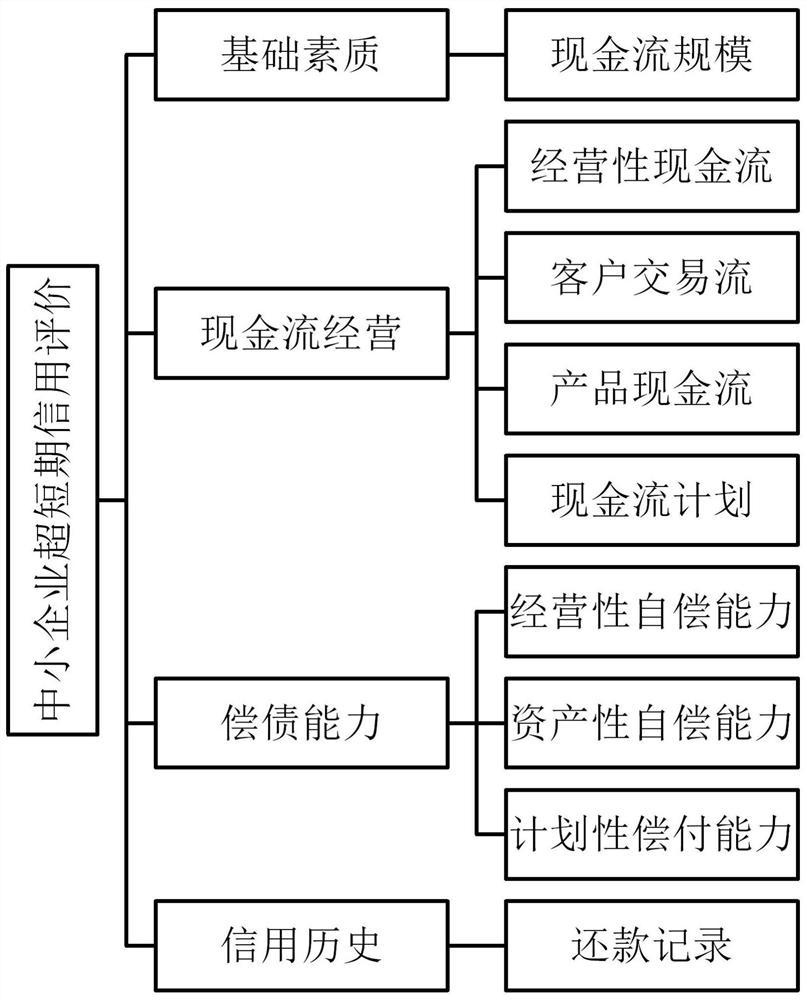

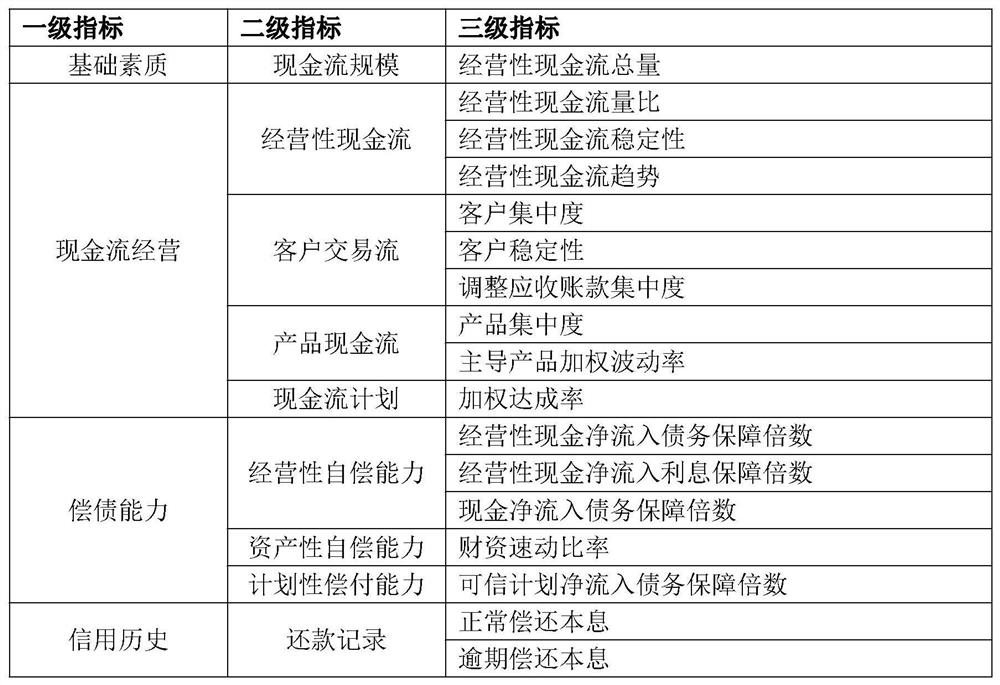

Medium and small enterprise ultra-short term credit evaluation method based on dynamic financial resource flow

A technology for credit evaluation and small and medium-sized enterprises, applied in the field of ultra-short-term credit evaluation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

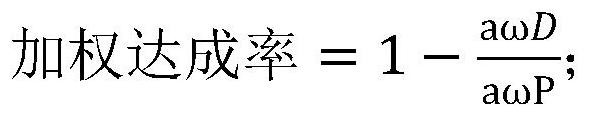

Method used

Image

Examples

Embodiment Construction

[0015] The implementation of this model includes the construction and use of the model.

[0016] The construction of the model is divided into 8 steps:

[0017] Step 1. Data collection:

[0018] Based on the Saas fund management system, through continuous cooperation with enterprises, it helps enterprises improve their financial management capabilities, and dynamically obtains financial flow information under the authorization of enterprises.

[0019] Financial flow information includes:

[0020] a. Information such as the amount, time, counterparty, region, purpose, type (including operational and non-operational) of all capital inflows and outflows in the business management of the enterprise;

[0021] b. Plans for the inflow and outflow of corporate funds, including volume, date, counterparty, purpose, and type;

[0022] c. The future capital inflow (investment income) and outflow (principal repayment, interest payment, planned investment) caused by enterprise investment...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com