Mobile telephone transaction systems and methods

a mobile telephone and transaction system technology, applied in payment protocols, special services for subscribers, instruments, etc., can solve the problems of fraud, theft, and other misuse of checks and credit/debit accounts, and cost both banks and consumers substantial sums of money, and achieve financial losses for both banks and individuals

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

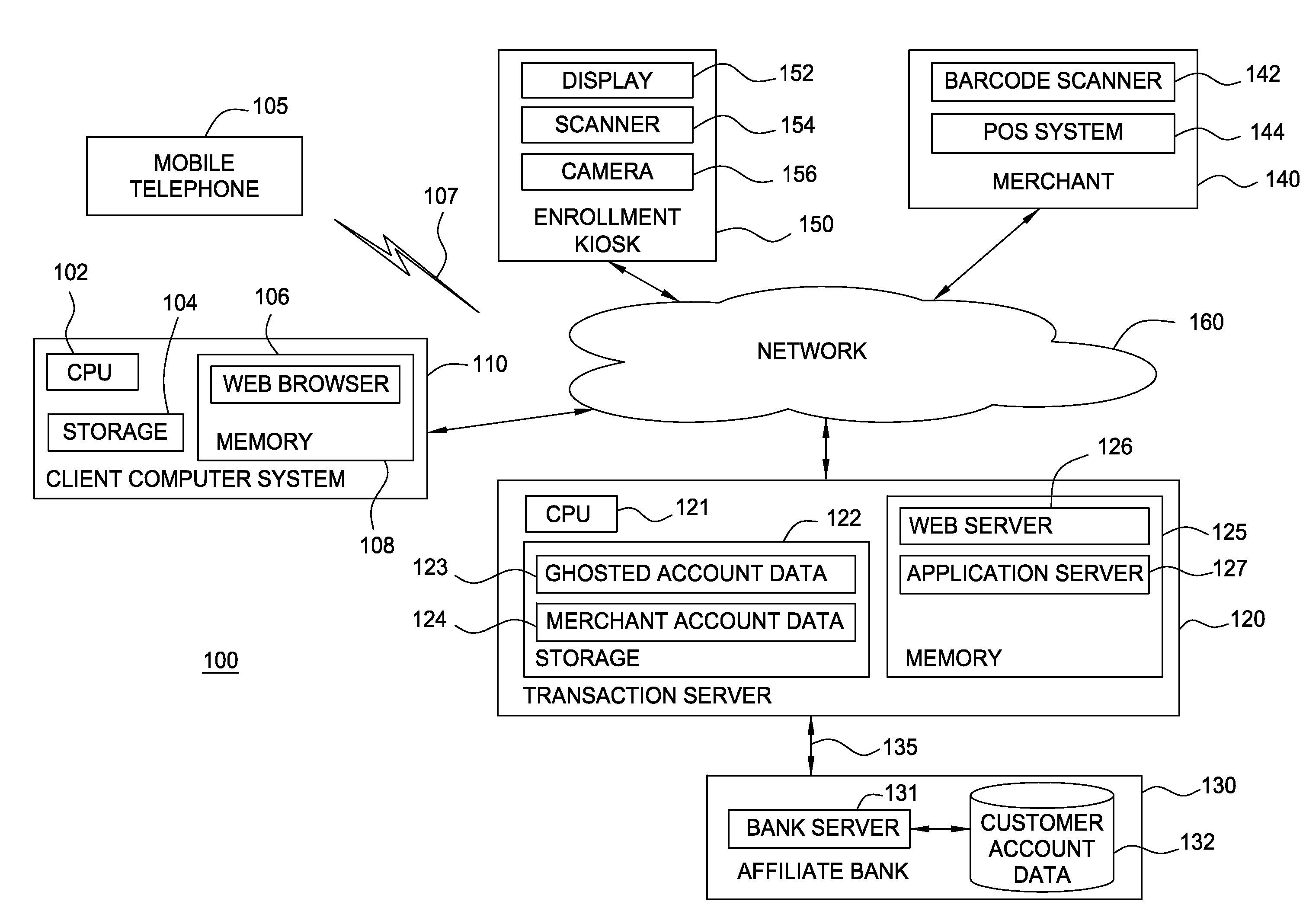

