Portfolio Optimization

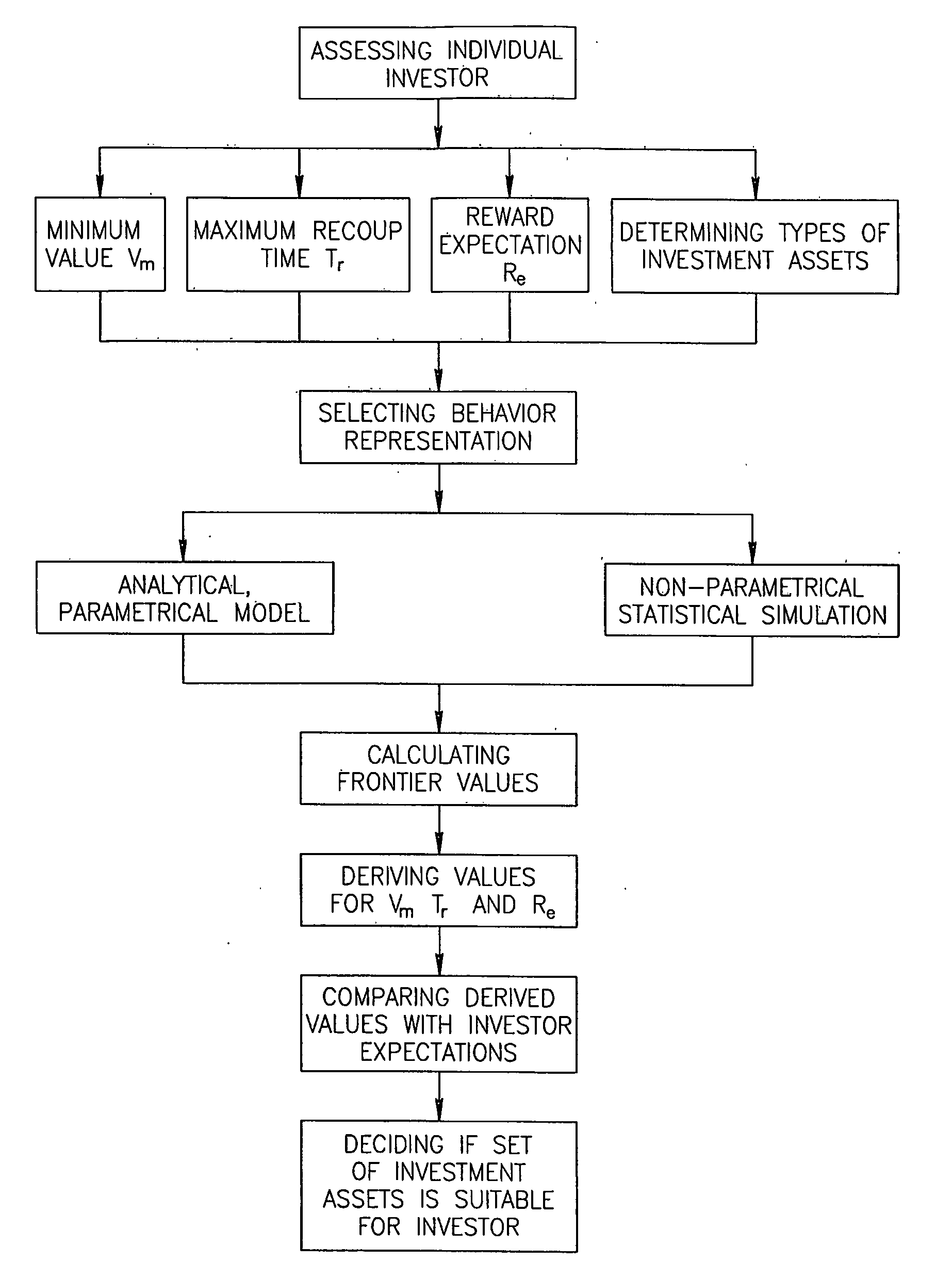

a portfolio optimization and portfolio technology, applied in the field of investments, can solve the problems of exacerbated problems, difficult investment choices for the typical individual investor, and investors without understanding or resources to properly inves

