Method and system for establishing, monitoring, and reserving a guaranteed minimum value return on select investments

a technology of guaranteed minimum value and investment return, which is applied in the field of method and system for establishing, monitoring and reserving a guaranteed minimum value return on select investments, can solve the problems of not having a method and system for ensuring a higher rate of return, not providing sophisticated projection and modeling techniques, etc., to maximize the return of retirement savings and retirement benefits, and focus and enhance consumer benefits.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

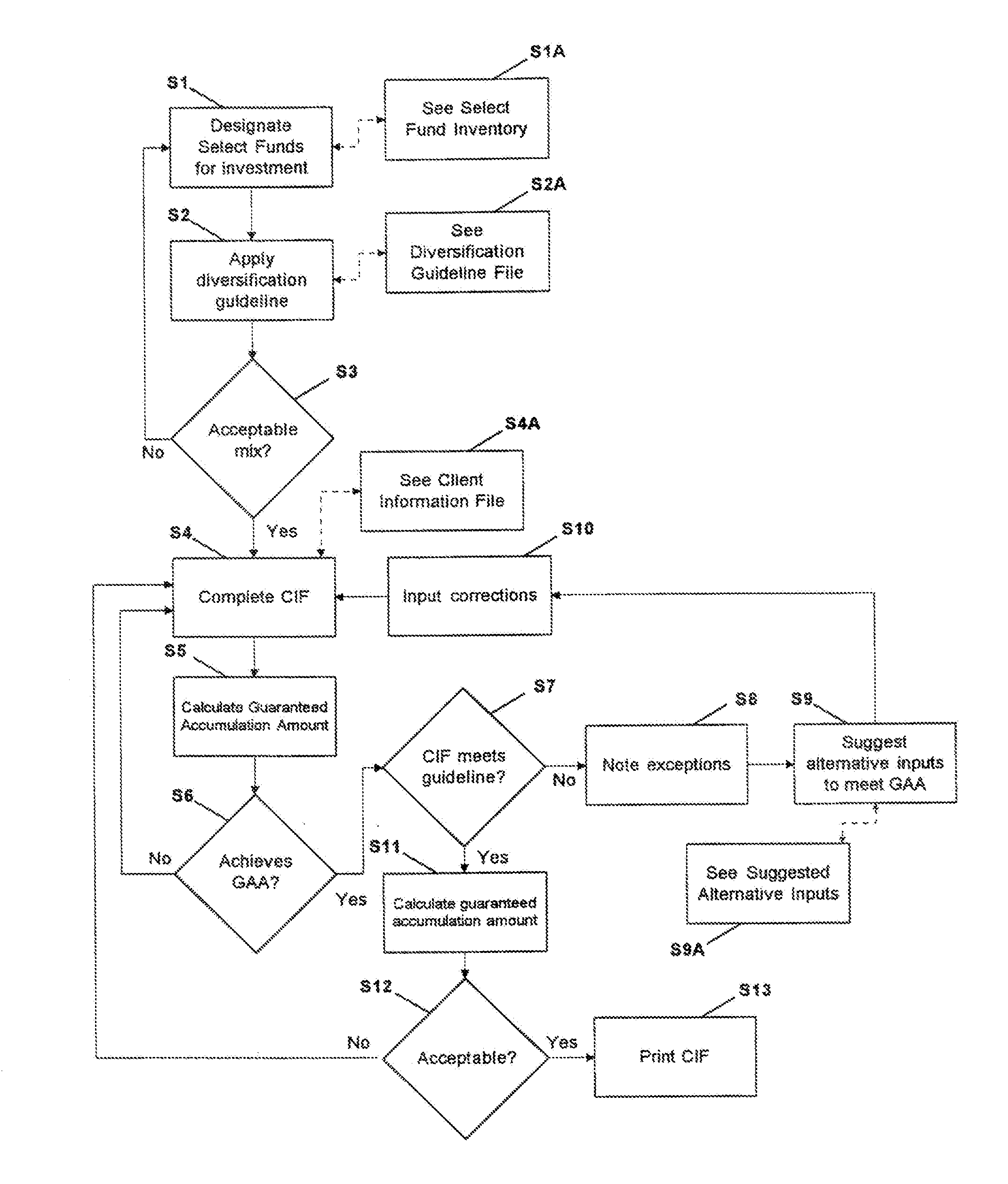

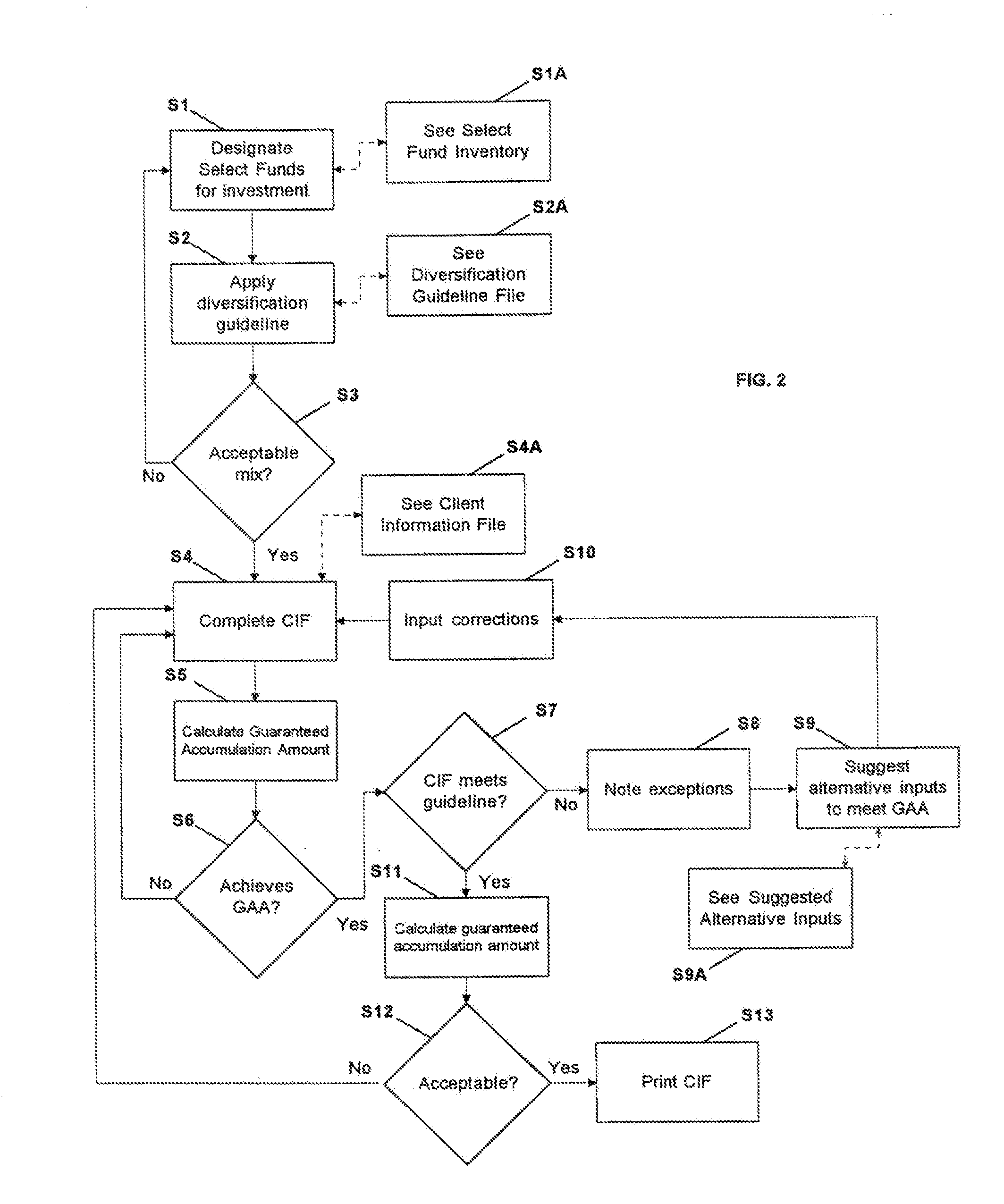

[0054]The process of the present allows individual investors to purchase a minimum guaranteed annual return (for example, 5%) on long term investments in mutual funds or separate account funds within variable annuities. The process also includes the pricing, administration, customer presentation and reserving for this minimum guarantee. The process also protects financial institutions that provide the guarantee by establishing a mechanism that insures investment diversification, which minimizes the possibility of poor long term investment results. The process also protects the financial institution by tracking payments and removing over-contributions from the selected mutual fund or variable annuity (VA) separate accounts that are subject to the minimum guaranteed annual return.

[0055]This is a unique process that allows the individual investor (or “client”) and their financial advisor (Investment Counselor; hereinafter, “IC”) to drastically change their typical asset allocation stra...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com