Assets depreciation computing management system and method

A computing management and asset technology, applied in the field of financial management, can solve the problems of increasing the workload of business operators, large data storage, and high implementation costs, and achieve the effects of reducing data storage, simple program processing, and low implementation costs.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

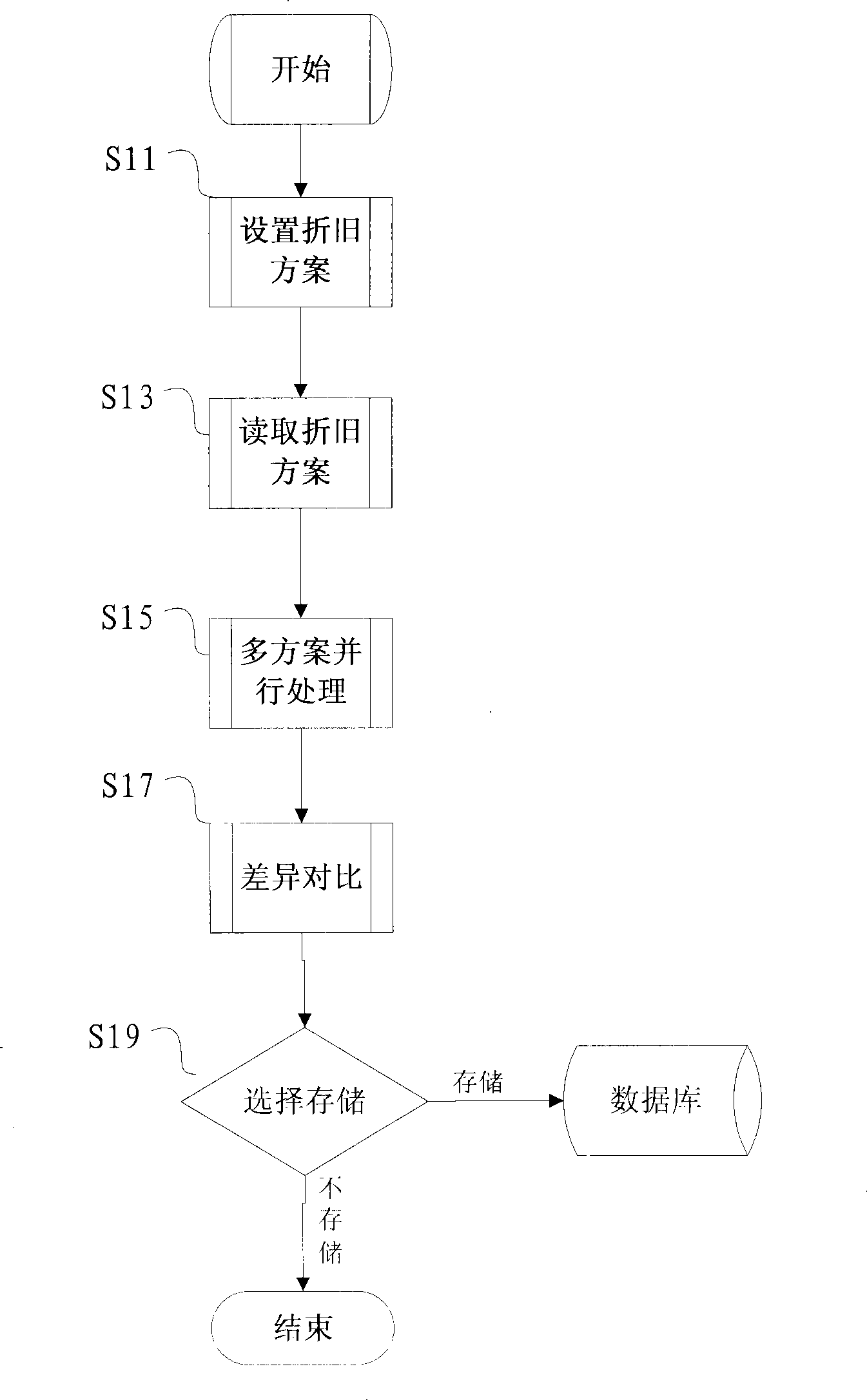

[0021] The present invention will be further described in detail below through specific embodiments in conjunction with the accompanying drawings.

