Pension institution credit enhancement system and method, storage medium and computer equipment

A computer and transaction information technology, applied in the field of communication, can solve problems such as uneven quality, opaque information, and low credit rating, and achieve the effect of reducing financing costs, reducing default risks, and low loan interest

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

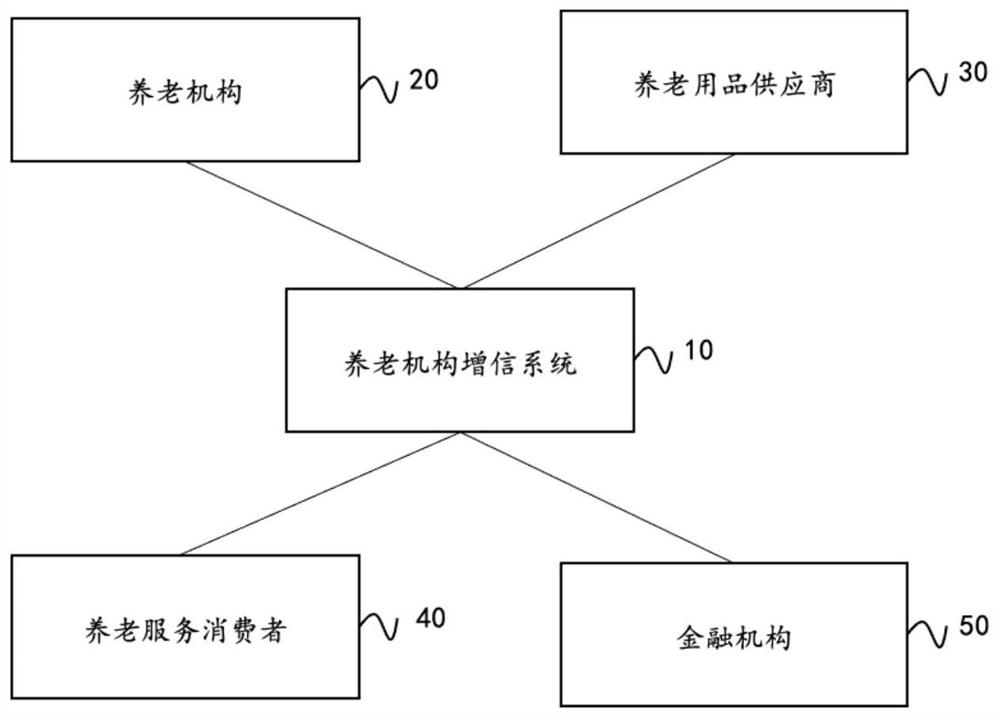

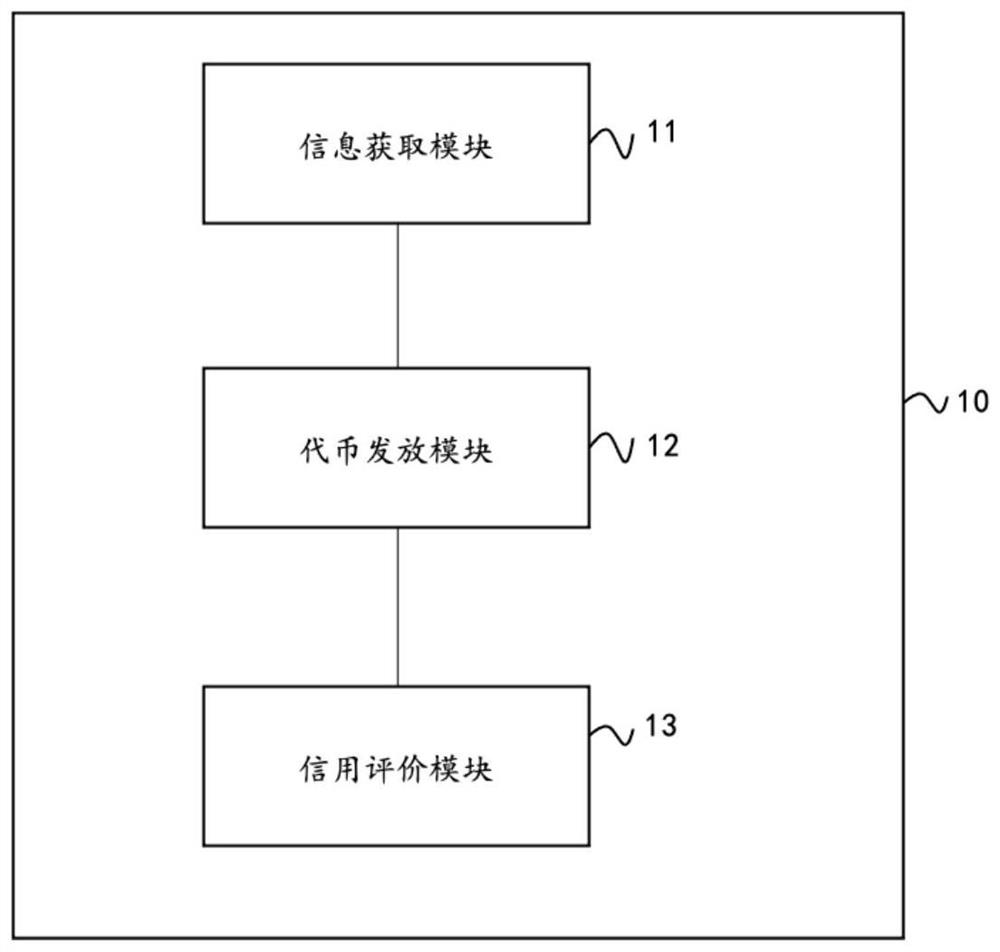

[0051] This embodiment provides a credit enhancement system for elderly care institutions. figure 1 It is a schematic diagram of the application scenario of the credit enhancement system for the elderly care institution provided by Embodiment 1 of the present invention. figure 2 It is a schematic diagram of the system structure of the pension institution credit enhancement system provided by Embodiment 1 of the present invention. see now figure 1 , figure 2 , to describe in detail the credit enhancement system for elderly care institutions provided in this embodiment.

[0052] Such as figure 1As shown, pension institutions 20 (such as nursing homes, etc.), pension supplies suppliers 30, pension service consumers 40 (such as the elderly, etc.), financial institutions 50 (such as banking institutions, etc.) can provide credit enhancement systems for pension institutions in this embodiment. Register in 10 and conduct transactions through the credit enhancement system 10 pro...

Embodiment 2

