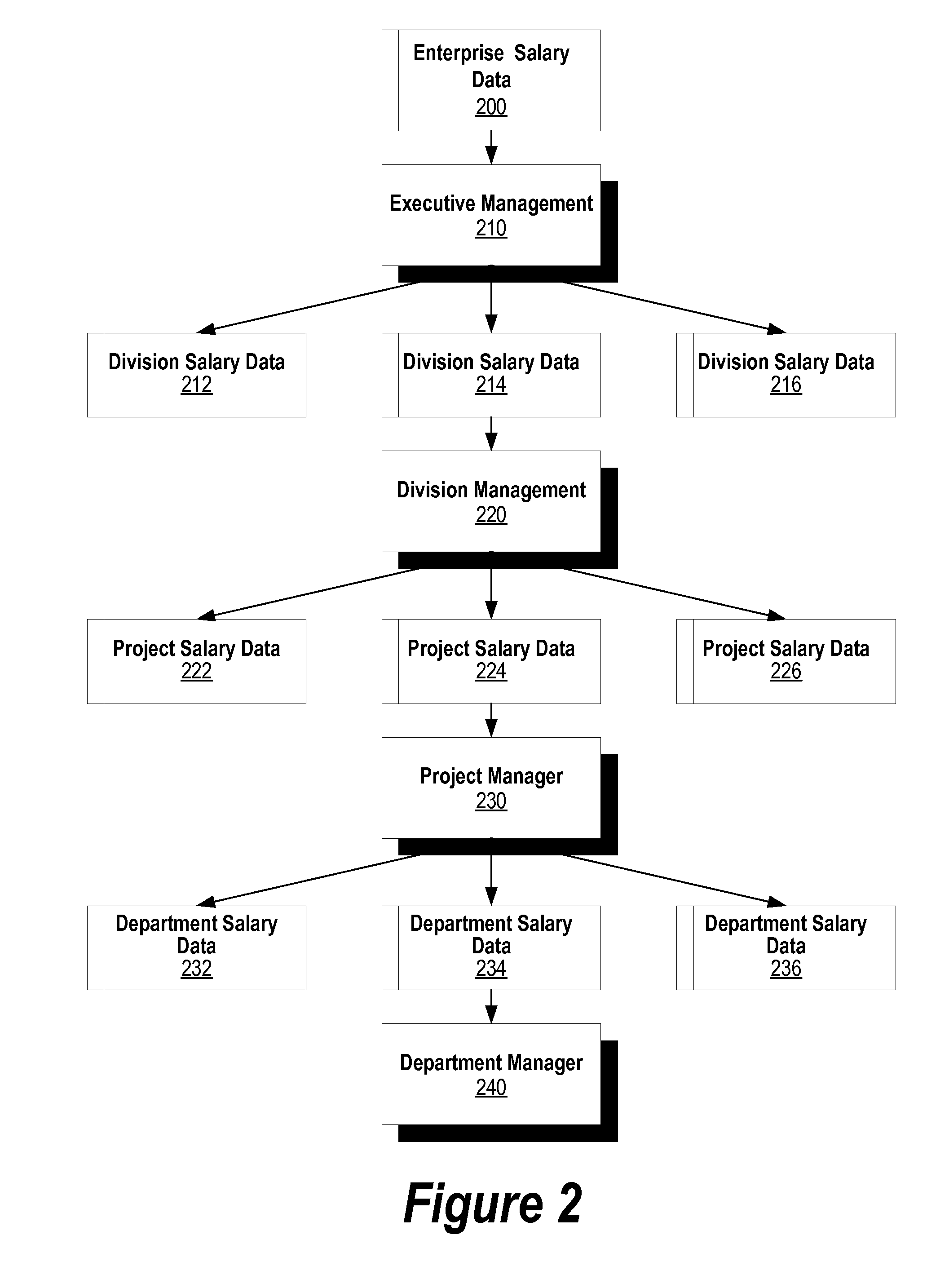

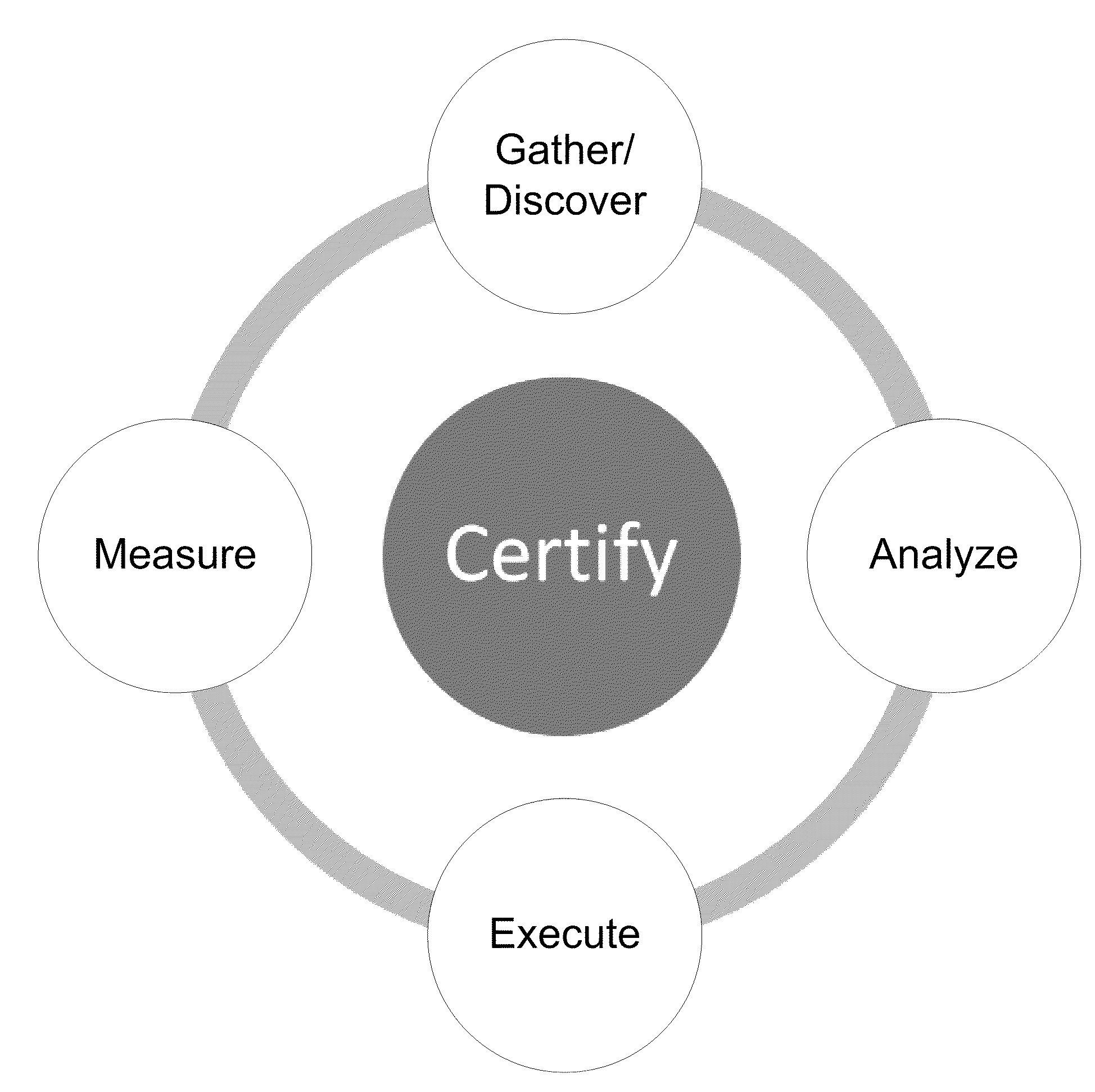

Resource Reduction Financial Impact Analysis

