Assumed bond structure-based expiration validity test method

A testing method and effective technology, applied in the fields of instruments, finance, and data processing applications, etc., can solve problems such as large fluctuations in bank profit and loss statements and failure to reflect the risk hedging effect from the perspective of risk management, so as to improve the level of risk management and accurately reflect The effect of risk hedging and the effect of facilitating effective development

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

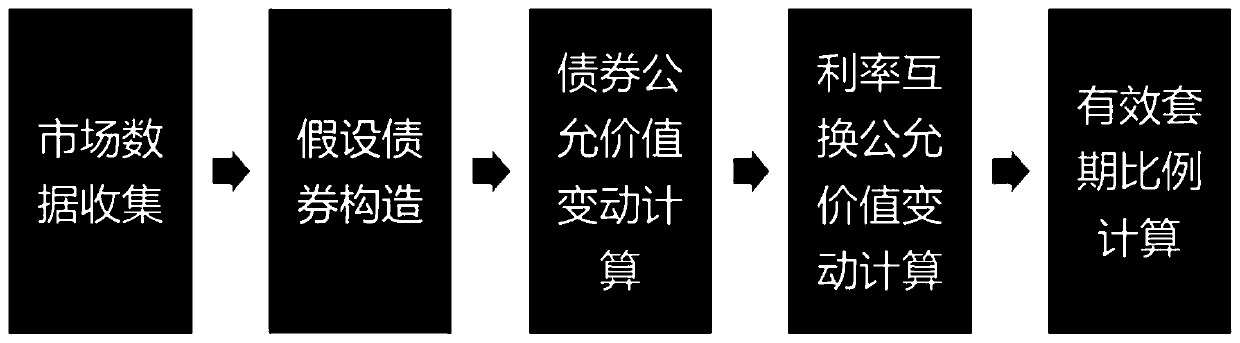

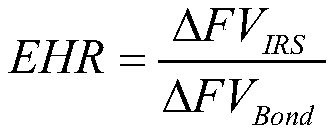

Method used

Image

Examples

Embodiment

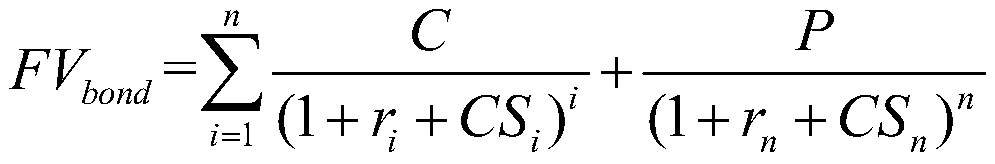

[0079] Suppose you hold a fixed-rate bond Bond1 with a face value of RMB 1,000, a coupon rate of 10%, and a semi-annual interest rate. The remaining period is two years, and the discount curve is SHIBOR (Shanghai Interbank Offered Rate). The bond cash flow statement can be calculated as shown in Table 1 (the market interest rate is assumed):

[0080] Table 1: Hypothetical Bond Cash Flow Statement

[0081]

[0082] Among them, Par represents the face value, Coupon rate represents the coupon rate, Interest Day represents the interest date, Daycount represents the remaining maturity, Flow represents the cash flow, SHIBOR Rate represents the Shanghai Interbank Offered Rate, PV represents the corresponding calculation amount, and Bond Yield represents the bond yield .

[0083] In order to hedge against the risk of market interest rate fluctuations implied by holding the fixed-rate bond, the trader entered into an interest rate swap transaction IRS1, the information being RMB 1,...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com