Method, device and device for online declaration of special additional deduction of individual tax

A special, individual tax technology, applied in the field of online declaration of individual tax special additional deductions, can solve the problems of low declaration efficiency and time-consuming, and achieve the effect of avoiding time-consuming and laborious, and improving declaration efficiency.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

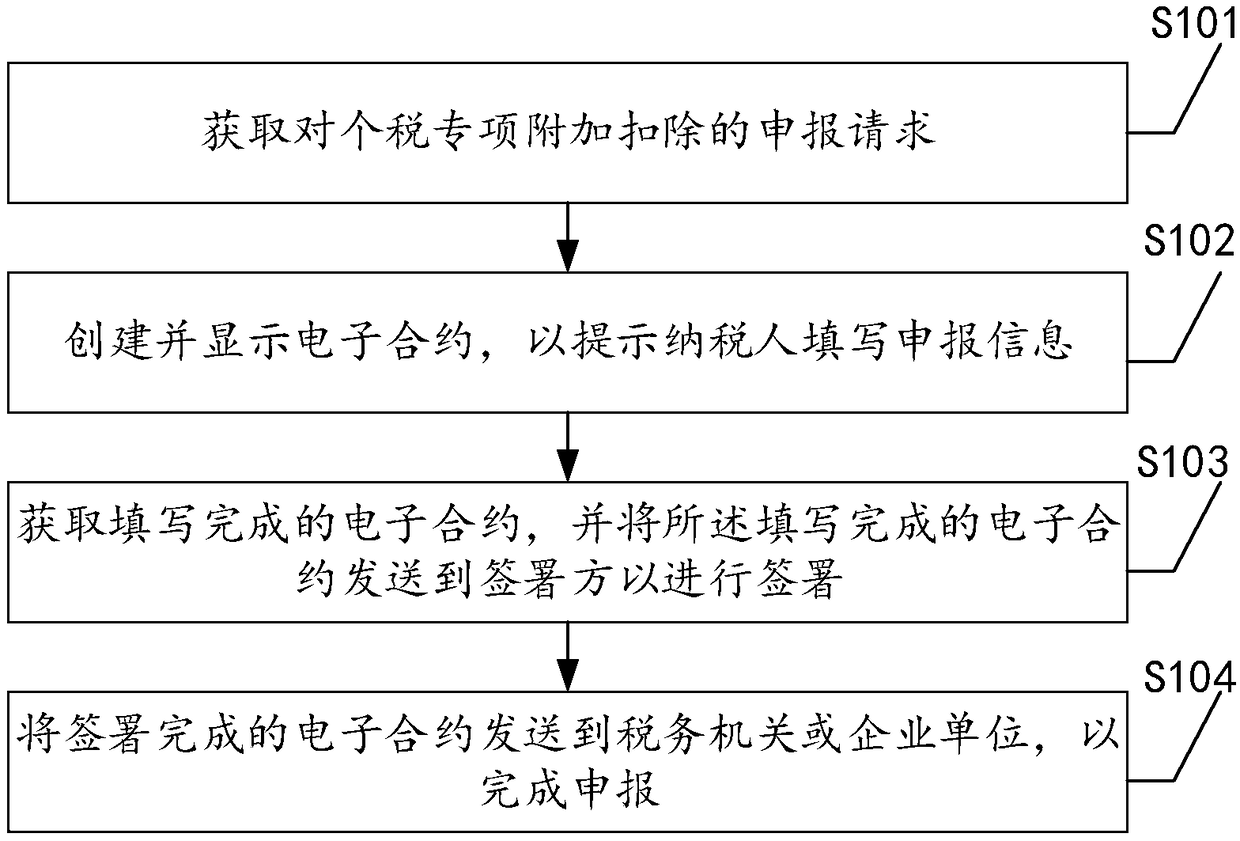

[0048] The following is an introduction to Embodiment 1 of a method for online declaration of special additional tax deduction provided by the present invention, see figure 1 , embodiment one includes:

[0049] Step S101: Obtain a declaration request for special additional deduction of individual tax.

[0050] The main purpose of this embodiment is to realize the declaration of special additional deduction of individual tax in an online manner. The above-mentioned special additional deduction of individual tax is called the special additional deduction of personal income tax. Continuing education, medical care for serious illnesses, interest on housing loans, housing rent, and support for the elderly include six special additional deductions. The above declaration request may be a request sent by the taxpayer to the preset device for online declaration, or a declaration request automatically triggered by the preset device for online declaration when a certain condition is met...