Owner:INT BUSINESS MASCH CORP

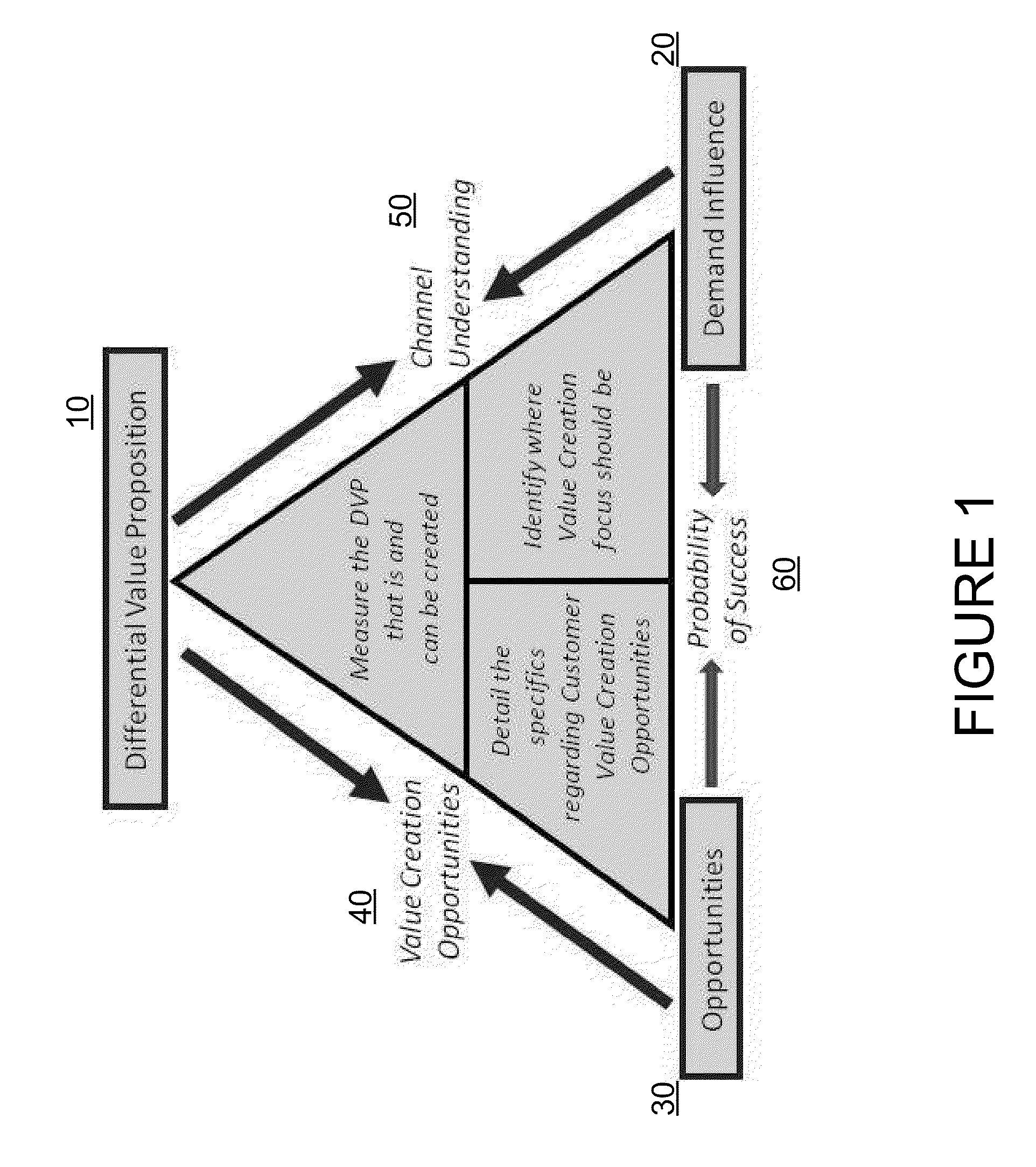

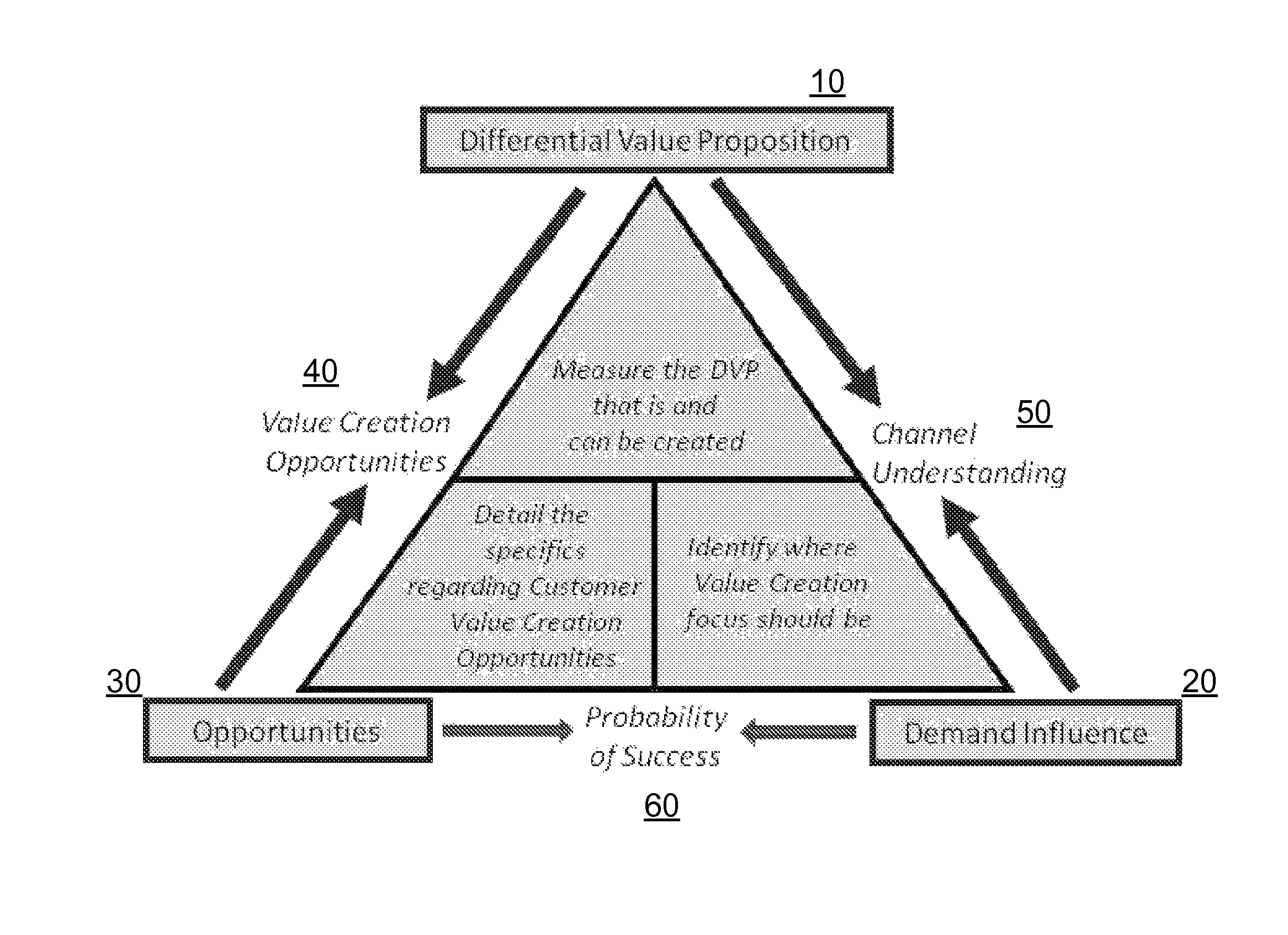

