Credit risk control decision method and apparatus

A decision-making method and credit technology, applied in the direction of instruments, finance, data processing applications, etc., can solve the problems of consuming manpower and material resources, large scoring errors, and low efficiency, and achieve high accuracy, avoid interference from human factors, and high efficiency Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

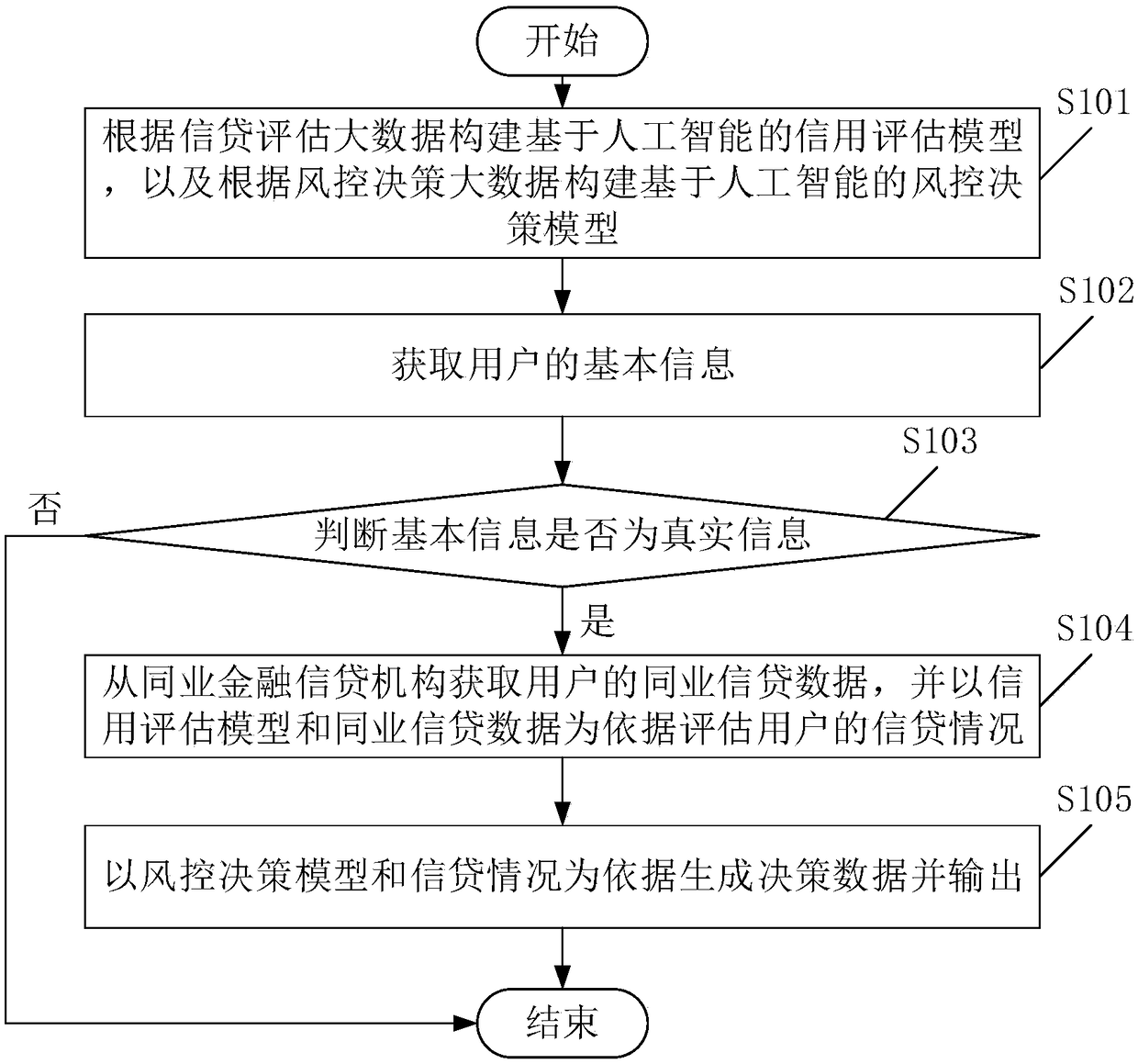

[0043] see figure 1 , figure 1 It is a schematic flowchart of the credit risk control decision-making method provided in Embodiment 1 of the present invention. like figure 1 As shown, the credit risk control decision-making method may include the following steps:

[0044] S101. Construct an artificial intelligence-based credit assessment model based on credit assessment big data, and construct an artificial intelligence-based risk control decision-making model based on risk control decision-making big data.

[0045] In this embodiment, the credit evaluation model is used to evaluate the user's credit situation, and the risk control decision model is used to generate decision data. By adopting the credit evaluation model and the risk control decision-making model for risk control decision-making, the decision-making results obtained are more objective.

