Financial economic loan risk assessment method and system

A risk assessment system and risk assessment technology, applied in finance, digital data authentication, and other database retrieval, can solve problems such as unfavorable financial lending institutions, inability to obtain risk levels, inaccurate risk assessment, etc., to facilitate data viewing, The effect of improving objectivity and accuracy and reducing lending risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0020] The present invention will be further explained below in conjunction with specific embodiments.

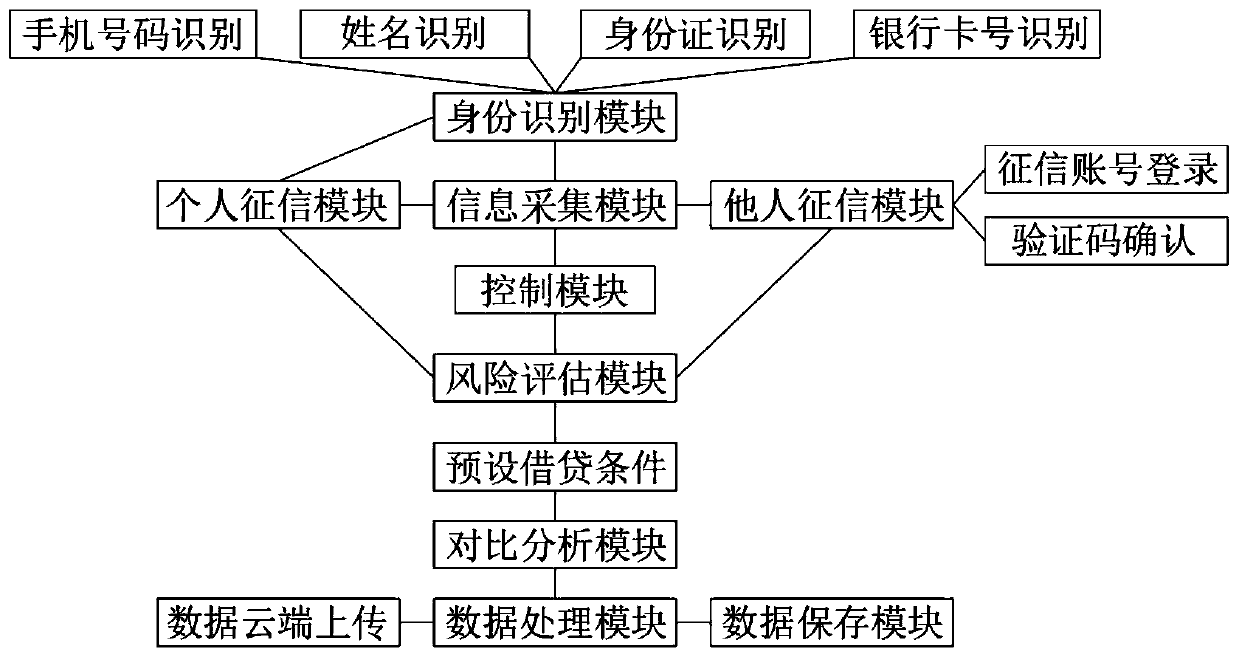

[0021] A financial and economic lending risk assessment system proposed by the present invention includes a control module placed in a control terminal, the control module is electrically connected with an information collection module and a risk assessment module, and the information collection module is used to obtain personal actual information of loan applicants, The risk assessment module is used to evaluate the loan risk result of the loan applicant. The information collection module includes a personal credit reference module, a credit reference module for others, and an identification module. The personal credit reference module is electrically connected to the identity recognition module, and the personal credit reference module is used for Obtain information on personal credit records of loan applicants, and the other credit information module is used to obtain the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com