A method for self-collection of quota invoices

A technology of invoice and quota, applied in the field of financial tax control equipment or financial management

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

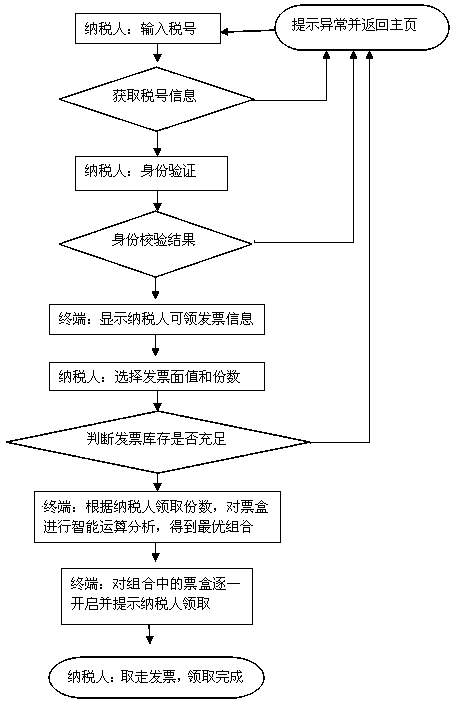

[0026] Such as figure 1 As shown, the improved fixed-rate invoice collection self-service terminal system includes the following steps:

[0027] Step 1. The taxpayer enters the tax ID number;

[0028] Step 2. The terminal obtains the tax ID information and verifies whether the tax ID information is legal. If not, go to step 10; if yes, go to step 3;

[0029] Step 3. The taxpayer swipes his ID card to verify his identity;

[0030] Step 4. The terminal verifies the identity of the taxpayer. If the verification is passed, go to step 5; otherwise, go to step 10;

[0031] Step 5. The terminal displays the invoice information that the taxpayer can receive;

[0032] Step 6. The taxpayer chooses the number and face value of fixed-rate invoices to receive;

[0033] a) The number of copies received can be any natural number, and the system can intelligently combine and open the ticket box according to the value input by the user.

[0034] b) Support 7 invoice denominations (1 yuan,...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com