System and method for customer value creation

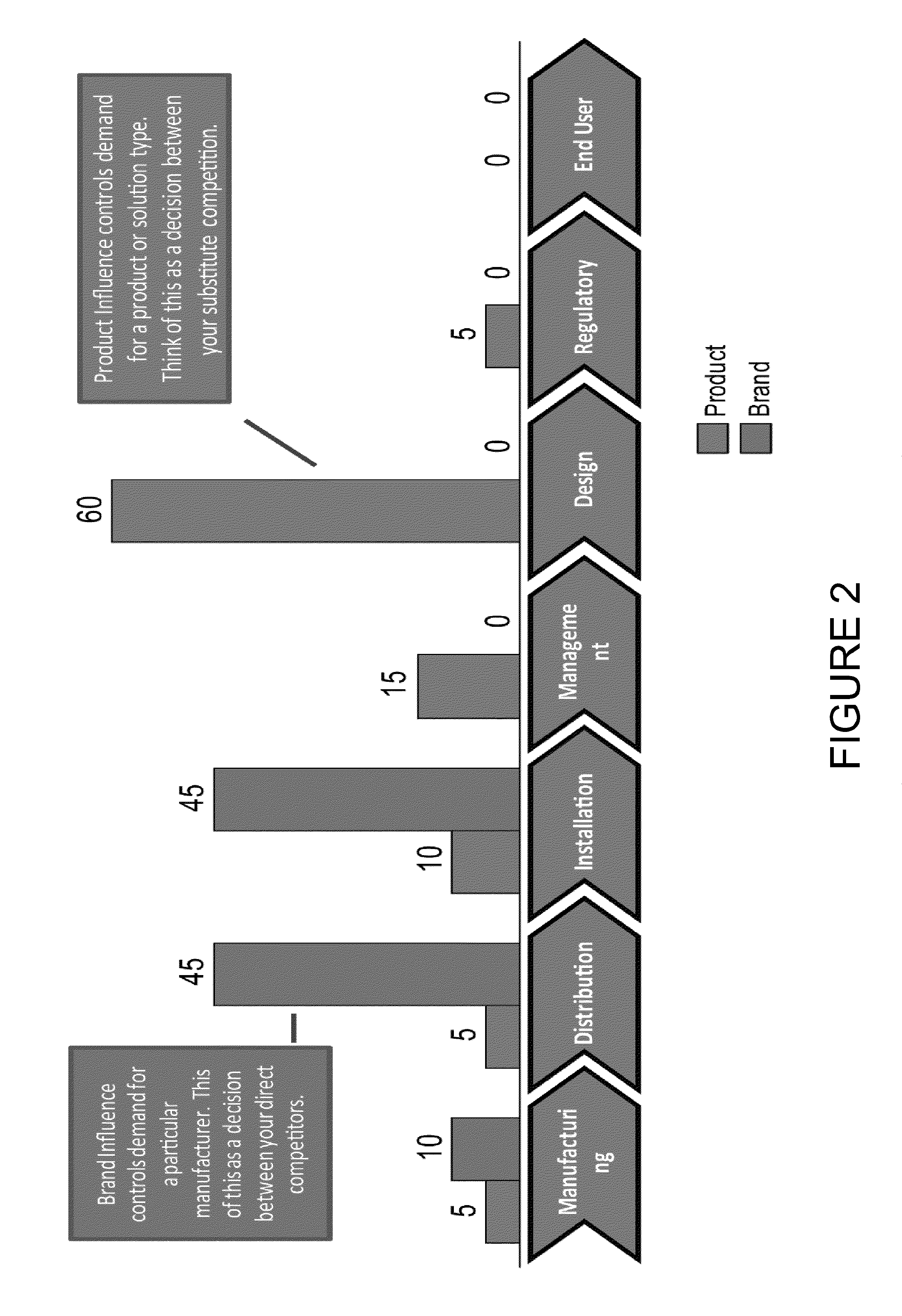