[0046] In this embodiment, after building the credit evaluation model and risk control decision-making model based on big...

Embodiment 2

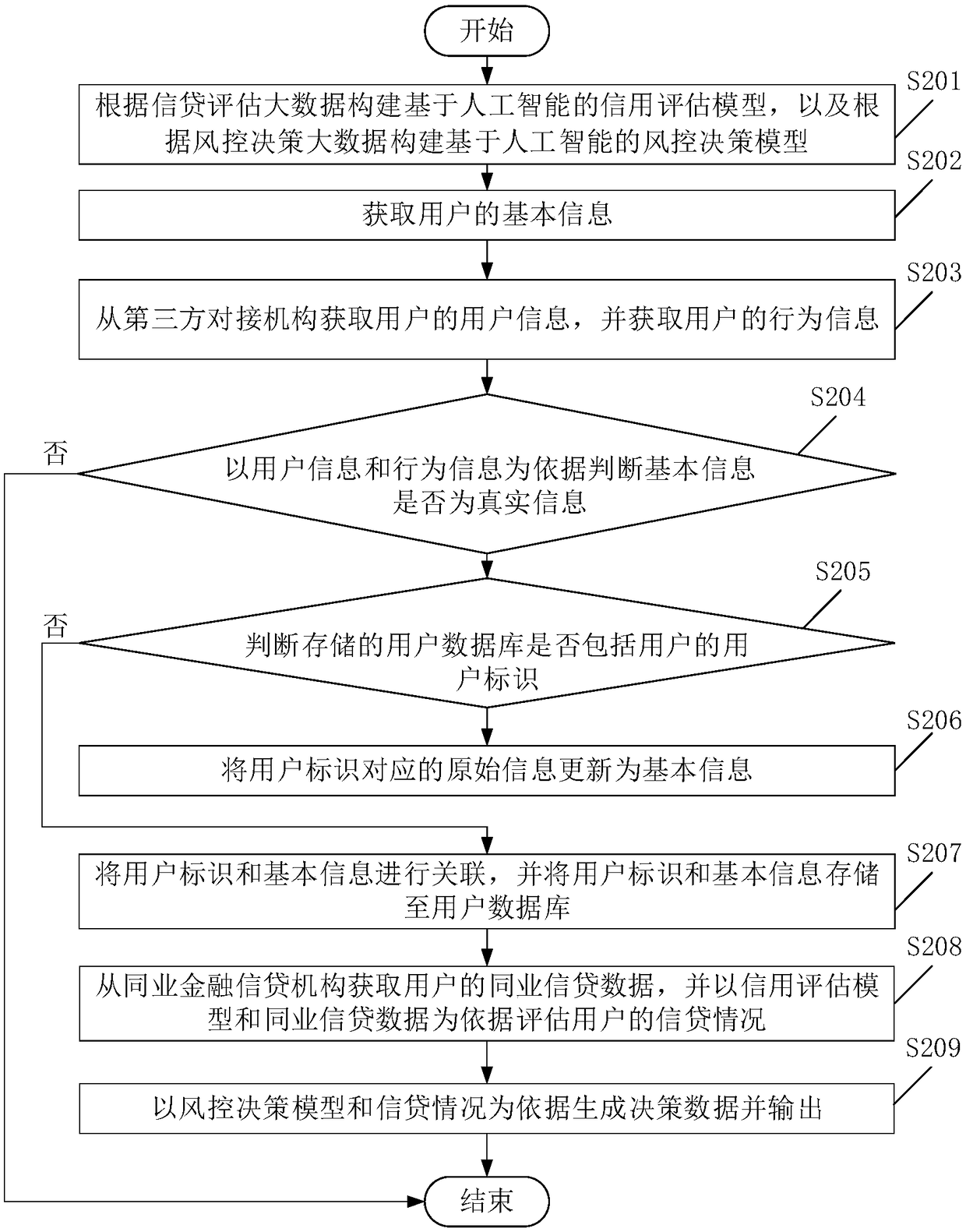

[0070] see figure 2 , figure 2 It is a schematic flowchart of the credit risk control decision-making method provided in Embodiment 2 of the present invention. like figure 2 As shown, the credit risk control decision-making method may include the following steps:

[0071] S201. Construct an artificial intelligence-based credit assessment model based on credit assessment big data, and construct an artificial intelligence-based risk control decision-making model based on risk control decision-making big data.

[0072] In this embodiment, the credit evaluation model is used to evaluate the user's credit situation, and the risk control decision model is used to generate decision data.

[0073] S202. Obtain the basic information of the user.

