Risk profiles in networked loan market and lending management system

a risk profile and networked loan technology, applied in the field of generating and processing lending and borrowing transactions, can solve the problems of risky client group, financial institutions hesitant to develop services for micro entities and small time entrepreneurs, and often limited track record or financial reporting capacity of micro entities

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

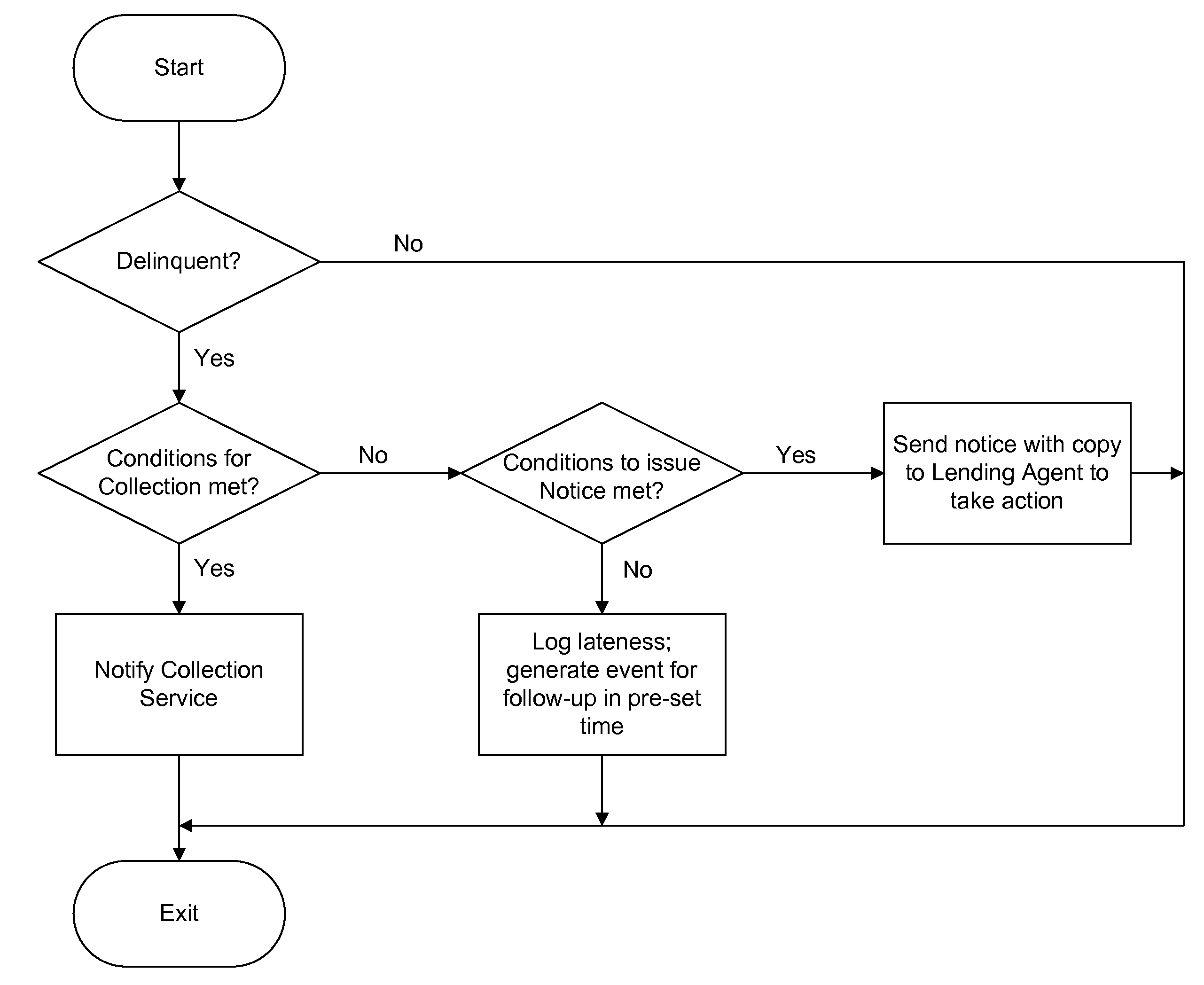

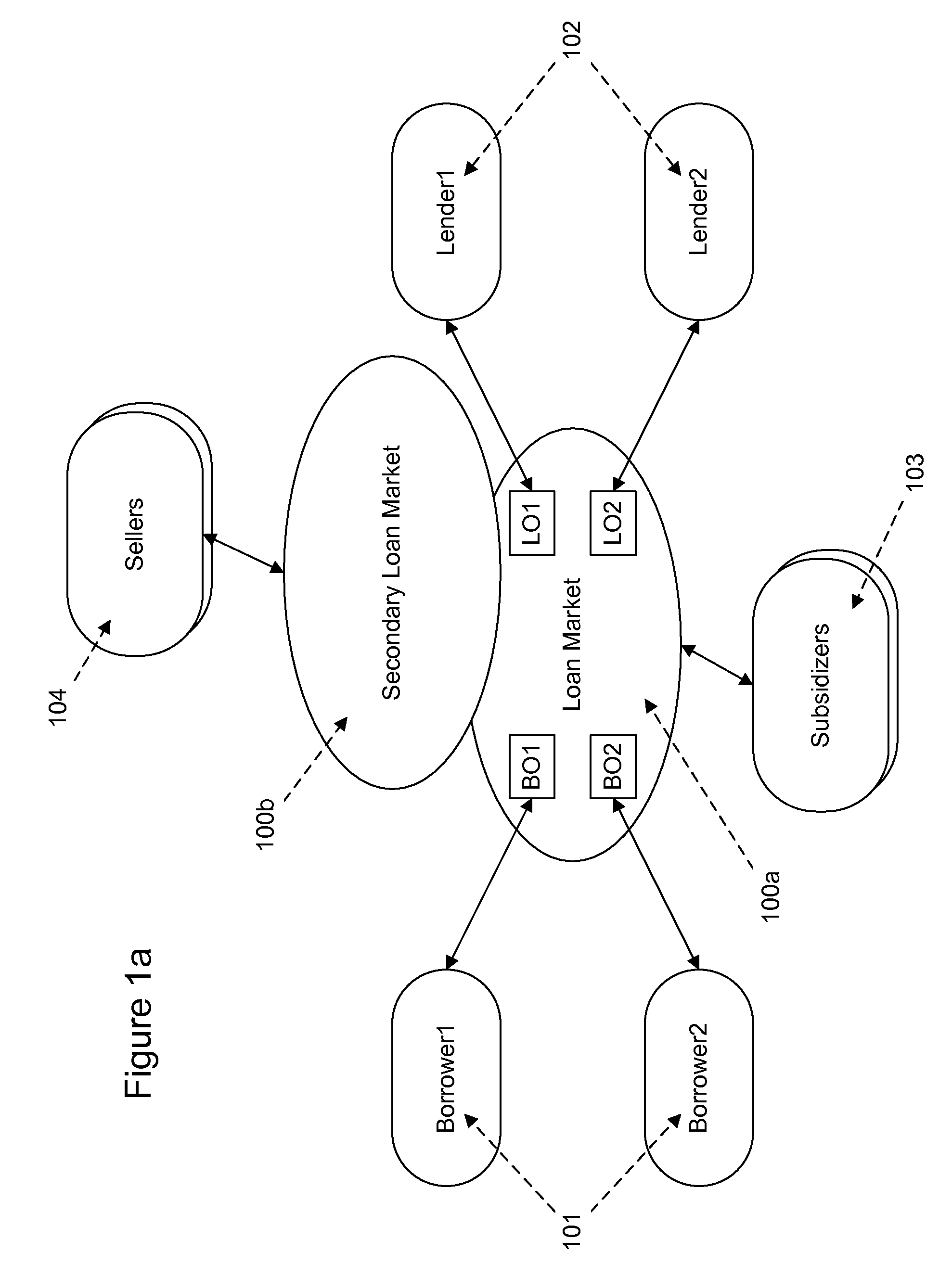

