Trading system and method having a configurable market depth tool with dynamic price axis

a trading system and dynamic price axis technology, applied in the field of trading system and method having a configurable market depth tool with dynamic price axis, can solve the problems of market failure to accept orders, time-consuming for traders, and severe competitive disadvantage for traders lacking a technologically advanced interface to trade in such markets

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

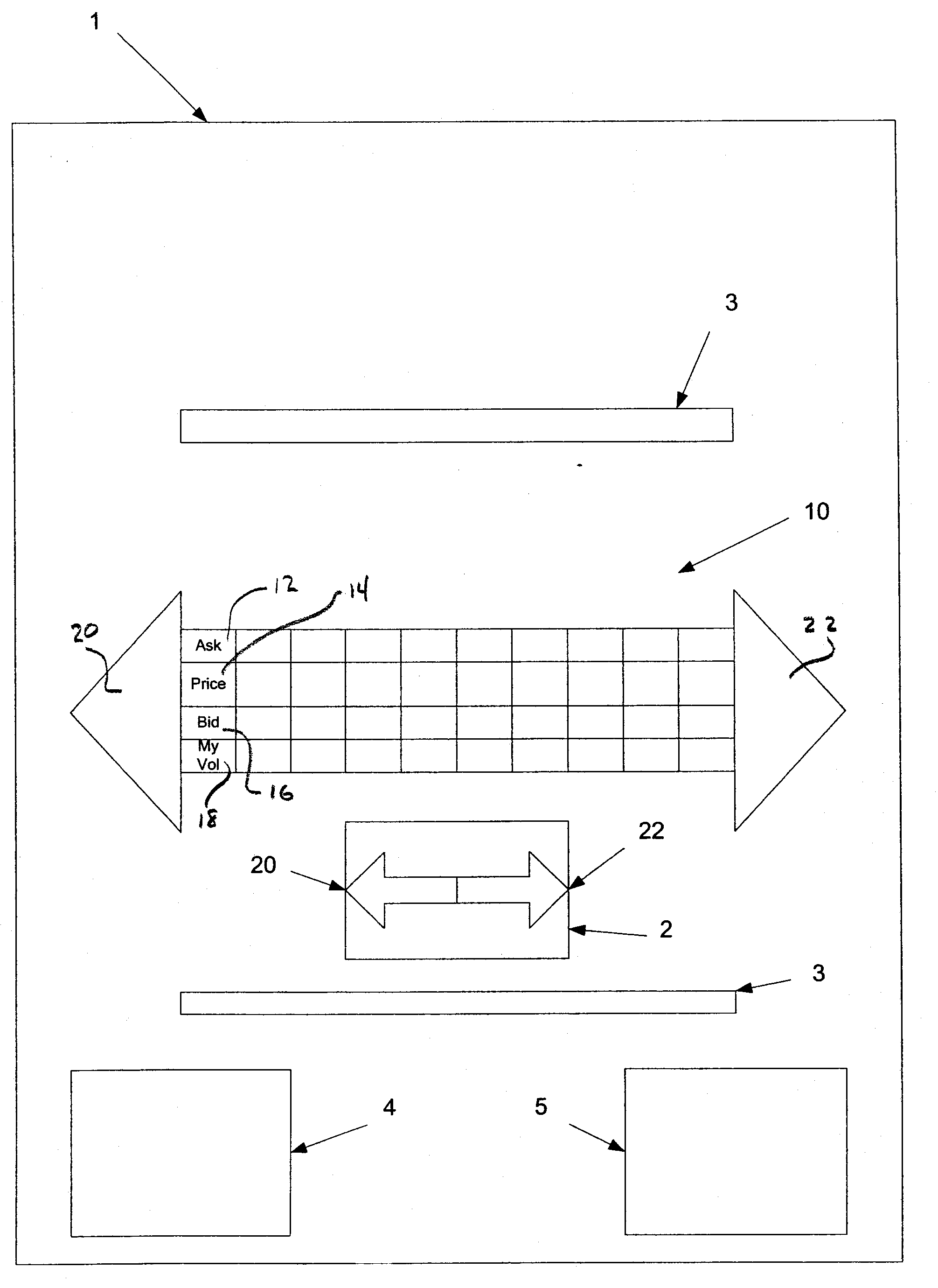