Embodiment 2

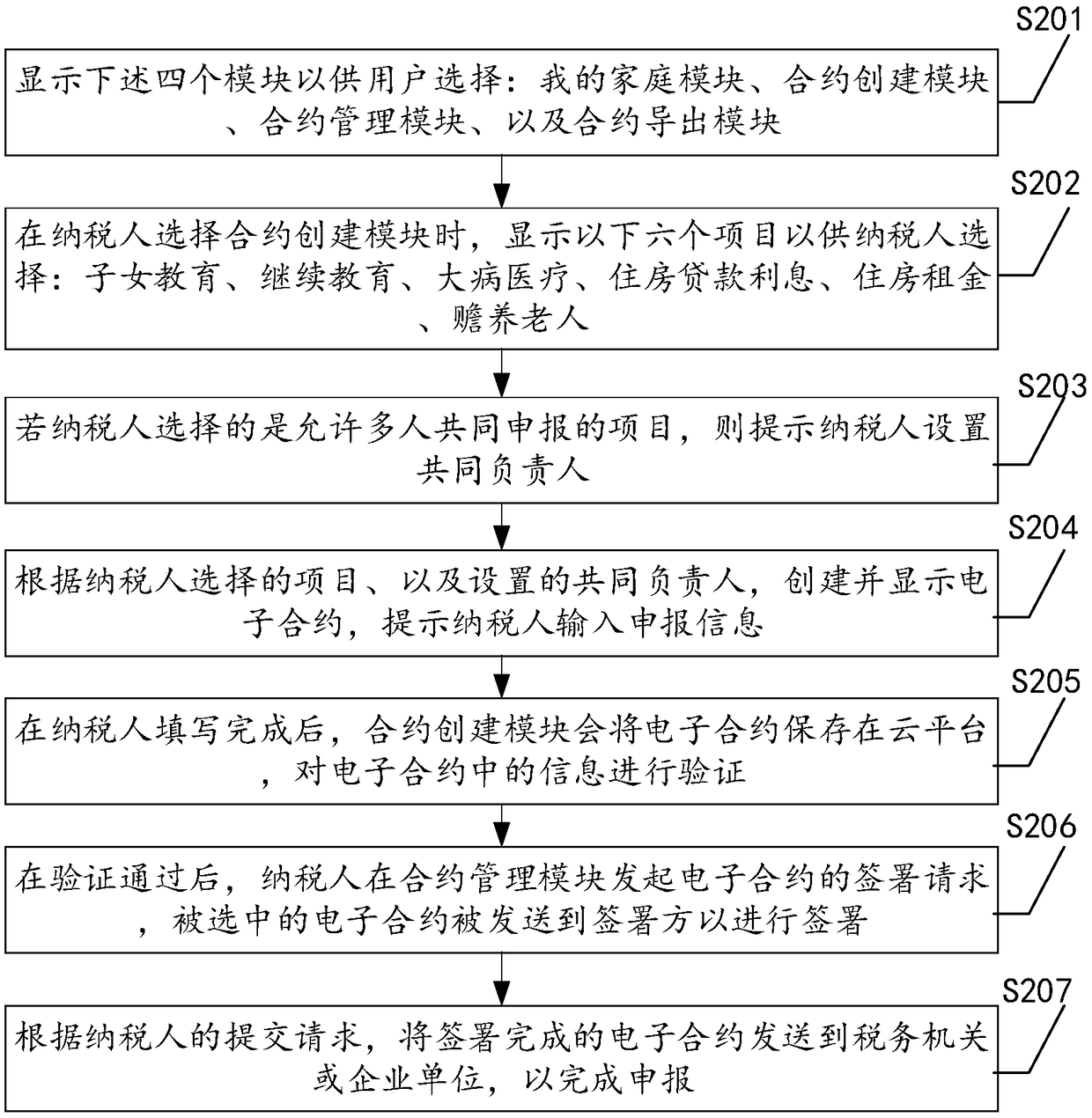

[0060] Specifically, see figure 2 , embodiment two includes:

[0061] Step S201: The following four modules are displayed for the user to choose: my family module, contract creation module, contract management module, and contract export module.