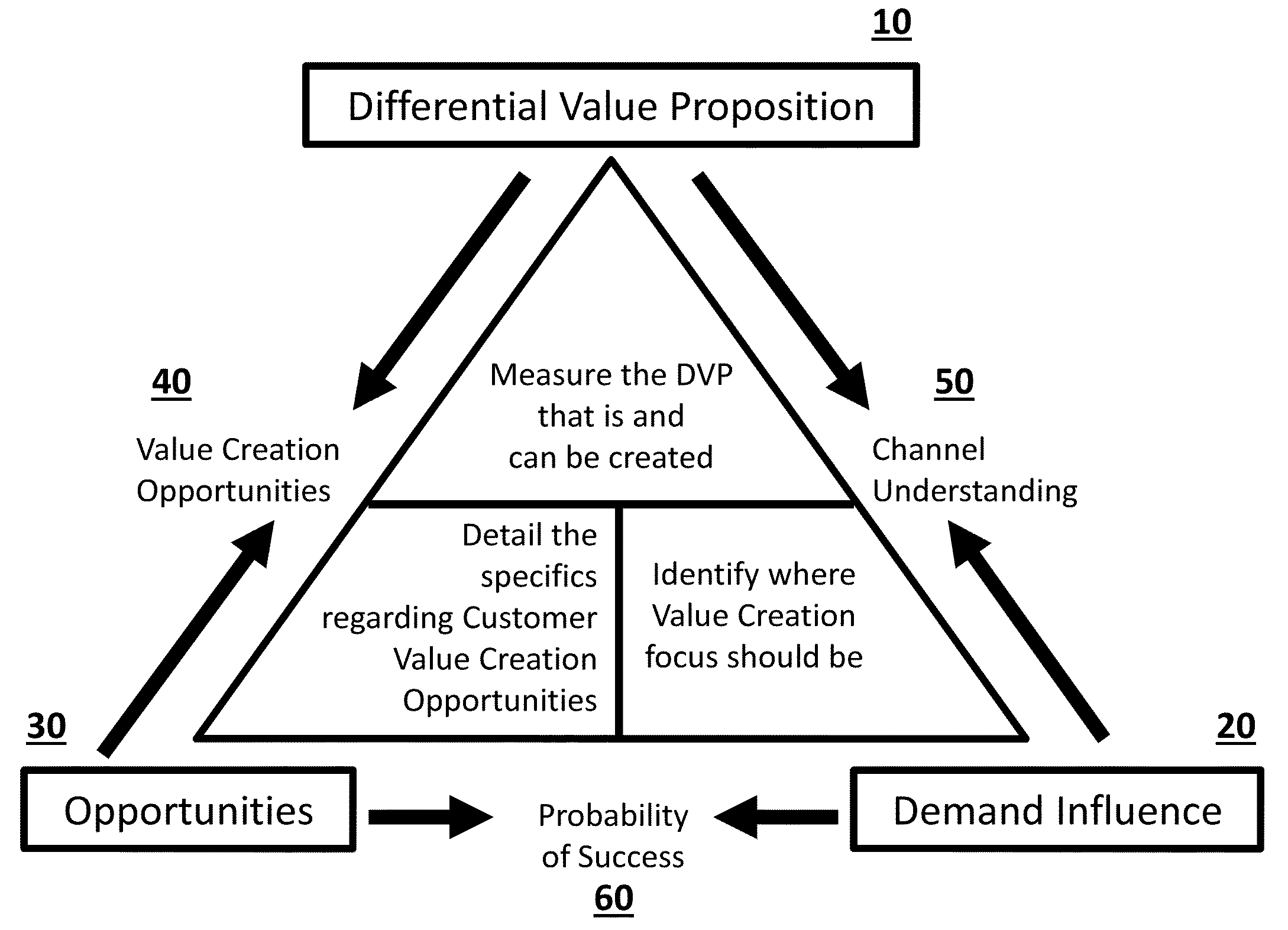

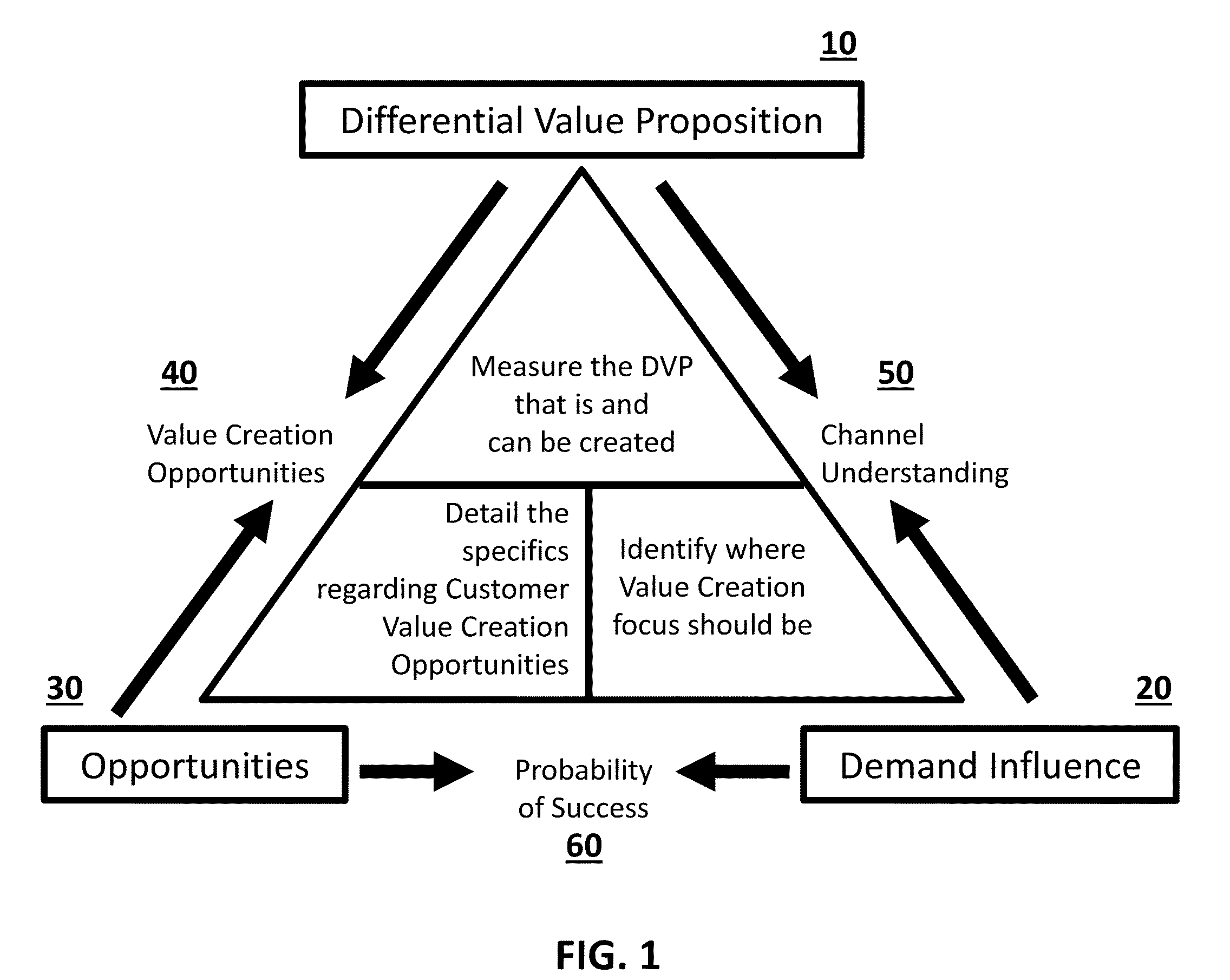

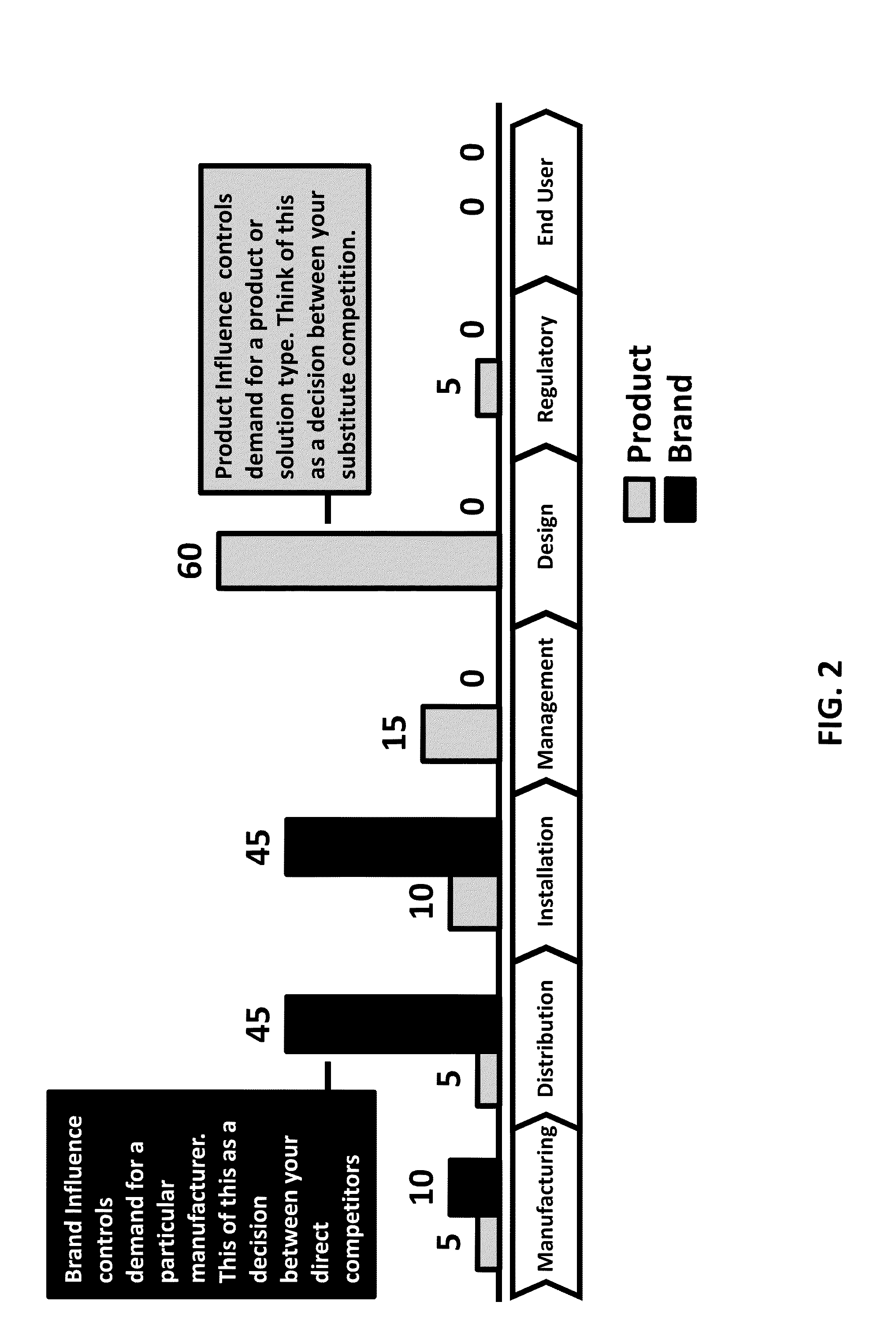

