Enterprise debt paying credit risk assessment system

A risk assessment system and enterprise technology, applied in the field of enterprise debt repayment credit risk assessment system, can solve the problems of low credibility of financial statement information, increase of bank credit risk, and decrease of forecasting ability, so as to ensure feasibility and credibility , Ensure the rigor of the evaluation, and solve the effect of low credibility

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

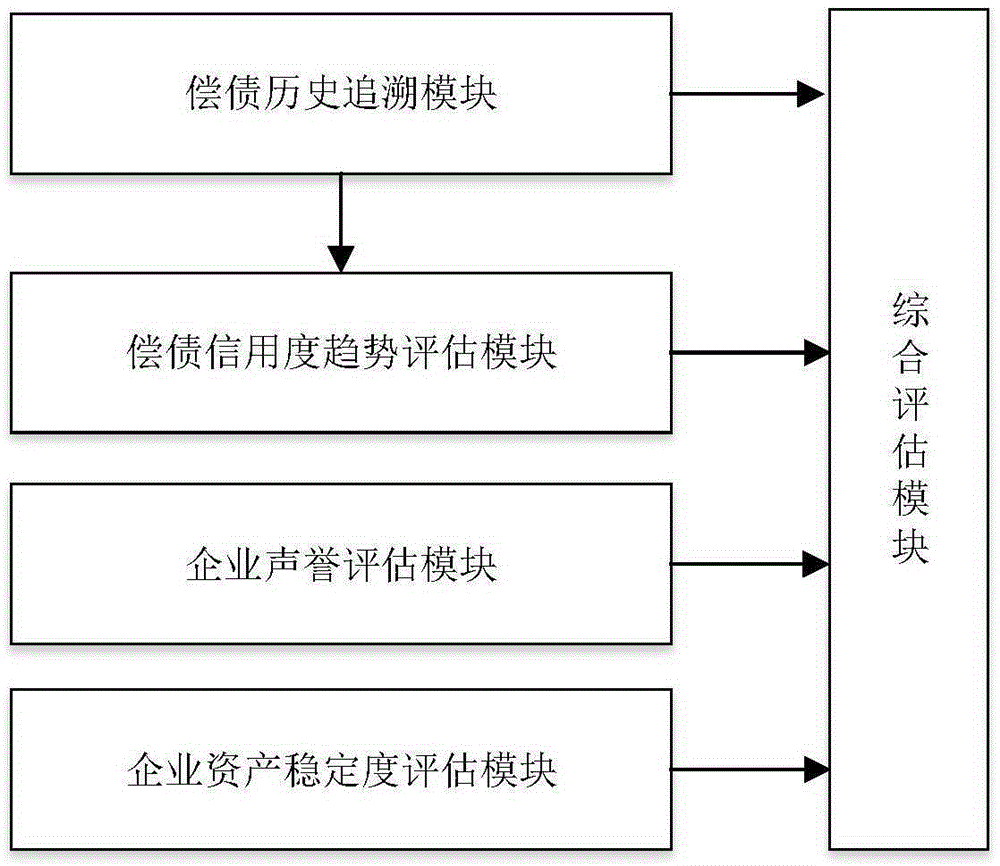

[0026] refer to figure 1 , an enterprise debt repayment credit risk assessment system proposed in this embodiment includes a debt repayment history tracing module, a debt repayment credit trend assessment module, an enterprise reputation assessment module, an enterprise asset stability assessment module and a comprehensive assessment module.

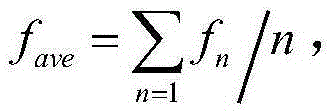

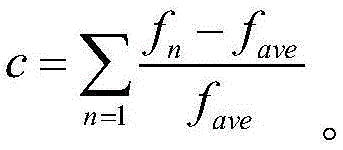

[0027] The debt repayment history tracing module is used to obtain the historical data of corporate debt repayment within a preset period of time, and evaluate the corporate debt repayment credit threshold a based on the historical data of corporate debt repayment. Specifically, the debt repayment history tracing module counts the number of on-due repayments A, the number of overdue repayments B, and the number of unpaid repayments C based on the historical data of corporate debt repayments, and then calculates the corporate debt repayment credit threshold a according to the first preset calculation model, the first The calculation model...

Embodiment 2

[0044] The difference between this embodiment and Embodiment 1 lies in the way of calculating the trend value λ.

[0045] In this embodiment, after evaluating the debt repayment credit segment value an of the enterprise in the corresponding time segment according to the enterprise debt repayment history data in each time segment, the debt repayment credit trend evaluation module evaluates the value an according to the enterprise repayment credit value in different time segments. Debt credit segment value an draws a trend chart of corporate debt repayment credit, and draws a slanted line according to the credit change trend chart, and then obtains the trend value λ according to the slanted line. The absolute value of is determined by the angle θ between the inclined line and the time axis. When the inclined line slopes downward along the time node, then λ≤0, and λ=sinθ; if the inclined line slopes upward along the time node, then the trend value λ≥0, and λ=-cosθ. In this embod...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com