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

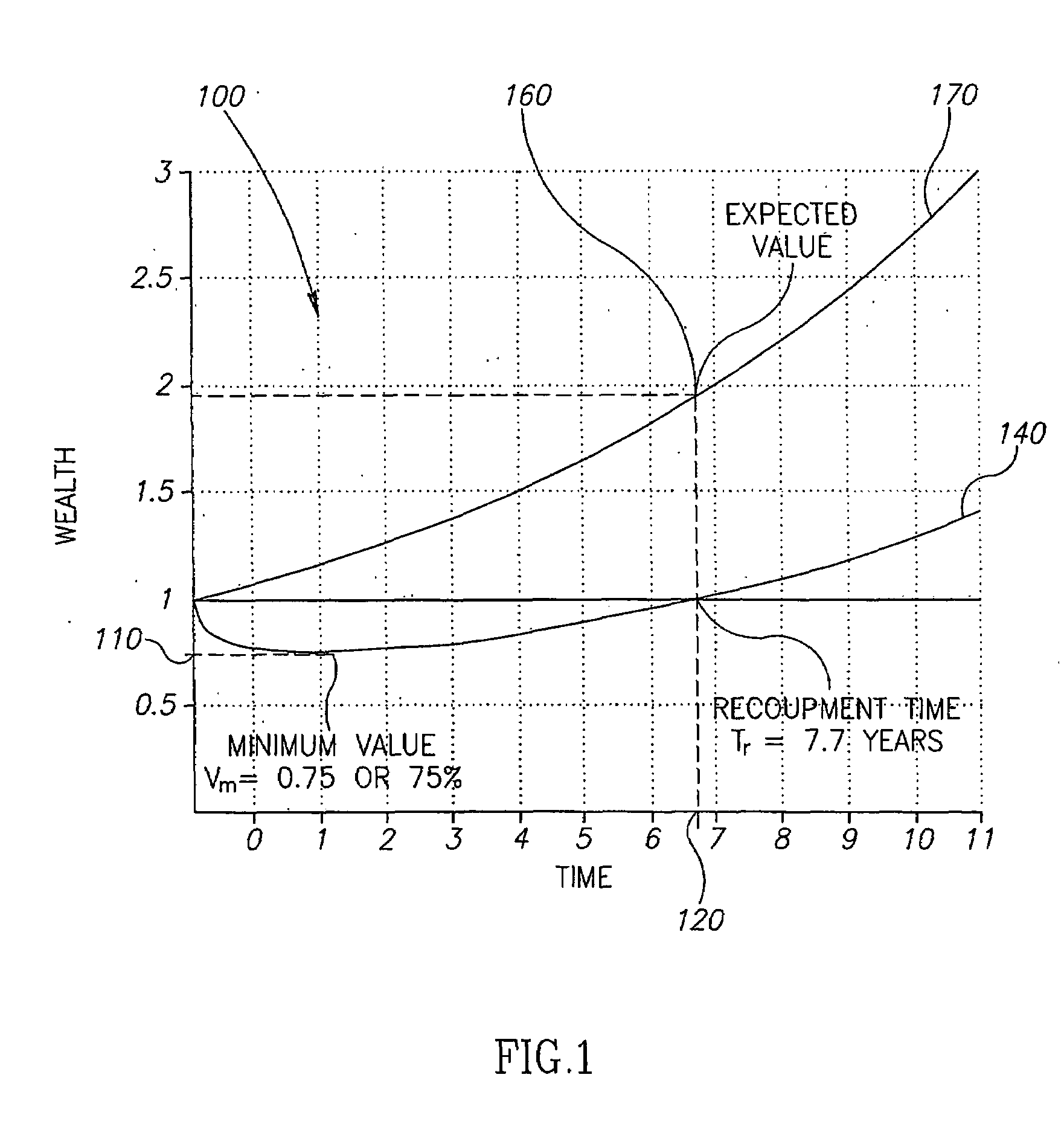

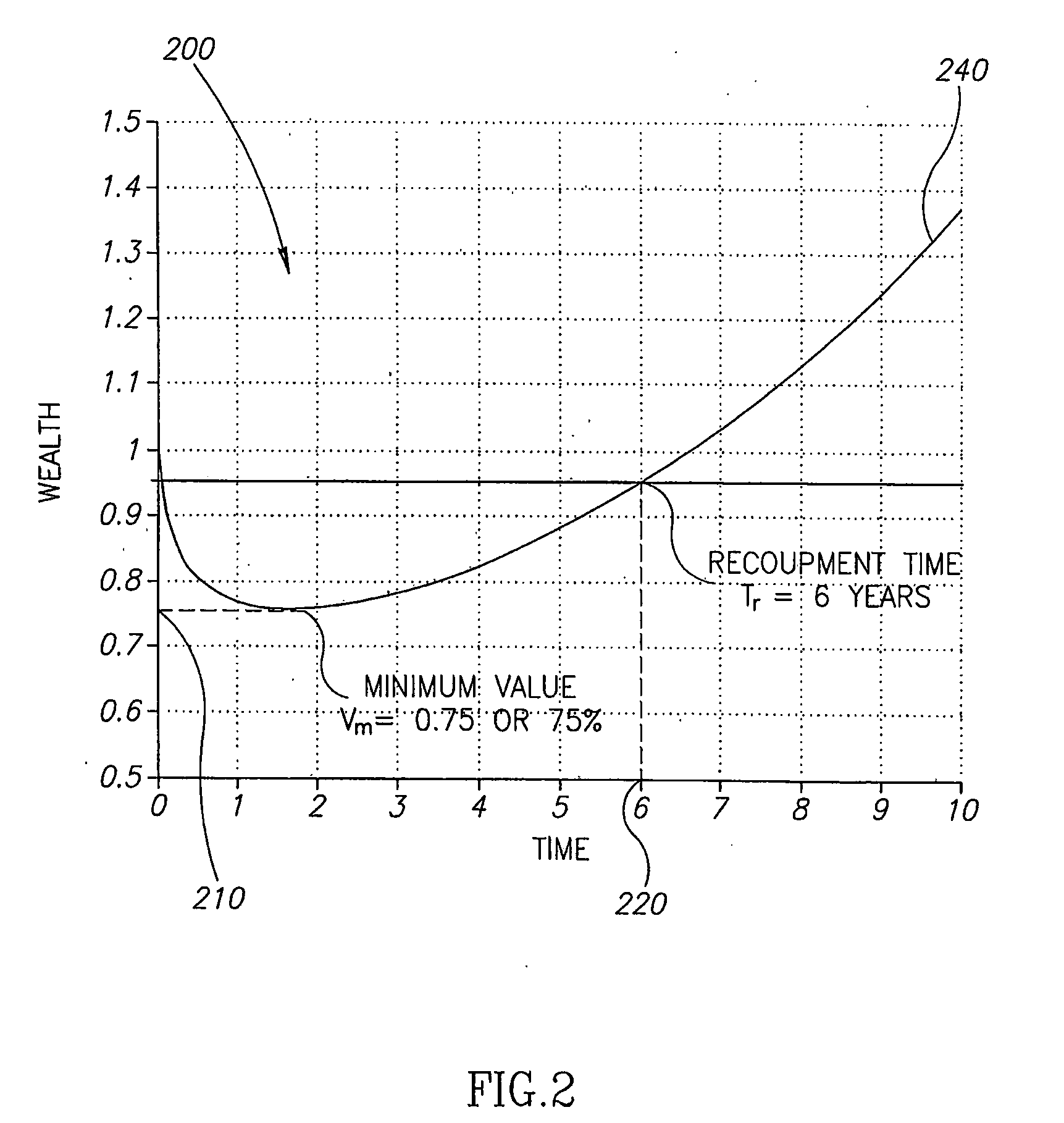

[0032]Inherent in every investment is a certain degree of risk. When investing in risky assets, an individual investor naturally expects the investment to yield some gain or return in excess of his initial investment at some later desired time. One risk is that of not being able to retrieve even the initial investment without waiting until some later time. Another risk is that the investor may have to liquidate the investment at some time earlier than desired time, when the investment is worth less than the initial investment. Balancing these risk factors is the reward of an increase or gain in the value of the investment that the investor hopes to achieve.

[0033]The success of rational individual investors at achieving their investment goals can be characterized by a Utility Function, U, which is dependent on three parameters: two measures of the risk and one measure of the expected reward; namely:

Tr Recoupment Time or payback period. This is a maximum period after which an investor...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com