[0074] In this embodiment, the user information includes one or more of the user's contact information, user's geographic information, and user-related demographic information, which is not limited in this embodiment.

[0075] S203. O...

Embodiment 3

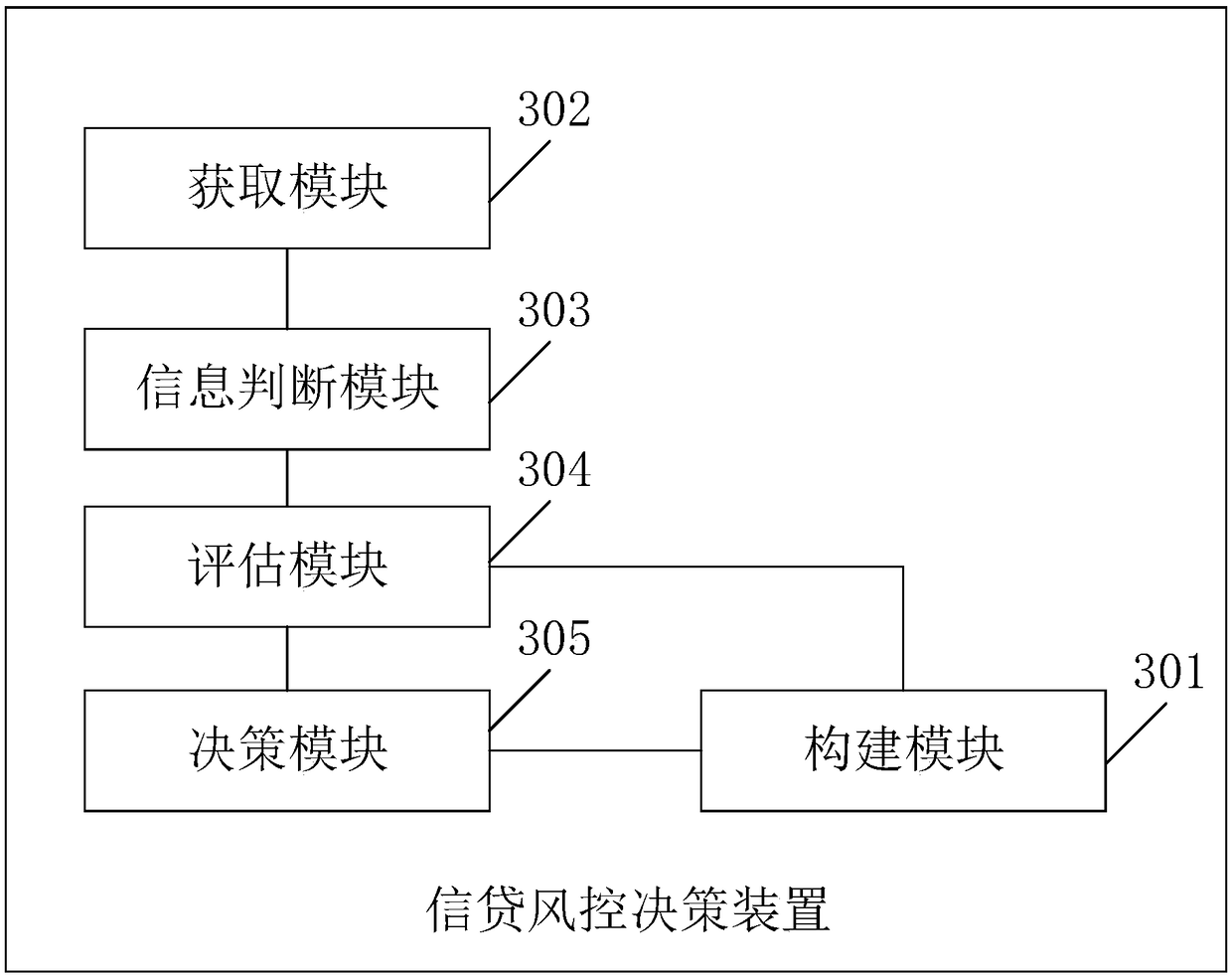

[0089] see image 3 , image 3 It is a schematic structural diagram of the credit risk control decision-making device provided in Embodiment 3 of the present invention. like image 3 As shown, the credit risk control decision-making device includes:

[0090] The construction module 301 is used to construct an artificial intelligence-based credit assessment model based on the credit assessment big data, and construct an artificial intelligence-based risk control decision-making model based on the risk control decision-making big data, wherein the credit assessment model is used to assess the user's credit situation, The risk control decision model is used to generate decision data.

[0091] An acquisition module 302, configured to acquire basic information of the user.

[0092] The information judging module 303 is used to judge whether the basic information is real information.

[0093] The evaluation module 304 is used to obtain the user's interbank credit data from the ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com