Taxpayer credit evaluation method based on distributed automatic feature combination

A credit evaluation and feature combination technology, applied in data processing applications, instruments, finance, etc., to improve accuracy, reduce cumbersome and complicated artificial feature construction process, and reduce cumbersome effects

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0042] This part describes in detail the specific implementation of the invention.

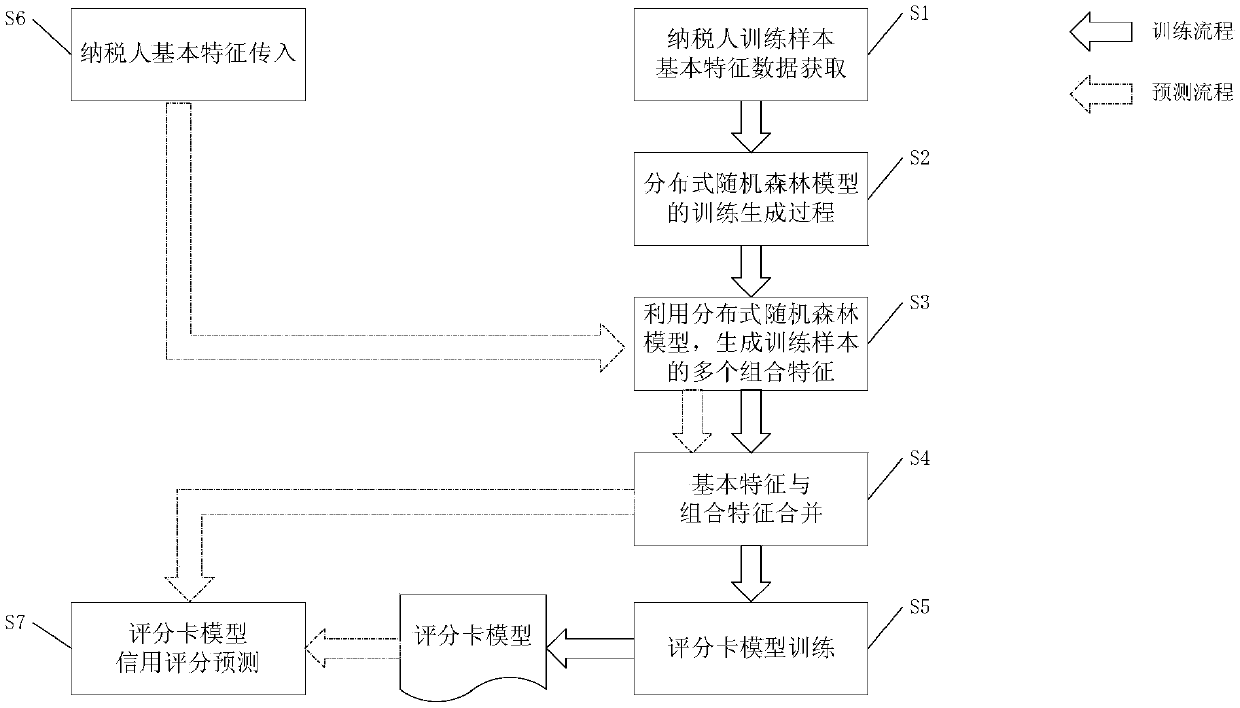

[0043] The training process of the credit evaluation model of distributed automatic combination features can be mainly divided into five steps S1-S5.

[0044] In step S1, it is necessary to construct a training sample of the credit evaluation model. The training sample selected here takes the taxpayer as the unit and includes the basic characteristics of the taxpayer in the four main fields of basic information, declaration information, tax information, invoice information, and relationship network. , where each domain includes a rich set of basic features. In addition, the taxpayer’s risk label is constructed according to the taxpayer’s historical risk situation. Taxpayers with risky behavior in historical records are used as black samples, and taxpayers without risky behavior are used as white samples for subsequent model training.