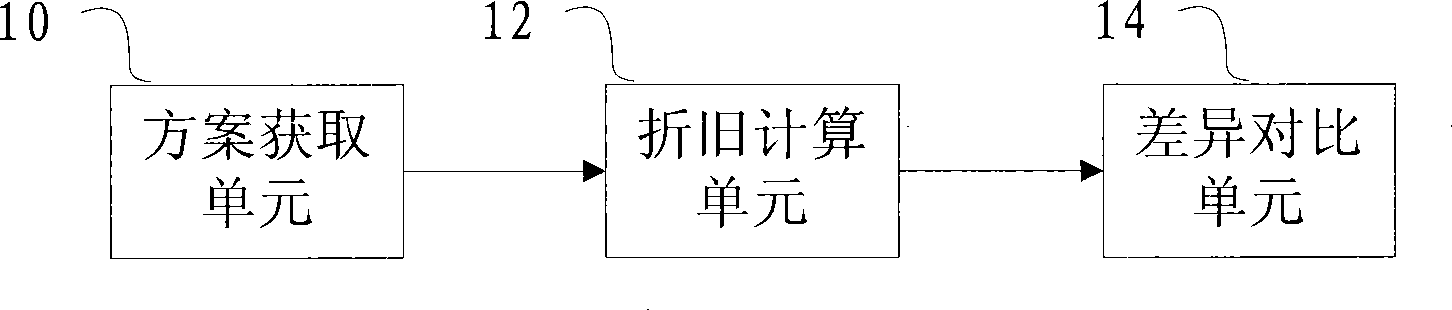

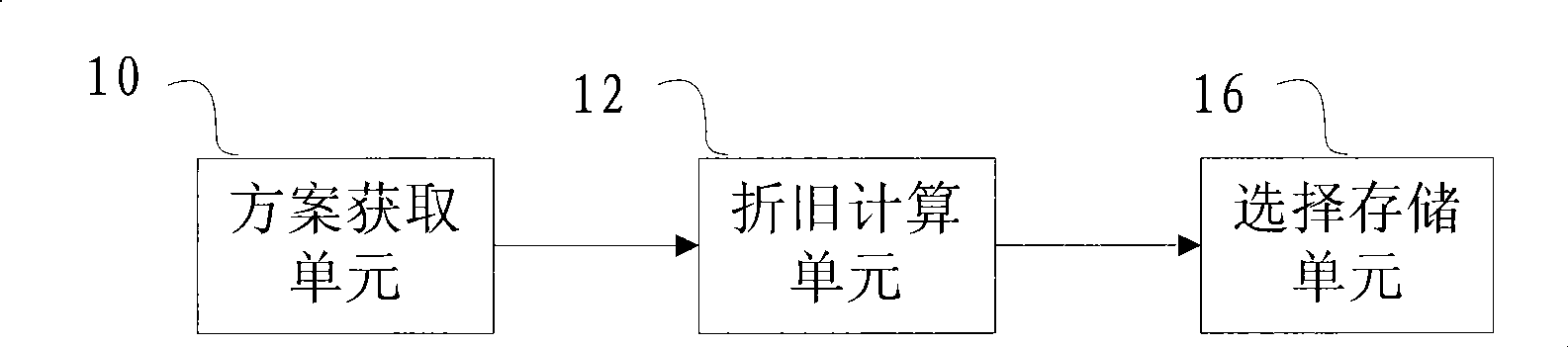

[0022] Please refer to figure 1 ,exist figure 1 In the shown embodiment, the asset depreciation calculation management system includes a scheme acquisition unit 10 , a depreciation calculation unit 12 and a difference comparison unit 14 . It should be noted that the connection relationship between the various units in all the diagrams of the present invention is to clearly illustrate the needs of their information interaction and control process, so it should be regarded as a logical connection relationship, and should not be limited to physical connections or this The connection mode described in the embodiment. in:

[0023] The scheme acquiring unit 10 is used to acquire at least two preset depreciation schemes. According to different modes of scheme acquisition, the structure of scheme acquisition unit 10 can also be differ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com