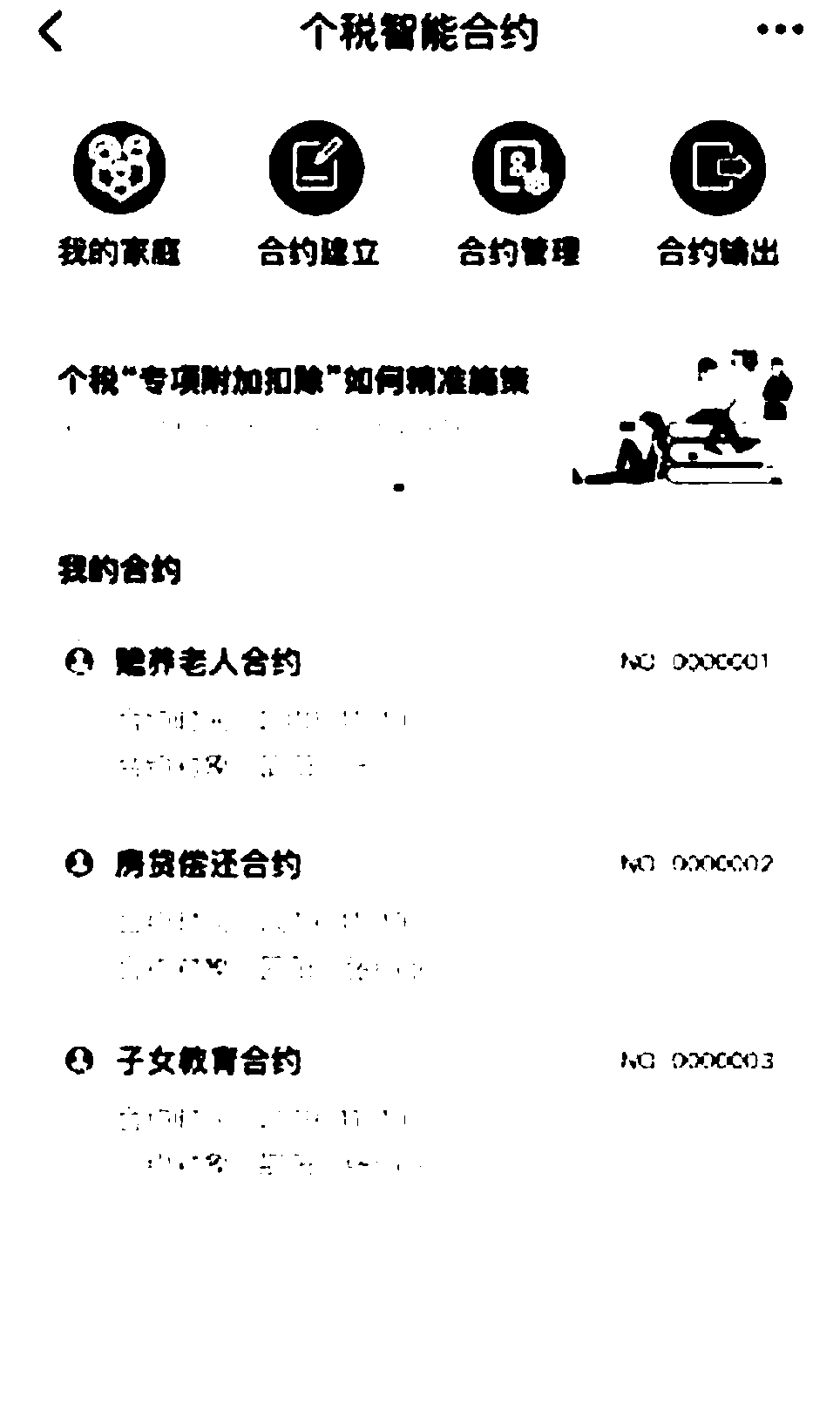

[0062] Specifically, in response to a taxpayer's successful login, display such as image 3 As shown in the main interface, the main interface includes the above four modules. The functions of the above four modules are introduced as follows: Figure 4 As shown, the My Family module is used to maintain the relevant information of the taxpayer himself and the taxpayer’s family members, such as spouse, brothers and sisters. The above-mentioned relevant information can include name, gender, date of birth, ID number, mobile phone number, unit tax number, unit address, family composition, etc.; the contract creation module stores a variety of electronic contract templates, which are used to create electronic contracts with specified t...

Embodiment approach

[0086] As an optional implementation, the device also includes:

[0087] Prompt module 805: used to prompt the taxpayer to upload the certification documents of the declaration information.

[0088] The device for declaring special additional deduction of individual tax online in this embodiment is used to realize the above-mentioned method for declaring special additional deduction of personal tax online, so the specific implementation of the device can be seen in the above-mentioned one online The embodiment part of the method for declaring the special additional deduction of personal tax, for example, the declaration request acquisition module 801, the electronic contract creation module 802, the electronic contract signing module 803, and the electronic contract sending module 804 are respectively used to realize the above-mentioned online declaration personal Steps S101, S102, S103, and S104 in the method for special additional tax deduction. Therefore, for the specific im...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com