Automated system for conditional order transactions in securities or other items in commerce

An order and condition technology, applied in data processing applications, special data processing applications, finance, etc., to solve problems such as the complexity of trade practices

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

example 1

[0096] A user can view the risk arbitrage order book in multiple formats, first, the price of the transferor's securities versus the price of the transferee's securities, second, the price of the transferor's "arbitrage discount" versus the price of the transferee's securities, and third, the "investment recovery" rate” to the transferee’s security price. In the first case, the user is looking at security prices and does not include the analytical premise, but he can change the underlying price and then view the set of orders correctly categorized and displayed as if the price of the underlying security had been changed. This does not affect how other users view the information, nor does it affect how orders are managed by the trading engine being viewed.

example 2

[0098] In the above example (third view: "investment recovery rate" vs. transferee security price), each user can enter the premises related to the remaining time of the transaction, holding cost, short discount, ex-dividend date, volatility, etc., and the interface can display The "Return on Investment" view of its order book implies the order of the user's prerequisites. Since each user's order book shows different numbers, one user can enter an order close to 18% IRR (internal profit rate), while another user can enter an order close to 12% IRR, and these orders may be exactly the same (in a certain 12% on one user's screen, 18% on another, and differently on other terminals).

example 3

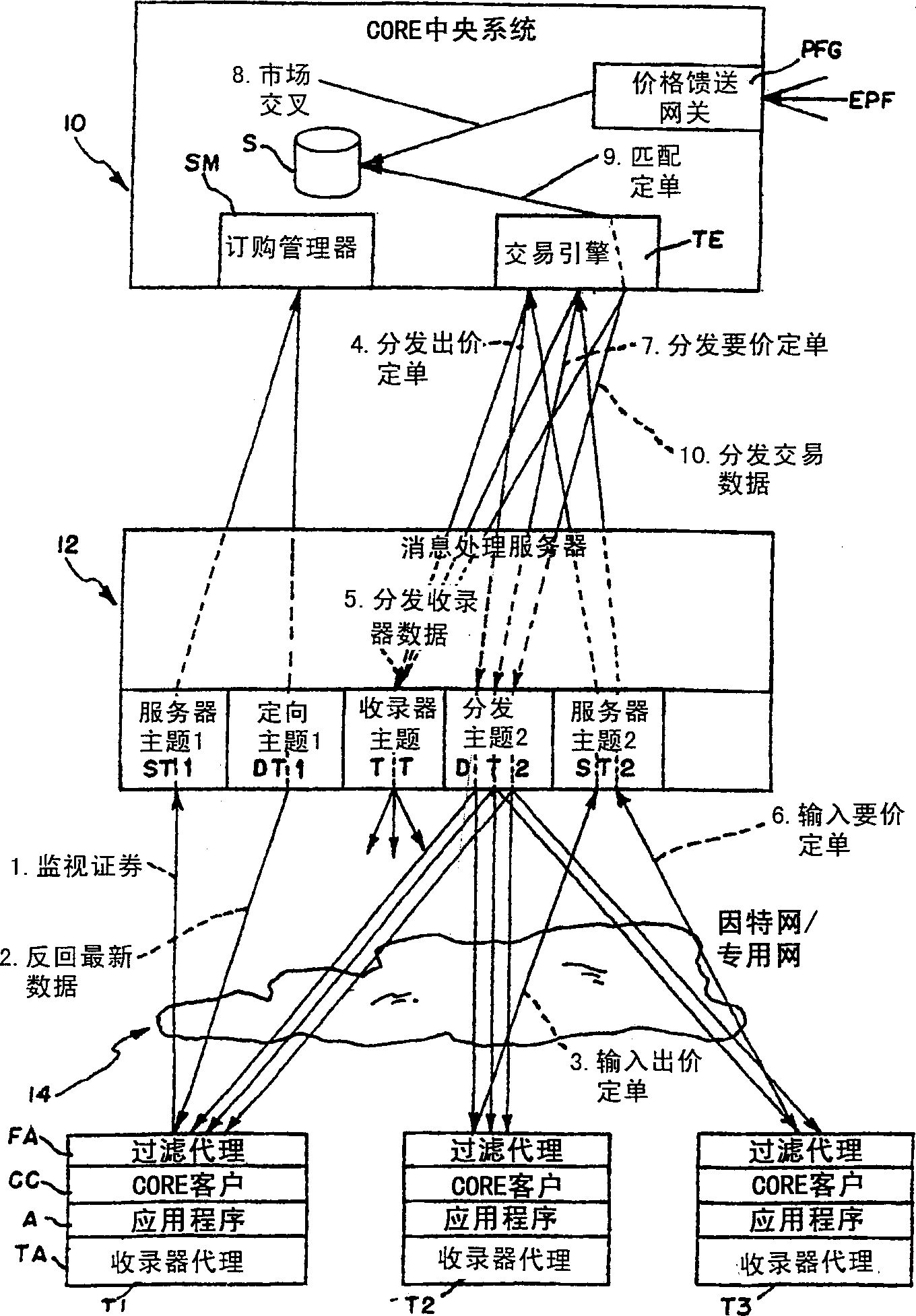

[0100] Currently, the bandwidth demand in the stock pre-order trading market is huge, and it is growing every day. The reason is that there are many contracts (buy and sell) for each underlying security. Floor brokers raise or lower their bids or asks for options when the market for the underlying stock of a security such as IBM changes. Distributing new quotes uses a lot of bandwidth since a 1 / 2 point change in IBM securities will affect the price of 100-200 contracts. The method of distributing algo orders reduces bandwidth because only changes in the underlying security price are sent to the UI. The UI accepts changes in the price of the underlying security and then displays the price for 100-200 contracts without "redistributing" the quote.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com