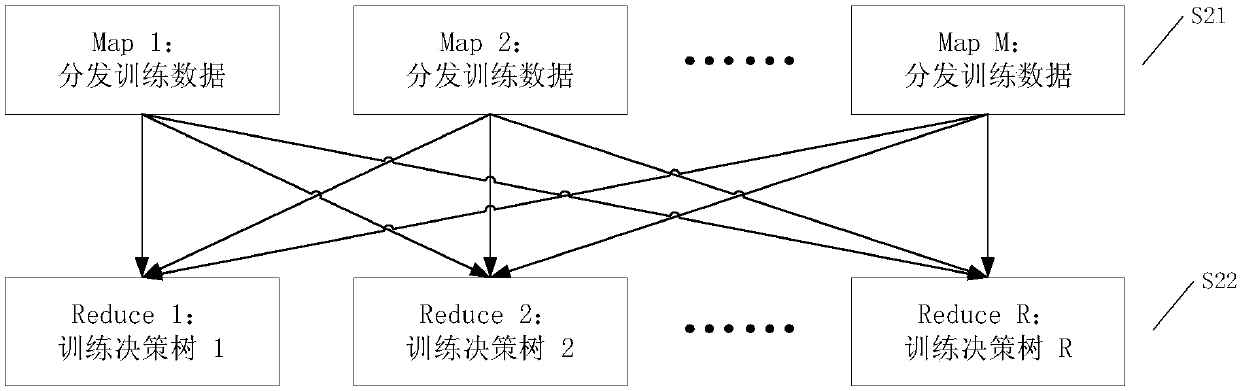

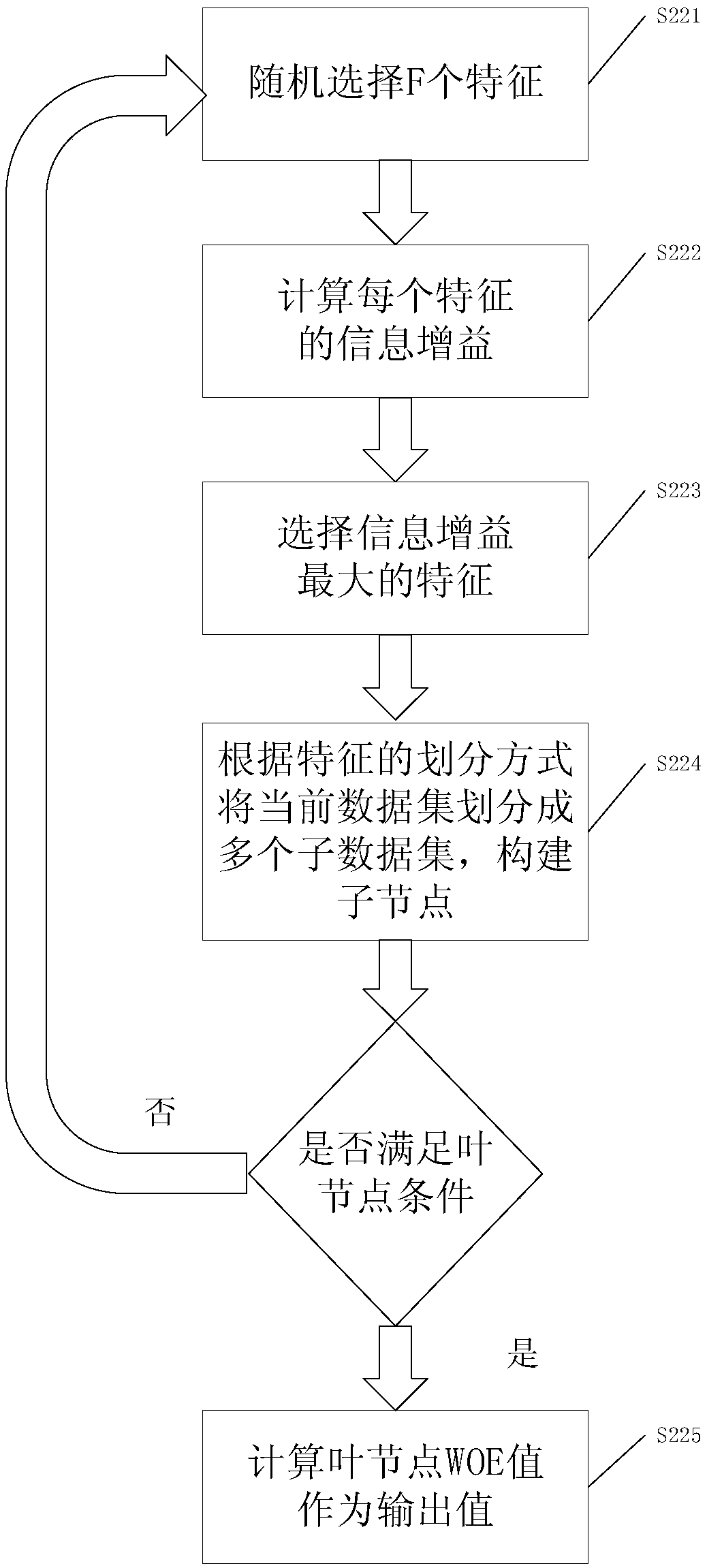

[0045] In step S2, a distributed random forest model is u...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com