Method and system for generating value added tax invoice information

A technology of information generation and value-added tax, applied in the field of information communication, can solve the problems of increasing the risk of manual misoperation and restricting the work efficiency of the invoicing process, so as to reduce the risk of manual misoperation, improve work efficiency, and realize the effect of information communication

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

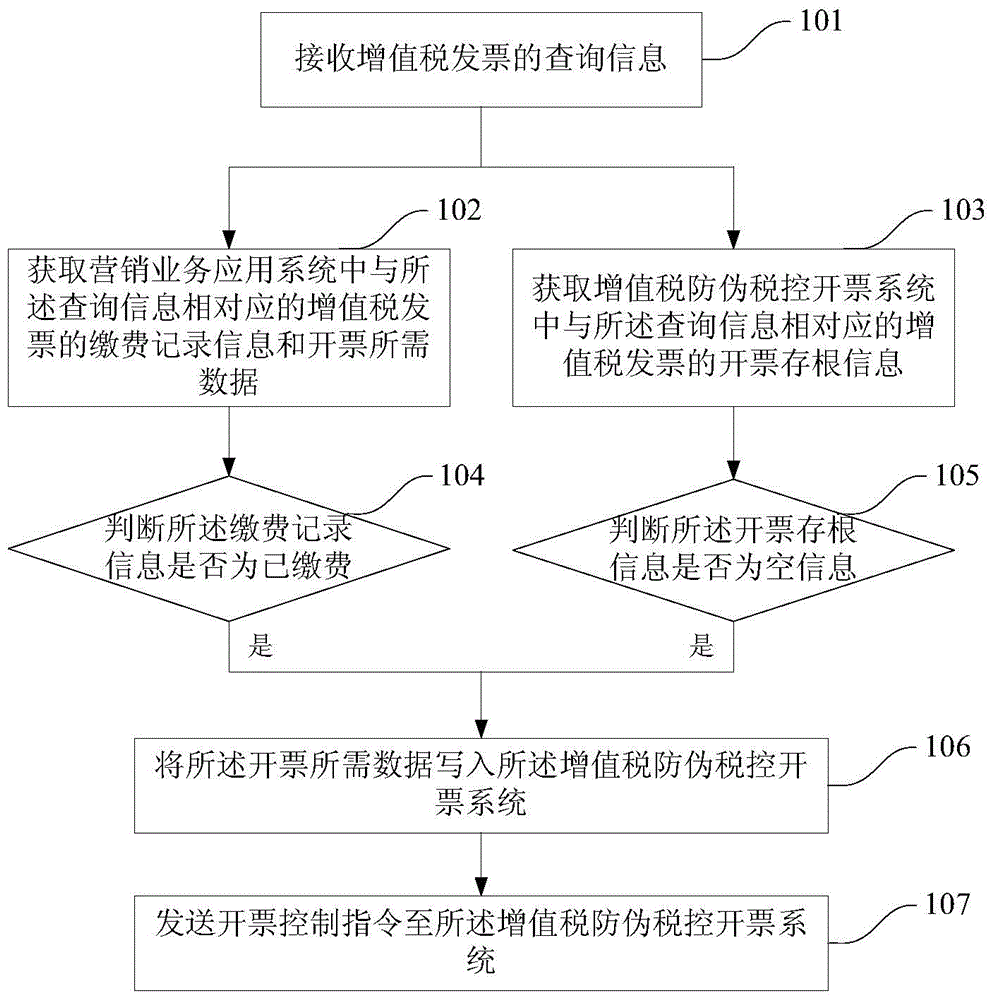

Embodiment 1

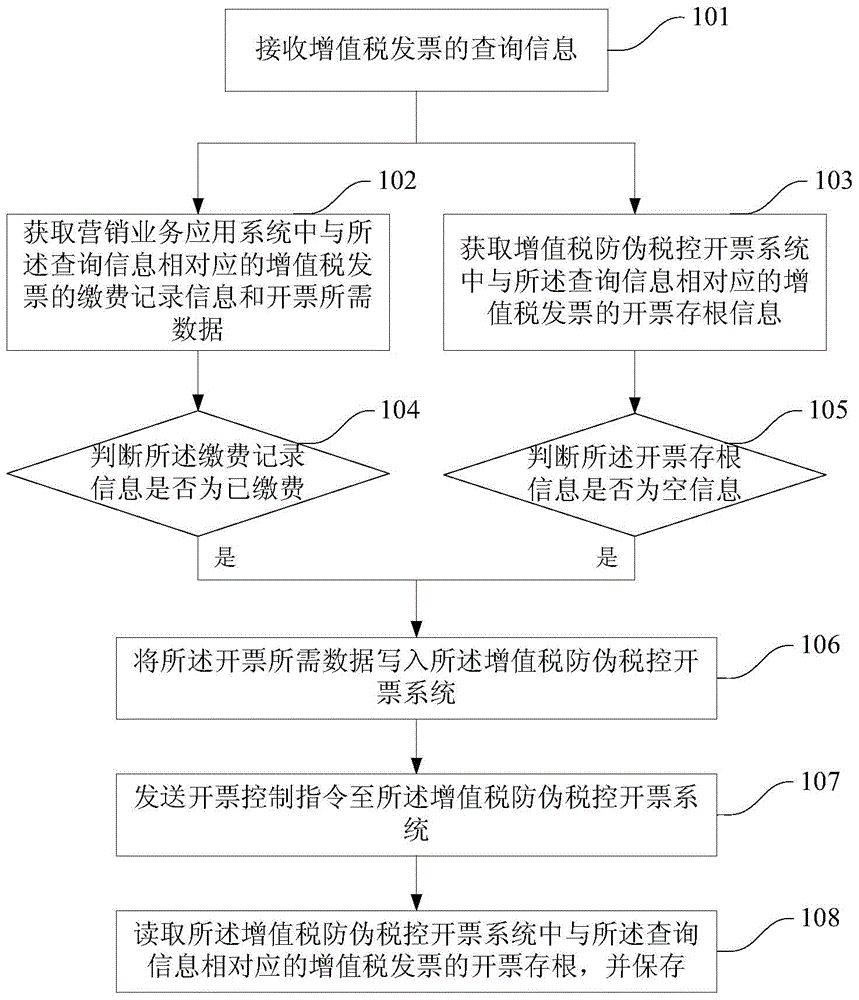

[0057] Based on Embodiment 1, Embodiment 2 of the present invention discloses another method for generating value-added tax invoice information, so as to realize information communication between the marketing business application system and the value-added tax anti-counterfeiting tax control billing system, see figure 2 , after step 107, further includes:

[0058] Step 108: Read the billing stub information of the value-added tax invoice corresponding to the query information in the value-added tax anti-counterfeiting tax control and billing system, and save it.

[0059] After the value-added tax anti-counterfeiting tax control billing system issues a value-added tax invoice for the user, it will generate and store the corresponding billing stub information. Therefore, the second embodiment uses a duplex communication channel to read the billing stub information back to the In the above value-added tax invoice information generation system, the actual invoicing situation at ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com