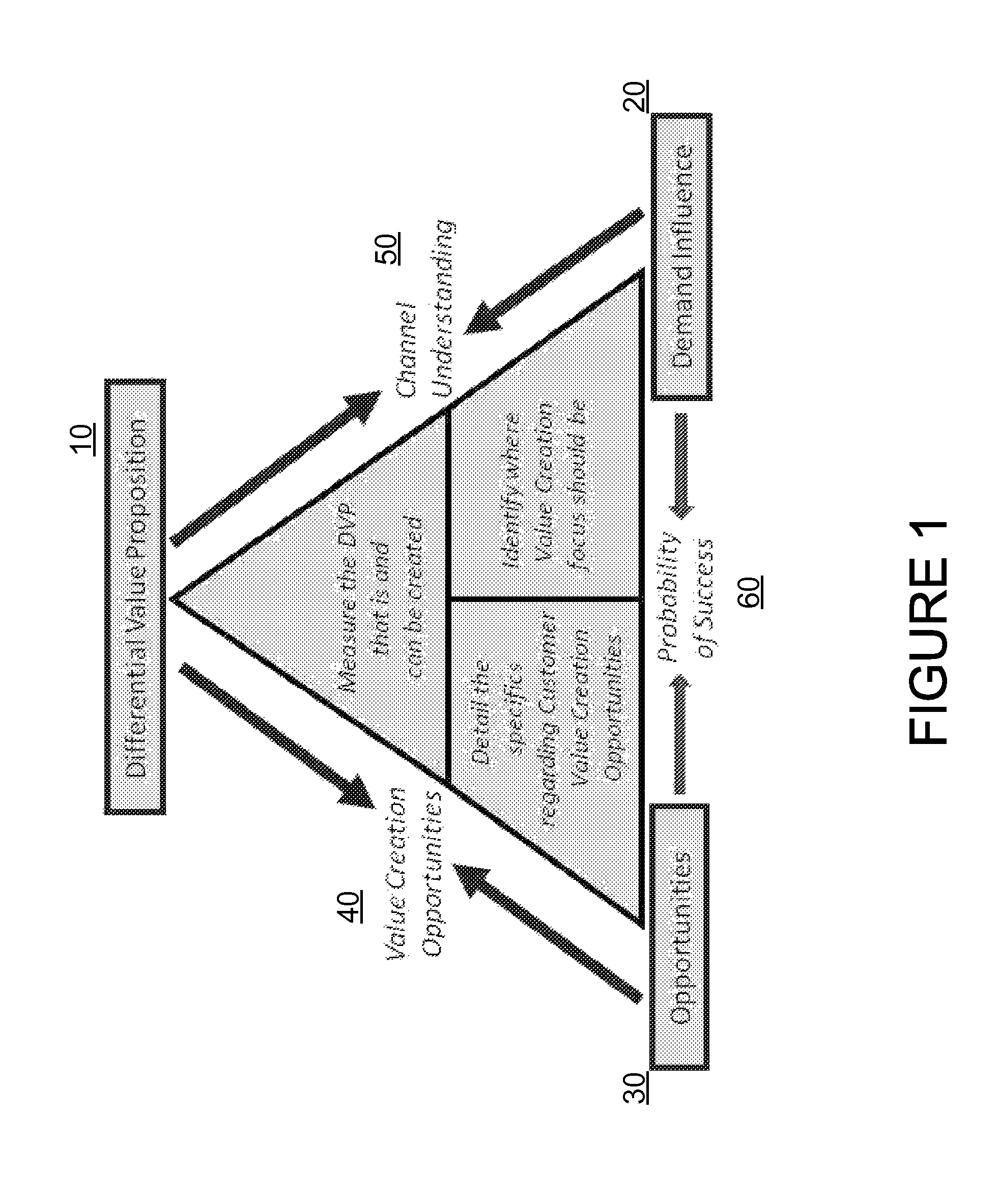

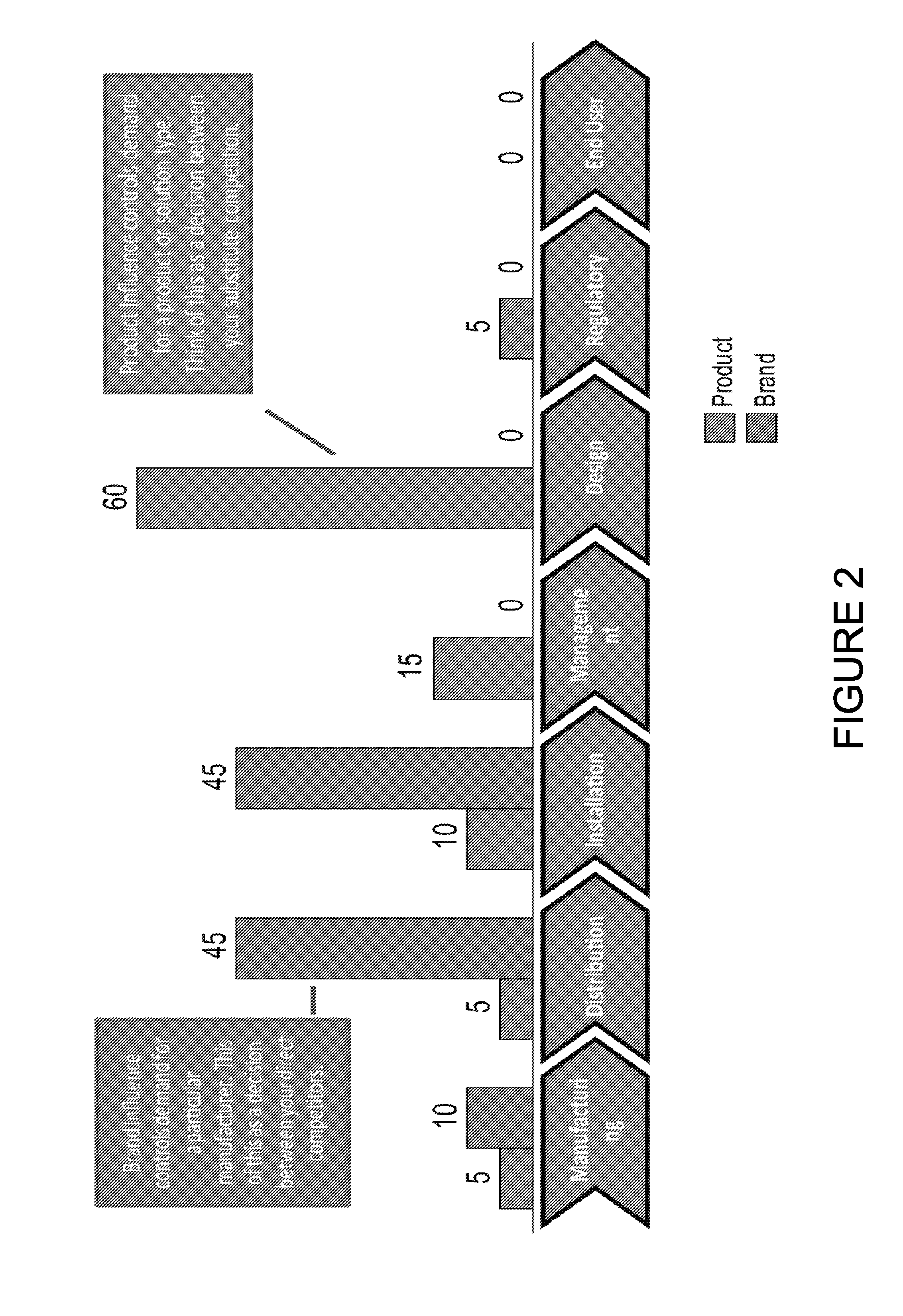

InactiveUS20100049592A1Optimizes returnEliminating investment is to failMarket predictionsDigital data processing detailsData setWeb browser