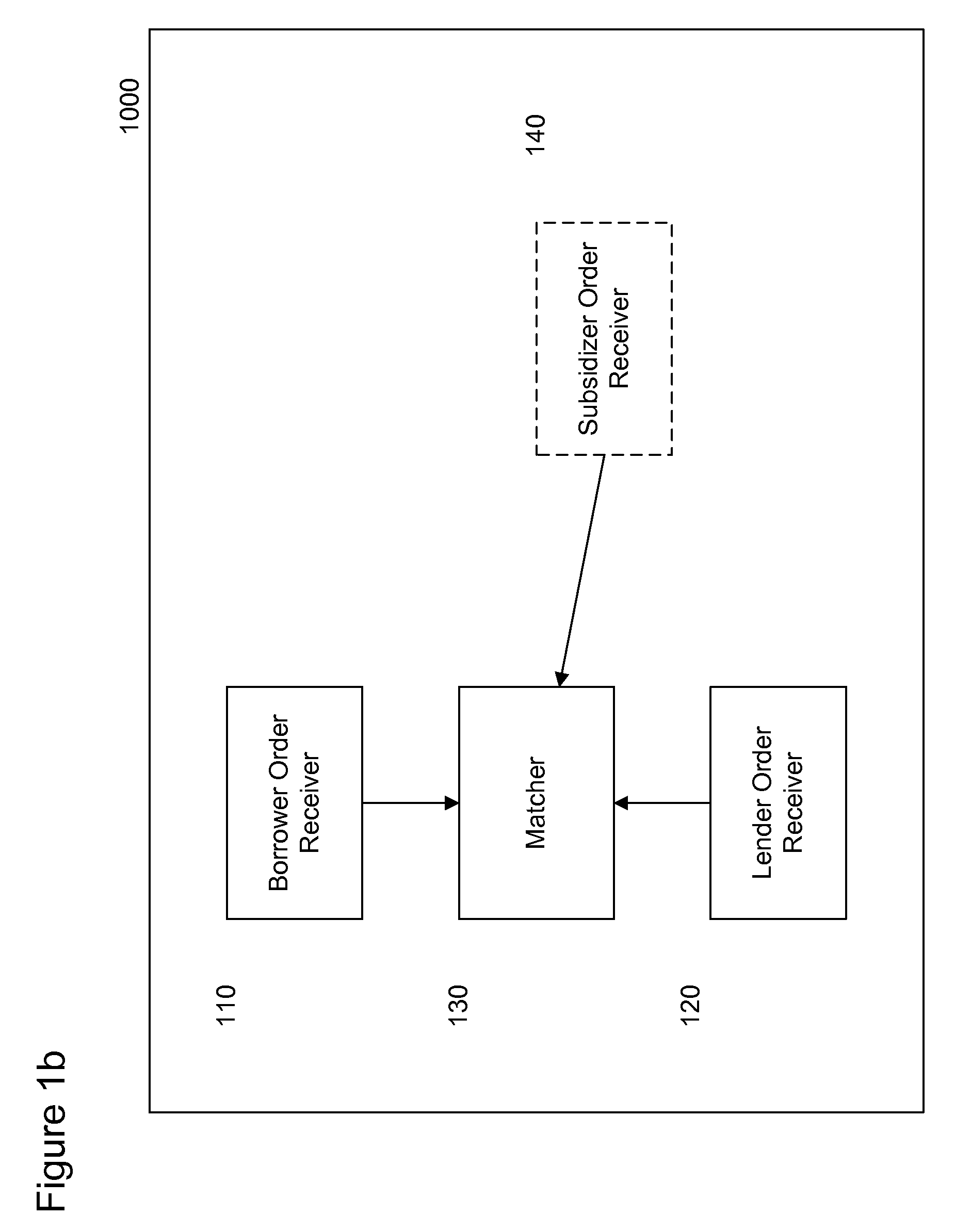

[0071]The present embodiments comprise an apparatus and a method for generating and processing lending and borrowing orders and for managing a flexible loan market that is preferably networked and allows participants to act as borrowers and lenders. As explained, the loan market manages loans throughout their lifetime from inception to completion of repayment. That is to say it manages the matching of borrowers to lenders at the start. It manages transfer of the loan from lender to lender and it manages repayment and default.

[0072]Preferred embodiments of the present invention relate to facilitating and managing a method for concurrent direct lending and borrowing transactions through a risk aware exchange. More particularly, a preferred embodiment of the present invention introduces a method for generating clusters of atomic loans that together match the risk profile and rates desired by lenders and acceptable to borrowers. A preferred embodiment of the present invention provides a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com