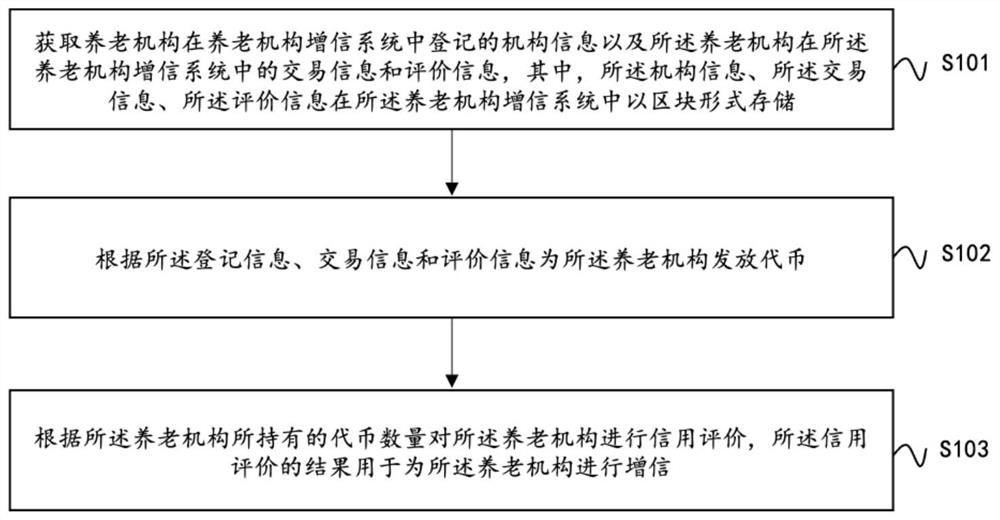

[0066] This embodiment provides a method for increasing the credit of an elderly care institution. image 3 It shows the method flowchart of the method for increasing the credit of elderly care institutions according to Embodiment 2 of the present invention. Such as image 3 As shown, the method for increasing the credit of elderly care institutions provided by this embodiment may include the following processing:

[0067]S101: Obtain the institution information registered by the pension institution in the pension institution credit enhancement system and the transaction information and evaluation information of the pension institution in the pension institution credit enhancement system, wherein the institution information, the transaction information, the The evaluation information is stored in the form of blocks in the credit enhancement system of the pension institution;

[0068] S102: Issue tokens for the elderly care institution according to the registration informatio...

Embodiment 3

[0087] This embodiment provides a computer-readable storage medium, such as a hard disk, an optical disk, a flash memory, a floppy disk, a magnetic tape, etc., on which computer-readable instructions are stored, and the computer-readable instructions can be executed by a processor to implement the method described in Embodiment 2. The handling of credit enhancement methods for elderly care institutions.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com