A system and related methods used by an organization to collect, manage, analyze and act on data (i.e., manage “customer value creation” or “CVC”) from customers. The system may be used by organizations without depending on consultants to manage customer value creation. The system comprises an integrated dataset and schema, termed “Customer Value Creation Data,” which comprises three data types: Differential Value Proposition; Demand Influence; and Opportunities. Differential Value Proposition is the ability of the organization's products and services to positively impact their customer's bottom line relative to the organization's competitors. The ability to create a DVP can be correlated to the investments and strategies made by the organization on an ongoing basis. The connection between an organization's investments and strategies, and their customer's bottom line, comprises three parts: the investments and strategies that an organization makes (Value Attributes); the relative importance or impact each investment or strategy has on a customer's bottom line (Value Attribute Scores); and the combined, quantified economic or financial impact that all the Value Attributes have on a customer's bottom line or profitability (Differential Value Proposition Percentage, or “DVP %”). The system may be embodied in a computer program that implements modules in the appropriate order, collects and stores relevant data, and perform necessary calculations. The program may be run through an Internet web browser.

Owner:VALKRE SOLUTIONS

System and method for customer value creation

InactiveUS20130282442A1Increase profitabilityIncrease the number ofResourcesMarket data gatheringData setProgram planning

A method and system for managing customer value creation may include receiving a dataset about a customer organization having value attributes with a relative numerical percentage score and a value; processing the dataset to generate a quantified economic or financial impact on a profitability of the customer organization based on the value attributes; generating a customer data collection template based on the quantified economic or financial impact for use in obtaining information from the customer organization; receiving another dataset about the customer organization based on information provided by the customer organization, the other dataset including value attributes having a relative numerical percentage score and a value; processing at least the other dataset to generate another quantified economic or financial impact on the profitability of the customer organization based on the value attributes; identifying one or more investment opportunities based on the another quantified economic or financial impact on the profitability of the customer organization; and generating and prioritizing one or more initiatives to achieve the identified investment opportunities to increase the profitability of the customer organization.

