Systems and methods for identifying and capturing potential bankcard spending

a technology of potential bankcard spending and system and method, applied in the field of system and method for identifying and capturing potential bankcard spending, can solve the problems of curtailed efforts to acquire new customers and grow the share of an institution, and lack of known technology in this resp

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0021]Hereinafter, various aspects of embodiments of the invention will be described. As used herein, any term in the singular may be interpreted to be in the plural, and alternatively, any term in the plural may be interpreted to be in the singular.

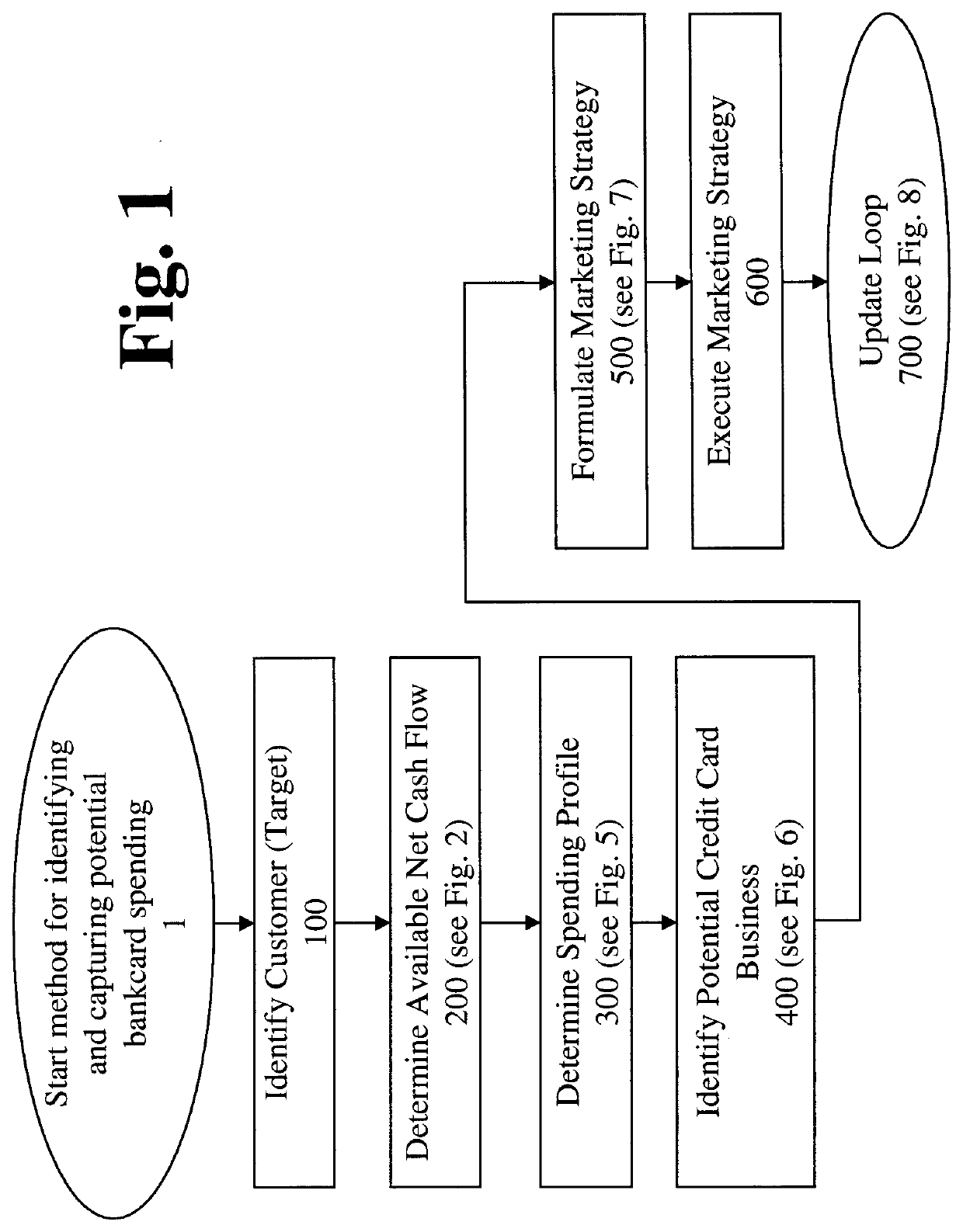

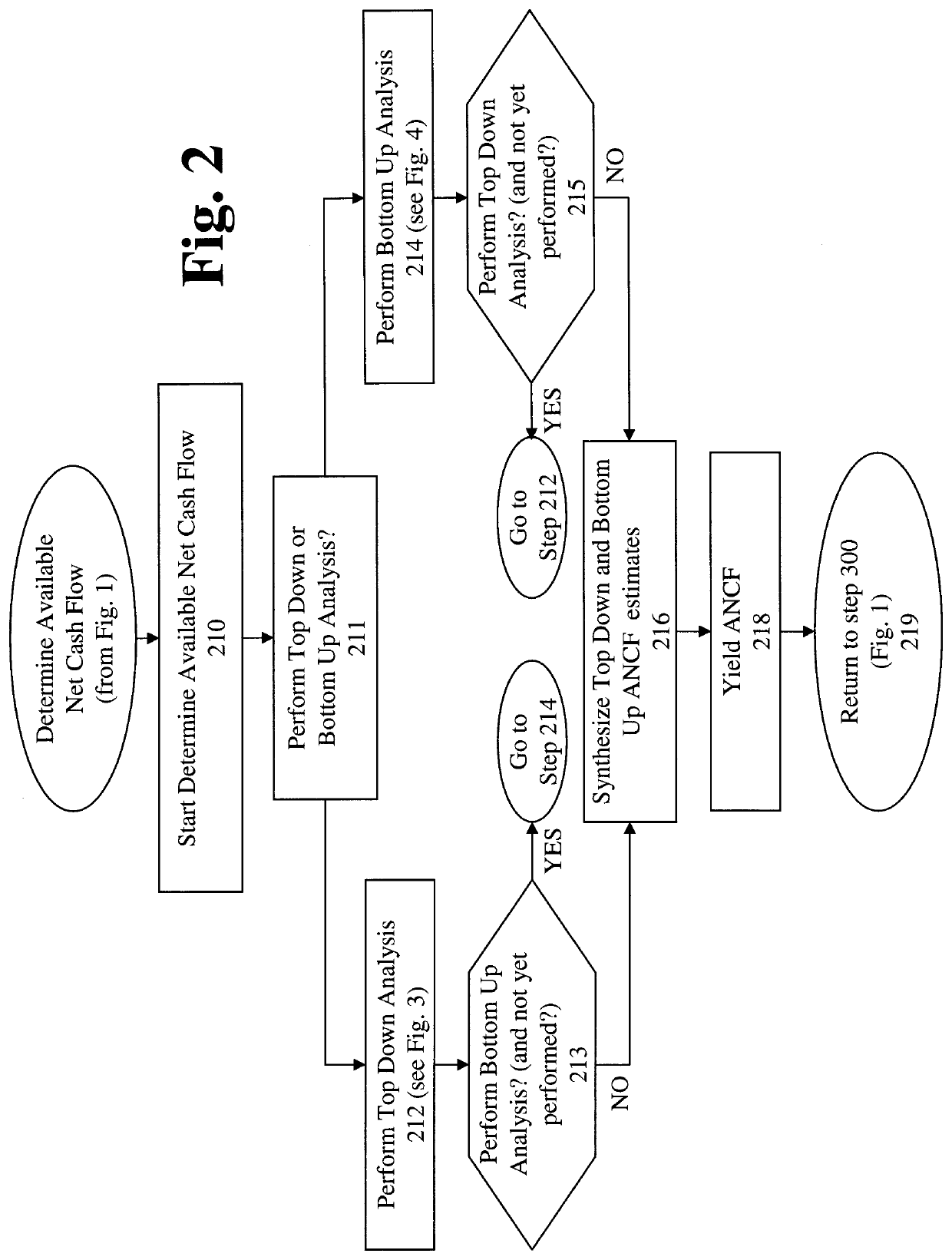

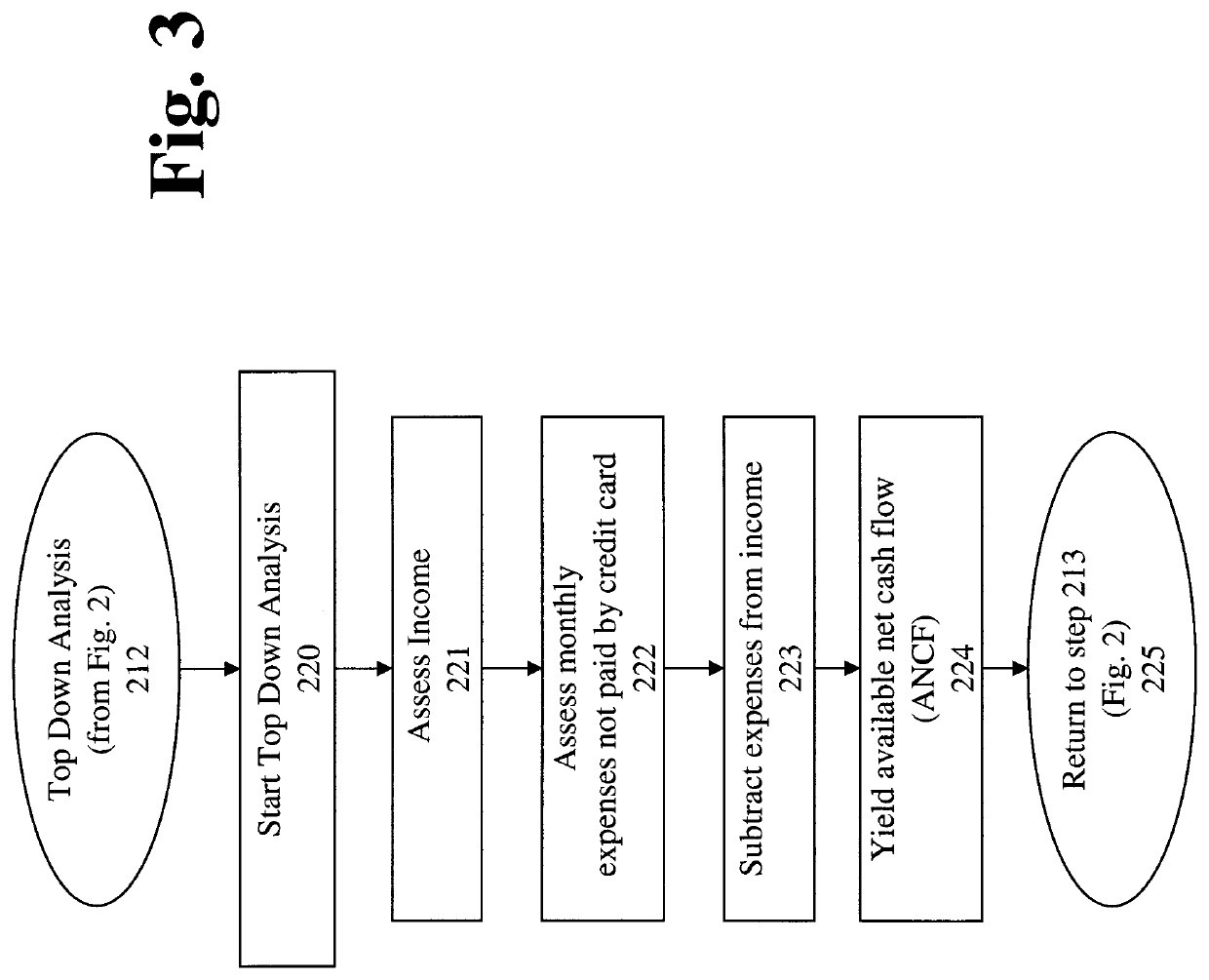

[0022]What is disclosed herein is a system and method for identifying and capturing potential bankcard spending. The invention uses innovative techniques to obtain highly individualized and detailed assessments of a customer's financial profile. The invention produces a marketing strategy that is highly effective and readily implemented. The invention can be supported using relatively simple hardware and software.

[0023]Various embodiment set forth herein are described in the context of a “credit card” and associated processing. However, it is understood that the invention has a much broader field of applicability. For example, with regards to financial transaction tools, the invention (and various features thereof) pertain to any type of...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com