Risk management system for commercial factoring cloud transaction

A risk management and commercial technology, applied in the field of financial risk management, can solve problems such as not combining financing audit operations, inability to effectively prevent fraud risks, and inability to connect to third-party data, so as to reduce staff costs and financing cycles, and improve risk management and control capabilities , the effect of reducing business risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

specific Embodiment 1

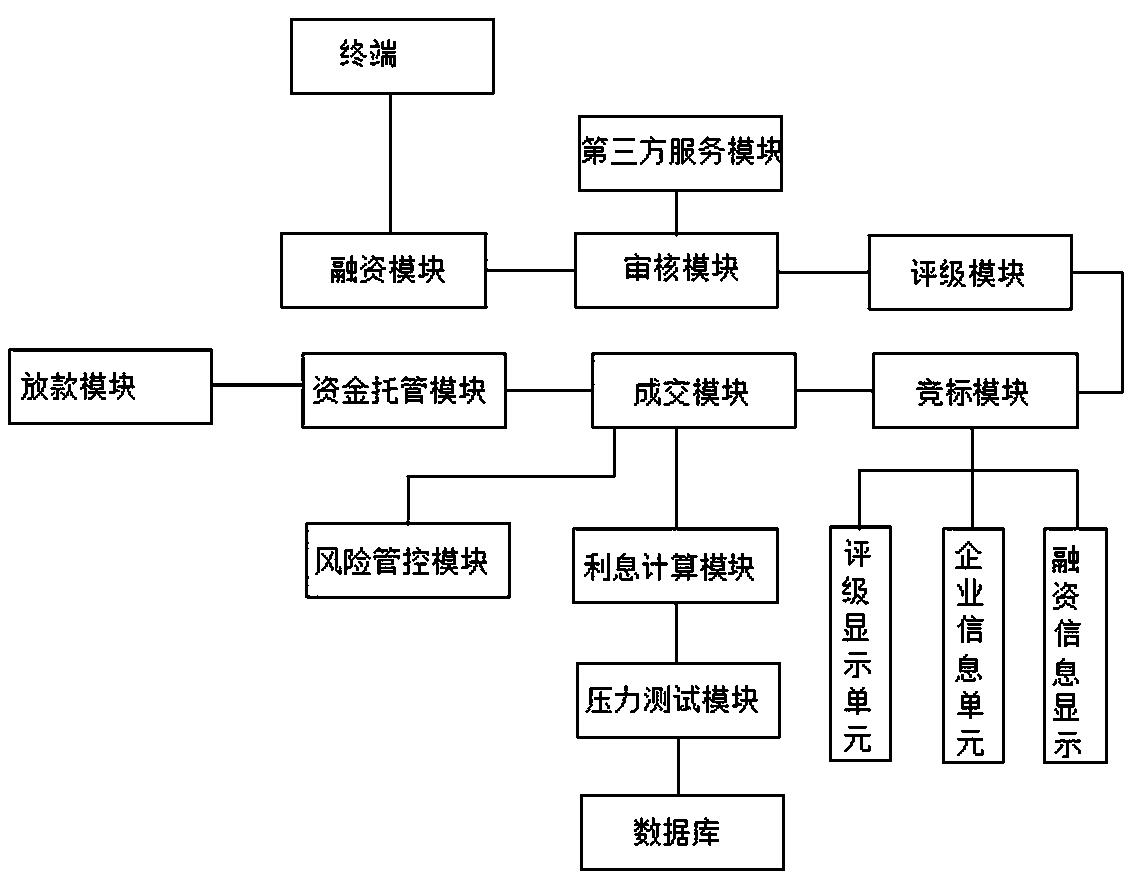

[0024] Specific embodiment 1: a risk management system for commercial factoring cloud transactions, characterized in that it includes:

[0025] Financing module, the financing module is used for financing parties to submit financing information and enterprise information, so;

[0026] An audit module, the financing module transmits financing information and enterprise information to the audit module, and the audit module is used to deepen the authenticity of the financing information and enterprise information, and transmits the results after the audit to the rating module or Return the failed deep result to the financing module;

[0027] A rating module, where the rating module is used to rate financing information and enterprise information, and form corresponding scores or levels;

[0028] Bidding module, the bidding module is used to display financing information and enterprise information on the cloud trading platform, and can be used by factoring companies to input inte...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com