Enterprise debt paying risk assessment method

A risk assessment and enterprise technology, applied in the direction of instruments, finance, data processing applications, etc., can solve problems such as structural errors, reduced forecasting ability, and increase bank credit risk, so as to achieve the effect of not being easy to fake and avoiding risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

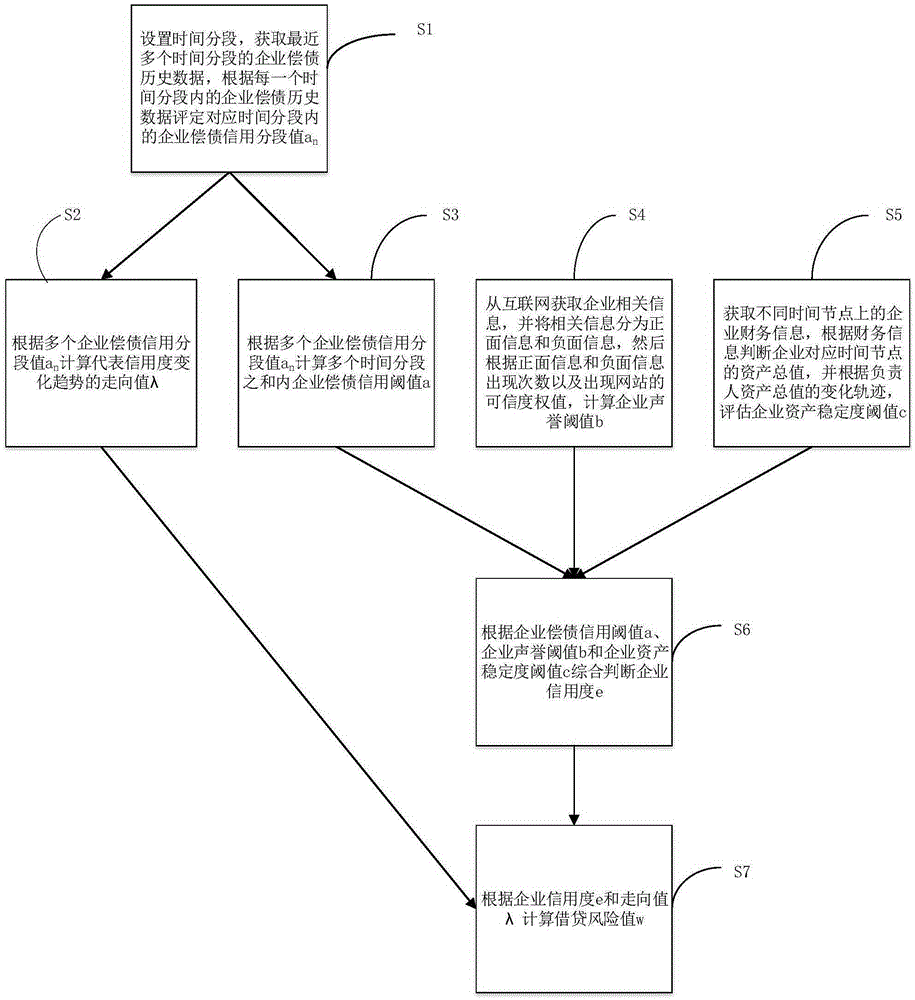

[0024] refer to figure 1 , a kind of enterprise debt repayment risk assessment method that the present invention proposes, comprises the following steps:

[0025] S1. Set the time segment, obtain the historical data of corporate debt repayment in multiple recent time segments, and calculate the number of scheduled repayments A according to the historical data of corporate debt repayment in each time segment n , Overdue repayment times B n and the outstanding number of C n Three types, and import the three types of data into the preset first calculation model to calculate and obtain the segmented value of the enterprise's debt repayment credit a n . The first calculation model is:

[0026] a n =K 1 A n +K 2 B n +K 3 C n 2 , K 1 、K 2 and K 3 Both are proportional coefficients, where K 1 >0,K 3 3 2 1 , specifically K 1 =10,K 2 = 1,K 3 =-10.

[0027] The debt repayment history of a company not only reflects the financial strength of the company, but also refle...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com