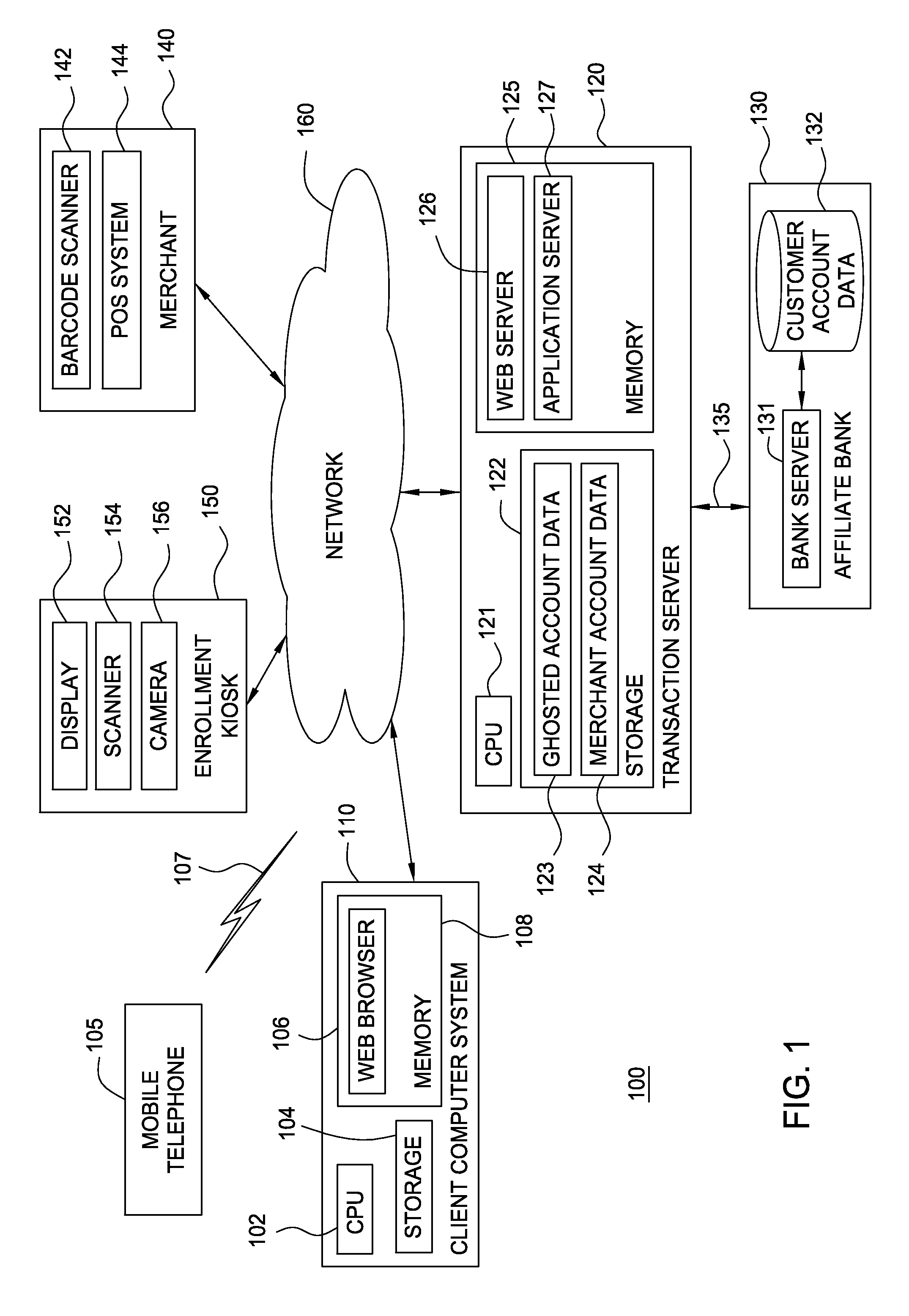

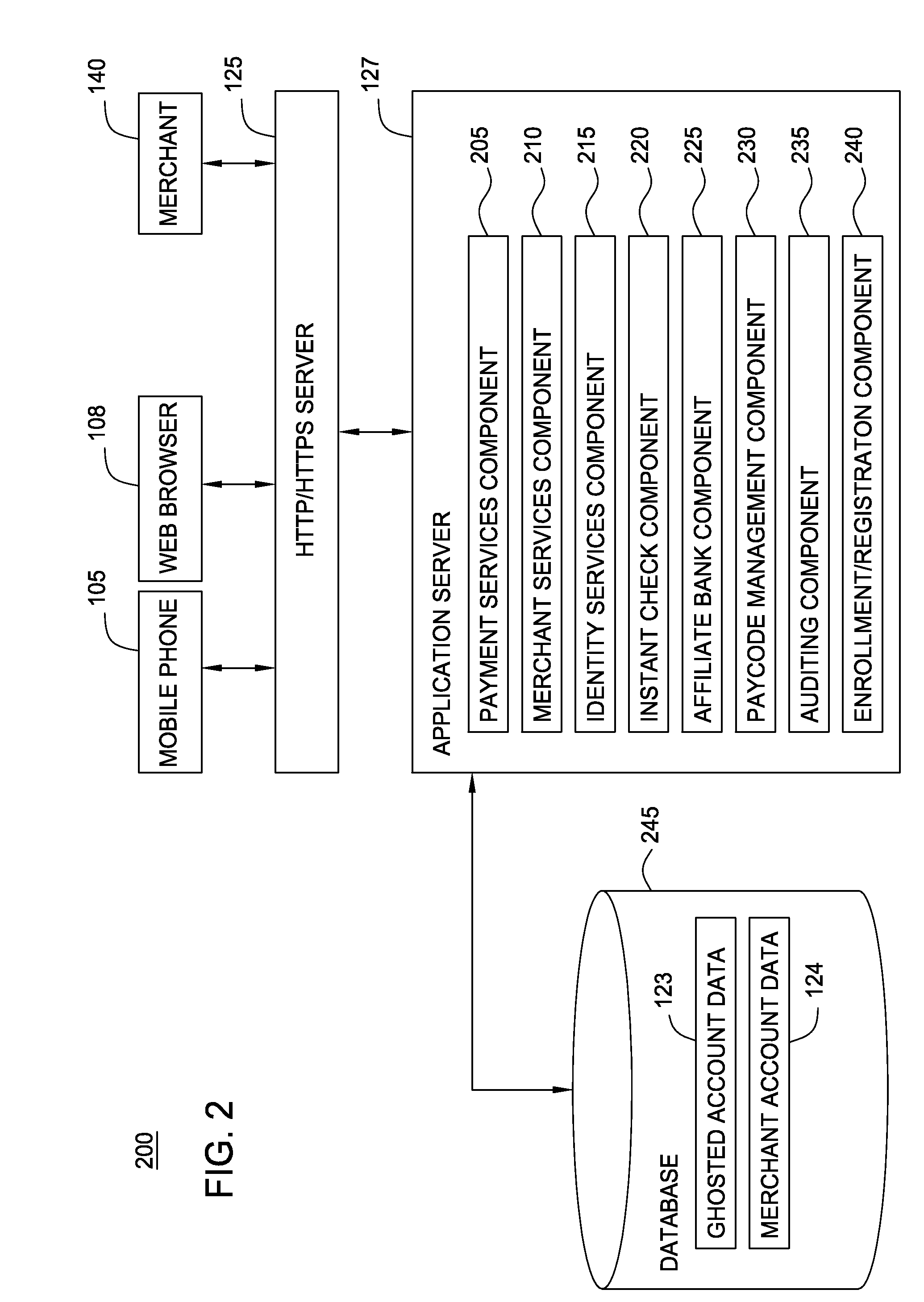

[0023]Embodiments of the invention generally provide transaction systems and methods for mobile telephone devices. For example, embodiments of the invention allow a mobile telephone, in conjunction with a payment transaction server, to be used directly as a payment device for a variety of financial transactions. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that both prevents identify theft and does not rely on transferring amounts to / from one stored value account to another.

[0024]In one embodiment, an individual enrolls their mobile telephone in the payment transaction system by providing a cell phone number, along with information as needed to identify that individual and to comply with “know-your-customer” laws, or other regulations. In a particular embodiment, the enrollment process may be kiosk-driven, where the user interacts with a kiosk to provide informat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com