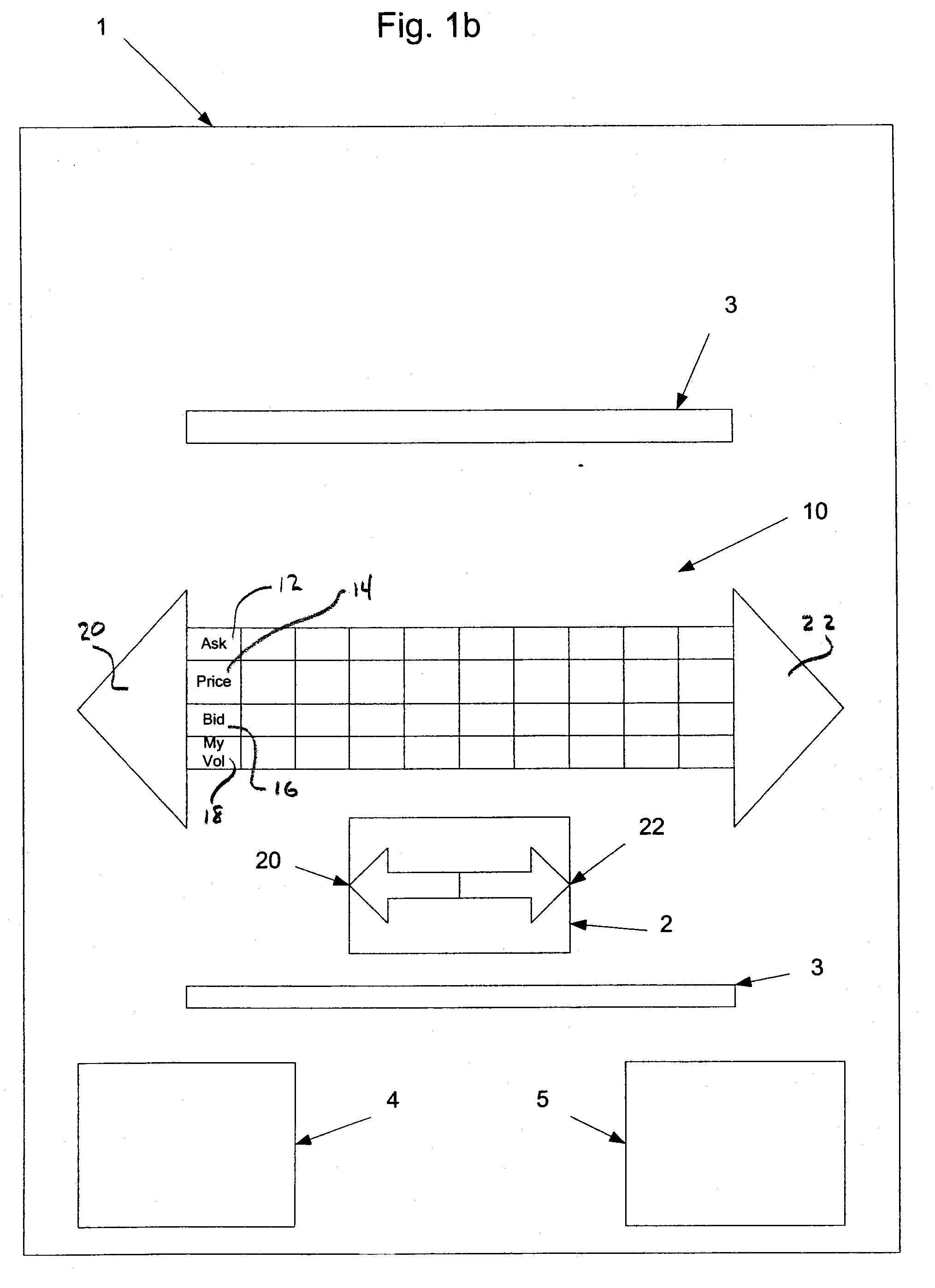

Embodiment Construction

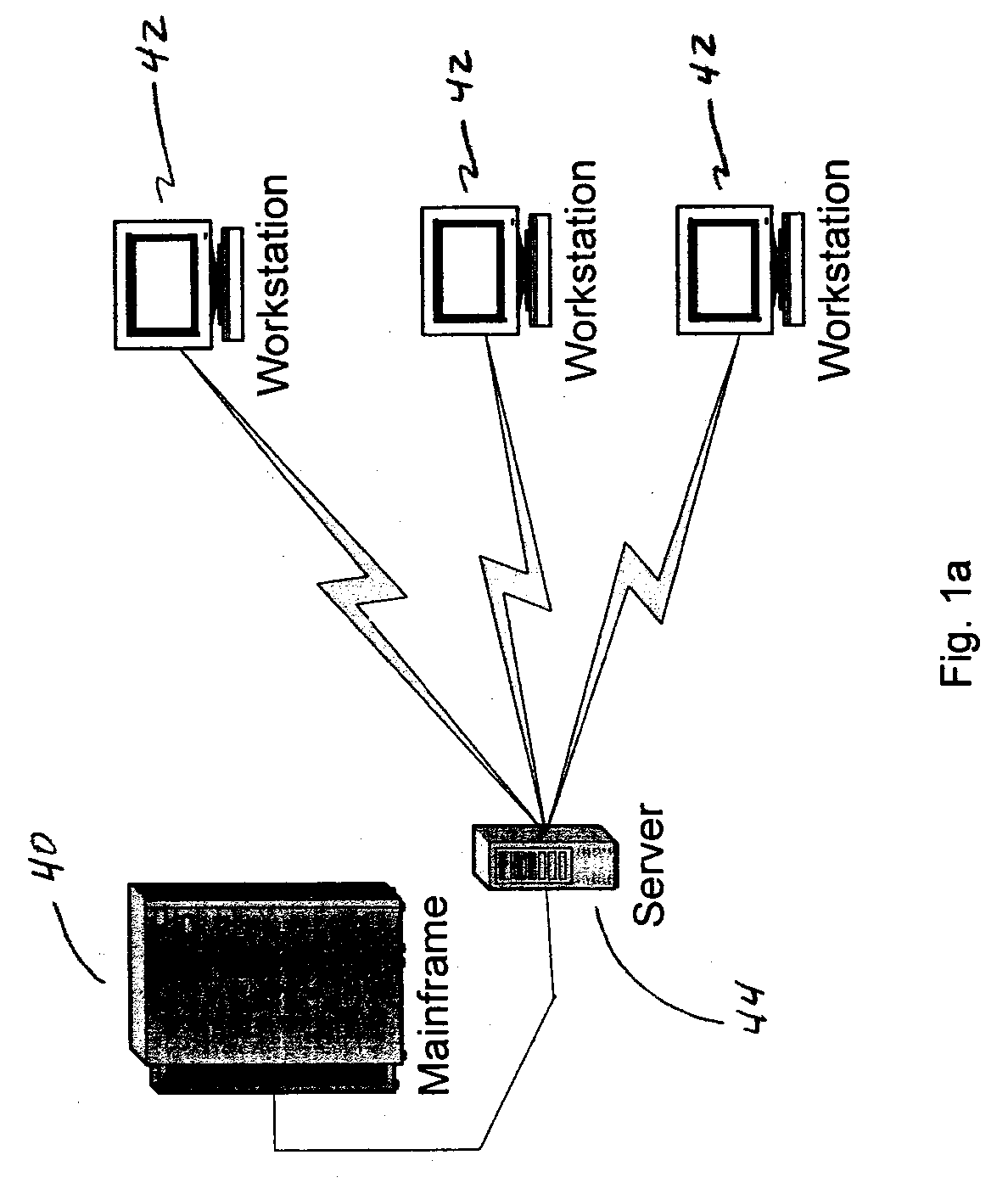

[0041]While the present invention is capable of embodiment in various forms, there is shown in the drawings and will be hereinafter described presently preferred embodiments with the understanding that the present disclosure is to be considered as an exemplification of the invention, and is not intended to limit the invention to the specific embodiments illustrated.

[0042]For the purposes of a clearer understanding of the matters discussed herein, certain terms used herein are, for convenience only, described below, along with a non-limiting, representative description of the meaning that may be attributable to such terms.

[0043](1) Inside market price—The price level that lies between the highest price bid and the lowest ask price in a market for a trading vehicle. The inside market price may or may not be a valid tradable market price.

[0044](2) Last trade price—the last traded price in a market for a trading vehicle.

[0045](3) Central market point (“CMP”)—A dynamic point that represe...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com