Owner:VALKRE SOLUTIONS

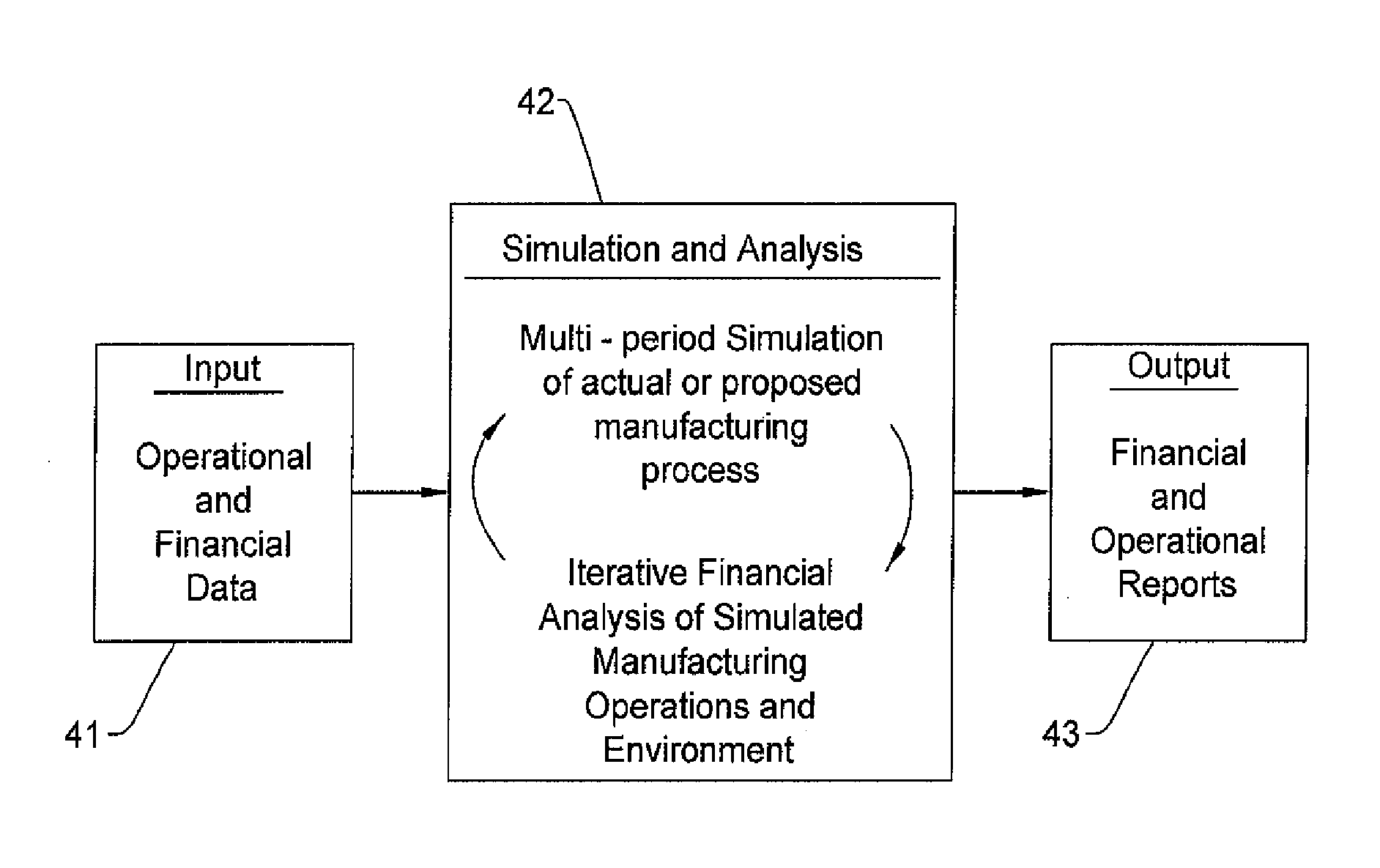

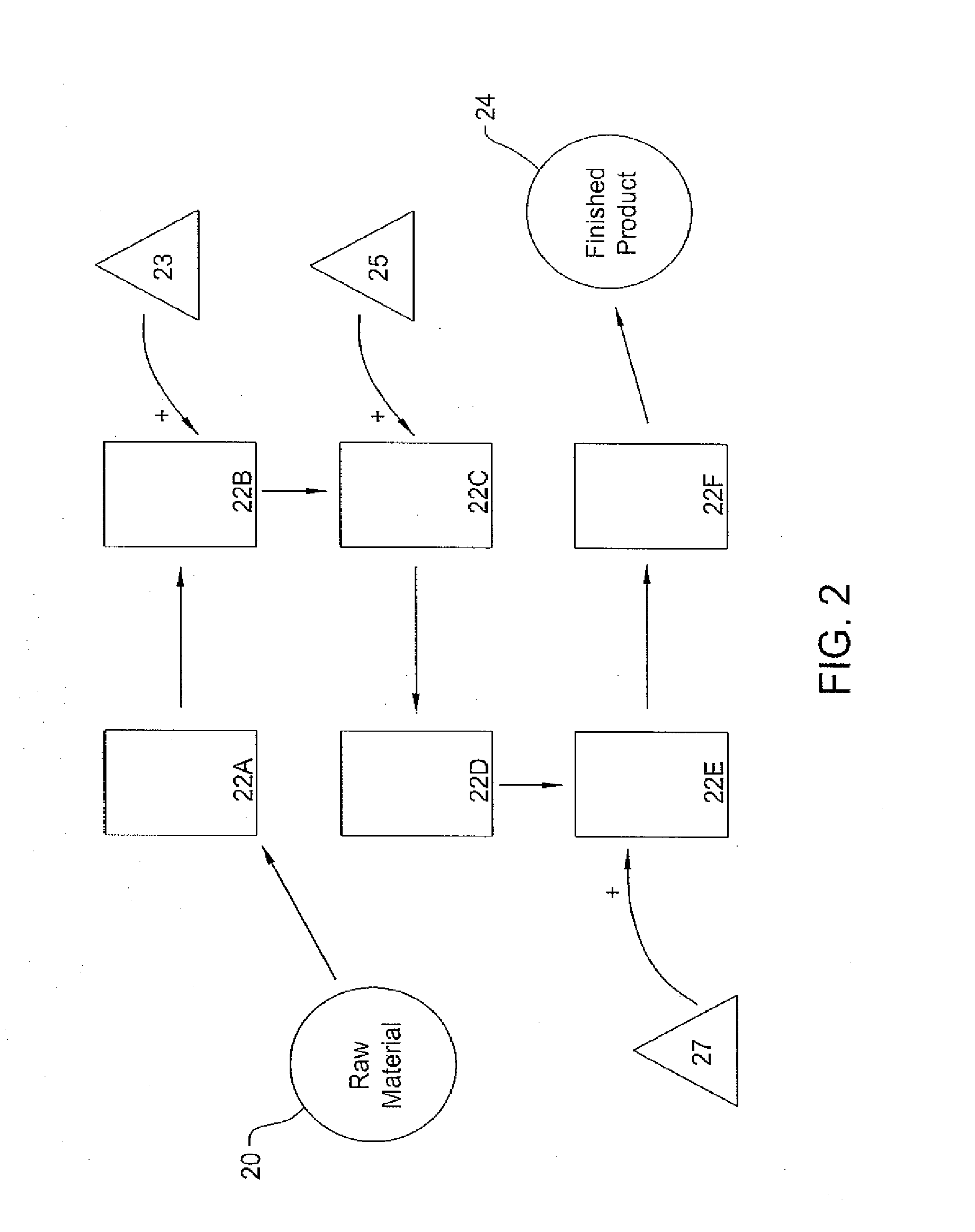

Multi-Period Financial Simulator of a Process

A system configured for predicting a financial impact of a process is provided that includes a financial forecasting system (FFS) having at least one operational parameter and at least one financial data. The system further includes a discrete event simulator (DES) in communication with the FFS, wherein the DES is configured simulate a process based upon the at least one operational parameter and the at least one financial data for a first period of time, communicate resultant data from the simulation to the FFS, such that the FFS is configured to update the at least one operational parameter and the at least one financial data, which are based upon the communicated resultant data, and the DES is further configured to simulate the process based upon the updated at least one operational parameter and the at least one financial data for a sequential second period of time. The FFS and the DES are further configured to replicate the simulations of the sequential first and second periods of time with the operational parameter and the financial data having different statistical variations, and determine a confidence interval associated with the communicated resultant data.

Owner:WESTERN MICHIGAN UNIVERSITY

System and method for customer value creation

InactiveUS8311879B2Increase profitabilityIncrease the number ofMarket predictionsDigital data processing detailsWeb browserData set

A system and related methods used by an organization to collect, manage, analyze and act on data (i.e., manage “customer value creation” or “CVC”) from customers. The system may be used by organizations without depending on consultants to manage customer value creation. The system comprises an integrated dataset and schema, termed “Customer Value Creation Data,” which comprises three data types: Differential Value Proposition; Demand Influence; and Opportunities. Differential Value Proposition is the ability of the organization's products and services to positively impact their customer's bottom line relative to the organization's competitors. The ability to create a DVP can be correlated to the investments and strategies made by the organization on an ongoing basis. The connection between an organization's investments and strategies, and their customer's bottom line, comprises three parts: the investments and strategies that an organization makes (Value Attributes); the relative importance or impact each investment or strategy has on a customer's bottom line (Value Attribute Scores); and the combined, quantified economic or financial impact that all the Value Attributes have on a customer's bottom line or profitability (Differential Value Proposition Percentage, or “DVP %”). The system may be embodied in a computer program that implements modules in the appropriate order, collects and stores relevant data, and perform necessary calculations. The program may be run through an Internet web browser.

Owner:VALKRE SOLUTIONS

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com