Enterprise management key risk indictor-based early warning method and system

A technology of risk indicators and enterprise management, applied in the field of early warning based on key risk indicators of enterprise management, can solve problems such as no evaluation of accuracy and effectiveness, no evaluation of the realization of business goals and expectations, and lack of clear definition of risk preferences

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

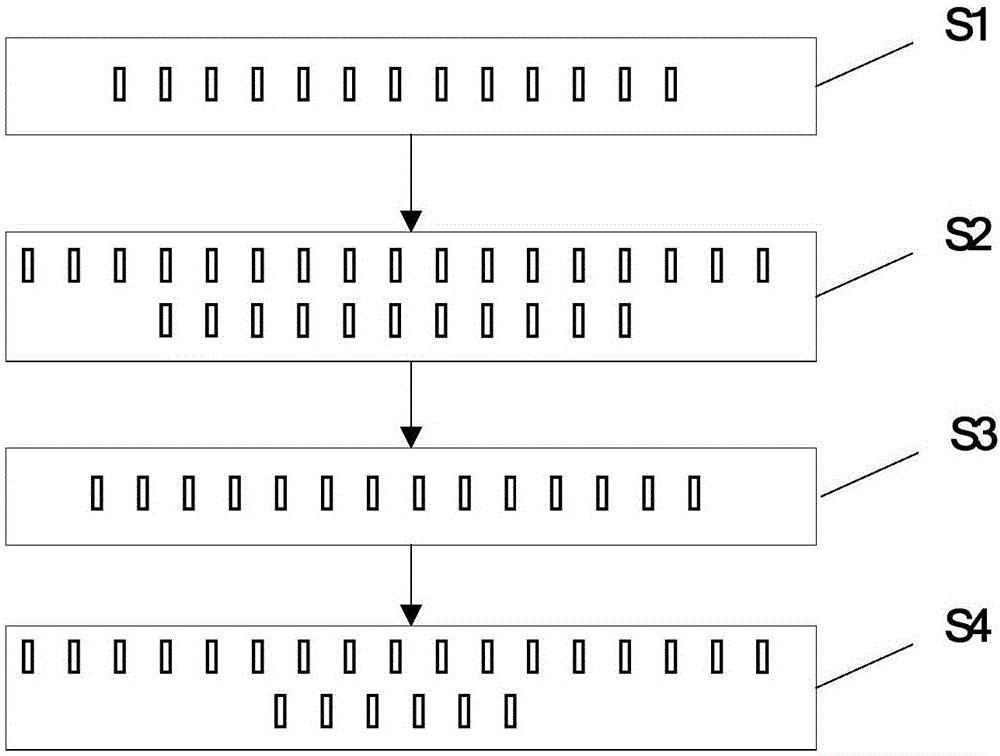

[0039] Such as figure 1 As shown, an early warning method based on key risk indicators of enterprise management in the embodiment of the present invention includes:

[0040] S1. Obtain the data of various risk indicators of enterprise management;

[0041] S2, according to the data of each risk indicator and the business objectives of the enterprise, delete and select key risk indicators;

[0042] S3, updating the key risk indicators according to the scheduled time;

[0043] S4. Sending an alarm signal if the key risk indicator exceeds a preset warning value.

[0044] In this embodiment, acquiring risk indicator data for enterprise management includes acquiring risk indicator data from multiple departments and multiple processes, wherein each risk indicator data includes: risk limit indicator data, key performance indicator data, risk event indicator data, Cooperative enterprise index data, risk assessment index data.

[0045] The risk limit indicator data refers to: the norm...

Embodiment 2

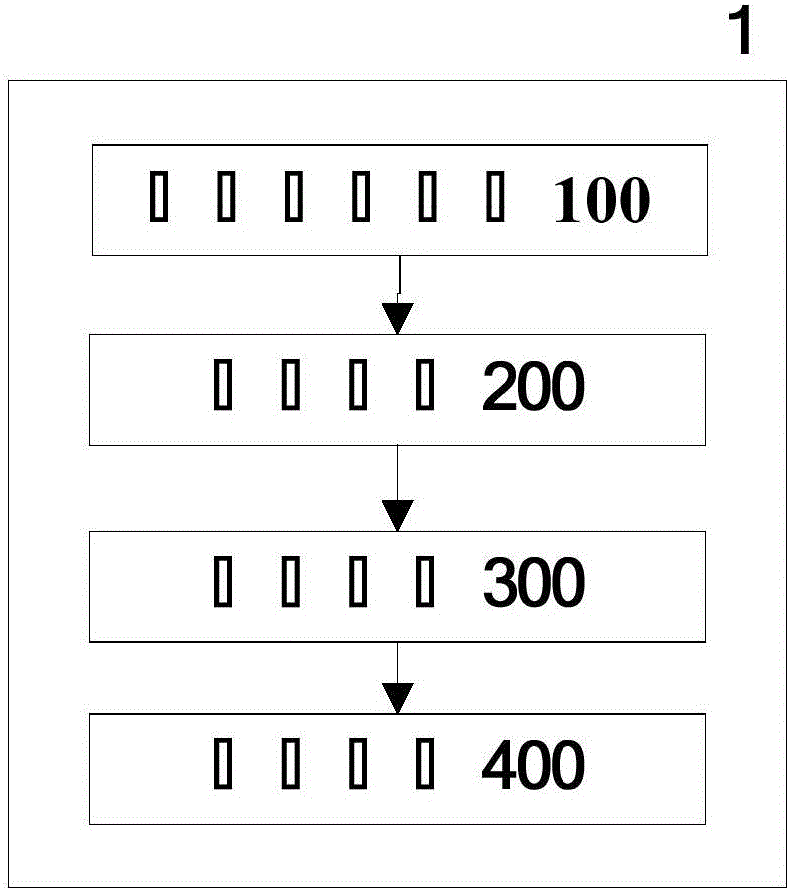

[0063] Such as figure 2 As shown, based on the same inventive concept of the method in Embodiment 1, an early warning system 1 based on key risk indicators of enterprise management in the embodiment of the present invention includes:

[0064] The data acquisition module 100 acquires the data of various risk indicators of enterprise management;

[0065] Deletion module 200, which deletes and selects key risk indicators according to the data of each risk indicator and the business objectives of the enterprise;

[0066] An updating module 300, updating key risk indicators according to a predetermined time;

[0067] The alarm module 400 sends out an alarm signal if the key risk indicator exceeds a preset warning value.

[0068] In this embodiment, acquiring risk indicator data for enterprise management includes acquiring risk indicator data from multiple departments and multiple processes, wherein each risk indicator data includes: risk limit indicator data, key performance ind...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com